Valuation Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Finnish Shopping Centers 2020 Centers Shopping Finnish Finnish Councilfinnish of Shopping Centers • Suomen Kauppakeskusyhdistys Ry

Succesful and evolving shopping center business – the beating heart of community! Menestyvä ja kehittyvä Finnish Shopping Centers 2020 kauppakeskusliiketoiminta – yhdyskunnan sykkivä sydän! Kauppakeskukset Finnish Council of Shopping Centers Annankatu 24, 2. krs. 00100 Helsinki puh. +358 9 4767 5711 www.kauppakeskusyhdistys.fi Finnish Shopping Centers 2020 Centers Shopping Finnish Kauppakeskukset Finnish Shopping Centers 2014 Centers Shopping Finnish Kauppakeskukset www.kauppakeskusyhdistys.fi Finnish Council of Shopping Centers • Suomen Kauppakeskusyhdistys ry Finnish Shopping Centers 2020 Kauppakeskukset 4 5 Introduction The Finnish Shopping Centers 2020 industry review transparency and knowledge of the sector among they are conveniently accessible. The business mix centers is as part of a community structure which is compiled by the Finnish Council of Shopping investors, customers, traders, and the main stake- changes constantly according to customer needs. is conveniently accessible. The key is to create rele- Centers. It provides a package of information on holders in the sector, both in Finland and abroad. Business proprietors are able to operate in an eco- vant spaces for people and to provide a community shopping centers for everyone interested in the logically and socially responsible way. The shopping hub. The ongoing trend is to provide non-retail uses sector. This is already the fourteenth annual review. Shopping centers are adapting to center business in Finland has reached its 30-year by increasing leisure in shopping centers and also Shopping Centers 2020 contains key figures about continuous change anniversary. It is not yet a mature sector, but it is in town centre regeneration. The mixed-use town the business sector as well as standardised intro- an area with continuous development. -

Lions Clubs International Club Membership Register

LIONS CLUBS INTERNATIONAL CLUB MEMBERSHIP REGISTER CLUB MMR MMR FCL YR MEMBERSHI P CHANGES TOTAL IDENT CLUB NAME DIST TYPE NBR RPT DATE RCV DATE OB NEW RENST TRANS DROPS NETCG MEMBERS 4017 020348 KVARNBO 107 A 1 09-2003 10-16-2003 -3 -3 45 0 0 0 -3 -3 42 4017 020363 MARIEHAMN 107 A 1 05-2003 08-11-2003 4017 020363 MARIEHAMN 107 A 1 06-2003 08-11-2003 4017 020363 MARIEHAMN 107 A 1 07-2003 08-11-2003 4017 020363 MARIEHAMN 107 A 1 08-2003 08-11-2003 4017 020363 MARIEHAMN 107 A 1 09-2003 10-21-2003 -1 -1 55 0 0 0 -1 -1 54 4017 041195 ALAND SODRA 107 A 1 08-2003 09-23-2003 24 0 0 0 0 0 24 4017 050840 BRANDO-KUMLINGE 107 A 1 07-2003 06-23-2003 4017 050840 BRANDO-KUMLINGE 107 A 1 08-2003 06-23-2003 4017 050840 BRANDO-KUMLINGE 107 A 1 09-2003 10-16-2003 20 0 0 0 0 0 20 4017 059671 ALAND FREJA 107 A 1 07-2003 09-18-2003 4017 059671 ALAND FREJA 107 A 1 08-2003 09-11-2003 4017 059671 ALAND FREJA 107 A 1 08-2003 10-08-2003 4017 059671 ALAND FREJA 107 A 1 09-2003 10-08-2003 4017 059671 ALAND FREJA 107 A 7 09-2003 10-13-2003 2 2 25 2 0 0 0 2 27 GRAND TOTALS Total Clubs: 5 169 2 0 0 -4 -2 167 Report Types: 1 - MMR 2 - Roster 4 - Charter Report 6 - MMR w/ Roster 7 - Correspondence 8 - Correction to Original MMR 9 - Amended Page 1 of 126 CLUB MMR MMR FCL YR MEMBERSHI P CHANGES TOTAL IDENT CLUB NAME DIST TYPE NBR RPT DATE RCV DATE OB NEW RENST TRANS DROPS NETCG MEMBERS 4019 020334 AURA 107 A 1 07-2003 07-04-2003 4019 020334 AURA 107 A 1 08-2003 06-04-2003 4019 020334 AURA 107 A 1 09-2003 10-06-2003 44 0 0 0 0 0 44 4019 020335 TURKU AURA 107 A 25 0 0 0 -

