This Time It's Personal: from Consumer to Co-Creator

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Most Contagious 2011

MOST CONTAGIOUS 2011 Cover image: Take This LoLLipop / Jason Zada most contagious / p.02 / mosT ConTAGIOUS 2011 / subsCripTion oFFer / 20% disCounT FuTure-prooFing your brain VALid unTiL 9Th JANUARY 2012 offering a saving of £200 gBP chapters / Contagious exists to find and filter the most innovative 01 / exercises in branding, technology, and popular culture, and movemenTs deliver this collective wisdom to our beloved subscribers. 02 / Once a year, we round up the highlights, identify what’s important proJeCTs and why, and push it out to the world, for free. 03 / serviCe Welcome to Most Contagious 2011, the only retrospective you’ll ever need. 04 / soCiaL It’s been an extraordinary year; economies in turmoil, empires 05 / torn down, dizzying technological progress, the evolution of idenTiTy brands into venture capitalists, the evolution of a generation of young people into entrepreneurs… 06 / TeChnoLogy It’s also been a bumper year for the Contagious crew. Our 07 / Insider consultancy division is now bringing insight and inspiration daTa to clients from Kraft to Nike, and Google to BBC Worldwide. We 08 / were thrilled with the success of our first Now / Next / Why event augmenTed in London in December, and are bringing the show to New York 09 / on February 22nd. Grab your ticket here. money We’ve added more people to our offices in London and New 10 / York, launched an office in India, and in 2012 have our sights haCk Culture firmly set on Brazil. Latin America, we’re on our way. Get ready! 11 / musiC 2.0 We would also like to take this opportunity to thank our friends, supporters and especially our valued subscribers, all over the 12 / world. -

What's Next for Ukpound Shops?

February 3, 2015 February 3, 2015 What’s Next For UK Pound Shops? Major UK pound shop chains have seen revenues surge in the post-recession years. The economic slump and the Woolworths failure paved the way for this segment’s rapid expansion of stores. With further expansion expected, we think the segment is looking increasingly crowded. Some players are now eying international markets in their bid for growth. DEBORAH WEINSWIG Executive Director–Head Global Retail & Technology Fung Business Intelligence Centre [email protected] New york: 646.839.7017 Fung Business Intelligence Centre (FBIC) publication: UK POUND SHOPS 1 Copyright © 2015 The Fung Group, All rights reserved. February 3, 2015 What’s Next For UK Pound Shops? THE POUND SHOP BOOM Variety-store retailers have proliferated rapidly in the UK, mirroring the store-expansion boom of discount grocery chains (notably Aldi and Lidl), as the low-price, no-frills formula has found particular resonance in Britain’s era of sluggish economic growth. This retail segment encompasses chains like Poundland, 99p Stores and Poundworld, which sell all of their products at fixed price points. Similar to the dollar chains Dollar General and Family Dollar in the US, everything in the pound stores sells for £1 (or 99p) and the goods are bought cheaply in bulk. The group also includes chains with more flexible pricing schemes. Those include B&M Bargains, Home Bargains and Poundstretcher. For both types of stores, the offerings are heavy on beauty and personal care, household fast-moving consumer goods (FMCGs) and food and beverages (particularly confectionery). Other categories typically include do-it-yourself (DIY) and automotive accessories, pet products and seasonal goods. -

Consumer Protection List 2019

Coimisiun um Competition and lomoiocht ogus Consumer Protection Cosoint Tomholtéiri Commission Consumer Protection List 2019 In accordance with section 86 of the Consumer Protection Act 2007, as amended. 1 January 2019 to 31 December 2019 1 Consumer protection enforcement concluded in 2019 1. Convictions/fines, penalties/compensations/compensation Orders Total number of convictions: Two On 21 February 2019, at Galway District Court, following an investigation by the CCPC Kevin McGann was convicted of providing false information to a consumer in relation to the usage or prior history of a motor vehicle, namely the motor vehicle’s previous crash history, which caused the consumer to make a transactional decision that they would not otherwise have made, thereby engaging in a misleading commercial practice which is a prohibited act or practice within the meaning of section 67 of the Consumer Protection Act 2007. The judge convicted him on two separate offences pursuant to section 47 of the Consumer Protection Act 2007. The judge ordered: Kevin McGann serve a four-month sentence suspended for 12 months. Kevin McGann pay a compensation order of €7,405.85 in favour of the consumer which was the full amount sought. Kevin McGann pay a costs order of €9,500 in favour of the CCPC, which was the full amount sought. On 9 July 2019, at Dublin District Court 8, following an investigation by the CCPC, Mark Healy was convicted of providing false information to a consumer in relation the motor vehicle’s previous crash history, and caused the consumer to make a transactional decision that the they would not otherwise have made, thereby engaging in a misleading commercial practice which is a prohibited act or practice within the meaning of section 67 of the Consumer Protection Act 2007. -

