5001820314.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TWO WHEELERS : MOTOR CYCLES M/S Royal Enfield Motors Ltd M/S Bajaj Auto Ltd M/S Honda Motorcycle & Scooter India Pvt. Ltd M

TWO WHEELERS : MOTOR CYCLES M/s Royal Enfield Motors Ltd Sl No. Index No. Nomenclature 1 63022-E Motor Cycle 350cc STD (12 Volt) Bullet Electra 2 63107-X Bullet Classic 500 3 64003-P Classic 500 Desert Strom 499cc 4 64004-H Thunderbird UCE 350cc 5 64005-I Classic 350cc 346 6 64006-S Bullet Electra UCE 346cc M/s Bajaj Auto Ltd Sl No. Index No. Nomenclature 1 63024-P Motor Cycle Bajaj Pulsar DTSi (150cc Electric Start) 2 63029-K Motor Cycle Bajaj Discover DTS-Si (Electric Start) 3 63030-X Motor Cycle Bajaj Discover 150 cc (Electric Start) 4 63032-D Bajaj Platina Motor Cycle DZ-02 (100cc) Alloy Wheel 5 63174-A Bajaj Platina 125 (With Electric Start) 6 63175-D Bajaj Discover 125 Drum Brake (Electric Start) 7 63176-E Bajaj Pulsar 135 LS (With Electric Start) 8 63177-L Bajaj Pulsar 180 (With Electric Start) 9 63178-P Bajaj Pulsar 220 (Without Full Fairing) (With Electric Start) 10 63179-H Bajaj Pulsar 220 F (With Full Fairing) (With Electric Start) 11 63180-I Bajaj Avenger 220 (With Electric Start) 12 64000-D Bajaj Discover 125 ST DTS-I Electric Start Disc Brake 13 64001-E Bajaj Discover 125 DTS-I Electric Start Disc Brake 14 64002-L Bajaj Discover 100 DTS-I Electric Start 4 Gears Drum Brake M/s Honda Motorcycle & Scooter India Pvt. Ltd Sl No. Index No. Nomenclature 1 63009-A Motor Cycle Honda CB Shine Self Drum Alloy (125 cc) 2 63010-D ‘Honda’ Unicorn (Self) Motor Cycle 4 Stroke Single Cylinder Air Cooled 150 cc 3 63122-L Honda CB Twister (Self Disc Alloy) 110cc 4 63124-H Honda CBR 150R STD 149.4cc 5 63125-I Honda ‘CBF Stunner’ (Self Disk Alloy) 125 cc 6 63128-K Honda CBR 150R DLX 149.4cc 7 63188-L Honda CB Trigger (STD) 149.1cc 8 63189-P Honda Dream Yuga (Self Drum Alloy) 109cc 9 63190-H Honda CB Twister 110cc (Self Drum Alloy) 10 63193-T Honda Dream Yuga (Kick Drum Alloy) 109cc 11 63194-K Honda Dream NEO (Kick Drum Spoke) 109cc 12 63195-X Honda Dream NEO (Kick Drum Alloy) 109cc 13 63196-A Honda Dream NEO (Self Drum Spoke) 109cc 14 63197-D Honda CBR 250R STD 249.6cc 15 63198-E Honda CBR 250R ABS 249.6cc M/s TVS Motor Company Ltd Sl No. -

