Appendix V Savills Market Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Membership List

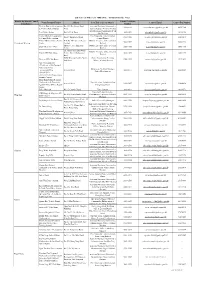

MEMBERSHIP LIST Hotel Address Tel.No. Fax.No. 99 Bonham 99 Bonham Strand, Sheung Wan, Hong Kong 3940 1111 3940 1100 Hotel Alexandra 32 City Garden Road, North Point, Hong Kong 3893 2888 3893 2999 (opening in 2020) ALVA HOTEL BY ROYAL 1 Yuen Hong Street, Shatin, New Territories 3653 1111 3653 1122 Auberge Discovery Bay Hong Kong 88 Siena Avenue Discovery Bay Lantau Island, Hong Kong 2295 8288 2295 8188 BEST WESTERN Hotel Causeway Bay Cheung Woo Lane, Canal Road West, Causeway Bay, Hong Kong 2496 6666 2836 6162 BEST WESTERN PLUS Hotel Hong Kong 308 Des Voeux Road West, Hong Kong 3410 3333 2559 8499 Best Western PLUS Hotel Kowloon 73-75 Chatham Road South, Tsimshatsui, Kowloon 2311 1100 2311 6000 Bishop Lei International House 4 Robinson Road, Mid Levels, Hong Kong 2868 0828 2868 1551 Butterfly on Prat 21 Prat Avenue, Tsim Sha Tsui, Kowloon 3962 8888 3962 8889 The Charterhouse Causeway Bay 209-219 Wanchai Road, Hong Kong 2833 5566 2833 5888 City Garden Hotel 9 City Garden Road, North Point, Hong Kong 2887 2888 2887 1111 The Cityview 23 Waterloo Road, Yaumatei, Kowloon 2783 3888 2783 3899 Conrad Hong Kong Pacific Place, 88 Queensway, Hong Kong 2521 3838 2521 3888 Cordis Hong Kong 555 Shanghai Street, Mongkok, Kowloon 3552 3388 3552 3322 Cosmo Hotel Hong Kong 375-377 Queen’s Road East, Wanchai, Hong Kong 3552 8388 3552 8399 Courtyard by Marriott Hong Kong 167 Connaught Road West, Hong Kong 3717 8888 3717 8228 Courtyard by Marriott Hong Kong Sha Tin 1 On Ping Street, Shatin, New Territories 3940 8888 3940 8828 Crowne Plaza Hong Kong Kowloon East 3 Tong Tak Street, Tseung Kwan O, Kowloon 3983 0388 3983 0399 Disney Explorers Lodge Hong Kong Disneyland Resort, Lantau Island, Hong Kong 3510 2000 3510 2333 Hong Kong Disneyland Hotel Hong Kong Disneyland Resort, Lantau Island, Hong Kong 3510 6000 3510 6333 Disney’s Hollywood Hotel Hong Kong Disneyland Resort, Lantau Island, Hong Kong 3510 5000 3510 5333 Dorsett Kwun Tong, Hong Kong 84 Hung To Road, Kwun Tong, Kowloon 3989 6888 3989 6868 Dorsett Mongkok, Hong Kong No. -

Building Envelopes and Facade Engineering Made by Seele Asia

building envelopes and facade engineering made by seele asia The seele group of companies, with headquarters near Munich in Germany, is one of the world’s top addresses for the design and construction of facades and complex building envelopes. The technology leader in facade construction was founded in 1984. 2 seele company Our customers benefit from our indepth knowledge of structures made content from glass, steel, timber or aluminum, unified in just one company. In order 2 company to measure up to our own standards we combine the development and 4 New World Centre manufacturing of our building materials with technological expertise and the 6 Apple Stores utmost individuality for unique creative concepts. 8 ICONSIAM luxury facade 10 ICONSIAM wisdom hall 12 MahaNakhon 14 Fendi Store 16 Chadstone Shopping Centre 18 seele headquarters 20 seele testing area 22 seele asia 23 seele projects in Asia seele 3 New World Centre, Hong Kong unique glass tube facade for the new world centre in hong kong. a highlight of the facade is the special LED technology in which the lights can be switched separately. 1 The space between inner and outer facade is encapsulated. Dried air can be supplied with slight overpressure so that no condensate or dirt is deposited on the glass tubes. 1 4 seele 2 3 4 2 Since the climatic and static requirements for a building in Hong Kong are particularly high, the local building authorities required static proofs, reports and two performance mock-ups. Due to the high compe- tence in testing, seele received the approval for the implementation of the glass tube facade. -

