Employment Land Use Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Land and Building Asset Schedule 2018

STRATFORD ON AVON DISTRICT COUNCIL - LAND AND BUILDING ASSETS - JANUARY 2018 Ownership No Address e Property Refere Easting Northing Title: Freehold/Leasehold Property Type User ADMINGTON 1 Land Adj Greenways Admington Shipston-on-Stour Warwickshire 010023753344 420150 246224 FREEHOLD LAND Licence ALCESTER 1 Local Nature Reserve Land Off Ragley Mill Lane Alcester Warwickshire 010023753356 408678 258011 FREEHOLD LAND Leasehold ALCESTER 2 Land At Ropewalk Ropewalk Alcester Warwickshire 010023753357 408820 257636 FREEHOLD LAND Licence Land (2) The Corner St Faiths Road And Off Gunnings Occupied by Local ALCESTER 3 010023753351 409290 257893 FREEHOLD LAND Road Alcester Warwickshire Authority Occupied by Local ALCESTER 4 Bulls Head Yard Public Car Park Bulls Head Yard Alcester Warwickshire 010023389962 408909 257445 FREEHOLD LAND Authority Occupied by Local ALCESTER 5 Bleachfield Street Car Park Bleachfield Street Alcester Warwickshire 010023753358 408862 257237 FREEHOLD LAND Authority Occupied by Local ALCESTER 6 Gunnings Bridge Car Park School Road Alcester Warwickshire 010023753352 409092 257679 LEASEHOLD LAND Authority LAND AND ALCESTER 7 Abbeyfield Society Henley Street Alcester Warwickshire B49 5QY 100070204205 409131 257601 FREEHOLD Leasehold BUILDINGS Kinwarton Farm Road Public Open Space Kinwarton Farm Occupied by Local ALCESTER 8 010023753360 409408 258504 FREEHOLD LAND Road Kinwarton Alcester Warwickshire Authority Occupied by Local ALCESTER 9 Land (2) Bleachfield Street Bleachfield Street Alcester Warwickshire 010023753361 408918 256858 FREEHOLD LAND Authority Occupied by Local ALCESTER 10 Springfield Road P.O.S. -

Key Messages Rural Isolation Stratford-On-Avon District

Produced by the Insight Service, July 2017 Rural Isolation Across South Warwickshire Districts Key Messages Rural & Urban Rural Population The Eleven Rural Isolation Lower Super Output Areas Age Breakdown Indicators Stratford-on-Avon District population living in Eleven indicators have been identified and agreed by the Lower Super Output Areas (LSOAs) across rural LSOAs: 96,870 working group, representing different aspects of social exclusion South Warwickshire for those deemed to be rurally isolated. 159 Under 18 18,415 18 - 24 5,744 Access to Car / Van – percentage of households of Stratford-on-Avon District’s LSOAs are 1 without access to a car/van classified as rural (59 out of 73) 25 - 34 7,914 81% Road distance to a Post Office (km) – average road 2 distance to a Post Office 35 - 44 10,857 of Warwick District’s LSOAs are classified as Road distance to a GP Premises (km) – average road 45 - 54 15,352 3 16% rural (14 out of 86) distance to a GP 55 - 64 13,596 Road Distance to a Food Store (km) – average road 4 distance to a Food Store Rural & Urban 65 + 24,992 Road Distance to a Primary School (km) – average Population Breakdown 5 road distance to a Primary School Rural Population Stratford-on-Avon District Warwick District People on Income Support - number of claimants Gender Breakdown 6 (proportion of population aged 16 years plus) 23,622 The gender split for the population living in rural People in receipt of Disability Living Allowance (DLA) - number 7 of claimants aged under 69 years (proportion of population LSOAs is: aged 0 -

