Annual Report 1939

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

M a R C H 1 9 3 9 Posed Radio Talk

\\'v) kr \VA1\Ao, 1° 9I thia 9d444e JOLLY JOE KELLEY PAN AMERICAN SLO 'N' EZY CORWIN RIDDELL HE "JAM PANTRY" FOUR PICTURE PAGES CAMERA CONTEST SONG OF THE MONTH and scores of other interest- ing stories and pictures left: Lost John, star cf the WSB Crossroad Frolics THE ONLY MAGAZINE PUBLISHED EXCLU- SIVELY FOR RURAL LISTENERS Vol, 2, No. 2 Ten Cents M A R C H 1 9 3 9 posed radio talk. He is well within his rights to close his facilities to any speaker who refuses to 1939 MARCH 1939 submit it. He is well within his rights to refuse to SUN MON broadcast a speech plainly calculated or likely to TUE WED THU FRI SAT stir up religious prejudice and strife. Such action is merely an act of good stewardship, I 2 3 4 distinctly in the public interest, and is not an abridg- IO ment of the right of free speech. The situation 5 6 7 8 9 II parallels the example once given by the late Justice 16 17 18 Oliver Wendell Holmes of the United States Su- 12 13 14 15 preme Court, where he declared that free speech did not give a man the right to yell "fire" in a crowded 19 20 21 22 23 24 25 theatre. 31 The responsibility to accept or to reject broadcast 26 27 28 29 30 material is one placed squarely on the shoulders of the American broadcaster. It is up to him to evalu- ate what is and what is not in the public interest. -

An Answer to Nelson Eddy Critics

AN ANSWER TO NELSON EDDY CRITICS ..I IIfllR7BDC2S4T 3 1 6M RADI Q7~ DOlJBLES YOlJR RADIO ENJOYMENT 731 PLYMOUTH COURT, CHICAGO, ILL. only German stations, but reports reach l\!riter's Plight us that they can also pick up English news broadcasts. This is contrary to The plight of the radio-writer is the Herr Hitler's plans. American news plight of every lone wolf. He is at the and English news is truthful news, mercy of stronger, better-organized which is embarrassing no end to the adversaries. Since the beginning of Nazis. broadcasting, he has been the creator We hope that German and Italian of programs which brought fame or listeners tune more and more often to fortune to others than himself. our American stations, for as William Musicians were forced to organize Penn put it, "The usefullest truths are to win themselves a place of respect plainest; and while we keep to them, in the radio pictures. Likew ise, the our differences cannot rise high." radio artists. But the writer is still any body's doormat. W e know of one case where a writer Leiters To The Editor was invited to submit ideas for a new program series to one of the greatest Editor, RADIO G U IDE: advertising agencies. He submitted I am ill hearty agreement that t h e script afte r script, devoted three months present-day chi ldren's prog1·wHS are to working on plans dictated by the not at al l suitable jar young people. agency, and was then kicked out the M any of t hem are too exciting and too upsetting. -

Groping in the Dark : an Early History of WHAS Radio

University of Louisville ThinkIR: The University of Louisville's Institutional Repository Electronic Theses and Dissertations 5-2012 Groping in the dark : an early history of WHAS radio. William A. Cummings 1982- University of Louisville Follow this and additional works at: https://ir.library.louisville.edu/etd Recommended Citation Cummings, William A. 1982-, "Groping in the dark : an early history of WHAS radio." (2012). Electronic Theses and Dissertations. Paper 298. https://doi.org/10.18297/etd/298 This Master's Thesis is brought to you for free and open access by ThinkIR: The University of Louisville's Institutional Repository. It has been accepted for inclusion in Electronic Theses and Dissertations by an authorized administrator of ThinkIR: The University of Louisville's Institutional Repository. This title appears here courtesy of the author, who has retained all other copyrights. For more information, please contact [email protected]. GROPING IN THE DARK: AN EARLY HISTORY OF WHAS RADIO By William A. Cummings B.A. University of Louisville, 2007 A Thesis Submitted to the Faculty of the College of Arts and Sciences of the University of Louisville in Partial Fulfillment of the Requirements for the Degree of Master of Arts Department of History University of Louisville Louisville, Kentucky May 2012 Copyright 2012 by William A. Cummings All Rights Reserved GROPING IN THE DARK: AN EARLY HISTORY OF WHAS RADIO By William A. Cummings B.A., University of Louisville, 2007 A Thesis Approved on April 5, 2012 by the following Thesis Committee: Thomas C. Mackey, Thesis Director Christine Ehrick Kyle Barnett ii DEDICATION This thesis is dedicated to the memory of my grandfather, Horace Nobles. -

