Annual-Report-2018.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TX-NR636 AV RECEIVER Advanced Manual

TX-NR636 AV RECEIVER Advanced Manual CONTENTS AM/FM Radio Receiving Function 2 Using Remote Controller for Playing Music Files 15 TV operation 42 Tuning into a Radio Station 2 About the Remote Controller 15 Blu-ray Disc player/DVD player/DVD recorder Presetting an AM/FM Radio Station 2 Remote Controller Buttons 15 operation 42 Using RDS (European, Australian and Asian models) 3 Icons Displayed during Playback 15 VCR/PVR operation 43 Playing Content from a USB Storage Device 4 Using the Listening Modes 16 Satellite receiver / Cable receiver operation 43 CD player operation 44 Listening to Internet Radio 5 Selecting Listening Mode 16 Cassette tape deck operation 44 About Internet Radio 5 Contents of Listening Modes 17 To operate CEC-compatible components 44 TuneIn 5 Checking the Input Format 19 Pandora®–Getting Started (U.S., Australia and Advanced Settings 20 Advanced Speaker Connection 45 New Zealand only) 6 How to Set 20 Bi-Amping 45 SiriusXM Internet Radio (North American only) 7 1.Input/Output Assign 21 Connecting and Operating Onkyo RI Components 46 Slacker Personal Radio (North American only) 8 2.Speaker Setup 24 About RI Function 46 Registering Other Internet Radios 9 3.Audio Adjust 27 RI Connection and Setting 46 DLNA Music Streaming 11 4.Source Setup 29 iPod/iPhone Operation 47 About DLNA 11 5.Listening Mode Preset 32 Firmware Update 48 Configuring the Windows Media Player 11 6.Miscellaneous 33 About Firmware Update 48 DLNA Playback 11 7.Hardware Setup 33 Updating the Firmware via Network 48 Controlling Remote Playback from a PC 12 8.Remote Controller Setup 39 Updating the Firmware via USB 49 9.Lock Setup 39 Music Streaming from a Shared Folder 13 Troubleshooting 51 Operating Other Components Using Remote About Shared Folder 13 Reference Information 58 Setting PC 13 Controller 40 Playing from a Shared Folder 13 Functions of REMOTE MODE Buttons 40 Programming Remote Control Codes 40 En AM/FM Radio Receiving Function Tuning into stations manually 2. -

Digitale Televisie

Digitale zenderlijst Radio Basispakket Kerkradio Radio+ (gratis bij een pluspakket) 801 NPO Radio 1 951 KR Oosternijkerk PKN Sint 865 Stingray Rock Anthems 802 NPO Radio 2 Ceciliakerk 866 Stingray The Spa 803 NPO 3FM 952 KR Nes PKN Johannestsjerke 867 Stingray Easy Listening 804 NPO Radio 4 953 KR Paesens Herv. Sint Antonius 868 Stingray Classic Rock 805 NPO Radio 5 954 KR Damwald Herv. De Ikker 869 Stingray Piratenhits 806 NPO Soul & Jazz 955 KR Damwoude Herv. 870 Stingray Salsa 807 NPO FunX Bonifatiuskerk 871 Stingray Dance Classics 808 Omrop Fryslân Radio 956 KR Damwald Geref. de 872 Stingray Comedy 809 RTV Noord Ontmoeting 873 Stingray Country 810 RTV Drenthe 957 KR Dokkum Chr. Geref. 874 Stingray Love Songs 811 RTV NOF De Oase 875 Stingray Motown 812 Lokale Omroep Ameland 960 KR Hollum Herv. Gem. Ameland 876 Stingray Reggae 813 RTV Kanaal 30 961 KR Kollum PKN Oosterkerk 877 Stingray Italia 815 NDR 1 Niedersachsen ◊ 965 KR Broeksterwoude PKN 878 Stingray France 816 NDR 2 ◊ 966 KR Metslawier PKN Rehoboth 879 Stingray Espana 817 NDR Kultur ◊ 967 KR Niawier PKN Ny Sion 880 Stingray Blues 818 BBC Radio 2 968 KR R’geest PKN Alexanderkerk 881 Stingray Oldies 819 BBC Radio 3 969 KR R’geest PKN MFC de Bijer 882 Stingray Nederpop Gold 820 BBC Radio 4 970 KR Wierum PKN Mariatsjerke 883 Stingray Schlager 821 BBC World Service 971 KR Hollum Doopsgez/Geref. 884 Stingray Rock and roll 822 VRT Radio 1 885 Stingray Classical 823 VRT Radio 2 Radio+ 886 Stingray Jazz 824 MNM (gratis bij een pluspakket) 887 Stingray Jazz Classics 825 Studio Brussel -

