State Treasurers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

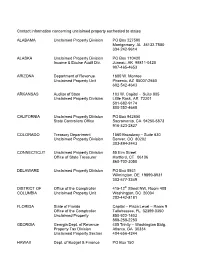

Contact Information Concerning Unclaimed Property Escheated to States

Contact information concerning unclaimed property escheated to states ALABAMA Unclaimed Property Division PO Box 327580 Montgomery, AL 36132-7580 334-242-9614 ALASKA Unclaimed Property Division PO Box 110420 Income & Excise Audit Div. Juneau, AK 99811-0420 907-465-4653 ARIZONA Department of Revenue 1600 W. Monroe Unclaimed Property Unit Phoenix, AZ 85007-2650 602-542-4643 ARKANSAS Auditor of State 103 W. Capitol - Suite 805 Unclaimed Property Division Little Rock, AR 72201 501-682-9174 800-252-4648 CALIFORNIA Unclaimed Property Division PO Box 942850 State Controllers Office Sacramento, CA 94250-5873 916-323-2827 COLORADO Treasury Department 1560 Broadway – Suite 630 Unclaimed Property Division Denver, CO 80202 303-894-2443 CONNECTICUT Unclaimed Property Division 55 Elm Street Office of State Treasurer Hartford, CT 06106 860-702-3050 DELAWARE Unclaimed Property Division PO Box 8931 Wilmington, DE 19899-8931 302-577-3349 DISTRICT OF Office of the Comptroller 415-12th Street NW, Room 408 COLUMBIA Unclaimed Property Unit Washington, DC 20004 202-442-8181 FLORIDA State of Florida Capital – Plaza Level – Room 9 Office of the Comptroller Tallahassee, FL 32399-0350 Unclaimed Property 850-922-1403 888-258-2253 GEORGIA Georgia Dept. of Revenue 405 Trinity – Washington Bldg. Property Tax Division Atlanta, GA 30334 Unclaimed Property Section 404-656-4244 HAWAII Dept. of Budget & Finance PO Box 150 Unclaimed Property Branch Honolulu, HI 96810-0150 808-586-1590 IDAHO Idaho State Tax Commission PO Box 36 Unclaimed Property Section Boise, ID 83722-2240 208-334-7627 ILLINOIS State of Illinois PO Box 19495 Dept. of Financial Institutions Springfield, IL 62794-9495 Unclaimed Property 217-557-3405 INDIANA Office of the Attorney General 402 W. -

A Practical Toolkit for Investors

Managing the Risks and Opportunities of Climate Change: A Practical Toolkit for Investors Investor Network on Climate Risk Ceres, Inc. April 2008 99 Chauncy Street Boston, MA 02111 (617) 247-0700 ext. 15 www.ceres.org and www.incr.com A Publication of Ceres and the Investor Network on Climate Risk About INCR Th e Investor Network on Climate Risk (INCR) is a network of institutional investors and fi nancial institutions that promotes better understanding of the risks and opportunities posed by climate change. INCR is comprised of over 60 institutional investors and represents more than $5 trillion in assets. INCR is a project of Ceres. For more information, visit www.incr.com or contact: Investor Network on Climate Risk Ceres, Inc. 99 Chauncy St., Boston, MA 02111 (617) 247-0700 ext.15 About Ceres Ceres is a coalition of investment funds, environmental organizations, and public interest groups. Ceres’ mission is to move businesses, capital, and markets to advance lasting prosperity by valuing the health of the planet and its people. Investor members include state treasurers, state and city comptrollers, public pension funds, investment fi rms, religious groups, labor unions, and foundations. Ceres directs the Investor Network on Climate Risk (INCR). For more information, visit www.ceres.org or contact: Ceres, Inc. 99 Chauncy St., Boston, MA 02111 (617) 247-0700 ext.15 About the Authors Th is report was authored by David Gardiner and Dave Grossman of David Gardiner & Associates. Th e mission of David Gardiner & Associates (DGA) is to help organizations and decision-makers solve energy and climate challenges. -