Monday Tuesday Wednesday Thursday Friday

MONDAY TUESDAY WEDNESDAY THURSDAY FRIDAY Chase Meadow Alcester Primary Care Centre Alcester Childrens Centre Dale Street Clinic Lighthorne Heath Clinic Community Centre Field Park Drive St Faith's Rd Dale Street Church Centre Lighthorne Childrens Centre Narrow Hall Meadow Alcester Alcester CV32 5HL Stratford Road Warwick B49 6PX B49 6AG Lighthorne Heath CV34 6BT 1st and 3rd Thursday CV33 9TW 2nd and 4th Tuesday 1st and 3rd Wednesday 9.30am - 11.30am 1.00pm – 3.00pm 1.30pm – 3.00pm 1.30pm – 3.00pm Last Friday 9.30am - 11.00am Lillington Children’s Centre Clinic Ellen Badger Hospital Bishops Itchington Clinic Hastings House Medical Centre Sydni Centre Mason Avenue Shipston on Stour Early Years Centre Rivers Way Cottage Square CV32 7QE CV36 4HP Poplar Road Wellesbourne CV31 1PT Bishops Itchington Warwick 10.00am – 12.00pm 2nd and 4th Tuesday CV47 2RT CV35 9RH 1st and 3rd 9.30am - 11.00 am 9.30am - 11.30am 1st Wednesday 1st and 3rd Thursday 1.00 pm – 2.45 pm 9.30am - 11am Rosebird Community Hall Bidford Methodist Church Temple Herdewyke Kineton Methodist Church Hall Shipston Rd Chapel Cl The Link Community Centre Southam Street Alderminster Bidford-on-Avon Stapledon Green Kineton Stratford-upon-Avon Alcester Temple Herdewyke Warwick CV37 8LU B50 4QB CV47 2UG CV35 0LL 2nd and 4th Monday 2nd & 4th Tuesday 2nd Wednesday 2nd Thursday 9.30am - 11.00am 10.30am – 12.00pm 10.30am – 12.00 pm 9.30am - 11.00am Appointment only 01926 815045 to book The Lees Chapel Lapworth Kenilworth United Reformed Hatton Park Village Hall Meon Medical Centre 89 Station -

Co Uncil L Ratfo Ord-O On-Av Von D Distr

Report to Stratford-on-Avon District Council by Pete Drew BSc (Hons), Dip TP (Dist) MRTPI an Inspector appointed by the Secretary of State for Communities and Local Government Date 20 June 2016 PLANNING AND COMPULSORY PURCHASE ACT 2004 (AS AMENDED) SECTION 20 REPORT ON THE EXAMINATION INTO THE STRATFORD-ON-AVON CORE STRATEGY Document submitted for examination on 30 September 2014 Hearings held between 6 and 29 January 2015 and 12 and 21 January 2016 Accompanied site inspections made on 2 and 3 February 2015 and 21 January 2016 File Ref: J3720/429/2 Contents Topic Page Table of abbreviations used in this report 3 Non-Technical Summary 4 Introduction and Background 5 Assessment of Duty to Co-operate 8 Assessment of Soundness 8 Main issues 8 Issue 1: Objectively Assessed Need 9 Issue 2: Sustainability Appraisal 27 Issue 3: Development strategy, including whether the 43 allocated housing sites are sound Issue 4: Economic development 83 Issue 5: Housing land supply 92 Issue 6: Affordable housing 118 Issue 7: Housing mix and type 123 Issue 8: Green Belt 129 Issue 9: Historic environment and design 131 Issue 10: Climate change and natural environment 133 Issue 11: Retail development 136 Issue 12: Miscellaneous policy issues: (i) special landscape areas; (ii) areas of restraint; (iii) the area strategies; (iv) accommodation for gypsies, travellers and travelling showpeople; (v) tourism and leisure development; (vi) healthy communities; (vii) transport and communications; (viii) developer contributions; and, (ix) the evening and night-time economy -

Lighthorne Heath - Kineton - Temple Herdewyke 77 Leamington - Bishops Tachbrook - Lighthorne Heath - Temple Herdewyke - Fenny Compton 77A