Nederland Op Glasvezel 2019

NEDERLAND OP GLASVEZEL Een actueel overzicht van ontwikkelingen in de glasvezelsector INHOUDSOPGAVE 1 Nederland op Glasvezel 3 Deelnemers 5 Partners 7 Kennispartners 8 Het waarom van een brancheorganisatie voor de glasvezelsector 11 Glasvezel 19 Stand van zaken: aanbod glasvezel voor huishoudens in Nederland 23 Over-the-top video – wat kan het Nederlandse internet aan? 25 Huishoudens met, en huishoudens zonder glasvezelaansluiting 30 Ontwikkelingen in het buitengebied 37 Zakelijke markt 43 Corenetwerken 46 Internationale verbindingen 50 Conclusie 53 Alle actieve fiber carriers in Nederland Copyright FCA. All rights reserved. CONTACT Fiber Carrier Association (FCA) +31 38 750 1920 [email protected] fibercarriers.nl Copyright FCA. All rights reserved. COLOFON Aan deze uitgave hebben Editie meegewerkt: Nederland op Glasvezel: Andrew van der Haar, FCA Jaargang 3, december 2019 Menno Driesse, Dialogic Wouter Pegtel, Splend Beschikbaarheid Michiel Cazemier, Splend Gratis te downloaden op fibercarriers.nl Artwork Sam Zondervan, Splend © 2019 Fiber Carrier Association 1 NEDERLAND OP GLASVEZEL Voor u ligt de derde editie van Nederland op Glasvezel, het jaarlijkse rapport van de Fiber Carrier Association (FCA) over de stand van zaken bij de uitrol van glasvezel in Nederland. De FCA verbindt de eigenaren en beheerders van glasvezelnetwerken in Nederland met als doel samenwerking en kennisdeling. Vanaf die tijd kon Nederland bellen met Nederlands-Indië, overigens Het tijdperk van communicatie via tegen voor die tijd astronomische licht bedragen. 90 jaar later is overduidelijk De oprichtingsvergadering van hoe belangrijk communicatie over de Fiber Carrier Association afstand is. Niet alleen voor vond in maart 2016 plaats op gesprekken, maar ook voor een symbolische locatie: Radio datastromen. -

Summary Notification Form Relating to Draft Decisions of the Authority for Consumers and Markets (ACM) with Respect to the Relevant Markets For

Summary notification form relating to draft decisions of the Authority for Consumers and Markets (ACM) with respect to the relevant markets for: Call termination on individual public telephone networks provided at a fixed location (market 3) “fixed voice termination” and Voice call termination on individual mobile networks ( market 7 ) “mobile voice termination” In accordance with article 6b.2 of the Netherlands Telecommunications Act and article 6 and 7 of the Framework directive, ACM notifies draft measures, which would affect trade between Member States to the Commission of the European Communities, BEREC and to the national regulatory authorities. The Commission, BEREC and the national regulatory authorities have the opportunity to make comments to ACM. This summary notification form relates to the draft decision of ACM with respect to the markets for fixed and mobile voice termination (ACM/DTVP/2013/202441). Comments to this draft measure can be sent to: [email protected]. Draft market analysis decision for fixed and mobile voice termination This notification concerns the draft decision for fixed and mobile voice termination on individual networks (market 3 and 7 of the EC recommendation on relevant markets). In the market analysis all operators offering fixed and mobile voice termination are found to have SMP. Obligations are imposed on all operators, these include: symmetric tariff regulation (price caps), access and transparency obligations. The draft decision will be uploaded to the CIRCA website, related annexes can be downloaded from ACM’s website at www.acm.nl (in Dutch) Comments to this draft measure can be sent to [email protected] . -

