2019 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mattel Films and Blumhouse Productions Partner to Bring ‘Magic 8 Ball®’ to the Big Screen

Mattel Films and Blumhouse Productions Partner to Bring ‘Magic 8 Ball®’ to the Big Screen June 3, 2019 First collaboration between Mattel Films and Blumhouse Productions, the producer of Get Out, Ma, Halloween Film director Jeff Wadlow, whose work includes Kick-Ass 2, Truth or Dare and the upcomingFantasy Island, has signed on to direct the production Sixth live-action film project Mattel Films has in development since its creation nine months ago, including Barbie®, Hot Wheels®, Masters of the Universe®, American Girl® and View Master® EL SEGUNDO, Calif.--(BUSINESS WIRE)--Jun. 3, 2019-- Mattel, Inc. (NASDAQ: MAT) today announced a partnership with Academy Award®- nominated production company Blumhouse Productions to create a live-action feature film based on the iconic, fortune-telling Magic 8 Ball®, selected by Time magazineas one of the100 greatest toys of all time. The film will be directed by critically-acclaimed director Jeff Wadlow, whose previous work includes notable films such as Kick-Ass 2 and Truth or Dare. Wadlow is writing the script with his collaborators, Jillian Jacobs and Chris Roach. This marks Mattel Film’s first partnership with independent powerhouse Blumhouse Productions, whose films have grossed more than $3 billion at the worldwide box office. The suspense-filled Magic 8 Ball movie will be adapted for audiences worldwide. It also marks the sixth project Mattel Films has in development, including plans to create feature films based on Mattel’s Barbie®, Hot Wheels®, Masters of the Universe®, American Girl® and View Master® brands. “Since the 1950s, Magic 8 Ball has inspired imagination, suspense and intrigue across generations. -

Mattel Films to Develop Rock 'Em Sock '

Mattel Films to Develop Rock ‘Em Sock ‘Em Robots Live-Action Motion Picture with Universal Pictures and Vin Diesel’s One Race Films April 19, 2021 Vin Diesel also to star in the film, written by Ryan Engle, based on the classic tabletop game about battling robots EL SEGUNDO, Calif.--(BUSINESS WIRE)--Apr. 19, 2021-- Mattel, Inc. (NASDAQ: MAT) announced today plans to develop Rock ‘Em Sock ‘Em Robots®, the classic tabletop game featuring battling robots, into a live-action motion picture. Mattel Films is working with Universal Pictures and Vin Diesel’s production company, One Race Films, on the project. Diesel will also star in the film. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210419005111/en/ Mattel Films will produce the project alongside Diesel and Samantha Vincent (“The Fast and the Furious” franchise) from One Race Films. Ryan Engle (“Rampage,” “The Commuter”) penned the screenplay for the action adventure, which follows a father and son who form an unlikely bond with an advanced war machine. Kevin McKeon will lead the project for Mattel Films. “To take the classic Rock 'Em Sock 'Em game, with Mattel as my partner, and align it with the kind of world building, franchise making success we have had with Universal, is truly exciting," said Vin Diesel. “We are proud to bring this iconic piece of Mattel IP to life on the big screen with our tremendously talented partners Vin Diesel, One Race Films and Universal,” added Robbie Brenner, executive producer of Mattel Films. “Our rich library of franchises continues to yield compelling stories and (Graphic: Business Wire) we look forward to creating what is sure to be a thrilling action adventure for the whole family to enjoy with Rock ‘Em Sock ‘Em Robots.” Launched in 1966, the Rock ‘Em Sock ‘Em Robots game was inspired by an arcade boxing game which pitted Red Rocker® against Blue Bomber® in a fight to knock his rival’s block off. -

