View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Employment and Working Conditions in the Air Transport Sector Over the Period 1997/2010

Study on the effects of the implementation of the EU aviation common market on employment and working conditions in the Air Transport Sector over the period 1997/2010 Final Report Report July 2012 Prepared for: Prepared by: European Commission Steer Davies Gleave DG MOVE 28-32 Upper Ground Unit E1 London SE1 9PD DM 24-5/106 B-1049 Brussels Belgium +44 (0)20 7910 5000 www.steerdaviesgleave.com Final Report CONTENTS EXECUTIVE SUMMARY ...................................................................................... I Background ............................................................................................ i Scope of this study ................................................................................... i Conclusions ........................................................................................... ii Recommendations .................................................................................. xi 1 INTRODUCTION ..................................................................................... 1 Background ............................................................................................ 1 Key findings of the 2010 Working Document .................................................... 1 The need for this study ............................................................................. 1 Structure of this report ............................................................................. 2 2 RESEARCH METHODOLOGY ....................................................................... 3 Objectives -

Sustainability Report for the Year Ended 1 July 2018 CONTENTS ABOUT US

Sustainability Report for the year ended 1 July 2018 CONTENTS ABOUT US About us Performance in 2017 Our business is based on 2 Chief Executive’s Review strong fundamentals 3 Our strategy 4 Our business model 6 Our strategic objectives Go-Ahead is one of the UK’s 8 Our performance 10 Our sustainability approach leading public transport providers, responsible for more than a billion journeys each year on our bus and rail services. Better teams Cleaner Responsible Stronger environment Business communities 12 Read about our responsible business priorities 12 Better teams 14 Happier customers Smarter Happier 16 Stronger communities technology customers 18 Smarter technologies 20 Cleaner environment 22 Our stakeholders 24 ESG data Regional bus London bus Rail We run fully owned We operate tendered Through Govia, a 65% commercial bus contracts for Transport owned joint businesses through our for London (TfL). venture with Keolis, seven bus operators This comprises 164 Go-Ahead currently predominantly in the routes from 17 depots in operates two UK rail south of England. We the capital. Around 85% franchises for the employ over 7,500 of these depots are Department for people and run around freehold. We are Transport (DfT), GTR 2,800 buses within these the biggest bus operator and Southeastern and Watch our video that summarises our businesses. We have in London with 23% operates over 4,800 daily performance last year at: operations in Brighton, share of the market, services. Until December www.go-ahead.com/sustainability Oxford, East Yorkshire, running over 2,100 buses 2017, Go-Ahead ran the Plymouth, East Anglia and employing more than London Midland and on the south coast 7,000 people. -

The Report from Passenger Transport Magazine

MAKinG TRAVEL SiMpLe apps Wide variations in journey planners quality of apps four stars Moovit For the first time, we have researched which apps are currently Combined rating: 4.5 (785k ratings) Operator: Moovit available to public transport users and how highly they are rated Developer: Moovit App Global LtD Why can’t using public which have been consistent table-toppers in CityMApper transport be as easy as Transport Focus’s National Rail Passenger Combined rating: 4.5 (78.6k ratings) ordering pizza? Speaking Survey, have not transferred their passion for Operator: Citymapper at an event in Glasgow customer service to their respective apps. Developer: Citymapper Limited earlier this year (PT208), First UK Bus was also among the 18 four-star robert jack Louise Coward, the acting rated bus operator apps, ahead of rivals Arriva trAinLine Managing Editor head of insight at passenger (which has different apps for information and Combined rating: 4.5 (69.4k ratings) watchdog Transport Focus, revealed research m-tickets) and Stagecoach. The 11 highest Operator: trainline which showed that young people want an rated bus operator apps were all developed Developer: trainline experience that is as easy to navigate as the one by Bournemouth-based Passenger, with provided by other retailers. Blackpool Transport, Warrington’s Own Buses, three stars She explained: “Young people challenged Borders Buses and Nottingham City Transport us with things like, ‘if I want to order a pizza all possessing apps with a 4.8-star rating - a trAveLine SW or I want to go and see a film, all I need to result that exceeds the 4.7-star rating achieved Combined rating: 3.4 (218 ratings) do is get my phone out go into an app’ .. -

