Portfolio Performance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2007 Year Ended March 31, 2007 Aiming for a 10% Global Market Share

Unicharm Corporation Annual Report 2007 Year Ended March 31, 2007 Aiming for a 10% Global Market Share Since its founding in 1961, Unicharm Corporation has carefully nurtured a corporate culture based on the management philosophy of becoming “Number One” by continually doing its best. To this end, we have consistently delivered customer-oriented materials and products and worked to enhance product application supporting people’s lives everywhere. Our mission is to provide the best products and services to people of all ages, from infants to the elderly. We are striving to position ourselves as a category leader in high-growth markets by actively expanding into new areas, particularly in Asia, and delivering a product lineup in tune with customer needs and the regions in which we operate. In this manner, we aim to acquire a 10% global market share. Unicharm Ideals ● WE contribute to creating a better life for humankind by offering only the finest products and services to the customer, both at home and abroad. ● WE strive to pursue correct corporate management principles which bring together corporate growth, well-being among associates and fulfill our social responsibilities. ● WE bring forth the fruits of cooperation based on integrity and harmony, by respecting the independence of the individual, and striving to promote the Five Great Pillars. Beliefs and Pledges Unicharm Five Great Pillars Ideals • Pledge to the Customers • Creativity & Innovation • Pledge to Our Shareholders Beliefs and • Ownership • Pledge to Business Partners Pledges • Spirit of Challenge • Pledge to the Associates • Leadership • Pledge to Society • Fair Play Five Great Pillars Contents Fiscal 2007 Highlights ................................................ -

Securities Report Unicharm Corporation

Securities Report (The English translation of the Report pursuant to Article 24, Paragraph 1 of the Financial Instruments and Exchange Act for the 57th fiscal year, from January 1, 2016 to December 31, 2016) Unicharm Corporation (E00678) 57th Fiscal Year (from January 1, 2016 to December 31, 2016) Securities Report 1. This report is the Securities Report submitted pursuant to Article 24, Paragraph 1 of the Financial Instruments and Exchange Act via the Electronic Disclosure for Investors’ Network (“EDINET”) as set forth in Article 27-30-2 of the same Act, generated and printed with a Table of Contents and page numbers added. 2. The end of the report contains the Independent Auditor’s Reports that were attached to the above Securities Report submitted via the above method and the Internal Control Report and Confirmation Note that were submitted with the Securities Report. Unicharm Corporation Table of Contents The 57th Securities Report Page Cover .......................................................................................................................................................................... 1 Part 1. Information on the Company ........................................................................................................ 2 I. Overview of the Company ......................................................................................................................... 2 1. Key financial data and trends ...................................................................................................................... -

Special Article

Special Article By Sanjeev Sinha Author Sanjeev Sinha From Cars to Curry seasonally. The human resources are trained through a rigorous curriculum on processes, hygiene and customer service and the Who would think that a Japanese company would look into selling necessary instructions for seasonal menu changes are provided curry in the country of its origin, India! I was quite surprised when through efficient on-the-job training systems. As a result, high I was invited to discuss an India marketing strategy with the quality and consistency are ensured, allowing the management to president of Japan’s largest curry shop chain, Coco Ichiban. When scale up easily. I asked what made him so confident that he could sell curry in the Now, if I were to describe India in one word, it would be country of its origin, he said the same question had been asked “diversity”. In India the concept of diversity can be found in almost when Toyota considered selling cars in the United States. everything and that’s one of the major causes of the variability, or This answer carried a lot of weight and made me think about what volatility, of the environment as well. People tend to be very creative it is that has made Japan so successful, especially in the last century, and sometimes have to be creative in the absence of organized in various businesses of a global nature. Japan is well known for its solutions, which is the concept of Jugad, often translated as “frugal excellent technology, but having lived in Japan for 19 years now, innovation”. -