La France Se Prépare À Mener La Guerre Dans L'espace

Maison d’Épargne et de Valeur dnca-investments.com Prise de parole : comment s’y préparer « Les Echos Executives » LE QUOTIDIEN DE L'ÉCONOMIE // LUNDI 10 SEPTEMBRE 2018 // lESECHOS.FR // DOSSIER PP.35 À 37 L’ESSENTIEL La France se prépare à mener SANTÉ : lE GOUVERNEMENT PRÊT À lÂCHER DU LEST Avant la présentation, le 18 sep- tembre, du plan santé, l’exécutif est prêt à relâcher la contrainte la guerre dans l’espace budgétaire sur les dépenses de santé. // P. 4 POURQUOI LES THÉÂTRES l Le ministère des Armées planche sur la future stratégie spatiale de défense française. PRIVÉS SONT SI CONVOÎTÉS Inauguration, réouverture, chan- l Les Russes ont tenté d’espionner un satellite militaire français, selon Florence Parly. gement de propriétaire… Les grandes manœuvres se poursui- vent autour des salles parisieNNes. ace à la menace d’une « guerre des étoiles », la minis- spatiale de défense française, qu’elle présentera eN détail eN Blanche d’une prochaine « Space Force » américaine. « J’y // ENQUÊTE P. 12 tre des Armées, Florence Parly, veut augmenter les fin d’année au président de la République. Après avoir vois un signal extrêmement puissant : le signal des confronta- F moyens de surveillance des satellites militaires. Elle révélé qu’un satellite russe avait tenté d’espionner un satel- tions à venir », dit-elle. Pour contrer les menaces, la ministre a dévoilé vendredi à Toulouse les axes de la future stratégie lite militaire français, elle a réagi à l’aNNonce par la Maison- souhaite « observer l’espace depuis l’espace ». // PAGE 19 ENTREPRISES & MARCHÉS Dix ans après la chute de Lehman : CO2 : BRUXELLES TRAVAILLE SUR LES NOUVELLES NORMES La Commission met la pressioN ce qu’a changé la crise du siècle sur les constructeurs automobiles, prévoyant un nouvel abaissement drastique des émissions de CO2 à horizon 2030. -

Innovalue #Payments

Innovalue #payments INSIGHT | OPINION Vol 7 • Q2 2014 Apple Pay: Taking a bite out of payments Christina Cordes, the start (usually merchants who already Associate accepted NFC). Furthermore, Apple announced significant bank partnerships Kalle Dunkel, with Bank of America, Capital One Bank, Associate Chase, Citi,Wells Fargo and others which together represent about 83% of the US credit Mirko Krauel, card purchase volume. Principal For now, Apple Pay is a solution for the US market only. In Europe, Apple will face more Following months and weeks of extensive speculation and leaked rumours, the new "Apple Pay is not revolutionary. It is evolutionary." iPhone 6 with its feature Apple Pay has finally been presented on 9th of September. button. That’s it. The innovation and lifestyle complex challenges. First of all, Europe is more To be frank, Apple Pay is not revolutionary. oriented Apple user base will push “their” solu- fragmented and has several markets with It is evolutionary as Apple uses the existing tion, especially in the US market where the only a low penetration rate of NFC enabled payment ecosystem and partners with estab- company has a market share of around 40%. POS terminals - at least for now. Furthermore, lished players. Also, none of the ingredients of However, a good mobile payment solu- Apple has a lower market share in a lot of Apple Pay are new but this seems to be the tion on the customer side is basically worthless European countries compared to the US. first recipe that people like and want. Obvi- if there are no POS acceptance points on the Finally, the banking landscape consists of ously, this is due to a multitude of reasons, merchant side. -

DONNA LANGLEY the Complete Pioneer of the Year Tribute Journal Will Be Available for Download on Our Website

2016 PIONEER OF THE YEAR DONNA LANGLEY The complete Pioneer of the Year Tribute Journal will be available for download on our website, www.wrpioneers.org/2016dinner. Thank you to all our sponsors. Renewable resources were used to produce this printed piece. A donation will be made on behalf of Donna Langley and the Will Rogers Motion Picture Pioneers Foundation to American Forestry. 2016 PIONEER OF THE YEAR Welcome On behalf of the Board of Directors of the Will Rogers Motion Picture Pioneers Foundation,thank you for attending the 2016 Pioneer of the Year Dinner. This is our 75th annual dinner, and this evening’s honoree Donna Langley, is a most-deserving one. The Pioneer of the Year award is bestowed upon an esteemed and respected member of the motion picture industry whose corporate leadership, service to the community and commitment to philanthropy is exceptional. Tonight we honor a visionary leader, a proven champion of the motion picture art form, and a woman who gives tirelessly of herself to our industry and to philanthropic causes-Donna Langley. The Pioneers Assistance Fund is the only industry program that provides both short- term and Quality of Life grants (long-term) to veterans of the motion picture industry who are encountering an illness, injury, or life-changing event. Thank you for donating generously to our industry charity-hopefully you will never have reason to call on the Pioneers Assistance Fund, but should the need arise we will be here to help. Please enjoy yourself tonight as we pay tribute to a true pioneer. -

