Sustainability Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Repair Manual

Repair Manual Showing Short Cuts and Methods for Repairing and Upkeep Durant and Star Cars FOUR CYLINDER MODELS JANUARY, 1929 DURANT MOTORS, Inc. BROADWAY AT 57th STREET NEW YORK CITY DURANT MOTOR CO. of NEW JERSEY DURANT MOTOR CO. of MICHIGAN Elizabeth, N. J. Lansing, Michigan DURANT MOTOR CO. of CALIFORNIA DURANT MOTOR CO. of CANADA, LTD. Oakland, Cal. Toronto (Leaside), Ontario 1 Blank page 2 WARRANTY E warrant each new DURANT and STAR motor vehicle so by us to be free from defects in material W under normal use and service, our obligation under this warranty being limited to making good at our factory any part or parts thereof which shall with ninety (90) days after delivery of such vehicle to the original purchaser be returned to us, transportation charges prepaid, and which our examination shall disclose to our satisfaction to have been thus defective, this warranty being expressly in lieu of all other warranties expressed or implied and of all other obliga- tions or liabilities on our part. This warranty shall not apply to any vehicle which shall have been repaired or altered outside of our factory in any way, so as in our judgment, to affect its stability or reliability, nor which has been subject to misuse, negligence or accident. We make no warranty whatever in respect to tires, rims, ignition apparatus, horns or other signaling devices, starting devices, generators, batteries, speedometers or other trade accessories, inasmuch as they are usually warranted separately by their respective manufacturers. We do not make any guarantee against, and we assume no responsibility for, any defect in metal or other material, or in any part, device, or trade accessory that cannot be dis- covered by ordinary factory inspection. -

Cloud-Based Visual Discovery in Astronomy: Big Data Exploration Using Game Engines and VR on EOSC

Novel EOSC services for Emerging Atmosphere, Underwater and Space Challenges 2020 October Cloud-Based Visual Discovery in Astronomy: Big Data Exploration using Game Engines and VR on EOSC Game engines are continuously evolving toolkits that assist in communicating with underlying frameworks and APIs for rendering, audio and interfacing. A game engine core functionality is its collection of libraries and user interface used to assist a developer in creating an artifact that can render and play sounds seamlessly, while handling collisions, updating physics, and processing AI and player inputs in a live and continuous looping mechanism. Game engines support scripting functionality through, e.g. C# in Unity [1] and Blueprints in Unreal, making them accessible to wide audiences of non-specialists. Some game companies modify engines for a game until they become bespoke, e.g. the creation of star citizen [3] which was being created using Amazon’s Lumebryard [4] until the game engine was modified enough for them to claim it as the bespoke “Star Engine”. On the opposite side of the spectrum, a game engine such as Frostbite [5] which specialised in dynamic destruction, bipedal first person animation and online multiplayer, was refactored into a versatile engine used for many different types of games [6]. Currently, there are over 100 game engines (see examples in Figure 1a). Game engines can be classified in a variety of ways, e.g. [7] outlines criteria based on requirements for knowledge of programming, reliance on popular web technologies, accessibility in terms of open source software and user customisation and deployment in professional settings. -

Rulemaking: 1999-10 FSOR Emission Standards and Test Procedures

State of California Environmental Protection Agency AIR RESOURCES BOARD EMISSION STANDARDS AND TEST PROCEDURES FOR NEW 2001 AND LATER MODEL YEAR SPARK-IGNITION MARINE ENGINES FINAL STATEMENT OF REASONS October 1999 State of California AIR RESOURCES BOARD Final Statement of Reasons for Rulemaking, Including Summary of Comments and Agency Response PUBLIC HEARING TO CONSIDER THE ADOPTION OF EMISSION STANDARDS AND TEST PROCEDURES FOR NEW 2001 AND LATER MODEL YEAR SPARK-IGNITION MARINE ENGINES Public Hearing Date: December 10, 1998 Agenda Item No.: 98-14-2 I. INTRODUCTION AND BACKGROUND ........................................................................................ 3 II. SUMMARY OF PUBLIC COMMENTS AND AGENCY RESPONSES – COMMENTS PRIOR TO OR AT THE HEARING .................................................................................................................. 7 A. EMISSION STANDARDS ................................................................................................................... 7 1. Adequacy of National Standards............................................................................................. 7 2. Lead Time ................................................................................................................................. 8 3. Technological Feasibility ........................................................................................................ 13 a. Technological Feasibility of California-specific Standards ..............................................................13 -

