BUFFETS RESTAURANTS HOLDINGS, INC., Et Al., Debtors. C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

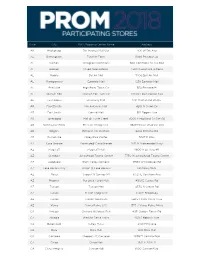

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

State City Shopping Center Address

State City Shopping Center Address AK ANCHORAGE 5TH AVENUE MALL SUR 406 W 5TH AVE AL FULTONDALE PROMENADE FULTONDALE 3363 LOWERY PKWY AL HOOVER RIVERCHASE GALLERIA 2300 RIVERCHASE GALLERIA AL MOBILE BEL AIR MALL 3400 BELL AIR MALL AR FAYETTEVILLE NW ARKANSAS MALL 4201 N SHILOH DR AR FORT SMITH CENTRAL MALL 5111 ROGERS AVE AR JONESBORO MALL @ TURTLE CREEK 3000 E HIGHLAND DR STE 516 AR LITTLE ROCK SHACKLEFORD CROSSING 2600 S SHACKLEFORD RD AR NORTH LITTLE ROCK MC CAIN SHOPG CNTR 3929 MCCAIN BLVD STE 500 AR ROGERS PINNACLE HLLS PROMDE 2202 BELLVIEW RD AZ CHANDLER MILL CROSSING 2180 S GILBERT RD AZ FLAGSTAFF FLAGSTAFF MALL 4600 N US HWY 89 AZ GLENDALE ARROWHEAD TOWNE CTR 7750 W ARROWHEAD TOWNE CENTER AZ GOODYEAR PALM VALLEY CORNERST 13333 W MCDOWELL RD AZ LAKE HAVASU CITY SHOPS @ LAKE HAVASU 5651 HWY 95 N AZ MESA SUPERST'N SPRINGS ML 6525 E SOUTHERN AVE AZ NOGALES MARIPOSA WEST PLAZA 220 W MARIPOSA RD AZ PHOENIX AHWATUKEE FOOTHILLS 5050 E RAY RD AZ PHOENIX CHRISTOWN SPECTRUM 1727 W BETHANY HOME RD AZ PHOENIX PARADISE VALLEY MALL 4510 E CACTUS RD AZ TEMPE TEMPE MARKETPLACE 1900 E RIO SALADO PKWY STE 140 AZ TUCSON EL CON SHPG CNTR 3501 E BROADWAY AZ TUCSON TUCSON MALL 4530 N ORACLE RD AZ TUCSON TUCSON SPECTRUM 5265 S CALLE SANTA CRUZ AZ YUMA YUMA PALMS S C 1375 S YUMA PALMS PKWY CA ANTIOCH ORCHARD @SLATTEN RCH 4951 SLATTEN RANCH RD CA ARCADIA WESTFLD SANTA ANITA 400 S BALDWIN AVE CA BAKERSFIELD VALLEY PLAZA 2501 MING AVE CA BREA BREA MALL 400 BREA MALL CA CARLSBAD PLAZA CAMINO REAL 2555 EL CAMINO REAL CA CARSON SOUTHBAY PAV @CARSON 20700 AVALON -

Michael Kors® Make Your Move at Sunglass Hut®

Michael Kors® Make Your Move at Sunglass Hut® Official Rules NO PURCHASE OR PAYMENT OF ANY KIND IS NECESSARY TO ENTER OR WIN. A PURCHASE OR PAYMENT WILL NOT INCREASE YOUR CHANCES OF WINNING. VOID WHERE PROHIBITED BY LAW OR REGULATION and outside the fifty United States (and the District of ColuMbia). Subject to all federal, state, and local laws, regulations, and ordinances. This Gift ProMotion (“Gift Promotion”) is open only to residents of the fifty (50) United States and the District of ColuMbia ("U.S.") who are at least eighteen (18) years old at the tiMe of entry (each who enters, an “Entrant”). 1. GIFT PROMOTION TIMING: Michael Kors® Make Your Move at Sunglass Hut® Gift Promotion (the “Gift ProMotion”) begins on Friday, March 22, 2019 at 12:01 a.m. Eastern Time (“ET”) and ends at 11:59:59 p.m. ET on Wednesday, April 3, 2019 (the “Gift Period”). Participation in the Gift Promotion does not constitute entry into any other promotion, contest or game. By participating in the Gift Promotion, each Entrant unconditionally accepts and agrees to comply with and abide by these Official Rules and the decisions of Luxottica of America Inc., 4000 Luxottica Place, Mason, OH 45040 d/b/a Sunglass Hut (the “Sponsor”) and WYNG, 360 Park Avenue S., 20th Floor, NY, NY 10010 (the “AdMinistrator”), whose decisions shall be final and legally binding in all respects. 2. ELIGIBILITY: Employees, officers, and directors of Sponsor, Administrator, and each of their respective directors, officers, shareholders, and employees, affiliates, subsidiaries, distributors, -