TRADING LIST.Xlsx

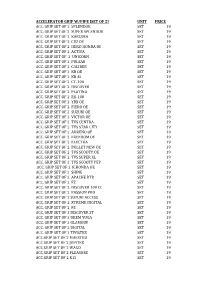

ACCELERATOR GRIP W/PIPE [SET OF 2] UNIT PRICE ACC. GRIP SET OF 2 SPLENDOR SET 19 ACC. GRIP SET OF 2 SUPER SPLENDOR SET 19 ACC. GRIP SET OF 2 KARIZMA SET 19 ACC. GRIP SET OF 2 CBZ OE SET 19 ACC. GRIP SET OF 2 HERO HONDA OE SET 19 ACC. GRIP SET OF 2 ACTIVA SET 19 ACC. GRIP SET OF 2 UNICORN SET 19 ACC. GRIP SET OF 2 PULSAR SET 19 ACC. GRIP SET OF 2 CALIBER SET 19 ACC. GRIP SET OF 2 KB OE SET 19 ACC. GRIP SET OF 2 KB 4S SET 19 ACC. GRIP SET OF 2 CT-100 SET 19 ACC. GRIP SET OF 2 DISCOVER SET 19 ACC. GRIP SET OF 2 PLATINA SET 19 ACC. GRIP SET OF 2 RX-100 SET 19 ACC. GRIP SET OF 2 YBX OE SET 19 ACC. GRIP SET OF 2 FIERO OE SET 19 ACC. GRIP SET OF 2 SUZUKI OE SET 19 ACC. GRIP SET OF 2 VICTOR OE SET 19 ACC. GRIP SET OF 2 TVS CENTRA SET 19 ACC. GRIP SET OF 2 TVS STAR CITY SET 19 ACC. GRIP SET OF 2 ADRENO OE SET 19 ACC. GRIP SET OF 2 FREEDOM OE SET 19 ACC. GRIP SET OF 2 ELECTRA SET 19 ACC. GRIP SET OF 2 BULLET NEW OE SET 19 ACC. GRIP SET OF 2 TVS SCOOTY OE SET 19 ACC. GRIP SET OF 2 TVS SUPER XL SET 19 ACC. GRIP SET OF 2 TVS SCOOTY PEP SET 19 ACC. GRIP SET OF 2 K.HONDA OE SET 19 ACC. -

Kilomiles Auto Product Range.Xlsx

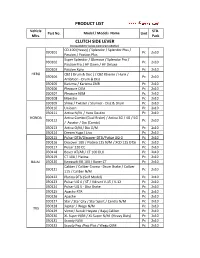

PRODUCT LIST Vehicle STD. Part No. Model / Models Name Unit Mfrs. Pack CLUTCH SIDE LEVER (Compatible for below mentioned vehichles) CD-100 (Heavy) / Splendor / Splendor Plus / 030101 Pc2x10 Passion / Passion Plus Super Splendor / Glamour / Splendor Pro / 030102 Pc2x10 Passion Pro / HF Dawn / HF Deluxe 030103 Passion Xpro Pc 2x10 HERO CBZ ( Drum & Disc ) / CBZ Xtreme / Hunk / 030104 Pc2x10 Ambition - Drum & Disc 030105 Karizma / Karizma ZMR Pc 2x10 030106 Pleasure O/M Pc 2x10 030107 Pleasure N/M Pc 2x10 030108 Maestro Pc 2x10 030109 Shine / Twister / Stunner - Disc & Drum Pc 2x10 030110 Unicorn Pc 2x10 030111 Activa N/M / Hero Destini Pc 2x10 HONDA Activa Combo (Dual Brake) / Activa 3G / 4G / 5G 030112 Pc2x10 / Aviator / Dio (Combi) 030113 Activa O/M / Dio O/M Pc 2x10 030114 Dream Yuga / Livo Pc 2x10 030115 Pulsar DTSi/Discover DTSi/Pulsar UG-3 Pc 2x10 030116 Discover 100 / Platina 125 N/M / XCD 125 DTSi Pc 2x10 030117 Pulsar 220 CC Pc 2x10 030118 Boxer AT/AR / CT 100 DLX Pc 2x10 030119 CT 100 / Platina Pc 2x10 BAJAJ 030120 Kawasaki KB 100 / Boxer CT Pc 2x10 Caliber / Caliber Croma - Drum Brake / Caliber 030121 Pc2x10 115 / Caliber N/M 030122 Platina DTSi (Self Model) Pc 2x10 030123 Pulsar UG 4 / ST / Vikrant V-15 / V-12 Pc 2x10 030124 Pulsar UG 5 - Disc Brake Pc 2x10 030125 Apache RTR Pc 2x10 030126 Apache Pc 2x10 030127 Star / Star City / Star Sport / Centra N/M Pc 2x10 030128 Jupiter / Wego N/M Pc 2x10 TVS 030129 Victor/ Suzuki Hayate / Bajaj Caliber Pc 2x10 030130 XL Super N/M / XL Super N/M (Heavy Duty) Pc 2x10 030131 Scooty N/M Pc 2x10 030132 Scooty Pep /Pep Plus / Wego O/M Pc 2x10 Vehicle STD. -