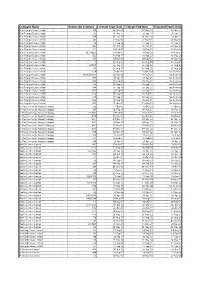

Operators Route Contracts

Company Name Routes On Contract Contract Start Date Contract End Date Extended Expiry Date Blue Triangle Buses Limited 300 06-Mar-10 07-Dec-18 03-Mar-17 Blue Triangle Buses Limited 193 01-Oct-11 28-Sep-18 28-Sep-18 Blue Triangle Buses Limited 364 01-Nov-14 01-Nov-19 29-Oct-21 Blue Triangle Buses Limited 147 07-May-16 07-May-21 05-May-23 Blue Triangle Buses Limited 376 17-Sep-16 17-Sep-21 15-Sep-23 Blue Triangle Buses Limited 346 01-Oct-16 01-Oct-21 29-Sep-23 Blue Triangle Buses Limited EL3 18-Feb-17 18-Feb-22 16-Feb-24 Blue Triangle Buses Limited EL1/NEL1 18-Feb-17 18-Feb-22 16-Feb-24 Blue Triangle Buses Limited EL2 18-Feb-17 18-Feb-22 16-Feb-24 Blue Triangle Buses Limited 101 04-Mar-17 04-Mar-22 01-Mar-24 Blue Triangle Buses Limited 5 26-Aug-17 26-Aug-22 23-Aug-24 Blue Triangle Buses Limited 15/N15 26-Aug-17 26-Aug-22 23-Aug-24 Blue Triangle Buses Limited 115 26-Aug-17 26-Aug-22 23-Aug-24 Blue Triangle Buses Limited 674 17-Oct-15 16-Oct-20 See footnote Blue Triangle Buses Limited 649/650/651 02-Jan-16 01-Jan-21 See footnote Blue Triangle Buses Limited 687 30-Apr-16 30-Apr-21 See footnote Blue Triangle Buses Limited 608 03-Sep-16 03-Sep-21 See footnote Blue Triangle Buses Limited 646 03-Sep-16 03-Sep-21 See footnote Blue Triangle Buses Limited 648 03-Sep-16 03-Sep-21 See footnote Blue Triangle Buses Limited 652 03-Sep-16 03-Sep-21 See footnote Blue Triangle Buses Limited 656 03-Sep-16 03-Sep-21 See footnote Blue Triangle Buses Limited 679 03-Sep-16 03-Sep-21 See footnote Blue Triangle Buses Limited 686 03-Sep-16 03-Sep-21 See footnote -

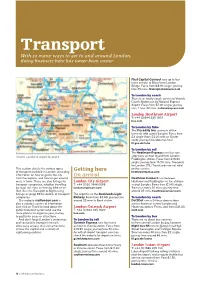

Transport with So Many Ways to Get to and Around London, Doing Business Here Has Never Been Easier

Transport With so many ways to get to and around London, doing business here has never been easier First Capital Connect runs up to four trains an hour to Blackfriars/London Bridge. Fares from £8.90 single; journey time 35 mins. firstcapitalconnect.co.uk To London by coach There is an hourly coach service to Victoria Coach Station run by National Express Airport. Fares from £7.30 single; journey time 1 hour 20 mins. nationalexpress.com London Heathrow Airport T: +44 (0)844 335 1801 baa.com To London by Tube The Piccadilly line connects all five terminals with central London. Fares from £4 single (from £2.20 with an Oyster card); journey time about an hour. tfl.gov.uk/tube To London by rail The Heathrow Express runs four non- Greater London & airport locations stop trains an hour to and from London Paddington station. Fares from £16.50 single; journey time 15-20 mins. Transport for London (TfL) Travelcards are not valid This section details the various types Getting here on this service. of transport available in London, providing heathrowexpress.com information on how to get to the city On arrival from the airports, and how to get around Heathrow Connect runs between once in town. There are also listings for London City Airport Heathrow and Paddington via five stations transport companies, whether travelling T: +44 (0)20 7646 0088 in west London. Fares from £7.40 single. by road, rail, river, or even by bike or on londoncityairport.com Trains run every 30 mins; journey time foot. See the Transport & Sightseeing around 25 mins. -

