Integrated Report 2019 Meiji Group’S Vision

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CURRICULUM VITAE Kenneth J. Ruoff Contact Information

CURRICULUM VITAE Kenneth J. Ruoff Contact Information: Department of History Portland State University P.O. Box 751 Portland, OR 97207-0751 Tel. (503) 725-3991 Fax. (503) 725-3953 e-mail: [email protected] http://web.pdx.edu/~ruoffk/ Education Ph.D. 1997 Columbia University History M.Phil. 1993 Columbia University History M.A. 1991 Columbia University History B.A. 1989 Harvard College East Asian Studies Study of advanced Japanese, Inter-University Center (formerly known as the Stanford Center), Yokohama, Japan, 1993-1994 (this is a non-degree program). Awards Tim Garrison Faculty Award for Historical Research, Portland State University, 2020. For Japan's Imperial House in the Postwar Era, 1945-2019. Ambassador, Hokkaido University, 2019-present. Branford Price Millar Award for Faculty Excellence, Portland State University, Spring 2015. For excellence in the areas of research and teaching, in particular, but also for community service. Commendation, Consulate General of Japan, Portland, OR, December 2014. For enriching the cultural landscape of Portland through programs sponsored by the Center for Japanese Studies and for improving the understanding of Japan both through these programs and through scholarship. Frances Fuller Victor Award for General Nonfiction (best work of nonfiction by an Oregon author), Oregon Book Awards sponsored by the Literary Arts Organization, 2012. For Imperial Japan at Its Zenith: The Wartime Celebration of the Empire’s 2,600th Anniversary. Jirõ Osaragi Prize for Commentary (in Japanese, the Osaragi Jirõ rondanshõ), 2004, awarded by the Asahi Newspaper Company (Asahi Shinbun) for the best book in the social sciences published in Japan during the previous year (For Kokumin no tennõ; translation of The People’s Emperor). -

Confectionery Fresh and Fermented Dairy Pharmaceuticals Processed

Creating new value as “Food and Health” professionals (TSE Section 1: 2269) To enrich the daily lives of customers of all ages by providing them with tastiness and enjoyment as well as products that contribute to their physical and emotional well-being Fresh and Fermented Dairy Confectionery Pharmaceuticals Antibacterial Generic drugs drugs Yogurt Drinking Chocolate/ Gummy milk Chocolate snacks Drugs for CNS disorders Processed Food Nutrition Ice cream Cheese Infant Enteral Sports nutrition formula formula Consolidated Performance and Share Price in Recent Years Net sales Operating income (%) ROE Payout ratio / DOE Share price (July 2014 – October 2017) (JPY1 bn) (JPY1 bn) 20 (%) (%) (JPY) 90 1,200 90 6 16 10,000 7,500 800 60 12 60 4 DOE 8 5,000 400 30 30 2 2,500 4 Payout ratio 0 0 0 0 0 0 3 3 3 3 3 3 3 3 3 3 3 3 E E E 7 0 1 4 7 0 1 4 7 0 1 4 7 0 / / / / 3 3 3 3 / / / / / / / / E / / / / / / / / / / / / / / 3 3 3 1 1 1 1 4 5 6 7 4 5 6 7 4 5 6 7 / / 3 / 4 5 5 5 6 6 6 7 7 7 / / / / 4 5 6 7 / 1 1 1 1 1 1 1 1 1 1 1 1 8 8 8 ' ' ' ' 1 4 1 1 1 5 1 1 1 6 1 1 1 7 ' ' ' ' ' ' ' ' 1 1 1 1 ' ' ' ' ' ' ' ' ' ' 8 ' ' ' ' 1 1 1 1 1 1 1 ' ' ' ' ' ' ' 1 ' History Major Shareholders Number of Percentage of (as of September 30, 2017) shares held total shares Meiji Sugar Co., Ltd., the origin of the Meiji Group, was established. -

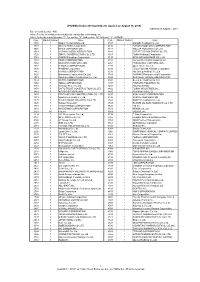

JPX-Nikkei Index 400 Constituents (Applied on August 31, 2021) Published on August 6, 2021 No