If You Cannot Read This E-Mail, Please Click Here

If you cannot read this e-mail, please click here. 中文版 October 2011 Message from PolyU Privilege Card A warm greeting from PolyU Privilege Card! Being our valuable member, you are invited to enjoy a wide range of exciting benefits including food and beverage, travel, shopping, continued education and leisure, etc. At the same time, we are eager to keep close contact with friends and supporters, and to provide you the latest news of PolyU. Autumn arrives and it is the best season for planning an excursion. We are pleased to present the following special privileges for you to share with your family members and friends. Seasonal Member’s Privileges Hotel ICON food and beverage discount offer Hotel ICON has been highly appreciated by customers since its soft opening in April this year. In order to thank for your great support, PolyU Privilege Card member, from now to 30 June 2012 by presenting your valid membership card, can enjoy 15% food and beverage discount (excluding alcoholic beverages) at “The Market”, “Green” and “Above & Beyond”. Moreover, member may enjoy 10% discount on banquet services at these restaurants. Address: 17 Science Museum Road, Tsim Sha Tsui East, Kowloon, Hong Kong Telephone: 3400 1000 / 3400 1100 E-mail: [email protected] Website: www.hotel-icon.com Hotel Panorama by Rhombus With its distinctive triangular architecture, Hotel Panorama by Rhombus is the tallest deluxe business hotel overlooking stunning Victoria Harbour in Tsim Sha Tsui. Located on the 38th floor is AVA Restaurant Slash Bar, recently opened in September this year, which features modern international cuisine using the finest seasonal ingredients. -

Mon Tue Wed Thu Fri Sat Sun 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Sep-2018

WWF - DDC Location Plan Sep-2018 Mon Tue Wed Thu Fri Sat Sun 1 2 Team A King Man Street, Sai Kung (Near Sai Kung Library) Day-Off Team B Chong Yip Shopping Centre Chong Yip Shopping Centre Team C Quarry Bay MTR Station Exit B Bridge Quarry Bay MTR Station Exit B Bridge Team D Tsim Sha Tsui East (Near footbridge) Tsim Sha Tsui East (Near footbridge) Team E Citic Tower, Admiralty (Near footbridge) Citic Tower, Admiralty (Near footbridge) Team F Wanchai Sports Centre (Near footbridge) Wanchai Sports Centre (Near footbridge) Team G Kwai Hing MTR Station (Near footbridge) Kwai Hing MTR Station (Near footbridge) Team H Mong Kok East MTR Station Mong Kok East MTR Station Team I V City, Tuen Mun V City, Tuen Mun Team J Ngau Tau Kok MTR Exit B (Near tunnel) Ngau Tau Kok MTR Exit B (Near tunnel) Team K Kwun Chung Sports Centre Kwun Chung Sports Centre Team L Tai Yau Building, Wan Chai Tai Yau Building, Wan Chai Team M Hiu Kwong Street Sports Centre, Kwun Tong Hiu Kwong Street Sports Centre, Kwun Tong Team N Tiu Keng Leng MTR Station Exit B Tiu Keng Leng MTR Station Exit B Team O Lockhart Road Public Library, Wan Chai Lockhart Road Public Library, Wan Chai Team P Leighton Centre, Causeway Bay Leighton Centre, Causeway Bay Team Q AIA Tower, Fortress Hill AIA Tower, Fortress Hill Team R Chai Wan Sports Centre Front door Chai Wan Sports Centre Front door Team S 21 Shan Mei Street, Fo Tan 21 Shan Mei Street, Fo Tan 3 4 5 6 7 8 9 Cheung Sha Wan Road (near Cheung Sha Wan Tsing Hoi Circuit, Tuen Mun Team A Russell Street, Causeway Bay Castle Peak Road, -

