2020 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

VANGUARD INTERNATIONAL EQUITY INDEX FUNDS Form N-Q

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2018-09-28 | Period of Report: 2018-07-31 SEC Accession No. 0000932471-18-007167 (HTML Version on secdatabase.com) FILER VANGUARD INTERNATIONAL EQUITY INDEX FUNDS Mailing Address Business Address PO BOX 2600 PO BOX 2600 CIK:857489| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1031 V26 V26 Type: N-Q | Act: 40 | File No.: 811-05972 | Film No.: 181093806 VALLEY FORGE PA 19482 VALLEY FORGE PA 19482 6106691000 Copyright © 2018 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT COMPANY Investment Company Act file number: 811-05972 Name of Registrant: VANGUARD INTERNATIONAL EQUITY FUNDS Address of Registrant: P.O. Box 2600 Valley Forge, PA 19482 Name and address of agent for service: Anne E. Robinson, Esquire P.O. Box 876 Valley Forge, PA 19482 Date of fiscal year end: October 31 Date of reporting period: July 31, 2018 Item 1: Schedule of Investments Vanguard Pacific Stock Index Fund Schedule of Investments (unaudited) As of July 31, 2018 Market Value Shares ($000) Common Stocks (99.6%)1 Australia (16.6%) Commonwealth Bank of Australia 1,856,264 103,370 BHP Billiton Ltd. 3,386,626 88,447 Westpac Banking Corp. 3,610,167 79,036 CSL Ltd. 475,901 69,628 Australia & New Zealand Banking Group Ltd. -

DFA INVESTMENT DIMENSIONS GROUP INC Form NPORT-P Filed

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2020-09-29 | Period of Report: 2020-07-31 SEC Accession No. 0001752724-20-200730 (HTML Version on secdatabase.com) FILER DFA INVESTMENT DIMENSIONS GROUP INC Mailing Address Business Address 6300 BEE CAVE ROAD 6300 BEE CAVE ROAD CIK:355437| IRS No.: 363129984 | State of Incorp.:MD | Fiscal Year End: 1031 BUILDING ONE BUILDING ONE Type: NPORT-P | Act: 40 | File No.: 811-03258 | Film No.: 201208198 AUSTIN TX 78746 AUSTIN TX 78746 (512) 306-7400 Copyright © 2020 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document DFA INVESTMENT DIMENSIONS GROUP INC. FORM N-Q REPORT July 31, 2020 (UNAUDITED) Table of Contents DEFINITIONS OF ABBREVIATIONS AND FOOTNOTES Emerging Markets Portfolio Emerging Markets Small Cap Portfolio Emerging Markets Value Portfolio Emerging Markets Core Equity Portfolio U.S. Large Cap Equity Portfolio DFA Commodity Strategy Portfolio DFA One-Year Fixed Income Portfolio DFA Two-Year Global Fixed Income Portfolio DFA Selectively Hedged Global Fixed Income Portfolio DFA Short-Term Government Portfolio DFA Five-Year Global Fixed Income Portfolio DFA World ex U.S. Government Fixed Income Portfolio DFA Intermediate Government Fixed Income Portfolio DFA Short-Term Extended Quality Portfolio DFA Intermediate-Term Extended Quality Portfolio DFA Targeted Credit Portfolio DFA Investment Grade Portfolio DFA Inflation-Protected Securities Portfolio DFA Short-Term Municipal Bond Portfolio DFA Intermediate-Term Municipal Bond Portfolio -

LTN20120213032.Pdf

IMPORTANT: If you are in any doubt about any of the contents of this prospectus, you should obtain independent professional advice. XIWANG SPECIAL STEEL COMPANY LIMITED (西王特鋼有限公司) (incorporated in Hong Kong with limited liability) GLOBAL OFFERING Number of Offer Shares under the : 500,000,000 Shares, comprising 400,000,000 New Global Offering Shares to be offered by the Company and 100,000,000 Sale Shares to be offered by the Selling Shareholder (subject to the Over-allotment Option) Number of International Offer Shares : 450,000,000 Shares (subject to adjustment and the Over-allotment Option) Number of Hong Kong Offer Shares : 50,000,000 Shares (subject to adjustment) Maximum Offer Price : HK$3.36 per Offer Share payable in full on application and subject to refund on final pricing, plus brokerage of 1%, Hong Kong Stock Exchange trading fee of 0.005% and SFC transaction levy of 0.003% Nominal value : HK$0.10 per Share Stock code : 1266 Sole Sponsor and Sole Global Coordinator Joint Bookrunners and Joint Lead Managers Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this prospectus. A copy of this prospectus, having attached thereto the documents specified in “Appendix VII — Documents Delivered to the Registrar of Companies and Available for Inspection”, has been registered by the Registrar of Companies in Hong Kong as required by section 38D of the Hong Kong Companies Ordinance (Chapter 32 of the Laws of Hong Kong). -

