Cover Sheet 1 7 5 1 4 S.E.C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Music in the Heart of Manila: Quiapo from the Colonial Period to Contemporary Times: Tradition, Change, Continuity Ma

Music in The Heart of Manila: Quiapo from the Colonial Period to Contemporary Times: Tradition, Change, Continuity Ma. Patricia Brillantes-Silvestre A brief history of Quiapo Quiapo is a key district of Manila, having as its boundaries the winding Pasig River and the districts of Sta. Cruz, San Miguel and Sampaloc. Its name comes from a floating water lily specie called kiyapo (Pistia stratiotes), with thick, light-green leaves, similar to a tiny, open cabbage. Pre-1800 maps of Manila show Quiapo as originally a cluster of islands with swampy lands and shallow waters (Andrade 2006, 40 in Zialcita), the perfect breeding place for the plant that gave its name to the district. Quiapo’s recorded history began in 1578 with the arrival of the Franciscans who established their main missionary headquarters in nearby Sta. Ana (Andrade 42), taking Quiapo, then a poor fishing village, into its sheepfold. They founded Quiapo Church and declared its parish as that of St. John the Baptist. The Jesuits arrived in 1581, and the discalced Augustinians in 1622 founded a chapel in honor of San Sebastian, at the site where the present Gothic-style basilica now stands. At about this time there were around 30,000 Chinese living in Manila and its surrounding areas, but the number swiftly increased due to the galleon trade, which brought in Mexican currency in exchange for Chinese silk and other products (Wickberg 1965). The Chinese, noted for their business acumen, had begun to settle in the district when Manila’s business center shifted there in the early 1900s (originally from the Parian/Chinese ghetto beside Intramuros in the 1500s, to Binondo in the 1850s, to Sta.Cruz at the turn of the century). -

NATIONAL CAPITAL REGION Child & Youth Welfare (Residential) ACCREDITED a HOME for the ANGELS CHILD Mrs

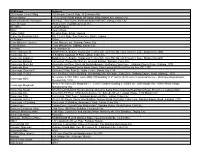

Directory of Social Welfare and Development Agencies (SWDAs) with VALID REGISTRATION, LICENSED TO OPERATE AND ACCREDITATION per AO 16 s. 2012 as of March, 2015 Name of Agency/ Contact Registration # License # Accred. # Programs and Services Service Clientele Area(s) of Address /Tel-Fax Nos. Person Delivery Operation Mode NATIONAL CAPITAL REGION Child & Youth Welfare (Residential) ACCREDITED A HOME FOR THE ANGELS CHILD Mrs. Ma. DSWD-NCR-RL-000086- DSWD-SB-A- adoption and foster care, homelife, Residentia 0-6 months old NCR CARING FOUNDATION, INC. Evelina I. 2011 000784-2012 social and health services l Care surrendered, 2306 Coral cor. Augusto Francisco Sts., Atienza November 21, 2011 to October 3, 2012 abandoned and San Andres Bukid, Manila Executive November 20, 2014 to October 2, foundling children Tel. #: 562-8085 Director 2015 Fax#: 562-8089 e-mail add:[email protected] ASILO DE SAN VICENTE DE PAUL Sr. Enriqueta DSWD-NCR RL-000032- DSWD-SB-A- temporary shelter, homelife Residentia residential care -5- NCR No. 1148 UN Avenue, Manila L. Legaste, 2010 0001035-2014 services, social services, l care and 10 years old (upon Tel. #: 523-3829/523-5264/522- DC December 25, 2013 to June 30, 2014 to psychological services, primary community-admission) 6898/522-1643 Administrator December 24, 2016 June 29, 2018 health care services, educational based neglected, Fax # 522-8696 (Residential services, supplemental feeding, surrendered, e-mail add: [email protected] Care) vocational technology program abandoned, (Level 2) (commercial cooking, food and physically abused, beverage, transient home) streetchildren DSWD-SB-A- emergency relief - vocational 000410-2010 technology progrm September 20, - youth 18 years 2010 to old above September 19, - transient home- 2013 financially hard up, (Community no relative in based) Manila BAHAY TULUYAN, INC. -

