Curriculum Source References the Following References Were Used In

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Optimal Execution of Portfolio Transactions∗

Optimal Execution of Portfolio Transactions¤ Robert Almgreny and Neil Chrissz December 2000 Abstract We consider the execution of portfolio transactions with the aim of minimizing a combination of volatility risk and transaction costs aris- ing from permanent and temporary market impact. For a simple lin- ear cost model, we explicitly construct the efficient frontier in the space of time-dependent liquidation strategies, which have minimum expected cost for a given level of uncertainty. We may then select op- timal strategies either by minimizing a quadratic utility function, or by minimizing Value at Risk. The latter choice leads to the concept of Liquidity-adjusted VAR, or L-VaR, that explicitly considers the best tradeoff between volatility risk and liquidation costs. ¤We thank Andrew Alford, Alix Baudin, Mark Carhart, Ray Iwanowski, and Giorgio De Santis (Goldman Sachs Asset Management), Robert Ferstenberg (ITG), Michael Weber (Merrill Lynch), Andrew Lo (Sloan School, MIT), and George Constaninides (Graduate School of Business, University of Chicago) for helpful conversations. This paper was begun while the first author was at the University of Chicago, and the second author was first at Morgan Stanley Dean Witter and then at Goldman Sachs Asset Management. yUniversity of Toronto, Departments of Mathematics and Computer Science; [email protected] zICor Brokerage and Courant Institute of Mathematical Sciences; [email protected] 1 December 2000 Almgren/Chriss: Optimal Execution 2 Contents Introduction 3 1 The Trading Model 6 1.1 The Definition of a Trading Strategy . 7 1.2 Price Dynamics . 7 1.3 Temporary market impact . 8 1.4 Capture and cost of trading trajectories . -

Board of Retirement Regular Meeting Sacramento County Employees’ Retirement System

Board of Retirement Regular Meeting Sacramento County Employees’ Retirement System Agenda Item 6 MEETING DATE: September 20, 2017 SUBJECT: Travel Reimbursement for Participation at Global Absolute Return Congress (October 23-25, 2017 in Boston, Massachusetts) Deliberation Receive SUBMITTED FOR: X Consent and Action and File RECOMMENDATION Staff recommends that the Board accept the travel and lodging reimbursement offered by Global Absolute Return Congress (‘Global ARC’) for SCERS’ Chief Investment Officer Steve Davis to participate on three discussion panels at this conference. PURPOSE To inform the Board on upcoming out-of-state travel and obtain advance approval to accept the travel and lodging reimbursement offered by Global ARC for Steve Davis’ participation in compliance with Government Code section 89500. BACKGROUND Sacramento County Employees’ Retirement System (‘SCERS’) has received an invitation to have one of its employees participate on three panels at the Global ARC Congress, which will be held in Boston, Massachusetts, from October 23 through October 25, 2017. Global ARC has requested that Steve Davis, SCERS’ Chief Investment Officer, be the designated employee. Included with the invitation was the offer from Global ARC to reimburse SCERS for admission, travel expenses, and lodging for three nights (October 22, 23 and 24) for the conference (See Exhibit A). Staff recommends that your Board approve acceptance of the gift, permit Mr. Davis to use the gift and publicly report its use in the Minutes for this meeting. DISCUSSION Trustees have repeatedly been advised that they should not accept conference fees or travel payments to attend industry events and conferences because such offers fall under the definition of a gift as that term is defined in the ethics chapter of the Public Reform Act, California Government Code §89500 et seq. -