43Gdy6nm9dgg55.Pdf

Investment Manager: AMP Capital Investors Limited ABN 59 001 777 591 | AFSL 232497 Issuer and Responsible Entity: BetaShares Capital Ltd ABN 78 139 566 868 | AFSL 341181 28 February 2017 Market Announcements Office ASX Limited AMP CAPITAL DYNAMIC MARKETS FUND (HEDGE FUND) (ASX CODE: DMKT) QUARTERLY PORTFOLIO DISCLOSURE We advise that the Fund’s portfolio as at 30 December 2016 comprised the following holdings: Security Weighting (%) Security Weighting (%) ETFs* SPDR S&P/ASX200 Fund 9.82 Vanguard Value ETF 2.09 Vanguard FTSE Emgerging Markets ETF 8.75 Vanguard Materials ETF 1.95 BetaShares FTSE RAFI AU 200 5.18 iShares Global Materials ETF 1.93 iShares Global Financials ETF 3.21 Topix-17 Banks ETF 1.70 Vaneck Vectors Russia ETF 2.74 Lyxor ETF STOXX Europe 600 Banks 1.61 SPDR Bank ETF 2.67 Vanguard Energy ETF 1.61 *Please note underlying ETF exposures are provided below on a weighted consolidated look through basis. AMP Capital Investors Limited 50 Bridge Street Sydney NSW 2000 Australia Client Services 1800 658 404 8.30am-5.30pm | [email protected] ampcapital.com.au For personal use only Important information: This information has been prepared by BetaShares Capital Ltd (ACN 139 566 868 AFS Licence 341181) ("BetaShares") the Responsible Entity and Issuer of the Fund. AMP Capital Investors Limited (“AMP Capital”) (ABN 59 001 777 591, and AFSL 232497) is the investment manager of the Fund and has been appointed by the Responsible Entity to provide investment management and associated services in respect of the Fund. It is general information only and does not take into account any person’s objectives, financial situation or needs. -

Annual Report 2013

Be Top of Consumer Mind CONTENTS Corporate Information 2 Financial Highlights 6 Chairman’s Statement 10 Chief Executive Officer’s Report 14 Management Discussion and Analysis 18 Biographies of Directors and Senior Management 26 Corporate Governance Report 30 Report of the Directors 40 Independent Auditor’s Report 53 Consolidated Balance Sheet 55 Company Balance Sheet 57 Consolidated Statement of Comprehensive Income 59 Consolidated Statement of Changes in Equity 60 Consolidated Cash Flow Statement 61 Notes to the Consolidated Financial Statements 62 Five-Year Financial Summary 147 Vinda International Holdings Limited CORPORATE INFORMATION Directors Authorised Representatives Mr. LI Chao Wang (resigned on 1 January 2014) Executive Directors Ms. ZHANG Dong Fang Mr. LI Chao Wang (Chairman) (appointed on 1 January 2014) Ms. YU Yi Fang (Vice Chairman) Ms. TAN Yi Yi Ms. ZHANG Dong Fang (Chief Executive Officer) Mr. DONG Yi Ping (Chief Technology Officer) Company Secretary Ms. TAN Yi Yi, ACCA Non-Executive Directors Mr. Jan Christer JOHANSSON Auditors (appointed on 1 January 2014) PricewaterhouseCoopers Mr. Jan Lennart PERSSON (appointed on 1 January 2014) Legal Advisers to the Company Mr. Johann Christoph MICHALSKI Stevenson, Wong & Co. (as to Hong Kong law) Mr. Ulf Olof Lennart SODERSTROM Conyers Dill & Pearman (as to Cayman Islands law) Independent Non-Executive Directors Registered Office Dr. CAO Zhen Lei Cricket Square, Hutchins Drive Mr. KAM Robert P.O. Box 2681 Mr. HUI Chin Tong, Godfrey Grand Cayman KY1-1111 Mr. TSUI King Fai Cayman Islands Alternate Directors Ms. LI Jielin (appointed on 1 January 2014 Principal Place of Business as alternate to Mr. LI, Ms. -