JPX-Nikkei Index 400 Constituents (applied on August 31, 2021) Published on August 6, 2021 No. of constituents : 400 (Note) The No. of constituents is subject to change due to de-listing. etc. (Note) As for the market division, "1"=1st section, "2"=2nd section, "M"=Mothers, "J"=JASDAQ. Code Market Divison Issue Code Market Divison Issue 1332 1 Nippon Suisan Kaisha,Ltd. 3048 1 BIC CAMERA INC. 1417 1 MIRAIT Holdings Corporation 3064 1 MonotaRO Co.,Ltd. 1605 1 INPEX CORPORATION 3088 1 Matsumotokiyoshi Holdings Co.,Ltd. 1719 1 HAZAMA ANDO CORPORATION 3092 1 ZOZO,Inc. 1720 1 TOKYU CONSTRUCTION CO., LTD. 3107 1 Daiwabo Holdings Co.,Ltd. 1721 1 COMSYS Holdings Corporation 3116 1 TOYOTA BOSHOKU CORPORATION 1766 1 TOKEN CORPORATION 3141 1 WELCIA HOLDINGS CO.,LTD. 1801 1 TAISEI CORPORATION 3148 1 CREATE SD HOLDINGS CO.,LTD. 1802 1 OBAYASHI CORPORATION 3167 1 TOKAI Holdings Corporation 1803 1 SHIMIZU CORPORATION 3231 1 Nomura Real Estate Holdings,Inc. 1808 1 HASEKO Corporation 3244 1 Samty Co.,Ltd. 1812 1 KAJIMA CORPORATION 3254 1 PRESSANCE CORPORATION 1820 1 Nishimatsu Construction Co.,Ltd. 3288 1 Open House Co.,Ltd. 1821 1 Sumitomo Mitsui Construction Co., Ltd. 3289 1 Tokyu Fudosan Holdings Corporation 1824 1 MAEDA CORPORATION 3291 1 Iida Group Holdings Co.,Ltd. 1860 1 TODA CORPORATION 3349 1 COSMOS Pharmaceutical Corporation 1861 1 Kumagai Gumi Co.,Ltd. 3360 1 SHIP HEALTHCARE HOLDINGS,INC. 1878 1 DAITO TRUST CONSTRUCTION CO.,LTD. 3382 1 Seven & I Holdings Co.,Ltd. 1881 1 NIPPO CORPORATION 3391 1 TSURUHA HOLDINGS INC. 1893 1 PENTA-OCEAN CONSTRUCTION CO.,LTD. -

Long Diagnostic Delay with Unknown Transmission Route Inversely Correlates with the Subsequent Doubling Time of Coronavirus Disease 2019 in Japan, February–March 2020

International Journal of Environmental Research and Public Health Article Long Diagnostic Delay with Unknown Transmission Route Inversely Correlates with the Subsequent Doubling Time of Coronavirus Disease 2019 in Japan, February–March 2020 Tsuyoshi Ogata 1,* and Hideo Tanaka 2 1 Tsuchiura Public Health Center of Ibaraki Prefectural Government, Tsuchiura 300-0812, Japan 2 Fujiidera Public Health Center of Osaka Prefectural Government, Fujiidera 583-0024, Japan; [email protected] * Correspondence: [email protected] Abstract: Long diagnostic delays (LDDs) may decrease the effectiveness of patient isolation in reducing subsequent transmission of coronavirus disease 2019 (COVID-19). This study aims to investigate the correlation between the proportion of LDD of COVID-19 patients with unknown transmission routes and the subsequent doubling time. LDD was defined as the duration between COVID-19 symptom onset and confirmation ≥6 days. We investigated the geographic correlation between the LDD proportion among 369 confirmed COVID-19 patients with symptom onset between the 9th and 11th week and the subsequent doubling time for 717 patients in the 12th–13th week among the six prefectures. The doubling time on March 29 (the end of the 13th week) ranged from 4.67 days in Chiba to 22.2 days in Aichi. Using a Pearson’s product-moment correlation (p-value = 0.00182) and multiple regression analyses that were adjusted for sex and age (correlation coefficient −0.729, 95% confidence interval: −0.923–−0.535, p-value = 0.0179), the proportion of LDD for unknown Citation: Ogata, T.; Tanaka, H. Long exposure patients was correlated inversely with the base 10 logarithm of the subsequent doubling Diagnostic Delay with Unknown time. -

