Final Report, Alternative Metals Study (For Circulating Coinage) Submitted

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Britain's Cartwheel Coinage of 1797

Britain's Cartwheel Coinage of 1797 by George Manz You've probably heard these words and names before: Cartwheel, Soho, Matthew Boulton, and James Watt. But did you know how instrumental they were in accelerating the Industrial Revolution? Like the strands of a rope, the history of Britain's 1797 Cartwheel coinage is intertwined with the Industrial Revolution. And that change in the method of producing goods for market is intermeshed with the Soho Mint and its owners, Matthew Boulton and James Watt. We begin this story in Birmingham, England in 1759 when Matthew Boulton Jr., now in his early 30s, inherited his father's toy business which manufactured many items, including buttons. Later that year, or possibly the following year, young Matthew Boulton's first wife Mary died. "While personally devastating," Richard Doty writes in his marvelous book, The Soho Mint & the Industrialization of Money, "the deaths of his father and his first wife helped make Soho possible. His father had left the toy business to him, while the estate of his wife, who was a daughter and co-heiress of the wealthy Luke Robinson of Litchfield, added to his growing resources." Doty, the curator of numismatics for the Smithsonian Institution in Washington, D.C., notes that Boulton eventually went on to wed Mary's sister Anne; Luke Robinson's other daughter and now sole heir to the family fortune. Boulton built a mill which he called Soho Manufactory, named for a place already called Soho, near Birmingham. The mill was erected beside Hockley Brook, which provided the water- power to help power the new factory. -

Numismatic Auctions, L.L.C. P.O

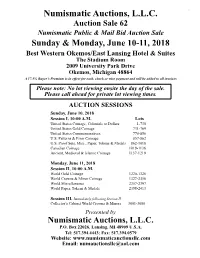

NumismaticNumismatic Auctions, LLC Auctions, Auction Sale 62 - June 10-11, 2018 L.L.C. Auction Sale 62 Numismatic Public & Mail Bid Auction Sale Sunday & Monday, June 10-11, 2018 Best Western Okemos/East Lansing Hotel & Suites The Stadium Room 2009 University Park Drive Okemos, Michigan 48864 A 17.5% Buyer’s Premium is in effect for cash, check or wire payment and will be added to all invoices Please note: No lot viewing onsite the day of the sale. Please call ahead for private lot viewing times. AUCTION SESSIONS Sunday, June 10, 2018 Session I, 10:00 A.M. Lots United States Coinage , Colonials to Dollars 1-730 United States Gold Coinage 731-769 United States Commemoratives 770-856 U.S. Patterns & Error Coinage 857-862 U.S. Proof Sets, Misc., Paper, Tokens & Medals 862-1018 Canadian Coinage 1019-1136 Ancient, Medieval & Islamic Coinage 1137-1219 Monday, June 11, 2018 Session II, 10:00 A.M. World Gold Coinage 1220-1326 World Crowns & Minor Coinage 1327-2356 World Miscellaneous 2357-2397 World Paper, Tokens & Medals 2398-2413 Session III, Immediately following Session II Collector’s Cabinet World Crowns & Minors 3001-3080 Presented by Numismatic Auctions, L.L.C. P.O. Box 22026, Lansing, MI 48909 U.S.A. Tel: 517.394.4443; Fax: 517.394.0579 Website: www.numismaticauctionsllc.com Email: [email protected] Numismatic Auctions, LLC Auction Sale 62 - June 10-11, 2018 Numismatic Auctions, L.L.C. Mailing Address: Tel: 517.394.4443; Fax: 517.394.0579 P.O. Box 22026 Email: [email protected] Lansing, MI 48909 U.S.A. -