Shiv Shakti Automobiles About Us

+91-8048961782 Shiv Shakti Automobiles https://www.indiamart.com/shivshaktiautomobiles-delhi/ About Us Established in 2007, Shiv Shakti Automobiles is a famous Manufacturer, Wholesaler And Trader of a wide gamut of Bike Parts, Bike Air Filter, Bike Brake Shoe, Bike Chain, Bike Clutch Plate, Bike Disc Brake and much more. For more information, please visit https://www.indiamart.com/shivshaktiautomobiles-delhi/profile.html BIKE PARTS B u s i n e s s S e g m e n t s Hero Bike Roller Hero Bike Small Roller Indecater for passion plus Activa Dio Rocker Set BIKE BRAKE SHOE B u s i n e s s S e g m e n t s Hero Splendor Bike Front Hero CD Deluxe Bike Rear Brake Shoes Brake Shoe Honda Bike Brake Shoe Hero Bike Rear Brake Shoe BIKE AIR FILTER B u s i n e s s S e g m e n t s Hero Maestro H Air Filter Super Splendor Bike Air Filter TVS Jupiter Air Filter Honda Activa 3G Air Filter BIKE DISC BRAKE B u s i n e s s S e g m e n t s Honda Shine New Modle Bike Hero Glamour FI Bike Front Disc Brake Pad Disc Brake Pad Honda CBR 150 Bike Disc Bajaj Pulsar Bike Disc Brake Brake Pad Pad BIKE CLUTCH PLATE B u s i n e s s S e g m e n t s Honda CB Twister Bike Clutch Bajaj Pulsar UG4 Bike Clutch Plate Plate Hero Passion Pro Bike Clutch Hero Glamour Bike Clutch Plate Plate BIKE ENGINE OIL B u s i n e s s S e g m e n t s Castrol Active Bike Engine Oil Castrol Bike Engine Oil Servo 4t 20w 40 Engine Oil Gulf Pride Engine Oil TWO WHEELER BRAKE CABLES B u s i n e s s S e g m e n t s Honda Shine Front Break Honda Activa Front Brake Cable Cable Bajaj Pulsar Front Break -

EXECUTIVE SUMMARY During the 80S, Hero Honda Became the First Company in India to Prove That It Was Possible to Drive a Vehicle Without Polluting the Roads

EXECUTIVE SUMMARY During the 80s, Hero Honda became the first company in India to prove that it was possible to drive a vehicle without polluting the roads. The company introduced new generation motorcycles that set industry benchmarks for fuel thrift and low emission. A legendary 'Fill it - Shut it - Forget it' campaign captured the imagination of commuters across India, and Hero Honda sold millions of bikes purely on the commitment of increased mileage. In today world customer is the king irrespective of whatever the business may be ,wherever the operations may be .A good business organization is known by its strong customer loyalty, which turns to become a unified family. Introduction: The Indian two-wheeler industry is experiencing a major shift in its shape and structure. The established players in the industry are taking a hard look at their portfolio of products and are in the process of reshuffling them to meet the expectations of customers. The beneficiary is of course the consumer, who has an increased array of products to choose from. The last four-five years have brought about a great change in the consumer preferences for two-wheelers. The market leaders of yesteryears are being driven to maintain their leadership position in the forthcoming years. Those who have had a great going in the last few years are fighting hard to retain their new supremacy. The two- wheeler industry is perhaps the most happening place in terms of new models launched, upgraded products and innovative marketing techniques. Gone are the days of regulation when the production of scooters and motorcycles was limited to two or three brands and the number of products produced was decided by the Government; today the Indian two- wheeler market is highly competitive with numerous players who offer anything and everything a consumer demands and that too at affordable price. -

