Council Regulation (EU) No 1154/2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Secondary Sanctions on the Iranian Financial Sector Create De Facto Embargo with Lasting Implications for the Biden Administration

Secondary Sanctions on the Iranian Financial Sector Create De Facto Embargo with Lasting Implications for the Biden Administration Abigail Eineman IRAN WATCH REPORT John P. Caves III January 2021 1 Introduction During their confirmation hearings last week in the U.S. Senate, President Joe Biden's key national security nominees noted that the new administration was prepared to return to the nuclear accord with Iran, but warned that such a return would not be swift. First, Iran would have to resume compliance with the accord's nuclear restrictions in a verifiable manner, according to Secretary of State designate Antony Blinken, at which point the United States would resume compliance as well. President Biden’s choice for director of national intelligence, Avril Haines, estimated during her confirmation hearing that “we are a long ways from that.”1 Compliance for the United States would mean reversing at least part of the Trump administration's “maximum pressure” campaign—a set of overlapping trade and financial restrictions on almost every part of Iran's economy. The outgoing administration made such a reversal more challenging, particularly as a result of the sanctions imposed on Iran's financial sector in the administration's final months. On October 8, 2020, the United States designated Iran’s financial sector pursuant to Executive Order (E.O.) 13902 and sanctioned eighteen Iranian banks.2 In doing so, the U.S. Treasury Department applied secondary sanctions to Iran's entire financial sector for the first time, potentially barring foreign entities from the U.S. financial system should they do business with Iranian banks. -

Department of the Treasury

Vol. 81 Monday, No. 49 March 14, 2016 Part IV Department of the Treasury Office of Foreign Assets Control Changes to Sanctions Lists Administered by the Office of Foreign Assets Control on Implementation Day Under the Joint Comprehensive Plan of Action; Notice VerDate Sep<11>2014 14:39 Mar 11, 2016 Jkt 238001 PO 00000 Frm 00001 Fmt 4717 Sfmt 4717 E:\FR\FM\14MRN2.SGM 14MRN2 jstallworth on DSK7TPTVN1PROD with NOTICES 13562 Federal Register / Vol. 81, No. 49 / Monday, March 14, 2016 / Notices DEPARTMENT OF THE TREASURY Department of the Treasury (not toll free Individuals numbers). 1. AFZALI, Ali, c/o Bank Mellat, Tehran, Office of Foreign Assets Control SUPPLEMENTARY INFORMATION: Iran; DOB 01 Jul 1967; nationality Iran; Electronic and Facsimile Availability Additional Sanctions Information—Subject Changes to Sanctions Lists to Secondary Sanctions (individual) Administered by the Office of Foreign The SDN List, the FSE List, the NS– [NPWMD] [IFSR]. Assets Control on Implementation Day ISA List, the E.O. 13599 List, and 2. AGHA–JANI, Dawood (a.k.a. Under the Joint Comprehensive Plan additional information concerning the AGHAJANI, Davood; a.k.a. AGHAJANI, of Action JCPOA and OFAC sanctions programs Davoud; a.k.a. AGHAJANI, Davud; a.k.a. are available from OFAC’s Web site AGHAJANI, Kalkhoran Davood; a.k.a. AGENCY: Office of Foreign Assets AQAJANI KHAMENA, Da’ud); DOB 23 Apr (www.treas.gov/ofac). Certain general Control, Treasury Department. 1957; POB Ardebil, Iran; nationality Iran; information pertaining to OFAC’s Additional Sanctions Information—Subject ACTION: Notice. sanctions programs is also available via to Secondary Sanctions; Passport I5824769 facsimile through a 24-hour fax-on- (Iran) (individual) [NPWMD] [IFSR]. -

Iran: State of the Art and Future Perspectives After the Reintroduction of All the Us Sanctions Against Iran

