Smartphone Design Win Quarterly Monitor

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Opg01 Torisetsu Shousai.Pdf

はじめに ごあいさつ このたびは「OPPO Find X2 Pro」(以下、「本製品」または「本体」と表記し ます)をお買い上げいただき、誠にありがとうございます。 ご使用の前に本体付属の『クイックスタートガイド』『ご利用にあたっての 注意事項』または『取扱説明書 詳細版』(本書)をお読みいただき、正しくお 使いください。 同梱品一覧 ご使用いただく前に、次の同梱物がすべて揃っていることをご確認ください。 • 携帯電話本体(保護フィルム(試供品)貼付け済み) • ACアダプタ • USB Type-C™データケーブル(試供品) • SIM取出し用ピン(試供品) • イヤホン(試供品) • 保護ケース(試供品) • クイックスタートガイド • ご利用にあたっての注意事項 取扱説明書について ■『クイックスタートガイド』『ご利用にあたっての注意事項』■ 初めてお使いになる前に必要な情報や注意事項を説明しています。 ■『取扱説明書■ ■詳細版』(本書) さまざまな機能のより詳しい説明を記載した『取扱説明書 詳細版』はau ホームページでご確認できます。 (https://www.au.com/support/service/mobile/guide/manual/) 1 メッセージを送信する................................................................................19 目次 グループを作る/グループに送信する.....................................................19 +メッセージを設定する............................................................................19 はじめに..............................................................................................................1 ブロックリストを設定する........................................................................20 ごあいさつ......................................................................................................1 公式アカウントとのやりとりをブロックする.........................................20 同梱品一覧......................................................................................................1 インターネット...............................................................................................20 取扱説明書について.......................................................................................1 インターネットに接続する........................................................................20 -

America's Best Deserve Our Best

Teachers and their Families America’s Best Deserve our best 25% Discount for Eligible Educators Certified/licensed K-12 classroom teachers/educators are eligible Existing customers qualify and it is for ALL the lines on your plan No Purchase Necessary Bring your Own devices to AT&T & get up to $500 in pre-paid Visa cards! Call - Text - Email Additional Promotions Authorized AT&T Retailer JP Stork *FREE Devices 720-635-6119 *FREE Wireless Charging [email protected] Pads w /3+ new phones AT&T April Promotional Pricing *No purchase necessary for 25% discount Eligible Devices: • Eligible Purchased Smartphones o iPhone XS 64GB ($900), 256GB ($1050), 512GB ($1250) o iPhone XR 64GB ($500), 128GB ($550) o iPhone 11 Pro 64GB ($900), 256GB ($1050), 512GB ($1250) o iPhone 11 Pro Max 64GB ($1000), 256GB ($1150), 512GB ($1350) o iPhone 12 mini 64GB ($700), 128GB ($750), 256GB ($850) o iPhone 12 64GB ($800), 128GB ($850), 256GB ($950) o iPhone 12 Pro 128GB ($1000), 256GB ($1100), 512GB ($1300) o iPhone 12 Pro Max 128GB ($1100), 256GB ($1200), 512GB ($1400) • Eligible Trade-in Smartphones: o To qualify for $700 credit, minimum Trade-In value must be $95 or higher after device condition questions have been answered o Eligible devices: ▪ Apple: 8, 8 Plus, X, XR, XS, XS Max, 11, 11 Pro, 11 Pro Max, 12, 12 mini, 12 Pro, 12 Pro Max ▪ Samsung: A71, A71 5G, Fold, Z Fold2 5G, Galaxy S9, Galaxy S9+, Galaxy S9+ Duos, Galaxy S10, Galaxy S10+, Galaxy S10 5G, Galaxy S10e, Galaxy S10 Lite, Galaxy S20, Galaxy S20 Ultra 5G, Galaxy S20+ 5G, Note9, Note10, Note10+, -

