Webinar Series Part 3: Understanding ABLE Accounts: Advancing Self-Sufficiency for Individuals with Disabilities and Their Families

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NAST Letter to the Congressional Military Family Caucus 7.21.20

July 21, 2020 Congressional Military Family Caucus Representative Sanford Bishop Representative Cathy McMorris Rodgers 2407 Rayburn HOB 1035 Longworth HOB Washington, D.C. 20515 Washington, D.C. 20515 President Deborah Goldberg, MA Dear Rep. Bishop and Rep. McMorris Rodgers: Executive Committee Henry Beck, ME As we celebrate the 30th Anniversary of the passage of the Americans with Disabilities Act David Damschen, UT Tim Eichenberg, NM (ADA), we can be proud of its positive impact on veterans with disabilities, while acknowledging Michael Frerichs, IL that there is much left to do. Dennis Milligan, AR Kelly Mitchell, IN The main purpose of the ADA is to provide people with disabilities equality of opportunity, full Shawn Wooden, CT participation in society, independent living, and economic self-sufficiency. But for more than two Executive Director decades after its passage, economic self-sufficiency was impossible for some. People with Shaun Snyder disabilities who need government benefits in order to live independently were blocked from saving 1201 Pennsylvania Ave, NW money. Without savings, economic self-sufficiency is unattainable. And without being able to Suite 800 fully participate in the economy, the other goals will not be fully realized. Washington, DC 20004 When the Achieving a Better Life Experience (ABLE) Act was passed into law in 2014, many www.NAST.org Americans with disabilities were empowered to save their own money to help pay for their disability expenses without fear of losing federal and state benefits. The Act was a meaningful step forward for people with disabilities. However, it came up short. After more than five years, and on the 30th birthday of the ADA, millions of Americans with disabilities, including veterans, still remain ineligible to open an ABLE account simply because they acquired their disability after they turned 26 years old. -

Testimony Before The

Testimony Before the U.S. House of Representatives, Subcommittee on Capital Markets, Insurance, and Government Sponsored Enterprises of the Committee on Financial Services June 2, 2004 Michael A. Olivas William B. Bates Distinguished Chair in Law and Director, Institute for Higher Education Law & Governance, University of Houston Law Center 100 Law Center Houston, Tx 77204-6060 [email protected] (713) 743-2078 Chairman Baker, Representative Hinojosa, and members of the Subcommittee: I am Michael A. Olivas, Professor of Law at the University of Houston Law Center, where I direct the Institute for Higher Education Law and Governance, the country’s only university research center devoted to the study of college law and finance issues. Thank you for the opportunity to present testimony this morning and to share research on prepaid plans and college savings plans, which I have been studying since they began. In a series of books and articles, I have been tracking these plans before and since they were accorded 529 status, and I am a true believer in the efficacy of these plans and the need for parents and family members to contribute to their children’s college education expenses. Because I have outlined my views elsewhere on the overall issues of equity and other public policy dimensions of these plans,1 I will concentrate this morning upon the consumer information/transparency/complexity issues-concerns that this subcommittee, its parent committee, and other public officials and citizens have expressed about related financial instruments, such as mutual funds, annuities, and complex commercial transactions.2 The Problem of System Complexity A good way to appreciate the complexity of 529 plans is to consider traditional retirement plans or 401K programs, and then make them more complicated. -

BACKGROUNDER No

BACKGROUNDER No. 3363 | NOVEMBER 15, 2018 Revised and Updated November 29, 2018 A State-by-State Comparison of 529 College Savings Plans Jonathan Butcher and Elizabeth Slattery Abstract As part of the Tax Cuts and Jobs Act enacted last year, federal lawmak- Key Points ers gave parents more flexibility with their own savings for their chil- dren’s education. Now, families that save money for college using what n Individuals and families should are commonly known as 529 college savings plans (named after Sec- have the ability to make decisions tion 529 of the Internal Revenue Code) can apply some of those savings about how to save and spend their hard-earned money. Inves- to pay tuition at private K–12 schools before a student finishes high tors must choose what is best for school. Because state policies and investment options are central com- their current and future needs. ponents of 529 plans, policymakers should review state laws to make n sure state rules do not interfere with the new options for students in With the Tax Cuts and Jobs Act, Washington gave families and federal tax law. Whether families and investors should use 529 savings students more options to utilize plans to pay for K–12 expenses is a decision for parents and students. their own savings. State policymakers should not interfere with parents who choose to n Families that save money for col- use their 529 savings plans to pay for K–12 education expenses. lege using 529 college savings plans can now use some of that Introduction savings to pay tuition at private As part of the Tax Cuts and Jobs Act (TCJA) enacted last year, K–12 schools—before a student federal lawmakers gave parents more flexibility with their own sav- finishes high school. -