KTI Market Review Spring 2019

KTI Market Review Spring 2019 The invested real estate market continues to grow Property transactions volume remains high Rental growth slowing down in the commercial property market Residential rents continue to increase KTI Market Review Spring 2019 Property transaction volume remains high in Finland. Investor interest is targeted at all sectors and regions. Foreign investor interest remains strong, but domestic players are also active in the transactions market. Strong investor demand and high development volumes contribute to the growth of the invested market. After a short break late in 2018, property yields have continued to compress. During the first quartile of 2018, transactions of the very best properties in the Helsinki CBD have been carried out at record low level yields. In addition to the Helsinki metropolitan area, yields have also decreased in the Tampere and Turku regions. Going forward, construction volumes are expected to decrease from their current high levels. However, commercial property stock continues to increase, as ongoing projects are completed in 2019 and 2020. In residential property development, the decrease in investor demand is slowing down the volumes from their record-high levels of 2018. Despite the decline, residential property construction volumes are expected to remain healthy. In the commercial property rental markets, the strong demand of the previous years is expected to slow down. In the Helsinki CBD, office rents continue to increase, but at a slower pace than in 2017 and 2018. The outlook in the retail market remains more negative, and rents are expected to remain stable in the best areas in Helsinki but to decrease in all other areas. -

Welcome to HAMK 2018-2019

Welcome to HAMK 2018-2019 Table of Content WELCOME TO HÄME UNIVERSITY OF APPLIED SCIENCES ........................................................................... 1 HAMKO – THE STUDENT UNION OF HÄME UNIVERSITY OF APPLIED SCIENCES ......................................... 2 1. FINLAND .................................................................................................................................................... 3 Finland in Figures ...................................................................................................................................... 4 Climate ...................................................................................................................................................... 4 Currency and Banks .................................................................................................................................. 4 Electricity .................................................................................................................................................. 4 Transportation .......................................................................................................................................... 5 Shopping and Cost of Living ..................................................................................................................... 6 2. FINNS, FINNISH LANGUAGE AND CULTURE .............................................................................................. 9 Finnish Language ................................................................................................................................... -

