FINAL CR Final Agile Writeup JAWS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Independent Chucks Brochure

PRODUCT CATALOG www.buckchuck.com Table of Contents Technical Information Why a Buck? .................................................................................................................................................................................................................................................3 Manual Chuck Selection ......................................................................................................................................................................................................................5 Spindle Identification for Mounting Plates .................................................................................................................................................................................6 Obsolete Chuck Crossover ...............................................................................................................................................................................................................7 Parts Breakdown ......................................................................................................................................................................................................................................8 ATSC Manual Steel Body Scroll Chucks --- Ajust-Tru ® Style 3 and 6 Jaw - Forged Steel Body Scroll Chuck - Hardened Reversible Top Jaws .................................................................................................9 3 and 6 Jaw - Forged Steel Body Scroll Chuck - Hardened -

Great White Shark) on Appendix I of the Convention of International Trade in Endangered Species of Wild Fauna and Flora (CITES)

Prop. 11.48 Proposal to include Carcharodon carcharias (Great White Shark) on Appendix I of the Convention of International Trade in Endangered Species of Wild Fauna and Flora (CITES) A. PROPOSAL ..............................................................................................3 B. PROPONENT............................................................................................3 C. SUPPORTING STATEMENT....................................................................3 1. Taxonomy.........................................................................................................................3 1.1 Class.................................................................................................................................... 1.2 Order................................................................................................................................... 1.3 Family ................................................................................................................................. 1.4 Species ................................................................................................................................ 1.5 Scientific Synonyms............................................................................................................. 1.6 Common Names .................................................................................................................. 2. Biological Parameters......................................................................................................3 -

JAWS: a Framework for High-Performance Web Servers

JAWS: A Framework for High-performance Web Servers James C. Hu Douglas C. Schmidt [email protected] [email protected] Department of Computer Science Washington University St. Louis, MO 63130 Abstract Siemens [1] and Kodak [2] and database search engines such as AltaVista and Lexis-Nexis. Developers of communication software face many challenges. To keep pace with increasing demand, it is essential to de- Communication software contains both inherent complexities, velop high-performance Web servers. However, developers such as fault detection and recovery, and accidental complex- face a remarkably rich set of design strategies when config- ities, such as the continuous re-rediscovery and re-invention uring and optimizing Web servers. For instance, developers of key concepts and components. Meeting these challenges must select from among a wide range of concurrency mod- requires a thorough understanding of object-oriented appli- els (such as Thread-per-Request vs. Thread Pool), dispatching cation frameworks and patterns. This paper illustrates how models (such as synchronous vs. asynchronous dispatching), we have applied frameworks and patterns for communication file caching models (such as LRU vs. LFU), and protocol pro- software to develop a high-performance Web server called cessing models (such as HTTP/1.0 vs. HTTP/1.1). No sin- JAWS. gle configuration is optimal for all hardware/software platform JAWS is an object-oriented framework that supports the and workloads [1, 3]. configuration of various Web server strategies, such as a The existence of all these alternative strategies ensures that Thread Pool concurrency model with asynchronous I/O and Web servers can be tailored to their users’ needs. -

Create a Profile for Jaws Users

Create a Profile The Commonwealth is committed to a diverse workforce, which includes those who require reasonable accommodations to do their job. The Candidate Portal has been tested by the Mass Office on Disability and the Mass Commission for the Blind for accessibility. This guide has been developed to assist candidates using JAWS 13 or 15 in creating a profile and applying for a job. Additionally, every job requisition posted on the site has the name and phone number of the Diversity/ADA coordinator included. Please reach out to them for any reasonable accommodation needed to apply for a job with the Commonwealth. Advantages of creating a profile The system works for you. If the system has your email it will send you a notification any time a new job posting matches your skills. This way you can immediately look at the posting and apply for that job. The system keeps all your information. This way you do not have to re-input your address, education, certifications and other common information. Each time you apply for another job the information is right there. Check it, correct/ edit/ update/ add to it and your application is ready to go. First time User creates a profile without applying for a job Go to Candidate job site Step 1. Go to Career Section - Create a Profile Step 2. Press Insert + F7 to access the Links List. Press the letter A until you hear ALL JOBS and press Enter. You will arrive at the All Jobs Page. Step 3. Press Insert + F7 to access the Links List. -