The Go-Ahead Group Plc Annual Report and Accounts 2019 1 Stable Cash Generative

Annual Report and Accounts for the year ended 29 June 2019 Taking care of every journey Taking care of every journey Regional bus Regional bus market share (%) We run fully owned commercial bus businesses through our eight bus operations in the UK. Our 8,550 people and 3,055 buses provide Stagecoach: 26% excellent services for our customers in towns and cities on the south FirstGroup: 21% coast of England, in north east England, East Yorkshire and East Anglia Arriva: 14% as well as in vibrant cities like Brighton, Oxford and Manchester. Go-Ahead’s bus customers are the most satisfied in the UK; recently Go-Ahead: 11% achieving our highest customer satisfaction score of 92%. One of our National Express: 7% key strengths in this market is our devolved operating model through Others: 21% which our experienced management teams deliver customer focused strategies in their local areas. We are proud of the role we play in improving the health and wellbeing of our communities through reducing carbon 2621+14+11+7+21L emissions with cleaner buses and taking cars off the road. London & International bus London bus market share (%) In London, we operate tendered bus contracts for Transport for London (TfL), running around 157 routes out of 16 depots. TfL specify the routes Go-Ahead: 23% and service frequency with the Mayor of London setting fares. Contracts Metroline: 18% are tendered for five years with a possible two year extension, based on Arriva: 18% performance against punctuality targets. In addition to earning revenue Stagecoach: 13% for the mileage we operate, we have the opportunity to earn Quality Incentive Contract bonuses if we meet these targets. -

The Demand for Public Transport: a Practical Guide

The demand for public transport: a practical guide R Balcombe, TRL Limited (Editor) R Mackett, Centre for Transport Studies, University College London N Paulley, TRL Limited J Preston, Transport Studies Unit, University of Oxford J Shires, Institute for Transport Studies, University of Leeds H Titheridge, Centre for Transport Studies, University College London M Wardman, Institute for Transport Studies, University of Leeds P White, Transport Studies Group, University of Westminster TRL Report TRL593 First Published 2004 ISSN 0968-4107 Copyright TRL Limited 2004. This report has been produced by the contributory authors and published by TRL Limited as part of a project funded by EPSRC (Grants No GR/R18550/01, GR/R18567/01 and GR/R18574/01) and also supported by a number of other institutions as listed on the acknowledgements page. The views expressed are those of the authors and not necessarily those of the supporting and funding organisations TRL is committed to optimising energy efficiency, reducing waste and promoting recycling and re-use. In support of these environmental goals, this report has been printed on recycled paper, comprising 100% post-consumer waste, manufactured using a TCF (totally chlorine free) process. ii ACKNOWLEDGEMENTS The assistance of the following organisations is gratefully acknowledged: Arriva International Association of Public Transport (UITP) Association of Train Operating Companies (ATOC) Local Government Association (LGA) Confederation of Passenger Transport (CPT) National Express Group plc Department for Transport (DfT) Nexus Engineering and Physical Sciences Research Network Rail Council (EPSRC) Rees Jeffery Road Fund FirstGroup plc Stagecoach Group plc Go-Ahead Group plc Strategic Rail Authority (SRA) Greater Manchester Public Transport Transport for London (TfL) Executive (GMPTE) Travel West Midlands The Working Group coordinating the project consisted of the authors and Jonathan Pugh and Matthew Chivers of ATOC and David Harley, David Walmsley and Mark James of CPT. -