Intellectual Property Center, 28 Upper Mckinley Rd

Intellectual Property Center, 28 Upper McKinley Rd. McKinley Hill Town Center, Fort Bonifacio, Taguig City 1634, Philippines Tel. No. 238-6300 Website: http://www.ipophil.gov.ph e-mail: [email protected] Publication Date < March 26, 2018 > 1 ALLOWED MARKS PUBLISHED FOR OPPOSITION .................................................................................................... 2 1.1 ALLOWED NATIONAL MARKS .............................................................................................................................................. 2 Intellectual Property Center, 28 Upper McKinley Rd. McKinley Hill Town Center, Fort Bonifacio, Taguig City 1634, Philippines Tel. No. 238-6300 Website: http://www.ipophil.gov.ph e-mail: [email protected] Publication Date < March 26, 2018 > 1 ALLOWED MARKS PUBLISHED FOR OPPOSITION 1.1 Allowed national marks Application No. Filing Date Mark Applicant Nice class(es) Number 16 March 1 4/2010/00500392 VIBRAM VIBRAM S.P.A. [IT] 25 2010 16 March 2 4/2010/00500393 VIBRAM VIBRAM S.P.A. [IT] 25 2010 16 CHAIN OF 3 4/2014/00015378 December DART INDUSTRIES INC. [US] 35 and41 CONFIDENCE 2014 GOLD LEATHER THE 13 July 4 4/2016/00008161 No. 1 QUALITY KENNO SY YAO [PH] 18 2016 LEATHER 6 October RICHMOND TOP GLASS 5 4/2016/00012180 SK TEMPERED 19 and20 2016 WORKS CORP. [PH] MICHAEL SIYTAOCO DOING 22 BUSINESS UNDER THE 6 4/2016/00015526 December COMPRESSION PRO STYLE EXXEL 25 2016 INTERNATIONAL TRADING [PH] MICHAEL SIYTAOCO DOING 22 BUSINESS UNDER THE 7 4/2016/00015527 December SPORTS + STYLE EXXEL 25 2016 INTERNATIONAL TRADING [PH] SHARP KABUSHIKI KAISHA 8 4/2016/00503367 7 July 2016 BE ORIGINAL also trading as SHARP 7; 9; 10; 11 and28 CORPORATION [JP] HENRY & SONS TRADING 27 October 9 4/2016/00505554 SIP FOR PEACE AND MANUFACTURING 30 2016 COMPANY, INC. -

APM Name Address 350 Arcade Comm'l Bldg 350 Arcade Comm'l Bldg, 15 Sunflower Rd Atrium Makati 1773 CGII-ATRIUM Makati GF Atrium Bldg

APM Name Address 350 Arcade Comm'l Bldg 350 Arcade Comm'l Bldg, 15 Sunflower Rd Atrium Makati 1773 CGII-ATRIUM Makati GF Atrium Bldg. Makati Ave, Makati City Author Solutions TGU tower 6th Floor, TGU Tower, Asiatown Business Park, Lahug, Cebu City Azure Bicutan West service road Bicutan Exit slex BC Office Lopez Building Black Asun's House Caltex SLEX S Luzon Expy, Biñan, Laguna Caltex Southwoods (nav) Blk. 7 Lot 9 Brgy. San Francisco, Biñan, Laguna CCN (Nav) Office Cebu Mitsumi- Canteen Cebu Mitsumi, Inc. Sabang, Danao City Cebu-Mitsumi Cebu Mitsumi Inc, Sabang, Danao City City Hall F.B. Harrison St. Converg Baguio B Building No A, Baguio- AyalaLand TechnoHub, John Hay Special Economic Zone, Baguio City 2600 Convergys - i2 i2 Building, Asiatown IT Park, Lahug, Cebu City Convergys baguio A Building No A, Baguio- AyalaLand TechnoHub, John Hay Special Economic Zone, Baguio City 2600 Convergys Banawa Convergys, Paseo San Ramon, Arcenas Estates, Banawa, Cebu City Convergys Block 44 Ground to 3rd Floor, Block 44 Northbridgeway, Northgate Cyberzone. , Alabang Zapote Road, Alabang, 1770 Convergys Eton 7F, Three Cyberpod Centris North Tower, Eton Centris EDSA cor Quezon Ave. QC 1100 Convergys Glorietta 5 Glorietta 5 Bldg. East St., Ayala Center, Makati City 1224 Convergys I Hub 2 6th - 9th Floor, IHub 2 Building, Northbridgeway, Northgate Cyberzone, Alabang-Zapote Road, Alabang, 1770 Mezzanine & 10th 19th Floors, MDC 100 Building, C.P. Garcia (C-5) corner Eastwood Avenue, Barangay Bagumbayan, Convergys MDC Quezon City, 1110 8th to 11th Floors SM Megamall I.T. Center, Carpark Building C, EDSA cor. Julia Vargas Ave., Wack-Wack Village, Convergys Megamall Mandaluyong City Convergys Nuvali One Evotech Building Nuvali Lakeside Evozone Santa Rosa-Tagaytay Road Santa Rosa, Province of Laguna 4026 Convergys One Ground to 8th Floor, 6796 Ayala Avenue cor. -

