Smallcap World Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Oman: Politics, Security, and U.S

Oman: Politics, Security, and U.S. Policy Updated January 27, 2020 Congressional Research Service https://crsreports.congress.gov RS21534 SUMMARY RS21534 Oman: Politics, Security, and U.S. Policy January 27, 2020 The Sultanate of Oman has been a strategic partner of the United States since 1980, when it became the first Persian Gulf state to sign a formal accord permitting the U.S. military to use its Kenneth Katzman facilities. Oman has hosted U.S. forces during every U.S. military operation in the region since Specialist in Middle then, and it is a partner in U.S. efforts to counter terrorist groups and related regional threats. The Eastern Affairs January 2020 death of Oman’s longtime leader, Sultan Qaboos bin Sa’id Al Said, is unlikely to alter U.S.-Oman ties or Oman’s regional policies. His successor, Haythim bin Tariq Al Said, a cousin selected by Oman’s royal family immediately upon the Sultan’s death, espouses policies similar to those of Qaboos. During Qaboos’ reign (1970-2020), Oman generally avoided joining other countries in the Gulf Cooperation Council (GCC: Saudi Arabia, Kuwait, UAE, Bahrain, Qatar, and Oman) in regional military interventions, instead seeking to mediate their resolution. Oman joined the U.S.-led coalition against the Islamic State organization, but it did not send forces to that effort, nor did it support groups fighting Syrian President Bashar Al Asad’s regime. It opposed the June 2017 Saudi/UAE-led isolation of Qatar and did not join a Saudi-led regional counterterrorism alliance until a year after that group was formed in December 2015. -

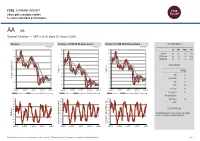

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance AA AA. General Retailers — GBP 0.25 at close 03 August 2020 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 03-Aug-2020 03-Aug-2020 03-Aug-2020 0.7 140 140 1D WTD MTD YTD 130 130 Absolute 4.6 4.6 4.6 -57.0 0.6 Rel.Sector 2.4 2.4 2.4 -48.8 120 120 Rel.Market 2.5 2.5 2.5 -46.1 110 110 0.5 100 100 VALUATION 90 0.4 90 80 Trailing Relative Price Relative Relative Price Relative 80 70 0.3 PE 1.6 70 Absolute Price (local currency) (local Price Absolute 60 EV/EBITDA 8.0 60 50 0.2 PB -ve 50 40 PCF 0.7 0.1 40 30 Div Yield 2.6 Aug-2019 Nov-2019 Feb-2020 May-2020 Aug-2020 Aug-2019 Nov-2019 Feb-2020 May-2020 Aug-2020 Aug-2019 Nov-2019 Feb-2020 May-2020 Aug-2020 Price/Sales 0.1 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity - 100 90 90 Div Payout 4.6 90 80 80 ROE - 80 70 70 70 Index) Share Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 40 The principal activity of the Company is providing 40 RSI RSI (Absolute) service of consumer roadside assistance. -

May CARG 2020.Pdf

ISSUE 30 – MAY 2020 ISSUE 30 – MAY ISSUE 29 – FEBRUARY 2020 Promoting positive mental health in teenagers and those who support them through the provision of mental health education, resilience strategies and early intervention What we offer Calm Harm is an Clear Fear is an app to Head Ed is a library stem4 offers mental stem4’s website is app to help young help children & young of mental health health conferences a comprehensive people manage the people manage the educational videos for students, parents, and clinically urge to self-harm symptoms of anxiety for use in schools education & health informed resource professionals www.stem4.org.uk Registered Charity No 1144506 Any individuals depicted in our images are models and used solely for illustrative purposes. We all know of young people, whether employees, family or friends, who are struggling in some way with mental health issues; at ARL, we are so very pleased to support the vital work of stem4: early intervention really can make a difference to young lives. Please help in any way that you can. ADVISER RANKINGS – CORPORATE ADVISERS RANKINGS GUIDE MAY 2020 | Q2 | ISSUE 30 All rights reserved. No part of this publication may be reproduced or transmitted The Corporate Advisers Rankings Guide is available to UK subscribers at £180 per in any form or by any means (including photocopying or recording) without the annum for four updated editions, including postage and packaging. A PDF version written permission of the copyright holder except in accordance with the provision is also available at £360 + VAT. of copyright Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency, Barnard’s Inn, 86 Fetter Lane, London, EC4A To appear in the Rankings Guide or for subscription details, please contact us 1EN. -