Store # Phone Number Store Shopping Center/Mall Address City ST Zip District Number 318 (907) 522-1254 Gamestop Dimond Center 80

Store # Phone Number Store Shopping Center/Mall Address City ST Zip District Number 318 (907) 522-1254 GameStop Dimond Center 800 East Dimond Boulevard #3-118 Anchorage AK 99515 665 1703 (907) 272-7341 GameStop Anchorage 5th Ave. Mall 320 W. 5th Ave, Suite 172 Anchorage AK 99501 665 6139 (907) 332-0000 GameStop Tikahtnu Commons 11118 N. Muldoon Rd. ste. 165 Anchorage AK 99504 665 6803 (907) 868-1688 GameStop Elmendorf AFB 5800 Westover Dr. Elmendorf AK 99506 75 1833 (907) 474-4550 GameStop Bentley Mall 32 College Rd. Fairbanks AK 99701 665 3219 (907) 456-5700 GameStop & Movies, Too Fairbanks Center 419 Merhar Avenue Suite A Fairbanks AK 99701 665 6140 (907) 357-5775 GameStop Cottonwood Creek Place 1867 E. George Parks Hwy Wasilla AK 99654 665 5601 (205) 621-3131 GameStop Colonial Promenade Alabaster 300 Colonial Prom Pkwy, #3100 Alabaster AL 35007 701 3915 (256) 233-3167 GameStop French Farm Pavillions 229 French Farm Blvd. Unit M Athens AL 35611 705 2989 (256) 538-2397 GameStop Attalia Plaza 977 Gilbert Ferry Rd. SE Attalla AL 35954 705 4115 (334) 887-0333 GameStop Colonial University Village 1627-28a Opelika Rd Auburn AL 36830 707 3917 (205) 425-4985 GameStop Colonial Promenade Tannehill 4933 Promenade Parkway, Suite 147 Bessemer AL 35022 701 1595 (205) 661-6010 GameStop Trussville S/C 5964 Chalkville Mountain Rd Birmingham AL 35235 700 3431 (205) 836-4717 GameStop Roebuck Center 9256 Parkway East, Suite C Birmingham AL 35206 700 3534 (205) 788-4035 GameStop & Movies, Too Five Pointes West S/C 2239 Bessemer Rd., Suite 14 Birmingham AL 35208 700 3693 (205) 957-2600 GameStop The Shops at Eastwood 1632 Montclair Blvd. -