TOBAM Maximum Diversification All World Developed Ex North America USD

TOBAM Maximum Diversification All World Developed ex North America USD 31/12/2019 Instrument Weight BP PLC 0.10% IDEMITSU KOSAN CO LTD 0.21% INPEX HOLDINGS INC 0.07% JX HOLDINGS INC 0.09% NESTE OIL OYJ 1.16% OMV AG 0.08% SANTOS LTD 0.02% SBM OFFSHORE NV 0.05% TGS NOPEC GEOPHYSICAL CO ASA 0.02% VOPAK 0.02% WOOD GROUP (JOHN) PLC 0.02% AIR LIQUIDE 0.23% AIR WATER INC 0.02% AKZO NOBEL 0.12% ALUMINA LTD 0.03% AMCOR PLC-CDI 0.08% AVON RESOURCES LTD 0.53% BORAL LTD 0.02% CHR HANSEN HOLDING A/S 0.08% DAICEL CHEMICAL INDUSTRIES 0.02% DOWA HOLDINGS CO LTD 0.01% EMS-CHEMIE HOLDING AG-REG 0.03% FLETCHER BUILDING LTD 0.02% FORTESCUE METALS GROUP LTD 0.60% GIVAUDAN-REG 0.16% HITACHI CHEMICAL CO LTD 0.03% HUHTAMAKI OYJ 0.03% ISRAEL CHEMICALS LTD 0.02% JAMES HARDIE INDUSTRIES-CDI 0.07% JFE HOLDINGS INC 0.02% KANSAI PAINT CO LTD 0.03% KURARAY CO LTD 0.03% MITSUBISHI MATERIALS CORP 0.02% NEWCREST MINING LTD 1.35% TOBAM Maximum Diversification All World Developed ex North America USD 31/12/2019 Instrument Weight NIPPON PAINT CO LTD 0.05% NIPPON PAPER INDUSTRIES CO L 0.04% NIPPON SHOKUBAI CO LTD 0.01% NISSAN CHEMICAL INDUSTRIES 0.04% NOF CORP 0.02% NORTHERN STAR RESOURCES LTD 0.66% NOVOZYMES A/S-B SHARES 0.07% OJI PAPER CO LTD 0.03% ORICA LTD 0.02% ORORA LTD 0.02% SARACEN MINERAL HOLDINGS LTD 0.32% SMURFIT KAPPA GROUP PLC 0.04% SYMRISE AG 0.04% TAIHEIYO CEMENT CORP 0.02% TAIYO NIPPON SANSO CORP 0.02% TEIJIN LTD 0.02% THYSSENKRUPP AG 0.04% TORAY INDUSTRIES INC 0.02% WIENERBERGER AG 0.02% ADP 0.04% AENA SA 0.09% ALFA LAVAL AB 0.04% ALL NIPPON AIRWAYS CO LTD -

International Corporate Investment in Ohio Operations June 2020

Research Office A State Affiliate of the U.S. Census Bureau International Corporate Investment in Ohio Operations 20 September 2007 June 20 June 2020 Table of Contents Introduction and Explanations Section 1: Maps Section 2: Alphabetical Listing by Company Name Section 3: Companies Listed by Country of Ultimate Parent Section 4: Companies Listed by County Location International Corporate Investment in Ohio Operations June 2020 THE DIRECTORY OF INTERNATIONAL CORPORATE INVESTMENT IN OHIO OPERATIONS is a listing of international enterprises that have an investment or managerial interest within the State of Ohio. The report contains graphical summaries of international firms in Ohio and alphabetical company listings sorted into three categories: company name, country of ultimate parent, and county location. The enterprises listed in this directory have 5 or more employees at individual locations. This directory was created based on information obtained from Dun & Bradstreet. This information was crosschecked against company Websites and online corporate directories such as ReferenceUSA®. There is no mandatory state filing of international status. When using this directory, it is important to recognize that global trade and commerce are dynamic and in constant flux. The ownership and location of the companies listed is subject to change. Employment counts may differ from totals published by other sources due to aggregation, definition, and time periods. Research Office Ohio Development Services Agency P.O. Box 1001, Columbus, Ohio 43266-1001 Telephone: (614) 466-2116 http://development.ohio.gov/reports/reports_research.htm International Investment in Ohio - This survey identifies 4,303 international establishments employing 269,488 people. - Companies from 50 countries were identified as having investments in Ohio. -

