PR 42/05 Strictly Embargoed for Release After

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Ben Terry Location Planning Manager -- More Than Just Shops

Ben Terry Location Planning Manager -- more than just shops Dixons Carphone plc is Europe’s leading specialist electrical and telecommunications retailer and services company, employing over 42,000 people in twelve countries Shop keepers? Have to be more than Shop Keepers Increasingly complexity and cost Retail supply chains Diversity of goods and how customers want them Store Reserve & Store Same day Online Installed setup collect ✓ ✓ ✓ ✓ ✗ ✓ ✓ ✓ ✓ ✓ ✗ ✓ ✓ Some ✓ ✓ Some ✓ ✓ Some ✓ ✗ ✓ ✓ How we currently do things - Newark o Centre of our UK&I Operations o Serves all UK&I Brands o Over 1.5m sq. ft. with max 4000 colleagues on site o Home Fulfillment Centre via CSC’s o Branch Fulfillment Centre o Small Products Warehouse o Customer Repair Centre Building 1 Overview Building 1 Building 1 o HFC (Home Fulfilment Centre); 440,000 sq. ft. in Chambers 2 and 3, a small portion of which is also utilised by Newark CSC. o Reverse Logistics (Returns) and Spares; 220,000 Chamber 1 Chamber 2 Chamber 3 sq. ft. on the ground floor of Chamber 1 o Customer Repair Centre; 184,000 sq. ft. on the mezzanine in Chamber 1. How we currently do things - CSCs o 22 Customer Service Centres o 5m+ home visits per year o 250 Specialist Engineers o +250,000 white goods repair in home o 7am to 9pm delivery slots o Enhanced Service Capability o Detailed Property Requirements Repair; Service; Install; Upgrade; Membership Ben Terry - Introduction Career History: 15 years experience in site location / retail analysis GeoBusiness Solutions – retail & leisure consultancy PinPoint -

Lapland UAS Thesis

RESEARCHING THE POTENTIAL OF MOBILE BIG DATA FOR BUSINESS DECISION-MAKING Case of Elgiganten AB - Haparanda Hung Duc Luu Bachelor's Thesis Lapland University of Applied Sciences Degree Programme in Business Information Technology Bachelor of Business Administration 2014 Abstract of thesis School of Business and Culture Degree Programme in Business Information Technology Author Duc Hung Luu Year 2014 Supervisor Vladimir Ryabov Commissioned by Harri Putila, Elgiganten AB - Haparanda Title of thesis Researching the Potential of Mobile Big Data for Business Decision-Making Case of Elgiganten AB - Haparanda No. of pages + app. 74 + 10 This research is focused on the area of mobile Big Data, particularly personal location data and its usage to gain insights into customers’ in-store behaviours. The objective of this research is to study the practical potential of mobile Big Data in order to evaluate its impact on business decision-making in the case company. This study was commissioned by Elgiganten AB – Haparanda. The case company is a part of Elkjøp Nordic AS, the largest consumer electronics and home appliances retailer in Sweden. The study stemmed from the need to increase the case company’s understanding of the customers’ behaviours. This research is practically oriented with the theoretical framework revolving around studying the mobile Big Data, sensors’ tracking technologies and Apache Hadoop applications. To accomplish the objectives of this research, the business scenario using mobile Big Data to support decision making in the case company was formulated and scrutinised. The qualitative research method was used in this single case study for the case company. Exploratory research approach was chosen due to the novelty of the research area. -

Appointment of Group Finance Director

27 March 2018 Embargoed until 7.00am Appointment of Group Finance Director Dixons Carphone plc (the "Company") announces the appointment of Jonny Mason to its Board as Group Finance Director, with effect from a date to be confirmed. Jonny has been Chief Financial Officer of Halfords plc since 2015 and was Interim Chief Executive Officer between September 2017 and January 2018. Prior to that Jonny was CFO of Scandi Standard AB, a Scandinavian company which successfully listed in Stockholm in June 2014. Jonny’s early career included CFO at Odeon and UCI Cinemas, Finance Director of Sainsbury’s Supermarkets and finance roles at Shell and Hanson plc. Ian Livingston, Chairman of Dixons Carphone, said: “The Board and I are very pleased to welcome Jonny Mason to the Group. Together with Alex Baldock, we now have a great new team to lead Dixons Carphone.” Alex Baldock, incoming Chief Executive Officer of Dixons Carphone, said: “I am delighted to have Jonny by my side. He has an outstanding track record and brings the experience and qualities we need to take Dixons Carphone into the next phase of its transformation.” Jonny Mason said: “I am thrilled to be joining Dixons Carphone. The business has undergone a tremendous journey over recent years and is well placed to meet customers’ ever growing and complex needs for technology. I have experienced first-hand as a customer the quality of our shops, product and services, from my time living in both the UK and Norway, and I feel proud to join the Group to work with Alex, the Board and our great team of colleagues.” There is no information which is required to be disclosed pursuant to Listing Rule 9.6.13. -