LEAMINGTON - BISHOPS TACHBROOK - LIGHTHORNE HEATH - KINETON - TEMPLE HERDEWYKE 77 LEAMINGTON - BISHOPS TACHBROOK - LIGHTHORNE HEATH - TEMPLE HERDEWYKE - FENNY COMPTON 77A MONDAYS TO SATURDAYS X77 77A 77A 77 77A 77 77A 77 77A 77 77 77A 77A 77 68 G1 SC NS HolS Sch NS S NS SC SC Trinity School Bus Park (Schooldays only) NS …. …. …. …. …. …. …. 1525 …. …. …. …. …. …. FS Warwickshire College (College Days Only) …. …. …. …. …. …. …. …. …. …. …. 1715 …. …. …. …. LEAMINGTON UPPER PARADE STAND J 0603 0830 0900 1010 1110 1210 1310 1420 1532 1605 1605 1725 1755 1805 1858 2330 Leamington Parish Church 0607 0834 0904 1014 1114 1214 1314 1424 1536 1609 1609 1729 1759 1809 1902 2334 Leamington opp. Railway Station …. …. …. 1016 1116 1216 1316 1426 …. …. 1611 1731 1801 1811 1905 …. Leamington Shopping Park …. …. …. 1019 1119 1219 1319 1429 …. …. … 1734 1804 1814 1908 …. Heathcote Hospital …. …. …. 1023 1123 1223 1323 1433 …. …. …. 1738 1808 1818 1912 …. Tachbrook Road Spa Park 0614 0841 0911 …. …. …. …. …. 1543 1616 M …. …. …. …. …. Bishops Tachbrook Mallory Road 0618L 0844L 0914L 1030 1130 1230 1330 1440 1548 1621 …. 1745 1815 1825 1923 R Ashorne …. …. …. …. …. …. 1340 …. R …. …. R R …. …. …. Moreton Morrell …. …. …. …. …. …. 1344 …. R …. …. R R …. …. …. Lighthorne Village …. …. …. …. …. …. 1351 …. R …. …. R R …. …. …. Lighthorne Heath Leam Road 0632H 0853H0923H 1041 1141 1241 1356 1451 R 1632 1642 R R 1836 1932H R Heritage Motor Centre …. …. …. 1045 1145 1245 1400 1455 …. …. …. …. …. …. …. …. Gaydon B4100 …. 0858 0928 …. 1148 …. 1403 …. R …. …. R R …. …. …. Gaydon Green 0638 …. …. 1049 …. 1249 …. 1459 …. 1636 1646 R R 1840 1935 R KINETON OPP CHURCH 0648 (0918) …. 1056 …. 1256 …. 1506 …. 1643 1653 R R 1847 1941 R Temple Herdewyke Stuart Gardens …. 0903 0933 …. 1153 1308 1408 …. R …. …. R R …. -

EX RC 020 Planning Inspectorate Report

SOUTH WESTERN RELIEF ROAD (SWRR) Evidence Report 31st July 2017 Disclaimer: This report has been jointly prepared by Stratford-on-Avon District Council and Warwickshire County Council Officers. It presents and utilises previous information provided as part of the preparation of the Stratford-on-Avon District Core Strategy. Please note: Warwickshire County Council advises that the report is yet to be reviewed and commented upon by their Cabinet to be signed off through their recognised reports processes and procedures. Table of Contents: Foreword .................................................................................................................... 1 1 Purpose of this Report ......................................................................................... 2 2 Background to Long Marston Airfield and the South Western Relief Road in the Core Strategy ............................................................................................................. 3 3 Identification of proposed route of the South Western Relief Road ..................... 9 4 Assessing Reasonable Alternatives ................................................................... 14 5 Conclusions of the Core Strategy Planning Inspector ........................................ 21 6 Summary and Conclusion .................................................................................. 24 Table of Figures: Figure 2.1 Site Location Plan for Long Marston Airfield ............................................. 3 Figure 2.2 Proposed Safeguarded Route -

Vebraalto.Com

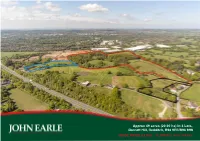

Approx 49 acres (20.00 ha) In 3 Lots, Gorcott Hill, Redditch, B98 9ER/B98 9HN GUIDE PRICE £8,000 - 10,000 Per Acre (+Fees) For sale by Public Auction, subject to prior sale, reserve and conditions at 6.30 pm on Tuesday 29th September 2020 at The View, Hill Farm Marina, Stratford Road, Wootton Wawen, Warwickshire, B95 6DE. 49 Acres (20.00 ha) of Land will be offered in 3 Lots; Lot 1 - 35.74 Acres (14.46 ha) of Land Lot 2 - 9.18 Acres (3.71 ha) of Land Lot 3 - 4.08 Acres (1.65 ha) of Land Large blocks of mature woodland/amenity land in the South Midlands area only occasionally come onto the open market. The opportunity now presented gives buyers the chance to purchase a useful acreage of mixed deciduous woodland which has been managed for timber production. The trees include good stands of oak with some ash and scots pine with an understory of bluebells and wild flowers in the Spring together with a rich diversity of birdlife. Originally part of the Skilts Estate (The bulk of which was sold in October 1948) there is an area extending to some 9.51 Acres (3.85 ha) of newly planted mixed woodland including sycamore, oak, alder etc. which will, in future years attract additional grant payments (further details from the auctioneer). The majority is South and South/East facing on the slopes of Gorcott Hill, easily accessed from the A435 dual carriageway. Lying some 14 miles South of Birmingham City Centre with excellent road communications via the M42 Motorway Junction 3. -

