Investment Test

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Determinants of Bank's Profitability in Ghana, The

The Determinants of Bank’s Profitability in Ghana, The Case of Merchant Bank Ghana Limited (MBG) and Ghana Commercial Bank (GCB) By Anthony Kofi Krakah & Aaron Ameyaw Henrik Sällberg (Supervisor) Master’s Thesis in Business Administration, MBA programme 2010 Table of Contents Table of Contents ............................................................................................................................................ i ABSTRACT ...................................................................................................................................................... v ACKNOWLEDGEMENT ........................................................................................................................................ vi CHAPTER ONE ............................................................................................................................................... 1 1.0 INTRODUCTION ...................................................................................................................................... 1 An overview of the banking industry in Ghana ..................................................................................................... 3 1.2 Background of the banks ......................................................................................................................... 6 Global Banking Industry .................................................................................................................. 12 Statement of the problem .......................................................................................................................... -

RESTRICTED WT/TPR/S/298 16 April 2014 (14-2369) Page

RESTRICTED WT/TPR/S/298 16 April 2014 (14-2369) Page: 1/105 Trade Policy Review Body TRADE POLICY REVIEW REPORT BY THE SECRETARIAT GHANA This report, prepared for the fourth Trade Policy Review of Ghana, has been drawn up by the WTO Secretariat on its own responsibility. The Secretariat has, as required by the Agreement establishing the Trade Policy Review Mechanism (Annex 3 of the Marrakesh Agreement Establishing the World Trade Organization), sought clarification from Ghana on its trade policies and practices. Any technical questions arising from this report may be addressed to Jacques Degbelo (tel.: 022 739 5583) and Catherine Hennis-Pierre (tel.: 022 739 5640). Document WT/TPR/G/298 contains the policy statement submitted by Ghana. Note: This report is subject to restricted circulation and press embargo until the end of the first session of the meeting of the Trade Policy Review Body on Ghana. This report was drafted in English. WT/TPR/S/298 • Ghana - 2 - CONTENTS SUMMARY ........................................................................................................................ 7 1 ECONOMIC ENVIRONMENT ........................................................................................ 10 1.1 Major Features of the Economy .................................................................................. 10 1.2 Recent Economic Developments.................................................................................. 13 1.3 Developments in Trade and Foreign Direct Investment .................................................. -

Annual Report 1998 Unidanmark Unibank Contents

Annual Report 1998 Unidanmark Unibank Contents Summary . 6 Financial review . 8 The Danish economy . 14 Business description . 15 Retail Banking . 15 Corporate Banking . 21 Markets . 23 Investment Banking . 25 Risk management . 26 Capital resources . 33 Employees . 35 Management and organisation . 37 Accounts Accounting policies . 42 The Unidanmark Group . 44 Unidanmark A/S . 50 Unibank A/S . 55 Notes . 59 Unidanmark’s Local Boards of Shareholders . 84 Unibank’s Business Forum . 85 Branches in Denmark . 86 International directory . 88 Notice of meeting . 90 Management Supervisory Board of Unidanmark Jørgen Høeg Pedersen (Chairman) Holger Klindt Andersen Laurids Caspersen Boisen Lene Haulrik* Steffen Hvidt* Povl Høier Mogens Hugo Jørgensen Brita Kierrumgaard* Kent Petersen* Mogens Petersen Keld Sengeløv * Appointed by employees Executive Board of Unidanmark Thorleif Krarup Supervisory Board of Unibank Unibank’s Supervisory Board has the same members as the Supervisory Board of Unidanmark. In addition, as required by Danish banking legisla- tion, the Danish Minister of Business and Industry has appointed one mem- ber of the Supervisory Board of Unibank, Mr Kai Kristensen. Executive Board of Unibank Thorleif Krarup (Chairman) Peter Schütze (Deputy Chairman) Christian Clausen Jørn Kristian Jensen Peter Lybecker Henrik Mogensen Vision We are a leading financial services company in Denmark with a prominent position in the Nordic market. We ensure our shareholders a return in line with the return of the best among comparable Nordic financial services companies. Through our customer focus, efficient business processes and technology we create customer satisfaction and attract new customers. This confirms the customers in their choice of bank. Unibank is an attractive workplace where team spirit and customer focus are important criteria for individual success. -

