Preserving Minority Depository Institutions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Chinese in Hawaii: an Annotated Bibliography

The Chinese in Hawaii AN ANNOTATED BIBLIOGRAPHY by NANCY FOON YOUNG Social Science Research Institute University of Hawaii Hawaii Series No. 4 THE CHINESE IN HAWAII HAWAII SERIES No. 4 Other publications in the HAWAII SERIES No. 1 The Japanese in Hawaii: 1868-1967 A Bibliography of the First Hundred Years by Mitsugu Matsuda [out of print] No. 2 The Koreans in Hawaii An Annotated Bibliography by Arthur L. Gardner No. 3 Culture and Behavior in Hawaii An Annotated Bibliography by Judith Rubano No. 5 The Japanese in Hawaii by Mitsugu Matsuda A Bibliography of Japanese Americans, revised by Dennis M. O g a w a with Jerry Y. Fujioka [forthcoming] T H E CHINESE IN HAWAII An Annotated Bibliography by N A N C Y F O O N Y O U N G supported by the HAWAII CHINESE HISTORY CENTER Social Science Research Institute • University of Hawaii • Honolulu • Hawaii Cover design by Bruce T. Erickson Kuan Yin Temple, 170 N. Vineyard Boulevard, Honolulu Distributed by: The University Press of Hawaii 535 Ward Avenue Honolulu, Hawaii 96814 International Standard Book Number: 0-8248-0265-9 Library of Congress Catalog Card Number: 73-620231 Social Science Research Institute University of Hawaii, Honolulu, Hawaii 96822 Copyright 1973 by the Social Science Research Institute All rights reserved. Published 1973 Printed in the United States of America TABLE OF CONTENTS FOREWORD vii PREFACE ix ACKNOWLEDGMENTS xi ABBREVIATIONS xii ANNOTATED BIBLIOGRAPHY 1 GLOSSARY 135 INDEX 139 v FOREWORD Hawaiians of Chinese ancestry have made and are continuing to make a rich contribution to every aspect of life in the islands. -

2015-2016 Annual Report

Chinese American Service League 2015 - 2016 Annual Report A Message From CASL CASL has always been a fiscally conservative organization, ensuring the best use of the money you entrust to us by making a tremendous impact on our community. However, 2016 was a year of great adversity for Illinois’ not- for-profit community and for CASL. The lack of state budget for much of our fiscal year had a significant impact on our operations. CASL merged our Family and Community Services Department with our Elderly Services Department to create an Elderly and Family Services Department. This move allowed us to further reduce costs while also reevaluating program outcomes and impact. We feel that the services and outcomes will be even stronger under the leadership of our senior program’s evidence-based, data-informed practices. We also moved our Middle School Program under the leadership of our very successful High School Program. This move has provided a greater level of continuity and seamless transition of students from middle to high school. In addition, we reevaluated and shifted our focus of the Middle School Program to a social-emotional model that will better assist our new immigrant teenagers in navigating the stresses and anxieties of a new school, new culture, and new way of life coupled with the already turbulent teenage years. Finally, with the reorganization and strengthening of our Development Program, we were better prepared to adapt to these changes. The sizable increase in revenue from our events, and refocus on individual and major donors and planned gifts, allowed us to better weather the storm. -

Community Development Bank City State ABC Bank CHICAGO IL Albina Community Bank PORTLAND OR American Metro Bank CHICAGO IL Aztec