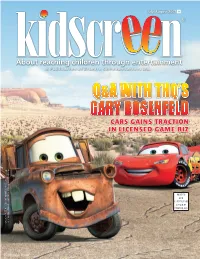

Q&A with Thq's Gary Rosenfeld

US$7.95 in the U.S. CA$8.95 in Canada US$9.95 outside of CanadaJuly/August & the U.S. 2007 1 ® Q&A WITH THQ’S GARY ROSENFELD CCARSARS GGAINSAINS TTRACTIONRACTION IINN LLICENSEDICENSED GGAMEAME BBIZIZ NUMBER 40050265 40050265 NUMBER ANADA USPS Approved Polywrap ANADA AFSM 100 CANADA POST AGREEMENT POST CANADA C IN PRINTED 001editcover_July_Aug07.indd1editcover_July_Aug07.indd 1 77/19/07/19/07 77:00:43:00:43 PMPM KKS.4562.Cartoon.inddS.4562.Cartoon.indd 2 77/20/07/20/07 55:06:05:06:05 PMPM KKS.4562.Cartoon.inddS.4562.Cartoon.indd 3 77/20/07/20/07 55:06:54:06:54 PMPM #8#+.#$.'019 9 9 Animation © Domo Production Committee. Domo © NHK-TYO 1998. [ZVijg^c\I]ZHiVg<^gah Star Girls and Planet Groove © Dianne Regan Sean Regan. XXXCJHUFOUUW K<C<M@J@FEJ8C<J19`^K\ek<ek\ikX`ed\ek%K\c%1)()$-'+$''-+\ok%)'(2\dX`c1iZfcc`ej7Y`^k\ek%km C@:<EJ@E>GIFDFK@FEJ19`^K\ek<ek\ikX`ed\ek%K\c%1)()$-'+$''-+\ok%)'-2\dX`c1idXippXe\b7Y`^k\ek%km KKS4548.BIGS4548.BIG TTENT.inddENT.indd 2 77/19/07/19/07 66:54:45:54:45 PMPM 1111 F3 to mine MMOG space for TV concepts 114Parthenon4 Kids: Geared up and ready to invest 1177 Will Backseat TV boost Nick’s in-car profile? 225Storm Hawks5 goes jjuly/augustuly/august viral with Guerilla 0077 HHighlightsighlights ffromrom tthishis iissuessue 10 up front 24 marketing France TV to invest in Chrysler and Nick hope more content and global to get more mileage out Special Reports web presence of the minivan set with 29 RADARSCREEN backseat TV feature Fred Seibert’s Frederator Films 13 ppd tries a fresh approach to Parthenon Kids offers 26 digital -

View Annual Report

2018 ANNUAL REPORT Our Mission To create innovative products and experiences that inspire, entertain and develop children through play. To Our Shareholders: I often say that at Mattel we Our performance last year is a testament to Mattel’s have a lot to play with and strong brands, our ability to execute methodically even a lot to play for and I believe in tough market conditions, as well as our strategic and this aptly describes where we long-standing relationships with our retail partners. are today. We are a company with a great legacy and Barbie and Hot Wheels continued their momentum deep heritage and our iconic throughout 2018. Barbie was the number one global brands continue to transcend fashion doll property last year3. We look forward to generations. We have a celebrating Barbie’s 60th anniversary throughout world-class team of creative 2019 with a number of exciting product launches and talent and business leaders events to continue to keep the brand on the leading- united by our passion to create innovative products and edge of relevance for kids. Equally impressive was the experiences that inspire, entertain and develop kids performance of Hot Wheels, the #1 property globally in through play. the vehicles supercategory4 in 2018. Since becoming CEO in April 2018, I’ve had the privilege We are also encouraged by our positive momentum of leading this great organization that is committed to with third-party IP, which presents a clear avenue for transforming Mattel into an IP-driven, high-performing toy incremental revenue. In 2018, Jurassic World™ exceeded company. -