"JPX-Nikkei Index 400"

JPX-Nikkei Index 400 Constituents (applied on August 30, 2019) Published on August 7, 2019 No. of constituents : 400 (Note) The No. of constituents is subject to change due to de-listing. etc. (Note) As for the market division, "1"=1st section, "2"=2nd section, "M"=Mothers, "J"=JASDAQ. Code Market Divison Issue Code Market Divison Issue 1332 1 Nippon Suisan Kaisha,Ltd. 3107 1 Daiwabo Holdings Co.,Ltd. 1333 1 Maruha Nichiro Corporation 3116 1 TOYOTA BOSHOKU CORPORATION 1605 1 INPEX CORPORATION 3141 1 WELCIA HOLDINGS CO.,LTD. 1719 1 HAZAMA ANDO CORPORATION 3148 1 CREATE SD HOLDINGS CO.,LTD. 1720 1 TOKYU CONSTRUCTION CO., LTD. 3167 1 TOKAI Holdings Corporation 1721 1 COMSYS Holdings Corporation 3197 1 SKYLARK HOLDINGS CO.,LTD. 1801 1 TAISEI CORPORATION 3231 1 Nomura Real Estate Holdings,Inc. 1802 1 OBAYASHI CORPORATION 3254 1 PRESSANCE CORPORATION 1803 1 SHIMIZU CORPORATION 3288 1 Open House Co.,Ltd. 1808 1 HASEKO Corporation 3289 1 Tokyu Fudosan Holdings Corporation 1812 1 KAJIMA CORPORATION 3291 1 Iida Group Holdings Co.,Ltd. 1820 1 Nishimatsu Construction Co.,Ltd. 3349 1 COSMOS Pharmaceutical Corporation 1821 1 Sumitomo Mitsui Construction Co., Ltd. 3360 1 SHIP HEALTHCARE HOLDINGS,INC. 1824 1 MAEDA CORPORATION 3382 1 Seven & I Holdings Co.,Ltd. 1860 1 TODA CORPORATION 3391 1 TSURUHA HOLDINGS INC. 1861 1 Kumagai Gumi Co.,Ltd. 3401 1 TEIJIN LIMITED 1878 1 DAITO TRUST CONSTRUCTION CO.,LTD. 3402 1 TORAY INDUSTRIES,INC. 1881 1 NIPPO CORPORATION 3405 1 KURARAY CO.,LTD. 1893 1 PENTA-OCEAN CONSTRUCTION CO.,LTD. 3407 1 ASAHI KASEI CORPORATION 1911 1 Sumitomo Forestry Co.,Ltd. -

Meiji Holdings Co., Ltd. FYE March 2018 Results and 2020 Medium-Term Business Plan Briefing for Analysts and Institutional Investors Q&A Summary

FYE March 2018 Results and 2020 Medium-Term Business Plan Briefing: QA Summary Meiji Holdings Co., Ltd. FYE March 2018 Results and 2020 Medium-Term Business Plan Briefing for Analysts and Institutional Investors Q&A Summary Date and time: May 17, 2018, 1:00 - 2:30 pm Presenters: Masahiko Matsuo President and Representative Director, Meiji Holdings Co., Ltd. Koichiro Shiozaki Member of the Board and Managing Executive Officer, Meiji Holdings Co., Ltd. Kazuo Kawamura President and Representative Director, Meiji Co., Ltd. Daikichiro Kobayashi President and Representative Director, Meiji Seika Pharma Co., Ltd. Q1. In the 2020 Medium-Term Business Plan, sales growth contributes significantly to operating income of JPY 110 billion. If you do not reach your sales targets, how will you achieve your operating income goal? A1. We are assuming that we will successfully increase sales but operating income, JPY 110 billion, may not come from sales growth alone. We will increase profitability by; 1) Improving our product mix, which will involve expanding high-profitability product lines, and 2) Implementing structural reforms to improve productivity Improved revenues from the Drinking Milk business will contribute significantly. We will improve Meiji Oishii Gyunyu brand revenues by promoting its 900 mL product launched in September 2016. We will evaluate low-performing Drinking Milk products and may discontinue some of them. Q2. In Japan, you are experiencing struggles with yogurt and chocolate sales growth recently. What strategies will you implement to stimulate growth for the coming FYE March 2020? A2. The Yogurt market is not recording constant growth. The market trend has been repeating growth and plateau phases. -