HOW I BECAME a QUANT ? Book Review

HOW I BECAME A QUANT ? Book Review RK December 18, 2011 Abstract This document comprises a brief summary of 25 quant stories mentioned in this book. 1 How I became a Quant ? Contents 1 David Leinweber 3 2 Ronald N. Kahn 3 3 Gregg E.Berman 4 4 Evan Schulman 5 5 Leslie Rahl 6 6 Thomas Wilson 7 7 Neil Chriss 8 8 Peter Carr 10 9 Mark Anson 10 10 Bjorn Flesaker 11 11 Peter Jackel 12 12 Andrew Davidson 13 13 Andrew B. Weisman 14 14 Clifford S. Asness 15 15 Stephen Kealhofer 15 16 Julian Shaw 16 17 Steve Allen 18 18 Mark Kritzman 19 19 Bruce I. Jacobs and Kenneth N. Levy 20 20 Tanya Styblo Beder 21 21 Allan Malz 21 22 Peter Muller 22 23 Andrew J. Sterge 22 24 John F ( Jack) Marshall 23 2 How I became a Quant ? 1 David Leinweber David Leinweber graduates from MIT and Harvard with a bachelors and PhD respectively. He lands up at RAND corporation to work on AI. After working many years on classified stuff, he moves to LISP machines Inc. Once the market turned harsh towards hardware firms, David moved to Inference Corporation, a software-only AI firm where he starts working on AI applied to finance. LISP, with its garbage collection mechanism is not really suited to real time financial trading applications. So, David goes on to start his own firm, Integrated Analytics where AI is used for stock picking. He launches, Market Mind, an AI based tool for equity trading. Soon after this startup success, he joins First Quadrant, a Quantitative investment management firm where his group starts managing $6 Billion. -

Fernando V. Ferreira

FERNANDO V. FERREIRA The Wharton School, University of Pennsylvania Phone: (215) 898-7181 430 Vance Hall Email: [email protected] 3733 Spruce Street http://real-faculty.wharton.upenn.edu/fferreir/ Philadelphia, PA 19104-6301 Updated: February 2021 EMPLOYMENT C. F. Koo Professor, The Wharton School, University of Pennsylvania Departments of Real Estate, and Business Economics and Public Policy, 2019-present C. F. Koo Associate Professor, The Wharton School, University of Pennsylvania Departments of Real Estate, and Business Economics and Public Policy, 2018-2019 Associate Professor, The Wharton School, University of Pennsylvania Departments of Real Estate, and Business Economics and Public Policy, 2011-2017 Assistant Professor, The Wharton School, Real Estate Department, 2004-2011 EDUCATION Ph.D. in Economics, University of California, Berkeley, 1999-2004 M.A. in Economics, Federal University of Rio Grande do Sul, Brazil, 1997-1999 B.A. in Economics, State University of Maringa, Brazil, 1992-1996 UNIVERSITY SERVICE Ph.D. Coordinator, Wharton Applied Economics Program, 2012-2014, 2016-2019 Ph.D. Co-Coordinator, Wharton Applied Economics Program, 2006-2011 Recruiting Committee Chair, 2012-2014, 2016, 2019 Graduate Council of the Faculties, 2012-2014 Wharton Dean’s Advisory Council, 2012-2013 PROFESSIONAL RESPONSIBILITIES AND OTHER POSITIONS Co-Organizer, NBER Summer Institute Real Estate Meeting, 2014-present Co-Editor, Journal of Public Economics, 2013-2018 Research Associate, National Bureau of Economic Research (NBER), 2008-present Faculty Fellow, Penn Institute for Urban Research, 2009-present Visiting Scholar, Federal Reserve Bank of Philadelphia, 2006-present Visiting Scholar, Federal Reserve Bank of New York, 2010, 2016, and 2017 Visiting Scholar, Nova School of Business and Economics, 2014-2015 RECENT CONSULTING ACTIVITIES Google X RESEARCH AND PUBLICATIONS Published and Forthcoming Articles “The Role of Price Spillovers in the American Housing Boom”, with Anthony DeFusco, Wenjie Ding, and Joseph Gyourko. -

