Fox Corporation Annual Report 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CORRECTION Iowa Wrestling to Appear on BTN 7 Times Big Ten Network Announces 2021 Big Ten Wrestling Schedule

From: Brewer, Christopher J [email protected] Subject: CORRECTION: Iowa Wrestling to Appear on BTN 7 Times -- Big Ten Network Announces 2021 Big Ten Wrestling Schedule Date: January 8, 2021 at 4:06 PM To: undisclosed-recipients:; Iowa vs. Nebraska on Jan. 15 is an 8 p.m. (CT) start time. From: Brewer, Christopher J <[email protected]> Sent: Friday, January 8, 2021 4:59 PM Cc: Brewer, Christopher J <[email protected]> Subject: Iowa Wrestling to Appear on BTN 7 Times -- Big Ten Network Announces 2021 Big Ten Wrestling Schedule The Big Ten Network announced Friday that six of top-ranked Iowa’s nine regular season duals will be televised. BTN will also televise the Big Ten Championships at Penn State on March 6-7. Iowa’s season opener against Nebraska on Jan. 15 will begin at 8 p.m. (CT). Other starts times have not yet been announced. The complete release from BTN is below. Day Date Visiting Team Home Team Time (CT) Friday Jan. 15 No. 5 Nebraska at No. 1 Iowa 8 PM Friday Jan. 22 No. 1 Iowa at No. 13 Minnesota TBD Sunday Jan. 31 No. 2 Michigan At No. 1 Iowa TBD Sunday Feb. 7 No. 1 Iowa vs. No. 7 Ohio State TBD Friday Feb. 12 No. 1 Iowa at No. 3 Penn State TBD Sunday Feb. 21 No. 1 Iowa at Wisconsin TBD B1G Saturday March 6 Championships at Penn State TBD B1G Sunday March 7 Championships at Penn State TBD FOR IMMEDIATE RELEASE Jan. 8, 2021 Link: https://wp.me/paBK59-5sjL Contact: Pat Kenny Big Ten Network Announces 2021 Big Ten Wrestling Schedule At least 18 duals scheduled to air on Big Ten Network CHICAGO, Ill. -

Analysis of Talk Shows Between Obama and Trump Administrations by Jack Norcross — 69

Analysis of Talk Shows Between Obama and Trump Administrations by Jack Norcross — 69 An Analysis of the Political Affiliations and Professions of Sunday Talk Show Guests Between the Obama and Trump Administrations Jack Norcross Journalism Elon University Submitted in partial fulfillment of the requirements in an undergraduate senior capstone course in communications Abstract The Sunday morning talk shows have long been a platform for high-quality journalism and analysis of the week’s top political headlines. This research will compare guests between the first two years of Barack Obama’s presidency and the first two years of Donald Trump’s presidency. A quantitative content analysis of television transcripts was used to identify changes in both the political affiliations and profession of the guests who appeared on NBC’s “Meet the Press,” CBS’s “Face the Nation,” ABC’s “This Week” and “Fox News Sunday” between the two administrations. Findings indicated that the dominant political viewpoint of guests differed by show during the Obama administration, while all shows hosted more Republicans than Democrats during the Trump administration. Furthermore, U.S. Senators and TV/Radio journalists were cumulatively the most frequent guests on the programs. I. Introduction Sunday morning political talk shows have been around since 1947, when NBC’s “Meet the Press” brought on politicians and newsmakers to be questioned by members of the press. The show’s format would evolve over the next 70 years, and give rise to fellow Sunday morning competitors including ABC’s “This Week,” CBS’s “Face the Nation” and “Fox News Sunday.” Since the mid-twentieth century, the overall media landscape significantly changed with the rise of cable news, social media and the consumption of online content. -