FAST RETAILING CO., LTD. Takeda Pharmaceutical Co., Ltd. Nisshin

ANNUAL REPORT OF PROXY VOTING RECORD REPORTING PERIOD: JULY 1, 2018 – JUNE 30, 2019 WisdomTree Japan Equity Index ETF (JAPN/JAPN.B) _________________________________________________________________________________________________________ FAST RETAILING CO., LTD. Meeting Date: 11/29/2018 Country: Japan Primary Security ID: J1346E100 Record Date: 08/31/2018 Meeting Type: Annual Ticker: 9983 Shares Voted: 50 Vote Proposal Text Proponent Mgmt Rec Instruction Elect Director Yanai, Tadashi Mgmt For For Elect Director Hambayashi, Toru Mgmt For For Elect Director Hattori, Nobumichi Mgmt For For Elect Director Shintaku, Masaaki Mgmt For For Elect Director Nawa, Takashi Mgmt For For Elect Director Ono, Naotake Mgmt For For Elect Director Okazaki, Takeshi Mgmt For For Elect Director Yanai, Kazumi Mgmt For For Elect Director Yanai, Koji Mgmt For For Appoint Statutory Auditor Tanaka, Akira Mgmt For For Appoint Statutory Auditor Kashitani, Takao Mgmt For For Takeda Pharmaceutical Co., Ltd. Meeting Date: 12/05/2018 Country: Japan Primary Security ID: J8129E108 Record Date: 10/19/2018 Meeting Type: Special Ticker: 4502 Shares Voted: 4,500 Vote Proposal Text Proponent Mgmt Rec Instruction Approve Issuance of Common Shares in Mgmt For For Preparation for Acquisition of Shire Plc Elect Director Ian Clark Mgmt For For Elect Director Olivier Bohuon Mgmt For For Elect Director Steven Gillis Mgmt For For Nisshin Steel Co., Ltd. Meeting Date: 12/10/2018 Country: Japan Primary Security ID: J57828105 Record Date: 09/30/2018 Meeting Type: Special Ticker: 5413 ANNUAL REPORT OF PROXY VOTING RECORD REPORTING PERIOD: JULY 1, 2018 – JUNE 30, 2019 WisdomTree Japan Equity Index ETF (JAPN/JAPN.B) _________________________________________________________________________________________________________ Nisshin Steel Co., Ltd. -

TOPIX100 Constituents (As of October 31, 2019) No. Code Issue No. Code Issue 1 1605 INPEX CORPORATION 51 7201 NISSAN MOTOR CO.,LTD

