December 15, 2019 Rep. Dominique Jackson Colorado General

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Colorado AFL-CIO 2018 Endorsements

Colorado AFL-CIO The Colorado AFL-CIO is the federation of more than 180 local and international unions, representing more than 130,000 workers 925 S. Niagara St #600, Denver, CO 80224 303-433-2100 | [email protected] Working people in Colorado need to know that their elected leadership is working hard for them. That is why we are thrilled to endorse a slate of union champions that have demonstrated their commitment to our members by expanding collective bargaining rights, raising wages, and making our workplaces safer. We believe that if these candidates win, our state will be more equitable and fair for all families. U S C O N G R E S S Congressional District 1 – Diana DeGette Congressional District 2 – Joe Neguse Congressional District 3 – Diane Mitsch Bush Congressional District 4 – Karen McCormick Congressional District 5 – Stephany Rose Spaulding Congressional District 6 – Jason Crow Congressional District 7 – Ed Perlmutter G O V E R N O R Jared Polis S T A T E T R E A S U R E R A T T O R N E Y G E N E R A L S E C R E T A R Y O F S T A T E Dave Young Phil Weiser Jena Griswold S T A T E S E N A T E SD 3 - Leroy Garcia SD 20 - Jessie Danielson SD 5 - Kerry Donovan SD 22 - Brittany Pettersen SD 11 - Pete Lee SD 24 - Faith Winter SD 13 - Phil Kelley SD 30 - Julia Varnell-Sarjeant SD 15 - Rebecca Cranston SD 32 - Robert Rodriguez SD 16 - Tammy Story SD 34 - Julie Gonzalez C U R E G E N T Lesley Smith aam/opeiu30/aflcio Colorado AFL-CIO The Colorado AFL-CIO is the federation of more than 180 local and international unions, representing more than 130,000 workers 925 S. -

Rep. Roberts' Sponsored Bills 2020

State Representative Dylan Roberts H.D. 26 - Eagle County & Routt County Legislative Review – 72nd General Assembly, 2020 Quick Stats: ● 25 bills introduced as prime sponsor ● 17 passed bills: 9 House, 8 Senate ● 100% of my bills had bipartisan sponsorship and/or received bipartisan votes ● 9 Town Hall meetings in HD26 in 2020 (in-person and virtual) Passed Bills: HOUSE BILLS HB1003: Rural Jump-start Zone Act Expansion The Rural Jump-Start Program incentivizes businesses to create and maintain jobs in rural parts of Colorado by providing tax incentives both to the businesses themselves and to their employees. These businesses must be located in designated economically distressed areas of Colorado known as Rural Jump-Start Zones. This bill extends the program for five years and allows economic development organizations to form Rural Jump-Start Zone programs so that more counties in more parts of the state can participate. Bi-partisan sponsorship: Reps. Janice Rich and Dylan Roberts & Sens. Kerry Donovan and Ray Scott Status: SIGNED INTO LAW BY THE GOVERNOR. HB1067: Management Of Property Held By Certain Junior College Districts This bill allows Moffat County Affiliated Junior College District (MCAJCD) to hold and sell its current real estate holdings as long as the sale is for fair market value as determined by an independent appraiser and the proceeds are used for the benefit of the Colorado Northwestern Community College (CNCC). Bi-partisan sponsorship: Reps. Perry Will and Dylan Roberts & Sens. Tammy Story and Rhonda Fields Status: SIGNED INTO LAW BY THE GOVERNOR. HB1157: Loaned Water For Instream Flows To Improve Environment This bill expands Colorado’s instream flow program, which allows water-rights holders to temporarily loan their water to the Colorado Water Conservation Board’s (CWCB) instream flow program during dry years without jeopardizing their water rights. -