DRAFT Bofa CRA PE

PUBLIC DISCLOSURE September 14, 2020 COMMUNITY REINVESTMENT ACT PERFORMANCE EVALUATION UniBank for Savings Certificate Number: 90290 49 Church Street Whitinsville, Massachusetts 01588 Division of Banks Federal Deposit Insurance Corporation 1000 Washington Street, 10th Floor 350 Fifth Avenue, Suite 1200 Boston, Massachusetts 02118 New York, New York 10118 This document is an evaluation of this institution’s record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods, consistent with safe and sound operation of the institution. This evaluation is not, nor should it be construed as, an assessment of the financial condition of this institution. The rating assigned to this institution does not represent an analysis, conclusion, or opinion of the Division of Banks or the Federal Deposit Insurance Corporation concerning the safety and soundness of this financial institution. TABLE OF CONTENTS Institution Rating Overall Rating ......................................................................................................................1 Performance Test Ratings Table .........................................................................................1 Summary of Major Factors Supporting Rating ....................................................................1 Institution Scope of Evaluation .............................................................................................................3 Description of Institution .....................................................................................................5 -

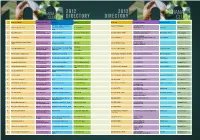

2012-Edition-GC100-Directory.Pdf

2012 2012 DIRECTORY DIRECTORY NAME OF COMPANY BUSINESS CATEGORY LOCATION ADDRESS TELEPHONE FAX/E-MAIL/WEBSITE CONTACT PERSON TITLE 7 Dr. Amilcar Cabral Road, Accra (233-302) 770189/90/91 “(233-302) 770187 1 Abosso GoldFields Limited Mining Institution Airport Residential Area P. O. Box KA 30742 www.goldfields.co.za” Alfred Baku Managing Director Accra Banking Services [email protected] Head, Corporate 2 Acces Bank (Ghana) (Commercial & Merchant) “Starlets ‘91 Road “P. O. Box GP 353 Osu- Accra” (233-302) 684860 / 742699 www.accessbankplc.com/gh Matilda Asante-Aseidu Communications (233-302) 2688960 3 Accra Brewery Manufacturing - Beverages Opp. Ohene Djan Staduim” P. O. Box GP351 (233-302) 688851-6 [email protected] Gregory Metcalf Managing Director www.sabmiller.com (233-302) 685176 4 Activa International Insurance Company Non-Banking-Insurance Graphic Road, Adabraka PMB KA 85 (233-32) 686352 / 672145 [email protected] Limited www.group-activa.com “P. O. Box 35 Banking Service-Rural & 3rd Floor Heritage Tower, 6th Ave. West (233-322) 420926 / 90099 Lucy Opoku-Arthur Ag General Manager 5 Adansi Rural Bank Limited Community Banking Ridge, Accra Fomena-Adansi” Banking Services-Rural & 6 Adonten Community Bank Limited Community Banking Head Office: Fomena - Adansi P.O.Box 140 3420-24109/027-895636/027-7609343 3420-26780 [email protected] Mr.Francis Mensah Senior Manager Banking Services-Rural & 7 Ahantaman Rural Bank Limited Community Banking New Tafo, Akyem, Eastern Region P. O. Box 41, Ahanta (233-312) 23431 / 21016 (233-312)29116 David Bampoe General Manager Banking Services-Rural & 8 Amanano Rural Bank Limited Community Banking Agona Ahanta,Western Region P. -

THE REPUBLIC of GHANA Global Medium Term Note Programme

THE REPUBLIC OF GHANA Global Medium Term Note Programme Under this Global Medium Term Note Programme (the “Programme”), the Republic of Ghana (the “Issuer”) may from time to time issue notes (the “Notes”) denominated in any currency agreed between the Issuer and the relevant Dealer (as defined below). Notes may be issued in bearer or registered form (respectively “Bearer Notes” and “Registered Notes”). The Notes may be issued on a continuing basis to one or more of the Dealers specified under “Overview of the Programme” and any additional Dealer appointed under the Programme from time to time by the Issuer (each a “Dealer” and together the “Dealers”), which appointment may be for a specific issue or on an ongoing basis. References in this Base Prospectus to the “relevant Dealer” shall, in the case of an issue of Notes being (or intended to be) subscribed by more than one Dealer, be to all Dealers agreeing to subscribe such Notes. An investment in Notes issued under the Programme involves certain risks. For a discussion of these risks see “Risk Factors”. This Base Prospectus has been approved as a base prospectus by the Financial Conduct Authority (the "FCA") as competent authority under Regulation (EU) 2017/1129 (the "Prospectus Regulation"). The FCA only approves this Base Prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Approval by the FCA should not be considered as an endorsement of the Issuer or of the quality of the Notes that are the subject of this Base Prospectus. Investors should make their own assessment as to the suitability of the Notes. -