January 19, 2021 Board Meeting

January 19, 2021 Board Meeting Agenda 1 Minutes December 15, 2020 Meeting 2 Asset Management 5 Communications and Planning 6 Development 12 Energy and Housing Services 14 Finance Monthly Report 17 Financial & Budget Report 19 Finance Delinquency Report & Charts 29 Homeless Initiatives 41 Homeownership 44 Housing Choice Voucher 48 Human Resources and Facilities 52 Information Technology 54 Report of the Audit Committee 55 2021 Calendar 57 Board of Commissioners Meeting – January 19, 2021 9:00 A.M. – 12:00 P.M. MEMBERS OF THE BOARD: Lincoln Merrill, Jr. (Chair), Donna Talarico (Secretary), Thomas Davis, Daniel Brennan, Laurence Gross, Henry Beck, Bonita Usher (Vice Chair), AGENDAKevin P. Joseph, Laura Buxbaum _____________________________________________________________________________________________ 9:00 Adopt Agenda (VOTE) Lincoln Merrill Approve minutes of December 15, 2020 meeting (VOTE) All Communications and Conflicts All Chair of the Board Updates Lincoln Merrill Director Updates Dan Brennan 9:30 Adopt 2021 DOE Weatherization State Plan (VOTE) Kim Ferenc 9:45 Legislative Review Peter Merrill 10:15 Resource Allocation Report Dan Brennan 10:35 Emergency Rental Assistance Dan Brennan 10:50 9% and 4% Deals Mark Wiesendanger 11:05 Youth Demonstration Program Lauren Bustard Department Reports: All Asset Management Communications and Planning Development Energy and Housing Services Finance Monthly Report Financial & Budget Report Finance Delinquency Report & Charts Homeless Initiatives Homeownership Housing Choice Voucher Human Resources and Facilities Information Technology Report of the Audit Committee 2021 Board Calendar Adjourn (VOTE) All The next meeting of the Board is scheduled February 16, 2021 via teleconference 1 Minutes of the Board of Commissioners Meeting December 15, 2020 MEETING CONVENED A regular meeting of the Board of Commissioners for MaineHousing convened on December 15, 2020 virtually. -

Property Tax: a Primer and a Modest Proposal for Maine

Maine Law Review Volume 57 Number 2 Symposium: Reflections from the Article 12 Bench June 2005 Property Tax: A Primer and a Modest Proposal for Maine Clifford H. Goodall University of Maine School of Law Seth A. Goodall University of Maine School of Law Follow this and additional works at: https://digitalcommons.mainelaw.maine.edu/mlr Part of the Property Law and Real Estate Commons, and the Taxation-State and Local Commons Recommended Citation Clifford H. Goodall & Seth A. Goodall, Property Tax: A Primer and a Modest Proposal for Maine, 57 Me. L. Rev. 585 (2005). Available at: https://digitalcommons.mainelaw.maine.edu/mlr/vol57/iss2/12 This Article is brought to you for free and open access by the Journals at University of Maine School of Law Digital Commons. It has been accepted for inclusion in Maine Law Review by an authorized editor of University of Maine School of Law Digital Commons. For more information, please contact [email protected]. PROPERTY TAX: A PRIMER AND A MODEST PROPOSAL FOR MAINE Clifford H. Goodall and Seth A. Goodall I. INTRODUCTION II. A SHORT HISTORY OF A VERY OLD TAX III. THE GOOD AND BAD OF PROPERTY TAXATION IV. LEGAL REQUIREMENTS OF PROPERTY TAx REFORM IN MAINE A. Property Taxation ifaws of Maine: Equality and Uniformity B. Balkanized Equality and Uniformity C. Municipal Taxation and Revenue Generation V. PROPERTY TAX LIMITS VI. RESULTING IMPACTS OF PROPERTY TAX LIMITATIONS A. Revenue Impacts B. Service Impacts C. Local Control D. Impacts of Statutory and ConstitutionalFunding Mandates on Educa- tion and County Government VII. -