2020 Abstract of Votes Cast

2020 Abstract of Votes Cast Office of the Secretary of State State of Colorado Jena Griswold, Secretary of State Christopher P. Beall, Deputy Secretary of State Judd Choate, Director of Elections Elections Division Office of the Secretary of State 1700 Broadway, Suite 550 Denver, CO 80290 Phone: (303) 894-2200, ext. 6307 Official Publication of the Abstract of Votes Cast for the Following Elections: 2019 Odd-Year 2020 Presidential Primary 2020 Primary 2020 General Dear Coloradans, It is my privilege to present the biennial election abstract report, which contains the official statewide election results for the 2019 coordinated election, 2020 presidential primary, 2020 statewide primary, and 2020 general election. This report also includes voter turnout statistics and a directory of state and county elected officials. The Colorado Secretary of State’s Election Division staff compiled this information from materials submitted by Colorado’s 64 county clerk and recorders. Additional information is available at Accountability in Colorado Elections (ACE), available online at https://www.sos.state.co.us/pubs/elections/ACE/index.html. Without a doubt, the 2020 election year will be remembered as one of our state’s most unusual and most historic. After starting with the state’s first presidential primary in 20 years, we oversaw two major statewide elections amidst a global pandemic and the worst forest fires in Colorado’s history. Yet, despite those challenges, Colorado voters enthusiastically made their voices heard. We set state participation records in each of those three elections, with 3,291,661 ballots cast in the general election, the most for any election in Colorado history. -

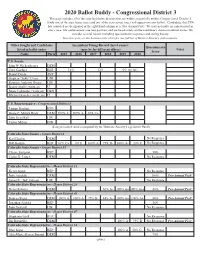

2020 Ballot Buddy - Congressional District 3 This Page Includes All of the State Legislative Districts That Are Within, Or Partially Within, Congressional District 3

2020 Ballot Buddy - Congressional District 3 This page includes all of the state legislative districts that are within, or partially within, Congressional District 3. (Only one of the state house races and one of the state senate races will appear on your ballot). Candidates that CVA has endorsed are designated in the right-hand column as a "Pro-Animal Pick." We may not make an endorsement in every race. Our endorsements are non-partisan, and are based solely on the candidate’s stance on animal issues. We consider several factors including questionnaire responses and voting history. New this year, see the bottom of the chart for our full list of District Attorney endorsements. Office Sought and Candidates Incumbent Voting Record (last 6 years): Questionnaire listed in ballot order (may be for different offices) Notes Score Name Party 2015 2016 2017 2018 2019 2020 U.S. Senate John W. Hickenlooper DEM Cory Gardner REP 14% 12% 0% (so far) Daniel Doyle AVP Stephan "Seku" Evans UNI Raymon Anthony Doane LIB Danny Skelly (write-in) U Bruce Lohmiller (write-in) GRN Michael Sanchez (write-in) U U.S. Representative - Congressional District 3 Lauren Boebert REP Diane E. Mitsch Bush DEM 100% A- 100% A- 67% C+ John Ryan Keil LIB Critter Milton IND (Congressional scores compiled by the Humane Society Legislative Fund) Colorado State Senate - Senate District 8 Karl Hanlon DEM No Response Bob Rankin REP 67% C+ 0% F 100% A 75% B- 100% A- 20% F No Response Colorado State Senate - Senate District 35 Cleave Simpson REP 50% Carlos R. -

Office of the Attorney

Office of the Attorney Bryan Treu 970-328-8685 Bryan.Treueaglecounty.us www.eagl ecou nty. us EAGLE COUNTY June 1, 2021 Heather Flannery Senior Assistant Attorney General Colorado Department of Law Business and Licensing Section Ralph L. Cart Colorado Judicial Center 1300 Broadway, 8th Floor Denver, Colorado 80203 (720) 508-6387 heather.flannery @ coarov Re: Violations of Colorado Open Records Act and Colorado Open Meetings Act; Pre Litigation Hold Notice and Request to Preserve All Relevant and Potentially Relevant Evidence. Dear Ms. Flannery, This communication addresses violations by your client, the Colorado State Board of Equalization (“SBOE”), of the Colorado Open Records Act, C.R.S. § 24-72-201, et. seq. (“CORA”) and the Colorado Open Meetings Law, C.RS. § 24-6-402 (“COML”). It provides written notice of Eagle County’s intent to file an application with the district court in Denver for a show cause order pursuant to C.R.S. § 24-72-204(5)(a). It also provides written notice of Eagle County’s intent to seek all legal remedies available for the SBOE violation of the COML, including review of the recorded executive session meeting that occurred during the March 26, 2021 meeting of the SBOE (the “March 26 Meeting”). This should be treated as a pre-litigation notice in order to prevent destruction of relevant or potentially relevant evidence, including but not limited to the recording of the executive session at the March 26 Meeting. 1. CORA As you know, on March 30, 2021, representatives of Eagle County made a request to your clients under CORA to inspect certain public records of the Colorado State Board of Equalization (“SBOE”). -