HELSINKI Key Retail Areas & Streets

GLOBAL CITIES RETAIL GUIDE HELSINKI Key Retail Areas & Streets MARKET OVERVIEW Data as of August 2012 KEY AREAS/ CONSUMER MAJOR RETAILERS NEW TYPICAL RENT RANGE OF STREETS/SHOPPING PROFILE PRESENT ENTRANTS FOR UNIT OF 200 UNIT SIZES CENTERS SQM High street district Local shoppers, Stockmann, H&M, Aleksi 13, Kluuvi, Kämp Galleria, Karen Millen, Filippa K, 100-180€/sqm/month 20-3,500 sqm tourists, business Zara, Louis Vuitton, Marimekko French Connection, Tiger (Stockmann density of Sweden department store 50 000 sqm) Kamppi Local shoppers, Bestseller (different stores), Mango, Guess, United Seppälä, Gant 30-170 €/sqm/month 20-1,500 sqm commuters Colors of Benetton, Sisley, Esprit, Brothers, Anttila, Clas Ohlson, Nike, Lidl Forum Local shoppers H&M, Intersport, Lindex, Seppälä, Nilson Shoes, Cubus 80-120 €/sqm/month 10-3,000 sqm Gina Tricot City-Center Local shoppers, Aleksi 13, Gina Tricot, Bestseller (Jack & Jones, Promod, Hard Rock Café, 40-120€/sqm/month 30-1,500 sqm commuters Vero moda), Angry Birds Shop Itis (Shopping Centre) Shoppers from Stockmann, Anttila, Zara, Stadium, H&M New Yorker 30-120 €/sqm/month 10-4,000 sqm* nearby areas Jumbo (Shopping Cen- Family shoppers Prisma, K-Citymarket (Hypermarkets), Stockmann, Core Lifestyle (Apple 30-120 €/sqm/month 10-4,000 sqm* tre) from surrounding H&M, Anttila, Zara, Stadium, Intersport, DinSko Premium Reseller), areas Bottega Verde Sello (Shopping Centre) Local Shoppers, Prisma, K-Citymarket (Hypermarkets), Lidl, Promod 45-55 €/sqm/month 30-3,000 sqm* commuters, Aleksi 13, H&M, Halonen, Clas Ohlson, Stadium, business density Intersport, Esprit, Gant Iso Omena Local Shoppers Prisma, K-Citymarket (Hypermarkets), H&M, Cubus, Guess 35-100 €/sqm/month 30-1,000 sqm* Lindex, Seppälä, Stadium, Specsavers, Sats *excluding hypermarkets CUSHMAN & WAKEFIELD. -

Gems in Seinäjoki

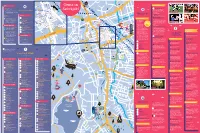

4 <- Vaasa 34 Y Valtionkatu stie 3 ga X Ä 10 en CULTURE, MUSEUMS INFO R Puskantie Gems in C 59 Kokkola -> Vaasantie 6 Emergency 50 A3 Seinäjoki City Theatre Koskenalantie 18 Z Awarded as the 2015 Theater of On call between 8am–8pm, Accommodation CITY CENTER 28 T Seinäjoki the Year. Versatile repertoire. Also p. +358 (0)6 425 5311 Koulukatu 6 58 39 has a lunch restaurant in gorgeous At nighttime between 8pm–8am, 33 surroundings. SJK SEINÄJOEN PALLOKERHO PAUKANEVA p. +358 (0)6 415 4555 22 70 Maamiehenk. Alvar Aallon katu 22 30 72 12 53 62 What to do Keskuskatu -> 37 Seinäjoki City Orchestra Police HOTELS 5 Juhonkatu 4 18 16 <- Kauhajoki Follow the repertoire at www.skor.fi 71 66 49 31 24 Sammonkatu 64 3 D Provincial museum of Tourist information 1 Scandic Seinäjoki <- Kalevankatu55 1 21 19 South Ostrobothnia South Ostrobothnia Tourist Kauppakatu 10 69 AALTO-CENTRE Porvarink. 56 A versatile and extensive museum Service Ltd. Located in the 13 15 6014 67 POHJA 2 Hotel Fooninki area located in the beautiful park area Travel Center (Matkakeskus) 61 1 Verkatehtaankatu 40 DAP The administrative Kaarretie 4 19 52 Ruukintie of Törnävä. The permanent exhibition premises 50 1 Valtionkatu and cultural center SQUASH & BOWLING CENTER THE DUDESONS ACTIVITY PARK 42 in the stone barn is about the past p. +358 (0)6 420 9090 3 Hotel-Restaurant Alma Kutojankatu of Seinäjoki is F 29 and present of Seinäjoki and the Ruukintie 4 20 Kauppakatu 67-> 48 one the most 32 57 Kulmak. substantial works province. -