Tarievenlijst Kabelnoord

Postbus 30 9100 AA Dokkum (0519) 701 701 [email protected] www.kabelnoord.nl Tarievenlijst Kabelnoord Tarieven per 1-5-2019 op basis van artikel 10 van de Algemene Voorwaarden van Kabelnoord te Dokkum Maandelijkse abonnementsvergoedingen Incl. 21% BTW 1. Basisabonnement € 21,50 2. Digitale televisie 2.1 Abonnement Kabelnoord Avontuur € 4,95 2.2 Abonnement Kabelnoord Familie € 4,95 2.3 Abonnement Kabelnoord Internationaal € 3,50 2.4 Abonnement Kabelnoord Totaal € 12,95 2.5 Abonnement Film1 € 15,95 2.6 Abonnement Ziggo Sport € 15,95 2.7 Abonnement FOX Sports Eredivisie € 8,50 2.8 Abonnement FOX Sports International € 7,50 2.9 Abonnement FOX Sports Totaal € 14,95 2.10 Abonnement Kabelnoord Live TV App € 0,00 3. Internet 3.1 Abonnement KNID Small € 25,00 3.2 Abonnement KNID Medium € 31,00 3.3 Abonnement KNID Large € 41,00 4. Telefonie 4.1 Abonnement Telefonie € 5,00 4.2 Abonnement Onbeperkt vast € 6,00 4.3 Abonnement Onbeperkt mobiel € 6,00 4.4 Abonnement Onbeperkt buitenland € 6,00 5. 3in1 pakketten 5.1 Abonnement 3in1 Small € 48,00 5.2 Abonnement 3in1 Medium € 55,00 5.3 Abonnement 3in1 Large € 65,00 Postbus 30 9100 AA Dokkum (0519) 701 701 [email protected] www.kabelnoord.nl Eenmalige, periodieke, incidentele vergoedingen 6. Aansluitkosten 6.1 • Als in een bestaand pand in een bekabeld gebied de kabel nog moet worden gelegd, incl. 20 meter graafwerk, tot aan de erfscheiding € 0,00 • Boven de 20 meter: prijs per meter € 12,50 6.2 Wijziging invoering aansluitpunt Verplaatsen aansluitpunt binnen een bestaand pand verloopt via offertetraject Offerte 7. -

Solutions for Pay TV Operators

Introduction In the era of cord-cutting and the streaming wars, Pay TV operators face intense competition for subscribers. They must reach more devices than ever before, with a user experience that stands out from the crowd - for all the right reasons! Enhanced features like network PVR and Catch-up TV are now so common in the marketplace that they are becoming must-have features for any serious pay TV operator. At the same time, consumers expect the flexibility to switch seamlessly between watching content in their living room via the set-top box (STB) and watching it on any of their favorite, other devices - from laptops, mobiles and tablets while they’re “on the go”, to streaming media devices, smart TVs and games consoles when they move to a different room. Operators who can’t deliver these essential capabilities find themselves rapidly falling behind. When other service providers offer a better user experience or can be accessed on a wider choice of devices, the cord cutting risk rises dramatically. Unfortunately, the need to reach new devices and offer new features comes as operators are also under pressure to trim costs. How can they balance consumer demand with their own financial and operational targets? To deliver these fully-featured user experiences, operators need flexible, future-proof technology strategies with sensible pricing. Multi-screen, multi-vendor, major headache Traditionally, running a pay TV service has involved putting together solutions from multiple technology vendors with many months (or years) of planning, development, integration and testing. There’s a tortuous, ever-growing project plan and an expanding price tag to match. -

