W. John Carpenter Irving, Texas

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Best Western Innsuites Hotel & Suites

Coast to Coast, Nation to Nation, BridgeStreet Worldwide No matter where business takes you, finding quality extended stay housing should never be an issue. That’s because there’s BridgeStreet. With thousands of fully furnished corporate apartments spanning the globe, BrideStreet provides you with everything you need, where you need it – from New York, Washington D.C., and Toronto to London, Paris, and everywhere else. Call BridgeStreet today and let us get to know what’s essential to your extended stay 1.800.B.SSTEET We’re also on the Global Distribution System (GDS) and adding cities all the time. Our GDS code is BK. Chek us out. WWW.BRIDGESTREET.COM WORLDWIDE 1.800.B.STREET (1.800.278.7338) ® UK 44.207.792.2222 FRANCE 33.142.94.1313 CANADA 1.800.667.8483 TTY/TTD (USA & CANADA) 1.888.428.0600 CORPORATE HOUSING MADE EASY ™ More than just car insurance. GEICO can insure your motorcycle, ATV, and RV. And the GEICO Insurance Agency can help you fi nd homeowners, renters, boat insurance, and more! ® Motorcycle and ATV coverages are underwritten by GEICO Indemnity Company. Homeowners, renters, boat and PWC coverages are written through non-affi liated insurance companies and are secured through the GEICO Insurance Agency, Inc. Some discounts, coverages, payment plans and features are not available in all states or all GEICO companies. Government Employees Insurance Co. • GEICO General Insurance Co. • GEICO Indemnity Co. • GEICO Casualty Co. These companies are subsidiaries of Berkshire Hathaway Inc. GEICO: Washington, DC 20076. GEICO Gecko image © 1999-2010. © 2010 GEICO NEWMARKET SERVICES ublisher of 95 U.S. -

Clientwise Visitor's Guide

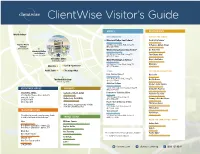

ClientWise Visitor’s Guide HOTELS RESTAURANTS Westin Irving * RECOMMENDED ACROSS THE STREET Marriott Dallas Las Colinas* Cork & Pig Tavern* marriott.com/dallas corkandpig.com Toyota Music 223 West Las Colinas Blvd., Irving, TX El Famoso (Diner & Bar) Factory (972) 831-0000 elfamosodiner.com & Restaurants Westin Irving Convention Center* Go Fish Poke Marriott Dallas marriott.com/westin gofshpoketexas.com Las Colinas* 500 W. Las Colinas Blvd., Irving, TX * Approx. 0.4 miles The Ginger Man (972) 505-2900 thegingerman.com ClientWise Offce * Hugo’s Invitados at Williams Square Omni Mandalay Las Colinas omnihotels.com hugosinvitados.com 221 East Las Colinas Blvd., Irving, TX Olivella’s* Olivella’s Cork & Pig Tavern* (972) 556-0800 olivellas.com Pacifc Table* The† Ginger Man OTHER TOYOTA MUSIC FACTORY Four Seasons Resort Bar Louie fourseasons.com barlouie.com 4150 N MacArthur Blvd., Irving, TX The Omni Mandalay* Boi Na Braza Approx. 0.5 miles (972) 717-0700 boinabraza.com Aloft Las Colinas Gloria’s Latin Cuisine marriott.com/aloft gloriascuisine.com CLIENTWISE OFFICE AIRPORTS 122 E. John Carpenter Freeway, Irving, TX Grimaldi’s Pizzeria (972) 717-6100 grimaldispizzeria.com ClientWise Offce Dallas/Fort Worth (DFW) Homewood Suites by Hilton Pachecho Taco Bar 5215 North O’Connor Blvd., Suite 320 dfwairport.com hilton.com pachecotacobar.com Irving, TX 75039 4300 Wingren Drive, Irving, TX Dallas Love Field (DAL) (972) 556-0665 Stumpy’s Hatchet House (914) 244-1545 dallas-lovefeld.com stumpyshh.com (800) 732-0876 Hyatt Place Dallas Las Colinas hyatt.com The Green Gator Both airports are approximately 11 miles greengatorrestaurants.com from the ClientWise offce. -