Community Development Bank City State ABC Bank CHICAGO IL Albina Community Bank PORTLAND OR American Metro Bank CHICAGO IL AztecAmerica Bank BERWYN IL Bank 2 OKLAHOMA CITY OK Bank of Cherokee County, Inc. TAHLEQUAH OK Bank of Kilmichael KILMICHAEL MS Bank of Okolona OKOLONA MS BankFirst Financial Services MACON MS BankPlus RIDGELAND MS Broadway Federal Bank LOS ANGELES CA Capitol City Bank & Trust Company ATLANTA GA Carver Federal Savings Bank NEW YORK NY Carver State Bank SAVANNAH GA Central Bank of Kansas City KANSAS CITY MO Citizens Bank of Weir WEIR KS Citizens Savings Bank and Trust Company NASHVILLE TN Citizens Trust Bank ATLANTA GA City First Bank of D.C., N.A. WASHINGTON DC City National Bank of New Jersey NEWARK NJ Commercial Capital Bank DEHLI LA Commonwealth National Bank MOBILE AL Community Bank of the Bay OAKLAND CA Community Capital Bank of Virginia CHRISTIANSBURG VA Community Commerce Bank CLAREMONT CA Edgebrook Bank CHICAGO IL First American International Bank BROOKLYN NY First Choice Bank CERRITOS CA First Eagle Bank CHICAGO IL First Independence Bank DETROIT MI First National Bank of Decatur County BAINBRIDGE GA First Security Bank BATESVILLE MS First Tuskegee Bank MONTGOMERY AL Fort Gibson State Bank FORT GIBSON OK Gateway Bank Federal Savings Bank OAKLAND CA Guaranty Bank & Trust BELZONI MS Harbor Bank of Maryland BALTIMORE MD Illinois Service Federal Savings and Loan Association CHICAGO IL Industrial Bank WASHINGTON DC International Bank of Chicago STONE PARK IL Liberty Bank and Trust Company NEW ORLEANS LA Magnolia State Bank BAY SPRINGS MS Mechanics and Farmers Bank DURHAM NC Merchants & Planters Bank RAYMOND MS Metro Bank LOUISVILLE KY Current as of 12-15-2013 Source: CDFI Fund Community Development Bank City State Mission Valley Bank SUN VALLEY CA Mitchell Bank MILWAUKEE WI Native American Bank, N.A. -

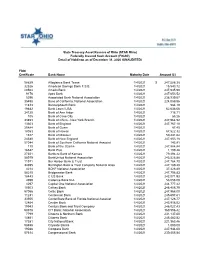

FDIC Certificate Bank Name Maturity Date Amount ($)

State Treasury Asset Reserve of Ohio (STAR Ohio) Federally Insured Cash Account (FICA®) Detail of Holdings as of December 31, 2020 (UNAUDITED) FDIC Certificate Bank Name Maturity Date Amount ($) 58629 Allegiance Bank Texas 1/4/2021 $ 247,586.38 32526 American Savings Bank F.S.B. 1/4/2021 15,543.72 20504 Ameris Bank 1/4/2021 247,935.99 9176 Apex Bank 1/4/2021 247,653.52 5296 Associated Bank National Association 1/4/2021 238,939.67 35498 Banc of California; National Association 1/4/2021 224,059.96 11813 BancorpSouth Bank 1/4/2021 584.19 19842 Bank Leumi USA 1/4/2021 62,638.66 34120 Bank of Ann Arbor 1/4/2021 718.71 105 Bank of Cave City 1/4/2021 55.26 33653 Bank of China - New York Branch 1/4/2021 247,964.52 13303 Bank of England 1/4/2021 247,767.10 20884 Bank of Guam 1/4/2021 87.45 18053 Bank of Hawaii 1/4/2021 67,522.32 1617 Bank of Missouri 1/4/2021 59,441.62 24540 Bank of New England 1/4/2021 247,853.18 57044 Bank of Southern California National Associat 1/4/2021 145.91 110 Bank of the Ozarks 1/4/2021 247,884.84 16547 Bank Plus 1/4/2021 1,199.46 27351 Bankers Bank of Kansas 1/4/2021 79,494.22 58979 BankUnited National Association 1/4/2021 243,528.88 11971 Bar Harbor Bank & Trust 1/4/2021 247,764.70 34395 Barrington Bank & Trust Company National Asso 1/4/2021 247,189.20 4214 BOKF National Association 1/4/2021 37,428.89 58210 Bridgewater Bank 1/4/2021 247,798.83 18443 C US Bank 1/4/2021 242,071.93 4999 Cadence Bank N.A. -

Annual Report on Preserving Minority Depository Institutions

Annual Report on Preserving Minority Depository Institutions December 2015 B OARDOF G OVERNORSOFTHE F EDERAL R ESERVE S YSTEM Annual Report on Preserving Minority Depository Institutions December 2015 B OARDOF G OVERNORSOFTHE F EDERAL R ESERVE S YSTEM This and other Federal Reserve Board reports and publications are available online at www.federalreserve.gov/publications/default.htm. To order copies of Federal Reserve Board publications offered in print, see the Board’s Publication Order Form (www.federalreserve.gov/pubs/orderform.pdf) or contact: Publications Fulfillment Mail Stop N-127 Board of Governors of the Federal Reserve System Washington, DC 20551 (ph) 202-452-3245 (fax) 202-728-5886 (e-mail) [email protected] iii Preface: Implementing the Dodd-Frank Act The Board of Governors of the Federal Reserve of the implementation initiatives completed by the System (Board) is responsible for implementing Board as well as the most significant initiatives the numerous provisions of the Dodd-Frank Wall Street Board expects to address in the future.1 Reform and Consumer Protection Act of 2010 (Dodd-Frank Act). The Dodd-Frank Act requires, among other things, that the Board produce reports to Congress on a number of topics. 1 Board of Governors of the Federal Reserve System, “About The Board maintains a Regulatory Reform website, Regulatory Reform” www.federalreserve.gov/newsevents/ reform_about.htm; “Implementing the Dodd-Frank Act: The which provides an overview of regulatory reform Federal Reserve Board’s Role,” www.federalreserve.gov/ efforts implementing the Dodd-Frank Act and a list newsevents/reform_milestones.htm. v Contents Abbreviations ............................................................................................................................ 1 Executive Summary ................................................................................................................ -