TOPIX100 Constituents (as of October 31, 2019) No. Code Issue No. Code Issue 1 1605 INPEX CORPORATION 51 7201 NISSAN MOTOR CO.,LTD. 2 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 52 7202 ISUZU MOTORS LIMITED 3 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 53 7203 TOYOTA MOTOR CORPORATION 4 1928 Sekisui House,Ltd. 54 7267 HONDA MOTOR CO.,LTD. 5 2502 Asahi Group Holdings,Ltd. 55 7269 SUZUKI MOTOR CORPORATION 6 2503 Kirin Holdings Company,Limited 56 7270 SUBARU CORPORATION 7 2802 Ajinomoto Co.,Inc. 57 7733 OLYMPUS CORPORATION 8 2914 JAPAN TOBACCO INC. 58 7741 HOYA CORPORATION 9 3382 Seven & I Holdings Co.,Ltd. 59 7751 CANON INC. 10 3402 TORAY INDUSTRIES,INC. 60 7832 BANDAI NAMCO Holdings Inc. 11 3407 ASAHI KASEI CORPORATION 61 7974 Nintendo Co.,Ltd. 12 4063 Shin-Etsu Chemical Co.,Ltd. 62 8001 ITOCHU Corporation 13 4188 Mitsubishi Chemical Holdings Corporation 63 8002 Marubeni Corporation 14 4452 Kao Corporation 64 8031 MITSUI & CO.,LTD. 15 4502 Takeda Pharmaceutical Company Limited 65 8035 Tokyo Electron Limited 16 4503 Astellas Pharma Inc. 66 8053 SUMITOMO CORPORATION 17 4507 Shionogi & Co.,Ltd. 67 8058 Mitsubishi Corporation 18 4519 CHUGAI PHARMACEUTICAL CO.,LTD. 68 8113 UNICHARM CORPORATION 19 4523 Eisai Co.,Ltd. 69 8267 AEON CO.,LTD. 20 4528 ONO PHARMACEUTICAL CO.,LTD. 70 8306 Mitsubishi UFJ Financial Group,Inc. 21 4543 TERUMO CORPORATION 71 8308 Resona Holdings, Inc. 22 4568 DAIICHI SANKYO COMPANY,LIMITED 72 8309 Sumitomo Mitsui Trust Holdings,Inc. 23 4578 Otsuka Holdings Co.,Ltd. 73 8316 Sumitomo Mitsui Financial Group,Inc. 24 4661 ORIENTAL LAND CO.,LTD. -

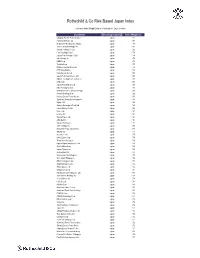

Rothschild & Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Chugoku Electric Power Co Inc/ Japan 1.01 Yamada Denki Co Ltd Japan 0.91 McDonald's Holdings Co Japan L Japan 0.88 Sushiro Global Holdings Ltd Japan 0.82 Skylark Holdings Co Ltd Japan 0.82 Fast Retailing Co Ltd Japan 0.78 Japan Post Holdings Co Ltd Japan 0.78 Ain Holdings Inc Japan 0.78 KDDI Corp Japan 0.77 Toshiba Corp Japan 0.75 Mizuho Financial Group Inc Japan 0.74 NTT DOCOMO Inc Japan 0.73 Kobe Bussan Co Ltd Japan 0.72 Japan Post Insurance Co Ltd Japan 0.69 Nippon Telegraph & Telephone C Japan 0.69 LINE Corp Japan 0.69 Japan Post Bank Co Ltd Japan 0.68 Nitori Holdings Co Ltd Japan 0.67 MS&AD Insurance Group Holdings Japan 0.66 Konami Holdings Corp Japan 0.66 Kyushu Electric Power Co Inc Japan 0.65 Sumitomo Realty & Development Japan 0.65 Fujitsu Ltd Japan 0.63 Suntory Beverage & Food Ltd Japan 0.63 Japan Airlines Co Ltd Japan 0.62 NEC Corp Japan 0.61 Lawson Inc Japan 0.60 Sekisui House Ltd Japan 0.60 ABC-Mart Inc Japan 0.60 Kyushu Railway Co Japan 0.60 ANA Holdings Inc Japan 0.59 Mitsubishi Heavy Industries Lt Japan 0.58 ORIX Corp Japan 0.57 Secom Co Ltd Japan 0.57 Seiko Epson Corp Japan 0.56 Trend Micro Inc/Japan Japan 0.56 Nippon Paper Industries Co Ltd Japan 0.56 Suzuki Motor Corp Japan 0.56 Japan Tobacco Inc Japan 0.55 Aozora Bank Ltd Japan 0.55 Sony Financial Holdings Inc Japan 0.55 West Japan Railway Co Japan 0.54 MEIJI Holdings Co Ltd Japan 0.54 Sugi Holdings Co Ltd Japan 0.54 Tokyo -