Continues Improvement

Desh ki Dhadkan Dhak Dhak Go By: o “Hero” is the brand name used by the Munjal brothers for their flagship company Hero Cycles Ltd. o A joint venture between the Hero Group and Honda Motor Company was established in 1984 as the Hero Honda Motors Limited at Dharuhera India. o During the 1980s, the company introduced motorcycles that were popular in India for their fuel economy and low cost. o A popular advertising campaign based on the slogan 'Fill it - Shut it - Forget it' that emphasised the motorcycle's fuel efficiency helped the company grow at a double-digit pace since inception. o Hero Honda has three manufacturing facilities based at Dharuhera, Gurgaon in Haryana and at Hardwar in Uttarakhand. These plants together are capable of churning out 3 million bikes per year. o Hero Honda has a large sales and service network with over 4,500 dealerships and service points across India. o During the fiscal year 2008-09, the company sold 3.7 million bikes, a growth of 12% over last year. In the same year, the company had a market share of 57% in the Indian market. o Hero Honda sells more two wheelers than the second, third and fourth placed two-wheeler companies put together. Hero Honda's bike Hero Honda Splendor, the world's largest- selling motorcycle for the years 2001-2003, selling more than one million units per year. o Total unit sales of 54,02,444 two-wheelers, growth of 17.44 per cent o Total net operating income of Rs. 19401.15 Crores, growth of 22.32 per cent o Net profit after tax at Rs. -

Afro Asiatic Exporters

+91-8045358073 Afro Asiatic Exporters https://www.afroasiatic.com/ We are one of the leading trader and A GOVERNMENT OF INDIA RECOGNISED EXPORT HOUSE of a wide range of optimum quality Motorcycles & Scooters, its Spares & Accessories. About Us Appreciated among our patrons for exporting an extensive array of world-class Motorcycles & Scooters, Afro Asiatic Exporters was set up in the year 1983. The product range offered by us consists of Bajaj Scooters, Hero Scooters, Honda Scooters and many more. Offered by us, these automobiles are sourced from authorized and certified vendors of the industry. Owing to this, these automobiles are highly appreciated for their design, look, performance, millage, maintenance and low power consumption. With the aid of our spacious warehousing unit and rich vendor base, we have been able to manage and meet the bulk demands in the most efficient manner. Our trading brands are Bajaj, Yamaha, Honda, Suzuki, TVS, Hero, LML, and Vespa. our workforce, which is inclusive of skilled and hardworking professionals, has helped us in catering to the precise needs of our valuable patrons, by following customer centric approaches whole dealing with our patrons. In addition to this, they work in close proximity with each other, in order to ensure that all the processes in our workplace are carried out in hassle-free manner. Established by our mentor, Mr. Sunil Mehra, we have been able to cater to a huge clientele across the world. He, with his experience and knowledge of this domain, has helped us in attaining the trust of our valuable patrons in the most efficient manner. -

ASK 2 Wheeler Disc Brake Pad Catalogue

2 WHEELER DISC BRAKE PAD S.No. APPLICATION ASK PART NO. TOTAL LENGTH TOTAL WIDTH THICKNESS DBP PICTURES CPI, DERBI, GILERA, PEUGEOT, 1 AS201111A0 35.7 49 7.1 PGO, PIAGGIO, SYM FRONT / REAR APRILIA, ATALA, BENELLI, BETA, 2 CAGIVA, DERBI, GILERA, HERCULES AS201211A0 39.9 49.51 7 (SACHS), HONDA ADIVA, APRILIA, BENELLI, BIMOTA, 3 AS201311A0 50.9 53.72 7.5 BOMBARDIER ATV APRILIA, ATK (USA), BETA, 4 BULTACO, CAGIVA, DERBI, FANTIC, AS201411A0 36.1 45 6 GARELLI, GASGAS, GILERA HONDA, YAMAHA ATV FRONT ! 5 AS201511A0 81 42 9.4 REAR APRILIA, BENELLI, BETA, KEEWAY, 6 AS201611A0 51.1 53.5 9.5 KSR MOTO BY GENERIC 7 HONDA REAR AS201711A0 81.82 37.5 9.6 APRILIA, KYMCO, MALAGUTI, 8 AS201811A0 117.6 40 8.6 PEUGEOT ITALJET, LINHAI, MBK, YAMAHA 9 AS201911A0 100.1 31.1 9 FRONT / REAR APRILIA, BENELLI, BETA, GASGAS, 10 GILERA, HONDA, HONDA-HM AS202011A0 77.1 / 94.6 42.1 7.6 ITALIA, PEUGEOT 11 HONDA SHINE AS203411A0 98.75 /111.4 33.3 /36.3 7.6 HARLEY DAVIDSON, HONDA, 12 AS204611A0 118.1 45.3 8.4 SUZUKI FRONT / REAR 13 BAJAJ PULSAR AS202811A0 93.6 36.29 7.7 14 HONDA CBZ AS203011A0 77 / 97 42 8.8 15 ITALJET, PIAGGIO FRONT AS202111A0 31.5 51 5.6 APRILIA, DERBI, GILERA, KEEWAY, 16 AS203511A0 97.1 / 77.4 41 9.2 PIAGGIO FRONT / REAR ASK Automotive Pvt. Ltd. Corporate Office: Plot No. 28 Sector-4, IMT Manesar (Gurgaon) - 122050, Haryan, India E-Mail: [email protected], [email protected] Tel: - +91 - 124 - 4659300, Fax: +91 - 124 - 4659388 Registered Office: 929/1 Flat No. -