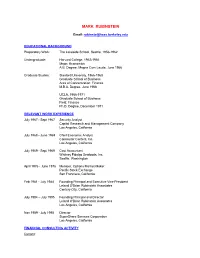

Mark Rubinstein

MARK RUBINSTEIN Email: [email protected] EDUCATIONAL BACKGROUND Preparatory Work: The Lakeside School, Seattle, 1956-1962 Undergraduate: Harvard College, 1962-1966 Major: Economics A.B. Degree, Magna Cum Laude, June 1966 Graduate Studies: Stanford University, 1966-1968 Graduate School of Business Area of Concentration: Finance M.B.A. Degree, June 1968 UCLA, 1968-1971 Graduate School of Business Field: Finance Ph.D. Degree, December 1971 RELEVANT WORK EXPERIENCE July 1967 - Sept 1967 Security Analyst Capital Research and Management Company Los Angeles, California July 1968 - June 1969 Chief Economic Analyst Commuter Centers, Inc. Los Angeles, California July 1969 - Sept 1969 Cost Accountant Whitney Fidalgo Seafoods, Inc. Seattle, Washington April 1976 - June 1976 Member, Options Market-Maker Pacific Stock Exchange San Francisco, California Feb 1981 - July 1984 Founding Principal and Executive Vice-President Leland O'Brien Rubinstein Associates Century City, California July 1984 – July 1995 Founding Principal and Director Leland O'Brien Rubinstein Associates Los Angeles, California Nov 1989 - July 1995 Director SuperShare Services Corporation Los Angeles, California FINANCIAL CONSULTING ACTIVITY Current: Past: Nov 1975 Pacific Stock Exchange (rules for underlying stocks for listing options) Feb-Apr 1977 Philadelphia Stock Exchange (economic justification of options on market index) Jan 1978-Mar 1979 Expert witness in Murray Case (security brokerage fraud) Apr 1978-Jul 1982 Expert witness in Blank Case (security brokerage fraud) Sep 1978-Jun 1979 Expert witness in Harris Case (security brokerage fraud) Sep-Oct 1979 Technique for valuing options on bonds Oct 1979-Feb 1981 Expert witness in Piron Case (security brokerage fraud) Jul 1984-May 1994 Leland O'Brien Rubinstein Associates (general consulting) Jul 1985-Dec 1995 Tradelink Corp. -

Registration Requirements for Foreign Securities

Financial Economists Roundtable Statement on Registration Requirements for Foreign Securities July 28, 1993 We the undersigned members of the Financial Economists Roundtable (FER) propose that American investors be allowed to trade the shares of major foreign companies as easily as they now trade the shares of U.S. companies. Our proposal should be viewed as a first step towards eliminating the regulatory impediments that now preclude the securities of most foreign firms from being traded on the principal U.S. equity markets. The Securities and Exchange Commission now requires foreign firms that wish to have their securities traded in these markets to register under the Securities Exchange Act of 1934, and, among other things, reconcile quantitatively their financial statements to U.S. generally accepted accounting principles (U.S. GAAP). This registration requirement hinders U.S. investors and exchanges in trading foreign shares. Eliminating impediments to the trading of foreign shares will enhance the competitive position of the United States in world equity markets and reduce the cost to U.S. investors, who trade these shares. Our proposal to facilitate the trading of foreign shares in U.S. markets is consistent with the principal elements of a recent suggestion made by the New York Stock Exchange. We propose that the equities of very large foreign companies be made eligible to be traded and/or listed in the United States on registered exchanges and on NASDAQ without conforming to all current SEC registration requirements. To be traded on U.S. equity markets, foreign companies would need to have available only their customary financial statements, independently audited, and have revenues of at least 3 billion dollars and a market capitalization of at least 1 billion dollars. -

Physicists Graduate from Wall Street Ver the Past Decade, the Number of Fall in Value