IRAN: STATE OF THE ART AND FUTURE PERSPECTIVES AFTER THE REINTRODUCTION OF ALL THE US SANCTIONS AGAINST IRAN AVV. MARCO PADOVAN AVV. MARCO ZINZANI Operating (or not) with Iran after the reintroduction of the second round of sanctions by the US Government Bologna, 9 November 2018 Sanctions against Iran between 16 January 2016 and 8 May 2018 - Free supply/export towards any Iranian person, entity or body or for the use in Iran - Prohibition for US persons to engage in transactions with Iran and with the of all goods, except for: Government of Iran except for operations conducted under an ad hoc or general authorisation; • those indicated in (EU) Regulation No. 267/2012; - General authorisations for, inter alia, medical devices (General License medical • specific goods which may be used with the purpose of internal devices); export of commercial passenger aircraft; import of Persian carpets and repression and control of telecommunication (EU Regulation foodstuff of Iranian origin, including pistachios and caviar. General License H No.359/2011); enabled non-US entities owned or controlled by a US person to establish trade relationships with Iran; • armaments (EU embargo in force until the Transition Day); - Designation of Iranian persons/entities suspected of committing human rights • the provision to designated persons/entities. violations, terrorism and engaged in missile proliferation; - Transactions with non-designated Iranian persons are allowed, as well as opening of - Prohibition for non-US financial institution to clear transactions -

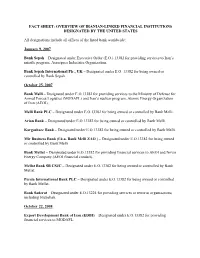

FACT SHEET: OVERVIEW of IRANIAN-LINKED FINANCIAL INSTITUTIONS DESIGNATED by the UNITED STATES All Designations Include All Offic

FACT SHEET: OVERVIEW OF IRANIAN-LINKED FINANCIAL INSTITUTIONS DESIGNATED BY THE UNITED STATES All designations include all offices of the listed bank worldwide: January 9, 2007 Bank Sepah – Designated under Executive Order (E.O.) 13382 for providing services to Iran’s missile program, Aerospace Industries Organization. Bank Sepah International Plc., UK – Designated under E.O. 13382 for being owned or controlled by Bank Sepah. October 25, 2007 Bank Melli – Designated under E.O.13382 for providing services to the Ministry of Defense for Armed Forces Logistics (MODAFL) and Iran’s nuclear program, Atomic Energy Organization of Iran (AEOI). Melli Bank PLC – Designated under E.O.13382 for being owned or controlled by Bank Melli. Arian Bank – Designated under E.O.13382 for being owned or controlled by Bank Melli. Kargoshaee Bank – Designated under E.O.13382 for being owned or controlled by Bank Melli. Mir Business Bank (f.k.a. Bank Melli ZAO ) – Designated under E.O.13382 for being owned or controlled by Bank Melli. Bank Mellat – Designated under E.O.13382 for providing financial services to AEOI and Novin Energy Company (AEOI financial conduit). Mellat Bank SB CSJC – Designated under E.O.13382 for being owned or controlled by Bank Mellat. Persia International Bank PLC – Designated under E.O.13382 for being owned or controlled by Bank Mellat. Bank Saderat – Designated under E.O.13224 for providing services to terrorist organizations, including Hizballah. October 22, 2008 Export Development Bank of Iran (EDBI) – Designated under E.O.13382 for providing financial services to MODAFL. Banco Internacional de Desarrollo – Designated under E.O.13382 for being owned or controlled by EDBI. -

Iran Sanctions

Iran Sanctions Kenneth Katzman Specialist in Middle Eastern Affairs January 6, 2012 Congressional Research Service 7-5700 www.crs.gov RS20871 CRS Report for Congress Prepared for Members and Committees of Congress Iran Sanctions Summary There is broad international support for imposing progressively strict economic sanctions on Iran to try to compel it to verifiably confine its nuclear program to purely peaceful uses. During 2011, there was broad agreement that sanctions had not hurt Iran’s economy to the point at which the Iranian leadership feels pressured to accommodate core Western goals on Iran’s nuclear program. However, as 2012 begins, Iran is indicating it perceives new U.S. and other sanctions affecting its vital oil export lifeline as a severe threat - to the point where Iran might threaten armed conflict in the Strait of Hormuz. It also has offered new nuclear talks in the hopes of heading off some of the oil export- related sanctions under consideration. The energy sector provides nearly 70% of Iran’s government revenues. The signs of effectiveness of sanctions mounted throughout 2011. The value of Iran’s rial has dropped dramatically over the past two years. Iranian leaders have admitted that Iran is virtually cut off from the international banking system. There have been a stream of announcements by major international firms since early 2010 that they are exiting or declining to undertake further work in the Iranian market, particularly the energy sector, taking with them often irreplaceable expertise. Partly as a result, Iran’s oil production has remained relatively steady at about 4.1 million barrels per day, defying Iranian efforts to increase production. -