School Management System

University of Ghana http://ugspace.ug.edu.gh UNIVERSITY OF GHANA BUSINESS SCHOOL SCHOOL MANAGEMENT SYSTEM THE EFFECT OF BANKING CRISES ON EMPLOYEES IN GHANA: THE CASE OF CONSOLIDATED BANK GHANA BY MR. STEVE HANSFORD QUANSAH (10702450) A PROJECT WORK SUBMITTED TO THE DEPARTMENT OF FINANCE, UNIVERSITY OF GHANA BUSINESS SCHOOL, UNIVERSITY OF GHANA, LEGON, IN PARTIAL FULFILLMENT OF THE REQUIREMENT FOR THE AWARD OF A DEGREE IN MSC DEVELOPMENT FINANCE JULY 2019 1 University of Ghana http://ugspace.ug.edu.gh DECLARATION I hereby declare that the thesis entitled “The Effect Of Banking Crises On Employees In Ghana: The Case Of Consolidated Bank Ghana” is the result of my original work under the research supervision of Prof. Godfred A. Bokpin, Department of Finance, University of Ghana Business School, and has not been presented in any other university or college or institution for examination or academic purposes, and that all works cited herein have been duly acknowledged. I am solely responsible for any shortcomings this research work may have. ……………………………...................... …………………………… MR. STEVE HANSFORD QUANSAH DATE i University of Ghana http://ugspace.ug.edu.gh CERTIFICATION I hereby certify that this study was supervised in accordance with procedures established by the University. This project work has been submitted for examination with my consent. …………………………… …………………………… PROF. GODFRED A. BOKPIN DATE SUPERVISOR ii University of Ghana http://ugspace.ug.edu.gh DEDICATION I dedicate this thesis to my family for their prayers, love, relentless support, patience, encouragement and understanding throughout this programme. iii University of Ghana http://ugspace.ug.edu.gh ACKNOWLEDGEMENTS My deepest appreciation goes to the Lord Almighty for the strength and wisdom to complete this study. -

Communicating with Informal Sector Clients: a Study of Strategies Employed by Ghana Commercial Bank and Unibank Ghana Limited

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Redfame Publishing: E-Journals Studies in Media and Communication Vol. 4, No. 1; June 2016 ISSN 2325-8071 E-ISSN 2325-808X Published by Redfame Publishing URL: http://smc.redfame.com Communicating with Informal Sector Clients: A study of Strategies Employed by Ghana Commercial Bank and Unibank Ghana Limited Denise D. Duncan Correspondence: Department of Communications Studies, Central University College, Ghana Received: April 22, 2015 Accepted: May 13, 2015 Online Published: January 22, 2016 doi:10.11114/smc.v4i1.1329 URL: http://dx.doi.org/10.11114/smc.v4i1.1329 Abstract Even though theoretical evidence exists that tells of the need for effective communication between banks and their informal sector clients, little seems to be understood about the exact nature of communication between the two. Guided by the two-way symmetrical model and the communication accommodation theory this study set out to identify the communication strategies used by Ghana Commercial Bank and Unibank Ghana Limited in communicating with their informal sector clients in building mutually beneficial relationships. The objective was to identify and describe the specific communication strategies used by Ghana Commercial Bank and Unibank Ghana Limited to communicate with those clients. The study employed the in-depth interview method in gathering data as well as documentary analysis. The study found that the communication strategies employed by the two banks included using relationship managers as well as employing the technique of code-switching or using languages the client understood when communicating with the informal sector clients. -

Press Release

PRESS RELEASE GOVERNMENT ESTABLISHES NEW INDIGENOUS BANK; BANK OF GHANA REVOKES LICENCES OF FIVE BANKS AND APPOINTS RECEIVER IN RESPECT OF THEIR ASSETS AND LIABILITIES The Bank of Ghana today has granted a universal banking licence to Consolidated Bank Ghana Limited established by the Government. The Bank of Ghana has also today revoked the licences of uniBank Ghana Limited, The Royal Bank Limited, Beige Bank Limited, Sovereign Bank Limited, and Construction Bank Limited and has appointed Mr. Nii Amanor Dodoo of KPMG as the Receiver for the five banks. All deposits of the five banks are safe and have been transferred to the Consolidated Bank. Customers can carry out their business as usual at their respective banks which will now become branches of the Consolidated Bank. All staff of these banks will become staff of the Consolidated Bank. Boards of Directors and shareholders of these banks no longer have any roles. Ghana needs a strong and stable banking sector to drive the process of economic transformation. A weak banking sector means that access to credit will be limited while lending rates will continue to be high. The Bank of Ghana is mandated by law to promote the safety, soundness, and stability of the financial system and to protect the interests of depositors. In this context, the Bank has over the last year rolled out measures to strengthen the financial system to protect the interests of depositors however, a number of legacy problems have plagued the banking sector including macroeconomic factors, poor corporate governance and risk management practices, related party transactions that were not above board, regulatory non-compliance, and poor supervision, (questionable licensing processes and weak enforcement) leading to a significant build-up of vulnerabilities in the sector. -