Pay TV in Australia Markets and Mergers

Pay TV in Australia Markets and Mergers Cento Veljanovski CASE ASSOCIATES Current Issues June 1999 Published by the Institute of Public Affairs ©1999 by Cento Veljanovski and Institute of Public Affairs Limited. All rights reserved. First published 1999 by Institute of Public Affairs Limited (Incorporated in the ACT)␣ A.C.N.␣ 008 627 727 Head Office: Level 2, 410 Collins Street, Melbourne, Victoria 3000, Australia Phone: (03) 9600 4744 Fax: (03) 9602 4989 Email: [email protected] Website: www.ipa.org.au Veljanovski, Cento G. Pay TV in Australia: markets and mergers Bibliography ISBN 0 909536␣ 64␣ 3 1.␣ Competition—Australia.␣ 2.␣ Subscription television— Government policy—Australia.␣ 3.␣ Consolidation and merger of corporations—Government policy—Australia.␣ 4.␣ Trade regulation—Australia.␣ I.␣ Title.␣ (Series: Current Issues (Institute of Public Affairs (Australia))). 384.5550994 Opinions expressed by the author are not necessarily endorsed by the Institute of Public Affairs. Printed by Impact Print, 69–79 Fallon Street, Brunswick, Victoria 3056 Contents Preface v The Author vi Glossary vii Chapter One: Introduction 1 Chapter Two: The Pay TV Picture 9 More Choice and Diversity 9 Packaging and Pricing 10 Delivery 12 The Operators 13 Chapter Three: A Brief History 15 The Beginning 15 Satellite TV 19 The Race to Cable 20 Programming 22 The Battle with FTA Television 23 Pay TV Finances 24 Chapter Four: A Model of Dynamic Competition 27 The Basics 27 Competition and Programme Costs 28 Programming Choice 30 Competitive Pay TV Systems 31 Facilities-based -

CHANNEL GUIDE Corpus Christi, TX

CHANNEL GUIDE Corpus Christi, TX TV SERVICES BASIC TV 2 Univision HD 12 KZTV CBS HD 22 Azteca America 192 TBN HD CHANNELS 816 CW-HD 3 Local Weather 13 KDF Independent 23 HSN HD 193 Inspiration Network 802 Univision HD 817 Telemundo HD 4 QVC HD 14 Retro TV 96 C-SPAN 270 Charge! 804 QVC HD 823 HSN HD 5 KIII ABC HD 15 My Network TV 137 QVC Plus 280 Grit 805 KIII ABC HD 7 KRIS NBC HD 16 CW 138 HSN 2 281 MeTV 807 KRIS NBC HD 8 UniMás 17 Telemundo HD 139 Jewelry TV 282 ION 809 KEDT PBS HD MUSIC CHOICE 9 KEDT PBS HD 18 Public Access 173 PBS Create 283 Create 811 KUQI FOX HD 701-752 10 Public Access 19 Educational Access 190 Daystar 284 Cozi TV 812 KZTV CBS HD 11 KUQI FOX HD 20 City of Corpus Christi 191 EWTN 291 UniMás 292 LATV PREFERRED TV (includes Basic TV) 1 On Demand 46 MSNBC HD 69 Oxygen HD 246 IndiePlex 841 Weather Channel HD 865 Bravo HD 6 NewsNation HD 47 truTV HD 70 History Channel HD 247 RetroPlex 842 CNN HD 866 Galavision HD 24 TNT HD 48 OWN HD 71 Travel Channel HD 393 HBO** 843 HLN HD 867 Syfy HD 25 TBS HD 49 TV Land HD 72 HGTV HD 397 Amazon Prime** 844 Fox News HD 868 Comedy Central HD 26 USA HD 50 Discovery HD 73 Food Network HD 398 HULU** 845 CNBC HD 869 Oxygen HD 27 A&E HD 51 TLC HD 77 SEC Network HD 399 NETFLIX** 846 MSNBC HD 870 History Channel HD 28 Lifetime HD 52 Animal Planet HD 78 SEC Network - Alternative HD CHANNELS 847 truTV HD 871 Travel Channel HD 29 E! HD 53 Freeform HD 79 Fox Sports 2 HD 806 NewsNation HD 848 OWN HD 872 HGTV HD 54 Hallmark Channel HD 30 Paramount Network HD 82 Tennis Channel 824 TNT HD 849 TV Land -