Stability of Coinage Metals Interacting with C60

nanomaterials Article Stability of Coinage Metals Interacting with C60 Navaratnarajah Kuganathan 1,2,* , Ratnasothy Srikaran 3 and Alexander Chroneos 1,2 1 Department of Materials, Imperial College London, London SW7 2AZ, UK; [email protected] 2 Faculty of Engineering, Environment and Computing, Coventry University, Priory Street, Coventry CV1 5FB, UK; [email protected] 3 Department of Chemistry, University of Jaffna, Sir. Pon Ramanathan Road, Thirunelvely, Jaffna 40000, Srilanka; [email protected] * Correspondence: [email protected] or [email protected] Received: 27 September 2019; Accepted: 17 October 2019; Published: 18 October 2019 Abstract: Buckminsterfullerene (C60) has been advocated as a perfect candidate material for the encapsulation and adsorption of a variety of metals and the resultant metallofullerenes have been considered for the use in different scientific, technological and medical areas. Using spin-polarized density functional theory together with dispersion correction, we examine the stability and electronic structures of endohedral and exohedral complexes formed between coinage metals (Cu, Ag and Au) and both non-defective and defective C60. Encapsulation is exoergic in both forms of C60 and their encapsulation energies are almost the same. Exohedral adsorption of all three metals is stronger than that of endohedral encapsulation in the non-defective C60. Structures and the stability of atoms interacting with an outer surface of a defective C60 are also discussed. As the atoms are stable both inside and outside the C60, the resultant complexes can be of interest in different scientific and medical fields. Furthermore, all complexes exhibit magnetic moments, inferring that they can be used as spintronic materials. -

Minting America: Coinage and the Contestation of American Identity, 1775-1800

ABSTRACT MINTING AMERICA: COINAGE AND THE CONTESTATION OF AMERICAN IDENTITY, 1775-1800 by James Patrick Ambuske “Minting America” investigates the ideological and culture links between American identity and national coinage in the wake of the American Revolution. In the Confederation period and in the Early Republic, Americans contested the creation of a national mint to produce coins. The catastrophic failure of the paper money issued by the Continental Congress during the War for Independence inspired an ideological debate in which Americans considered the broader implications of a national coinage. More than a means to conduct commerce, many citizens of the new nation saw coins as tangible representations of sovereignty and as a mechanism to convey the principles of the Revolution to future generations. They contested the physical symbolism as well as the rhetorical iconology of these early national coins. Debating the stories that coinage told helped Americans in this period shape the contours of a national identity. MINTING AMERICA: COINAGE AND THE CONTESTATION OF AMERICAN IDENTITY, 1775-1800 A Thesis Submitted to the Faculty of Miami University in partial fulfillment of the requirements for the degree of Master of Arts Department of History by James Patrick Ambuske Miami University Oxford, Ohio 2006 Advisor______________________ Andrew Cayton Reader_______________________ Carla Pestana Reader_______________________ Daniel Cobb Table of Contents Introduction: Coining Stories………………………………………....1 Chapter 1: “Ever to turn brown paper -

Appropriations for the Fiscal Year Ending September 30, 2019, and for Other Purposes

H. J. Res. 31 One Hundred Sixteenth Congress of the United States of America AT THE FIRST SESSION Begun and held at the City of Washington on Thursday, the third day of January, two thousand and nineteen Joint Resolution Making consolidated appropriations for the fiscal year ending September 30, 2019, and for other purposes. Resolved by the Senate and House of Representatives of the United States of America in Congress assembled, SECTION 1. SHORT TITLE. This Act may be cited as the ‘‘Consolidated Appropriations Act, 2019’’. SEC. 2. TABLE OF CONTENTS. Sec. 1. Short title. Sec. 2. Table of contents. Sec. 3. References. Sec. 4. Statement of appropriations. Sec. 5. Availability of funds. Sec. 6. Adjustments to compensation. Sec. 7. Technical correction. DIVISION A—DEPARTMENT OF HOMELAND SECURITY APPROPRIATIONS ACT, 2019 Title I—Departmental Management, Operations, Intelligence, and Oversight Title II—Security, Enforcement, and Investigations Title III—Protection, Preparedness, Response, and Recovery Title IV—Research, Development, Training, and Services Title V—General Provisions DIVISION B—AGRICULTURE, RURAL DEVELOPMENT, FOOD AND DRUG ADMINISTRATION, AND RELATED AGENCIES APPROPRIATIONS ACT, 2019 Title I—Agricultural Programs Title II—Farm Production and Conservation Programs Title III—Rural Development Programs Title IV—Domestic Food Programs Title V—Foreign Assistance and Related Programs Title VI—Related Agency and Food and Drug Administration Title VII—General Provisions DIVISION C—COMMERCE, JUSTICE, SCIENCE, AND RELATED AGENCIES APPROPRIATIONS ACT, 2019 Title I—Department of Commerce Title II—Department of Justice Title III—Science Title IV—Related Agencies Title V—General Provisions DIVISION D—FINANCIAL SERVICES AND GENERAL GOVERNMENT APPROPRIATIONS ACT, 2019 Title I—Department of the Treasury Title II—Executive Office of the President and Funds Appropriated to the President Title III—The Judiciary Title IV—District of Columbia H. -