HBG USA Fall 2021 - Page 1

GRAND CENTRAL PUBLISHING The Antisocial Network The GameStop Short Squeeze and the Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees Ben Mezrich Summary The definitive account of the story of the year, the can’t-make-this-up Gamestop short squeeze—a David vs. Goliath tale of fortunes won and lost overnight that changed Wall Street forever. In The Antisocial Network, bestselling author Ben Mezrich tells the true story of the subreddit WallStreetBets, a loosely affiliated group of private investors and internet trolls who took down one of the biggest hedge funds on Wall Street, and in so doing, fired the first shot in a revolution that threatens to upend the financial establishment. Told with deep access, from multiple angles, it examines the culmination of a populist movement that began with the intersection of social media and the growth of simplified, democratizing financial Grand Central Publishing portals—represented by the biggest upstart in the business, RobinHood, and its millions of mostly millennial 9781538707555 Pub Date: 9/7/21 devotees. $28.00 USD/$35.00 CAD Hardcover The unlikely focus of the battle: GameStop, a flailing brick and mortar dinosaur catering to teenagers and 288 Pages outsiders, that had somehow outlived forbearers like Blockbuster Video and Petsmart as the world rapidly Carton Qty: 20 moved online. The story comes to a ... Print Run: 75K Business & Economics / Consumer Behavior Contributor Bio BUS016000 Ben Mezrich is the New York Times bestselling author of The Accidental Billionaires (adapted by Aaron Sorkin 9 in H | 6 in W into the David Fincher film The Social Network) and Bringing Down the House (adapted into the #1 box office hit film 21), as well as many other bestselling books. -

Tommy Dorsey

Glenn Miller Archives TOMMY DORSEY 1 9 3 9 Prepared by: Dennis M. Spragg CHRONOLOGY Part 1 - Chapter 5 Updated March 16, 2021 Table of Contents January 1939 3 February 1939 20 March 1939 29 April 1939 37 May 1939 44 June 1939 59 July 1939 73 August 1939 86 September 1939 109 October 1939 125 November 1939 135 December 1939 144 2 January 1939 January 1, 1939 (Sunday) Midnight - 12:30 am Hotel New Yorker New York (CBS) (WABC) sustaining broadcast January 2, 1939 (Monday) 11:00-11:30 pm Hotel New Yorker New York (Mutual) (WOR) sustaining broadcast Personnel Add Nat Leslie, arranger January 4, 1939 (Wednesday) 8:30 - 9:00 pm “The Raleigh and Kool Show” 79A NBC Radio City New York (NBC-Red) (WEAF) broadcast Bud Collyer, announcer Nat Leslie, arranger The Pied Pipers (Josephine Stafford, John Huddleston, Hal Hopper, Chuck Lowry, Bud Hervey, George Tait, Woody Newbury, Dick Whittinghill), guests I’m Gettin’ Sentimental Over You - opening theme, Two Cigarettes In The Dark Humoresque - Paul Weston arrangement What Do You Know About Love? – Edythe Wright, vocal It’s A Killer – Nat Leslie arrangement Let’s Stop The Clock Judgment Day Is Coming – Deane Kincaide arrangement Russian Lullaby, Down Home Rag – Deane Kincaide arrangement Symphony In Riffs – Benny Carter arrangement I’m Gettin’ Sentimental Over You - closing theme January 4, 1939 (Wednesday) 11:30 pm – Midnight “The Raleigh and Kool Show” 79B Western Feed NBC Radio City New York (NBC-Red) broadcast January 6, 1939 (Friday) 11:30 pm – Midnight Hotel New Yorker New York (CBS) (WABC) sustaining broadcast 3 January 7, 1939 (Saturday) 11:00 - 11:30 pm Hotel New Yorker New York (Mutual) (WOR) sustaining broadcast January 8, 1939 (Sunday) Midnight - 12:30 am Hotel New Yorker New York (CBS) (WABC) sustaining broadcast Broadcast cancelled - see Variety article, following. -