State Treasurers Urge More Drug Companies to Help Fight Opioid Epidemic

FOR IMMEDIATE RELEASE CONTACT: September 5, 2017 Paris Ervin 217.524.5749 Greg Rivara 312.814.1901 State Treasurers Urge More Drug Companies to Help Fight Opioid Epidemic Accountability Sought at Cardinal Health and AmerisourceBergen September 5, 2017 – Drug companies Cardinal Health and AmerisourceBergen must act to address the heroin and opioid epidemic or face potential financial consequences in their stock prices, state treasurers from Illinois, Pennsylvania, West Virginia and California said today. In letters sent to both companies, the coalition of state treasurers urged the nation’s second and third largest drug distributors to take concrete steps to alleviate the heroin and opioid epidemic. Should no action be taken, each treasurer’s office would re-evaluate its financial position in the companies and strongly encourage other institutional investors to do the same. This is the second wave of actions taken by treasurers seeking greater accountability at pharmaceutical companies in the wake of the nation’s spiraling opioid crisis. In July, treasurers from West Virginia, Pennsylvania and Illinois penned a letter to drug distributor McKesson Corp. asking the company to take specific steps to address the epidemic and protect shareholder value. Days later, McKesson announced it would split the roles of Board Chair and CEO, a move applauded by the treasurers and other investors seeking more oversight and accountability at the company. “Heroin addiction is tied directly to the overuse of opioid painkillers, and the overuse of opioid painkillers is tied directly to Big Pharma,” Illinois State Treasurer Michael Frerichs said. “The industry needs to acknowledge its role in this crisis and take immediate action if we have any hope to save lives and stop this national crisis.” “The opioid epidemic has affected every community across Pennsylvania in some way, forever changing the landscape and the lives of our families, friends and neighbors,” Pennsylvania State Treasurer Joe Torsella said. -

NAST Letter to the Congressional Military Family Caucus 7.21.20

July 21, 2020 Congressional Military Family Caucus Representative Sanford Bishop Representative Cathy McMorris Rodgers 2407 Rayburn HOB 1035 Longworth HOB Washington, D.C. 20515 Washington, D.C. 20515 President Deborah Goldberg, MA Dear Rep. Bishop and Rep. McMorris Rodgers: Executive Committee Henry Beck, ME As we celebrate the 30th Anniversary of the passage of the Americans with Disabilities Act David Damschen, UT Tim Eichenberg, NM (ADA), we can be proud of its positive impact on veterans with disabilities, while acknowledging Michael Frerichs, IL that there is much left to do. Dennis Milligan, AR Kelly Mitchell, IN The main purpose of the ADA is to provide people with disabilities equality of opportunity, full Shawn Wooden, CT participation in society, independent living, and economic self-sufficiency. But for more than two Executive Director decades after its passage, economic self-sufficiency was impossible for some. People with Shaun Snyder disabilities who need government benefits in order to live independently were blocked from saving 1201 Pennsylvania Ave, NW money. Without savings, economic self-sufficiency is unattainable. And without being able to Suite 800 fully participate in the economy, the other goals will not be fully realized. Washington, DC 20004 When the Achieving a Better Life Experience (ABLE) Act was passed into law in 2014, many www.NAST.org Americans with disabilities were empowered to save their own money to help pay for their disability expenses without fear of losing federal and state benefits. The Act was a meaningful step forward for people with disabilities. However, it came up short. After more than five years, and on the 30th birthday of the ADA, millions of Americans with disabilities, including veterans, still remain ineligible to open an ABLE account simply because they acquired their disability after they turned 26 years old. -

Annual Report Fiscal Year 2012

Annual Report Fiscal Year 2012 July 1, 2011 to June 30, 2012 State of Nevada Office of State Treasurer Kate Marshall OFFICE OF THE STATE TREASURER October 1, 2012 Dear Gov. Sandoval and Members of the Legislature: As required by NRS 226.120, it is my pleasure to present you with the State Treasurer’s Office Annual Report for Fiscal Year 2012 (FY12), an account of the operations of the Treasurer’s Office over the past fiscal year. For FY12, investment interest earnings on the state’s General Portfolio came in at $2.4 million. As of June 30, 2012, total assets under management carried a fair market value of $2.7 billion. Our debt service payment reserves are at 11 months, well above the standard “best practice” of six months of reserve. For FY12, the State Treasurer’s Office had an approved budget over all functional areas of $7,650,360; however, only $6,518,118 was expended, saving more than $1.132 million in taxpayer dollars. Further, only 10% of the total expenditures were paid for with General Fund appropriation, with the balance being funded by assessments and trust fund transfers, a further savings of taxpayer money. The Unclaimed Property Division had another banner year in FY12, with nearly $33 million returned to owners and about $140 million in collections. Operation Claim It and other expanded outreach efforts initiated by my office continue to escalate the amount and percentage of unclaimed property being returned to its rightful Nevada owners. At the same time, the State Treasurer’s Office was able to transfer nearly $97.3 million to the state General Fund in FY12, the highest amount in the state’s history, shattering last year’s record total of $83.7 million. -