The BBC Video C Olle CT

THE BBC VIDEO COLLECTION at learn more alexanderstreet.com/bbc The BBC Video Collection The BBC’s mission is to enrich people’s lives with programs that inform, educate, and entertain. The BBC Video Collection combines 700 of Alexander Street’s most-viewed BBC films. Topics in the collection span multiple subjects and appeal to many patron types. Viewers will experience relevant, timely documentaries, and your library will see immediate usage and a positive return on investment. Popular series and films Purchase details • International Terrorism • The Royal Opera House Performances The BBC Video Collection is available via • Ancient Worlds • Beijing: Biography of an Imperial Capital subscription and outright purchase to libraries worldwide. Free MARC records are • Civilization • Eat, Fast, and Live Longer included for all films. • History of Flight • Nature’s Weirdest Events • Heroes of World War II • Inside the Louvre • The Space Age: NASA’s Story • Did God Have a Wife? • Australia • How to Build a Dinosaur Request a The breadth of content, along with flexible acquisition options, makes the BBC Video Collection relevant not only to students, scholars, and free other patrons, but to academic programs in history, science, business, trial art, music, health, and more. Faculty across the curriculum will find these documentaries useful in creating rich online, hybrid, and in- class experiences. alexanderstreet.com/bbc POWERFUL, ENHANCED PLATFORM SYNCHRONOUS, SEARCHABLE SCROLLING TRANSCRIPTS Scan or keyword-search the full text of each video. Click any spot in the transcript to jump straight to that segment of the video. Many videos feature on-screen transcripts. SHAREABLE PLAYLISTS AND PERMANENT LINKS Add all of your favorite films and clips into an online playlist. -

Dolphin P-K Teacher's Guide

Dolphin P-K Teacher’s Guide Table of Contents ii Goal and Objectives iii Message to Our Teacher Partners 1 Dolphin Overview 3 Dolphin Activities 23 Dolphin Discovery Dramatic Play 7 Which Animals Live with 25 Dolphins? Picture This: Dolphin Mosaic 9 Pod Count 27 Dolphins on the Move 13 How Do They Measure Up? 31 Where Do I Live? Food Search 15 dorsal dorsal 35 Dolphin or fin peduncle Other Sea Creature? median blowhole notch posterior Build a anterior fluke17s melon 37 pectoral Dolphin Recycling flipper eye rostrum ear Can Make a bottlenose dolphin Difference! 19 ventral lengDolphinth = 10-14 feet / 3-4.2 meters Hokeypokey 41 d Vocabularyi p h o l n Goal and Message to Our Objectives Teacher Partners At l a n t i s , Paradise Island, strives to inspire students to learn Goal: Students will develop an understanding of what a more about the ocean that surrounds dolphin is and where it lives. them in The Bahamas. Through interactive, interdisciplinary activities in the classroom and at Atlantis, we endeavor to help students develop an understanding of the marine world along with Upon the completion of the Dolphin W e a r e the desire to conserve it and its wildlife. Dolphin Cay Objectives: provides students with a thrilling and inspirational program, students will be able to: a resource for you. Atlantis, Paradise Island, offers opportunity to learn about dolphins and their undersea a variety of education programs on world as well as ways they can help conserve them. themes such as dolphins, coral reefs, sharks, Through students’ visit to Atlantis, we hope to Determine which animals live in the ocean like dolphins. -

Classwork for Weeks

Great White Sharks It can be found in almost all oceans all over the world and is the largest predatory fish. A full grown Great White Shark can grow up to 20 feet. That is more than three full grown men! Great White Sharks are so large that very few animals hunt them. Great White Sharks are meat eaters. They usually eat fish. Some Great White Sharks have been known to eat sea lions, seals, dolphins, and even whales. The Great White Shark does not chew up their food. It just takes a big bite. Then it gulps it down! The Great White Shark is a great hunter. It uses its senses to find its prey. Their sense of smell is very strong. It can smell blood in the water up to three miles away! The Great White Shark will lurk under the water. It will swim in a burst of speed to the surface of the water in a huge leap. It grabs its prey in its jaws. Gulp! Most Great White Shark attacks are accidents. The shark mistakes the human for its usual prey. In most Great White Shark attacks on humans, the shark just takes a bite before swimming off. Ouch! What a painful mistake! Great White Sharks Questions 1. A full grown Great White shark can grow up to _________________. That is more than _______ full grown men! 2. Name 3 things that Great White sharks eat. ________________________________________________________________ 3. How do Great White sharks find their prey? ________________________________________________________________ 4. Do most Great White sharks attack people on purpose? How do you know? ________________________________________________________________ 5. -