Treasury Management Training Symposium

2017 NAST Treasury Management Training Symposium May 9-12, 2017 | Marriott City Center | Minneapolis, MN A MESSAGE FROM NAST’S PRESIDENT Welcome to the 2017 National Association of State Treasurers (NAST) Treasury Management Training Symposium. I am honored to represent my colleagues as NAST President for 2017 and look forward to working with each of you as we work to build on the progress made under my predecessors. With your support and attendance at this conference, as well as September’s Annual Conference in Boston, NAST is poised to have another outstanding year. NAST is off to a great start in 2017 with an increased presence in national media, a successful legislative conference and continued enhancement of both our administrative operations and fiscal management. Our membership and its leadership team are working hard to continually improve this already great organization. Together we are striving to provide treasurers, treasury officials and staff, network and corporate affiliates rich opportunities to discuss and engage on pertinent issues impacting each of our states. Your leadership team understands that our organization’s success relies on the active participation of both our public and private sector members and we are committed to ensuring this partnership earns a positive return on investment. NAST’s annual training symposium gets to the heart of what we do as treasury professionals and allows us a unique opportunity to learn from, and share with, each other. This year’s symposium features more training tracks than ever with a variety of practical topics. Whether you are looking to learn more about best practices and innovations in unclaimed property, public/private partnerships, or financial literacy, you are sure to benefit from the outstanding program offerings. -

National Endowment for Financial Education & the Council For

National Endowment for Financial Education & the Council for Economic Education Financial Education Policy Convening Initiative July 19, 2021 FINANCIAL EDUCATION POLICY CONVENING INITIATIVE EXECUTIVE SUMMARY In early 2021, the National Endowment for Financial Education® (NEFE®) and the Council for Economic Education (CEE) held a series of virtual financial education policy discussions focused on practices and policies. Although these five events had their own rich discussions, each touched upon themes that resonated across multiple convenings: Effective financial education is well-defined for educators; relevant to learners; provided by educators who are competent in the subject matter; reflective of thoughtful educational design; started at an early age; and linked to decisions that learners are readily able to make. There are many paths to financial stability. Communities have differing resources and approaches to achieving this, yet these pathways are not often reflected in traditional, mainstream financial education curricula. In addition, signals of financial well-being are not universal. Economic class, race, gender, age and cultural background all play a role in how each individual defines financial well-being. Access to financial institutions can be challenged by location, policies and trust, largely due to historical barriers and discrimination. Appropriately funded, intentional statewide approaches to financial education not only make a difference in individual lives but could also help move the equity needle for communities. INITIATIVE OVERVIEW From January 26 through February 11, 2021, the National Endowment for Economic Education (NEFE) and the Council for Economic Education (CEE) developed a series of five virtual financial education policy convenings. Over 250 representatives across sectors attended at least one of these discussions to explore issues surrounding the state of financial education in various settings across the country. -