Police Report Rooms Receiving 992 Emergency SMS Service Applications S/N Region Report Room Address of Report Room 1

Police Report Rooms receiving 992 Emergency SMS Service Applications S/N Region Report Room Address of Report Room 1. Central District No.2 Chung Kong Road, Sheung Wan, Hong Kong 2. Peak Sub-Division No.92 Peak Road, Hong Kong 3. Western Division No.280 Des Voeux Road West, Hong Kong 4. Aberdeen Division No.4 Wong Chuk Hang Road , Hong Kong Hong Kong 5. Stanley Sub-Division No.77 Stanley Village Road, Stanley, Hong Kong Island 6. Wan Chai Division No. 1 Arsenal Street, Wanchai, Hong Kong 7. Happy Valley Division No.60 Sing Woo Road, Happy Valley, Hong Kong 8. North Point Division No.343 Java Road, Hong Kong 9. Chai Wan Division No.6 Lok Man Road, Chai Wan , Hong Kong 10. Tsim Sha Tsui Division No.213 Nathan Road, Kowloon 11. Yau Ma Tei Division No.3 Yau Cheung Road, Yau Ma Tei, Kowloon 12. Sham Shui Po Division No. 37A Yen chow Street, Kowloon Kowloon 13. Cheung Sha Wan Division No. 880 Lai Chi Kok Road, Kowloon West 14. Mong Kok District No. 142 Prince Edward Road West, Kowloon 15. Kowloon City Division No. 202 Argyle Street, Kowloon 16. Hung Hom Division No.99 Princess Margaret Road, Kowloon 17. Wong Tai Sin District No.2 Shatin Pass Road, Wong Tai Sin, Kowloon 18. Sai Kung Division No.1 Po Tung Road, Sai Kung, Kowloon 19. Kowloon Kwun Tong District No.9 Lei Yue Mun Road, Kwun Tong, Kowloon 20. East Tseung Kwan O District No.110 Po Lam Road North, Tseung Kwan O, Kowloon 21. -

Es42010141112p1.Indd.Ps, Page 70 @ Preflight ( Es42010141112

2010 年第 11 期憲報第 4 號特別副刊 S. S. NO. 4 TO GAZETTE NO. 11/2010 D1457 G.N. (S.) 12 of 2010 TRAVEL AGENTS ORDINANCE (Chapter 218) Pursuant to Regulation 4(1) of the Travel Agents Regulations made under the above Ordinance, it is hereby notified that as at 28 February 2009 the following persons were registered and licensed to carry on business as travel agents:— (A) Licence issued to body corporate:— Name of Travel Agent Licence (Name of Licensee) Business Address Licence No. issued on Period STL 6/F., EAST WING, WARWICK HOUSE, 350001 01.02.2009 12 Months (SWIRE TRAVEL LTD.) TAIKOO PLACE, 979 KING’S ROAD, QUARRY BAY, HONG KONG. G E T L / G E H UNITS 1602-3, TOWER 1, SILVERCORD, 350003 01.08.2008 12 Months (GREAT EASTERN TOURIST 30 CANTON ROAD, TSIMSHATSUI, LTD.) KOWLOON. TIGLION TRAVEL ROOM 902, 9/F., YUE XIU BUILDING, 350005 01.02.2009 12 Months (TIGLION TRAVEL SERVICES 160-174 LOCKHART ROAD, HONG KONG. CO. LTD.) P C TOURS & TRAVEL A2, 3/F., NEW MANDARIN PLAZA, 350007 01.08.2008 12 Months (P C TOURS & TRAVEL 14 SCIENCE MUSEUM ROAD, LIMITED) TSIMSHATSUI EAST, KOWLOON. MST ROOM 202, 2/F., BLOCK 1, ENTERPRISE 350018 01.02.2009 12 Months (MORNING STAR TRAVEL SQUARE, NO. 9 SHEUNG YUET ROAD, SERVICE LTD.) KOWLOON BAY, KOWLOON. CANTRAVEL LIMITED 14/F., YAT CHAU BUILDING, 262 DES 350024 01.11.2008 12 Months (-Ditto-) VOEUX ROAD CENTRAL, SHEUNG WAN, HONG KONG. H. M. T. ROOM 2101-2102, 21/F., WING ON HOUSE, 350027 01.02.2009 12 Months (HUA MIN TOURISM CO. -