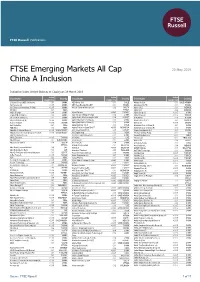

FTSE Emerging Markets All Cap China a Inclusion

FTSE Russell Publications FTSE Emerging Markets All Cap 20 May 2019 China A Inclusion Indicative Index Weight Data as at Closing on 29 March 2019 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 21Vianet Group (ADS) (N Shares) 0.01 CHINA AES Gener S.A. 0.01 CHILE Almarai Co Ltd 0.01 SAUDI ARABIA 360 Security (A) <0.005 CHINA AES Tiete Energia SA UNIT 0.01 BRAZIL Alpargatas SA PN 0.01 BRAZIL 361 Degrees International (P Chip) <0.005 CHINA African Rainbow Minerals Ltd 0.02 SOUTH Alpek S.A.B. 0.01 MEXICO 3M India 0.01 INDIA AFRICA Alpha Bank 0.04 GREECE 3SBio (P Chip) 0.04 CHINA Afyon Cimento <0.005 TURKEY Alpha Group (A) <0.005 CHINA 51job ADR (N Shares) 0.03 CHINA Agile Group Holdings (P Chip) 0.04 CHINA Alpha Networks <0.005 TAIWAN 58.com ADS (N Shares) 0.12 CHINA Agility Public Warehousing Co KSC 0.04 KUWAIT ALROSA ao 0.06 RUSSIA 5I5j Holding Group (A) <0.005 CHINA Agricultural Bank of China (A) 0.06 CHINA Alsea S.A.B. de C.V. 0.02 MEXICO A.G.V. Products <0.005 TAIWAN Agricultural Bank of China (H) 0.26 CHINA Altek Corp <0.005 TAIWAN Aarti Industries 0.01 INDIA Aguas Andinas S.A. A 0.03 CHILE Aluminum Corp of China (A) 0.01 CHINA ABB India 0.02 INDIA Agung Podomoro Land Tbk PT <0.005 INDONESIA Aluminum Corp of China (H) 0.03 CHINA Abdullah Al Othaim Markets <0.005 SAUDI ARABIA Ahli United Bank B.S.C. -

Vanguard Total International Stock Index Fund Annual Report October

Annual Report | October 31, 2020 Vanguard Total International Stock Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard. -