S/C/W/270 18 July 2006 ORGANIZATION (06-3471) Council for Trade in Services

WORLD TRADE RESTRICTED S/C/W/270 18 July 2006 ORGANIZATION (06-3471) Council for Trade in Services SECOND REVIEW OF THE AIR TRANSPORT ANNEX DEVELOPMENTS IN THE AIR TRANSPORT SECTOR (PART ONE) Note by the Secretariat1 TABLE OF CONTENTS LIST OF TABLES, CHARTS, FIGURES AND APPENDIXES......................................................vi LIST OF ACRONYMS ........................................................................................................................ix INTRODUCTION..................................................................................................................................1 I. AIRCRAFT REPAIR AND MAINTENANCE (MRO).........................................................4 A. ECONOMIC DEVELOPMENTS .......................................................................................................4 B. REGULATORY DEVELOPMENTS.................................................................................................13 1. Developments concerning the regulation of Maintenance Repair and Overhaul .........13 (a) General evolution ..............................................................................................................13 (b) Maintenance Steering Group (MSG) rules........................................................................13 (c) WTO developments...........................................................................................................13 (d) European Communities .....................................................................................................14 -

Project Overview & Branding

Project Overview & Branding 25th June 2014 1 Overview • Background • Delivery • Branding • Website • Key Dates • SHBOA • Red Funnel 2 Background Funding secured following a successful bid to the DfT’s Local Sustainable Transport Fund. Three overarching strands: • Procure a centralised back office system; • Rollout the necessary equipment; & • Rebrand and turn the existing Solent Travelcard ‘smart’. 3 Delivery Key Activities Status Back Office System Procurement & Implementation (HCC, SCC & PCC) Complete Marketing / Branding Agency Procurement Complete Website Procurement Complete Rollout Bus Operator Equipment Complete Commercials - Bus Complete Commercials - Ferry Complete Events Company Procurement Current Rollout Ferry Equipment (Inland & IoW) Current Launch Event & Road Shows Current Stakeholder Engagement & Promotion Current 4 Branding Comprehensive exercise, involving focus groups and public consultation. Solent Go is: • Dynamic; • Connected; & • Flexible. 5 Branding 6 Website – www.solentgo.co.uk 7 Website – Homepage 8 Website – Fares Page 9 Key Dates Date Event 27th June Solent Go Agreement Signing Event 24th July Breakfast Briefing – Partners / Stakeholders 4th August Launch – Southampton Bargate August - October Road Show Events (x12 across the region) 26th October City Bus Tickets Go Live *Red Funnel due to go live in early 2015. 10 Project Partners: SHBOA First Hovertravel Solent Transport Go South Coast Red Funnel Portsmouth City Council Stagecoach Gosport Ferry Hampshire County Council Unilink Hythe Ferry Southampton City -

The Value of New Transport in Deprived Areas Who Benefi Ts, How and Why? Karen Lucas, Sophie Tyler and Georgina Christodoulou

The value of new transport in deprived areas Who benefi ts, how and why? Karen Lucas, Sophie Tyler and Georgina Christodoulou An assessment of the value of new transport services to people living in deprived neighbourhoods in England. Regeneration strategies for deprived areas are currently under review. To date there has been little if any direct evaluation of the contribution of transport services to local regeneration. This study evaluates the benefi ts – both monetary and quality of life – of transport services to the people who use them and to the local practitioners responsible for the wider regeneration of these neighbourhoods. It covers: • the policy context; • characteristics of the four case study areas (Braunstone, Leicester; Camborne, Pool, and Redruth, Cornwall; Wythenshawe, Manchester and Walsall, West Midlands); • key fi ndings from interviews with local professionals; • information on use of the services and their value to local people; • an evaluation of the social benefi ts of the services; • key messages for local and central government. This publication can be provided in other formats, such as large print, Braille and audio. Please contact: Communications, Joseph Rowntree Foundation, The Homestead, 40 Water End, York YO30 6WP. Tel: 01904 615905. Email: [email protected] The value of new transport in deprived areas Who benefi ts, how and why? Karen Lucas, Sophie Tyler and Georgina Christodoulou The Joseph Rowntree Foundation has supported this project as part of its programme of research and innovative development projects, which it hopes will be of value to policymakers, practitioners and service users. The facts presented and views expressed in this report are, however, those of the authors and not necessarily those of the Foundation. -