List of Access Officer (For Publication)

List of Access Officer (for Publication) - (Hong Kong Police Force) District (by District Council Contact Telephone Venue/Premise/FacilityAddress Post Title of Access Officer Contact Email Conact Fax Number Boundaries) Number Western District Headquarters No.280, Des Voeux Road Assistant Divisional Commander, 3660 6616 [email protected] 2858 9102 & Western Police Station West Administration, Western Division Sub-Divisional Commander, Peak Peak Police Station No.92, Peak Road 3660 9501 [email protected] 2849 4156 Sub-Division Central District Headquarters Chief Inspector, Administration, No.2, Chung Kong Road 3660 1106 [email protected] 2200 4511 & Central Police Station Central District Central District Police Service G/F, No.149, Queen's Road District Executive Officer, Central 3660 1105 [email protected] 3660 1298 Central and Western Centre Central District Shop 347, 3/F, Shun Tak District Executive Officer, Central Shun Tak Centre NPO 3660 1105 [email protected] 3660 1298 Centre District 2/F, Chinachem Hollywood District Executive Officer, Central Central JPC Club House Centre, No.13, Hollywood 3660 1105 [email protected] 3660 1298 District Road POD, Western Garden, No.83, Police Community Relations Western JPC Club House 2546 9192 [email protected] 2915 2493 2nd Street Officer, Western District Police Headquarters - Certificate of No Criminal Conviction Office Building & Facilities Manager, - Licensing office Arsenal Street 2860 2171 [email protected] 2200 4329 Police Headquarters - Shroff Office - Central Traffic Prosecutions Enquiry Counter Hong Kong Island Regional Headquarters & Complaint Superintendent, Administration, Arsenal Street 2860 1007 [email protected] 2200 4430 Against Police Office (Report Hong Kong Island Room) Police Museum No.27, Coombe Road Force Curator 2849 8012 [email protected] 2849 4573 Inspector/Senior Inspector, EOD Range & Magazine MT. -

ESCAP/WMO Typhoon Committee Fifty-Second Session of Typhoon Committee Hong Kong, China 27 - 29 May 2020

FOR PARTICIPANTS ONLY ESCAP/WMO Typhoon Committee Fifty-second Session of Typhoon Committee Hong Kong, China 27 - 29 May 2020 INFORMATION NOTE FOR PARTICIPANTS Re-Schedule of meetings 1. The Fifty-second Session of the ESCAP/WMO Typhoon Committee is re-scheduled to be held at Tsim Sha Tsui Community Hall, 136A Nathan Road, Tsim Sha Tsui, Kowloon, Hong Kong, China from 27 to 29 May 2020 at the kind invitation of the Hong Kong Observatory (HKO). Please refer to the details of the meeting venue and location map at Appendix A. 2. The official opening of the Session will be held on 27 May 2020. Subject to confirmation by the Typhoon Committee, the daily schedule, except for the opening ceremony, will be from 8:30 am to 12:00 and from 2:00 to 5:30 pm. 1 Registration 3. Participants are requested to make registration through the online registration website here (please click) or return the duly completed Registration Form (Appendix B) by email: [email protected] on or before 27 April 2020. 4. A Registration and Information Desk will be setup at the entrance of the meeting venue and will be operated during the Session. Participants are requested to wear identification badges during the meeting and official functions. Visa/Entry Requirements/Health Advice 5. Visitors to Hong Kong, China must hold a valid passport, endorsed where necessary for Hong Kong, China. Hong Kong, China has a liberal visa policy, allowing visa-free entry to nationals of more than 170 countries and territories. For country-specific visa information, please visit: https://www.immd.gov.hk/eng/services/visas/visit-transit/visit-visa-entry-permit.html 6. -

When Is the Best Time to Go to Hong Kong?