Mint Mark [email protected]

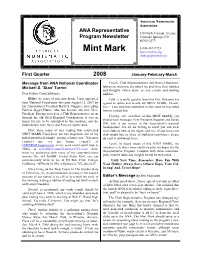

American Numismatic Association ANA Representative 818 North Cascade Avenue Program Newsletter Colorado Springs, CO 80903-3279 1-800-367-9723 Mint Mark www.money.org [email protected] First Quarter 2008 January-February-March Message from ANA National Coordinator Fourth, Club Representatives and District Represen- Michael S. ‘Stan’ Turrini tatives are welcome to contact me and share their updates and thoughts. Given above are my e-mails and mailing Dear Fellow Coin Hobbyists, address. Hello! As many of you now know, I was appointed Fifth, it is really good to learn that Eric Holcomb has your National Coordinator this past August 12, 2007 by agreed to return and to edit our MINT MARK. Thanks, our Association’s President Barry S. Stuppler, succeeding Eric! I am sure that elsewhere in this issue he has noted Patricia Jagger-Finner, who has become our new Vice- how to contact him. President. Having served as a Club Representative on up through the old titled Regional Coordinators, it was an Closing, one, elsewhere in this MINT MARK, you honor for me to be appointed to this position, and the should have messages from President Stuppler and Sandy endorsement from Barry and Patti are appreciated. Hill, who is our contact at the Association’s national headquarters. We all are willing to assist you and local First, since many of you reading this resurrected coin clubs as best as we might, and two, if any local coin MINT MARK I may have not met in person, one of my club would like to share its bulletins/newsletters, please initial priorities is simply ‘getting to know you.’ You may do mail or download to me. -

List of Business 6Th November 2019

ORDERS APPROVED AND BUSINESS TRANSACTED AT THE PRIVY COUNCIL HELD BY THE QUEEN AT BUCKINGHAM PALACE ON 6TH NOVEMBER 2019 COUNSELLORS PRESENT The Rt Hon Jacob Rees-Mogg (Lord President) The Rt Hon Robert Buckland QC The Rt Hon Alister Jack The Rt Hon Alok Sharma Privy The Rt Hon The Lord Ashton of Hyde, the Rt Hon Conor Burns, Counsellors the Rt Hon Zac Goldsmith, the Rt Hon Alec Shelbrooke, the Rt Hon Christopher Skidmore and the Rt Hon Rishi Sunak were sworn as Members of Her Majesty’s Most Honourable Privy Council. Order appointing Jesse Norman a Member of Her Majesty’s Most Honourable Privy Council. Proclamations Proclamation declaring the calling of a new Parliament on the 17th of December 2019 and an Order directing the Lord Chancellor to cause the Great Seal to be affixed to the Proclamation. Six Proclamations:— 1. determining the specifications and designs for a new series of seven thousand pound, two thousand pound, one thousand pound and five hundred pound gold coins; and a new series of one thousand pound, five hundred pound and ten pound silver coins; 2. determining the specifications and designs for a new series of one thousand pound, five hundred pound, one hundred pound and twenty-five pound gold coins; a new series of five hundred pound, ten pound, five pound and two pound standard silver coins; a new series of ten pound silver piedfort coins; a new series of one hundred pound platinum coins; and a new series of five pound cupro-nickel coins; 3. determining the specifications and designs for a new series of five hundred pound, two hundred pound, one hundred pound, fifty pound, twenty-five pound, ten pound, one pound and fifty pence gold coins; a new series of five hundred pound, ten pound, two pound, one pound, fifty pence, twenty pence, ten pence and five pence silver coins; and a new series of twenty-five pound platinum coins; 4. -