Mattel Films, Daniel Kaluuya's 59% and Valparaiso Pictures

Mattel Films, Daniel Kaluuya’s 59% and Valparaiso Pictures Announce Plans to Bring “Barney” to the Big Screen October 18, 2019 “Barney” marks the first collaboration between Mattel Films and production companies 59% and Valparaiso Pictures Development project is the eighth live-action film Mattel Films has announced since its creation one year ago EL SEGUNDO, Calif.--(BUSINESS WIRE)--Oct. 18, 2019-- Mattel, Inc. (NASDAQ: MAT) and production companies 59% and Valparaiso Pictures announced a partnership to develop a live-action motion picture based on Barney, Mattel’s iconic loveable, purple dinosaur. Mattel Films will co-produce “Barney” alongside Academy Award®-nominee Daniel Kaluuya (“Get Out,” “Black Panther”), Rowan Riley and Amandla Crichlow at 59%, as well as Valparaiso's David Carrico, Adam Paulsen and Bobby Hoppey. Kevin McKeon will also shepherd the project for Mattel Films. “Barney” represents the first partnership between the production companies and Mattel Films. “Working with Daniel Kaluuya will enable us to take a completely new approach to ‘Barney’ that will surprise audiences and subvert expectations,” said Robbie Brenner, Mattel Films. “The project will speak to the nostalgia of the brand in a way that will resonate with adults, while entertaining today’s kids.” "Barney was a ubiquitous figure in many of our childhoods, then he disappeared into the shadows, left misunderstood,” said Daniel Kaluuya, 59%. “We're excited to explore this compelling modern-day hero and see if his message of 'I love you, you love me' can stand the test of time." “Barney is a dinosaur from our imagination, and we can’t wait to get ‘I love you, you love me’ stuck in heads everywhere, yet again,” said David Carrico, Valparaiso Pictures. -

Mattel Films and Marc Forster's 2Dux² Partner to Develop

Mattel Films and Marc Forster’s 2Dux² Partner to Develop “Thomas & Friends®” Feature Film October 6, 2020 Marc Forster to direct the four-quadrant family adventure that blends live-action and animation “Thomas & Friends” marks the tenth Mattel Films project in development EL SEGUNDO, Calif.--October 6, 2020-- Mattel, Inc. (NASDAQ: MAT) and production company 2Dux² announced today plans to develop a feature film based on Thomas & Friends®, the global franchise about the iconic blue engine. Mattel Films and 2Dux² will bring Thomas & Friends to life through a four-quadrant family adventure that blends live-action and animation. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201006005440/en/ Mattel Films will co-produce the film alongside Marc Forster (“Christopher Robin,” “Finding Neverland,” “Quantum of Solace”), who will also direct, and Renée Wolfe (“Christopher Robin,” “All I See Is You”), co-founder and co-CEO of 2Dux². Alyssa Hill (“A Taste of Power”) and Jesse Wigutow (“TRON3” - upcoming) have penned the script. Robbie Brenner, executive producer, and Kevin McKeon, supervising producer, will lead the project for Mattel Films. “Thomas is a beloved global franchise that focuses on the importance of friendship, a theme that resonates deeply with children and parents around the world,” said Brenner. “Marc is an incredible storyteller and I look forward to partnering with him to tell Thomas’ story in a modern and unexpected way.” “Thomas has been a personal favorite of mine since childhood,” said Forster. “I couldn’t be more excited to be working with Robbie and the entire team at Mattel, and embarking on this beautiful journey with such a timeless property.” Thomas & Friends, celebrating its 75th anniversary this year, introduces children to the world around them through the wonder and awe of trains. -