12-19-Summary.Pdf

DEPARTMENT OF BUSINESS OVERSIGHT SUMMARY OF PENDING APPLICATIONS AS OF DECEMBER 2019 APPLICATION TYPE PAGE NO. BANK APPLICATION NEW BANKS 1 MERGER 1 NEW BRANCH 1 NEW FACILITY 2 RELOCATION OF BRANCH 3 RELOCATION OF FACILITY 3 DISCONTINUANCE OF BRANCH OFFICE 3 DISCONTINUANCE OF FACILITY 4 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 5 TRUST COMPANY APPLICATION NEW TRUST COMPANY 6 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 6 DISCONTINUANCE OF OFFICE 6 FOREIGN (OTHER STATE) BANK APPLICATION NEW OFFICE 7 RELOCATION OF OFFICE 7 CREDIT UNION APPLICATION MERGER 7 CONVERSION 8 MONEY TRANSMITTER APPLICATION NEW TRANSMITTER 8 CHANGE OF NAME 8 1 BANK APPLICATION NEW BANKS Filed: 1 LEGACY BANK Proposed location: Street address to be determined, Temecula, Riverside County Correspondent: James Hicken c/o Carpenter & Company, 2 Park Plaza, Suite 550, Irvine, CA 92614 Phone: 661-733-5099 Filed: 11/8/19 MERGER Filed: 1 Approved: 1 GRAND MOUNTAIN BANK, FSB, Granby, Colorado, to merge with and into UNITED BUSINESS BANK, Walnut Creek, CA Filed: 12/6/19 PACIFIC GLOBAL BANK, Chicago, Illinois, to merge with and into ROYAL BUSINESS BANK, Los Angeles, California Filed: 10/21/19 Approved: 12/23/19 NEW BRANCH No Objection: 2 Opened: 3 BAC COMMUNITY BANK 3448 Deer Valley Road, Antioch, Contra Costa County No Objection: 11/26/19 CALWEST BANK 408 E. State Street, Redlands, San Bernardino County Opened: 4/29/19 PACIFIC CITY BANK 45-47 Sylvan Avenue, Englewood Cliffs, Bergen County, New Jersey No Objection: 6/28/19 SUNWEST BANK 10011 Centennial Parkway, Sandy City, Salt Lake County, Utah Opened: 12/19/19 U.S. -

The Large Bank Protection Act: Raising the CFPB’S Enforcement and Supervision Asset Threshold Would Place American Consumers at Risk Christopher L

The Large Bank Protection Act: Raising the CFPB’s Enforcement and Supervision Asset Threshold Would Place American Consumers at Risk Christopher L. Peterson May 3, 2018 1620 Eye Street, NW, Suite 200 | Washington, DC 20006 | (202) 387-6121 | consumerfed.org Executive Summary Congress is currently considering raising the total asset threshold for Consumer Financial Protection Bureau (CFPB) supervision and enforcement of banks from $10 billion to $50 billion. This report analyzes the effect of this change on the number of banks subject to CFPB oversight. Furthermore, this report looks at the CFPB’s enforcement track record in cases against banks within the $10-to-$50-billion-range, and highlights examples of enforcement actions previously taken by the CFPB that would have been impossible if the asset threshold were set at $50 billion under the original Dodd-Frank Act. Raising the CFPB supervision and enforcement threshold from ten to fifty billion dollars would: • Cut the number of banks subject to CFPB supervision and enforcement by 65% from 124 to 43. Currently, 124 out of 5,679 banks are subject to CFPB enforcement. Raising the CFPB oversight threshold to fifty billion dollars would place 81 of the nation’s largest banks beyond the supervisory and enforcement jurisdiction of the CFPB. • Eliminate CFPB oversight of nearly 50 of the largest banks bailed out during the financial crisis. Forty-nine of 81 large banks in the $10 to $50 billion asset range took TARP funds during the Great Recession. After bailing out these banks with taxpayer money, Congress is now considering removing them from the supervision and enforcement authority of the agency designed to prevent some of the same behavior that caused the crisis. -