BP Dropped 4.5% As It Revealed a 50% Fall in Profits

Market Roundup Chart 1: Inflation (CPI) projection Shares were on a losing streak this week ahead of next Tuesday’s US presidential election. The FTSE 100 index was off 0.6% on Monday, although with October coming to a close the blue-chip index still recorded its fifth monthly increase in a row. Tuesday saw the FTSE 100 lose another 0.5% amid rising concerns about a possible Trump victory in the US election. Royal Dutch Shell shares jumped 4% after announcing better than expected third-quarter profits, but BP dropped 4.5% as it revealed a 50% fall in profits. The market fell 1% on Wednesday as opinion polls continued to narrow in the US. Standard Chartered lost 4.3%, falling for the second day running after disappointing third-quarter results on Tuesday, while Barclays was off 2.5%. Source: Bank of England Inflation Report Data at 4/11/2016 However G4S leapt 10.3% on a positive trading update. EasyJet, among the FTSE 100’s worst performers this year, also rose 2.9% Chart 2: Markit/CIPS Manufacturing PMI after HSBC upgraded the airline’s shares to a “buy” and lifted its target price from 800p to 1,150p. 60 On Thursday the FTSE 100 was down another 0.8% - though mid-cap 58 shares rose - as the pound strengthened after the High Court ruled the 56 government would need parliamentary approval to trigger Article 50, 54 the treaty clause to leave the EU. 52 GlaxoSmithKline, a major beneficiary of sterling weakness, lost 3.3%, 50 while Pearson was down 2.1%. -

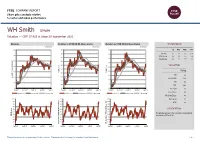

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance WH Smith SMWH Retailers — GBP 17.425 at close 29 September 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 29-Sep-2021 29-Sep-2021 29-Sep-2021 22 180 180 1D WTD MTD YTD 170 170 Absolute 0.0 1.8 6.8 15.4 20 Rel.Sector -0.7 3.0 5.5 -1.4 160 160 Rel.Market -0.9 1.5 7.7 4.1 18 150 150 140 VALUATION 16 140 130 Trailing 14 130 Relative Price Relative Relative Price Relative 120 120 PE -ve 110 Absolute Price (local (local currency) AbsolutePrice 12 EV/EBITDA 30.8 110 100 10 PB 9.6 90 100 PCF 26.4 8 80 90 Div Yield 0.0 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Price/Sales 2.1 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 4.3 100 100 100 Div Payout 0.0 90 90 90 ROE -ve 80 80 80 70 70 Index) Share 70 Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 The principal activity of the Company is retailing and 40 40 40 RSI RSI (Absolute) associated activities in UK. 30 30 30 20 20 20 10 10 10 RSI (Relative to FTSE UKFTSE All to RSI (Relative RSI (Relative to FTSE UKFTSE All to RSI (Relative 0 0 0 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Past performance is no guarantee of future results. -

Dixons/Compaq/Packard Bell

COMPETITION ACT 1998 DECISION OF THE DIRECTOR GENERAL OF FAIR TRADING No CA98/3/2001* 6 APRIL 2001 DIXONS STORES GROUP LIMITED* /COMPAQ COMPUTER LIMITED/PACKARD BELL NEC LIMITED* Relating to a finding by the Director General of Fair Trading (the ‘Director’) that agreements have not infringed the prohibition imposed by section 2 (the ‘Chapter I prohibition’) of the Competition Act 1998 (the ‘Act’), and that conduct has not infringed the prohibition imposed by section 18 (the ‘Chapter II prohibition’) of the Act. I. INTRODUCTION 1. This decision relates to an agreement between DSG Retail Limited (‘DSG’) and Compaq Computer Limited (‘Compaq’) dated 27 August 1999 (the ‘Compaq Agreement’) and to an agreement between DSG and Packard Bell NEC Limited (‘Packard Bell’) dated 12 November 1999 (the ‘Packard Bell Agreement’) (collectively the ‘Agreements’) concerning the exclusive distribution in the UK of personal computers. 2. This decision is made pursuant to the Act in accordance with rule 15(1) of the Competition Act 1998 (Director’s rules) Order 2000 (the ‘Director’s rules’)1 It states the facts on which the Director relies and his reasons for the decision. II. THE FACTS A. THE COMPLAINT 3. Following the execution of the Agreements and announcement of the consequent cessation of supplies of personal computers to the John Lewis Partnership plc (‘John Lewis’) and Tempo Holdings Limited, (‘Tempo’) (collectively referred to hereinafter as ‘JLT’ unless otherwise specified) the Office received a complaint (‘the * Certain information has been excluded from this document in order to comply with the provisions of section 56 of the Competition Act 1998 (confidentiality and disclosure of information). -