A Look at the 2020 Legislative Session

The Vol. 40 No. 1 Spring 2020 The 2019 People’s Lobby Trip was our biggest ever. But already, more people have registered for the 2020 trip on February 24. A look at the 2020 legislative session by Jeriel Clark leave for employees, lowering the priorities include: current status as sole supplier of Political & cost of higher education, and of transmission, distribution, and Organizing Director course the continual need to fix House Bill 20-1064 which would customer service functions. and maintain Colorado roads. enact a 2020 study through the Public Utilities Commission House Bills 20-1162 and 20-1163 The 2020 Legislative Session Whether or not lawmakers can (PUC) to take a close look at take on reduction and is off and running and it looks overcome the deep partisan Community Choice Energy. responsibility through to be a busy one. Just a few divides that marked the 2019 Community Choice Energy polystyrene and single-use days into the 2020 Colorado session to make progress on these (CCE) is a concept currently plastics bans and management. legislative session, the Western critical issues remains to be seen. implemented in numerous states, Well thought-out, and with Colorado Alliance Legislative under which local municipal- exemptions for hospitals, assisted Committee was already tracking Amidst the partisan bickering ities could choose to purchase living facilities, etc., these over 30 bills that center around and 2020 election theatrics electricity at wholesale through two bills would implement a our mission. Now, more than impacting the Colorado Capitol, a supplier other than the local statewide reduction for single- 450 bills have been introduced our Alliance is focusing on what investor-owned electric utility. -

How It Happened : an Inside Look at States' 2021 Major Affordability Laws

How it Happened : An Inside Look at States’ 2021 Major Affordability Laws Wed 6/30 SUMMARY KEYWORDS state, Colorado, option, people, Nevada, health care, Washington, provide, providers, public, plan, access, support, bill, hear, care, individuals, legislation, representative, insurance 01:40 - ANITA PRAMODA everyone and thank you for joining us today. I am Anita Pramoda, and I'm delighted to be leading off this event. I am a member of the United States of Care board and a business owner in Nevada. And I'm especially proud to talk to you today because my home state just passed the nation's second public health insurance operation . You will hear more about this today. And I'm delighted that the partners from Colorado and Washington are here joining this conversation. Their states have also made great strides in providing more affordable coverage to the people. Here in Nevada and across the world this pandemic has been hard. We have so many hospitality professionals in our state, and they were some of the hardest hit with job cuts. And with people's health insurance tied to their jobs, that's another hit to their security. Even before COVID, Nevada has long been among the states with the lowest health insurance rates. It's clear how desperately we need change. This public option will provide that change and we'll open up more affordable plans to more than 350,000 of our uninsured neighbors, as well as those who've been carrying insurance that they could barely afford. It's a huge relief for even more people from the fear of losing their insurance if the economy takes another hit. -

Staff Requests You Establish Bi-Weekly Telephone Meetings During the Colorado Legislative Session