City- Fiscal Year 2018-19 Local Streets and Roads Proposed Project List

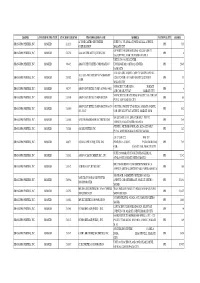

City- Fiscal Year 2018-19 Local Streets and Roads Proposed Project List *The Proposed Project List will be finalized upon the Commission's adoption of the cities and counties eligible for funding. August 3, 2018 Est. Project Est. Project Est Useful Life Est Useful Life Assembly Agency Name County Project Type Title Description Location Senate Districts Start Completion Min Max Districts Resurfacing and repair of street pavement, and restoration of flowlines of associated The Pavement Management program that is funded in FY 18-19 is spread throughout the City of Road Maintenance & Alameda Alameda Pavement Management curb and gutter, in order to extend the life of the street and improve its ridability for Alameda. Streets identified for resurfacing include sections of Alameda Avenue, Fernside Boulevard, 05/2018 11/2018 30 40 18 9 Rehabilitation cyclists and motorists. Harbor Bay Parkway, Park Street and Versailles Avenue. Throughout the City of Alameda - the backlog of repairs includes about 5,000 locations, of which Road Maintenance & Street tree root pruning and sidewalk repair to maintain pedestrian circulation and Alameda Alameda Sidewalks several clusters will be chosen that address the oldest requests, and maximize economy by 07/2018 06/2019 10 70 18 9 Rehabilitation safety, and minimize future damage to the street and sidewalk. aggregating sites in close location to each other. This project consists of asphalt overlay of Evelyn Street from Garfield Avenue to Road Maintenance & Albany Alameda 17/18 Carryover Portland Avenue, for a distance of approximately 600 feet. It will also include base Evelyn Street from Garfield Avenue to Portland Avenue, in the City of Albany 05/2018 09/2018 20 30 15 9 Rehabilitation repair, traffic striping and upgrade of existing curb ramp to meet ADA requirements. -

Shang List 052316

ISSUER STOCKHOLDER TYPE STOCKHOLDER NO STOCKHOLDER NAME ADDRESS NATIONALITY SHARES A. T. DE CASTRO SECURITIES SUITE 701, 7/F AYALA TOWER AYALA AVENUE, SHANG PROPERTIES, INC. BROKER 211123 PH 535 CORPORATION MAKATI CITY G/F FORTUNE LIFE BUILDING 162 LEGASPI ST., SHANG PROPERTIES, INC. BROKER 211238 AAA SOUTHEAST EQUITIES, INC. PH 8 LEGASPI VILL. MAKATI, METRO MANILA UNIT E 2904-A PSE CENTER SHANG PROPERTIES, INC. BROKER 80442 ABACUS SECURITIES CORPORATION EXCHANGE RD., ORTIGAS CENTER PH 2,049 PASIG CITY ALL ASIA SEC. MGMT. CORP. 7/F SYCIP-LAW ALL ALL ASIA SECURITIES MANAGEMENT SHANG PROPERTIES, INC. BROKER 211322 ASIA CENTER 105 PASEO DE ROXAS STREET PH 35 CORP. MAKATI CITY 5/F PACIFIC STAR BLDG., MAKATI SHANG PROPERTIES, INC. BROKER 80257 AMON SECURITIES CORP. A/C#001-54011 PH 6 AVE COR GIL PUYAT MAKATI CITY 5/F PACIFIC STAR BUILDING MAKATI AVE. COR. GIL SHANG PROPERTIES, INC. BROKER 211303 AMON SECURITIES CORPORATION PH 98 PUYAT AVE MAKATI CITY AMON SECURITIES CORPORATION A/C # 10TH FLR., PACIFIC STAR BLDG. MAKATI AVENUE, SHANG PROPERTIES, INC. BROKER 211050 PH 982 001-33247 COR. SEN GIL PUYAT AVENUE, MAKATI, M. M. 3/F ASIAN PLAZA 1, SENATOR GIL J. PUYAT SHANG PROPERTIES, INC. BROKER 211014 ANSCOR HAGEDORN SECURITIES INC PH 285 AVENUE, MAKATI METRO MANILA 9TH FLR., METROBANK PLAZA BLDG SEN GIL J. SHANG PROPERTIES, INC. BROKER 211244 ASI SECURITIES, INC. PH 142 PUYAT AVENUE MAKATI, METRO MANILA A/C-CAXN1222 RM. 207 SHANG PROPERTIES, INC. BROKER 80673 ASIAN CAPITAL EQUITIES, INC. PENINSULA COURT, PASEO DE ROXAS PH 785 COR., MAKATI AVE., MAKATI CITY SUITE 210 MAKATI STOCK EXCHANGE BLDG., SHANG PROPERTIES, INC. -