NEWS by Jennifer Ouellette Physicists Graduate from Wall Street ver the past decade, the number of fall in value. methods for predicting the stock market. OOPh.D. physicists employed in the finan- Hence, “risk management is more techni- Then, in the 1960s and early 1970s, Benoit cial community has increased dramatically. cal than ever,” says Neil Chriss, a vice presi- Mandelbrot—now widely known as the Once considered something of an anomaly dent and portfolio manager at Goldman “father of fractals” and an IBM Fellow Emeri- on Wall Street and in banking, physicists— Sachs Asset Management, who heads a fledg- tus at IBM’s T. J. Watson Research Center— and their fellow Ph.D.’s in mathematics, ling master’s program in financial mathemat- proposed a model of price variations that computer science, and engineering—have ics at New York University. “The need to eventually evolved into the concept of frac- become a critical element to successful control risk has become a computationally tional Brownian motion in multifractal time. investment strategies, gradually replacing intensive problem, involving the ability to Among other conclusions, Mandelbrot, who many employees who lack strong statistical price many different assets quickly.” worked at IBM from 1958 to 1993, demon- and analytical backgrounds. Today, quanti- Not surprisingly, the problem-solving strated that wealth acquired on the stock tative methods are commonplace on Wall skills of physicists are useful in this capacity, market is typically acquired during a small Street, despite concerns about their predic- as are their abilities to view a problem in a number of highly favorable periods—a find- tive accuracy, and the proliferation of Ph.D. -

Neoclassical Finance

PRINCETON LECTURES IN FINANCE Yacine Ait-Sahalia, Series Editor The Princeton Lectures in Finance, published by arrangement with the Bendheim Center for Finance of Princeton University, are based on annual lectures offered at Princeton University. Each year, the Bendheim Center invites a leading figure in the field of finance to deliver a set of lectures on a topic of major significance to researchers and professionals around the world. Stephen A. Ross, Neoclassical Finance Copyright © 2005 by Princeton University Press Published by Princeton University Press, 41 William Street, Princeton, New Jersey 08540 In the United Kingdom: Princeton University Press, 3 Market Place, Woodstock, Oxfordshire OX20 1SY All Rights Reserved Library of Congress Cataloging-in-Publication Data Ross, Stephen A. Neoclassical finance / Stephen A. Ross. p. cm. — (Princeton lectures in finance) Includes bibliographical references and index. ISBN 0-691-12138-9 (cloth : alk. paper) 1. Finance. 2. Efficient market theory. I. Title. II. Series. HG173.R675 2004 332.01—dc22 2004048901 British Library Cataloging-in-Publication Data is available Printed on acid-free paoer. ∞ pup.princeton.edu Printed in the United States of America 13579108642 To Carol, Kate, Jon, Doug, Lucy and my parents CONTENTS PREFACE ix ONE No Arbitrage: The Fundamental Theorem of Finance 1 TWO Bounding the Pricing Kernel, Asset Pricing, and Complete Markets 22 THREE Efficient Markets 42 FOUR A Neoclassical Look at Behavioral Finance: The Closed-End Fund Puzzle 66 BIBLIOGRAPHY 95 INDEX 101 PREFACE HIS MONOGRAPH IS based on the Princeton University Lectures in Finance that I gave in the spring of 2001. The Princeton lectures Tgave me a wonderful opportunity both to refine and expound on my views of modern finance. -

Blue Chip Managers for the Next Decade

TOMORROW’S TITANS Blue Chip Managers for the Next Decade IN ASSOCIATION WITH TOMORROW'S TITANS IN ASSOCIATION WITH Tomorrow's Titans: Blue Chip Managers for the 2010s In association with Ernst & Young HAMLIN LOVELL, CFA, CAIA, FRM dentifying the industry leaders of tomorrow The cosmopolitan nature of the hedge fund industry The final selection of the 40 was made solely by The matters, because allocators need constantly to means that over 20 primary nationalities were on Hedge Fund Journal. I search for new talent. Some managers among the long list with over 10 in the final 40. The limited Tomorrow’s Titans are hard closed already, but may number of women making the shortlist very simply Manager locations be accessible via secondary markets or exchange- reflects their still limited role in occupying senior The geographic distribution of the 40 reveals 17 listed vehicles. front-office positions in hedge funds. in the US, 18 in Europe and the rest in Asia and elsewhere. We have grouped the 40 by region, but Sourcing the survey within each region the 40 are ordered randomly. A broad spectrum of the investment industry contributed to the survey, often on a confidential Many emerging and frontier markets largely fall basis. Amongst allocators, we spoke to pension outside the scope of the survey, although many of funds, endowments, foundations, sovereign the managers are making significant allocations to wealth funds, funds of hedge funds, family offices, As a leading global provider of services to these markets. insurance companies, wealthy individuals, third the hedge fund industry, Ernst & Young is party marketing agents and investment consultants. -