Opmaak 1 20-05-16 16:12 Pagina 72

URC 7145 РУССКИЙ Список кодов Откройте батарейный отсек Вставьте 2 батарейки типа ААА Evolve_4_ manual 18 T 11x23_710812_PRINT_Opmaak 1 20-05-16 16:12 Pagina 72 РУССКИЙ РУССКИЙ ТАБЛИЦА КНОПОК POWER: MAGIC: настройка пульта включение и ДУ. выключение питания. WATCH TV: объединение WATCH MOVIE: объединение двух и более устройств в один двух и более устройств в режим для просмотра ТВ. один режим для просмотра фильмов. MODE: выбор устройств, управляемых пультом. AV: выбор источника FAV: сигнала для текущего любимые каналы. устройства. GUIDE: телегид, INFO: отображение электронный телегид. информации о текущем воспроизведении. SMART: доступ к Интернету и интеллектуальным функциям телевизора или устройства, подключен - EXIT: выход из меню ного к Интернету. текущего устройства. MENU: отображение меню BACK: возвращение на шаг текущего устройства. назад в меню текущего PP: предыдущая устройства. программа, последний канал. VOL: увеличение, уменьшение +/-: следующий или пре - громкости и отключение звука. дыдущий канал. 16:9: настройка 3D: доступ к параметрам соотношения сторон трехмерного изображения телевизора или ресивера (если поддерживается). цифрового телевидения. Красная, зеленая, желтая, синяя — клавиши функции «фасттекст» или быстрого доступа. PLAYBACK: клавиши воспроизведения для LIST: отображение списка текущего устройства. зафиксированных программ. 72 Evolve_4_ manual 18 T 11x23_710812_PRINT_Opmaak 1 20-05-16 16:12 Pagina 73 РУССКИЙ ESPAÑOL Благодарим вас за покупку универсального пульта One For All 4! Теперь вы можете управлять всеми аудио- и видеоустройствами с помощью одного пульта ДУ, который также имеет дополнительные функции, позволяющие объединять устройства в единую рабочую группу, отправлять несколько команд одним нажатием клавиши (макрокоманды), а также настраивать пульт ДУ в соответствии с вашими потребностями. Чтобы начать работу с новым пультом ДУ, прежде всего необходимо настроить его на управ- ление всеми устройствами домашнего кинотеатра. -

SOUNDTOUCH® 300 Universal Remote Control

SOUNDTOUCH® 300 universal remote control SETUP GUIDE • INSTALLATIONSVEJLEDNING • SETUP-ANLEITUNG • INSTALLATIEHANDLEIDING GUÍA DE CONFIGURACIÓN • ASENNUSOPAS • GUIDE D’INSTALLATION GUIDA ALL’INSTALLAZIONE • TELEPÍTÉSI ÚTMUTATÓ • OPPSETTVEILEDNING PRZEWODNIK KONFIGURACJI • GUIA DE CONFIGURAÇÃO • INSTALLATIONSGUIDE SETUP-ANLEITUNG INHALT Programmieren der Universalfernbedienung ..... 3 Universal Remote Control Device Codes TV ............................................................................................................... 6 Verwendung der Fernbedienung Cable ......................................................................................................... 8 Tasten der Universalfernbedienung ............................................. 4 Satellite .................................................................................................... 10 Quellenauswahl ..................................................................................... 4 DVD ........................................................................................................... 13 Bluetooth®-Technologie CD .............................................................................................................. 16 Abstimmung mit einem Mobilgerät .............................................. 5 Audio Accessory .................................................................................. 16 Abstimmen eines Mobilgeräts mit NFC ...................................... 5 Video Accessory .................................................................................. -