Fact File Poem/Song Programme 5 22 May by Sam Mcbratney

B B C Northern Ireland Learning One Potato, Two Potato Summer 2007 Wasps Programme 5 By Sam McBratney 22 May Wasps are considered to be a hazard by many people during the warmer months. In today’s story Colvin decides he is a friend of wasps – though later he is not so sure. Fact File • There are more then one million different species of insect, divided into thirty major groups, separated mainly by differences in the wings and the methods of feeding. • Wasps have biting jaws, used for eating solid food (as have grasshoppers and beetles). The jaws are not inside the mouth, but are really special legs, just outside the mouth. There are sharp teeth on them which cut the food into small pieces. Other ‘legs’ around the mouth help to hold the food and put it into the mouth when it has been cut up. The jaws and other feeding limbs are collectively known as the mouth-parts of the insect. • The wasp’s sting is its means of defence. Unlike some other insects and animals which employ camoufl age as a protection, wasps depend on their bold colours as a warning to predators. Only female wasps can sting. • Some insects, such as the hoverfl y, survive because their colours resemble a wasp’s. Birds avoid them for this reason. There are many such examples of mimicry in a variety of harmless insects. Poem/Song It’s morning in the kitchen, Soon breakfast will begin; We’ll have bread with jam or honey And some fancy biscuits from the tin. -

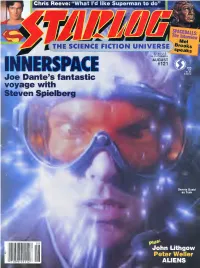

Starlog Magazine Issue

'ne Interview Mel 1 THE SCIENCE FICTION UNIVERSE Brooks UGUST INNERSPACE #121 Joe Dante's fantastic voyage with Steven Spielberg 08 John Lithgow Peter Weller '71896H9112 1 ALIENS -v> The Motion Picture GROUP, ! CANNON INC.*sra ,GOLAN-GLOBUS..K?mEDWARO R. PRESSMAN FILM CORPORATION .GARY G0D0ARO™ DOLPH LUNOGREN • PRANK fANGELLA MASTERS OF THE UNIVERSE the MOTION ORE ™»COURTENEY COX • JAMES TOIKAN • CHRISTINA PICKLES,* MEG FOSTERS V "SBILL CONTIgS JULIE WEISS Z ANNE V. COATES, ACE. SK RICHARD EDLUND7K WILLIAM STOUT SMNIA BAER B EDWARD R PRESSMAN»™,„ ELLIOT SCHICK -S DAVID ODEll^MENAHEM GOUNJfOMM GLOBUS^TGARY GOODARD *B«xw*H<*-*mm i;-* poiBYsriniol CANNON HJ I COMING TO EARTH THIS AUGUST AUGUST 1987 NUMBER 121 THE SCIENCE FICTION UNIVERSE Christopher Reeve—Page 37 beJohn Uthgow—Page 16 Galaxy Rangers—Page 65 MEL BROOKS SPACEBALLS: THE DIRECTOR The master of genre spoofs cant even give the "Star wars" saga an even break Karen Allen—Page 23 Peter weller—Page 45 14 DAVID CERROLD'S GENERATIONS A view from the bridge at those 37 CHRISTOPHER REEVE who serve behind "Star Trek: The THE MAN INSIDE Next Generation" "SUPERMAN IV" 16 ACTING! GENIUS! in this fourth film flight, the Man JOHN LITHGOW! of Steel regains his humanity Planet 10's favorite loony is 45 PETER WELLER just wild about "Harry & the CODENAME: ROBOCOP Hendersons" The "Buckaroo Banzai" star strikes 20 OF SHARKS & "STAR TREK" back as a cyborg centurion in search of heart "Corbomite Maneuver" & a "Colossus" director Joseph 50 TRIBUTE Sargent puts the bite on Remembering Ray Bolger, "Jaws: -

"It's Aimed at Kids - the Kid in Everybody": George Lucas, Star Wars and Children's Entertainment by Peter Krämer, University of East Anglia, UK