Hair: the Performance of Rebellion in American Musical Theatre of the 1960S’

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Winchester Research Repository University of Winchester ‘Hair: The Performance of Rebellion in American Musical Theatre of the 1960s’ Sarah Elisabeth Browne ORCID: 0000-0003-2002-9794 Doctor of Philosophy December 2017 This Thesis has been completed as a requirement for a postgraduate research degree of the University of Winchester MPhil/PhD THESES OPEN ACCESS / EMBARGO AGREEMENT FORM This Agreement should be completed, signed and bound with the hard copy of the thesis and also included in the e-copy. (see Thesis Presentation Guidelines for details). Access Permissions and Transfer of Non-Exclusive Rights By giving permission you understand that your thesis will be accessible to a wide variety of people and institutions – including automated agents – via the World Wide Web and that an electronic copy of your thesis may also be included in the British Library Electronic Theses On-line System (EThOS). Once the Work is deposited, a citation to the Work will always remain visible. Removal of the Work can be made after discussion with the University of Winchester’s Research Repository, who shall make best efforts to ensure removal of the Work from any third party with whom the University of Winchester’s Research Repository has an agreement. Agreement: I understand that the thesis listed on this form will be deposited in the University of Winchester’s Research Repository, and by giving permission to the University of Winchester to make my thesis publically available I agree that the: • University of Winchester’s Research Repository administrators or any third party with whom the University of Winchester’s Research Repository has an agreement to do so may, without changing content, translate the Work to any medium or format for the purpose of future preservation and accessibility. -

The Competition and Consumer Protection Commission

CompetitionContents and Consumer Protection Commission Annual Report 2019 CCPC ANNUAL REPORT 2019 i Contents 2019 in numbers 2 From the Chairperson 4 Making an impact in priority markets 6 Strategic Goal 1 16 Strategic Goal 2 26 Strategic Goal 3 36 Strategic Goal 4 46 Corporate information 52 Appendix 1: Organisational chart 58 Appendix 2: Consumer protection list 59 Appendix 3: Statement on internal control 67 CCPC ANNUAL REPORT 2019 1 2019 in numbers First 41,589 criminal prosecution for consumers contacted gun- jumping in relation 1,843,537 our helpline to to a merger visits to our website seek information about 282,857 their rights and personal visits to our financial finance products product cost and services comparisons on ccpc.ie 2 traders were convicted of selling crashed cars 4 following a criminal appearances before prosecution Joint Oireachtas Committees 39 positions were filled 32 across the organisation 3,479 Fixed Payment Notices through recruitment, employees in issued to traders for internal promotions and our organisations across breaches of consumer mobility programme 5,419 Ireland benefitted from protection law subscribers to our Money skills for life our consumer financial education newsletter programme 2 First 41,589 criminal prosecution for consumers contacted gun- jumping in relation 1,843,537 our helpline to to a merger visits to our website seek information about 282,857 their rights and personal visits to our financial finance products product cost and services comparisons on ccpc.ie 2 traders were convicted of -