The New Era of Doing Business with Iran: Iran’S International Commercial Transactions and Global Security

Pace International Law Review Volume 29 Issue 1 Article 1 January 2017 The New Era of Doing Business with Iran: Iran’s International Commercial Transactions and Global Security John Changiz Vafai Archival Magazine Follow this and additional works at: https://digitalcommons.pace.edu/pilr Part of the Banking and Finance Law Commons, Commercial Law Commons, Comparative and Foreign Law Commons, Contracts Commons, Dispute Resolution and Arbitration Commons, International Law Commons, International Trade Law Commons, and the National Security Law Commons Recommended Citation John Changiz Vafai, The New Era of Doing Business with Iran: Iran’s International Commercial Transactions and Global Security, 29 Pace Int'l L. Rev. 1 (2017) Available at: https://digitalcommons.pace.edu/pilr/vol29/iss1/1 This Article is brought to you for free and open access by the School of Law at DigitalCommons@Pace. It has been accepted for inclusion in Pace International Law Review by an authorized administrator of DigitalCommons@Pace. For more information, please contact [email protected]. JOHN CHANGEIZ VAFAI- THE NEW ERA WITH IRAN (DO NOT DELETE) 10/27/2017 2:26 PM THE NEW ERA OF DOING BUSINESS WITH IRAN: IRAN’S INTERNATIONAL COMMERCIAL TRANSACTIONS AND GLOBAL SECURITY John Changiz Vafai* ABSTRACT On January 17, 2016, in a statement following his signing of the Joint Comprehensive Plan of Action (JCPOA) with Iran, President Obama addressed that country’s people, stating that “yours is a great civilization, with a vibrant culture that has so much to contribute to the world – in commerce, and in science and the arts.” While the former U.S. -

Iran Sanctions

Iran Sanctions Kenneth Katzman Specialist in Middle Eastern Affairs Updated May 21, 2019 Congressional Research Service 7-.... www.crs.gov RS20871 SUMMARY RS20871 Iran Sanctions May 21, 2019 Successive Administrations have used sanctions extensively to try to change Iran’s behavior. Sanctions have had a substantial effect on Iran’s economy but little, if any, Kenneth Katzman observable effect on Iran’s conventional defense programs or regional malign activities. Specialist in Middle During 2012-2015, when the global community was relatively united in pressuring Iran, Eastern Affairs Iran’s economy shrank as its crude oil exports fell by more than 50%, and Iran had [email protected] limited ability to utilize its $120 billion in assets held abroad. For a copy of the full report, please call 7-.... or visit The 2015 multilateral nuclear accord (Joint Comprehensive Plan of Action, JCPOA) www.crs.gov. provided Iran broad relief through the waiving of relevant sanctions, revocation of relevant executive orders (E.O.s), and the lifting of U.N. and EU sanctions. Remaining in place were a general ban on U.S. trade with Iran and U.S. sanctions on Iran’s support for regional governments and armed factions, its human rights abuses, its efforts to acquire missile and advanced conventional weapons capabilities, and the Islamic Revolutionary Guard Corps (IRGC). Under U.N. Security Council Resolution 2231, which enshrined the JCPOA, nonbinding U.N. restrictions on Iran’s development of nuclear-capable ballistic missiles and a binding ban on its importation or exportation of arms remain in place for several years. -

Jurisdiction Is of Primary Money Laundering Concern, the Secretary Is Required to Consult