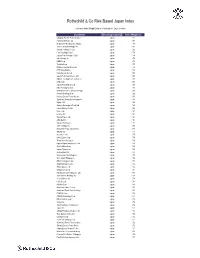

R&Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of June 30, 2021 on close Constituent Exchange Country Index Weight(%) McDonald's Holdings Co Japan L Japan 1.29 Idemitsu Kosan Co Ltd Japan 1.12 SoftBank Corp Japan 1.05 Nintendo Co Ltd Japan 0.86 Hitachi Metals Ltd Japan 0.83 Yakult Honsha Co Ltd Japan 0.82 Iwatani Corp Japan 0.81 ENEOS Holdings Inc Japan 0.79 FUJIFILM Holdings Corp Japan 0.78 KDDI Corp Japan 0.75 Toshiba Corp Japan 0.73 Calbee Inc Japan 0.73 Ajinomoto Co Inc Japan 0.72 Eisai Co Ltd Japan 0.72 Nissin Foods Holdings Co Ltd Japan 0.71 Morinaga Milk Industry Co Ltd Japan 0.70 Japan Tobacco Inc Japan 0.66 H.U. Group Holdings Inc Japan 0.66 JCR Pharmaceuticals Co Ltd Japan 0.64 MEIJI Holdings Co Ltd Japan 0.64 Yamazaki Baking Co Ltd Japan 0.63 Chugoku Electric Power Co Inc/ Japan 0.63 Nippon Gas Co Ltd Japan 0.63 PeptiDream Inc Japan 0.62 Chubu Electric Power Co Inc Japan 0.62 Seven & i Holdings Co Ltd Japan 0.62 FP Corp Japan 0.61 Pola Orbis Holdings Inc Japan 0.61 Lion Corp Japan 0.61 Shiseido Co Ltd Japan 0.60 Nippon Telegraph & Telephone C Japan 0.60 Nichirei Corp Japan 0.59 Japan Post Bank Co Ltd Japan 0.59 Kobayashi Pharmaceutical Co Lt Japan 0.59 Anritsu Corp Japan 0.58 Skylark Holdings Co Ltd Japan 0.58 Kyowa Kirin Co Ltd Japan 0.58 Lawson Inc Japan 0.58 Suntory Beverage & Food Ltd Japan 0.57 Kinden Corp Japan 0.57 MS&AD Insurance Group Holdings Japan 0.56 Shimano Inc Japan 0.56 Mitsubishi Corp Japan 0.56 Zensho Holdings Co Ltd Japan 0.56 Tokai Carbon Co Ltd Japan 0.56 Japan Post Holdings Co Ltd -

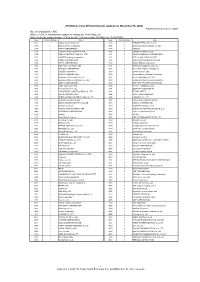

"JPX-Nikkei Index 400"

JPX-Nikkei Index 400 Constituents (applied on November 30, 2020) Published on November 9, 2020 No. of constituents : 400 (Note) The No. of constituents is subject to change due to de-listing. etc. (Note) As for the market division, "1"=1st section, "2"=2nd section, "M"=Mothers, "J"=JASDAQ. Code Market Divison Issue Code Market Divison Issue 1332 1 Nippon Suisan Kaisha,Ltd. 3086 1 J.FRONT RETAILING Co.,Ltd. 1333 1 Maruha Nichiro Corporation 3088 1 Matsumotokiyoshi Holdings Co.,Ltd. 1605 1 INPEX CORPORATION 3092 1 ZOZO,Inc. 1719 1 HAZAMA ANDO CORPORATION 3107 1 Daiwabo Holdings Co.,Ltd. 1720 1 TOKYU CONSTRUCTION CO., LTD. 3116 1 TOYOTA BOSHOKU CORPORATION 1721 1 COMSYS Holdings Corporation 3141 1 WELCIA HOLDINGS CO.,LTD. 1766 1 TOKEN CORPORATION 3148 1 CREATE SD HOLDINGS CO.,LTD. 1801 1 TAISEI CORPORATION 3167 1 TOKAI Holdings Corporation 1802 1 OBAYASHI CORPORATION 3197 1 SKYLARK HOLDINGS CO.,LTD. 1803 1 SHIMIZU CORPORATION 3231 1 Nomura Real Estate Holdings,Inc. 1808 1 HASEKO Corporation 3288 1 Open House Co.,Ltd. 1812 1 KAJIMA CORPORATION 3289 1 Tokyu Fudosan Holdings Corporation 1820 1 Nishimatsu Construction Co.,Ltd. 3291 1 Iida Group Holdings Co.,Ltd. 1821 1 Sumitomo Mitsui Construction Co., Ltd. 3349 1 COSMOS Pharmaceutical Corporation 1824 1 MAEDA CORPORATION 3360 1 SHIP HEALTHCARE HOLDINGS,INC. 1860 1 TODA CORPORATION 3382 1 Seven & I Holdings Co.,Ltd. 1861 1 Kumagai Gumi Co.,Ltd. 3391 1 TSURUHA HOLDINGS INC. 1878 1 DAITO TRUST CONSTRUCTION CO.,LTD. 3401 1 TEIJIN LIMITED 1881 1 NIPPO CORPORATION 3402 1 TORAY INDUSTRIES,INC. -