Palawan Pawsnhop As of August, 2015

Palawan Pawsnhop As of August, 2015 Name of Office/Branch Complete Business Addess Business Hours NATIONAL CAPITAL REGION Mon-Fri Manila City Recto 1548 Capitan Pepe Bldg., C.M. Recto Ave., Sta. Cruz, Manila 8:00 - 5:30 PM Quiapo Unit H&I, G/F #355-359 Quezon Blvd., Quiapo, Manila 7:30 - 6:30 PM V.Mapa 4036 Ramon Magsaysay Blvd., Sta. Mesa, Manila 8:00 - 5:30 PM 2505 P. Guevarra Street, Cor. Blumentritt Street, Brgy. 367, Zone 37, Diii, Sta. Blumentritt 7:30 - 6:30 PM Cruz, Manila Stall #2, South West Phase, LRT United Nations Station, Brgy. 670, Zone 72, Blumentritt 8:00 - 5:30 PM Ermita, Manila Vito Cruz #1, East Phase, Lrt Vito Cruz Station, Taft Ave., Brgy. 728, Malate, Manila 8:00 - 5:30 PM Divisoria 1040 Ilaya Street, Tondo, Manila 8:00 - 5:30 PM España #1660 España Blvd., Brgy. 454, Sampaloc, Manila 8:00 - 5:30 PM Pritil 1738-D Juan Luna Street, Tondo, Manila 8:00 - 5:30 PM Pedro Gil 907 Pedro Gil Street, Brgy. 675, Zone 73, Ermita 8:00 - 5:30 PM G/F Stall 6, Block H, LRT 1 Central Terminal Station, Arroceros Street, Brgy. 659, LRT 1 Central Station 8:00 - 5:30 PM Zone 71, Ermita, Manila Recto UE # 2099 Claro M. Recto, Sampaloc, Manila 8:00 - 5:30 PM Punta Sta. Ana # 2544 J.Posadas Street, Sta. Ana, Manila 8:00 - 5:30 PM Carriedo Stall #8,Blk C, LRT Carriedo Stn, Brgy. 306, Zone 30, Sta. Cruz , Manila 7:30 - 7:00 PM Sta.Ana Manila 2027 Pedro Gil Street Sta. -

Directory of Swdas Valid

List of Social Welfare and Development Agencies (SWDAs) with VALID REGISTRATION, LICENSED TO OPERATE AND ACCREDITATION CERTIFICATES per AO 17 s. 2008 as of January 11, 2012 Name of Agency/ Contact Registration Licens Accred. # Programs and Services Service Clientele Area(s) of Address /Tel-Fax Nos. Person # e # Delivery Operation Mode NATIONAL CAPITAL REGION (NCR) Children & Youth Welfare (Residential) A HOME FOR THE ANGELS Mrs. Ma. DSWD-NCR-RL- SB-2008-100 adoption and foster care, homelife, Residentia 0-6 months old NCR CHILD CARING FOUNDATION, Evelina I. 000086-2011 September 23, social and health services l Care surrendered, INC. Atienza November 21, 2011 2008 to abandoned and 2306 Coral cor. Augusto Francisco Executive to November 20, September 22, foundling children Sts., Director 2014 2011 San Andres Bukid, Manila Tel. #: 562-8085 Fax#: 562-8089 e-mail add:[email protected] ASILO DE SAN VICENTE DE Sr. Nieva C. DSWD-NCR RL- DSWD-SB-A- temporary shelter, homelife services, Residentia residential care -5- NCR PAUL Manzano 000032-2010 000409-2010 social services, psychological services, l care and 10 years old (upon No. 1148 UN Avenue, Manila Administrator July 16, 2010 to July September 20, primary health care services, educational community- admission) Tel. #: 523-3829/523-5264; 522- 15, 2013 2010 to services, supplemental feeding, based neglected, 6898/522-1643 September 19, vocational technology program surrendered, Fax # 522-8696 2013 (commercial cooking, food and abandoned, e-mail add: [email protected] (Residential beverage, transient home) emergency physically abused, care) relief streetchildren - vocational DSWD-SB-A- technology progrm 000410-2010 - youth 18 years September 20, old above 2010 to - transient home- September 19, financially hard up, 2013 no relative in (Community Manila based) Page 1 of 332 Name of Agency/ Contact Registration Licens Accred. -