Hero Motocorp

17 September 2020 Company Update | Sector: Automobile Hero Motocorp BSE SENSEX S&P CNX CMP: INR3,062 TP: INR3,900 (+27%) Upgrade to BUY 38,980 11,516 Increased volume visibility, with levers to drive upside GST cut; focus on bolstering weak areas could drive growth, re-rating HMCL is in a sweet spot as strong rural-led recovery plays to its strength in the Economy–Executive category in the Motorcycles segment. With an apt product Bloomberg HMCL IN portfolio for the rural market, the highest brand recall, and a strong distribution Equity Shares (m) 200 M.Cap.(INRb)/(USDb) 611.6 / 8.3 network, it is best placed to benefit from low penetration and ongoing 52-Week Range (INR) 3180 / 1475 momentum in the rural economy. 1, 6, 12 Rel. Per (%) 2/39/12 HMCL’s competitive positioning has improved in both the 100cc and 125cc 12M Avg Val (INR M) 3336 categories post BS6. This is attributable to the narrowing of the price differential Free float (%) 65.2 in the Economy segment (vis-à-vis BJAUTs CT100) and product upgrades in Executive 125cc. This would enable further recovery in market share in FY21 – Financials & Valuations (INR b) signs of recovery are visible YTD. Y/E March FY20 FY21E FY22E HMCL has a very weak presence in other segments such as Scooters, Premium Sales 288.4 310.6 373.9 Motorcycles and Exports, which contribute over 55% to the 2W industry. It has EBITDA 39.6 42.4 55.5 Adj. PAT 30.6 31.2 40.7 just 5% market share in these segments. -

Dependable Quality Partnering the 2-Wheeler Industry

Dependable Quality Partnering the 2-Wheeler Industry NNE INNE WI R W R AUTO MANUAL 2-WHEELER AUTO MANUAL 2-WHEELER National Engineering Industries Limited (NEIL) was founded in 1946 and is a manufacturer of Bearings under the brand NBC We belong to CK Birla Group (Group Revenue: $1.6 Bn) with diversified interests in Automotive, Construction, Consumer Goods and IT Sector We are India's largest manufacturer with production of 150 Mn Bearings (Ball Bearings, Taper Roller Bearings, DRAC and Railway Bearings) annually in over 1000 sizes from 10mm bore to 2000mm OD Our four state-of-the-art Manufacturing Facilities and Technology Centre are one of the largest in Asia We are one of the preferred suppliers to OEMs and After Market in India as well as in EU and NAFTA We are winners of the DEMING GRAND PRIZE for Quality in 2015 and all our plants are ISO/TS/OHSAS certified We are awarded rating of 5A2 by Dun & Bradstreet indicating strong financial capability AUTO MANUAL 2-WHEELER Index Page No. Honda Motorcycles & Scooter India Pvt. Ltd 01 Suzuki Motorcycle India Ltd. 06 Yamaha Motor India Pvt. Ltd. 09 Hero Motor Corp Ltd. 13 Bajaj Auto Ltd. 17 Piaggio 22 Royal Eneld Ltd. 22 TVS Motor Company 25 Mahindra Two Wheelers Ltd. 29 Application Bearing Location OE Part Number Bearing Number Per O Honda Motorcycles & Scooter India Pvt. Ltd. Activa New Engine Cam Shaft RH 91007-KWP -6000-R2 6904 1 Engine Cam Shaft LH 96100-6000-300 6000 1 Engine Crank Shaft LH 91002-KWP-D030-Y3 6007 1 Engine Crank Shaft RH 91001-KWP-D030-Y3 6205Z 1 Transmission Drive Shaft -

Hero Motocorp Continues Sales Momentum in December'20 to Clock 4.4 Lakh Units Reports Best-Ever Q3 with 18.45 Lakh Units