National Survey Report of Japan 2019

Task 1 Strategic PV Analysis and Outreach National Survey Report of PV Power Applications in JAPAN 2019 Prepared by: Mitsuhiro YAMAZAKI, New Energy and Industrial Technology Development Organization (NEDO) Osamu IKKI, RTS Corporation PVPS Task 1 – National Survey Report of PV Power Applications in JAPANNational Survey Report of Japan 2019 What is IEA PVPS TCP? The International Energy Agency (IEA), founded in 1974, is an autonomous body within the framework of the Organization for Economic Cooperation and Development (OECD). The Technology Collaboration Programme (TCP) was created with a belief that the future of energy security and sustainability starts with global collaboration. The programme is made up of 6.000 experts across government, academia, and industry dedicated to advancing common research and the application of specific energy technologies . The IEA Photovoltaic Power Systems Programme (IEA PVPS) is one of the TCP’s within the IEA and was established in 1993. The mission of the programme is to “enhance the international collaborative efforts which facilitate the role of photovoltaic sol ar energy as a cornerstone in the transition to sustainable energy systems.” In order to achieve this, the Programme’s participants have undertaken a variety of joint research projects in PV power systems applications. The overall programme is headed by an Execu tive Committee, comprised of one delegate from each country or organisation member, which designates distinct ‘Tasks,’ that may be research projects or activity areas. The IEA PVPS participating countries are Australia, Austria, Belgium, Canada, Chile, China, Denmark, Finland, France, Germany, Israel, Italy, Japan, Korea, Malaysia, Mexico, Morocco, the Netherlands, Norway, Portugal, South Africa, Spain, Sweden, Switzerland, Thailand, Turkey, and the United States of America. -

Rothschild & Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Chugoku Electric Power Co Inc/ Japan 1.01 Yamada Denki Co Ltd Japan 0.91 McDonald's Holdings Co Japan L Japan 0.88 Sushiro Global Holdings Ltd Japan 0.82 Skylark Holdings Co Ltd Japan 0.82 Fast Retailing Co Ltd Japan 0.78 Japan Post Holdings Co Ltd Japan 0.78 Ain Holdings Inc Japan 0.78 KDDI Corp Japan 0.77 Toshiba Corp Japan 0.75 Mizuho Financial Group Inc Japan 0.74 NTT DOCOMO Inc Japan 0.73 Kobe Bussan Co Ltd Japan 0.72 Japan Post Insurance Co Ltd Japan 0.69 Nippon Telegraph & Telephone C Japan 0.69 LINE Corp Japan 0.69 Japan Post Bank Co Ltd Japan 0.68 Nitori Holdings Co Ltd Japan 0.67 MS&AD Insurance Group Holdings Japan 0.66 Konami Holdings Corp Japan 0.66 Kyushu Electric Power Co Inc Japan 0.65 Sumitomo Realty & Development Japan 0.65 Fujitsu Ltd Japan 0.63 Suntory Beverage & Food Ltd Japan 0.63 Japan Airlines Co Ltd Japan 0.62 NEC Corp Japan 0.61 Lawson Inc Japan 0.60 Sekisui House Ltd Japan 0.60 ABC-Mart Inc Japan 0.60 Kyushu Railway Co Japan 0.60 ANA Holdings Inc Japan 0.59 Mitsubishi Heavy Industries Lt Japan 0.58 ORIX Corp Japan 0.57 Secom Co Ltd Japan 0.57 Seiko Epson Corp Japan 0.56 Trend Micro Inc/Japan Japan 0.56 Nippon Paper Industries Co Ltd Japan 0.56 Suzuki Motor Corp Japan 0.56 Japan Tobacco Inc Japan 0.55 Aozora Bank Ltd Japan 0.55 Sony Financial Holdings Inc Japan 0.55 West Japan Railway Co Japan 0.54 MEIJI Holdings Co Ltd Japan 0.54 Sugi Holdings Co Ltd Japan 0.54 Tokyo -