Report 529 Plan Activity

AN EXCLUSIVE YEAR-END 529 REVIEW OF REPORT 529 PLAN ACTIVITY MARCH 2016 March 2016 The college Savings Plans Network (cSPN), a leading objective, non-profit voice for Section 529 Plans, is pleased to present findings from its 2015 year-end 529 Report. The report provides the latest information about 529 plans to parents, financial advisors and other key stakeholders to make informed decisions on how best to save for college. I believe that college is an investment in a child’s future. 529 plans are a successful way for families to make that investment. These plans are manageable, affordable and tax-advantaged. Today’s job market is more competitive than ever before, placing a premium on a college degree. Higher education opens up more career options and increasing earnings potential. Findings from the 2015 year-end 529 Report demonstrate that American families are continuing to invest in 529 plans, one of the most compelling ways for families of all income levels to plan ahead and save for college. CSPN is committed to helping families make that start by offering convenient tools and valuable information that can assist them in making wise decisions about saving for college. I encourage you to visit www.collegeSavings.org to learn how 529 plans are helping millions of American families make higher education dreams a reality for their children, grandchildren or even themselves. Hon. Young BoozeR, State tReaSuReR of alaBama chair, college SaviNgS PlaNS NeTwork execuTive Summary The College Savings Plans Network’s (CSPN) 529 Report is an independent source for complete and up-to-date information on Section 529 College Savings Plans. -

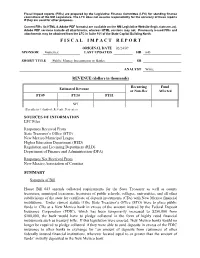

F I S C a L I M P a C T R E P O

Fiscal impact reports (FIRs) are prepared by the Legislative Finance Committee (LFC) for standing finance committees of the NM Legislature. The LFC does not assume responsibility for the accuracy of these reports if they are used for other purposes. Current FIRs (in HTML & Adobe PDF formats) are available on the NM Legislative Website (legis.state.nm.us). Adobe PDF versions include all attachments, whereas HTML versions may not. Previously issued FIRs and attachments may be obtained from the LFC in Suite 101 of the State Capitol Building North. F I S C A L I M P A C T R E P O R T ORIGINAL DATE 02/24/09 SPONSOR Gutierrez LAST UPDATED HB 643 SHORT TITLE Public Money Investments in Banks SB ANALYST White REVENUE (dollars in thousands) Recurring Fund Estimated Revenue or Non-Rec Affected FY09 FY10 FY11 NFI (Parenthesis ( ) Indicate Revenue Decreases) SOURCES OF INFORMATION LFC Files Responses Received From State Treasurer’s Office (STO) New Mexico Municipal League Higher Education Department (HED) Regulation and Licensing Department (RLD) Department of Finance and Administration (DFA) Responses Not Received From New Mexico Association of Counties SUMMARY Synopsis of Bill House Bill 643 amends collateral requirements for the State Treasurer as well as county treasurers, municipal treasurers, treasurers of public schools, colleges, universities, and all other subdivisions of the state for certificate of deposit investments (CDs) with New Mexico financial institutions. Under current statute if the State Treasurer’s Office (STO) were to place public funds in CDs at a New Mexico bank in excess of the amount insured by the Federal Deposit Insurance Corporation (FDIC), which has been temporarily increased to $250,000 from $100,000, the bank would have to pledge collateral in the form of highly rated financial instruments such as treasury bills. -