Press Release New Delhi, January 1, 2021 HERO MOTOCORP CONTINUES SALES MOMENTUM IN DECEMBER’20 TO CLOCK 4.4 LAKH UNITS REPORTS BEST-EVER Q3 WITH 18.45 LAKH UNITS Capping off a highly disrupted and challenging year on a positive note, Hero MotoCorp Ltd, the world’s largest two-wheeler manufacturer sold 447,335 units of motorcycles and scooters in December’20. The company had sold 424,845 units over the corresponding month of the previous year (December 2019). Hero MotoCorp further consolidated its market leadership by clocking its best ever third quarter, with 18.45 lakh units sold during the October-December period. This is a 19.7% growth over the corresponding quarter in the previous fiscal (FY’20) when the Company had sold 15.41 lakh units. The December volumes indicate the continuously improving consumer sentiment and the company expects the positive trend to continue in the new year, despite challenges posed by Covid-19 pandemic. The wide range of best-in-class products and consistent alignment of new technologies and services will ensure company’s strong growth impetus in 2021. Dec’20 Dec’19 YTD FY’21 YTD FY’20 Motorcycles 415,099 403,625 38,96,089 47,10,766 Scooters 32,236 21,220 3,27,136 3,64,442 Total 447,335 424,845 42,23,225 50,75,208 Domestic 425,033 412,009 41,03,381 49,46,508 Exports 22,302 12,836 1,19,844 1,28,700 Press Release Highlights | January-December 2020 Product Launches - Launched a range of premium and youthful motorcycles– Xtreme 160R, Xtreme 200S (BS-VI), Pleasure+ Platinum, Glamour Blaze and Splendor+ Black and -

RAIDA® Bike Cover Size Chart

RAIDA® Bike cover Size chart Model RainPro SeasonPro Model RainPro SeasonPro Aprilia Strom 125 S S Hyosung Aquila GV250 2XL 2XL Aprilia SR 125 S S Hyosung Aquila Pro650 2XL 2XL Aprilia SR150 S S Hyosung GT250R XL XL Aprilia SR 160 S S Hyosung GT650R XL XL Aprilia Dorsoduro 900 2XL 2XL Aprilia Shiver 900 2XL 2XL Indian Sout 2XL 2XL Indian FTR 1200 S 2XL 2XL Ather 450 S S Indian Chief 2XL 2XL Ather 450X S S Indian Chieftain 2XL 2XL Indian Sopringfield 2XL 2XL Bajaj Pulsar 135 LS M M Indian Road master 2XL 2XL Bajaj Pulsar 150 L L Bajaj Pulsar 180 L L Jawa XL XL Bajaj Pulsar NS160 L L Jawa Forty Two XL XL Bajaj V12 M M Jawa Perak XL XL Bajaj V15 M M Bajaj CT100 S S Kawasaki KLX 110 M Bajaj Discover 125 S S Kawasaki Ninja 300 XL XL Bajaj Platina S S Kawasaki Ninja 400 XL XL Bajaj Avenger 150 Street XL XL Kawasaki Z250 XL XL Bajaj Avenger 220 Cruise XL XL Kawasaki Ninja 650 XL XL Bajaj Avenger 220 Street XL XL Kawasaki Z650 XL XL Bajaj Dominar 400 XL XL Kawasaki Versys 1000 3XL 2XL Bajaj Dominar 250 XL XL Kawasaki Versys 650 2XL XL Bajaj Pulsar 220F XL XL Kawasaki Z900 2XL 2XL Bajaj Pulsar NS200 XL XL Kawasaki Z100 2XL 2XL Bajaj Pulsar RS200 XL XL Kawasaki Ninja H2R 2XL 2XL Kawasaki ZX-10R 2XL 2XL Benelli 302R XL XL Kawasaki Vulcan XL XL Benelli TNT 25 XL XL Kawasaki ZX-6R XL XL Benelli TNT 300 XL XL Kawasaki W800 XL XL Benelli TNT 600GT XL XL Benelli TNT600i XL XL KTM 125 Duke XL XL Benelli Imperial 400 XL XL KTM 200 Duke XL XL Benelli Leoncino 250 XL XL KTM 250 Duke XL XL Benelli Leoncino 500 XL XL KTM 390 Duke XL XL Benelli TRK 502X 2XL