Academy of Management 2001 Annual Meeting Program

AM 2001 Sec A 5/1/01 8:47 AM Page 1 Academy of Management 2001 Meeting Marriott Wardman Park Hotel Hilton Washington & Towers Omni-Shoreham Hotel 2660 Woodley Road, NW 1919 Connecticut Avenue, NW 2500 Calvert Street, NW Washington, D.C. 20008 Washington, D.C. 20009 Washington, D.C. 20008 Phone: 1-202-328-2000 Phone: 1-202-483-3000 Phone: 1-202-234-0700 Fax: 1-202-234-0015 Fax: 1-202-232-0438 Fax: 1-202-265-7972 AM 2001 Sec A 5/1/01 8:47 AM Page 2 Academy of Management 2001 Meeting Table of Contents Section A: Information and Registration Welcome . A3 Washington Metro Map . A17 Distinguished and Featured Speakers . A4 Local Arrangements Committee Special Tours. A18 Meet the Meeting Planners . A6 Tour Reservation form . A20 Special Thanks to . A8 University Meeting Sponsors . A21 Registration, Housing and Travel Guidelines . A10 Placement Services . A26 Early Registration form . A12 2001 AoM Exhibitors . A28 Hotel Reservations . A13 William H. Newman Award Nominees . A30 Housing Reservation Form . A14 Carolyn Dexter Award Nominees . A31 Travel Information. A15 About the Academy of Management . A33 Welcome to Washington! . A16 2001 Meeting Statistics. A36 Sections B & C: 2001 Meeting Program Conference Program Guide . B1 Division Programs . C1 Session Details: Friday. C58 Saturday . C62 Sunday . C75 Monday . C86 Tuesday. C132 Wednesday . C165 Section D: Index of People on the Program Section E: Hotel Floor Plans Listing of Abbreviations, Inside Back Cover The Academy of Management 2001 Meeting Program Credits Logo designed by Rachel Gutek www.guppyart.com. Program designed by Rob Sexton, S Design, [email protected] Art & Poetry At the Still Point,There is only the Dance by Nancy Adler, McGill U. -

Introductory Note

Introductory Note: Section 58 of the New Zealand Superannuation and Retirement Income Act 2001 requires that the Guardians must invest the Fund on a prudent, commercial basis, and in a manner consistent with best-practice portfolio management. The Guardians have determined that this requires broad diversification of investments. The Fund’s investment strategy includes holding investments benchmarked to global market indices. On 30 June 2011, the Fund’s portfolio held over 6000 listed companies, providing diversification across most of the world’s countries and industries. The Table below sets out our direct exposure to listed companies, by country of exposure. Country of exposure is defined as location of the ultimate global parent's place of incorporation, except in the case of tax haven countries, where we instead look to the place of business for the headquarters of the ultimate global parent. The Fund also has indirect exposure to other companies through total return swaps linked to market indices and through investment in pooled funds. As the Fund increases in value, both the number of securities and the average size of each holding tend to increase. Security Name Value in New Zealand Dollars Australia Abacus Property Group 32,897 Acrux Ltd 36,391 Adelaide Brighton Ltd 101,165 AGL Energy Ltd 1,957,445 Alesco Corp Ltd 19,809 Alkane Resources Ltd 28,026 Alumina Ltd 145,456 Amcor Ltd 255,625 AMP Ltd 4,032,208 Ansell Ltd 116,456 APA Group 131,716 APN News & Media Ltd 2,829,583 Aquila Resources Ltd 84,275 ARB Corp Ltd 32,632 Ardent Leisure -