Application Record

Court File No. ONTARIO SUPERIOR COURT OF JUSTICE (COMMERCIAL LIST) IN THE MATTER OF THE COMPANIES’ CREDITORS ARRANGEMENT ACT, R.S.C. 1985, c. C-36, AS AMENDED AND IN THE MATTER OF A PLAN OF COMPROMISE OR ARRANGEMENT OF PAYLESS SHOESOURCE CANADA INC. AND PAYLESS SHOESOURCE CANADA GP INC. (the “Applicants”) APPLICATION RECORD February 19, 2019 Cassels Brock & Blackwell LLP 2100 Scotia Plaza 40 King Street West Toronto, ON M5H 3C2 Ryan Jacobs LSO#: 59510J Tel: 416. 860.6465 Fax: 416. 640.3189 [email protected] Jane Dietrich LSO#: 49302U Tel : 416. 860.5223 Fax : 416. 640.3144 [email protected] Natalie E. Levine LSO#: 64980K Tel : 416. 860.6568 Fax : 416. 640.3207 [email protected] Lawyers for Payless ShoeSource Canada Inc., Payless ShoeSource Canada GP Inc. and Payless ShoeSource Canada LP TO: SERVICE LIST ATTACHED LEGAL*47453748.1 SERVICE LIST TO: Cassels Brock & Blackwell LLP Scotia Plaza 40 King Street West, Suite 2100 Toronto, ON M5H 3C2 Ryan Jacobs Tel: 416.860.6465 Fax: 416.640.3189 [email protected] Jane Dietrich Tel: 416.860.5223 Fax: 416.640.3144 [email protected] Natalie E. Levine Tel: 416.860.6568 Fax: 416.640.3207 [email protected] Monique Sassi Tel: 416.860.6572 Fax: 416.642.7150 [email protected] Lawyers for Payless ShoeSource Canada Inc., Payless ShoeSource Canada GP Inc. and Payless ShoeSource Canada LP, (collectively, the “Payless Canada Entities”) LEGAL*47453748.1 AND TO: Akin Gump Strauss Hauer & Feld LLP One Bryant Park New York, NY 10036-6745 Ira Dizengoff Tel: 212.872.1096 Fax: 212.872.1002 [email protected] Meredith Lahaie Tel: 212.872.8032 Fax: 212.872.1002 [email protected] Kevin Zuzolo Tel: 212.872.7471 Fax: 212.872.1002 [email protected] Julie Thompson Tel: 202.887.4516 Fax: 202.887.4288 [email protected] Lawyers for Payless Holdings LLC and its debtor affiliates AND TO: FTI Consulting Canada Inc. -

Organizations with Certificates of Insurance

CERTIFICATES of INSURANCE 08.02.21 - 08.01.22 THIS IS A CURRENT LIST OF ORGANZIATIONS THAT HAVE RECEIVED GIRL SCOUTS OF WESTERN WASHINGTON COI. 4 CORNERS SELF STORAGE 24215 SE 271st Place Maple Valley WA 98038 Aberdeen School District 216 N. G St. Aberdeen WA 98520 Agnus Dei Lutheran Church Attn: Cindy 10511 Peacock HIll Ave NW Gig Harbor WA 98332 Aldersgate United Methodist Church Attn: Wendi Brick 14230 SE Newport Way Bellevue WA 98006 Alki UCC Attn: Larisa Wanserski 6115 SW Hinds Seattle WA 98116 American Girl Store Attn: Anthony Walser 3000 184th St SW Lynnwood WA 98037 Anacortes Lutheran Church Attn: Rachel Devine 2100 O Avenue Anacortes WA 98221 Anacortes School District 2200 M Ave Anacortes Anacortes WA 98221 Annie Wright Schools Attn: Erin Gann 827 N. Tacoma Ave Tacoma WA 98403 Archdiocese of Seattle St. John the Evangelist 106 N 79th St Seattle WA 98103 Archdiocese of Seattle-St Michael's School St. Michael Parish & School 1208 11th Avenue Olympia WA 98501 Arena Sports, Inc Attn: Whitney Simmons 9040 Willows Rd NE # 102 Redmond WA 98115 Arlington Boys & Girls Club 18513 59th Ave. NE Arlington WA 98223 Arlington School District Attn: Katherine Ray 315 North French Avenue Arlington WA 98223 Assumption St. Bridgett School 6220 32nd Ave., NE Seattle WA 98155 AUBURN PARKS & RECREATION 910 Ninth Street SE Auburn WA 98002 Auburn School District 915 - 4th Street, NE Auburn WA 98002 74169- Avis Budget Group, Inc. and its Subsidiaries 4500 S. 129th East Ave., Suite 100 PO Box 690360 Tulsa OK 0360 Bainbridge Island Parks & Recreation Attn: Mike Mejia 7666 NE High School Road Bainbridge Island WA 98110 Bainbridge Island School District 8489 Madison Ave. -