Anticipated Acquisition by London and South Eastern Railway, a Wholly Owned Subsidiary of Govia Limited, of the Integrated Kent Rail Franchise

Anticipated acquisition by London and South Eastern Railway, a wholly owned subsidiary of Govia Limited, of the Integrated Kent Rail Franchise The OFT's decision on reference under section 33(1) given on 28 March 2006. Full text of decision published 4 April 2006. PARTIES 1. Govia Limited (Govia) is a rail franchise holding company. It was formed as a joint venture between The Go-Ahead Group Plc (Go-Ahead) and Keolis (UK) Limited (a subsidiary of Keolis SA), which have shareholdings in Govia of 65 per cent and 35 per cent respectively. Govia will acquire the Integrated Kent Rail Franchise through its wholly owned subsidiary, London and South Eastern Railway (LSER). 2. The Integrated Kent Rail Franchise (IKF) will include passenger rail services on the network currently operated by South Eastern Trains (SET), a subsidiary of the Strategic Rail Authority (SRA). IKF is a commuter network serving several areas around the South East of England, parts of Greater London and several London termini. IKF will also include new domestic high-speed services from London St Pancras, making use of the Channel Tunnel Rail Link. SET's turnover for the year ended 31 March 2005 was £443.3 million. TRANSACTION 3. Govia (through LSER) was named the preferred bidder for IKF on 30 November 2005. IKF is due to commence on 1 April 2006 and will run for six years, although the contract allows for an extension of two years if performance targets are met. Alternatively, in the event of a delay to the start of the new high speed services using the Channel Tunnel Rail Link, the franchise may be extended by two years. -

Cambridge University Library Map Department Collection of Plans of Towns in England, Wales, Scotland, Isle of Man and Channel Islands Classmark = Maps.TPE

Cambridge University Library Map Department collection of plans of towns in England, Wales, Scotland, Isle of Man and Channel Islands Classmark = Maps.TPE. followed by town name and date, the ID is also useful * Indicates that the item is filed in the Outsize sequence Abbots Bromley Staffordshire ID Date Pub Code Notes/Part 1076 2001 Abbots Bromley Parish Council Sm,G Abbots Langley Hertfordshire ID Date Pub Code Notes/Part 1693 1971 ? T Aberdeen ID Date Pub Code Notes/Part 4811 1960 ca. Bartholomew - Town plan T, E 1260 1988 Aberdeen Tourist Board T 1222 1994 ca. Footprints - The Pint Sized Guide T [Aberdeen pub guide.] 461 1996 Bartholomew - Streetfinder Map 658 1997 Bartholomew - Streetfinder Atlas 664 1997 Bartholomew - Streetfinder Colour Ma 654 1998 Collins - Streetfinder Atlas 629 1998 ca. Collins - Streetfinder Map Westhill, Elrick 905 1999 Hallewell Sm,GB,Walk Aberdeen on foot 628 1999 ca. Nicolson Westhill, Elrick 1307 2001 ca. Nicolson - Street Guide T 1316 2003 Collins - Streetfinder T 02 February 2021 Page 1 of 296 3293 2004 Cityscape Maps T,S,Transport,P Transport,Shopping, Guide map and 3048 2005 Nicolson - Street Atlas 3820 2010 ca. Nicolson T & Bieldside, Bridge of Don, Bucksbur 4974 2016 Nicolson Digital - Street map, 1:14,000 T Aberdour ID Date Pub Code Notes/Part 2944 2005 ca. Fife Tourist Board T, G Aberfan ID Date Pub Code Notes/Part 393 1997 ca. Manderley Sm Treharris, Troedyrhiw, Merthyr Vale Aberfeldy ID Date Pub Code Notes/Part 1659 1956 Scottish Field Studies Association T Abergavenny Monmouthshire ID Date Pub Code Notes/Part 395 1996 ca.