Feminist Barbie: Mattel’S Remakes of Classic Tales

MP: An Online Feminist Journal Fall 2010: Vol.3, Issue 2 Feminist Barbie: Mattel’s Remakes of Classic Tales By Julie Still Arguably the most pervasive form of media marketed to pre-teen girls are the Disney princess films. In fact, it would be difficult to fully study any other media franchise aimed at that age and gender market without comparing it to Disney. The purpose of this article is to do exactly that with the Mattel Barbie film series. Both are targeted to young girls, both feature female characters, and, to provide a more narrow comparison, both use film scripts based on existing literature, often fairy or folk tales. The two have been compared previously (see Orr) but primarily from a marketing and development perspective. This study will focus more on gendered aspects of the selected stories and characters. The classic Disney animated princess movies such as Cinderella, Snow White, and Sleeping Beauty and the newer princess films, including Beauty and the Beast, Little Mermaid, and Aladdin, were all based on fairy tales, traditionally viewed as “patriarchal folklore and morality fables” (Craven 124). All featured beautiful but passive title characters who find happiness only when the dashing prince charges in with sword raised and fights off the dragon, sorcerer, wicked witch, or other villain. Cinderella is even so helpless that she has to be rescued by mice and birds. Beauty and the Beast’s Belle is the sacrificial virgin who saves her father by giving herself to the beast, whom she redeems with her love and the help of enchanted household furnishings. -

Building on Belief Integrated Annual Report 2020-21

Building on belief Integrated Annual Report 2020-21 Backdrop: The iconic campus of the Tata Research Design and Development Center at Hadapsar in Pune, India Content About TCS 03 Statutory Section Standalone Statement of Changes in Equity 269 Board of Directors 04 Notice 35 Standalone Statement of Cash Flows 272 Management Team 05 Directors’ Report 47 Notes forming part of the Standalone Financial Statements 274 Letter from the Chairman 07 Corporate Governance Report 72 Statement under section 129 of the Companies Letter from the CEO 09 Management Discussion and Analysis 98 Act, 2013 relating to Subsidiary Companies 324 Performance Highlights 15 Consolidated Financial Statements The Year Gone By 16 Glossary 328 Independent Auditors’ Report 174 Thematic Section Consolidated Balance Sheet 183 GRI Annexures TRDDC: Built on a Belief in the Future 20 Consolidated Statement of Profit and Loss 185 About this Report 337 Operating Model and Front-end Consolidated Statement of Changes in Equity 187 Stakeholder Engagement Framework 338 Transformation: Phoenix Group 22 Consolidated Statement of Cash Flows 190 Identification of Material Topics 340 Business Model Innovation: Toyo Tire 23 Notes forming part of the Consolidated GRI Content Index 344 Building on Belief: A Panel Discussion 24 Financial Statements 192 Customer Journey Transformation: bpost 28 Citizen Services Transformation: Connecticut Standalone Financial Statements Department of Labor 29 Independent Auditors’ Report 255 Q&A with CFO and CHRO 30 Standalone Balance Sheet 266 Business Transformation: -

Top 20 Issuers of Credit Cards Worldwide 2013

FOR 44 YEARS, THE LEADING PUBLICATION COVERING PAYMENT SYSTEMS WORLDWIDE DECEMBER 2014 / ISSUE 1053 TOP MAESTRO ISSUERS WORLDWIDE The 100 largest issuers of Maestro brand debit cards based on Top 20 Issuers of purchases at merchants for calendar year 2013 are listed on page 10. The issuers represented 37 countries. Credit Cards Worldwide 2013 > see p. 10 Ranked by Outstandings ($Bil.) LEASE TO OWN FOR E-COMMERCE UNITED STATES JPMorgan Chase 1 126 Zibby is a lease-to-own payment option online retailers of B of A 2 101 electronics, furniture, appliances, musical instruments, and other Amex 3 89 durable goods can offer nonprime credit score and underbanked Citibank 4 86 > see p. 6 Capital One 5 68 PULSE SUES VISA OVER DEBIT CARDS Discover 6 53 Wells Fargo 12 31 Discover Financial Services’ Pulse PIN-based debit network has U.S. Bank 15 25 sued Visa Inc. in United States District Court for the Southern USAA 20 17 District of Texas. Pulse wants the court to stop PIN-Authenticated > see p. 6 CHINA ICBC 7 50 SKRILL PROGRESS IN THE U.S. China Merchants 8 47 Skrill is a payment service provider (PSP) handling over 100 China Construct. 9 44 international and local payment options for over 156,000 Bank of China 10 36 businesses. The majority of those businesses are online gambling Agricultural Bank 11 32 > see p. 8 Bank of Commun. 14 27 China Minsheng 17 19 RIPPLESHOT FRAUD DETECTION ANALYTICS China Everbright 19 17 Most software that fights payment card fraud focuses on providing UNITED KINGDOM risk scores for individual transactions in real time.