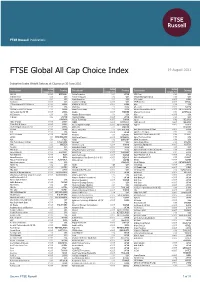

FTSE Global All Cap Choice Index

2 FTSE Russell Publications 19 August 2021 FTSE Global All Cap Choice Index Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 1&1 AG <0.005 GERMANY Activia Properties 0.01 JAPAN AES Corp. 0.03 USA 10X Genomics 0.03 USA Activision Blizzard 0.12 USA Affiliated Managers Group 0.01 USA 1Life Healthcare 0.01 USA Acuity Brands Inc 0.01 USA Affle (India) <0.005 INDIA 1st Source <0.005 USA Acushnet Holdings <0.005 USA AFI Properties <0.005 ISRAEL 21Vianet Group ADS (N Shares) <0.005 CHINA ADAMA (A) (SC SZ) <0.005 CHINA Aflac 0.06 USA 2U <0.005 USA Adani Gas 0.01 INDIA AfreecaTV <0.005 KOREA 360 DigiTech ADS (N Shares) 0.01 CHINA Adani Green Energy 0.01 INDIA African Rainbow Minerals Ltd <0.005 SOUTH AFRICA 360 Security (A) (SC SH) <0.005 CHINA Adapteo <0.005 SWEDEN Afterpay Touch Group 0.03 AUSTRALIA 3-D Systems 0.01 USA Adaptive Biotechnologies 0.01 USA Afya <0.005 USA 3i Group 0.02 UNITED Adastria Holdings <0.005 JAPAN AGCO Corp 0.01 USA KINGDOM A-Data Technology <0.005 TAIWAN Ageas 0.02 BELGIUM 3SBio (P Chip) <0.005 CHINA ADBRI <0.005 AUSTRALIA AGFA-Gevaert <0.005 BELGIUM 51job ADS (N Shares) <0.005 CHINA Adcock Ingram Holdings <0.005 SOUTH AFRICA Aggreko <0.005 UNITED 5I5j Holding Group (A) (SC SZ) <0.005 CHINA Addtech B 0.01 SWEDEN KINGDOM 77 Bank <0.005 JAPAN Adecco Group AG 0.02 SWITZERLAND Agile Group Holdings (P Chip) <0.005 CHINA 8x8 <0.005 USA Adeka <0.005 JAPAN Agilent Technologies 0.07 USA A.G.V. -

Sinolink Securities (Hong Kong) Company Limited 1/12/2016 1 長和 70% 2 中電控股 70% 3 香港中華煤氣 70% 4 九龍倉集團 70% 5 匯豐控股 70% 6 電能實業 70% 7 Hoifu Energy Group Ltd

Sinolink Securities (Hong Kong) Company Limited 1/12/2016 1 長和 70% 2 中電控股 70% 3 香港中華煤氣 70% 4 九龍倉集團 70% 5 匯豐控股 70% 6 電能實業 70% 7 Hoifu Energy Group Ltd. 20% 8 電訊盈科 60% 9 NINE EXPRESS LTD 20% 10 恒隆集團 60% 11 恒生銀行 70% 12 恒基地產 70% 14 希慎興業 60% 15 Vantage International (Holdings) Ltd. 50% 16 新鴻基地產 70% 17 新世界發展 70% 18 Oriental Press Group Ltd. 15% 19 太古股份公司A 70% 20 會德豐 60% 22 Mexan Ltd. 15% 23 東亞銀行 70% 25 Chevalier International Holdings Ltd. 20% 26 China Motor Bus Co., Ltd. 25% 27 銀河娛樂 70% 28 TIAN AN CHINA INVESTMENTS CO LTD 40% 29 Dynamic Holdings Ltd. 40% 31 China Aerospace International Holdings Ltd. 55% 32 Cross-Harbour (Holdings) Ltd., The 35% 33 Asia Investment Finance Group Ltd. 15% 34 Kowloon Development Co. Ltd. 40% 35 Far East Consortium International Ltd. 50% 38 第一拖拉機股份 50% 39 China Beidahuang Industry Group Holdings Ltd. 10% 41 Great Eagle Holdings Ltd. 60% 42 Northeast Electric Development Co. Ltd. - H Shares 40% 43 C.P. POKPHAND 40% 44 Hong Kong Aircraft Engineering Co. Ltd. 45% 45 Hongkong and Shanghai Hotels, Ltd., The 40% 46 Computer And Technologies Holdings Ltd. 15% 47 Hop Hing Group Holdings Ltd. 15% 48 China Automotive Interior Decoration Holdings Ltd. 20% 50 Hong Kong Ferry (Holdings) Co. Ltd. 35% 51 Harbour Centre Development Ltd. 15% 52 Fairwood Holdings Ltd. 55% 53 GUOCO GROUP 40% 54 合和實業 60% 55 NEWAY GROUP HOLDINGS LTD 20% 56 Allied Properties (HK) Ltd. 35% 57 Chen Hsong Holdings Ltd. 10% 58 Sunway International Holdings Ltd. -