Kaiser Chiefs Never Miss a Beat Mp3, Flac, Wma

Kaiser Chiefs Never Miss A Beat mp3, flac, wma DOWNLOAD LINKS (Clickable) Genre: Rock Album: Never Miss A Beat Country: Australia Released: 2008 Style: Indie Rock MP3 version RAR size: 1141 mb FLAC version RAR size: 1602 mb WMA version RAR size: 1925 mb Rating: 4.5 Votes: 395 Other Formats: DMF ADX VOX MOD AAC RA MPC Tracklist Hide Credits Never Miss A Beat Backing Vocals – Anne-Marie Chirema, Lily Allen, Lou Hayter, Sarah Jones Engineer 1 3:10 [Assistant] – Tom Morris Engineer [Mix Engineer] – John O'MahonyMastered By – John Davis Mixed By – Andy WallaceMixed By [Assistant] – Jan Petrov Sooner Or Later 2 3:49 Mastered By – Simon FrancisMixed By – Eliot James Never Miss A Beat (Yuksek Remix) 3 Remix – Yuksek Never Miss A Beat (RAC Remix) 4 Remix – André Allen Anjos Companies, etc. Licensed From – B-Unique Records Credits Engineer – Eliot James, Mark Ronson Engineer [Assistant] – Raj Das, Samuel Navel, Tim Goalen Producer – Eliot James, Mark Ronson Written-By – White*, Baines*, Hodgson*, Wilson*, Rix* Barcode and Other Identifiers Barcode: 9341004002494 Other versions Category Artist Title (Format) Label Category Country Year Kaiser Never Miss A Beat (CD, B-Unique BUN145CD BUN145CD Europe 2008 Chiefs Single) Records, Polydor Kaiser Never Miss A Beat B-Unique none none UK 2008 Chiefs (CDr, Single, Promo) Records Kaiser Never Miss A Beat (7", B-Unique BUN1457 BUN1457 UK 2008 Chiefs Single) Records Kaiser Never Miss A Beat B-Unique none none UK 2008 Chiefs (CDr, Single, Promo) Records Kaiser Never Miss A Beat (CD, B-Unique UK & BUN145CDP BUN145CDP 2008 Chiefs Single, Promo) Records Europe Related Music albums to Never Miss A Beat by Kaiser Chiefs Miss Mee Feat. -

Henry Street Report

RESEARCH THE HENRY STREET REPORT TRENDS ANALYSIS OUTLOOK THE HENRY STREET REPORT RESEARCH SUMMARY HENRY STREET projected to rise by 2.5% in 2017 conscious Irish consumer, a behavioural With 1 GPO Buildings now let agreed, the spread over ground and upper ground 1. Growth in real incomes is Introduction according to the Economic and Social legacy of the recent recession. Whether only building available on a new lease is levels, a reduction of a third compared supporting an expansion in Situated in the north city centre, the retail Research Institute (ESRI). In the context this changes as real incomes grow 45 Henry Street, which is being marketed to its previous combined footprint. The consumer spending remains to be seen. The fall in the value thoroughfare known as Henry Street is of a 0.6% forecast for general inflation, at a rent of €3,660 psm. Regarding the new larger unit is the flagship store for its comprised of a single pedestrianised the growth in earnings will boost real of Sterling against the Euro since the shadow letting market, 52 Henry is let Topshop brand in Ireland, with the Zone 2. Prime Zone A Henry Street street bounded by O’Connell Street to incomes and thus consumer spending Brexit referendum is providing a further agreed while a new tenant is being sought A rent standing at €4,155 psm. The rents are now in the order of the east and Jervis Street to the west. power. Also, net migration returned to incentive for cross-border shopping. for 17 Henry Street. -

SOUVENIR MARKETING in TOURISM RETAILING SHOPPER and RETAILER PERCEPTIONS by KRISTEN K

SOUVENIR MARKETING IN TOURISM RETAILING SHOPPER AND RETAILER PERCEPTIONS by KRISTEN K. SWANSON, B.S., M.S. A DISSERTATION IN CLOTHING, TEXTILES, AND MERCHANDISING Submitted to the Graduate Faculty of Texas Tech University in Partial Fulfillment of the Requirements for the Degree of DOCTOR OF PHILOSOPHY Approved Accepted August, 1994 1 o t.i.H" ^b^/ •b C'J ® 1994 Kristen Kathleen Swanson ACKNOWLEDGEMENTS The researcher would like to thank Dr. Patricia Horridge, advisor and friend, for her guidance and support at Texas Tech University. Dr. Horridge continually gives of herself to encourage and inspire her students. Additionally, this researcher would like to thank Dr. Claud Davidson, Dr. linger Eberspacher, Dr. Lynn Huffman, and Dr. JoAnn Shroyer for allowing this exploratory research to take place, and keep the study grounded. Each committee member took time to listen, evaluate and strengthen this study. Thank you to Tom Combrink, Arizona Hospitality Research and Resource Center, Northern Arizona University, for assisting with the statistical analysis. Further, this researcher would like to thank all of the graduate students who came before her, for it is by their accomplishments and mistakes that the present study was enhanced. The researcher would like to thank her husband James Power, her parents Richard and Bonnie Swanson, and Bill and Ruby Power, and special friends Chris and Judy Everett for their constant support in accomplishing this study and the degree which comes with the work. 11 TABLE OF CONTENTS ACKNOWLEDGEMENTS ii ABSTRACT vii LIST OF TABLES ix CHAPTER L INTRODUCTION 1 Theoretical Framework 2 Statement of Problem 3 Purposes of the Study 6 Research Objectives and Questions 7 Research Objectives 7 Research Questions 8 Limitations 9 Definition of Terms 9 II. -