NOTICES of the AMS VOLUME 42, NUMBER 8 People.Qxp 5/8/98 3:47 PM Page 887

people.qxp 5/8/98 3:47 PM Page 886 Mathematics People anybody in need; where others might slough it off, he is Franklin Institute Awards right there.” In May, the Franklin Institute presented medals to seven Chen Ning Yang of the State University of New York at individuals whose pioneering work in science, engineering, Stony Brook received the Bower Award and Prize for and education made significant contributions to under- Achievement in Science. This is the first year that this standing of the world. In addition to an awards dinner, a $250,000 award was given. The citation for the award to series of lectures and symposia highlighted the work of the Yang reads: “For the formulation of a general field theory honorees. Among those receiving awards were three who which synthesizes the physical laws of nature and provides have made important mathematical contributions. us with an understanding of the fundamental forces of the Joel L. Lebowitz of Rutgers University received the universe. As one of the conceptual masterpieces of the twen- Delmer S. Fahrney Medal “for his dynamic leadership which tieth century explaining the interaction of subatomic par- has advanced the field of statistical mechanics, and for his ticles, his theory has profoundly reshaped the development inspiring humanitarian efforts on behalf of oppressed sci- of physics and modern geometry during the last forty entists throughout the world.” Lebowitz, the George William years. This theoretical model, already ranked alongside the Hill Professor of Mathematics and Physics at Rutgers, is not works of Newton, Maxwell, and Einstein, will surely have only a renowned mathematician and physicist but also a a comparable influence on future generations. -