The Video Game Industry an Industry Analysis, from a VC Perspective

The Video Game Industry An Industry Analysis, from a VC Perspective Nik Shah T’05 MBA Fellows Project March 11, 2005 Hanover, NH The Video Game Industry An Industry Analysis, from a VC Perspective Authors: Nik Shah • The video game industry is poised for significant growth, but [email protected] many sectors have already matured. Video games are a large and Tuck Class of 2005 growing market. However, within it, there are only selected portions that contain venture capital investment opportunities. Our analysis Charles Haigh [email protected] highlights these sectors, which are interesting for reasons including Tuck Class of 2005 significant technological change, high growth rates, new product development and lack of a clear market leader. • The opportunity lies in non-core products and services. We believe that the core hardware and game software markets are fairly mature and require intensive capital investment and strong technology knowledge for success. The best markets for investment are those that provide valuable new products and services to game developers, publishers and gamers themselves. These are the areas that will build out the industry as it undergoes significant growth. A Quick Snapshot of Our Identified Areas of Interest • Online Games and Platforms. Few online games have historically been venture funded and most are subject to the same “hit or miss” market adoption as console games, but as this segment grows, an opportunity for leading technology publishers and platforms will emerge. New developers will use these technologies to enable the faster and cheaper production of online games. The developers of new online games also present an opportunity as new methods of gameplay and game genres are explored. -

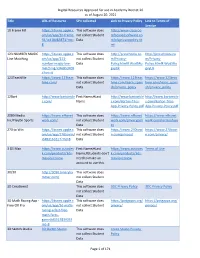

Digital Resources Approved for Use in Academy District 20 As Of

Digital Resources Approved for use in Academy District 20 as of August 20, 2021 Title URL of Resource SPII collected Link to Privacy Policy Link to Terms of Service 10 Frame Fill https://itunes.apple.c This software does http://www.classroo om/us/app/10-frame- not collect Student mfocusedsoftware.co fill/id418083871?mt= Data m/cfsprivacypolicy.ht 8 ml 123 NUMBER MAGIC https://itunes.apple.c This software does http://preschoolu.co http://preschoolu.co Line Matching om/us/app/123- not collect Student m/Privacy- m/Privacy- number-magic-line- Data Policy.html#.Wud5Ro Policy.html#.Wud5Ro matching/id46853409 gvyUk gvyUk 4?mt=8 123TeachMe https://www.123teac This software does https://www.123teac https://www.123teac hme.com/ not collect Student hme.com/learn_spani hme.com/learn_spani Data sh/privacy_policy sh/privacy_policy 12Bart http://www.bartontile First Name;#Last http://www.bartontile http://www.bartontile s.com/ Name s.com/Barton-Tiles- s.com/Barton-Tiles- App-Privacy-Policy.pdf App-Privacy-Policy.pdf 2080 Media https://www.nfhsnet This software does https://www.nfhsnet https://www.nfhsnet Inc/PlayOn Sports work.com/ not collect Student work.com/privacypoli work.com/termsofuse Data cy 270 to Win https://itunes.apple.c This software does https://www.270towi https://www.270towi om/us/app/270towin/ not collect Student n.com/privacy/ n.com/privacy/ id483161617?mt=8 Data 3 DS Max https://www.autodes First Name;#Last https://www.autodes Terms of Use k.com/products/3ds- Name;#Students don't k.com/products/3ds- max/overview need to make an max/overview account to use this. -

Rapid, Continuous Movement Between Nodes As an Accessible Virtual

Rapid, continuous movement between nodes as an accessible virtual reality locomotion technique HABGOOD, Jacob <http://orcid.org/0000-0003-4531-0507>, MOORE, David, WILSON, David and ALAPONT, Sergio Available from Sheffield Hallam University Research Archive (SHURA) at: http://shura.shu.ac.uk/18594/ This document is the author deposited version. You are advised to consult the publisher's version if you wish to cite from it. Published version HABGOOD, Jacob, MOORE, David, WILSON, David and ALAPONT, Sergio (2018). Rapid, continuous movement between nodes as an accessible virtual reality locomotion technique. In: IEEE VR 2018 Conference. IEEE, 371-378. Copyright and re-use policy See http://shura.shu.ac.uk/information.html Sheffield Hallam University Research Archive http://shura.shu.ac.uk Rapid, Continuous Movement Between Nodes as an Accessible Virtual Reality Locomotion Technique M. P. Jacob Habgood* David Moore David Wilson Sergio Alapont Steel Minions Game Studio Steel Minions Game Studio Steel Minions Game Studio Steel Minions Game Studio Sheffield Hallam University Sheffield Hallam University Sheffield Hallam University Sheffield Hallam University ABSTRACT The confounding effect of player locomotion on the vestibulo- In this paper, we examine an approach to locomotion which ocular reflex is one of the principal causes of motion sickness in maintains users’ continuity of motion by making rapid, continuous immersive virtual reality. Continuous motion is particularly movements between nodal waypoints. The motion is made at a problematic for stationary user configurations, and teleportation fast, linear velocity with instant acceleration and deceleration. has become the prevailing approach for providing accessible Continuous movements made with ‘real-world’ speeds and locomotion. -