Corporate Governance Report Meiji Holdings Co., Ltd

Corporate Governance Report Last Update: June 29, 2021 Meiji Holdings Co., Ltd. Kazuo Kawamura, CEO, President and Representative Director Securities Code: 2269 https://www.meiji.com/global The corporate governance of Meiji Holdings Co., Ltd. (the “Company,” “we,” or “us”) is described below. 1. Basic Views on Corporate Governance, Capital Structure, Corporate Profile and Other Basic Information 1. Basic Views The Meiji Group's (the “Group”) philosophy is to brighten customers' daily lives as a corporate group in the Food and Health fields. Our mission is to widen the world of “Tastiness and Enjoyment” and meet all expectations regarding “Health and Reassurance.” We do this with the goal of continuing to find innovative ways to meet our customers' needs, today and tomorrow. In this way, we aim to achieve sustainable growth and increase corporate value over the medium to long term. The basic approach to management of the Group is for operating companies to manage businesses autonomously while collaborating with each other under the holding company's control. The main role of Meiji Holdings Co., Ltd. is to advance Groupwide management strategies, create an optimal operating structure, and oversee the business management of operating companies. Responsibility for operational execution is delegated to operating companies appropriately. Within the Group, oversight and execution of business management are separated. Accordingly, the Group has established and operates a corporate governance system including a Board of Directors. Meiji Holdings is a company with audit & supervisory board members. The Board of Directors' oversight and audit & supervisory board members' auditing heighten the objectivity and transparency of business management. -

The Eleventh Mitsui Fudosan Sports Academy for Tokyo 2020 the Olympic and Paralympic Games Tokyo 2020 Movement

August 21, 2017 For immediate release Mitsui Fudosan Co., Ltd. Mitsui Fudosan Residential Co., Ltd. Mitsui Fudosan supports the Olympic Games Tokyo 2020 as a Tokyo 2020 Gold Partner (Real Estate Development) . Mitsui Fudosan Residential Co., Ltd. is a Mitsui Fudosan Group Company Creating Neighborhoods While Utilizing the "Power of Sports" The Eleventh Mitsui Fudosan Sports Academy for Tokyo 2020 The Olympic and Paralympic Games Tokyo 2020 Movement Hosting Decided for Soccer Academy and Nutrition Seminar Presented by Meiji Holdings Co., Ltd. Mitsui Fudosan Co., Ltd., a leading global real estate company headquartered in Tokyo, announced today that it will hold the Mitsui Fudosan Sports Academy for Tokyo 2020 on September 3, 2017. Mitsui Fudosan, a Tokyo 2020 Gold Partner sponsor in the category of “Real Estate Development”, holds the Mitsui Fudosan Sports Academy for Tokyo 2020, a sports classroom conducted with The Tokyo Organising Committee of the Olympic and Paralympic Games. Top class athletes are invited to be instructors, and through their classroom descriptions the participants are able to experience the Olympic and Paralympic competitions. The Eleventh Mitsui Fudosan Sports Academy will be held at MIFA Football Park Toyosu, which is located in the Toyosu area where Mitsui Fudosan is moving ahead with a redevelopment project. This will be a Soccer Academy and will welcome Keita Suzuki, who played in the qualifying matches for the Olympic Games Athens 2004, and Karina Maruyama, who appeared in the Olympic Games Athens 2004 and the Olympic Games Beijin 2008 as instructors. Holding the academy in an area where Mitsui Fudosan is engaged in neighborhood creation will help to invigorate the community and foster enthusiasm for the Olympic and Paralympic Games Tokyo 2020.