American Century Investments® Quarterly Portfolio Holdings Avantis

American Century Investments® Quarterly Portfolio Holdings Avantis® Emerging Markets Equity ETF (AVEM) November 30, 2020 Avantis Emerging Markets Equity ETF - Schedule of Investments NOVEMBER 30, 2020 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 100.1% Brazil — 5.6% AES Tiete Energia SA 100,200 299,250 Aliansce Sonae Shopping Centers SA(1) 13,600 67,221 Alliar Medicos A Frente SA 300 608 Alpargatas SA, Preference Shares 3,700 28,247 Alupar Investimento SA 9,800 44,762 Ambev SA, ADR 128,781 342,557 Arezzo Industria e Comercio SA 7,000 90,809 Atacadao SA 20,500 76,224 Azul SA, ADR(1)(2) 7,899 168,012 B2W Cia Digital(1) 3,400 45,027 B3 SA - Brasil Bolsa Balcao 65,700 688,345 Banco ABC Brasil SA, Preference Shares 8,800 24,130 Banco Bradesco SA 48,460 197,190 Banco Bradesco SA, ADR 155,990 708,195 Banco BTG Pactual SA 14,300 210,707 Banco do Brasil SA 55,890 355,950 Banco do Estado do Rio Grande do Sul SA, Class B Preference Shares 26,000 64,643 Banco Inter SA 2,700 36,740 Banco Inter SA, Preference Shares 7,100 32,337 Banco Pan SA, Preference Shares 36,800 64,225 Banco Santander Brasil SA, ADR(2) 21,322 155,224 BB Seguridade Participacoes SA 32,700 176,946 BK Brasil Operacao e Assessoria a Restaurantes SA 300 609 BR Malls Participacoes SA(1) 64,100 117,374 BR Properties SA 31,200 60,858 BrasilAgro - Co. Brasileira de Propriedades Agricolas 1,500 7,658 Braskem SA, ADR(2) 7,362 61,988 BRF SA, ADR(1) 65,511 269,250 Camil Alimentos SA 17,100 35,940 CCR SA 139,200 339,075 Centrais Eletricas Brasileiras SA, ADR(2) 13,437 -

Vinda International Holdings Limited (於開曼群島註冊成立的有限公司) (Incorporated in the Cayman Islands with Limited Liability) 股份代號: 3331 Stock Code: 3331 年 報

維達國際控股有限公司 Vinda International Holdings Limited (於開曼群島註冊成立的有限公司) (incorporated in the Cayman Islands with limited liability) 股份代號: 3331 Stock Code: 3331 年 報 2015 International Holdings Limited Vinda Annual Report 2015 維達國際控股有限公司 Annual Report 2015 年報 2013-16 2013-16 Contents 2 Corporate Information 4 Financial Highlights 6 Chairman’s Statement 8 CEO Report 11 Management Discussion and Analysis 17 Environmental, Social and Governance (ESG) Report 2015 28 Biographies of Directors and Senior Management 36 Corporate Governance Report 51 Report of the Directors 69 Independent Auditor’s Report 71 Consolidated Balance Sheet 73 Consolidated Statement of Comprehensive Income 74 Consolidated Statement of Changes in Equity 75 Consolidated Cash Flow Statement 76 Notes to the Consolidated Financial Statements 159 Five-Year Financial Summary Vinda International Holdings Limited Annual Report 2015 1 Corporate Information Directors Nomination Committee Executive Directors Mr. LI Chao Wang (Committee Chairman) Mr. LI Chao Wang (Chairman) Mr. Jan Christer JOHANSSON Ms. YU Yi Fang (Vice Chairman) Mr. CHIA Yen On Mr. Johann Christoph MICHALSKI Mr. KAM Robert (Chief Executive Officer) Mr. WONG Kwai Huen, Albert (with effect from 1 October 2015) Ms. LI Jielin (Deputy Chief Executive Officer) Risk Management Committee (appointed on 1 October 2015) Mr. Jan Christer JOHANSSON (Committee Chairman) Mr. DONG Yi Ping (Chief Technology Officer) Ms. YU Yi Fang Ms. ZHANG Dong Fang (Chief Executive Officer) Mr. Johann Christoph MICHALSKI (resigned on 1 October 2015) Mr. Ulf Olof Lennart SODERSTROM Non-Executive Directors Mr. TSUI King Fai Mr. Jan Christer JOHANSSON (Vice Chairman) Mr. Carl Magnus GROTH (appointed on 1 July 2015) Executive Committee Mr. Ulf Olof Lennart SODERSTROM Mr.