Integration of Actual, Virtual and Augmenting Realities of The

Recognizing Frames and Constructing Realities: The Implications of the Integration of Actual, Virtual and Augmenting Realities of the Optical Mediascape of Quiapo By Brian S. Bantugan Introduction Quiapo, in the Philippines, has long been associated with folk culture and much of it revolves around the Catholic Quiapo Church. Wikipedia describes it first and foremost as “a well known district of old Manila, Philippines, and a place which offers cheap prices on items ranging from electronics to native handicrafts,” a home of the Black Nazarene, and the seat of the politically historical Plaza Miranda (en.wikipedia.org/wiki/Quiapo ) where an “army of fortune tellers and stores offering herbal products” ply their services and products, respectively. It’s glory as a center of “trade, fashion, art, higher learning and the elites of Manila” slowly faded away after the construction of the Light Rail Transit that darkened the main street, Rizal Boulevard, and the surrounding commercial districts of Avenida, Binondo, Sta. Cruz, Escolta. But Quiapo Church is no longer the sole cultural center of Quiapo. The Golden Mosque of the Muslims on the other side of Quezon Boulevard, just across Quiapo Church, has also become a center of a distinct culture that is more linked to media and digital economy. The emergence of this “other” side of Quiapo brought about by the proliferation of the optical media economy now renders it a case that goes beyond 1 traditionalism. Its optical media-driven economy has already transformed a local landscape and economy. Aside from “bandits”, Wikipedia identified “piracy” as “the biggest problem underlying the district” as its public streets have become open markets of “pirated movies, software and pornographic videos” (en.wikipedia.org/wiki/Quiapo ). -

Report Name:Philippine Broiler Market Trends and Prospects

Voluntary Report – Voluntary - Public Distribution Date: March 31,2020 Report Number: RP2020-0035 Report Name: Philippine Broiler Market Trends and Prospects Country: Philippines Post: Manila Report Category: Poultry and Products, Product Brief Prepared By: Approved By: Ryan Bedford Report Highlights: Boosted by rising incomes, a growing middle class, and robust demand in food service and retail, the Philippine broiler sector has surged over the past decade and is set to continue in the coming years. The United States Department of Agriculture (USDA), Foreign Agricultural Service (FAS) in Manila, Philippines commissioned the University of Asia and the Pacific (UA&P) to conduct a broad study on the Philippine broiler market, emerging trends, and prospects for future growth. THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Introduction The Philippines is a fast-growing emerging market with a service-based economy and a population of 109 million in a combined landmass the size of Arizona. With increasing incomes and a burgeoning middle class, Filipinos are consuming more protein while also showing increasing preference for poultry. While pork had traditionally been the main protein source for Philippine diets, in 2019, chicken overtook pork for the first time in per capita consumption. As such and despite still present market access constraints limiting access to U.S. corn and poultry products, the Philippines continues to present long-term growth prospects for U.S. suppliers throughout the value chain, including in the form of agricultural inputs to support local poultry production, ingredients used by the local meat processing industry, and finished, consumer-ready products sold to retailers and food service providers. -