Toyota Music Factory.Pdf

More than music! Exceptional sounds, and tastes. A true regional destination. Events drawing from far and wide. Making everyday special! Smiles, laughter and excitement. Where people love to come time and time again. Be part of it! Building the best of times. Drawing the crowds Toyota Music Factory is the area’s premier entertainment and lifestyle center perfectly located just north of O’Connor between U.S. Highway 114 and Las Colinas Boulevard, Toyota Music Factory is easily accessible from Dallas, Fort Worth, a multitude of suburbs and DFW Airport and Love Field. Along with this ideal location, it’s been designed with specific features to draw thousands of visitors for one unforgettable experience after the next: THE PAVILION AT TOYOTA MUSIC FACTORY This state-of-the-art 8,OOO capacity convertible Performance Hall — operated by the global leader in concerts, Live Nation — regularly showcases artists from around the world. TEXAS LOTTERY PLAZA Gigantic open-air plaza with outdoor stage brings in crowds for regularly-programmed live music, festivals, fashion shows, movies, open-air markets and more. 400,OOO SQUARE FEET OF BARS, RESTAURANTS AND ENTERTAINMENT n More than 20 RBE concepts n Corporate campus of Ethos International. MAMA TRIED ALAMO DRAFT HOUSE Get your outlaw and your blue Seven screens for new release grass on with your friends— movies, family and independent and even your dog—at the films, as well as signature biggest, newest country bar and repertory programming. honky tonk in town. Experiences MERCY WINE BAR BAR LOUIE The award-winning Mercy Wine Experience your local bar with Bar goes even further. -

Cistercian Preparatory School: the First 50 Year

CISTERCIAN PREPARATORY SCHOOL THE FIRST 50 YEARS 1962 2012 David E. Stewart Headmasters CISTercIAN PreparaTORY SCHOOL 1962 - 2012 Fr. Damian Szödényi, 1962 - 1969 Fr. Denis Farkasfalvy, 1969 - 1974 Fr. Henry Marton 1974 - 1975 Fr. Denis Farkasfalvy, 1975 - 1981 Fr. Bernard Marton, 1981 - 1996 Fr. Peter Verhalen ’73, 1996 - 2012 Fr. Paul McCormick, 2012 - Fr. Damian Szödényi Fr. Henry Marton Headmaster, 1962 - 1969 Headmaster, 1974 - 1975 (b. 1912, d. 1998) (b. 1925, d. 2006) Pictured on the cover (l-r): Fr. Bernard Marton, Abbot Peter Verhalen ’73, Fr. Paul McCormick, and Abbot Emeritus Denis Farkasfalvy. Cover photo by Jim Reisch CISTERCIAN PREPARATORY SCHOOL THE FIRST 50 YEARS David E. Stewart ’74 Thanks and acknowledgements The heart of this book comes from over ten years of stories published in The Continuum, the alumni magazine for Cistercian Prep School. Thanks to Abbot Peter Verhalen and Abbot Emeritus Denis Farkasfalvy and many other monks, faculty members, staff, alumni, and parents for their trust and willingness to share so much in the pages of the magazine and this book. Christine Medaille contributed her time and talent to writing Chapter 8 and Brian Melton ’71 contributed mightily to Chapter 11. Thanks to Jim Reisch for his outstanding photography throughout this book, and especially for the cover shot. Priceless moments from the sixties were captured by or provided by Jane Bret and Fr. Melchior Chladek. Thanks to Rodney Walter for collecting the yearbook photographs used in the book and identifying the students in them. Thanks to Fr. Bernard Marton, Sylvia Najera, and Bridgette Gimenez for their help in editing and proofing. -

They Got Milk!

FOCUS FALL 2012 Hunger Doesn’t They Got Milk! Take A Holiday Hunger doesn’t take a holiday, and we need your continued support of the Food Pantry now through the holidays to help stamp out hunger! Your ongoing financial and food donations during the fall and winter months are greatly appreciated, as increasing client volume places a greater demand on food distribution Sitting at our respective desks child’s exclamation that makes us to needy residents of Irving. just down the hall from the Food realize how fortunate we are in our Pantry, we heard a young child own lives that we have food in our As November and December (with his parents receiving their homes, the rent is paid, and the approach, please consider food order) exclaim in a most lights come on when we turn the a special Thanksgiving and excited voice, “Oh goodie, we’ve switch. Christmas holiday food drive got milk!” at your business, church, club, The Food Pantry served an average or school. The earlier the food You can imagine, we all choked out of 700 families per month last is donated, the more clients a collective gasp. year; however, this summer was can be served during this brutal – an average of 930 families special time of the year. So many days we get caught up per month. Spending for items not in the business part of serving donated is currently $36,979 over Some families have to choose our clients. It’s hearing that young budget. between buying groceries or Please see Milk on Page 4 sending a child to the doctor Please see Holiday on Page 4 Inside 2,3 The Great Harvest -