Chapter 4 the Right-Wing Media Enablers of Anti-Islam Propaganda

Chapter 4 The right-wing media enablers of anti-Islam propaganda Spreading anti-Muslim hate in America depends on a well-developed right-wing media echo chamber to amplify a few marginal voices. The think tank misinforma- tion experts and grassroots and religious-right organizations profiled in this report boast a symbiotic relationship with a loosely aligned, ideologically-akin group of right-wing blogs, magazines, radio stations, newspapers, and television news shows to spread their anti-Islam messages and myths. The media outlets, in turn, give members of this network the exposure needed to amplify their message, reach larger audiences, drive fundraising numbers, and grow their membership base. Some well-established conservative media outlets are a key part of this echo cham- ber, mixing coverage of alarmist threats posed by the mere existence of Muslims in America with other news stories. Chief among the media partners are the Fox News empire,1 the influential conservative magazine National Review and its website,2 a host of right-wing radio hosts, The Washington Times newspaper and website,3 and the Christian Broadcasting Network and website.4 They tout Frank Gaffney, David Yerushalmi, Daniel Pipes, Robert Spencer, Steven Emerson, and others as experts, and invite supposedly moderate Muslim and Arabs to endorse bigoted views. In so doing, these media organizations amplify harm- ful, anti-Muslim views to wide audiences. (See box on page 86) In this chapter we profile some of the right-wing media enablers, beginning with the websites, then hate radio, then the television outlets. The websites A network of right-wing websites and blogs are frequently the primary movers of anti-Muslim messages and myths. -

Pre-Upfront Thoughts on Broadcast TV, Promotions, Nielsen, and AVOD by Steve Sternberg

April 2021 #105 ________________________________________________________________________________________ _______ Pre-Upfront Thoughts on Broadcast TV, Promotions, Nielsen, and AVOD By Steve Sternberg Last year’s upfront season was different from any I’ve been involved in during my 40 years in the business. Because of the COVID-19 pandemic, there were no live network presentations to the industry, and for the first time since I’ve been evaluating television programming, I did not watch any of the fall pilots before the shows aired. Many new and returning series experienced production delays, resulting in staggered premieres, shortened seasons, and unexpected cancellations. The big San Diego and New York comic-cons were canceled. There was virtually no pre-season buzz for new broadcast or cable series. Stuck at home with fewer new episodes of scripted series than ever to watch on ad-supported TV, people turned to streaming services in large numbers. Netflix, which had plenty of shows in the pipeline, surged in terms of both viewers and new subscribers. Disney+, boosted by season 2 of The Mandalorian and new Marvel series, WandaVision and Falcon and the Winter Soldier, was able to experience tremendous growth. A Sternberg Report Sponsored Message The Sternberg Report ©2021 ________________________________________________________________________________________ _______ Amazon Prime Video, and Hulu also managed to substantially grow their subscriber bases. Warner Bros. announcing it would release all of its movies in 2021 simultaneously in theaters and on HBO Max (led by Wonder Woman 1984 and Godzilla vs. Kong), helped add subscribers to that streaming platform as well – as did its successful original series, The Flight Attendant. CBS All Access, rebranded as Paramount+, also enjoyed growth. -