Jan Bormeth Vilhelmsen Og Ma

0 ucvbnmqwertyuiopåasdfghjklæøzxcv Executive Summary The master thesis at hand is a study of the Danish retail store chain Tiger and EQT’s decision to acquire a 70% stake in the company. The aim in this thesis is twofold. Firstly, a valuation of Zebra per June 30, 2015, will be conducted. Secondly, an analysis of the value creation during EQT’s ownership period is performed. The main objective in this thesis is to estimate the fair Enterprise Value per June 30, 2015, through a DCF-analysis. Based on Zebra’s strategic position and its historical financial performance, the expected future earnings and cash flow generations were forecasted and resulted in an Enterprise Value of DKK 8,864 million from which the Group accounted for DKK 8,350 million and the Japanese Joint Venture for DKK 515 million. Based on these figures, Zebra’s fair value of equity comprises DKK 7,789 million. Of this figure, EQT’s share of the equity amounts to DKK 5,219 million and DKK 2,874 million when correcting for the 50/50 owned subsidiaries. At EQT’s entry in the beginning of 2013, the purchase price for its stake was DKK 1,600 million, according to different sources, resulting in an IRR for EQT on 26.48% per year. This IRR is satisfying since it is above the expected return for Private Equity investments which historically has a threshold for an IRR on over 20% per year, and in more recent time a threshold between 12-17% per year. The objective in the second part of this thesis is to analyze how EQT has created or destroyed value during its ownership period based on an IRR for Zebra, excluding the Japanese Joint Venture. -

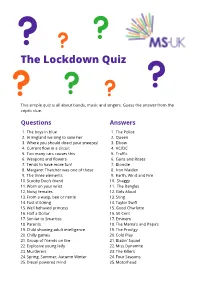

The Lockdown Quiz

The Lockdown Quiz This simple quiz is all about bands, music and singers. Guess the answer from the criptic clue. Questions Answers 1. The boys in blue 1. The Police 2. In England we sing to save her 2. Queen 3. Where you should direct your sneezes! 3. Elbow 4. Current flow in a circuit 4. AC/DC 5. Too many cars causes this 5. Traffic 6. Weapons and flowers 6. Guns and Roses 7. Tends to have more fun! 7. Blondie 8. Margaret Thatcher was one of these 8. Iron Maiden 9. The three elements 9. Earth, Wind and Fire 10. Scooby Doo’s friend 10. Shaggy 11. Worn on your wrist 11. The Bangles 12. Noisy females 12. Girls Aloud 13. From a wasp, bee or nettle 13. Sting 14. Fast stitching 14. Taylor Swift 15. Well behaved princess 15. Good Charlotte 16. Half a Dollar 16. 50 Cent 17. Similar to Smarties 17. Eminem 18. Parents 18. The Mama’s and Papa’s 19. Child showing adult intelligence 19. The Prodigy 20. Chilly games 20. Cold Play 21. Group of friends on fire 21. Blazin’ Squad 22. Explosive young lady 22. Miss Dynamite 23. Murderers 23. The Killers 24. Spring, Summer, Autumn Winter 24. Four Seasons 25. Diesel powered mind 25. Motorhead Questions Answers 26. Cold marsupials 26. Arctic Monkeys 27. Out of focus 27. Blur 28. Also known as a goat-pea 28. Black Eyed Peas 29. To make the boys wink 29. P!nk 30. Ten divided by two 30. Five 31. German emperor and ruler of the village 31. -