Summary of the White Paper on Manufacturing Industries (Monodzukuri) 2009

Summary of the White Paper on Manufacturing Industries (Monodzukuri) 2009 May 2009 Ministry of Economy, Trade and Industry Ministry of Health, Labour and Welfare Ministry of Education, Culture, Sports, Science and Technology <Table of Contents> Part 1 Current State of Manufacturing Infrastructure Technology and Related Issues Chapter 1: Status of Manufacturing Industries in Japan under the Worldwide Recession[p. 3] Section 1 Status of manufacturing industries in Japan under the worldwide recession Section 2 Current state of employment/labor of manufacturing workers Chapter 2: Challenges and Prospects Facing Japan’s Monodzukuri Industries[p. 12] -Strategic Move for the Growth of Japan’s Monodzukuri Industries- Section 1 Japan’s monodzukuri industries turn expanding limitations on resources and environmental constraints into a strength and continue to grow Section 2 Japan’s monodzukuri industries strive to enhance the level of manufacturing (monodzukuri) capability Section 3 Restructuring of global supply chains and merchandise strategy under worldwide recession Section 4 Strategic moves for the growth of manufacturing industries/approaches to and challenges for the development of prospective areas Chapter 3: Strengthening the Manufacturing Base by Developing Human Resources as the Core for Monodzukuri [p. 39] Section 1 Securing and training of core human resources in manufacturing industries Section 2 Skill development measures related to “monodzukuri” Chapter 4: Research and Development and Promotion of Study to Support the Basis of Monodzukuri [p. 50] Section 1 Situation of R&D and promotion of study to support the basis of monodzukuri Section 2 Promotion of regional R&D for strengthening of industrial capabilities Section 3 Promotion of R&D to enhance industrial capabilities Section 4 Development of monodzukuri human resources through school educational programs Part 2 Measures and Policies Implemented in Fiscal 2008 Relating to the Promotion of Manufacturing Infrastructure Technology [p. -

A List of Companies and Organizations for Human Rights Due Diligence Workshop in Japan

A list of Companies and Organizations for Human Rights Due Diligence Workshop in Japan *This list shows companies and organizations that participated in Human Rights Due Diligence Workshop in Japan *Names of the participants are listed in final reports of each year`s workshop. Developed on 3rd of April, 2020 A list of Companies for the Workshop Asahi Glass Co., Ltd., ASICS Corporation, Ajinomoto Co., Inc., ANA HOLDINGS INC., ABeam Consulting Ltd., ALPSELECTRICCO.,LTD., ANRITSU CORPORATION, E-Square Inc, EQ Management Limited, AEON CO., LTD., Insight Consulting Inc., The Walt Disney Company (Japan) Ltd., SGS Japan Inc., SG Holdings Co., Ltd., NTT DATA Corporation, NTT DOCOMO, INC., KAO Corporation, Kawasaki Kisen Kaisha, Ltd., Kawasaki Heavy Industries, Ltd., Casley Consulting, Inc., Kewpie Corporation, Kyodo Printing Co., Ltd., QUICK Corp ESG Research Center, Cuore C3 Co., Ltd., KUREHA CORPORATION, KOSÉ Corporation, INPEX CORPORATION, KONICA MINOLTA, INC., SUSCOM, Sanofi K.K., YUIDEA Inc., JSR Corporation, JCB Co., Ltd., Shiseido Company, Limited, NIPPON STEEL ENGINEERING CO., LTD., Sumitomo Chemical Company, Limited, SEKISUI CHEMICAL CO., LTD., Seven & i Holdings Co., Ltd., Sony Corporation, Sompo Risk Management Inc., DAIICHI SANKYO COMPANY, LIMITED, Takenaka Corporation, Duskin Co., Ltd., CHUGAI PHARMACEUTICAL CO., LTD., TDK Corporation, Teijin Limited, Taylor Made Golf Company, Inc., Deloitte Tohmatsu Consulting LLC, TOKIO MARINE & NICHIDO RISK CONSULTING CO.,LTD., Tokyo Foundation, TOSHIBA CORPORATION, TOTO LTD., TOYO SEIKAN GROUP -