The Delta Perspective

Sports rights: Not yet the ‘slam dunk’ for OTTs Sam Evans - Partner José del Valle-Iturriaga - Partner and Head of the Media, Sports & Entertainment practice Batuhan Er - Senior Consultant Raghul Suthagar - Consultant February 2019 THE DELTA PERSPECTIVE THE DELTA THETHE DELTADELTA PERSPECTIVEPERSPECTIVE THE DELTA PERSPECTIVE Sports rights: Not yet the ‘slam dunk’ for OTTs Authors: Sam Evans - Partner José del Valle-Iturriaga - Partner and Head of the Media, Sports & Entertainment practice Batuhan Er - Senior Consultant Raghul Suthagar - Consultant A shifting sports rights correction or a point of reflection as landscape leading internet platforms consider their premium content strategies. The value of sports rights has Overall, the global sports rights steadily increased across markets market is expected to continue with leagues such as NFL, La Liga growing annually at more than 4% and NBA growing 41%, 87% and for the coming years. 111% respectively between 2013 and 2018. For some properties, A significant driver of growth where there has historically been is expected to be the deeper consistent and rapid growth, penetration of new ‘non- like the English Premier League traditional’, i.e. non-pay TV players (EPL), most recent auctions have such as technology platforms and plateaued in rights value, which social media companies. These signifies a potential market players not only increase the 3 THE DELTA PERSPECTIVE Exhibit 1: Sports rights inflation and media rights market outlook Sport rights inflation 2018 Media Rights Market Outlook -

FOX CASE STUDY in BRIEF Going Live with .FOX

CL dot brand case studies Oct 2020.qxp_Layout 1 07/07/2020 10:22 Page 1 .FOX An iconic broadcasting company .FOX CASE STUDY IN BRIEF Going live with .FOX • Initiatives US multinational media corporation Fox Corp was one of the first mass Simplified navigation, entertainment brands to go live with a dot brand. It has used the .FOX TLD to content-driven (vanity) URLs support its digital entertainment businesses, which include the streaming of films, tv, music, and related products and services under the world-famous • Main model of use FOX brand. Web forwarding and marketing sites Fox Corporation (Fox) was formed in 2019 after the acquisition of the 21st Century • Key benefits Fox movie, cable and broadcast divisions by The Walt Disney Company. Fox retained Consumer trust, speed to market, HR, the television network and broadcast stations, including Fox News, Fox Sports and employee resources, and enhanced the Fox Network. Its Fox Television Stations division owns and operates 29 broadcast SEO TV stations in the United States. Its digital presence also covers a range of live streaming websites and on-demand mobile applications, each created to satisfy consumers’ changing viewing habits. Its portfolio also includes betting and gambling brands, such as Fox Bet. CORP.FOX With its .FOX registration, the corporation sought, in particular, to design a “trusted, “.FOX is a trusted specialized, hierarchical, and intuitive namespace” 1 for its iconic brands that could simplify user traffic and popularise its digital presence. This has led to the digital space for introduction of more than a hundred .FOX domain names, ranging from web everything you love forwarding to campaign sites, and internal URLs. -