UBI Banca Group: Interim Financial Report As at and for the Period

Interim financial report as at and for the period th ended 30 September 2017 Translation from the Italian original which remains the definitive version Legislative Decree No. 25 of 15th February 2016 implemented Directive 2013/50/EU (the “Transparency II” Directive) which, amongst other things, repealed the obligation to publish “Resoconti intermedi” (quarterly interim financial reports, the accounting documents introduced in 2007 to replace the “Relazioni trimestrali”, also quarterly reports by the “Transparency” Directive 2004/109/EC which harmonised transparency obligations concerning information on issuers with shares admitted for trading on regulated markets). This decree, in force since 18th March 2016, amended the Consolidated Finance Law (Legislative Decree No. 58/1998), with reference in particular to “Financial reports” pursuant to Art. 154-ter, eliminating the obligation to publish interim financial reports for the first and third quarters. In view of the option provided for by the Directive and on the basis of observations made by the market when two consultations were held by the Consob, this Commission amended the Issuers’ Regulations with Resolution No. 19770 of 26th October 2016, which introduced Art. 82-ter (additional periodic financial reports), which came into force from 2nd January 2017. On the basis of this provision, listed companies have the option to choose whether or not to publish periodic financial reports that are additional to the annual and half yearly financial reports provided for by Art. 154- ter of the Consolidated Finance Law. If they choose to publish these on a voluntary basis, they must disclose this to market, specifying the items of information they intend to provide in order for the decisions taken to be clear and stable over time. -

T I S ^ E ' Cottons CUSTOMIZED KITCHENS 0^

: : ' I '■ ;:'vV WEDKBBDAY, FEBRUARY 2,.lO li' JL ffba Wahtlkir tfnnrlrrBtpr Eurntog frrtJh Avenga Dnflr KsC Prsss Ron I at P. a WsaBSa rue tha fairth •« ill- •■t. iWk t \ ^ 9 , 6 8 0 lawet by aaow aarty FtMay; e of «ka AniH FYMay, mow amy ebaago «a i lul Town / I V. ManehtSner— A tity of Vittage Charm midbi t I m k Pwxda’t Vuflon nMOtben t» iDMt tUa ave* MANCHESTER, CONN„ THURSDAY, FEBRUARY 3,1949 PRKJE FOUR CENTS StatTjO at the 8^^" VOL. LX \T n„ NO. 105 (TWENTY PAGES) AtMy cltaC^l. where they wli) SMART YOUNO H O ifB M leave for a lobogfan party. 'I ( . ■ ■ The 0* Troop 16, Olrl President Congratulates Retiring Generals floouta, wm ba omitted thto week. ENTIRTAIN IN Sharp Partisan Rows The next meeting held World Gets Notice . Thuraday, Fhbniary 10, under the l c a ! 3 e ^ 0* Mia. Lealle Hoyt and SaT^tawrence MacQUpln, In T IA P A R T Y St. Jamaa’a adUwl hall. RedMove Will Not •In Senate and House An Important btialneae meeting a t the CoamopoHtan Club will b e , held Friday attemoon at two Be Let Hurt Unity o'clock In the Federation room of j center church houae, when the | mambera will vote on the revtaed i On Budget, Housing by-lawa. A talk on the “Ro- Real ^Significance Seen ^nen of Silver” wlU foUow the, Norway’s Own — Imalneaa aenlon, and a large at In Acheson’s Rejec tendance of merabera le hoped for. tion of Stalin’s' Lat Democratic Floor Lead Mra. -