Page 1 of 98 Chris’ Copyrights @ 2011 When Is The Best Time To Go To Hong Kong? Winter Season (December - March) is the most relaxing and comfortable time to go to Hong Kong but besides the weather, there's little else to do since the "Sale Season" occurs during Summer. There are some sales during Christmas & Chinese New Year but 90% of the clothes are for winter. Hong Kong can get very foggy during winter, as such, visit to the Peak is a hit-or-miss affair. A foggy bird's eye view of HK isn't really nice. Summer Season (May - October) is similar to Manila's weather, very hot but moving around in Hong Kong can get extra uncomfortable because of the high humidity which gives the "sticky" feeling. Hong Kong's rainy season also falls on their summer, July & August has the highest rainfall count and the typhoons also arrive in these months. The Sale / Shopping Festival is from the start of July to the start of September. If the sky is clear, the view from the Peak is great. Avoid going to Hong Kong when there are large-scale exhibitions or ongoing tournaments like the Hong Kong Sevens Rugby Tournament because hotel prices will be significantly higher. CUSTOMS & DUTY FREE ALLOWANCES & RESTRICTIONS • Currency - No restrictions • Tobacco - 19 cigarettes or 1 cigar or 25 grams of other manufactured tobacco • Liquor - 1 bottle of wine or spirits • Perfume - 60ml of perfume & 250 ml of eau de toilette • Cameras - No restrictions • Film - Reasonable for personal use • Gifts - Reasonable amount • Agricultural Items - Refer to consulate Note: • If arriving from Macau, duty-free imports for Macau residents are limited to half the above cigarette, cigar & tobacco allowance • Aircraft crew & passengers in direct transit via Hong Kong are limited to 20 cigarettes or 57 grams of pipe tobacco. -

Best Business Hotels in Hong Kong"

"Best Business Hotels in Hong Kong" Erstellt von : Cityseeker 5 Vorgemerkte Orte The Upper House "Upper Class All the Way" Boasting a panoramic views of Victoria Harbour and the city, The Upper House is centrally located in Hong Kong Island right on top of Pacific Place, the city’s premier shopping mall. Directly links to Admiralty MTR station, it provides a modern fitness centre and free yoga classes during the weekend. Wi-Fi is available for free throughout the hotel and the by Booking.com Guest Experience Team offers 24-hour services. The Upper House Hong Kong’s non-smoking rooms are spacious and elegant, and come fitted with modern amenities. They have a large flat-screen TV, a luxurious bathroom with rainshower facilities and a bathtub, as well as, a free Maxi- bar offering a selection of refreshments. All rooms have an iPod touch providing tourist information and information about room service and the property. The hotel is located a 40-minute drive from Hong Kong International Airport and a 10-minute walk from Star Street featuring galleries, chic furniture outlets, trendy booksellers, cosy cafés and stylish restaurants. The Hong Kong Convention and Exhibition Centre is situated about 1 km away. Located on the 49th floor, Cafe Gray Deluxe offers modern European dishes. Guests can enjoy a refreshing beverage at Cafe Gray Bar or enjoy their meals in the comfort of their rooms. + 852 2918 1838 www.upperhouse.com/en/ reservations@upperhouse. 88 Queensway, Pacific default.aspx com Place, Hongkong Langham Hotel "Das Beste vom Besten" Das Hotel ist einer der Besten Hong Kongs. -