Sears Store Locations

Sears Store Locations ST City Name Address Adress2 Zip AK ANCHORAGE ANCHORAGE(SUR) 700 E NORTHERN LIGHTS BLVD 99503 AK WASILLA WASILLA 1000 S SEWARD MERIDIAN RD 99654 AL BIRMINGHAM BIRMINGHAM/RIVERCHASE RIVERCHASE GALLERIA MALL 2500 RIVERCHASE GALLERIA 35244 AL GADSDEN GADSDEN GADSDEN MALL 1001 RAINBOW DR 35901 AL TUSCALOOSA TUSCALOOSA 207 UNIVERSITY MALL 1701 MCFARLAND BLVD E 35404 AR FORT SMITH FT SMITH CENTRAL MALL 5111 ROGERS AVE 72903 CA CITRUS HTS CITRUS HTS-SUNRISE SUNRISE MALL 5900 SUNRISE MALL 95610 CA CLOVIS CLOVIS SIERRA VISTA MALL 1140 SHAW AVE 93612 CA EL CAJON EL CAJON PARKWAY PLZ 575 FLETCHER PKWY 92020 CA EUREKA EUREKA BAYSHORE MALL - BOX 1 3300 BROADWAY 95501 CA FRESNO FRESNO MANCHESTER CTR 3636 N BLACKSTONE AVE 93726 CA MODESTO MODESTO VINTAGE FAIRE MALL 100 VINTAGE FAIRE MALL 95356 CA PALMDALE PALMDALE ANTELOPE VLY MALL 1345 W AVENUE P 93551 CA REDDING REDDING MOUNT SHASTA MALL 1403 HILLTOP DR 96003 CA ROSEVILLE ROSEVILLE GALLERIA AT ROSEVILLE 1191 GALLERIA BLVD 95678 CA SANTA ROSA SANTA ROSA SANTA ROSA PLAZA 100 SANTA ROSA PLAZA 95401 CA TEMECULA TEMECULA TEMECULA VALLEY MALL 40710 WINCHESTER RD 92591 CA VISALIA VISALIA SEQUOIA MALL 3501 S MOONEY BLVD 93277 CO COLORADO SPGS COLORADO SPRINGS CHAPEL HILLS S/C 1650 BRIARGATE BLVD 80920 CO PUEBLO PUEBLO PUEBLO MALL 3201 DILLON DR 81008 CT DANBURY DANBURY DANBURY FAIR MALL 7 BACKUS AVE (EX 3 RT 84) 06810 CT WATERFORD WATERFORD 850 HARTFORD TNPK RTS 85 AND 95 06385 DE DOVER DOVER 1000 DOVER MALL RR 13 19901 FL GAINESVILLE GAINESVILLE OAKS MALL 6201 W NEWBERRY RD 32605 FL -

Store # State City Mall/Shopping Center Name Address Date

Store # State City Mall/Shopping Center Name Address Date 2918 AL ALABASTER COLONIAL PROMENADE 340 S COLONIAL DR Now Open! 2218 AL HOOVER RIVERCHASE GALLERIA 2300 RIVERCHASE GALLERIA Now Open! 219 AL MOBILE BEL AIR MALL MOBILE, AL 36606-3411 Now Open! 2840 AL MONTGOMERY EASTDALE MALL MONTGOMERY, AL 36117-2154 Now Open! 2956 AL PRATTVILLE HIGH POINT TOWN CENTER PRATTVILLE, AL 36066-6542 Now Open! 2875 AL SPANISH FORT SPANISH FORT TOWN CENTER 22500 TOWN CENTER AVE Now Open! 2869 AL TRUSSVILLE TUTWILER FARM 5060 PINNACLE SQ Now Open! 2709 AR FAYETTEVILLE NW ARKANSAS MALL 4201 N SHILOH DR Now Open! 1961 AR FORT SMITH CENTRAL MALL 5111 ROGERS AVE Now Open! 2914 AR LITTLE ROCK SHACKLEFORD CROSSING 2600 S SHACKLEFORD RD Now Open! 663 AR NORTH LITTLE ROCK MCCAIN SHOPPING CENTER 3929 MCCAIN BLVD STE 500 Now Open! 2879 AR ROGERS PINNACLE HLLS PROMENADE 2202 BELLVIEW RD Now Open! 2936 AZ CASA GRANDE PROMENADE AT CASA GRANDE 1041 N PROMENADE PKWY Now Open! 157 AZ CHANDLER MILL CROSSING 2180 S GILBERT RD Now Open! 251 AZ GLENDALE ARROWHEAD TOWNE CENTER 7750 W ARROWHEAD TOWNE CENTER Now Open! 2842 AZ GOODYEAR PALM VALLEY CORNERST 13333 W MCDOWELL RD Now Open! 2940 AZ LAKE HAVASU CITY SHOPS AT LAKE HAVASU 5651 HWY 95 N Now Open! 2419 AZ MESA SUPERSTITION SPRINGS MALL 6525 E SOUTHERN AVE Now Open! 2846 AZ PHOENIX AHWATUKEE FOOTHILLS 5050 E RAY RD Now Open! 1480 AZ PHOENIX PARADISE VALLEY MALL 4510 E CACTUS RD Now Open! 2902 AZ TEMPE TEMPE MARKETPLACE 1900 E RIO SALADO PKWY STE 140 Now Open! 1130 AZ TUCSON EL CON SHOPPING CENTER 3501 E BROADWAY Now Open! -