Recommended Area Hotels with Special UD Rates

Recommended Area Hotels with Special UD Rates The following area hotels have special UD rates for families of prospective and current students, faculty and guests to the University of Dallas and are recommended by the Office of Admission. Rates are subject to hotel availability; please contact the hotel for more information. Staybridge Suites Distance : Offers Shuttling : 2220 Market Place Blvd. UD: 9.1 miles To/From UD campus & Irving, Texas 75062 DFW airport: 9.6 miles DFW Airport upon 972-401-4700 Love Field: 14.6 miles reservation. UD Rate: $9$9$99$9 9 weekdays $8$8$89$8 999 weekends Four Seasons Resort & Distance : Offers Shuttling: Club UD: 2.99 miles To/From UD campus via 4150 North MacArthur Blvd. DFW airport: 10.69 Mercedes 500 series Irving, Texas, 75038 miles (subject to availability) . 972-717-0700 Love Field: 10.7 miles UD Rate: (Mon(Mon----Fri)Fri) Deluxe: $2$266665555.00.00.00.00 Standards: $225$225.00.00.00.00 Courtyard by Marriott Distance : Offers Shuttling: 1151 W. Walnut Hill UD: 5.28 miles Complimentary Irving, TX 75038 DFW airport: 10.36 UD Rate: 972-550-8100 miles $99 weekdays Love Field: 12.51 miles $69 weekends aloft Hotel Distance : Offers Shuttling : 122 East John Carpenter UD: 3.1 miles To/From UD campus Freeway DFW airport: 12.9 miles (M-F 7:00am - 6:30pm) Irving, TX 75062 Love Field: 8.7 miles UD Rate: (972) 717-6100 $119 weekdays $69 weekends Wyndham Las Colinas Distance : Offers Shuttling : 110 John Carpenter Fwy UD: 2.2 miles To/From UD Campus & Irving, Texas 75039 DFW airport: 9 miles within 5 miles 972-650-1600 -

Restaurants & Attractions

ESTER S BL 635 VD North Lake V A L L E Y R A NCH PKWY Restaurants & D Attractions R E N I NORTH DIRECTORY L M T A L C E B PKWY A FREEPORT B L R V 161 T D 635 J H O UR H N CA RP EN TE R F RW Y ROYAL LN Dallas/Fort Worth N International Airport L 114 W R IE I V V EY E LL R F A S V N I O D R T E H W D E S R T HW Y Irving Convention Center at Las Colinas / Visitor Info C SPUR N D 348 W ALNUT HILL LN S E T O B R Y D M R R A N D E C NORTHGATE DR B R A L G R V E N L I T L D 114 A E H D LOOP W H V U 12 C L R B O R ELLE RD CH SPUR North IrvingRO & Las Colinas Restaurants 1 Po Melvin’s Zeytin Pacific Table Kabuki Japanese Einstein The Keg (972) 255-3919 Mediterranean Grill Opening soon Restaurant Brothers Bagels Steakhouse & Bar (972) 887-2000 Shawarma Bar (214) 305-2868 (972) 756-2875 (972) 556-9188 2 FroYo Smoolicious Opening soon Kitchen 101 Lover’s Egg Roll The Ranch at (972) 717-6300 5 Granada Market & Deli Opening soon (972) 753-7888 Las Colinas Midori Sushi 7 Alamo Drafthouse (972) 830-8445 Nosh & Bottle (972) 506-7262 (972) 887-1818 Cinema / 10 Boston Market Italian Cafe The Vetted Well (469) 442-0808 (972) 756-0772 Red Hot & Blue Spirit Grille (972) 402-0225 (972) 717-7575 (972) 401-0000 Bar & Grill Pop Factory Sarigama Jinbeh Japanese (469) 713-3424 (469) 499-3095 Indian Cafe SmashBurger Via Real (972) 302-2681 (972) 650-9001 Restaurant Bar Louie Rayleigh (972) 853-8803 (972) 869-4011 (469) 217-8370 Underground / Veranda Starbucks Coffee Le Peep Violet Room (972) 556-9871 3 6 Cork & Pig Tavern Boi Na Braza Greek -