BIC Nazwa BIC Reprezentanta BIC Rozrachunkowy

BIC Nazwa BIC reprezentanta BIC rozrachunkowy AABAFI22 BANK OF ALAND PLC AABAFI22XXX ABKLCY2N ALPHA BANK CYPRUS LTD ABKLCY2NXXX ABNANL2A ABN AMRO BANK NV ABNANL2AXXX ADYBNL2A ADYEN B.V. ADYBNL2AXXX AGRIFRPP CREDIT AGRICOLE SA AGRIFRPPXXX AIBKIE2D ALLIED IRISH BANKS PLC AIBKIE2DXXX ALBADKKK ARBEJDERNES LANDSBANK ALBADKKKXXX APSBMTMT APS Bank APSBMTMTXXX ATBANL2A Amsterdam Trade Bank N.V. ATBANL2AXXX BACRIT22 CREDITO EMILIANO SPA BACRIT22XXX BAPPIT22 Banco BPM s.p.a. BAPPIT22XXX BARCBEBB Barclays Bank Ireland - Belgium Branch BARCBEBBXXX BARCDEFF BARCLAYS BANK IRELAND - FRANKFURT BRANCH BARCDEFFXXX BARCFRPC Barclays Bank Ireland Plc, France branch BARCFRPCXXX BARCGB22 BARCLAYS BANK PLC BARCGB22XXX BARCIE2D BARCLAYS BANK IRELAND PLC BARCIE2DXXX BARCLULL Barclays Bank Ireland - Luxembourg Branch BARCLULLXXX BARCNL22 Barclays Bank Ireland - Netherlands Branch BARCNL22XXX BARCPTPC Barclays Bank Ireland Plc, Portugal branch BARCPTPCXXX BBPIPTPL BANCO BPI SA BBPIPTPLXXX BBRUBEBB ING BANK NV BRUSSELS BBRUBEBBXXX BBRUBEBC ING BELGIUM NV/SA BBRUBEBCXXX BBVAESMM BANCO BILBAO VIZCAYA BBVAESMMXXX BCEELULL BANQUE ET CAISSE DEPARGNE DE BCEELULLXXX BCITITMM INTESA SANPAOLO SPA BCITITMMXXX BCOEESMM BANCO COOPERATIVO BCOEESMMXXX BCOMPTPL BANCO COMERCIAL PORTUGUES SA BCOMPTPLXXX BCYPCY2N BANK OF CYPRUS PUBLIC COMPANY LTD BCYPCY2NXXX BDFEFRPP BANQUE DE FRANCE BDFEFRPPXXX BESCPTPL NOVO BANCO, SA BESCPTPLXXX BGLLLULL BGL BNP PARIBAS BGLLLULLXXX BILLLULL BANQUE INTERNATIONALE A LUXEMBOURG BILLLULLXXX BILLLULL BANQUE INTERNATIONALE A LUXEMBOURG BILLLULLXXX BITAITRR BANCA DITALIA BITAITRRXXX BKAUATWW UNICREDIT BANK AUSTRIA AG BKAUATWWXXX BKBKESMM BANKINTER SA BKBKESMMXXX BLUXLULL BANQUE DE LUXEMBOURG BLUXLULLXXX BMPBBEBB AION S.A. BMPBBEBBXXX BNGRGRAA BANK OF GREECE S.A. BNGRGRAAXXX BNIFMTMT BNF BANK PLC BNIFMTMTXXX BNPAFRPP BNP PARIBAS SA BNPAFRPPXXX BNPAIE2D BNP PARIBAS DUBLIN BRANCH BNPAIE2DXXX BOFADEFX BANK OF AMERICA EUROPE DAC FRANKFURT BOFADEFXXXX BOFIIE2D BANK OF IRELAND BOFIIE2DXXX BOTKFRPX MUFG BANK, LTD. -

Technical Energy Audit New Mexico State University Professional Services Contract #201302796-A