Mall List by DMA.Xlsx

April 10, 2014 DMA GLA Monthly HH Rank DMA Mall Name City State Sq. Ft. Traffic Income 1 New York, NY Galleria at White Plains Mall White Plains NY 875,926 1,034,000 $95,000 2 Los Angeles, CA Galleria at Tyler Riverside CA 1,200,000 1,010,000 $72,983 2 Los Angeles, CA Glendale Galleria Glendale CA 1,500,000 2,100,000 $83,859 2 Los Angeles, CA Montclair Plaza Montclair CA 1,350,000 1,048,000 $82,228 2 Los Angeles, CA Moreno Valley Mall Moreno Valley CA 1,090,000 707,000 $78,357 2 Los Angeles, CA Northridge Fashion Center Northridge CA 1,440,000 1,753,000 $80,145 2 Los Angeles, CA Southbay Pavilion Carson CA 967,000 651,000 $61,906 3 Chicago, IL Century Shopping Centre Chicago IL 186,000 279,000 3 Chicago, IL Golf Mill Shopping Center Niles IL 1,057,000 1,078,000 $81,843 3 Chicago, IL Northbrook Court Northbrook IL 1,000,000 1,047,000 $121,617 3 Chicago, IL Spring Hill Mall West Dundee IL 1,370,000 1,282,000 $98,009 4 Philadelphia, PA Cherry Hill Mall Cherry Hill NJ 1,304,200 1,304,200 $65,306 4 Philadelphia, PA Cumberland Mall Vineland NJ 942,000 1,000,000 $74,750 4 Philadelphia, PA Deptford Mall Deptford NJ 1,039,000 1,069,000 $75,107 4 Philadelphia, PA Exton Square Mall Exton PA 1,086,300 774,000 $92,401 4 Philadelphia, PA Gallery at Market East Philadelphia PA 1,090,100 821,000 $51,226 4 Philadelphia, PA Hamilton Mall Hamilton Township NJ 1,036,000 1,000,000 $81,561 4 Philadelphia, PA King of Prussia King of Prussia PA 2,613,000 1,084,000 $81,337 4 Philadelphia, PA Lehigh Valley Mall Whitehall PA 1,169,000 1,000,000 $68,017 4 Philadelphia, -

Store # State City Mall/Shopping Center Name Address 1831 AK

Store # State City Mall/Shopping Center Name Address 1831 AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave. 2994 AL Fultondale Promenade Fultondale 3363 Lowery Pkwy 2218 AL Hoover Riverchase Galleria 2300 Riverchase Galleria 219 AL Mobile Bel Air Mall 3400 Bell Air Mall 2840 AL Montgomery Eastdale Mall 1236 Eastdale Mall 2869 AL Trussville Tutwiler Farm 5060 Pinnacle Square 2709 AR Fayetteville Northwest Arkansas Mall 4201 N Shiloh Dr. 1961 AR Fort Smith Central Mall 5111 Rogers Ave. 2914 AR Little Rock Shackleford Crossing 2600 S Shackleford. Rd. 2879 AR Rogers Pinnacle Hills Promenade 2202 Bellview Rd. 157 AZ Chandler Mill Crossing 2180 S Gilbert Rd. 251 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center 2842 AZ Goodyear Palm Valley Cornerstone 13333 W Mcdowell Rd. 2940 AZ Lake Havasu City Shops at Lake Havasu 5651 Hwy 95 N 2419 AZ Mesa Superst'n Springs Ml 6525 E Southern Ave. 2846 AZ Phoenix Ahwatukee Foothills 5050 E Ray Rd. 2889 AZ Phoenix Christown SpeCenterum 1727 W Bethany Home Rd. 1480 AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd. 2902 AZ Tempe Tempe Marketplace 1900 E Rio Salado Pkwy Suite 140 90 AZ Tucson Tucson Mall 4530 N Oracle Rd. 2913 AZ Tucson Tucson SpeCenterum 5265 S Calle Santa Cruz 2837 AZ Yuma Yuma Palms Shopping Center 1375 S Yuma Palms Pkwy 2955 CA Antioch Orchard at Slatten Rch 4951 Slatten Ranch Rd. 1417 CA Arcadia Westfield Santa Anita 400 S Baldwin Ave. 2209 CA Bakersfield Valley Plaza 2501 Ming Ave. 2648 CA Brea Brea Mall 400 Brea Mall 566 CA Carlsbad Plaza Camino Real 2555 El Camino Real 246 CA Carson Southbay Pavilion at Carson 20700 Avalon Blvd 2937 CA Chino Rancho Del Chino Shopping Center 14659 Ramona Ave. -