TAB Records-Stations (TABSERVER08)

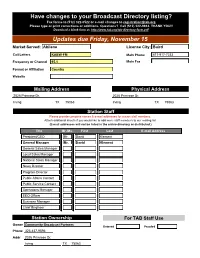

Have changes to your Broadcast Directory listing? Fax forms to (512) 322-0522 or e-mail changes to [email protected] Please type or print corrections or additions. Questions? Call (512) 322-9944. THANK YOU!! Download a blank form at: http://www.tab.org/tab-directory-form.pdf Updates due Friday, November 15 Market Served: Abilene License City: Baird Call Letters KABW-FM Main Phone 817-917-7233 Frequency or Channel 95.1 Main Fax Format or Affiliation Country Website Mailing Address Physical Address 2026 Primrose Dr. 2026 Primrose Dr. Irving TX 75063 Irving TX 75063 Station Staff Please provide complete names & e-mail addresses for station staff members. Attach additional sheets if you would like to add more staff members to our mailing list. (E-mail addresses will not be listed in the online directory or distributed.) Title Mr./Ms. First Last E-mail Address President/CEO Mr. David Klement General Manager Mr. David Klement General Sales Manager Local Sales Manager National Sales Manager News Director Program Director Public Affairs Contact Public Service Contact Operations Manager EEO Officer Business Manager Chief Engineer Station Ownership For TAB Staff Use Owner Community Broadcast Partners Entered Proofed Phone 325-437-9596 Addr 2026 Primrose Dr. Irving TX 75063 Have changes to your Broadcast Directory listing? Fax forms to (512) 322-0522 or e-mail changes to [email protected] Please type or print corrections or additions. Questions? Call (512) 322-9944. THANK YOU!! Download a blank form at: http://www.tab.org/tab-directory-form.pdf Updates due Friday, November 15 Market Served: Abilene License City: Abilene Call Letters KACU-FM Main Phone 325-674-2441 Frequency or Channel 89.7 Main Fax 325-674-2417 Format or Affiliation Soft AC, News (NPR) Website www.kacu.org Mailing Address Physical Address ACU Station 1600 Campus Court Abilene TX 79699-7820 Abilene TX 79601 Station Staff Please provide complete names & e-mail addresses for station staff members. -

Student Handbook 2018-2019

University of Dallas Student Handbook 2018-2019 TABLE OF CONTENTS TABLE OF CONTENTS ........................................................................................................................ 2 UNIVERSITY OF DALLAS MISSION STATEMENT ................................................................................. 4 EMERGENCIES .................................................................................................................................. 6 CAMPUS DIRECTORY ........................................................................................................................ 9 STUDENT CODE OF CONDUCT ........................................................................................................ 11 I. Purpose ................................................................................................................................... 11 II. Definitions ............................................................................................................................. 11 III. Scope ..................................................................................................................................... 13 IV. Academic Integrity ................................................................................................................ 13 V. Residence Hall Rules and Regulations .................................................................................... 13 VI. Violations of the Law and Code ............................................................................................ -

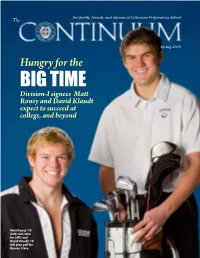

BIG TIME Division-I Signees Matt Roney and David Klaudt Expect to Succeed at College, and Beyond