The World's Most Active Consumer Electronics Professionals on Social

Europe's Most Active Consumer Electronics Professionals on Social - May 2021 Industry at a glance: Why should you care? So, where does your company rank? Position Company Name LinkedIn URL Location Employees on LinkedIn No. Employees Shared (Last 30 Days) % Shared (Last 30 Days) 1 EPOS https://www.linkedin.com/company/eposaudio/Denmark 438) 121) 27.63% 2 VanMoof https://www.linkedin.com/company/vanmoof/Netherlands 346) 80) 23.12% 3 ATAG Benelux https://www.linkedin.com/company/atagbenelux/Netherlands 269) 59) 21.93% 4 Eurofred https://www.linkedin.com/company/eurofred-group/Spain 206) 43) 20.87% 5 Zound Industries https://www.linkedin.com/company/zoundindustries/Sweden 245) 49) 20.00% 6 Cellularline https://www.linkedin.com/company/cellularline-group/Italy 227) 44) 19.38% 7 Jabra https://www.linkedin.com/company/jabra/Denmark 1,898) 351) 18.49% 8 Swappie https://www.linkedin.com/company/swappie/Finland 331) 57) 17.22% 9 Trust International https://www.linkedin.com/company/trustofficial/Netherlands 261) 41) 15.71% 10 LDLC https://www.linkedin.com/company/ldlc/France 393) 58) 14.76% 11 Devialet https://www.linkedin.com/company/devialet/France 326) 46) 14.11% 12 Netatmo https://www.linkedin.com/company/netatmo/France 251) 35) 13.94% 13 Skousen https://www.linkedin.com/company/skousen/Denmark 235) 30) 12.77% 14 WhiteAway https://www.linkedin.com/company/whiteaway-group/Denmark 252) 31) 12.30% 15 - COYOTE - https://www.linkedin.com/company/coyotesystem/France 340) 38) 11.18% 16 Bang & Olufsen https://www.linkedin.com/company/bangolufsen/Denmark -

Targeting the Gender Gap What Retailers Are Doing to Tackle Gender Diversity at the Top

RetailWeek November 2016 BE INSPIRED Targeting the gender gap What retailers are doing to tackle gender diversity at the top l Who inspires you? Female retail leaders name their role models l Turning words into actions How to bring about real change in retail boardrooms BE INSPIRED INTRODUCTION CONTENTS Addressing boardroom diversity Targeting the gender gap Only eight months after the launch of Be Inspired, Retail 4 What UK retailers are doing to Week has been overwhelmed by the positive response plug the gender gap in the boardroom throughout the sector. More than 40 senior leaders – women and men – from the biggest names in UK retail have pledged Who inspires you? their support as ambassadors. Thousands have watched 8 Female retail leaders tell us who inspired them to reach for the top our launch documentary and read and tweeted about our features, interviews and blogs. Hundreds of aspiring future Turning words into actions female leaders have signed up to our series of mentoring 10 We look at how women could breakfast sessions hosted by our ambassadors. And seven be better represented in the upper echelons of the retail world retailers – at the time of going to print Co-op, Debenhams, Dunelm, House of Fraser, New Look, O2 and Tesco – have pledged their support as retail partners. COVER IMAGE: SHUTTERSTOCK Be Inspired is the widest-reaching campaign that Retail Week has ever launched and we hope its success even this early on is because of its focus on people. Deben- hams chairman Sir Ian Cheshire, who took part in the filming of our second Be Inspired documentary, which launched this week, believes addressing the problem of a lack of boardroom diversity must lie in the creation of role models and the implementation of active mentoring. -