In Association With

ALI AKAY DANIELE BENATOFF JOHN BURBANK MARK CARHART TONY CHEDRAOUI NEIL CHRISS CHASE COLEMAN STEPHEN CZECH DEREK DUNN JOHN ECKERSON JEFFREY ENSLIN LOIC FERRY BRIAN FRANK CARL STEPHEN GEORGE ROB GIBBONS KAY HAIGH JOHN HO CARL HUTTENLOCHER RAY IWANOWSKI LOREN KATZOVITZ MASSI KHADJENOURI W. VIVIAN LAU BEN LEVINE GREG LIPPMAN JONATHAN MARTIN MARK MCGOLDRICK SAM MORLAND PETER MULLER MICHAEL PASCUTTI GUILLAUME RAMBOURG GERARD SATUR JENS-PETER STEIN MORGAN SZE GEORGE TAYLOR GALIA VELIMUKHAMETOVA JAIME VIESER BOAZ WEINSTEIN MICHAEL WEINSTOCK DANNY YONG JOE ZHOU ALI AKAY DANIELE BENATOFF JOHN BURBANK MARK CARHART TONY CHEDRAOUI NEIL CHRISS CHASE COLEMAN STEPHEN CZECH DEREK DUNN JOHN ECKERSON JEFFREY ENSLIN LOIC FERRY BRIAN FRANK CARL STEPHEN GEORGE ROB GIBBONS KAY HAIGH JOHN HO CARL HUTTENLOCHER RAY IWANOWSKI LOREN KATZOVITZ MASSI KHADJENOURI W. VIVIAN LAU BEN LEVINE GREG LIPPMAN JONATHAN MARTIN MARK MCGOLDRICK SAM MORLAND PETER MULLER MICHAEL PASCUTTI GUILLAUME RAMBOURG GERARD SATUR JENS-PETER STEIN MORGAN SZE GEORGE TAYLOR GALIA VELIMUKHAMETOVA JAIME VIESER BOAZ WEINSTEIN MICHAEL WEINSTOCK DANNY YONG JOE ZHOU ALI AKAY DANIELE BENATOFF JOHN BURBANK MARK CARHART TONY CHEDRAOUI NEIL CHRISS CHASE COLEMAN STEPHEN CZECH DEREK DUNN JOHN ECKERSON JEFFREY ENSLIN LOIC FERRY BRIAN FRANK CARL STEPHEN GEORGE ROB GIBBONS KAY HAIGH JOHN HO CARL HUTTENLOCHER RAY IWANOWSKI LOREN KATZOVITZ MASSI KHADJENOURI W. VIVIAN LAU BEN LEVINE GREG LIPPMAN JONATHAN MARTIN MARK MCGOLDRICK SAM MORLAND PETER MULLER MICHAEL PASCUTTI GUILLAUME RAMBOURG GERARD SATUR JENS-PETER STEIN MORGAN SZE GEORGE TAYLOR GALIA VELIMUKHAMETOVA JAIME VIESER BOAZ WEINSTEIN MICHAEL WEINSTOCK DANNY YONG JOE ZHOU ALI AKAY DANIELE BENATOFF JOHN BURBANK MARK CARHART TONY CHEDRAOUI NEIL CHRISS CHASE COLEMAN STEPHEN CZECH DEREK DUNN JOHN ECKERSON JEFFREY ENSLIN LOIC FERRY BRIAN FRANK CARL STEPHEN GEORGE ROB GIBBONS KAY HAIGH JOHN HO CARL HUTTENLOCHER RAY IWANOWSKI LOREN KATZOVITZ MASSI KHADJENOURI W. -

Copyrighted Material

P1: OTE/PGN P2: OTE JWPR007-Lindsey May 28, 2007 15:16 Contents Acknowledgments xiii Introduction 1 Chapter 1 David Leinweber President, Leinweber & Co. 9 A Series of Accidents 10 Grey Silver Shadow 13 Destroy before Reading 16 A Little Artificial Intelligence Goes a Long Way 18 How Do You Keep the Rats from Eating the Wires 20 COPYRIGHTEDStocks Are Stories, Bonds AreMATERIAL Mathematics 23 HAL’s Broker 26 Chapter 2 Ronald N. Kahn Global Head of Advanced Equity Strategies, Barclays Global Investors 29 Physics to Finance 30 BARRA’s First Rocket Scientist 34 v P1: OTE/PGN P2: OTE JWPR007-Lindsey May 28, 2007 15:16 vi CONTENTS Active Portfolio Management 42 Barclays Global Investors 44 The Future 46 Chapter 3 Gregg E. Berman Strategic Business Development, RiskMetrics Group 49 A Quantitative Beginning 50 Putting It to the Test 53 A Martian Summer 57 Physics on Trial 57 A Twist of Fate 59 A Point of Inflection 60 A Circuitous Route to Wall Street 61 The Last Mile 65 Chapter 4 Evan Schulman Chairman, Upstream Technologies, LLC 67 Measurement 68 Market Cycles 69 Process 69 Risk 70 And Return 71 Trading Costs 72 Informationless Trades 73 Applying it All 73 Electronic Trading 75 Lattice Trading 75 Net Exchange 76 Upstream 79 Articles 81 Chapter 5 Leslie Rahl President, Capital Market Risk Advisors 83 Growing Up in Manhattan 83 College and Graduate School 85 Nineteen Years at Citibank 88 Fifteen Years (So Far!) Running Capital Market Risk Advisors 90 P1: OTE/PGN P2: OTE JWPR007-Lindsey May 28, 2007 15:16 Contents vii Going Plural 92 The Personal Side 92 So How Did I Become a Quant? 92 Chapter 6 Thomas C.