WSM Tower Transmission Complex Text by Carroll Van West

WSM Tower Transmission Complex Text by Carroll Van West The WSM Tower Transmission Complex, at 8012 Concord Road in Brentwood, Williamson County, Tennessee, is listed in the National Register of Historic Places. The 1932 “diamond” tower is a unique structure with a shape that allowed the radio station as one of the nation’s federally designated clear channels to broadcast to forty states a program of music, news, and public service geared to largely a rural and small town audience. The complex has state and national significance in the area of the military history of the Cold War era since it was one of the original stations that served a military/civil defense role in the CONELRAD system beginning in 1951. As an engineering structure, the complex’s tower has national significance as an engineering marvel. The WSM Tower, at 808 feet, is the tallest Blaw-Knox Diamond Radio Tower in North America and is one of six similarly designed Blaw-Knox towers to have once existed in North America. Originally constructed at 878 feet in 1932, the tower was lowered by 70 feet in 1939 to improve radio transmission and reception. The tower was the third of four of its kind in the world [the others were in New Jersey (not extant); Budapest, Hungary (not extant), Brentwood, Tennessee, and Cincinnati, Ohio.] The WSM Tower is the oldest surviving intact example of this type of radio tower in the world. Architecturally, the main building in the complex has local significance as an excellent example of a Colonial Revival design by Russell Hart of the locally prominent architectural firm of Hart, Freeland, Roberts. -

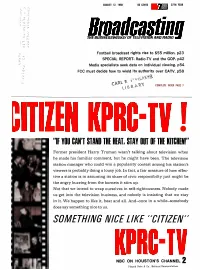

Citilen KPRC1V!

AUGUST 12, 1968 50 CENTS II trill 37TH YEAR Hroadenting THE BUSINESSWEEKLY OF TELEVISION AND RADIO Football broadcast rights rise to $55 million. p23 SPECIAL REPORT: Radio -TV and the GOP. p42 Media specialists seek data cn individual viewing. p54 FCC must decide how to wield its authority over CATV. p58 it CARL 1_1BR°i COMPLETE INDEX PAGE 7 CITIlEN KPRC1V! "IF YOU CAN'T STAND THE HEAT, STAY OUT OF THE KITCHEN!" Former president Harry Truman wasn't talking about television when he made his familiar comment, but he might have been. The television station manager who could win a popularity contest among his station's viewers is probably doing a lousy job. In fact, a fair measure of how effec- tive a station is in assuming its share of civic responsibilty just might be the angry buzzing from the hornets it stirs up. Not that we intend to wrap ourselves in self -rightousness. Nobody made us get into the television business, and nobody is insisting that we stay in it. We happen to like it, heat and all. And -once in a while- somebody does say something nice to us. SOMETHING NICE LIKE "CITIZEN" KPRC1V NBC ON HOUSTON'S CHANNEL 2 Fdward Patry & en National Renrecanrativec Soundest buy in sight... A Jerrold CATV system Jerrold Total Turnkey CATV is the kind that's put and training of operating personnel. n hó t, there together so it stays together -physically and finan- need be no loose ends. Jerrold delivers a CATV cially. The kind that has turned most potential CATV system that is the best possible beginning for a solid system owners to Jerrold in the last 16 years. -

A History of Educational Radio in Chicago with Emphasis on WBEZ-FM, 1920-1960

Loyola University Chicago Loyola eCommons Dissertations Theses and Dissertations 1991 A History of Educational Radio in Chicago with Emphasis on WBEZ-FM, 1920-1960 Jerry J. Field Loyola University Chicago Follow this and additional works at: https://ecommons.luc.edu/luc_diss Part of the Education Commons Recommended Citation Field, Jerry J., "A History of Educational Radio in Chicago with Emphasis on WBEZ-FM, 1920-1960" (1991). Dissertations. 2273. https://ecommons.luc.edu/luc_diss/2273 This Dissertation is brought to you for free and open access by the Theses and Dissertations at Loyola eCommons. It has been accepted for inclusion in Dissertations by an authorized administrator of Loyola eCommons. For more information, please contact [email protected]. This work is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 License. Copyright © 1991 Jerry J. Field A History of Educational Radio In Chicago With Emphasis on WBEZ-FM: 1920-1960 by Jerry J. Field A Dissertation Proposal Submitted to the Faculty of the School of Education of Loyola Uni_versity of_ Chicago in Partial Fulfillment of the Requirements for the Degree of Doctor of Education (Ed.D.) MAY 1991 Jerry J. Field Loyola University of Chicago A HISTORY OF EDUCATIONAL RADIO IN CHICAGO WITH EMPHASIS ON WBEZ-FM: 1920-1960 The Chicago Board of Education was considered one of the pioneers in the use of educational radio in the nation. How radio programs were used by the Chicago Board of Education during the period of 1920 through 1960 is the focus of the dissertation. The Board's use of radio programs as a supplement to the existing lessons was unique to the teaching curriculum.