Näsijärvi Pyhäjärvi

Kuru Mäntylä 85 90 Velaatta Poikelus 85 90 Orivesi 47, 49, 95 Terälahti 90 Mutala Maisansalo 90A 85 90C Teisko kko 90B Oriveden Lakiala Vastamäki asema Asuntila 92 95A 81 90 Hietasmäki 84 Viitapohja Kämmenniemi 92 90, 92 28 Moisio Iso-Kartano 80, 81, 84, 85 Siivikkala 90, 92 Peuranta Metsäkylä 80 92 83 Haavisto Eerola Honkasalo 90, 92 28 Julkujärvi 95 83 Kirkonseutu Kintulammi Elovainio 80, 81, 84, 85 92 83 Aitoniemi Eräjärvi Pappilanniemi 49 80-85 91 83 Sorila Taraste Pohtola 28A, 90-92 28B Ylöjärvi 28 Aitolahti Ruutana 80-85 91 28B Nurmi 80 Ryydynpohja Laureenin- Lentävänniemi 8Y, 28, 90 9, 19, 38 kallio 28B 85 Pohjola 80Y, 81 Olkahinen Järvenpää Ryydynpohja Niemi Reuharinniemi Näsijärvi 8Y, 28, 90 49 14 14 14 14 80 Lintulampi Teivo 28 Vuorentausta Kumpula 85 80Y, 81 14 8Y, 28, 90 9, 19, 38 80, 81 Niemenranta 20 8 Haukiluoma 21, 71, 80 8 Lamminpää 21,71 85 Rauhaniemi Atala 21 21,71 Lielahti 95 9, 14, 21, 19, 28, 38, 71, 80 2 28, 90 8 81 Potilashotelli 29 Tohloppi 5, 38 Ikuri 71 20 Lappi Ruotula Niihama 8, 29 Epilänharju Hiedanranta 2 Tays Arvo Särkänniemi Ranta-Tampella 1, 8, 28, 38, 42, 1, 8, 28, 38, 42, 28, 29, 90 Risso 21 8 Tohloppi 9, 14, 21, 19, 28, 38, 80 5, 38 90, 95 Myllypuro 100 11, 30, 31 Petsamo 90, 95 29 81 Santalahti 15A Tesoma Ristimäki 9, 14, 19, 21, 26 8, 17, 20,21, 26, 71 9, 14, 19, 21, 38, 71, 72, 80, 85 71, 72, 80, 85, 100 2 Osmonmäki 8 15A, 71 8, 17 Tohlopinranta Tays 8Y 38 38 Saukkola 80 Linnavuori 71 71 26 5, 38 1, 8, 28, 29, 80, 90, 95 29 42 79 17 26 15A 8, 17, 20, 15, Amuri Finlayson Jussinkylä Takahuhti Linnainmaa -

Mapic Insight

mapic insight THE 23RD EDITION OF MAPIC WILL TAKE PLACE ACROSS THREE DAYS DURING 15-17 NOVEMBER AT THE PALAIS DES FESTIVALS IN CANNES, ONCE AGAIN OFFERING THE INTERNATIONAL Courses RETAIL REAL ESTATE INDUSTRY AN OPPORTUNITYTO LEARN ABOUT THE LATEST TRENDS IN THE INDUSTRY, SPARK of Retail DEALS AND EXPAND BUSINESS OPPORTUNITIES. m DREAM ISLAND, MOSCOW, RUSSIA DEVELOPER: REGIONS GROUP ince 1995, MAPIC has been the premier event Food services are largely transforming shopping centres MAPIC 2017 Set to Entertain for industry professionals. Organised by Reed into convivial lifestyle venues. Media companies, film and video game specialists are MIDEM.this edition will feature more than 8,500 The point of sale experience is a vital element in disrupting leisure offerings in shopping centres through participants from across the international retail persuading consumers to go out rather than buy online. partnerships with various commercial real estate Sreal estate sector. For ultra-connected clients, the shopping experience players.The entertainment leader and top international With an extensive exhibition zone set to be on and its associated human encounters are more video game publisher Ubisoft will be taking part in a site, and with two days featuring more than 100 important than the product itself. As a result, traditional panel session during the event to discuss the growing retail conferences, keynote addresses and networking shopping centres are transforming into social sites for concept of the "Family Entertainment Centre". events featuring more than 200 industry experts, meeting others and leisure activities where people This concept is now offering a leisure attraction and MAPIC gives its attendees a chance like no other to come to spend the day. -