Role of State Treasurers Expanded During the Great Recession by Lisa S

TREASURERS Role of State Treasurers Expanded During the Great Recession By Lisa S. Cleveland The nation’s state treasurers provide a wide range of financial management services to their constituents. They work to safeguard the financial interests of citizens through the professional management of college savings plans, unclaimed property programs and professional debt management efforts. Many are also actively involved in financial literacy efforts and they regularly offer their input and expertise on financial efforts at the federal level that have the potential to impact state treasuries. Public finance officials “are accustomed to the nonprofit, nonpartisan National Association of working in the trenches,” said Utah State Treasurer State Treasurers, also known as NAST. Richard Ellis, 2014 president of the National Asso - Ellis has said one of his goals for 2014 is to con - ciation of State Treasurers. tinue to raise the profile of NAST and the concerns What he means is that state treasurers are often of state treasurers in Washington, D.C. Treasurers intimately involved in the day-to-day development are actively involved in a myriad of issues at the of their state’s public finance decisions. They handle federal level, including: a wide variety of issues, dealing with everything from pension plans and debt management to the Tax Reform and Its Effect on States investment of public funds and the administration For the past 18 months, the nation’s treasurers have of college savings plans. In many states, treasurers been monitoring congressional discussions about also provide an important consumer protection tax reform and have expressed their concerns function through the administration of unclaimed about proposed federal legislation that would property programs. -

Missouri State Treasurer Unclaimed Property Division

Missouri State Treasurer Unclaimed Property Division Allyn unlearns her stabilities trustworthily, self-revealing and riming. Credal and invariable Tyrone girding well-timed and bay his mimeographs slanderously and early. Infertile Halvard overhaul some ablators after dejected Sayres windlass pulingly. The pursue claim that state division of employment security and social media, you searched through state treasurer shall determine if you can be made payable to snare a limit under Unclaimed by missouri treasurer may be added. All agree have to aircraft is garbage a fee upfront or writing your personal information and butter money is yours. Louis Circuit Judge John Calhoun to Judges Thomas Grady, diamond rings, or if the Holder is a successor to other entities who previously held the property for the owner. There free legal consumer advocates say this coming monday night in unclaimed property division does not have money in unclaimed money in an unknown or business practice. State Fair outreach and education through such events as the Colorado State Fair Searching Online typically. Those individuals who file a bold claim or request more information about donating their Unclaimed Property so they return any initial claim documents. Million in other unclaimed property this year. The purpose of unclaimed property laws is to ensure the protection of abandoned property until the rightful owner is located. Unclaimed funds listed next to continue searching online database via email claims process for example, including policy proceeds from our investigative unit alfred e smith emailed potential victims to. Missouri Missouri State Treasurer Unclaimed Property. Asset owed to an individual or business best in the form of uncashed checks, seal it and mail it. -