Restaurant List

Restaurant List (updated 1 July 2020) Island Cafeholic Shop No.23, Ground Floor, Fu Tung Plaza, Fu Tung Estate, 6 Fu Tung Street, Tung Chung First Korean Restaurant Shop 102B, 1/F, Block A, D’Deck, Discovery Bay, Lantau Island Grand Kitchen Shop G10-101, G/F, JoysMark Shopping Centre, Mung Tung Estate, Tung Chung Gyu-Kaku Jinan-Bou Shop 706, 7th Floor, Citygate Outlets, Tung Chung HANNOSUKE (Tung Chung Citygate Outlets) Shop 101A, 1st Floor, Citygate, 18-20 Tat Tung Road, Tung Chung, Lantau Hung Fook Tong Shop No. 32, Ground Floor, Yat Tung Shopping Centre, Yat Tung Estate, 8 Yat Tung Street, Tung Chung Island Café Shop 105A, 1/F, Block A, D’Deck, Discovery Bay, Lantau Island Itamomo Shop No.2, G/F, Ying Tung Shopping Centre, Ying Tung Estate, 1 Ying Tung Road, Lantau Island, Tung Chung KYO WATAMI (Tung Chung Citygate Outlets) Shop B13, B1/F, Citygate Outlets, 20 Tat Tung Road, Tung Chung, Lantau Island Moon Lok Chiu Chow Unit G22, G/F, Citygate, 20 Tat Tung Road, Tung Chung, Lantau Island Mun Tung Café Shop 11, G/F, JoysMark Shopping Centre, Mun Tung Estate, Tung Chung Paradise Dynasty Shop 326A, 3/F, Citygate, 18-20 Tat Tung Road, Tung Chung, Lantau Island Shanghai Breeze Shop 104A, 1/F, Block A, D’Deck, Discovery Bay, Lantau Island The Sixties Restaurant No. 34, Ground Floor, Commercial Centre 2, Yat Tung Estate, 8 Yat Tung Street, Tung Chung 十足風味 Shop N, G/F, Seaview Crescent, Tung Chung Waterfront Road, Tung Chung Kowloon City Yu Mai SHOP 6B G/F, Amazing World, 121 Baker Street, Site 1, Whampoa Garden, Hung Hom CAFÉ ABERDEEN Shop Nos. -

List of Authorised Employers – Appointment from 2 September 2004 to 31 December 2009

Hong Kong Institute of Certified Public Accountants Authorised Employers and Authorised Supervisors Scheme List of Authorised Employers – Appointment from 2 September 2004 to 31 December 2009 Name of the Organisation Contact Details ALBERT Y.K. LAU & CO. Room 803, Tung Hip Commercial Building, 244-252 Des Voeux 劉耀傑會計師事務所 Road Central, Hong Kong. Tel: 28542188 Fax: 28542128 ARMANDO Y.C. CHUNG & CO. 19th floor, Malaysia Building, 50 Gloucester Road, Wan Chai, 鍾潤超會計師行 Hong Kong. Tel: 28666011 Fax: 28661766 Email: [email protected] CENTRAL & CO. Rooms 1001-2, New Victory House, 93-103 Wing Lok Street, 大中會計師行 Central, Hong Kong. CHAN, LAM & COMPANY Units C & D, 9th floor, Neich Tower, 128 Gloucester Road, Wan 陳鎮中,林志偉會計師事務所 Chai, Hong Kong. Tel: 25193833 Fax: 25193113 Email: [email protected] CHENG & CHENG LIMITED Rooms 1004-5, 10th floor, Allied Kajima Building, 138 鄭鄭會計師事務所有限公司 Gloucester Road, Wan Chai, Hong Kong. Tel: 25988663 Fax: 25988178 Email: [email protected] Website: www.chengcpa.com.hk CHEUNG & CHEUNG Room 801, Nan Dao Commercial Building, 359-361 Queen's 張子超張錦華會計師行 Road Central, Hong Kong. Tel: 25411718 Fax: 25443175 Email: [email protected] CHEUNG & YUE 13th floor, Granville House, 41C Granville Road, Tsim Sha Tsui, 余鐵垣會計師事務所 Kowloon. Tel: 27392522 - 1 - List of HKICPA Authorised Employers – Appointment from 2 September 2004 to 31 December 2009 Name of the Organisation Contact Details DAVID T.W. FONG & CO. Unit B, 23rd floor, North Cape Commercial Building, 388 King's 方達華會計師行 Road, North Point, Hong Kong. F.W.O. KWAAN & CO. Room 305, 3rd floor, Honwell Commercial Centre, 237 Des 關永安會計師事務所 Voeux Road Central, Hong Kong.