(BILLINGCODE: 4810-02) DEPARTMENT OF THE TREASURY Finding that the Islamic Republic of Iran is a Jurisdiction of Primary Money Laundering Concern AGENCY: The Financial Crimes Enforcement Network (“FinCEN”), Treasury. ACTION: Notice of finding. SUMMARY: Pursuant to the authority contained in 31 U.S.C. 5318A, the Secretary of the Treasury, through his delegate, the Director of FinCEN, finds that reasonable grounds exist for concluding that the Islamic Republic of Iran is a jurisdiction of primary money laundering concern. DATES: The finding made in this notice is effective as of [INSERT DATE OF PUBLICATION OF THIS DOCUMENT IN THE FEDERAL REGISTER]. FOR FURTHER INFORMATION CONTACT: Regulatory Policy and Programs Division, FinCEN, (800) 949-2732. SUPPLEMENTARY INFORMATION: I. Background A. Statutory Provisions On October 26, 2001, the President signed into law the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (the “USA PATRIOT Act”), Public Law 107-56. Title III of the USA PATRIOT Act amends the anti-money laundering provisions of the Bank Secrecy Act (“BSA”), codified at 12 U.S.C. 1829b, 12 U.S.C 1951-1959, and 31 U.S.C. 5311-5314 and 5316-5332, to promote prevention, detection, and prosecution of international money laundering and the financing of terrorism. Regulations implementing the BSA appear at 31 CFR Chapter X. Section 311 of the USA PATRIOT Act (“section 311”) added 31 U.S.C. section 5318A to the BSA, granting the Secretary of the Treasury (the “Secretary”) the authority, upon finding that reasonable grounds exist for concluding that a foreign jurisdiction, institution, class of transactions, or type of account is of “primary money laundering concern,” to require domestic financial institutions and financial agencies to take certain “special measures” against the primary money laundering concern. -

Iranian Sanctions

December 2, 2011 Iranian Sanctions United States Designates Iran as a Primary Money Laundering Concern under Section 311 of the USA PATRIOT Act; New Sanctions Target Persons Who Provide Goods, Services, Technology or Support that Contributes to Iran’s Development of Petroleum Resources or Production of Petrochemical Products SUMMARY In response to recent revelations regarding Iran’s nuclear weapons program, and in advance of significant legislation currently under consideration by the U.S. Congress, the United States has imposed several new sanctions measures targeting Iran. First, although short of calls by some to sanction the Central Bank of Iran (also known as Bank Markazi), the U.S. Treasury Department issued a finding pursuant to Section 311 of the USA PATRIOT Act that Iran is a jurisdiction of primary money laundering concern, and issued proposed rules that would impose special measures against banking institutions in Iran, including the Central Bank of Iran. The special measures would prohibit U.S. financial institutions and financial agencies from opening or maintaining a correspondent account for or on behalf of an Iranian banking institution and will also require covered financial institutions to apply special due diligence measures to their correspondent accounts for non-U.S. financial institutions to guard against their improper indirect use by Iranian banking institutions. In addition, on November 21, 2011, President Obama issued Executive Order 13590. E.O. 13590 parallels and enhances the Iran Sanctions Act, targeting for sanctions any person who provides goods, services, technology or support that contributes to Iran’s development of petroleum resources or production of petrochemical products. -

Iran Sanctions

Iran Sanctions (name redacted) Specialist in Middle Eastern Affairs June 29, 2018 Congressional Research Service 7-.... www.crs.gov RS20871 Iran Sanctions Summary The multilateral nuclear accord (Joint Comprehensive Plan of Action, or JCPOA) provided Iran broad relief from U.N. and multilateral sanctions, as well as U.S. secondary sanctions (sanctions on foreign firms that do business with Iran) on Iran’s civilian economic sectors. Upon the January 16, 2016, implementation of the JCPOA, U.S. Administration waivers of relevant sanctions laws took effect, relevant executive orders (E.O.s) were revoked, and corresponding U.N. and EU sanctions were lifted. Remaining in place were a general ban on U.S. trade with Iran and U.S. secondary sanctions imposed on Iran’s support for regional governments and armed factions, its human rights abuses, its efforts to acquire missile and advanced conventional weapons capabilities, and the Islamic Revolutionary Guard Corps (IRGC). Some additional sanctions on these entities and activities were made mandatory by the Countering America’s Adversaries through Sanctions Act (CAATSA, P.L. 115-44), which also increases sanctions on Russia and North Korea. Under U.N. Security Council Resolution 2231, nonbinding U.N. restrictions on Iran’s development of nuclear-capable ballistic missiles and a binding ban on its importation or exportation of arms remain in place for several years. However, Iran has continued to support regional armed factions and to develop ballistic missiles despite the U.N. restrictions, and did so even when strict international economic sanctions were in place during 2010-2015. On May 8, 2018, President Trump announced that the United States would no longer participate in the JCPOA and that all U.S. -