"It's aimed at kids - the kid in everybody": George Lucas, Star Wars and Children's Entertainment By Peter Krämer, University of East Anglia, UK When Star Wars was released in May 1977, Time magazine hailed it as "The Year's Best Movie" and characterised the special quality of the film with the statement: "It's aimed at kids - the kid in everybody" (Anon., 1977). Many film scholars, highly critical of the aesthetic and ideological preoccupations of Star Wars and of contemporary Hollywood cinema in general, have elaborated on the second part in Time magazine's formula. They have argued that Star Wars is indeed aimed at "the kid in everybody", that is it invites adult spectators to regress to an earlier phase in their social and psychic development and to indulge in infantile fantasies of omnipotence and oedipal strife as well as nostalgically returning to an earlier period in history (the 1950s) when they were kids and the world around them could be imagined as a better place. For these scholars, much of post-1977 Hollywood cinema is characterised by such infantilisation, regression and nostalgia (see, for example, Wood, 1985). I will return to this ideological critique at the end of this essay. For now, however, I want to address a different set of questions about production and marketing strategies as well as actual audiences: What about the first part of Time magazine's formula? Was Star Wars aimed at children? If it was, how did it try to appeal to them, and did it succeed? I am going to address these questions first of all by looking forward from 1977 to the status Star Wars has achieved in the popular culture of the late 1990s. -

1St Annual Vintage Film Awards Winners Announced

Contact James Rogers EMBARGO UNTIL 17:15 LONDON TIME Telephone +32 497 946 840 May 11, 2016 Email [email protected] Website www.vintagefilmawards.com ST 1 ANNUAL VINTAGE FILM AWARDS WINNERS ANNOUNCED Trophies go to films that stand the test of time BRUSSELS, BE, May 11, 2016– The first annual Vintage Film Awards were given tonight at the Press Club Brussels Europe, recognizing the films from 1995, 1985, 1975 and 1965 that audiences remember the best and still want to watch most. Award Categories Statuettes were awarded in the following categories: Vintage Film: Among the nominees, the film audiences would “most want to watch tonight” Zeitgeist Film: Among the nominees, the film still generating the most excitement among fans Vintage Performance by an Actor and Actress: For the best-remembered performance by leading actors in the nominated films Vintage Soundtrack Song: For the most-loved song from an original soundtrack in each year Selection Criteria - Shortlists Shortlists of 10 films from each year were determined by many factors, including: Enduring popularity. Do people still talk about the film and remember the dialogue? Is it still shown on television? Do many people still like it, rate it, and comment about it on social media? Sales. Are people still paying to watch this film (on DVD, via streaming, in theatres)? Trends. Has a limited-release film developed a cult following over the years? Are young people aware of the film? Selection Criteria - Winners Voting on vintagefilmawards.com narrowed the shortlists to 5 final nominees. Winners were determined by a third-party opinion poll of 1 200 adults in the English-speaking world. -

Lost (And Found) in Translation SEPTEMBER

Lost (and Found) in Translation: The writing of the film Gavagai and approaching film adaptation as intersemiotic translation Kirk Kjeldsen PhD / Doctoral Thesis The Polish National Film, Television and Theatre School in Lodz Film and Television Directing Department supervisor: Dr hab. Piotr Mikucki Table of Contents Abstract …………………………………………………………………………………………. 3 Section 1: Gavagai ....………………………………………………………………………….. 4 Section 2: A Model for Adaptation Analysis ……………...………………………………... 31 Section 3: Application of the Adaptation Analysis Model Gavagai ……………………………………………………………………….. 42 Solaris (Solyaris) (1968) .……………………………………………………. 55 Solaris (1972) …………………………………………………………………. 63 Solaris (2002) …………………………………………………………………. 78 Section 4: Conclusions ……….…………………………………………………………….... 91 References ………………………………………………………………………………… 103 Appendices …………………………………………………………………………………. 110 3 Abstract The purpose of this work is to consider film adaptation as a modality of intersemiotic translation, using the example of the writing of the screenplay for the feature film Gavagai, a form of an adaptation or intersemiotic translation involving the poetry of Tarjei Vesaas, and to put forth a model for adaptation or intersemiotic translation analysis of film narratives, incorporating elements from dramatic and literary theory (including the terminology of Aristotle, Frank Daniel via David Howard & Edward Mabley, Joseph Campbell, Lajos Egri, Syd Field, and Robert McKee) as well as elements from adaptation and translation studies (including Jeal-Paul Vinay and Jean Darbelnet’s taxonomy of translation shifts or shift types). The model will then be used for descriptive, comparative, and interpretative analysis of Gavagai as well as the multiple adaptations or intersemiotic translations of Stanisław Lem’s Solaris (the versions written by Nikolay Kemasky and directed by Lidiya Ishimbayeva and Boris Nirenburg, written by Fridrikh Gorenshtein and Andrei Tarkovsky and directed by Tarkovsky, and written and directed by Steven Soderbergh).