Full Property Address Primary Liable

Full Property Address Primary Liable party name 2019 Opening Balance Current Relief Current RV Write on/off net effect 119, Westborough, Scarborough, North Yorkshire, YO11 1LP The Edinburgh Woollen Mill Ltd 35249.5 71500 4 Dnc Scaffolding, 62, Gladstone Lane, Scarborough, North Yorkshire, YO12 7BS Dnc Scaffolding Ltd 2352 4900 Ebony House, Queen Margarets Road, Scarborough, North Yorkshire, YO11 2YH Mj Builders Scarborough Ltd 6240 Small Business Relief England 13000 Walker & Hutton Store, Main Street, Irton, Scarborough, North Yorkshire, YO12 4RH Walker & Hutton Scarborough Ltd 780 Small Business Relief England 1625 Halfords Ltd, Seamer Road, Scarborough, North Yorkshire, YO12 4DH Halfords Ltd 49300 100000 1st 2nd & 3rd Floors, 39 - 40, Queen Street, Scarborough, North Yorkshire, YO11 1HQ Yorkshire Coast Workshops Ltd 10560 DISCRETIONARY RELIEF NON PROFIT MAKING 22000 Grosmont Co-Op, Front Street, Grosmont, Whitby, North Yorkshire, YO22 5QE Grosmont Coop Society Ltd 2119.9 DISCRETIONARY RURAL RATE RELIEF 4300 Dw Engineering, Cholmley Way, Whitby, North Yorkshire, YO22 4NJ At Cowen & Son Ltd 9600 20000 17, Pier Road, Whitby, North Yorkshire, YO21 3PU John Bull Confectioners Ltd 9360 19500 62 - 63, Westborough, Scarborough, North Yorkshire, YO11 1TS Winn & Co (Yorkshire) Ltd 12000 25000 Des Winks Cars Ltd, Hopper Hill Road, Scarborough, North Yorkshire, YO11 3YF Des Winks [Cars] Ltd 85289 173000 1, Aberdeen Walk, Scarborough, North Yorkshire, YO11 1BA Thomas Of York Ltd 23400 48750 Waste Transfer Station, Seamer, Scarborough, North Yorkshire, -

UK Annual Report 2015 (Including the Transparency Report)

Investing to become the Clear Choice UK Annual Report 2015 (including the Transparency Report) December 2015 KPMG.com/uk Highlights Strategic report Profit before tax and Revenue members’ profit shares £1,958m £383m (2014: £1,909m) (2014: £414m) +2.6% -7% 2013 2014 2015 2013 2014 2015 Average partner Total tax payable remuneration to HMRC £623k £786m (2014: £715K) (2014: £711m) -13% +11% 2013 2014 2015 2013 2014 2015 Contribution Our people UK employees KPMG LLP Annual Report 2015 Annual Report KPMG LLP 11,652 Audit Advisory Partners Tax 617 Community support Organisations supported Audit Tax Advisory Contribution Contribution Contribution £197m £151m £308m (2014: £181m) (2014: £129m) (2014: £324m) 1,049 +9% +17% –5% (2014: 878) © 2015 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Strategic report Contents Strategic report 4 Chairman’s statement 10 Strategy 12 Our business model 16 Financial overview 18 Audit 22 Solutions 28 International Markets and Government 32 National Markets 36 People and resources 40 Corporate Responsibility 46 Our taxes paid and collected 47 Independent limited assurance report Governance 52 Our structure and governance 54 LLP governance 58 Activities of the Audit & Risk Committee in the year 59 Activities of the Nomination & Remuneration Committee in the year KPMG in the UK is one of 60 Activities of the Ethics Committee in the year 61 Quality and risk management the largest member firms 2015 Annual Report KPMG LLP 61 Risk, potential impact and mitigations of KPMG’s global network 63 Audit quality indicators 66 Statement by the Board of KPMG LLP providing Audit, Tax and on effectiveness of internal controls and independence Advisory services. -

Index to the US Department of State Documents Collection, 2010

Description of document: Index to the US Department of State Documents Collection, 2010 Requested date: 13-May-2010 Released date: 03-December-2010 Posted date: 09-May-2011 Source of document: Freedom of Information Act Officer Office of Information Programs and Services A/GIS/IPS/RL US Department of State Washington, D. C. 20522-8100 Fax: 202-261-8579 Notes: This index lists documents the State Department has released under the Freedom of Information Act (FOIA) The number in the right-most column on the released pages indicates the number of microfiche sheets available for each topic/request The governmentattic.org web site (“the site”) is noncommercial and free to the public. The site and materials made available on the site, such as this file, are for reference only. The governmentattic.org web site and its principals have made every effort to make this information as complete and as accurate as possible, however, there may be mistakes and omissions, both typographical and in content. The governmentattic.org web site and its principals shall have neither liability nor responsibility to any person or entity with respect to any loss or damage caused, or alleged to have been caused, directly or indirectly, by the information provided on the governmentattic.org web site or in this file. The public records published on the site were obtained from government agencies using proper legal channels. Each document is identified as to the source. Any concerns about the contents of the site should be directed to the agency originating the document in question. GovernmentAttic.org is not responsible for the contents of documents published on the website. -