Banken Die Mit 5. November Auf Der US-SDN-Liste Zu Finden Sind Wir Erheben Keinen Anspruch Auf Vollständigkeit

Banken die mit 5. November auf der US-SDN-Liste zu finden sind Wir erheben keinen Anspruch auf Vollständigkeit. Rechtliche Auskünfte können wir - trotz intensiver Recherche - stets nur ohne Gewähr geben. Amin Investment Bank (ABINIB) Iran Arian Bank Afghanistan linked to Bank Melli Iran Subject to Secondary Sanctions all office worldwide (SDGT)(IFSR) Atieh Sazan Day Iran linked to Day Bank Subject to Secondary Sanctions (SDGT)(IFSR) Ayandeh Bank Iran linked to IR of Iran Broadcasting Subject to Secondary Sanctions all offices worldwide Banco Internactional de Desarrollo Venezuela linked to Export Dev. Bank of Iran Subject to Secondary Sanctions (SDGT)(IFSR) Bank Kargoshaee Iran linked to Bank Melli Iran Subject to Secondary Sanctions all office worldwide (SDGT)(IFSR) Bank Keshavarzi (Agricultural Bank of Iran) Iran all offices worldwide (Iran) Bank Markazi Jomouri Islami Iran Iran Subject to Secondary Sanctions Bank Maskan (Housing Bank of Iran) Iran all offices worldwide (Iran) Bank Melli Iran Iran linked to IRGC Subject to Secondary Sanctions all offices worldwide (Iran)(SDGT)(IFRS) Bank Mellat Iran linked to Mehr Eqtesad bank Subject o Secondary Sanctions all branches worldwide (Iran)(SDGT)(IFSR) Bank Mellat Yerevan Armenia linked to Bank Mellat Subject to Secondary Sanctions all office worldwide (SDGT)(IFSR) Bank of Industry and Mine Iran linked to Bank Sepah Subject to Secondary Sanctions all offices worldwide (Iran)(SDGT)(IFRS) Bank Refah Kargaran Iran all offices worldwide (Iran) Bank Saderat Iran Subject to Secondary Sanctions -

Iran Sanctions International Trade Alert

International Trade Alert Iran Sanctions Are Here—Breaking Down What Contact This Means For Business Mahmoud Baki Fadlallah Email Dubai November 26, 2018 +971 4.409.6850 Key Points Wynn H. Segall Email • As of November 5, 2018, the United States concluded the second of two wind-down Washington, D.C. periods for re-imposition of U.S. sanctions on Iran following the May 8, 2018, +1 202.887.4573 announcement that the United States would cease participation in the JCPOA. Effective November 5, 2018, all U.S. sanctions on Iran that were lifted or waived as Nnedinma C. Ifudu Nweke part of the Iran nuclear deal were re-imposed. Email Washington, D.C. • In addition to re-imposing sanctions, OFAC designated more than 700 individuals, +1 202.887.4013 entities, vessels and aircraft on the SDN list, which represents a significant increase over the approximately 400 parties designated before the implementation of the JCPOA. Chiara Klaui Email • The United States granted SREs to eight countries—China, Greece, India, Italy, London Japan, South Korea, Taiwan and Turkey—which exempt financial institutions in +44 20.7661.5342 these countries from U.S. sanctions for facilitating significant financial transactions related to the purchase of oil from Iran. Johann Strauss Email Dubai Background +971 4.317.3040 On May 8, 2018, President Donald Trump announced that he was withdrawing the United States from the Iran nuclear deal—a decision that provided for the re-imposition Andrew R. Schlossberg Email of U.S. sanctions on Iran that were lifted or waived as part of the deal.