Test Coverage Guide

TEST COVERAGE GUIDE Test Coverage Guide A Blueprint for Strategic Mobile & Web Testing SUMMER 2021 1 www.perfecto.io TEST COVERAGE GUIDE ‘WHAT SHOULD I BE TESTING RIGHT NOW?’ Our customers often come to Perfecto testing experts with a few crucial questions: What combination of devices, browsers, and operating systems should we be testing against right now? What updates should we be planning for in the future? This guide provides data to help you answer those questions. Because no single data source tells the full story, we’ve combined exclusive Perfecto data and global mobile market usage data to provide a benchmark of devices, web browsers, and user conditions to test on — so you can make strategic decisions about test coverage across mobile and web applications. CONTENTS 3 Putting Coverage Data Into Practice MOBILE RECOMMENDATIONS 6 Market Share by Country 8 Device Index by Country 18 Mobile Release Calendar WEB & OS RECOMMENDATIONS 20 Market Share by Country 21 Browser Index by Desktop OS 22 Web Release Calendar 23 About Perfecto 2 www.perfecto.io TEST COVERAGE GUIDE DATA INTO PRACTICE How can the coverage data be applied to real-world executions? Here are five considerations when assessing size, capacity, and the right platform coverage in a mobile test lab. Optimize Your Lab Configuration Balance Data & Analysis With Risk Combine data in this guide with your own Bundle in test data parameters (like number of tests, analysis and risk assessment to decide whether test duration, and required execution time). These to start testing with the Essential, Enhanced, or parameters provide the actual time a full- cycle or Extended mobile coverage buckets. -

Microsoft Surface Duo Teardown Guide ID: 136576 - Draft: 2021-04-30

Microsoft Surface Duo Teardown Guide ID: 136576 - Draft: 2021-04-30 Microsoft Surface Duo Teardown An exploratory teardown of the Microsoft Surface Duo, a brand-new take on foldables with a surprisingly simple hinge but precious few concessions to repair. Written By: Taylor Dixon This document was generated on 2021-05-02 03:27:09 PM (MST). © iFixit — CC BY-NC-SA www.iFixit.com Page 1 of 16 Microsoft Surface Duo Teardown Guide ID: 136576 - Draft: 2021-04-30 INTRODUCTION Microsoft has reportedly been working on the Surface Duo for six years. We can probably tear it down in less time than that, but with any brand-new form factor, there are no guarantees. Here’s hoping the Duo boasts the repairability of recent Microsoft sequels like the Surface Laptop 3 or the Surface Pro X—otherwise, we could be in for a long haul. Let’s get this teardown started! For more teardowns, we’ve got a trio of social media options for you: for quick text we’ve got Twitter, for sweet pics there’s Instagram, and for the phablet of the media world there’s Facebook. If you’d rather get the full scoop on what we’re up to, sign up for our newsletter! TOOLS: T2 Torx Screwdriver (1) T3 Torx Screwdriver (1) T5 Torx Screwdriver (1) Tri-point Y000 Screwdriver (1) Spudger (1) Tweezers (1) Heat Gun (1) iFixit Opening Picks set of 6 (1) Plastic Cards (1) This document was generated on 2021-05-02 03:27:09 PM (MST). © iFixit — CC BY-NC-SA www.iFixit.com Page 2 of 16 Microsoft Surface Duo Teardown Guide ID: 136576 - Draft: 2021-04-30 Step 1 — Microsoft Surface Duo Teardown The long-awaited Surface Duo is here! For $1,400 you get two impossibly thin slices of hardware that you can fold up and put in your pocket.. -

Test Report on Terminal Compatibility of Huawei's WLAN Products

Huawei WLAN ● Wi-Fi Experience Interoperability Test Reports Test Report on Terminal Compatibility of Huawei's WLAN Products Huawei Technologies Co., Ltd. Test Report on Terminal Compatibility of Huawei's WLAN Products 1 Overview WLAN technology defined in IEEE 802.11 is gaining wide popularity today. WLAN access can replace wired access as the last-mile access solution in scenarios such as public hotspot, home broadband access, and enterprise wireless offices. Compared with other wireless technologies, WLAN is easier to operate and provides higher bandwidth with lower costs, fully meeting user requirements for high-speed wireless broadband services. Wi-Fi terminals are major carriers of WLAN technology and play an essential part in WLAN technology promotion and application. Mature terminal products available on the market cover finance, healthcare, education, transportation, energy, and retail industries. On the basis of WLAN technology, the terminals derive their unique authentication behaviors and implementation methods, for example, using different operating systems. Difference in Wi-Fi chips used by the terminals presents a big challenge to terminal compatibility of Huawei's WLAN products. Figure 1-1 Various WLAN terminals To identify access behaviors and implementation methods of various WLAN terminals and validate Huawei WLAN products' compatibility with the latest mainstream terminals used in various industries, Huawei WLAN product test team carried out a survey on mainstream terminals available on market. Based on the survey result, the team used technologies and methods specific to the WLAN field to test performance indicators of Huawei's WLAN products, including the access capability, authentication and encryption, roaming, protocol, and terminal identification. -