Cross-Boundary Growth of Redditch Borough

Housing Growth Background Document January 2013 Introduction Bromsgrove District Council and Redditch Borough Council jointly consulted on cross boundary growth options in 2010. Since then changes to the planning system have meant that both Councils need to work together to find a solution to meet the growth needs of Redditch which cannot all be sustainably accommodated within the Borough. The Councils have agreed to work together to find land within Bromsgrove District, in the vicinity of Redditch Borough, to sustainably accommodate this additional housing growth. This is a non-technical document that has been written to explain how a location has been identified by officers of both authorities to meet this cross-boundary growth. For this reason, technical information is not included but cross-referenced or results summarised in the relevant paragraphs. This document is structured to reflect the process of site selection and the following provides a summary of what each chapter will cover: Chapter Summary 1. Background To explain why cross boundary growth is necessary and how the growth requirements have been determined. This will cover the legislation, planning policies and evidence documents that are relevant to this cross boundary growth issue. 2. Strategic Objectives To identify the Strategic Objectives which site(s) will need to contribute to. 3. Methodology To explain how the site selection process was carried out and the sources of information. 4. Area Assessment Principles To identify the principles that will be used in the area assessment process. 5. Broad Area Appraisal To identify broad area(s) that are more appropriate for accommodating the development in accordance with relevant criteria. -

Weekly List Dated 19 April 2021

Stratford-on-Avon District Council Development Control Valid Applications Received Weekly list Dated 19 April 2021 The following Planning Applications received since the publication of the previous list dated 12 April 2021; may be viewed via the Council’s website http://apps.stratford.gov.uk/eplanning or electronically at Stratford on Avon District Council, Elizabeth House, Church Street, Stratford upon Avon CV37 6HX, during normal office hours, 8.45 am to 5.15 pm Monday to Wednesday inclusive, 8.45 am to 5.00 pm Thursday and Friday. To save the inconvenience of travelling to Elizabeth House, a copy of the submitted plan(s) have also been forwarded to the local Parish Council to whom you may refer. Any persons wishing to make representations about any of these applications may do so in writing to Planning Applications, Stratford on Avon District Council, Elizabeth House, Church Street, Stratford upon Avon CV37 6HX or alternatively by email; planning.applications@stratford- dc.gov.uk. Please note that all comments received will be a matter of public record and will be made available for public inspection on the Council’s website at www.stratford.gov.uk/planning. _____________________________________________________________________________ App No 21/00812/FUL Received 12 March 2021 Valid 7 April 2021 Location 26 High Street Alcester B49 5AB Proposal Change of use from a restaurant to a mixed use as a restaurant and a drinking establishment Applicant Name Louise Carroll Agents Name Steve Bromley Agents Address 189 Evesham Road Stratford Upon -

Download CD8/5 Water Cycle Study

Warwickshire sub-regional Water Cycle Study North Warwickshire Borough Council Final report Halcrow Group Limited Burderop Park Swindon SN4 0QD March 2010 01793 812479 http://www.halcrow.com/html/our_markets/watercycleplanning.htm Halcrow Group Limited has prepared this report in accordance with the instructions of their client, Rugby Borough Council, on behalf of the partner authorities. Any other persons who use any information contained herein do so at their own risk. © Halcrow Group Limited 2010 Sustaining & Improving the Quality of People’s Lives Warwickshire sub-regional Water Cycle Study North Warwickshire Borough Council Scoping and outline final report Halcrow Group Limited Burderop Park Swindon SN4 0QD March 2009 01793 812479 http://www.halcrow.com/html/our_markets/watercycleplanning.htm Halcrow Group Limited has prepared this report in accordance with the instructions of their client, Rugby Borough Council, on behalf of the partner authorities. Any other persons who use any information contained herein do so at their own risk. © Halcrow Group Limited 2010 Page i Sustaining & Improving the Quality of People’s Lives Page ii Sustaining & Improving the Quality of People’s Lives Warwickshire sub-regional Water Cycle Study Scoping and outline final water cycle study report Revision schedule Date Document reference Stage Author Approver 6th Nov v 0.1 Substantive Ali Cotton Andy 2009 draft McConkey 19 th Feb v1.0 Draft final Ali Cotton Andy 2010 McConkey 15 th March v2.0 Final Ali Cotton 2010 Page iii Sustaining & Improving the Quality -