Kansainvälisten Kiinteistösijoittajien Merkitys Kiinteistö- Ja Rakennusalalle

KANSAINVÄLISTEN KIINTEISTÖSIJOITTAJIEN MERKITYS KIINTEISTÖ- JA RAKENNUSALALLE Varatoimitusjohtaja Juhani Reen, Newsec Oy RTS/Rakennusfoorumi 8.5.2007 Newsec Yleiskatsaus • Tarjoamme palveluita kiinteistönomistajille, tilojen käyttäjille sekä kiinteistösijoittajille koko pohjoismaissa Office Partners Representation Offices • 500 työntekijää, joista 85 Suomessa • Suomen liiketoiminnot: - transaktioneuvonanto (kaupat, arviot ja vuokraus) - management • Neuvonantajana toteutuneissa transaktioissa 8,I miljardin euron edestä vuodesta 2000 lähtien (3.0 Mrd euroa vuonna 2006) Muutamia viimeaikaisia ”highlighteja” : • Euromoney nimesi Newsecin Suomen parhaaksi neuvonantajaksi • Neuvonantajana UPM:n pääkonttorin kaupassa ~77 M€ • Neuvonantajana Keskon salkun kaupassa yli 200 M€ • Ruotsissa neuvonantajana kaikkien aikojen suurimmassa kiinteistökaupassa yli 1 Mrd€ • Pohjoismainen yhteistyö aktivoitu tehokkaaksi yhteistyöksi, joista konkreettisia esimerkkejä viikkopalaverit Ruotsin ja Norjan kanssa sekä työntekijöiden vaihto-ohjelma - 1 - Suurten kauppojen määrä Pohjoismaissa - 2 - Transactions Volume domestic international international portfolio estimated 6 5 4 3 1000MEUR 2 1 0 2001 2002 2003 2004 2005 2006 2007 Stock trading of listed property companies not included Source: KTI 2006- 3 - Top 5 foreign investors in Finland - 4 - ”Top 10” Transactions in Helsinki Region (years 2002-) NAME / USER TEN OFFICE BUILDINGS IN TYPE HELSINKI Region 63MEUR, Q3/2004 JUMBO SHOPPING PRICE, SIZE m² ILMARINEN POLAR AVIAPOLIS LEISURECENTER/ CENTER, 135MEUR, TIME -

VALUATION REPORT ASUNTO OY VUORIKATU 6 (SHARES 1-142) OFFICE UNIT LH2, 142 Sq M VUORIKATU 6 00100 HELSINKI

VALUATION REPORT ASUNTO OY VUORIKATU 6 (SHARES 1-142) OFFICE UNIT LH2, 142 sq m VUORIKATU 6 00100 HELSINKI Value Date: 3.2.2021 The Date of the Report: 9.2.2021 CONTENTS DESCRIPTION OF THE ASSIGNMENT • Contents and Description of the assignment • The valuation report is ordered by Harri Saravuo, PKS Retail Oy for • Property Description financing purposes. • Location and Area • The purpose of the valuation is to define the market value of the office unit. • Site and Town plan The valuation currency is Euro. • Building, Pictures and Floor plans • The valuation object is the shares 1-142 of Asunto Oy Vuorikatu • Rental income • 6, located at the address Vuorikatu 6, 00100 Helsinki. The shares • The Property Compared to Market entitle the holder to control an office unit LH2 with lettable area • Market review of 142 sqm. The valuation object is described more detailed on • Economy page 7. • Corona – Material Valuation Uncertainty • The valuation report is conducted by Tiina Kykyri as the • Investment Market responsible valuer and Kaj Söderman as the controller of the valuation. They both act in this valuation in the capacity of an • HMA Office Market independent valuer. • Comparable transactions • Tiina Kykyri has visited the valuation object and made an external • Valuation and internal inspection on 3.2.2021 and gives more information • Valuation assumptions and parametres about the report: • Market Value and Summary [email protected], • Basic principals, Terminology and Liability +358 50 530 4664. • Data used in the valuation • The valuers are qualified and have the required experience. • The valuation is based on information regarding the property and Due to the outbreak of the Novel Coronavirus (COVID-19), at the valuation date its surroundings received from the client, from public registers we do not consider that we can rely upon previous market evidence to fully and from other information sources. -