Swiss Federal Coins – Respectable and Trustworthy

Swiss Federal Coins – Respectable and Trustworthy Switzerland stands aloof from the European Union. But Switzerland too once introduced its own single currency – the first federal constitution of 1848 put an end to Switzerland's previously fragmented coinage. The minting of coins in the individual cantons was abolished, and the coinage became the exclusive responsibility of the central government of the Swiss Confederation. And what the Confederation minted was the Swiss franc – French things were very much in fashion, and the decimal structure of the new currency made it convenient to work with. It's tough too, though, the Swiss franc, like a real mountaineer, strong enough to stand up to the euro any day. 1 von 10 www.sunflower.ch Swiss Confederation, 5 Francs 1850, Paris Denomination: 5 Franken Mint Authority: Swiss Confederation Mint: Paris Year of Issue: 1850 Weight (g): 24.97 Diameter (mm): 37.0 Material: Silver Owner: Sunflower Foundation During the first half of the 19th century, every Swiss canton minted its own coins. The resulting confusion is hard to imagine today – good, valuable money mixed with worthless coins. Only when the sovereign single states joined into the Swiss Confederation in 1848, a legal basis for a complete reformation of the Swiss currency was at hand. Antoine Bovy from Geneva designed the first series of Swiss coins that showed the image of a sitting Helvetia. This type was minted until 1874, when it was exchanged by the standing Helvetia. 2 von 10 www.sunflower.ch Swiss Confederation, 2 Francs 1850, Paris Denomination: 2 Franken Mint Authority: Swiss Confederation Mint: Paris Year of Issue: 1850 Weight (g): 9.97 Diameter (mm): 27.0 Material: Silver Owner: Sunflower Foundation Two years after the introduction of the Swiss federal constitution (1848) the first Swiss coins were issued. -

2002 United States Mint Annual Report

UNITED STATES MINT 2 0 0 2 ANNUAL REPORT UNITED STATES MINT The Mission of the United States Mint is to manufacture the highest quality circulating, numismatic, and bullion coins at the lowest possible cost and to deliver them in a timely manner...to expand our markets through exceptional customer service, product development, and innovative marketing... to sell numismatic and bullion products at a reasonable price and profit...and to provide security over assets entrusted to us. United States Mint Team Vision The United States Mint will: Provide Value to the American people; Ensure Integrity in our commitments and communications; Achieve world-class Performance. PRIORITIES Business Results: We all will achieve excellent business results. We will continuously improve our business, measuring ourselves Founded in 1792, the United against world-class organizations. Our investments in the States Mint became a bureau of United States Mint will be prudent and thoughtful to provide the best return on investment to the American people. the Treasury Department in 1873 and today is the world’s largest Stakeholders: We value and are inclusive of our stakeholders and hold ourselves accountable for ensuring honest, open and coin manufacturer, with operations timely communications. We will meet or exceed their expecta- in California, Kentucky, Maryland, tions in achieving world class performance. New York, Pennsylvania and Products: We are our products. We will meet the highest levels Washington D.C. of quality, innovation, and efficiency. Involved People: We value all our people.We will provide them a safe workplace and the tools and training they need. We will offer an innovative and flexible working environment where everyone can make a contribution each day. -