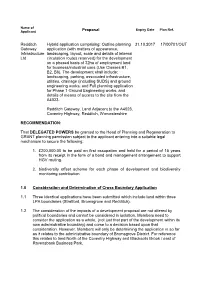

Redditch Gateway, Land Adjacent to the A4023, Coventry Highway, Redditch, Worcestershire

Name of Expiry Date Plan Ref. Applicant Proposal _______________________________________________________________________________________________________________________________________________________ Redditch Hybrid application comprising: Outline planning 31.10.2017 17/00701/OUT Gateway application (with matters of appearance, Infrastructure landscaping, layout, scale and details of internal Ltd circulation routes reserved) for the development on a phased basis of 32ha of employment land for business/industrial uses (Use Classes B1, B2, B8). The development shall include: landscaping, parking, associated infrastructure, utilities, drainage (including SUDS) and ground engineering works; and Full planning application for Phase 1 Ground Engineering works, and details of means of access to the site from the A4023. Redditch Gateway, Land Adjacent to the A4023, Coventry Highway, Redditch, Worcestershire RECOMMENDATION: That DELEGATED POWERS be granted to the Head of Planning and Regeneration to GRANT planning permission subject to the applicant entering into a suitable legal mechanism to secure the following: 1. £200,000.00 to be paid on first occupation and held for a period of 15 years from its receipt in the form of a bond and management arrangement to support HGV routing. 2. biodiversity offset scheme for each phase of development and biodiversity monitoring contribution. 1.0 Consideration and Determination of Cross Boundary Application 1.1 Three identical applications have been submitted which include land within three LPA boundaries (Stratford, Bromsgrove and Redditch). 1.2 The consideration of the impacts of a development proposal are not altered by political boundaries and cannot be considered in isolation. Members need to consider the application as a whole, (not just that part of the development within its own administrative boundary) and come to a decision based upon that consideration. -

Local Toddler Groups MONDAY Health Visitor

Lighthorne Heath & District Children’s Centre: Stratford Road Lighthorne Heath, Warwickshire CV33 9TW T: 01926 691105 E: [email protected] W: www.parentingproject.org.uk F: www.facebook.com/pages/lighthorne-heath-childrens-centre/767277346720682 Local Toddler Groups MONDAY Health Visitor Contact Numbers 09:30-11:00 Kineton Baby & Toddler Group Southam (for Fenny & Temple) 01926 815045 10:00-11:30 Priors Marston Toddler Group – Parish Church Shipston 01926 626546 Kineton 01926 626559 WEDNESDAY 09:00-10:30 Toddle-In Group – Kineton Methodist Hall Other services available at the Children’s Centre 09:30-11:30 Lighthorne Toddler Group – Lighthorne Village Hall Speech & Language Screening Counselling Service 09:45-11:45 Fenny Compton Toddler Group Home Visiting Service Triple P courses Children Centre Sessions Health Visitor Clinic See your Health Visitor, baby weigh and play Chatter Matters for Babies Songs, rhymes and sensory activities for babies to support their early communication skills - Course £10 Chatter Matters for Toddlers Songs, rhymes and fun activities for toddlers to help develop speech, language and communication skills - Course £10 Baby Play Play sessions 0-12 months - suggested donation £1.50 Boogie Tots Music and Movement for 0-5 years - suggested donation £1.50 Messy Explorers Messy play sessions for families with children 0-5 years – suggested donation £1.50 Speech and Language Drop In Drop in to discuss your child’s speech development with a therapist Baby Massage 6 week ‘touch and learn’ programme for