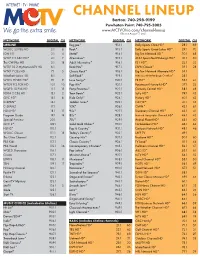

Powhatan Point Channel Lineup

CHANNEL LINEUP Barton: 740-298-9199 Powhatan Point: 740-795-5005 www.MCTVOhio.com/channel-lineup Effective August 17, 2021. NETWORK DIGITAL CH NETWORK DIGITAL CH NETWORK DIGITAL CH LIFELINE Reggae* 912 .1 Bally Sports Ohio HD* 28.1 69 WOUC 20 PBS HD 2.1 8 Rock* 913.1 Bally Sports Great Lakes HD* 29.1 70 ION HD 3.1 4 Metal* 914.1 Big Ten Network HD* 30.1 68 WTRF 7.3 ABC HD* 4.1 7 Alternative* 915.1 AT&T SportsNet Pittsburgh HD* 31.1 30 The CW Plus HD 5.1 18 Adult Alternative* 916.1 FS1 HD* 32.1 32 WTRF 33.2 MyNetworkTV HD 6.1 Rock Hits* 917.1 ESPN Classic* 33.1 28 WTRF 7 CBS HD 7.1 5 Classic Rock* 918.1 Big Ten Network Alternate HD* 34.1 WeatherNation HD 8.1 Soft Rock* 919.1 AT&T SportsNet Pittsburgh Overflow* 35.1 WTOV 9 NBC HD* 9.1 9 Love Songs* 920.1 FX HD* 36.1 47 WTOV 9.2 FOX HD 10.1 10 Pop Hits* 921.1 Paramount Network HD* 37.1 22 WQED 13 PBS HD 11 .1 13 Party Favorites* 922.1 Comedy Central HD* 38.1 48 KDKA 2 CBS HD 12 .1 2 Teen Beats* 923.1 SyFy HD* 39.1 45 QVC HD* 15.1 6 Kidz Only!* 924.1 History HD* 40.1 42 C-SPAN* 16.1 Toddler Tunes* 925.1 TLC HD* 41.1 53 C-SPAN2 17.1 Y2K* 926.1 OWN* 42.1 67 HSN HD* 18.1 12 90s* 927.1 Discovery Channel HD* 43.1 41 Program Guide 19.1 14 80s* 928.1 National Geographic Channel HD* 44.1 43 Special Preview 20.1 70s* 929.1 Animal Planet HD* 45.1 40 QVC 2* 109.1 Solid Gold Oldies* 930.1 Nickelodeon HD* 46.1 64 HSN2* 11 0 .1 Pop & Country* 931.1 Cartoon Network HD* 48.1 46 WOUC Classic 111 .1 15 Today's Country* 932.1 LAFF TV 49.1 The Ohio Channel 112 .1 Country Hits* 933.1 Freeform HD* 50.1 60 PBS -

Challenging ESPN: How Fox Sports Can Play in ESPN's Arena

Challenging ESPN: How Fox Sports can play in ESPN’s Arena Kristopher M. Gundersen May 1, 2014 Professor Richard Linowes – Kogod School of Business University Honors Spring 2014 Gundersen 1 Abstract The purpose of this study is to explore the relationship ESPN has with the sports broadcasting industry. The study focuses on future prospects for the industry in relation to ESPN and its most prominent rival Fox Sports. It introduces significant players in the market aside from ESPN and Fox Sports and goes on to analyze the current industry conditions in the United States and abroad. To explore the future conditions for the market, the main method used was a SWOT analysis juxtaposing ESPN and Fox Sports. Ultimately, the study found that ESPN is primed to maintain its monopoly on the market for many years to come but Fox Sports is positioned well to compete with the industry behemoth down the road. In order to position itself alongside ESPN as a sports broadcasting power, Fox Sports needs to adjust its time horizon, improve its bids for broadcast rights, focus on the personalities of its shows, and partner with current popular athletes. Additionally, because Fox Sports has such a strong regional persona and presence outside of sports, it should leverage the relationship it has with those viewers to power its national network. Gundersen 2 Introduction The world of sports is a fast-paced and exciting one that attracts fanatics from all over. They are attracted to specific sports as a whole, teams within a sport, and traditions that go along with each sport. -