Influence of Relativistic Effects on Hydrolysis Of

RADIOCHEMISTRY, STABLE ISOTOPES, NUCLEAR ANALYTICAL METHODS, GENERAL CHEMISTRY 57 INFLUENCE OF RELATIVISTIC EFFECTS ON HYDROLYSIS OF THE HEAVY METAL CATIONS Maria Barysz1/, Jerzy Leszczyński1/, Barbara Zielińska, Aleksander Bilewicz 1/ Department of Quantum Chemistry, Faculty of Chemistry, Nicolaus Copernicus University, Toruń, Poland The process of hydrolysis is related to the interac- Some models for the explanation of this phe- tion between the oxygen in the water molecule and nomenon have been proposed but none of them the metal cation as shown in the following reac- appears to be sufficiently adequate and complete tion [1]: [l, 7]. On the other hand, certain empirical corre- n(n1)+−++ M(H2x O)→+ M(H 2x1 O)− (OH) H lations between experimental data and parameters Therefore, the tendency to hydrolyze increases which characterize cations suggest that a success- with increasing oxidation state of the cation and ful model of the phenomenon must explicitly in- decreasing ionic radius. This is understandable clude relativistic effects. For heavy ions these ef- because with decreasing M-O distance, the polar- fects should be important for predicting the struc- izing effect of smaller cation on the O-H bond in ture and strength of the cation-water complexes. the aqua ligand increases, which, in turn results in The present paper aims at showing the role of the easier loss of the proton from the hydrated cation. relativistic effects on the structure and energetics The ability to hydrolysis has been discussed in many of these complexes and their ability to release pro- papers in terms of the charge (Z) and ionic radii tons. -

GLOSSARY of PLATING TERMS Acid Gold: a Mildly Acidic Process That Is Used When Plating from 7 to 200 Mils of Gold

GLOSSARY OF PLATING TERMS Acid gold: A mildly acidic process that is used when plating from 7 to 200 mils of gold. The deposits are usually 23kt purity, and it is not usually used as the final finish. Antique: A process which involves the application of a dark top coating over bronze or silver. This coating, either plated or painted, is partially removed to expose some of the underlying metal. Anti-tarnish: A protective coating that provides minimal tarnish protection for a low cost. Barrel plating: A type of mass finishing that takes place in a barrel or tub. Barrel plating is usually requested for very small pieces where pricing must be kept low. Black nickel: A bright or matte, dark plating process that is used to highlight antique finishes. Or, when used as a final color it will range from dark grey to light black. A bright black nickel will yield the darkest color. Bright finish: A high luster, smooth finish. CASS testing: The Copper-Accelerated Acetic Acid Salt Spray test is the same as the Neutral Salt Spray (NSS) test, except it is accelerated, with typical time cycles being 8 and 24 hours. Cold nickel: A non-brightened nickel bath which replicates the original finish, that is, bright areas remain bright and dull areas remain dull. Color: Describes the final top coating (flash) which could be white, silver, 14kt gold (Hamilton), 18kt gold, or 24kt gold (English gold). See "gold flash" and "cyanide gold." Copper: An excellent undercoat in the plating process. Copper provides good conductivity and forms an excellent protective barrier between the base metal and the plate. -

Coins, Banknotes & Tokens at 11Am Affordable Jewellery & Watches At

Chartered Surveyors Bury St Edmunds Land & Estate Agents 01284 748 625 150 YEARS est. 1869 Auctioneers & Valuers www.lsk.co.uk C Auctioneers & Valuers Tuesday 11th May 2020 Coins, Banknotes & Tokens at 11am Affordable Jewellery & Watches at 2pm Bid online through our website at LSKlive for free – see our website for more details Strong foundation. Exciting future IMPORTANT NOTICES Special attention is drawn to the Terms of Sale on our Bank. LLOYDS, Risbygate Street, BURY ST EDMUNDS website and displayed in the saleroom. CLIENT: Lacy Scott & Knight LLP Paddle Bidding All buyers attending the auction need to ACCOUNT NO: 32257868 register for a paddle number to enable them to bid, this SORT CODE: 30-64-22 process is simple and takes approximately 30 seconds, SWIFT/BIC CODE: LOYDGB21666 however we do require some form of identification i.e. IBAN NO: GB71 LOYD 3064 2232 2578 68 driver's licence. Collection/Delivery All lots must be removed from the Absentee Bidding Buyers can submit commission bids by Auction Centre by midday on the Friday following the email, telephone, or via our website sale unless prior arrangement has been made with the www.lskauctioncentre.co.uk and we will bid on your auctioneers. behalf. It is important to allow sufficient time for Packing and Postage For Jewellery & Watches and Coins commission bids to be processed when leaving bids. Lacy & Banknotes auctions only, we offer a reduced UK Special Scott & Knight offer a free online bidding service via our Delivery charge of £12 per parcel regardless of the website which becomes ‘live’ half an hour before the amount of lots.