CHSA HP2010.Pdf

The Hawai‘i Chinese: Their Experience and Identity Over Two Centuries 2 0 1 0 CHINESE AMERICA History&Perspectives thej O u r n a l O f T HE C H I n E s E H I s T O r I C a l s OCIET y O f a m E r I C a Chinese America History and PersPectives the Journal of the chinese Historical society of america 2010 Special issUe The hawai‘i Chinese Chinese Historical society of america with UCLA asian american studies center Chinese America: History & Perspectives – The Journal of the Chinese Historical Society of America The Hawai‘i Chinese chinese Historical society of america museum & learning center 965 clay street san francisco, california 94108 chsa.org copyright © 2010 chinese Historical society of america. all rights reserved. copyright of individual articles remains with the author(s). design by side By side studios, san francisco. Permission is granted for reproducing up to fifty copies of any one article for educa- tional Use as defined by thed igital millennium copyright act. to order additional copies or inquire about large-order discounts, see order form at back or email [email protected]. articles appearing in this journal are indexed in Historical Abstracts and America: History and Life. about the cover image: Hawai‘i chinese student alliance. courtesy of douglas d. l. chong. Contents Preface v Franklin Ng introdUction 1 the Hawai‘i chinese: their experience and identity over two centuries David Y. H. Wu and Harry J. Lamley Hawai‘i’s nam long 13 their Background and identity as a Zhongshan subgroup Douglas D. -

Federal Register/Vol. 78, No. 24/Tuesday, February 5, 2013

Federal Register / Vol. 78, No. 24 / Tuesday, February 5, 2013 / Notices 8131 company name (if any) and EIB–2013– Agency, Ninth Floor, Housing Mission lending to first-time homebuyers. 12 0008 on any attached document. and Goals (DHMG), 400 Seventh Street CFR 1290.3. Only members subject to SW., Washington, DC 20024, or by the CRA must meet the CRA standard. Sharon A. Whitt, electronic mail at hmgcommunity 12 CFR 1290.3(b). All members, Records Clearance Officer. [email protected]. including those not subject to CRA, [FR Doc. 2013–02466 Filed 2–4–13; 8:45 am] FOR FURTHER INFORMATION CONTACT: must meet the first-time homebuyer BILLING CODE 6690–01–P Rona Richardson, Administrative Office standard. 12 CFR 1290.3(c). Manager, Housing Mission and Goals Under the rule, FHFA selects (DHMG), Federal Housing Finance approximately one-eighth of the FEDERAL HOUSING FINANCE Agency, by telephone at 202–649–3224, members in each Bank district for AGENCY by electronic mail at Rona.Richardson@ community support review each [No. 2013–N–01] FHFA.gov, or by hard-copy mail at the calendar quarter. 12 CFR 1290.2(a). Federal Housing Finance Agency, Ninth FHFA will not review an institution’s Federal Home Loan Bank Members Floor, 400 Seventh Street SW., community support performance until it Selected for Community Support Washington, DC 20024. has been a Bank member for at least one Review SUPPLEMENTARY INFORMATION: year. Selection for review is not, nor should it be construed as, any AGENCY: Federal Housing Finance I. Selection for Community Support indication of either the financial Agency. -

Investing in the Future of Mission-Driven Banks a Guide to Facilitating New Partnerships PUBLISHED BY

Federal Deposit Insurance Corporation Investing in the Future of Mission-Driven Banks A Guide to Facilitating New Partnerships PUBLISHED BY: Federal Deposit Insurance Corporation 550 17th Street, NW, Washington, D.C. 20429 877-ASK FDIC (877-275-3342) The Federal Deposit Insurance Corporation (FDIC) has taken steps to ensure that the information and data presented in this publication are accurate and current. However, the FDIC makes no express or implied warranty about such information or data, and hereby expressly disclaims all legal liability and responsibility to persons or entities that use or access this publication and its content, based on their reliance on any information or data included. The FDIC welcomes comments or suggestions about this publication or our Minority Depository Institutions (MDI) Program. Contact the MDI Program at [email protected]. When citing this publication, please use the following: Investing in the Future of Mission-Driven Banks, Federal Deposit Insurance Corporation, Washington, D.C. (October 2020), https://www.fdic.gov/mdi. Investing in the Future of Mission-Driven Banks A Guide to Facilitating New Partnerships Contents Executive Summary .......................................................................................................... 1 Overview ........................................................................................................................... 2 Minority Depository Institutions ................................................................................. 2 Community -