Store # State City Mall/Shopping Center Name Address 1831 AK Anchorage 5Th Avenue Mall-Sur 406 W 5Th Ave

Store # State City Mall/Shopping Center Name Address 1831 AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave. 2131 AL Huntsville Madison Square 5901 University Dr 219 AL Mobile Bel Air Mall 3400 Bell Air Mall 2840 AL Montgomery Eastdale Mall 1236 Eastdale Mall 2956 AL Prattville High Point Town Center 550 Pinnacle Place 2875 AL Spanish Fort Spanish Fort Town Center 22500 Towncenter Ave 2869 AL Trussville Tutwiler Farm 5060 Pinnacle Square 1786 AL Tuscaloosa University Mall 1701 MacFarland Blvd East 2709 AR Fayetteville Northwest Arkansas Mall 4201 N Shiloh Dr 1961 AR Fort Smith Central Mall 5111 Rogers Ave. 2835 AR Jonesboro Mall at Turtle Creek 300 E Highland Dr Ste 516 2914 AR Little Rock Shackleford Crossing 2600 S Shackleford. Rd. 663 AR North Little Rock McCain Shopping Center 3929 McCain Blvd Ste 500 2879 AR Rogers Pinnacle Hills Promenade 2202 Bellview Rd. 2936 AZ Casa Grande Promenade at Casa Grande 1041 N Promenade Pkwy 251 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center 2842 AZ Goodyear Palm Valley Cornerstone 13333 W Mcdowell Rd. 2940 AZ Lake Havasu City Shops at Lake Havasu 5651 Hwy 95 N 2419 AZ Mesa Superst'n Springs Ml 6525 E Southern Ave. 2846 AZ Phoenix Ahwatukee Foothills 5050 E Ray Rd. 1480 AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd. 90 AZ Tucson Tucson Mall 4530 N Oracle Rd. 2913 AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz 2955 CA Antioch Orchard at Slatten Ranch 4951 Slatten Ranch Rd. 1417 CA Arcadia Westfield Santa Anita 400 S Baldwin Ave. -

Tacoma (Seattle), Washington the Tacoma Transformation

BUSINESS CARD DIE AREA 225 West Washington Street Indianapolis, IN 46204 (317) 636-1600 simon.com Information as of 5/1/16 Simon is a global leader in retail real estate ownership, management and development and an S&P 100 company (Simon Property Group, NYSE:SPG). TACOMA (SEATTLE), WASHINGTON THE TACOMA TRANSFORMATION Nestled between Seattle and Olympia, Tacoma is quickly becoming a beacon for economic growth in the South Sound region. The third largest city in the state of Washington, Tacoma serves a market of more than one million people. — The market has grown 15% over the past ten years and is projected to grow by 62% (127,000 people) over the next 25 years. — A popular tourist destination, Tacoma boasts an idyllic setting with stunning water and mountain views and over 2,700 hotel rooms. Pierce County visitor spending topped $1 billion in 2015 (45.4% was in Tacoma). — Economic development in the area is booming. Plans are underway to build a large residential and commercial project just three miles from Tacoma Mall. The 6.4-acre mixed-use project will feature 360 residential units, 90,000 square feet of offices, plus 480 parking stalls. — The 119,000-square-foot convention center hosted 210 events in 2016. — As a result of the successful 2015 PGA US Open, Chambers Bay Golf Course is building a 160 room $45 million hotel and spa. — Tacoma is considered a top-10 market nationwide for multi- family investment. In 2017, Tacoma will be third in the nation for income growth. THE BUSINESS OF BUSINESS Tacoma serves as the center of business activity for the South Sound region and is a major gateway port for international trade.