Investment Performance of the Overall Fund, and of the Individual Fund Managers, for the Quarter to 30 September 2008 and the Twelve Months Ending on That Same Date

NORTH YORKSHIRE COUNTY COUNCIL PENSION FUND COMMITTEE 27 NOVEMBER 2008 PERFORMANCE OF THE FUND'S PORTFOLIO FOR THE QUARTER AND YEAR ENDING 30 SEPTEMBER 2008 Report of the Treasurer 1.0 PURPOSE OF REPORT 1.1 To report the investment performance of the overall Fund, and of the individual Fund Managers, for the Quarter to 30 September 2008 and the twelve months ending on that same date. 2.0 PERFORMANCE REPORT 2.1 The report (attached as a separate document) produced by Mellon Analytical Solutions (MAS) provides a complete performance analysis of the North Yorkshire Pension Fund for the quarter and year ending 30 September 2008. 2.2 Using the format prepared by MAS the report highlights the performance of the total Fund by asset class against the customised Fund benchmark. In addition, there is an analysis of the performance of each manager against their specific benchmark and a comparison of performance levels over time. 3.0 PERFORMANCE OF THE FUND 3.1 The performance of the various managers against their benchmarks for the Quarter ended 30 September 2008 is detailed on pages 5 / 7 of the MAS report. This performance is measured on a time-weighted basis and expressed as a +/- variation to their benchmark. 3.2 The absolute overall return for the quarter (-10.9%) was below the customised benchmark (-5.4%) by 5.5%. 3.3 Over the rolling year the Fund performance was 8.4% below the customised benchmark. The 12 month absolute return of -20.9% is down on the figure for the 12 months ended June 2008 (-11.5%). -

Description Holding Book Cost Market Price Market Value £000'S £000'S

DORSET COUNTY PENSION FUND VALUATION OF PORTFOLIO AT CLOSE OF BUSINESS 31 March 2017 Book Market Description Holding Market Value Cost Price £000's £000's UK EQUITIES MINING ACACIA MINING 33,000 147.93 4.502 148.57 ANGLO AMERICAN ORD USD0.54 270,390 2,804.18 12.27 3,317.69 ANTOFAGASTA ORD GBP0.05 74,500 151.50 8.355 622.45 BHP BILLITON ORD USD0.50 436,926 2,401.54 12.395 5,415.70 CENTAMIN EGYPT LTD 226,000 349.07 1.732 391.43 FRESNILLO 35,500 88.20 15.52 550.96 GLENCORE XSTRATA 2,412,543 5,662.91 3.141 7,577.80 HOCHSCHILD MINING ORD GBP0.25 49,000 108.90 2.765 135.49 KAZ MINERALS 53,600 89.80 4.551 243.93 PETRA DIAMONDS 106,900 169.67 1.329 142.07 POLYMETAL INT'L 53,800 514.30 9.945 535.04 RANDGOLD RESOURCES ORD USD0.05 19,250 485.32 69.7 1,341.73 RIO TINTO ORD GBP0.10 (REG) 250,150 2,876.49 32.185 8,051.08 VEDANTA RESOURCES ORD USD0.10 18,500 75.07 8.11 150.04 Total MINING 15,924.89 28,524.69 OIL & GAS PRODUCERS AFREN PLC 218,000 215.93 0 0.00 BP ORD USD0.25 3,948,100 13,177.95 4.5885 18,115.86 CAIRN ENERGY ORD GBP0.06153846153 119,207 236.32 2.048 244.14 NOSTRUM OIL & GAS 17,700 84.36 4.796 84.89 ROYAL DUTCH 'B' ORD EUR0.07 1,642,961 20,190.09 21.945 36,054.78 TULLOW OIL ORD GBP 0.10 188,500 789.92 1.99026 375.16 Total OIL & GAS PRODUCERS 34,694.58 54,658.45 CHEMICALS CRODA INTL ORD GBP0.10 26,995 211.15 35.77 965.61 ELEMENTIS 99,000 130.23 2.899 287.00 JOHNSON MATTHEY ORD GBP1.00 40,357 446.31 30.82 1,243.80 SYNTHOMER 57,665 118.87 4.751 273.97 VICTREX ORD GBP0.01 17,000 111.61 19.02 323.34 Total CHEMICALS 1,018.16 3,087.91 CONSTRUCTION -