M EMORANDUM TO: BOARD OF DIRECTORS, CRWCD FROM: ZANE KESSLER, DIRECTOR OF GOVERNMENT RELATIONS SUBJECT: STATE LEGISLATIVE AFFAIRS DATE: JANUARY 2, 2020 ACTIONS: • Staff requests you establish bi-weekly telephone meetings during the Colorado legislative session. • Adopt positions on legislation of interest (to be provided at the meeting) • Provide direction and input on anticipated legislation STRATEGIC INITIATIVE(S): • 1.A, 1.B Outreach and Advocacy _____________________________________________________________________________ Returning to the traditional second Wednesday of the New Year, the Colorado General Assembly will open the 2nd Regular Session of the 72nd General Assembly on Wednesday, January 8, adjourning no later than midnight May 7. Colorado Democrats continue to enjoy the majority in both the House and Senate and, of course, the Governor's office. West Slope House members will be in positions of leadership and influence again in 2020. Representative KC Becker (D-HD13) will continue to serve as Speaker of the House, and Senator. Kerry Donovan (D-SD5) will chair the Senate Agriculture Committee while Representative Dylan Roberts (D-HD26) will chair the House Rural Affairs and Agriculture Committee. The full slate of River District legislators is below: House District Name River District Counties HD 13 Rep. KC Becker (D) Grand HD26 Rep. Dylan Roberts (D) Eagle and Routt HD54 Rep. Matt Soper (R) Mesa and Delta HD55 Rep. Janice Rich (R) Mesa (Clifton, Fruitvale, Grand Junction, Orchard Mesa and Redlands) HD57 Rep. Perry Will (R) Garfield, Rio Blanco and Moffat 970.945.8522 201 Centennial Street | PO Box 1120 ColoradoRiverDistrict.org Glenwood Springs, CO 81602 State Legislative Affairs January 2, 2020 Page 2 of 5 HD58 Rep. -

Colorado House Democrats 2020 End of Session Report

Colorado House Democrats 2020 End of Session Report MEETING THE MOMENT, GOVERNING RESPONSIBLY IN A CRISIS The 2020 legislative session was unlike any other session before it. From an unprecedented global health emergency and the dire budget consequences we faced, to the chaotic flashpoint of a centuries-long struggle for justice taking place outside of the Capitol, we’ve had everything but business as usual at the General Assembly this year. Colorado House Democrats rose to the occasion and worked to pass responsible laws to protect the health and safety of hardworking Coloradans and get our state back on track. In response to the pandemic, we passed legislation to provide $270 millions in grants and loans to small businesses, channeled tens of millions in direct housing assistance, utilities support and mental health assistance, ensured access to paid sick leave for Colorado workers and expanded unemployment benefits) to help hardworking Coloradans make ends meet. When the murder of George Floyd sparked protests about generations of racial injustice in Denver and across the country, House Democrats stepped up and passed sweeping, bipartisan reform measures to enhance accountability, integrity, and transparency in law enforcement. We also continued to move our state forward on issues that are important to Coloradans, such as improving air quality, reducing the cost of health care, addressing youth nicotine use, creating a robust retirement savings system and increasing access to higher education. We worked to protect renters and increase -

HOUSE JOURNAL SEVENTY-SECOND GENERAL ASSEMBLY STATE of COLORADO Second Regular Session

Page 1 HOUSE JOURNAL SEVENTY-SECOND GENERAL ASSEMBLY STATE OF COLORADO Second Regular Session First Legislative Day Wednesday, January 8, 2020 1 Prayer by Pastor Joe Agne, Community United Methodist Church, 2 Cedaredge. 3 4 Colors were posted by Senior Airman Joshua Miller, Airman First Class 5 Emma Campbell, Airman First Class Aysaiah Franks, Airman First Class 6 Evan Knight, Mile High Honor Guard. 7 8 The National Anthem was performed by Tony Exum Jr. 9 10 Pledge of Allegiance was led by Ryder Kunkle, Leo Kunkle, Flatirons 11 Elementary Watershed School, Boulder. 12 13 The Speaker appointed Robin Jones, Chief Clerk. 14 15 _______________ 16 17 RESIGNATION 18 19 May 12, 2019 20 21 Dear Marilyn: 22 23 I am resigning my seat as the elected representative of House District 50 24 effective Sunday, May 12th, 2019. 25 26 Sincerely, 27 28 Rochelle Galindo 29 State Representative 30 House District 50 31 32 ______________ 33 34 COMMUNICATIONS 35 36 STATE OF COLORADO 37 DEPARTMENT OF STATE 38 39 UNITED STATES OF AMERICA ) SS. CERTIFICATE 40 STATE OF COLORADO ) 41 42 I, Jena Griswold, Secretary of State, certify that the attached is a true and 43 exact copy of the Nomination by Vacancy Committee as filed in this 44 office on June 3, 2019 by the Democratic 50th House District Vacancy Page 2 House Journal--1st Day--January 8, 2020 1 Committee, appointing Mary Young to fill the vacancy in the office of 2 Colorado State House, District 50, caused by the resignation of the 3 honorable Rochelle Galindo. 4 5 In testimony whereof I have set my hand and affixed the Great Seal of the 6 State of Colorado, at the City of Denver this fifth day of June 2019. -