Starlight - Repertoire

STARLIGHT - REPERTOIRE '10s Shape Of You – Ed Sheeran Uptown Funk - Mark Ronson feat. Bruno Mars Love Me Like You Do - Ellie Goulding King - Years & Years Only Girl (In The World) - Rihanna Price Tag - Jessie J Rolling In The Deep – Adele Locked Out Of Heaven - Bruno Mars Get Lucky - Daft Punk Happy - Pharrell Williams Wake Me Up- Avicii [email protected] '00s Mr. Brightside - The Killers Valerie – Amy Winehouse I'm a believer - Smash Mouth Sex On Fire - Kings Of Leon Teenage Dirtbag – Wheatus I Predict A Riot - Kaiser Chiefs Mercy – Duffy She's So Lovely - Scouting For Girls Chelsea Dagger – The Fratellis Are You Gonna Be My Girl? - Jet Take Me Out - Franz Ferdinand Seven Nation Army – The White Stripes Naïve- The Kooks I kissed A Girl - Katy Perry Dakota- Stereophonics [email protected] '90s All The Small Things- Blink 182 What’s Up – 4 Non Blondes Save Tonight- Eagle Eyed Cherry Breakfast at Tiffany’s- Deep Blue Something Song 2 – Blur Place Your Hands – Reef Let Me Entertain You – Robbie Williams I'll be there for you - The Rembrants Smells Like Teen Spirit - Nirvana Are You Gonna Go My Way? - Lenny Kravitz Hard To Handle - Black Crowes [email protected] '80s Living On A Prayer – Bon Jovi Walking On Sunshine - Katrina & The Waves Billie Jean – Michael Jackson Don't Stop Believin' - Journey Footloose - Kenny Loggins Faith - George Michael Kiss – Prince Summer Of '69 - Bryan Adams Sweet Child O' Mine - Guns And Roses Call Me - Blondie Wake Me Up Before You Go-Go – Wham! Shake a Tail Feather - Ray Charles Take On Me - A-ha 500 Miles – The Proclaimers A Town Called Malice - The Jam I Love Rock & Roll - Joan Jett The Power Of Love – Huey Lewis and The News [email protected] '70s Don't Stop Me Now – Queen Highway To Hell – AC/DC All Right Now – Free Play That Funky Music - Wild Cherry Sweet Home Alabama – Lynyrd Skynyrd Dancing Queen – ABBA YMCA – Village People You’re The One That I Want – J. -

Song Artist/Performed By

SONG ARTIST/PERFORMED BY Africa Toto Ain’t Nobody Chaka Khan All About That Bass Megan Trainor All Star Smash Mouth All You Need Is Love The Beatles At Last Etta James Beneath Your Beautiful Labrinth, ft. Emeli Sande Blackbird The Beatles Blinding Lights The Weeknd Bohemian Rhapsody Queen Boys Will Be Boys The Ordinary Boys Brown Eyed Girl Van Morrison Call Me Maybe Carly Rae Jepsen Chelsea Dagger The Fratellis Crazy In Love Beyonce Dancing In The Moonlight Toploader Despacito Luis Fonsi, ft. Daddy Yankee Don’t Stop Believing Journey Don’t Stop Me Now Queen Don’t You Want Me The Human League Eye Of The Tiger Survivor Fascination Alphabeat Forget You CeeLo Green Girls Just Want To Have Fun Cyndi Lauper God Only Knows The Beach Boys Hallelujah Leonard Cohen Happy Pharrell Williams Havana Camila Cabello Hello Adele Help! The Beatles High Hopes Panic! At The Disco Hit Me Baby One More Time Britney Spears I Got You (I Feel Good) James Brown I’m A Believer The Monkees I Want You Back The Jackson 5 Jump Van Halen Just Dance Lady Gaga Little Things One Direction Living On A Prayer Bon Jovi Locked Out Of Heaven Bruno Mars Message In A Bottle The Police Mr Blue Sky Electric Light Orchestra Mr Brightside The Killers Perfect Ed Sheeran Rather Be Clean Bandit Rolling In The Deep Adele Ruby The Kaiser Chiefs Sandstorm Darude September Earth, Wind & Fire Seven Nation Army The White Stripes Shake It Off Taylor Swift Shotgun George Ezra Shut Up And Dance Walk The Moon Signed, Sealed, Delivered Stevie Wonder Sir Duke Stevie Wonder Skyfall Adele Sk8er Boi