Prepared for New Mexico State University Las Cruces, New Mexico Technical Energy Audit Professional Services Contract #201302796-A January 31, 2014 Technical Energy Audit New Mexico State University Professional Services Contract #201302796-A January 31, 2014 Prepared for New Mexico State University Las Cruces, New Mexico Presented by: Michael Boyer Mailing Address: Account Executive 60 East Rio Salado Parkway, Suite 1001 Ameresco, Inc. Tempe, Arizona 85281 P: 801.425.3421 Local Office: E: [email protected] 6100 Foulois Road, Building 737 Hill Air Force Base, Utah 04856 Technical Energy Audit Executive Summary Ameresco, Inc. (Ameresco) is pleased to submit this Technical Energy Audit (TEA) to New Mexico State University (NMSU). Based on our site visits, work, and observations throughout the Las Cruces campus, this TEA provides recommended energy conservation measures (ECMs) that would reduce energy and operational costs at 45 campus buildings and campus wide facilities. Ameresco developed this TEA based on NMSU’s Professional Services Contract #201302796-A and Ameresco’s site visits, workshops, and utility analysis and energy calculations. This TEA is intended to provide an overall representation of the potential for energy and operational savings at NMSU. Based on the data collected from site surveys, facility interviews, and other means, Ameresco identified several ECMs that could help NMSU reduce overall operational costs. ES.1 Energy Conservation Measures ECMs found to have the best financial performance or are high priorities for NMSU include: • ECM 1: Interior Lighting • ECM 2: Exterior Lighting • ECM 3: Exterior Pole Mounted Lighting • ECM 6: Retrocommissioning • ECM 7: Variable Air Volume Retrofit • ECM 10: Economizer Upgrade or Repair • ECM 12: Chilled Water Pump Bypass • ECM 26: Satellite Plant Energy Savings • ECM 28: MyEnergyPro™-OpsPRO • ECM 29: MyEnergyPro™-DashPRO • ECM 30: MyEnergyPro™-Optimization Model ES.2 Savings Total projected savings from implementing these ECMs are $1,278,725. -

Participatory Gaming Culture

Master thesis Participatory gaming culture: Indie game design as dialogue between player & creator Martijn van Best student ID: 3175421 [email protected] New Media Studies Faculty of Humanities UTRECHT UNIVERSITY Course code: 200700088 THE-Scriptie / MA NMDC Supervisor: Erna Kotkamp Second reader: René Glas DATE: March 28th, 2011 1 To Mieke 2 Abstract In this thesis I argue that the current dichotomy between indie game design and mainstream design based on commercial appeal versus creative audacity is non-constructive. Instead, I wish to investigate to what extent indie game designers are able to establish a personal dialogue with their audience through their game. I frame independent game design as a participatory culture in which indies alter and modify existing game design conventions through a practice called abusive game design. This is a concept developed by Douglas Wilson and Miguel Sicart. Players who wish to master (partially) abusive games, need to learn about the designer's intentions rather than the game system. I argue that a designer's visibility in this way allows for a dialogue between creator and player. However, in a case study of indie title Super Crate Box (2010), it appears that in order to maintain a sense of fun, certain conventions of mainstream game design need to be adhered to. Indie designers, who often have the most visible and personal relationship with their audience, need to navigate between their wish for a personal connection with players and user friendly, but 'faceless' design. Scaling the tipping point too much to the abusive side instead of the conventional one, may be counter to designers' wishes to create an enjoyable game. -

Radio, Submillimetre, and Infrared Signals from Embryonic Supernova

UNIVERSITY OF TOKYO MASTERS THESIS Radio, Submillimetre, and Infrared Signals from Embryonic Supernova Remnants 誕誕誕生生生444数数数十十十年年年)))UUU...mmm新新新星星星---555かかからII... 電電電波波波、、、サササブ66???JJJ、、、ttt赤赤赤)))放放放射射射 Author: Supervisor: Conor M. B. OMAND Dr. Naoki YOSHIDA A thesis submitted in fulfillment of the requirements for the degree of Masters of Science in the Theoretical Astrophysics Group Graduate School of Science January 25, 2018 iii Declaration of Authorship I, Conor M. B. OMAND, declare that this thesis titled, “Radio, Submillimetre, and Infrared Signals from Embryonic Supernova Remnants ” and the work presented in it are my own. I confirm that: • This work was done wholly or mainly while in candidature for a research de- gree at this University. • Where any part of this thesis has previously been submitted for a degree or any other qualification at this University or any other institution, this has been clearly stated. • Where I have consulted the published work of others, this is always clearly attributed. • Where I have quoted from the work of others, the source is always given. With the exception of such quotations, this thesis is entirely my own work. • I have acknowledged all main sources of help. v Abstract Radio, Submillimetre, and Infrared Signals from Embryonic Supernova Remnants Today, large surveys detect thousands of supernovae a year, and our understanding of their causes, mechanisms, and aftermath is very thorough. However, there are several other transients, including Gamma-Ray Bursts (GRBs), Hypernovae (HNe), Super- Luminous Supernovae (SLSNe), and Fast Radio Bursts (FRBs), where the causes and mechanisms are less certain or even completely unknown. The remnant of the deaths of stars in a certain mass range is a neutron star.