OPPOCARE+ for Find X2 Series

R-OCARE+/OTSR/180/200604001 OPPOCARE+ For Find X2 Series OPPOCARE+ provides smartphone owners a professional, reliable, convenient and trustworthy ‘After Sales Service’ solution along with other bundled benefits for smart phones (hereinafter referred to as “Offer”). i. Plan Benefits It is a comprehensive plan designed for your peace of mind in case your mobile gets damaged. The key benefits under the Plan are: One Time Screen Replacement within 180 days from the date of activation. Free pick-up & drop for repairs in major cities* within warranty period. Free Screen Guard & Back Cover Service. Platinum care-: 24*7 Hotline support. *Each benefit is referred as a service product & Specific T&C’s related to each service product is mentioned separately. ii. Offer period, Place, Outlet Coverage OPPOCARE+ is valid for all OPPO Find X2 series (“Products”). Offer shall be valid across the territory of India. This offer is available on the products purchased through OPPO’s authorized online & offline stores. Purchase of the products through online platforms is subject to T&C’s hosted on their particular website. OPPO reserves the right to extend or annul the offer at its sole discretion. iii. Publicity Customers unconditionally consent to accessing/use of information and/or images of Participant (if any, clicked or shared by Customer) by OPPO or its authorized agency for media coverage, advertisement or publicity for present & future communications without any further consideration to the Participant including promotion of its products anywhere in the World. R-OCARE+/OTSR/180/200604001 iv. General Conditions Customer hereby acknowledges and agrees to share the information by the Company to its affiliates, service providers etc. -

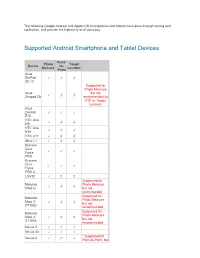

Supported Android Smartphone and Tablet Devices

The following Google Android and Apple iOS smartphones and tablets have gone through testing and calibration, and provide the highest level of accuracy: Supported Android Smartphone and Tablet Devices Point- Photo Target Device to- Measure Location Point Asus ZenPad ✓ ✗ ✗ 3S 10 Supported for Photo Measure Asus but not ✓ ✗ ✗ Zenpad Z8 recommended for P2P or Target Location Asus Zenpad ✓ ✓ ✓ Z10 HTC One ✓ ✗ ✗ M8 HTC One ✓ ✗ ✗ Mini HTC U11 ✓ ✗ ✗ iNew L1 ✓ ✗ ✗ Kyocera Dura ✓ ✓ ✓ Force PRO Kyocera Dura ✓ ✓ ✓ Force PRO 2 LGV20 ✓ ✗ ✗ Supported for Motorola Photo Measure ✓ ✗ ✗ Moto G but not recommended Supported for Motorola Photo Measure Moto X ✓ ✗ ✗ but not XT1052 recommended Supported for Motorola Photo Measure Moto X ✓ ✗ ✗ but not XT1053 recommended Nexus 5 ✓ ✓ ✓ Nexus 5X ✓ ✓ ✓ * Supported for Nexus 6 ✓ ✓* ✓ Point-to-Point, but cannot guarantee +/-3% accuracy * Supported for Point-to-Point, but Nexus 6P ✓ ✓* ✓ cannot guarantee +/-3% accuracy * Supported for Point-to-Point, but Nexus 7 ✓ ✓* ✓ cannot guarantee +/-3% accuracy Samsung Galaxy ✓ ✓ ✓ A20 Samsung Galaxy J7 ✓ ✗ ✓ Prime * Supported for Samsung Point-to-Point, but GALAXY ✓ ✓* ✓ cannot guarantee Note3 +/-3% accuracy Samsung GALAXY ✓ ✓ ✓ Note 4 * Supported for Samsung Point-to-Point, but GALAXY ✓ ✓* ✓ cannot guarantee Note 5 +/-3% accuracy Samsung GALAXY ✓ ✓ ✓ Note 8 Samsung GALAXY ✓ ✓ ✓ Note 9 Samsung GALAXY ✓ ✓ ✓ Note 10 Samsung GALAXY ✓ ✓ ✓ Note 10+ Samsung GALAXY ✓ ✓ ✓ Note 10+ 5G Supported for Samsung Photo Measure GALAXY ✓ ✗ ✗ but not Tab 4 (old) recommended Samsung Supported for -