Website Updating Acas List of Branches with Address.Xlsx

Metropolitan Bank & Trust Company List of Branches as of June 30, 2017 BRANCH NAME ADDRESS BARANGAY DISTRICT CITY/MUNICIPALITY PROVINCE 1 168 MALL (NEW DIVISORIA MARKET) 6/F UNIT 607, 168 SHOPPING MALL, STA. ELENA/SOLER STREETS BINONDO MANILA METRO MANILA 2 20TH AVENUE‐CUBAO NO. 100 20TH AVENUE TAGUMPAY CUBAO QUEZON CITY METRO MANILA 3 999 MALL /TABORA 3/F 999 MALL, SOLER STREET BINONDO MANILA METRO MANILA 4 A. ARNAIZ‐SAN LORENZO 908 A. ARNAIZ AVENUE MAKATI CITY METRO MANILA 5 A. LACSON AVENUE‐SAMPALOC MOTHER ROSARIO BLDG., 1243 A.H. LACSON AVENUE SAMPALOC MANILA METRO MANILA 6 A. MACEDA 1174 A. MACEDA STREET SAMPALOC MANILA METRO MANILA 7 ACACIA‐AYALA ALABANG UNIT 101, ALABANG BUSINESS TOWER, ACACIA AVENUE, MADRIGAL BUSINESS PARK ALABANG MUNTINLUPA CITY METRO MANILA 8 ACROPOLIS METROBANK BUILDING, E. RODRIGUEZ AVENUE, ACROPOLIS QUEZON CITY METRO MANILA 9 ADB EXT. OFFICE 6 ADB AVENUE 1501 MANDALUYONG CITY METRO MANILA 10 ADDITION HILLS 204 WILSON STREET SAN JUAN CITY METRO MANILA 11 ADRIATICO ROTHMAN INN HOTEL, 1633 ADRIATICO STREET MALATE MANILA METRO MANILA 12 AGOO LA UNION STA. BARBARA NATIONAL HIGHWAY AGOO LA UNION 13 AGUINALDO‐IMUS AGUINALDO HIGHWAY TANZANG LUMA IMUS CAVITE 14 AGUIRRE ‐ SALCEDO 235 CATTLEYA CONDOMINIUM BUILDING, SALCEDO STREET, LEGASPI VILLAGE MAKATI CITY METRO MANILA 15 AGUSAN DEL SUR BONIFACIO STREET SAN FRANCISCO AGUSAN DEL SUR 16 ALABANG VALDEZ BUILDING, MONTELLANO STREET ALABANG MUNTINLUPA CITY METRO MANILA 17 ALAMINOS, PANGASINAN QUEZON AVENUE (NATIONAL ROAD) POBLACION ALAMINOS CITY PANGASINAN 18 ALFARO G/F ALPAP BUILDING, 140 LP LEVISTE STREET, SALCEDO VILLAGE MAKATI CITY METRO MANILA 19 ANDA CIRCLE‐PORT AREA KNIGHTS OF RIZAL BUILDING, BONIFACIO DRIVE PORT AREA MANILA METRO MANILA 20 ANGELES ‐ BALIBAGO MCARTHUR HIGHWAY BALIBAGO ANGELES CITY PAMPANGA 21 ANGELES ‐ MAIN HENSON STREET ANGELES CITY PAMPANGA 22 ANGELES ‐ MARQUEE MALL LEVEL 1, SPACE 1002, MARQUEE MALL, FRANCISCO G. -

Getting Options

GETTING OPTIONS A Handbook on Getting Education, Training and Work Options for Persons with Disabilities at the National Capital Region GETTING OPTIONS Copyright 2014 National Council on Disability Affairs All rights reserved Disclaimer Reproduction of material of this publication for sale or other commercial purposes, including publicity and advertising, is prohibited without the written permission from the National Council on Disability Affairs (NCDA). Application for permission should be addressed to the Executive Director with statement of purpose and extent of production. Published by: National Council on Disability Affairs NCDA Bldg., Isidora Street, Brgy. Holy Spirit, 1127 Quezon City 2 ISBN 978-621-95138-3-8 GETTING OPTIONS GETTING OPTIONS A Handbook on Getting Education, Training and Work Options for Persons with Disabilities at the National Capital Region 3 GETTING OPTIONS ACKNOWLEDGMENT: This Handbook is part of the fulfilment of my Re-Entry Action Plan for Australian Scholarship Awards on Master of Social Science Specialization in Human Service Management at the University of Newcastle, Australia. The Handbook aims to let the students, parents and service providers know where and how to get available resources in education, training and employment for persons with disabilities at the National Capital Region. Added also, are practical tips on how and what to prepare when getting these opportunities. I would like to sincerely thank NCDA Management for their support led by Acting Executive Director Carmen Reyes-Zubiaga. May I also acknowledge, Deputy Executive Director Mateo A. Lee, Jr., for motivating me as my coach during the initial development of this Handbook. Let me also thank my ever supportive Division Chief of Technical Cooperation Division Ms.