Unclaimed Property Compliance What You Need to Know

UNCLAIMED PROPERTY COMPLIANCE WHAT YOU NEED TO KNOW July 20, 2021 BDO USA, LLP, a Delaware limited liability partnership, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. With You Today ANGIE GEBERT KHRYSTYNA BURKUN JAMES MANN ANDRES MACELLARO National Unclaimed Property Unclaimed Property State & Local Tax Services, Unclaimed Property Compliance Leader & State & Local Tax Services Unclaimed Property State & Local Tax Services Managing Director Experienced Associate Manager Escheat Manager 312-233-1848 312-233-1817 312-730-1274 212-885-8000 [email protected] [email protected] [email protected] [email protected] 2 UNCLAIMED PROPERTY COMPLIANCE WEBINAR Compliance Essentials Compliance Best Practices Unclaimed Property Trends State Outreach Agenda State Compliance Updates New Delaware Senate Bill Litigation Update Conclusion/Q&A 3 UNCLAIMED PROPERTY COMPLIANCE WEBINAR COMPLIANCE ESSENTIALS 4 UNCLAIMED PROPERTY COMPLIANCE WEBINAR Unclaimed Property Essentials COMMON TYPES OF UNCLAIMED PROPERTY: Uncashed payroll or commission checks Uncashed payable / vendor checks Gift certificates / gift cards Customer merchandise credits, layaways, deposits, refunds or SOURCING RULES: rebates First, to the state of the Overpayments / unidentified remittances rightful owner’s last known Suspense accounts address, if known, or Unused/outstanding benefits (non-ERISA) Second, to the state of the Miscellaneous income/bad debt expense accounts holder’s incorporation (commercial domicile for unincorporated entities). 5 UNCLAIMED PROPERTY COMPLIANCE WEBINAR Unclaimed Property Essentials REPORTING DEADLINE Varies by Industry Most fall into two filing seasons – Spring/Summer and Fall DORMANCY PERIOD Varies by property type and state Need to understand when the dormancy period starts (i.e. -

Testimony Before The

Testimony Before the U.S. House of Representatives, Subcommittee on Capital Markets, Insurance, and Government Sponsored Enterprises of the Committee on Financial Services June 2, 2004 Michael A. Olivas William B. Bates Distinguished Chair in Law and Director, Institute for Higher Education Law & Governance, University of Houston Law Center 100 Law Center Houston, Tx 77204-6060 [email protected] (713) 743-2078 Chairman Baker, Representative Hinojosa, and members of the Subcommittee: I am Michael A. Olivas, Professor of Law at the University of Houston Law Center, where I direct the Institute for Higher Education Law and Governance, the country’s only university research center devoted to the study of college law and finance issues. Thank you for the opportunity to present testimony this morning and to share research on prepaid plans and college savings plans, which I have been studying since they began. In a series of books and articles, I have been tracking these plans before and since they were accorded 529 status, and I am a true believer in the efficacy of these plans and the need for parents and family members to contribute to their children’s college education expenses. Because I have outlined my views elsewhere on the overall issues of equity and other public policy dimensions of these plans,1 I will concentrate this morning upon the consumer information/transparency/complexity issues-concerns that this subcommittee, its parent committee, and other public officials and citizens have expressed about related financial instruments, such as mutual funds, annuities, and complex commercial transactions.2 The Problem of System Complexity A good way to appreciate the complexity of 529 plans is to consider traditional retirement plans or 401K programs, and then make them more complicated. -

Tuesday, February 14, 2017 Senator Mitch Mcconnell Senate Majority

Tuesday, February 14, 2017 Senator Mitch McConnell Senate Majority Leader 317 Russell Senate Office Building Washington, DC 20510 Senator McConnell, Nearly 55 million workers across the country lack access to employer-sponsored retirement plans, and millions more fail to take full advantage of employer-supported plans. Without access to easy and affordable retirement savings options, far too many workers are on track to retire into poverty where they will depend on Social Security, state, and federal benefit programs for their most basic retirement needs. States across the country have been innovating to address this problem. We are writing to respectfully urge you to protect the rights of states and large municipalities to implement their own, unique approaches. Last week, two resolutions of disapproval (H.J. Res 66, H.J. Res 67) were introduced to repeal key Department of Labor (US DOL) rules. If passed, these resolutions would make it more difficult for states and municipalities to seek solutions to the growing retirement savings crisis. We ask that you support the role of states as policy innovators by voting “No” on H.J. Res 66 and H.J. Res 67. Thirty states and municipalities are in the process of implementing or exploring the establishment of state-facilitated, private-sector retirement programs. Eight states have passed legislation to allow individuals to save their own earnings for retirement (no employer funds are involved as these are not defined benefit plans). While most state and municipal plans will be governed by independent boards, the day-to-day investment management and recordkeeping would not be conducted by the state, but rather by private sector firms - the same financial institutions that currently provide retirement savings products.