XM:MI-10-5G-Phone-8GB-256GB Datasheet

XM:MI-10-5G-Phone-8GB-256GB Datasheet Get a Quote Overview Related Similar 5G Phones Product Code SIM Battery Chipset Support 5G Bands Size Samsung Galaxy Dual Snapdragon S20 Ultra SM- 5000mAh 5G TDD Sub6: N41(2500)/N78(3500)/N79(4500) 6.9 inches SIM 865+ G9880 Samsung Galaxy Dual Snapdragon Note20 Ultra SM- 4500mAh 5G TDD Sub6: N41(2500)/N78(3500)/N79(4500) 6.9 inches SIM 865+ N9860 Samsung Galaxy Z Dual Snapdragon 3300mAh 5G TDD Sub6: N41(2500)/ N78(3500)/N79(4500) 6.7 inches Flip SM-F7070 SIM 865+ HUAWEI P40 5G Dual 3800mAh Kirin 990 5G NR: n1/n3/n41(2515M-2690MHz)/n77/n78/n79 6.1 inches Phone SIM HUAWEI Mate 40 Dual 4200 5G NR: n1/n3/n28 (TX: 703 MHz-733 MHz, RX: 758 MHz-788 MHz) Kirin 9000E 6.5 inches 5G Phone SIM mAh /n38/n40/n41/n77/n78/n79/n80/n84 iPhone 12 / iPhone Dual 2815 5G A14 Bionic chip 6.1 inches 12 Pro SIM mAh NR: n1/n2/n3/n5/n7/n8/n12/n20/n25/n28/n38/n40/n41/n66/n77/n78/n79 Dual 3687 5G NR: iPhone 12 Pro Max A14 Bionic chip 6.7 inches SIM mAh n1/n2/n3/n5/n7/n8/n12/n20/n25/n28/n38/n40/n41/n66/n77/n78/n79 Xiaomi Mi 10 5G Dual Snapdragon 6.67 4780mAh 5G NR: n1/n3/n41/n78/n79 Phone SIM 865 inches Dual 4500 Snapdragon 6.67 Xiaomi Mi 10 Ultra 5G NR: n1/n3/n41/n78/n79 SIM mAh 865 (7 nm+) inches OPPO Reno4 5G Dual Snapdragon 4020mAh 5G NR: n1/n3/n41/n77/n78/n79 6.4 inches Phone SIM 765G OPPO Find X2 5G Dual Snapdragon 4200mAh 5G NR: n1/n41/n78/n79 6.7 inches Phone SIM 865 Learn More: 5G Devices Get More Information Do you have any question about the Xiaomi MI 10 5G Phone 8GB+256GB? Contact us now via Live Chat or [email protected]. -