Dixonsgroupplcinterimresultsforth

Dixons Group plc interim results for the 28 weeks ended 15 November 2003 Dixons Group plc, Europe's leading specialist electrical retailer, today announces interim results. INTERIM RESULTS • Turnover increased by 21% to £3.1 billion (2002/03: £2.6 billion). • Group like for like sales up 1%; UK like for like sales were flat and International like for like up 3%. • Operating profit (including goodwill amortisation) increased by 15% to £102.4 million (2002/03: £89.4 million). • Profit before tax (excluding goodwill amortisation) increased by 9% to £105.7 million (2002/03: £97.1 million). • Profit before tax (including goodwill amortisation) increased by 9% to £103.4 million (2002/03: £94.8 million). • Basic earnings per share increased by 3% to 3.7 pence (2002/03: 3.6 pence). Interim dividend of 1.660 pence (2002/03: 1.510 pence), an increase of 10%. • On 24 November 2003, the Group successfully sold 48.4 million Wanadoo SA shares, raising ?310 million (£216 million) cash • On 8 December 2003, the Group disposed of its European property development business, Codic International SA for ?33 million (£23 million) cash. CHRISTMAS TRADING Group sales for the 8 weeks ended 10 January 2004 were up 12% in total and 5% on a like for like basis. In the UK, sales increased by 7% in total and 4% on a like for like basis. Sales in the International division increased by 28% in total and 7% on a like for like basis. Sir John Collins, Chairman, commented as follows: "The Group achieved solid results in the first half year, with good sales and profit growth in a challenging retail market. -

European Technology Media & Telecommunications Monitor

European Technology Media & Telecommunications Monitor Market and Industry Update H1 2013 Piper Jaffray European TMT Team: Eric Sanschagrin Managing Director Head of European TMT [email protected] +44 (0) 207 796 8420 Jessica Harneyford Associate [email protected] +44 (0) 207 796 8416 Peter Shin Analyst [email protected] +44 (0) 207 796 8444 Julie Wright Executive Assistant [email protected] +44 (0) 207 796 8427 TECHNOLOGY, MEDIA & TELECOMMUNICATIONS MONITOR Market and Industry Update Selected Piper Jaffray H1 2013 TMT Transactions TMT Investment Banking Transactions Date: June 2013 $47,500,000 Client: IPtronics A/S Transaction: Mellanox Technologies, Ltd. signed a definitive agreement to acquire IPtronics A/S from Creandum AB, Sunstone Capital A/S and others for $47.5 million in cash. Pursuant to the Has Been Acquired By transaction, IPtronics’ current location in Roskilde, Denmark will serve as Mellanox’s first research and development centre in Europe and IPtronics A/S will operate as a wholly-owned indirect subsidiary of Mellanox Technologies, Ltd. Client Description: Mellanox Technologies Ltd. is a leading supplier of end-to-end InfiniBand and June 2013 Ethernet interconnect solutions and services for servers and storage. PJC Role: Piper Jaffray acted as exclusive financial advisor to IPtronics A/S. Date: May 2013 $46,000,000 Client: inContact, Inc. (NasdaqCM: SAAS) Transaction: inContact closed a $46.0 million follow-on offering of 6,396,389 shares of common stock, priced at $7.15 per share. Client Description: inContact, Inc. provides cloud contact center software solutions. PJC Role: Piper Jaffray acted as bookrunner for the offering. -

Operating Review International

Operating review 1 International 2 3 4 1. Unbeatable offers in Gentofte – El Giganten’s biggest store in Denmark. 2. Gigantti doubled its store base in Finland, growing from four to eight stores. 3. Thousands of customers queued to shop in the first Electro World store in Budapest, February 2002. 4. Shopping for fantastic offers at the Electro World opening. 22 Dixons Group plc Annual Report & Accounts 2001/02 4 The International Retail division achieved Elkjøp opened 15 new stores, including an operating profit of £15.2 million five El Gigantens in Sweden and four (£22.3 million) on sales increased by Gigantti stores in Finland, bringing its 14 per cent to £688 million (£602 million). total to 148 stores in five countries. We intend to open a further 11 new Nordic countries stores in this financial year. Elkjøp’s sales increased by 12 per cent to £596 million (£531 million). Although Central Europe like for like sales were 1 per cent lower, In February, the Elkjøp team launched this reflected a downturn in a number the Group’s first store in Hungary under of Nordic markets. Elkjøp continued to the Electro World brand. The 43,000 5 gain share in each of its markets. square feet store combines the best of the Group’s formats from around In July 2001, Elkjøp completed Europe. The store has quickly established the purchase of seven out of town a strong market presence.We intend SuperRadio stores in Denmark. to open a further Electro World store These stores have been rebranded in Budapest and our first in Prague this under Elkjøp’s El Giganten fascia and financial year.