Find Your Nearest Site

Find your nearest site Scotland Northern Ireland North East Isle of Man Yorkshire and the Humber North West East Midlands Wales West Midlands East of England Greater London South West South East East Midlands Site name Phone number Address Town/City Post code PRESTIGE - PROMECH GARAGE SERVICES 01664 503467 UNIT 3B ARNOLD NG5 7FJ PRESTIGE - AUTOMOTO CAR CARE CENTRE 01664 503467 33-41 HIGH ROAD BEESTON NG9 4AF STONEACRE PETERBOROUGH BOONGATE 01405 744192 FORTY ACRE ROAD BOONGATE PE1 5PS PRESTIGE - BOSTON TYRE & AUTO CENTRE 01664 503467 46 FYDELL STREET BOSTON PE21 8LF VERTU HONDA BOSTON 1 MARSH LANE BOSTON PE21 7QS NTA COALVILLE LEICS (503) 01530 834321 26 ASHBY ROAD COALVILLE LE67 3LA PRESTIGE - ANDERSON COMMERCIALS LTD 01664 503467 UNIT 7-8 SOUTH STREET COALVILLE LE67 1EU NTA CORBY NORTHANTS (495) 01536 203508 LLOYDS ROAD CORBY NN17 1AW PRESTIGE - CORBY CAR CARE CENTRE 01664 503467 3 CURIE COURTYARD CORBY NN17 5DU PRESTIGE - M & A CARS LTD 01664 503467 11 WHITTLE ROAD CORBY NN17 5DX HALFORDS GRANTHAM (677) 01476 591435 LONDON ROAD GRANTHAM NG31 6HS NTA GRANTHAM (655) 01476 575887 68 LONDON ROAD GRANTHAM NG31 6HR PRESTIGE - GRANTHAM SERVICE & MOT CENTRE 01664 503467 UNIT 1 ALMA PARK ROAD GRANTHAM NG31 9SE STONEACRE GRANTHAM 01405 744192 TOLLEMACHE ROAD SOUTH GRANTHAM NG31 7UH HALFORDS NOTTINGHAM HUCKNALL (210) 0115 963 8825 UNIT 4 CHRISTOPHER COURT HUCKNALL NG15 6EP PRESTIGE - ROMANS TYRES & EXHAUST LTD 01664 503467 11 STONEHILL HUNTINGDON PE29 6ED HALFORDS KETTERING (005) 01536 410421 TRAFALGAR ROAD KETTERING NN16 8DB PRESTIGE - SIGNATURE -

University of London Oman and the West

University of London Oman and the West: State Formation in Oman since 1920 A thesis submitted to the London School of Economics and Political Science in candidacy for the degree of Doctor of Philosophy Francis Carey Owtram 1999 UMI Number: U126805 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. Dissertation Publishing UMI U126805 Published by ProQuest LLC 2014. Copyright in the Dissertation held by the Author. Microform Edition © ProQuest LLC. All rights reserved. This work is protected against unauthorized copying under Title 17, United States Code. ProQuest LLC 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, Ml 48106-1346 bLOSiL ZZLL d ABSTRACT This thesis analyses the external and internal influences on the process of state formation in Oman since 1920 and places this process in comparative perspective with the other states of the Gulf Cooperation Council. It considers the extent to which the concepts of informal empire and collaboration are useful in analysing the relationship between Oman, Britain and the United States. The theoretical framework is the historical materialist paradigm of International Relations. State formation in Oman since 1920 is examined in a historical narrative structured by three themes: (1) the international context of Western involvement, (2) the development of Western strategic interests in Oman and (3) their economic, social and political impact on Oman.