All Floors & More Inc .K & S Innovation Inc .Sd Air Llc 1

.ALL FLOORS & MORE INC .K & S INNOVATION INC .SD AIR LLC JOSEF ROGERS SEOUNG PARK RICHARD S SZWARC 7744 PETERS ROAD BOX 118 3583 LOST OAK DR 500 HANGAR ST PLANTATION FL 33324 BUFORD GA 30519-4525 SIOUX FALLS SD 57104 1 877 JNK TOGO 1 ROOFING COMPANY 1 STAR ENERGY ANTHONY D HOYT FERNANDO BOWEN JUDY A ROSE 5011 YELLOWSTONE PARK DR 1918 NW 66 ST 228 SACRAMENTO ST FREMONT CA 94538 MIAMI FL 33147 AUBURN CA 95603 10K WIZARD TECHNOLOGY LLC 12TH STREET GYM, INC 1640 2 AVE REST CORP P.O.BOX 975302 ATTN: MR. PIPER NUNZIO MONTAGNA DALLAS TX 75397-5302 204 SOUTH 12TH STREET 303 E 85TH PHILADELPHIA PA 19107 NEW YORK NY 10028 1830 CUBAN AND LATIN 1ST AVENUE SELF STORAGE 1ST INVSTMNT HM MADELEINE RAMIREZ KENNETH L. BROWN BRUCE A FACINO 6820 BIRD RD 120 SEA VIEW DRIVE 316 THRUSH CT MIAMI FL 33155 SAN RAFAEL CA 94901 ROSEVILLE CA 95747 2/90 SIGN SYSTEMS, INC. 202 TAPSCOTT EIOPO CORP 20NINE DESIGN STUDIOS, LLC P.O.BOX 888289 KWAKU NODUMEHLEI 1100 EAST HECTOR STREET,SUITE 305 GRAND RAPIDS MI 49588-8289 202 TAPSCOTT ST CONSHOHOCKEN PA 19428 BROOKLYN NY 11212 21 INC 2304 GRAND AVENUE LLC 2485 OCEAN AVE DEV LLC DAVE SOCHANEK BRUCE FIELDS OLGA LEVITANSKAYA 1861 CHERRY RUN CT NW 71 GREENE ST 3 MYSTIC LANE GRAND RAPIDS MI 49504 NEW YORK NY 10012 NORTHPORT NY 11235 30 DAYS RE CORP 327 EAST 84TH STREET INC 327 EAST 84TH STREET INC JAMES W STRATTON C/O CYNTHIA HEINZ C/O CYNTHIA HEINZ 15 S NEPTUNE AVE 878 HIGH POINTE CIR 878 HIGH POINTE CIR CLEARWATER FL 33765 MINNEOLA FL 34715 MINNEOLA FL 34715 3RD UNIVERSAL CORP 4TH AND INCHES 4WHEELS4U MERCY LOGAN YVETTE MORREALE ROSA ALLEN MURZDA 2980 E CAPITOL EXP #50-110 24821 SILVERSMITH DR 7512 E 11TH ST SAN JOSE CA 95148 LUTZ FL 33548-3322 TULSA OK 74112 54 MINT STREET LTD 95 TORGHELE FAMILY TRUST 95 TORGHELE FAMILY TRUST ROBERT MCCORMIC 1275 E. -

1 MORGAN STANLEY AUDIT RESOLUTION AGREEMENT This

MORGAN STANLEY AUDIT RESOLUTION AGREEMENT This Audit Resolution Agreement sets forth the terms and conditions for finalizing and resolving the unclaimed property audit that Verus Financial LLC ("Auditor") is conducting of Morgan Stanley, Morgan Stanley Distribution, Inc., Morgan Stanley Smith Barney LLC, and Morgan Stanley & Co. LLC (collectively, “Company”) on behalf of the states identified in the attached Schedule A (the "Participating States") that become Signatory States by executing the Agreement. WHEREAS Auditor is conducting an audit of the Company to identify property that was required to be reported and remitted to the Participating States on or before December 31, 2014 (the “Audit”); WHEREAS the Company has cooperated with the Signatory States and Auditor by making its books and records available for examination, and its personnel and agents available to assist as requested by the Signatory States and Auditor; WHEREAS the Company and the Signatory States recognize that a multi-state audit of this nature may be complex and time-consuming and that, in the absence of a prior understanding between the Parties, disputes may arise concerning how the Audit should be conducted; and WHEREAS the Company and the Signatory States desire to avoid unnecessary disputes and to have the Audit conducted in the most efficient and effective manner possible; NOW, THEREFORE, the Parties agree as follows: I. Definitions For purposes of this Agreement, capitalized terms have the meanings set forth below: 1 (a) "Agreement" means this Audit Resolution Agreement entered into among the Signatory States and the Company, which is also signed by Auditor as the authorized third party auditor for the Signatory States. -