![Appointment of Outside Directors by TSE-Listed Companies [Preliminary Figures]](https://docslib.b-cdn.net/cover/4238/appointment-of-outside-directors-by-tse-listed-companies-preliminary-figures-2314238.webp)

Appointment of Outside Directors by TSE-Listed Companies [Preliminary Figures]

Appointment of Outside Directors by TSE-Listed Companies [Preliminary Figures] Tokyo Stock Exchange, Inc. June 17, 2015 Appointment of Outside Directors 92.0% of the 1st Section appoint outside directors. [Ratio of 1st Section Companies with Outside Directors] 100% 92.0% 90% 80% 74.3% +17.7% 70% 62.3% 60% 55.4% 51.4% 48.5% 46.3% 50% 44.0% 45.2% 41.6% 40% 35.0% 30% 20% 10% 0% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 * Figures for years prior to 2015 are based on (i) corporate governance reports and (ii) research on corporate governance of the listed companies conducted by Japan Association of Corporate Directors. The figure for 2015 incorporates information in independent directors/auditors notifications submitted by listed companies on or before June 16, 2015. Ⓒ2015 Tokyo Stock Exchange, Inc. All rights reserved. 2 Appointment of Independent Directors 84.7% of the 1st Section appoint independent directors. [Ratio of 1st Section Companies with Independent Directors] 100% 90% 84.7% 80% +23.3% 70% 61.4% 60% 46.9% 50% 38.8% 40% 34.6% 31.5% 30% 20% 10% 0% 2010 2011 2012 2013 2014 2015 * Figures for years prior to 2015 are based on corporate governance reports. The figure for 2015 incorporates information in independent directors/auditors notifications submitted by listed companies on or before June 16, 2015. What is an independent director ? An outside director that is designated as an independent directors under the TSE listing rules. To protect the interests of general shareholders, TSE requires listed companies to file highly independent outside directors/auditors as independent directors/auditors. -

List of Donor Companies: Business Sector Emergency Donation for Earthquake Victims in Central Java, Indonesia, on May 27, 2006 (In Alphabetical Order of Companies)

List of Donor Companies: Business Sector Emergency Donation for Earthquake Victims in Central Java, Indonesia, on May 27, 2006 (in alphabetical order of companies) As of August 25, 2006 Nippon Keidanren Total amount contributed: \1,621,520,000.- Nippon Keidanren has been instrumental in soliciting business sector funds when disasters hit hard various parts of the world in the past. On May 27, 2006, central part of Java Island, Indonesia, was struck by a heavy earthquake, claiming more than 5,000 human lives and injuring almost 40,000, creating over 400,000 refugees and causing damages to more than 500,000 houses. Believing that the damages there were extensive, Nippon Keidanren initiated fund raising activities and provided solicited funds and goods such as tents and water purifiers for Indonesian people through Red Cross and NPOs under the auspice of the Japan Platform. Following is the list of donor companies that provided funds and goods through Nippon Keidanren and / or independently. 1 ABB K.K. 40 BOSCH CORPORATION 79 DAIWA HOUSE INDUSTRY CO.,LTD. 2 ACOM CO.,LTD. 41 BRIDGESTONE CORPORATION 80 DAIWA SECURITIES GROUP INC. 3 ADEKA CORPORATION 42 BROTHER INDUSTRIES,LTD. 81 DAIWABO COMPANY LIMITED 4 ADVANEX INC. 43 BUNKYODO CO.,LTD. 82 DENKI KAGAKU KOGYO K.K. 5 ADVANTEST CORPORATION 44 BUSINESS CONSULTANTS,INC. 83 DENSO CORPORATION 6 AEON 45 CALBEE FOODS CO.,LTD. 84 DENTSU INC. 7 AICHI STEEL CORPORATION 46 Canon Group 85 DHC CORPORATION 8 AICHI TOKEI DENKI CO.,LTD. 47 CAPCOM CO.,LTD. 86 DOWA MINING COMPANY,LTD. 9 AIFUL CORPORATION 48 CASIO COMPUTER CO.,LTD.