CB Top Ten Report

CB Top Ten Report Ranking the Top Ten Percent of Banks by Peer Group September 30, 2018 YTD 584 Wald, Irvine, CA 92618 | TOLL (877) 367-8235 | www.CB-Resource.com CB Top Ten™ CB TOP TEN™ Overview Third Quarter 2018 I. OVERVIEW t Table of Contents Page 2 t Purpose, Methodology & Definitions Page 2 t Executive Summary Page 3 II. C-CORP TOP TEN PERCENT t Peer Group 1: Less Than $100 Million Page 4 t Peer Group 2: $100-249 Million Page 8 t Peer Group 3: $250-449 Million Page 12 t Peer Group 4: $500-999 Million Page 16 t Peer Group 5: $1-5 Billion Page 18 Table of Contents II. SUB-S TOP TEN PERCENT t Peer Group 1: Less Than $100 Million Page 20 t Peer Group 2: $100-249 Million Page 22 t Peer Group 3: $250-449 Million Page 26 t Peer Group 4: $500-999 Million Page 28 t Peer Group 5: $1-5 Billion Page 29 Purpose The purpose of the CB Top Ten™ is to provide a comparative summary, by peer group, of the top ten percent of banks based upon key performance indicators, selected by CB Resource, Inc. Components The report ranks the top ten percent of banks within each peer group by eight performance indicators. The report is separated between C corporation (C- Corp) banks and subchapter S (Sub-S) banks. For each peer group the report includes a listing in alphabetical order of the banks falling within the top ten percent of their group and a scorecard ranking those banks based upon their composite scores. -

COMMUNITY BANK LANDSCAPE Illinois 1St Quarter 2019

COMMUNITY BANK LANDSCAPE Illinois 1st Quarter 2019 RESEARCH | INVESTMENT BANKING | EQUITY SALES & TRADING | FIXED INCOME | CORPORATE & PRIVATE CLIENT SERVICES TABLE OF CONTENTS SECTION DESCRIPTION I. ILLINOIS BANK REGULATORY DATA II. FIG PARTNERS UPDATE 2 I. ILLINOIS BANK REGULATORY DATA OVERVIEW – ILLINOIS BANK REGULATORY DATA Chicago METHODOLOGY Rockford Metro ▪ 6 county regions separated by geographic relevance ▪ Data as of most recent available Peoria quarter as of March 31, 2019 Champaign ▪ Regulatory call report data shown for all banks Edwardsville KEY STATE OBSERVATIONS ▪ Median loan growth of -1.81% ▪ Median NIM of 3.51% Marion NOTES FOR ALL REGIONS: Note: Texas Ratio = (NPAs + Loans 90+ PD)/ (TCE+LLR) NPAs = Nonaccrual Loans + (Loans 90+ PD ) + Restructured Loans + OREO Nonaccrual loans, Loans 90+ PD and OREO are adjusted to exclude the FDIC guaranteed portion of these assets Source: S&P Global Market Intelligence, Most Recent Available Quarter 4 CHICAGO METRO BANKS (1 OF 5) Company Information Balance Sheet Highlights Capital Adequacy Asset Quality Financial Performance Total Total MRQ Total MRQ Lns / Leverage RBC NPA/ NPA ex Restr/ Texas LLR/ NCOs/ MRQ MRQ MRQ MRQ Assets Lns Growth Deposits Growth Dep. Ratio Ratio Assets Assets Ratio Loans Loans Net Inc. ROAA N.I.M. Efficiency Name City ($M) ($M) (%) ($M) (%) (%) (%) (%) (%) (%) (%) (%) (%) ($000) (%) (%) (%) 1st Equity Bank Skokie $98 $80 (21.4) % $75 (12.8) % 107.0 % 14.79 % 18.51 % 5.19 % 4.10 % 31.8 % 1.42 % 0.00 % $337 1.34 % 3.38 % 60.0 % 1st Equity Bank Northwest Buffalo Grove 39 30 (8.3) 30 (30.3) 99.9 22.06 34.67 0.00 0.00 0.0 1.33 0.00 95 0.94 3.23 73.1 Albany Bank & Trust Co.