Harga Gadget 19 APRIL 2021.Xlsx

DATE : 21 APRIL 2021 SENARAI HARGA TELEFON *POTONGAN PINJAMAN TAHUNAN (RM) BIL MODEL DESKRIPSI TUNAI (RM) 1 234567 SAMSUNG 1 SAMSUNG A022 (3+32gb) AKSESORI STANDARD 399.00 46 24 17 13 11 10 8 1 SAMSUNG A025/A02S (4+64gb) AKSESORI STANDARD 529.00 58 31 21 17 14 12 11 1 SAMSUNG A125 (6+128GB) AKSESORI STANDARD 799.00 84 44 31 24 20 17 15 1 SAMSUNG A42 (8+128GB) 5G AKSESORI STANDARD 1,599.00 158 84 58 46 38 33 29 1 SAMSUNG A32 (8+128GB) 4G (NEW) AKSESORI STANDARD 1,099.00 112 59 41 32 27 23 21 1 SAMSUNG A32 (8+128GB) 5G (NEW) AKSESORI STANDARD 1,199.00 121 64 45 35 29 25 22 1 SAMSUNG A52 (8+256GB) (NEW) AKSESORI STANDARD 1,499.00 149 79 55 43 36 31 28 1 SAMSUNG A72 (8+256GB) (NEW) AKSESORI STANDARD 1,799.00 177 94 65 51 42 37 33 1 SAMSUNG A515 (8+256GB) (NEW) AKSESORI STANDARD 1,399.00 140 74 51 40 33 29 26 1 SAMSUNG A715 (8+128GB) AKSESORI STANDARD 1,699.00 168 89 62 48 40 35 31 1 SAMSUNG GALAXY FOLD 2 5G (F916b) AKSESORI STANDARD 7,999.00 758 400 279 218 182 157 140 1 SAMSUNG Z FLIP AKSESORI STANDARD 3,999.00 383 202 141 110 92 80 71 1 SAMSUNG S20 FE 5G (G781) AKSESORI STANDARD 2,999.00 290 153 107 83 69 60 53 1 SAMSUNG S21 (128GB) (NEW) AKSESORI STANDARD 3,499.00 336 178 124 97 81 70 62 1 SAMSUNG S21 (256GB) (NEW) AKSESORI STANDARD 3,699.00 355 188 131 102 85 74 66 1 SAMSUNG S21+ (128GB) (NEW) AKSESORI STANDARD 3,999.00 383 202 141 110 92 80 71 1 SAMSUNG S21+ (256GB) (NEW) AKSESORI STANDARD 4,299.00 411 217 151 118 99 85 76 1 SAMSUNG S21 ULTRA 5G (128GB) (NEW) AKSESORI STANDARD 4,999.00 477 252 175 137 114 99 88 1 SAMSUNG S21 ULTRA 5G -

Detectan En Android Un Fallo De Seguridad Torino, Que Utiliza Los Nú- Meros Del 1 Al 10, Y Los Cla- Sifica De La Siguiente Forma

LUNES 7 DE OCTUBRE DEL 2019 Sección B ¿PUEDE coMPETIR coN LA TABLETA DE AppLE? Surface Pro 7 Afirma vs. iPad Pro NASA que ›› Microsoft mejoró la Surface Pro 7 con nuevos procesadores y gráficos, ningún mientras que el iPad Pro recibe nuevos poderes gracias a iPadOS asteroide impactará CDMX.- Microsoft anun- positivos 2-en-1 con Windows ció durante su evento del 2 10. Pero, ¿es suficiente pa- la Tierra de octubre en Nueva York la ra evitar que las personas nueva Surface Pro 7, pero el usen en cambio un iPad Pro en futuro anuncio pudo verse eclipsa- de Apple para tenerlo como do entre tantas novedades, reemplazo de una computa- cercano pues Microsoft también anun- dora portátil? Sí, el hardware ció ese día la nueva Surface actual del iPad Pro tiene ca- La Administración Nacional Laptop 3 y hasta un teléfo- si un año de antigüedad, pe- de la Aeronáutica y del no Android de doble pantalla, ro Apple acaba de lanzar iPa- Espacio (NASA) desmin- el Surface Duo, y una table- dOS, una versión actualiza- tió desde hace tiempo que ta de doble pantalla Surface da de iPad de iOS con nue- un asteroide pasaría muy Neo con el software Windows vas características para ayu- cerca o que se impacta- 10X para dispositivos de do- dar a que se sienta más como ría con la Tierra este jue- ble pantalla. También fue un sistema operativo de ves, aunque en redes so- eclipsado por la Surface Pro escritorio. ciales fue difundido ese te- X, una tableta de 13 pulga- La característica que ge- mor, y agregó que no existe das que ejecuta Windows en neró mucho interés cuando otra amenaza en un futuro una versión personalizada de iPadOS entró en beta fue la cercano. -