Afstemmen Op Een Radiozender

Details over AM/FM-ontvangst Afstemmen op een radiozender Automatisch tunen 1. Druk enkele keren op TUNER op de afstandsbediening om "AM" of "FM" te selecteren. 2. Druk op TUN MODE zodat het "AUTO"controlelampje op het display gaat branden. 3. Druk op de cursors / om het automatisch tunen te starten. Als alternatief kunt u op TUNING op het hoofdtoestel drukken om het automatisch tunen te starten. Automatisch zoeken stopt wanneer een zender is gevonden. Wanneer op een radiozender ingetuned is, brandt het controlelampje " TUNED " op het display. Wanneer afgestemd op een FMradiozender zal de "FM STEREO"indicator branden. Er wordt geen geluid uitgevoerd terwijl de " TUNED "indicator uit is. Wanneer het signaal van een FMradiozender zwak is: Radiogolven kunnen zwak zijn afhankelijk van de bouwconstructie en omgevingsomstandigheden. In dat geval voert u de procedure uit zoals hieronder in "Handmatig Tunen" uitgelegd wordt, om de gewenste zender met de hand te selecteren. Handmatig tunen 1. Druk enkele keren op TUNER op de afstandsbediening om "AM" of "FM" te selecteren. 2. Druk op TUN MODE zodat het "AUTO"controlelampje op het display uitgaat. 3. Terwijl u op de cursors / drukt, selecteert u de gewenste radiozender. Als alternatief kunt u op TUNING op het hoofdtoestel drukken. De frequentie verandert met 1 stap iedere keer wanneer u op de knop drukt. De frequentie verandert voortdurend als de knop wordt ingedrukt en stopt wanneer de knop wordt losgelaten. Stem af door op het display te kijken. Naar automatisch tunen terugkeren: Druk nogmaals op TUN MODE op de afstandsbediening. Het toestel stemt automatisch af op een radiozender. -

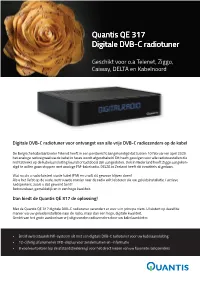

Quantis QE 317 Digitale DVB-C Radiotuner Quantis QE

Quantis QE 317 Digitale DVB-C radiotuner Geschikt voor o.a Telenet, Ziggo, Caiway, DELTA en Kabelnoord Digitale DVB-C radiotuner voor ontvangst van alle vrije DVB-C radiozenders op de kabel De Belgische kabelaanbieder Telenet heeft in een persbericht aangekondigd dat tussen 10 februari en april 2020 het analoge radiosignaal via de kabel in fases wordt afgeschakeld. Dit heeft gevolgen voor alle radiotoestellen die rechtstreeks op de kabelaansluiting (wandcontactdoos) zijn aangesloten. Ook in Nederland heeft Ziggo aangekon- digd te willen gaan stoppen met analoge FM-kabelradio. DELTA in Zeeland heeft dit inmiddels al gedaan. Wat nu als u radio luistert via de kabel (FM) en u wilt dit gewoon blijven doen? Als u het liefst op de oude, vertrouwde manier naar de radio wilt luisteren via uw geluidsinstallatie / actieve luidsprekers, zoals u dat gewend bent? Betrouwbaar, gemakkelijk en in een hoge kwaliteit. Dan biedt de Quantis QE 317 de oplossing! Met de Quantis QE 317 digitale DVB-C radiotuner verandert er voor u in principe niets. U luistert op dezelfde manier via uw geluidsinstallatie naar de radio, maar dan een hoge, digitale kwaliteit. Geniet van het grote aanbod van vrij uitgezonden radiozenders door uw kabelaanbieder. • Breid uw bestaande hifi-systeem uit met een digitale DVB-C radiotuner voor uw kabelaansluiting • 12-cijferig alfanumeriek VFD-display voor zendernamen en -informatie • 8 voorkeurtoetsen (op de afstandsbediening) voor het direct kiezen van uw favoriete radiozenders Quantis QE 317 Digitale DVB-C radiotuner Specificaties -