Tonttihakuohjelmointi 2021-2025

TONTTIHAKUOHJELMOINTI 2021-2025 Yhtiömuotoiset tontit • Tehdään viisivuotiskaudeksi • Perustuu asemakaavoitusohjelmaan • Ohjelmoinnissa esitetään kunakin vuonna yleiseen tonttihakuun ja erilaisiin kilpailuihin haettavaksi tuleva rakennusoikeuden määrä • Ohjelmoinnissa esitetään vuosittain kohtuuhintaiseen asuntotuotantoon haettavaksi laitettavan rakennusoikeuden osuus • Kohtuuhintaisen tuotannon määritelmä MAL4-sopimuksesta: a) ARA-rahoituksella toteutettavat • Tavalliset vuokra-asunnot (pitkä ja lyhyt korkot) • Asumisoikeusasunnot • Erityisryhmäasunnot vanhusväestölle, asunnottomille, kehitysvammaisille, opiskelijoille ja nuorisolle sekä muille erityisryhmille (pitkä korkotuki + investointiavustus) • ARA:n tukemat monimuotoisen asumisen kokeilut, kuten sekarahoitteiset kohteet asuntojen monipuolisen hallintamuodon varmistamiseksi b) kuntakonsernin oma ARA-vuokratasoa vastaava vuokra-asuntotuotanto (omakustannusperiaate) 2 • Kohtuuhintaisen vuokra-asuntotuotannon riittävyyden varmistamiseksi tontteja voidaan luovuttaa neuvottelumenettelyllä kaupunkikonserniin kuuluvien vuokra-asuntoyhteisöjen omaan vuokra- asuntotuotantoon • Toteutetaan Hiilineutraali Tampere 2030 tiekartan toimenpiteitä ja tavoitteita, kohdat: 112. Hiilijalanjälkiarviointi (pilotointi) 115. Nollaenergiarakentaminen 117. Kestävän ja älykkään rakentamisen teemat 130. Puurakentaminen 158. Hajautettujen energiajärjestelmien pilotointi. • Yksityisten maanomistajien ja/tai hankekehityskaavojen kautta hakuun tuleva rakennusoikeuden määrä esitetään yhtenä lukuna Excel-taulukossa; -

Citycon Annual Report 2007 Annual Report Citycon Business and Property Portfolio

Pohjoisesplanadi 35 AB Tel. +358 9 680 36 70 www.citycon.fi FI-00100 Helsinki, Fax +358 9 680 36 788 [email protected] Finland Annual Report 2007 Contents 2007 Citycon in Brief .....................................................................................................................................1 Citycon as an Investment and Information for Shareholders .............................2 CEO’s Review ...........................................................................................................................................4 Business Environment .....................................................................................................................6 Citycon Annual Report Annual Report Citycon Business and Property Portfolio ...............................................................................................9 Finland ....................................................................................................................................................27 Sweden ...................................................................................................................................................30 Baltic Countries ................................................................................................................................32 Human Resources ...........................................................................................................................34 Profit Performance and Financial Position ..................................................................37