2018 LEGISLATIVE FORECAST a Steep Climb to Common Ground

2018 LEGISLATIVE FORECAST A Steep Climb to Common Ground Informing Policy. Advancing Health. Acknowledgements Colorado Health Institute staff contributors to this report: • Joe Hanel, Associate Director of Strategic Communications, Coauthor • Allie Morgan, Associate Director for Legislative Services, Coauthor • Brian Clark • Cliff Foster • Deborah Goeken • Emily Johnson • Ian Pelto Special thanks to CHI’s legislative monitors, Jennifer Miles and her team at Frontline Public Affairs, and Mike Beasley of 5280 Strategies, for their advice and insight. Our Funders 2 Colorado Health Institute A Steep Climb to Common Ground JANUARY 10, 2018 The end is near for much of the political leadership at the Colorado State Capitol. The state’s term limits law means 2018 will be the final legislative session for the speaker of the House, the Senate president and Gov. John Hickenlooper. Hickenlooper, a two-term Democrat who also served But Washington politics will bring another year of twice as Denver mayor, has sought to govern from uncertainty to the state, especially surrounding health the center during his years at the helm in Colorado. care. The Trump administration struggled in 2017 to But common ground between the two parties will translate its goals into policy, as evidenced by the failure be difficult to find during his final legislative session, to repeal the Affordable Care Act (ACA). But the White particularly because 2018 is an election year. House brushed aside legislative setbacks and turned to executive action to roll back key features of the ACA and It will be the fourth straight year of a one-vote shorten the enrollment period for private insurance. -

Contributor Citystate Contributortype Amount Contribution Date Contributiontype Inkind Major PUBLIC EDUCATION COMMITTEE DENVER

Contribution Contributor CityState ContributorType Amount Date ContributionType InKind Major PUBLIC EDUCATION Small Donor Monetary COMMITTEE DENVER, CO Committee 2250 6/29/12 (Itemized) No No PUBLIC EDUCATION Small Donor Monetary COMMITTEE DENVER, CO Committee 2250 8/15/12 (Itemized) No No COLORADO PROFESSIONAL FIRE FIGHTERS SMALL Small Donor Monetary DONOR FUND DENVER, CO Committee 2000 6/29/12 (Itemized) No No COLORADO CONSERVATION VOTERS ACTION FUND (SDC) Small Donor Monetary (CCVAF SDC) DENVER, CO Committee 1250 8/30/12 (Itemized) No No STEAMBOAT Monetary DIANE MITSCH BUSH SPRINGS, CO Candidate 1000 5/1/12 (Itemized) No No COLORADO TRIAL LAWYERS ASSOCIATION SMALL DONOR Small Donor Monetary COMMITTEE (CTLA) DENVER, CO Committee 1000 8/9/12 (Itemized) No No STEAMBOAT Monetary DIANE MITSCH BUSH SPRINGS, CO Candidate 900 7/7/12 (Itemized) No No STEAMBOAT Non-Monetary DIANE MITSCH BUSH SPRINGS, CO Candidate 600 9/18/12 (Itemized) Yes No STEAMBOAT Monetary DIANE MITSCH BUSH SPRINGS, CO Candidate 500 6/21/12 (Itemized) No No COLORADO AMERICAN FEDERATION OF LABOR & CONGRESS OF INDUSTRIAL ORGANIZATIONS NONPARTISAN SMALL Small Donor Monetary DONOR DENVER, CO Committee 500 7/2/12 (Itemized) No No AFT COLORADO FEDERATION OF TEACHERS, SCHOOL, HEALTH AND PUBLIC CASTLE Small Donor Monetary EMPLOYEES (SDC) ROCK, CO Committee 500 8/31/12 (Itemized) No No AFSCME COUNCIL 76 SMALL DONOR COMMITTEE (AMERICAN FEDERATION OF STATE COUNTY AND Small Donor Monetary MUNICIPAL EMPLOYEES DENVER, CO Committee 500 9/4/12 (Itemized) No No STEAMBOAT Monetary GARY NELSON