Hon. Young Boozer Elected Chair of the College Savings Plans Network

FOR IMMEDIATE RELEASE: Media Contacts: Abby Berman Maggie Beaudouin 646.695.7044 646.695.7050 [email protected] [email protected] The College Savings Plans Network Elects New Chair and Board Members Alabama State Treasurer Young Boozer to Serve as Chair in 2016 and 2017 LEXINGTON, KY (January 6, 2016) — Alabama State Treasurer Young Boozer has been elected to serve as chairman of the College Savings Plans Network (CSPN) effective as of January 1. Treasurer Boozer is joined by new vice chair, Jim DiUlio, and new treasurer, Kathleen McGrath. Recently added to the board are Rachel Biar of Nebraska, Hon. Kelly Mitchell of Indiana, and Kevin Thompson of Florida. CSPN, the leading objective source of information about Section 529 College Savings Plans, provides resources for families of all income levels to plan ahead, save for college, and reduce their reliance on student loans. The network brings together state administrators of 529 savings and prepaid plans as well as their private sector partners and is dedicated to framing national policy affecting 529 plans. In his upcoming role, Treasurer Boozer will work alongside the executive board to carry out programs in an effort to promote 529 plans. “It is an honor to be elected by my peers for the position as CSPN chair,” said Boozer. “Saving for college is a huge undertaking and I’m excited to work with the leading resource to encourage families to begin investing and give them the tools to do so.” Boozer also currently serves as chair of the board for Alabama’s Prepaid College Tuition Program (PACT) and Alabama’s 529 college savings program, CollegeCounts. -

State Treasurers

NATIONAL ASSOCIATION OF STATE TREASURERS. August 29, 2014. Department of the Treasury Office of the Comptroller of the Currency 400 7th Street SW, Suite 3E-218, Mail Stop 9W-11 Washington, DC 20219. President Attn: Legislative and Regulatory Activities Division Richard Ellis, UT. Docket ID OCC-2013-0016. Board of Governors of the Federal Reserve System 20th Street and Constitution Avenue NW Washington, DC 20551. Attn: Robert deV. Frierson, Secretary Docket Number R-1466. Federal Deposit Insurance Corporation 550 17th Street, NW Washington, DC 20429. Attn: Comments / Legal ESS Robert E. Feldman, Executive Secretary 2760 Research Park Drive RIN Number 3064-AE04. PO Box 11910 Lexington, KY 40511. P (859) 244-8175. F (859) 244-8001. The National Association of State Treasurers ("NAST") is a bi-partisan association that is comprised of all state treasurers, or state finance officials with comparable responsibilities, from the United States, its commonwealths, territories, and the District of Columbia. The National Association of State Auditors, Comptrollers and Treasurers, is an organization for state officials tasked with the financial management of state government. NASACT's membership is comprised of officials who have been elected or appointed to the offices of state auditor, state comptroller or state treasurer in the 50 states, the District of Columbia, and the U.S. territories. www.NAST.org, On September 3, 2014, the Board of Governors of the Federal Reserve System (Board) and the Federal Deposit Insurance Corporation (FDIC) are scheduled to vote on the liquidity coverage ratio (LCR) final rule. We are very concerned and dismayed about news reports suggesting that the final rule by the Board, FDIC, and Office of the Comptroller of the Currency (OCC) (collectively, "the Agencies") may exclude municipal securities from the definition of "High Quality Liquid Assets" (HQLAs). -

College Savings Plans Network Reported

AN EXCLUSIVE YEAR-END 529 REVIEW OF REPORT 529 PLAN ACTIVITY MARCH 2017 MARCH 2017 The College Savings Plans Network (CSPN), the leading objective, non-profit voice for Section 529 Plans (defined in the following pages), is pleased to present its 2016 year-end 529 Report which provides recent growth trends of 529 plans. Findings from the 2016 year-end 529 Report demonstrate that American families are selecting 529 plans to save for college, and continue to make contributions to the plans in preparation for the increasing cost of tuition. The vision of CSPN is to provide a broadened awareness, understanding, and use of 529 plans to empower families to save for higher education. The numerous benefits of 529 plans, including its tax-advantaged status, offer a simple, flexible, and beneficial way for families of all income levels to save for higher education. Today’s job market is more competitive than ever before, placing a premium on a college degree. Higher education provides an advantage while opening up more career options and increasing earnings potential. I encourage you to visit www.CollegeSavings.org to learn how 529 plans are helping millions of American families make higher education dreams a reality for their children, grandchildren or even themselves. HON. YOUNG BOOZER, STATE TREASURER OF ALABAMA CHAIR, COLLEGE SAVINGS PLANS NETWORK EXECUTIVE SUMMARY The College Savings Plans Network’s (CSPN) 529 Report is an independent source for complete and up-to-date information on Section 529 College Savings Plans. The 2016 529 Report includes data from 108 savings and prepaid tuition plans (Section 529 Plans).