The For family, friends, and alumni of Cistercian Preparatory School Spring 2010 Hungry for the BIG TIME Division-I signees Matt Roney and David Klaudt expect to succeed at college, and beyond Matt Roney ’10 (left) will swim for SMU and David Klaudt ’10 will play golf for Kansas State. None of us can do it alone Accomplishing great feats requires help and support orking together, caring for one another – also recognize the men and women who helped Wthis issue of The Continuum more than them to achieve their successes. others highlights the way our successes are only Behind each of these athletes’ achievements, CISTERCIAN possible with the help of others. several important figures stood, sometimes PREPARATORY Dr. Pruit shares with anonymously, to provide essential support. SCHOOL all of us a moving tribute In our second feature, you will see the to Mr. Walter in which he professional support Cistercian has received over Rev. Peter Verhalen ’73 Headmaster recognizes Rodney for the years from talented and committed alumni having taught him how to like architect Gary Cunningham ‘72, landscape Rev. Bernard Marton Assistant Headmaster navigate the busy streets of architect David Hocker ’96, and builder Warren the Cistercian bus route and, Andres ‘77, who are helping Cistercian envision a Greg Novinski ’82 Head of Upper School infinitely more importantly, proper entrance to the school and ways to maintain how to navigate the multiple our contemplative character in the midst of all the Fr. Paul McCormick Head of Middle School vocations we all answer. development around us. Letter from Robert J. -

FOR LEASE 4301 N. Macarthur Blvd., Irving, TX

FOR LEASE 4301 N. MacArthur Blvd., Irving, TX LARGE MEDICAL OR BUSINESS SUITES AVAILABLE FOR LEASE IN LAS COLINAS; RANGING FROM 1,952 SQ. FT. TO 5,878 SQ. FT. CONTACT JAMES L. FALVO OR LESTER NEVELS AT (214) 750-9898 OR [email protected] [email protected] Cottonwood Medical & Dental Plaza is located at 4301 MacArthur Blvd. Irving, Las Colinas in Dallas County, Texas. The property is well located fronting MacArthur Blvd., a major traffic artery which extends from Coppell North of I-635 (LBJ Freeway) South across SH 114, SH 183 to I-30. Las Colinas is an affluent and upscale, developed area in Dallas suburb of Irving. Due to its central location between Dallas and Fort Worth and its proximity to DFW International Airport and Love Field. Las Colinas has been a viable place in the Metroplex for corporate and business relocation. As a planned community, it has many corporate offices, luxury hotels, landmark office towers, luxury townhomes, distinguished single-family homes, private country clubs, gated enclaves and urban lofts. Las Colinas is the headquarters for Fortune 500 Companies Commercial Metals, ExxonMobil, Fluor Corporation and Kimberly-Clark And also Mission Foods, Trend Micro, Abbott Laboratories, AT&T, Big 12 Conference, Conference USA, CitiGroup, General Motors Financial, Microsoft, Nokia, Nokia Siemens Networks, Oracle, and Verizon. 4301 MacArthur sits directly across MacArthur from the Four Seasons Resort and Golf Club. Adjacent to the north lies the Jack E. Singley Academy and North Lake College. Along MacArthur, both north and south, lie numerous medical providers, upscale shopping offices and high end residential both single and multi-family. -

Vol. 6 No. 5 May 1997

Complimentary to churches f///< /' and community groups ifflmorftij ©ppnrhmftij Nefris QfON 2730 STEMMONS FRWY. STE. 1202 TOWER WEST, DALLAS, TEXAS 75207 VOLUME 6, NO. 5 May 1997 TPA w _ orth community Ethnic Notes Development Corp. Explores Challenges Makes A Difference Race Theory V100 From The Editor ,\ ,£^( Chris Pryer )^ (0) I? fi © 1^ "->^^ \ photo by Derrick Waiteri (S fl(^ a The Tiger City still plagued hy racial disliarniony The lead news stories of the last few at the club was not necessarily problem this absence also reflects one reason why is Black weeks have been an interesting indica atic because " there are more white people race relations here remain in turmoil. tion of the state of race relations in Dallas. in Dallas than blacks anyway," The sad I spedfically refer to the fact that in Of course the whole sports world— Ironically, one of the stories, which truth of this situation is that it reminds all order to make the Ebony list, one must heck, even the sports obhvious—has appeared in the Dallas Morning News, of us that, irrespective of the wealth have shown both leadership and a histo been abuzz about the feat of Tiger Woods examined the public's perceptions about and/or success that one might have ry of accomplishments. Unfortunately, at the 1997 Masters Golf Tournament in the improvement (or lack thereof) of rela achieved, if you are bbck, you still have our examples of these criteria are far and August, Ga. Mr. Woods won golf's most tions between the various racial groups problems being accepted in certain cor few between, espedally when you elimi prestigious tournament by a whopping in our city.