First National Bank Ghana

First National Bank Online Banking Enterprise™ - Payment Cut-Off Times Direct Payment Express Payment Instant Payment Service Service Service Service Anytime during the day Monday - Friday Anytime (including Saturdays, Sundays within the allowed cut-off and Public Holidays) processing times. In accordance with the cut-off Submission times below. Payments submitted after the cut-off times below will be processed on the next business day. Monday to Friday To First National Bank: To Participating Banks n/a No cut-off time between 09h15 and 11h35 Cut-off To other banks: 09h00 - Times 18h00 Saturdays, Sundays and Public Holidays Payments to both First National Bank and to other banks will n/a only be submitted for processing on the next business day. Any payment processed to a Any payment processed to a Participating Any payment authorised Bank through the Instant Payment service and fully processed to a Participating Bank through the Express service type within the type will be cleared within 1 minute of it Participating Bank being authorised and fully processed on Clearing allowed cut-off processing through the Direct the same day. Times: Payment service type times will be cleared within 6 within the allowed cut-off hours of it being authorised and processing times will be fully processed on the same cleared on the next day. business day. Express payments are Instant payments are posted to the posted to the recipient’s recipient’s account on the same business All payments are posted account on the same day. to the recipient’s account business day. on the next business day. -

Ghana-Banking-Survey-2019.Pdf

Banking reforms so far: topmost issues on the minds of bank CEOs August 2019 www.pwc.com/gh Table of contents CSP’s message 2 GAB CEO’s message 4 Tax Leader’s message 5 1 Economy of Ghana 7 2 Survey analysis 12 3 Banking industry overview 35 4 Total operating assets 39 5 Market share analysis 44 6 Profitability and efficiency 56 7 Return to shareholders 64 8 Liquidity 69 9 Asset quality 79 Appendices 84 PwC 2019 Ghana Banking Survey 1 CSP’s message their banks thus far, as well as the those related to the new minimum challenges and opportunities that capital requirement: they foresee. Heritage Bank Limited (HBL) and Highlights of the Premium Bank Ghana Limited (PBG) had their licences revoked. banking sector The reasons provided by BoG for the revocation of their licences reforms were insolvency in the case of Perhaps, one of the most significant Premium bank and questionable components of the banking sector source of capital for Heritage reforms is the new minimum capital bank. directive issued on 11 September Bank of Baroda (BoB) “closed 2017. The directive required shop” and exited the market on universal banks operating in Ghana their own volition also for reasons Vish Ashiagbor to increase their minimum stated related to the new minimum capital to GHS400 million by the capital requirement. Country Senior Partner end of 2018. BoG approved three mergers Following the deadline for involving six banks, effectively Background to this compliance, the changes in the accounting for three more exits. year’s survey banking sector have largely gone in The approved mergers are: 1. -

Bank of Ghana Closes Seven Banks in Banking Crisis

ECONOMY Bank of Ghana closes seven banks in banking crisis Ghana has over the past one year been embroiled in a banking crisis with the closure of seven banks, the assumption of two by GCB Bank Ltd and the consolidation of the others into a new one, writes *Etornam Nyalatorgbi. UT Bank (one of the defunct banks) Insert: Dr. Addison, Governor of Bank of Ghana hana is licking the wounds from ``Poor banking practices, coupled ``There was unusual forbearance by the its worst banking crisis ever. with weak supervision and regulation by Bank of Ghana, which resulted in the ex- Seven bank closures within the the Bank of Ghana has significantly un- tension of significant amounts of emer- Gspace of one year, about 2,700 jobs on dermined the stability of the banking and gency liquidity assistance to these ailing the line and government piling onto its other non-bank financial institutions,’’ banks.’’ debt 7.9 billion cedis ($1.7 billion) to Central Bank Governor Dr. Ernest Ad- It is not abnormal for banks to fall pay for the difference between liabilities dison, said in March when he placed the on the Central Bank’s Emergency Li- and assets of the collapsed banks to allow now defunct uniBank Ltd. under the ad- quidity Assistance when they are short of other lenders take them over. ministration of accounting firm KPMG. cash to meet depositors’ demands once Vol. 21 No. 3 African Agenda 33 ECONOMY “GCB Bank has sacked 450 staff of the two de- funct banks it took over with plans to cut 250 more.