To Serve Sports Fans. Anytime. Anywhere

TO SERVE SPORTS FANS. ANYTIME. ANYWHERE. MEDIA KIT 2013 OVERVIEW ESPNLA’S ECOSYSTEM RADIO - ESPNLA 710AM The flagship station of the Los Angeles Lakers, USC Football and Basketball, and in partnership with the Los Angeles Angels of Anaheim. Plus, live coverage of major sporting events, including: NBA Playoffs, World Series, Bowl Championship Series, X Games and more! DIGITAL - ESPNLA.COM The #1 sports website in Southern California representing all the Los Angeles sports franchises including: Lakers, Clippers, Dodgers, Angels, Kings, USC, UCLA, and more! EVENT ACTIVATION – ESPNLA hosts signature events like the Charity Golf Classic, Youth Basketball Weekend, USC Tailgates, Lakers Friday Night Live, for clients to showcase their products. SOCIAL MEDIA Twitter.com/ESPNLA710 Facebook.com/ESPNLA Instagram.com/ESPNLA710 STATION LINEUP PROGRAMMING SCHEDULE HOSTS BROADCAST DAYS MIKE & MIKE 3:00AM-7:00AM MONDAY-FRIDAY “THE HERD” 7:00AM-10:00AM MONDAY-FRIDAY COLIN COWHERD “ESPNLA NOW” 10:00AM-12:00PM MONDAY-FRIDAY MARK WILLARD MASON & IRELAND 12:00PM-3:00PM MONDAY-FRIDAY MAX & MARCELLUS 3:00PM-7:00PM MONDAY-FRIDAY ESPN Play-by-Play/ 7:00PM-3:00AM MONDAY-FRIDAY ESPN Programming ALL HOURS SAT-SUN WEEKEND WARRIOR 7:00AM-9:00AM SATURDAY *All times Pacific Mike Greenberg Mike Greenberg joined ESPN in 1996 as an anchor for ESPNEWS and was named co-host of Mike & Mike in the MONDAY - FRIDAY | 3:00AM – 7:00AM Morning with Mike Golic in 1999. In 2007, Greenberg hosted ABC’s “Duel,” and conducted play-by-play for Arena Football League games. He has also appeared in other ESPN media outlets, including: ESPN’s Mike & Mike at Night, TILT, League Night and “Off Mikes,” Emmy Award-winning cartoon. -

Nexstar Media Group Stations(1)

Nexstar Media Group Stations(1) Full Full Full Market Power Primary Market Power Primary Market Power Primary Rank Market Stations Affiliation Rank Market Stations Affiliation Rank Market Stations Affiliation 2 Los Angeles, CA KTLA The CW 57 Mobile, AL WKRG CBS 111 Springfield, MA WWLP NBC 3 Chicago, IL WGN Independent WFNA The CW 112 Lansing, MI WLAJ ABC 4 Philadelphia, PA WPHL MNTV 59 Albany, NY WTEN ABC WLNS CBS 5 Dallas, TX KDAF The CW WXXA FOX 113 Sioux Falls, SD KELO CBS 6 San Francisco, CA KRON MNTV 60 Wilkes Barre, PA WBRE NBC KDLO CBS 7 DC/Hagerstown, WDVM(2) Independent WYOU CBS KPLO CBS MD WDCW The CW 61 Knoxville, TN WATE ABC 114 Tyler-Longview, TX KETK NBC 8 Houston, TX KIAH The CW 62 Little Rock, AR KARK NBC KFXK FOX 12 Tampa, FL WFLA NBC KARZ MNTV 115 Youngstown, OH WYTV ABC WTTA MNTV KLRT FOX WKBN CBS 13 Seattle, WA KCPQ(3) FOX KASN The CW 120 Peoria, IL WMBD CBS KZJO MNTV 63 Dayton, OH WDTN NBC WYZZ FOX 17 Denver, CO KDVR FOX WBDT The CW 123 Lafayette, LA KLFY CBS KWGN The CW 66 Honolulu, HI KHON FOX 125 Bakersfield, CA KGET NBC KFCT FOX KHAW FOX 129 La Crosse, WI WLAX FOX 19 Cleveland, OH WJW FOX KAII FOX WEUX FOX 20 Sacramento, CA KTXL FOX KGMD MNTV 130 Columbus, GA WRBL CBS 22 Portland, OR KOIN CBS KGMV MNTV 132 Amarillo, TX KAMR NBC KRCW The CW KHII MNTV KCIT FOX 23 St. Louis, MO KPLR The CW 67 Green Bay, WI WFRV CBS 138 Rockford, IL WQRF FOX KTVI FOX 68 Des Moines, IA WHO NBC WTVO ABC 25 Indianapolis, IN WTTV CBS 69 Roanoke, VA WFXR FOX 140 Monroe, AR KARD FOX WTTK CBS WWCW The CW WXIN FOX KTVE NBC 72 Wichita, KS