ASUS A002 2 Asus Zenfone AR ASUS A002 1 Asus Zenfone AR (ZS571KL) ASUS A002

FAQ for Toyota AR MY (iOS and Android) Q1. What types of devices are required to operate Toyota AR MY? A1. Toyota AR MY requires the latest high-end Apple and Android mobile devices with ARKit and ARcore to operate smoothly. Q2. What types of Apple devices can support Toyota AR MY? A2. The Apple iPhone (iPhone 6S and above), iPhone SE, iPad Pro (2nd Generation and above) and iPad (5th Generation and above). Q3. What types of Android mobile devices support Toyota AR MY? A3. Android devices such as AndroidOS 8 and above support the AR core framework. Other supporting Android devices are listed as below: Manufacturer Model Name Model Code Asus ROG Phone ASUS_Z01QD_1 Asus ZenFone Ares (ZS572KL) ASUS_A002_2 Asus ZenFone AR ASUS_A002_1 Asus ZenFone AR (ZS571KL) ASUS_A002 Manufacturer Model Name Model Code Google Pixel 3 blueline Google Pixel sailfish Google Pixel 2 walleye Google Pixel XL marlin Google Pixel 3 XL crosshatch Google Pixel 2 XL taimen Manufacturer Model Name Model Code Huawei Honor 8X HWJSN-H Huawei Honor 8X Max HWJSN-HM Huawei P20 Pro HWCLT Huawei P20 Pro HW-01K Huawei Honor 10 HWCOL Huawei P20 lite HWANE Huawei Nexus 6P angler Huawei Mate 20 X HWEVR Huawei Mate 20 Pro HWLYA Huawei nova 3 HWPAR Huawei Honor Magic 2 HWTNY Huawei HUAWEI Y9 2019 HWJKM-H Huawei Mate 20 HWHMA Huawei Mate 20 lite HWSNE Huawei nova 3i HWINE Manufacturer Model Name Model Code LG Electronics Q8 anna LG Electronics Q8 cv7an LG Electronics G7 One phoenix_sprout LG Electronics LG G6 lucye LG Electronics JOJO L-02K LG Electronics LG G7 ThinQ judyln LG Electronics -

IWGGCR/2 I INTERNATIONAL WORKING GROUP on GAS-COOLED REACTORS

vv International Atomic Energy Agency IWGGCR/2 i INTERNATIONAL WORKING GROUP ON GAS-COOLED REACTORS Specialists Meeting on Coolant Chemistry, Plate-out and Decontamination in Gas-cooled Reactors Juelich, Federal Republic of Germany 2-4 December 1980 SUMMARY REPORT INTERNATIONAL ATOMIC ENERGY AGENCY Specialists' Meeting on Coolant Chemistry, Plate-out and Decontamination in Gas-cooled Reactors Juelich, Federal Republic of Germany 2-4 December 1980 Chairman: C.-B. von der Decken Kernforschungsanlage Juelich GmbH. Institut fuer Reaktorbauelemente Juelich, Federal Republic of Germany Scientific Secretary: J. Kupitz International Atomic Energy Agency Vienna, Austria SUMMARY REPORT Printed by the IAEA in Austria May 1981 CONTENTS 1. INTRODUCTION 5 2. SUMMARY AND CONCLUSIONS 2A. Fission Product Plnte-out 1 & 2 5 2П. Decontamination of Activity 6 2C. Coolant Chemistry 6 21). Discussions, Conclusions and Recommendations 7 3. CONTRIBUTIONS In-pile helium loop "Comédie" 8 J J. Abnssin, R.J. Blanchard, J. Gentil Out-ot'-pile helium loop for liftoff experiments 17 R.J. Blanchard, A. Bros, J. Gentil Experimental facilities for plate-out investigations and future work 26 K. Muenchow, II. Dederichs, N. Iniotakis, B. Sackmann Results from plate-out investigations 35 N. Iniotakis, J. Malinowaki, H. Gottaut, K. Muenchow F.P. plate-out study using in-pile loop OGL-1 44 0. Baba Fission product behavior in the peach bottom and Fort St. Vrain HTGRs 49 D.L. Hanson, N.L. Baldwin, D.E. Strong Iodine sorption and desorption from low-alloy steel. and graphite 55 R.P. Wichner, M.F. Osborne, R.A. Lorenz, R.B. Briggs Remarks on possibilities and limitations of theoretical approach to plate-out problems 64 E.