CAO Kabel & Telecom 2011-2012 Definitief 20 Mei 2011

CAO KABEL & TELECOM 2011-2012 CAO Kabel & Telecom 2011-2012 definitief 20 mei 2011 1 van 66 CAO KABEL & TELECOM / inhoudsopgave THEMA Paragraaf Onderwerp Pagina INLEIDING 1 Voorwoord 3 2 Uitgangspunten CAO 4 MIJN WERK 3 Arbeidsovereenkomst 5 4 Werkplek en mobiliteit 6 MIJN TIJD 5 Arbeidsduur 7 6 Werktijden 8 7 Afwijkende werktijden 9 8 Meeruren en overwerk 10 9 Volcontinudienst 11 10 Consignatiedienst 13 11 Vakantie 14 12 Bovenwettelijke vakantie 15 13 Verlof kopen 16 14 Verlof Budget 17 15 Zwangerschaps- en bevallingsverlof 18 16 Verlof bij bevalling en kraamverlof 19 17 Adoptieverlof en pleegzorgverlof 20 18 Ouderschapsverlof 21 19 Kortdurend zorgverlof 22 20 Langdurend zorgverlof 23 21 Calamiteitenverlof 24 22 Buitengewoon verlof 25 23 Bijzondere omstandigheden 26 24 Sabbatical leave 27 MIJN INKOMEN 25 Functiewaardering 28 26 Beloning / salaris, salarisschaal, salaristabel 29 27 Cao-verhoging 30 28 Beoordeling / salarisaanpassing 31 29 Resultaatafhankelijke uitkering 33 30 Benefit Budget 34 MIJN GEZONDHEID 31 Loondoorbetaling bij ziekte 36 32 Ontslagprocedure bij arbeidsongeschiktheid 38 33 Minder dan 35% arbeidsongeschikt 39 34 Loondoorbetaling bij bedrijfsongeval 40 35.A Zorgverzekering 41 35.B Verzekering bij gedeeltelijke arbeidsongeschiktheid 42 36 Overlijdensuitkering 43 MIJN LOOPBAAN 37 Opleiding en employability 44 38 Reorganisaties 45 39 Werkloosheid 46 40 Demotie 49 41 Levensloopregeling 50 42 Bijdrage Levensloopregeling 51 43 Pre-pensioen (FPU en FUR) 52 44 Pensioen 53 OVERIGE BEPALINGEN 45 Gedragsregels 54 46 Bezwaar en beroep 57 47 Afspraken met vakbonden 58 48 Overgangsregeling jubileumgratificatie 60 49 Begrippenlijst, links en adressen 61 CAO Kabel & Telecom 2011-2012 definitief 20 mei 2011 2 van 66 Inleiding 1. -

Device Codes

UNIVERSAL REMOTE DEVICE CODES Europe CONTENTS Universal Remote Device Codes TV ............................................................................................................... 3 Cable-Satellite ....................................................................................... 8 DVD ........................................................................................................... 17 Game ......................................................................................................... 21 AUX ........................................................................................................... 22 2 Universal Remote DEVICE CODES Aristona .......................................... 00082 BenQ ..................................................02391 Challenger .......................................03070 TV ART ...................................................02670 Berthen ............................................02692 Changhong ......................................01766 Acer ....................................................01652 Art Mito ............................................03833 Black Diamond ................................01859 Chimei .............................................. 03752 Acoustic Solutions ....................... 02044 Atec .................................................... 03157 Blaupunkt .........................................00133 CHL....................................................06565 Acronn .............................................. 09610 Atlantic ...........................................