Euronext Investor Toolbox

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annex A, Information Products

ANNEX A, INFORMATION PRODUCTS OF THE EMDDA (APPLICABLE FROM AUGUST 2019) Annex A outlines the following Information products: ■ Euronext Indices Information Products ■ Euronext Cash Information Products ■ Euronext Derivatives Information Products ■ Other Information Products ■ Euronext Real Time Reference Prices All capitalized terms used but not defined herein will have the meaning as defined in the General Conditions. EURONEXT INDICES INFORMATION PRODUCTS Euronext Global Index Group compiles, calculates and publishes indices and iNAVs. It includes indices such as: the main national market indices such as the AEX®, Bel 20®, CAC 40®, ISEQ20® and PSI 20®, global/European/Euronext indices such as the Euronext 100® and Next 150® and a wide variety of sector and other indices. This also comprises volatility indices computed by Euronext, such as the VCAC and VAEX, and strategy indices. Euronext All Indices This Information product provides information relating to all indices calculated and published by Euronext, except for the ISE Bond Index. It includes real-time index levels, open, high, low and closing level of the indices. EURONEXT CASH INFORMATION PRODUCTS Euronext Cash Information Products comprise the Amsterdam, Brussels, Dublin, Lisbon and Paris regulated cash markets, including its equity markets, its Exchange Traded Funds (ETFs) and funds markets, its warrants and certificates markets and its fixed income markets. Euronext Continental Cash (Consolidated Pack) Last Price This Information product provides information about trades on Euronext’s cash markets in Amsterdam, Brussels, Lisbon and Paris and the ETF(s) traded on Euronext Dublin. It includes traded prices and quantities, open, high, low and closing prices of securities traded on Euronext’s cash markets. -

Compliance Statement

Compliance Statement Administrator: Euronext Dublin Full name: Euronext Dublin (The Irish Stock Exchange plc) Relevant National Competent Authority: CBI Compliance Statement Euronext Indices Euronext Dublin Version notes latest version February 2020 Version Version notes Euronext Dublin 1 October 2019 Initial version February 2020 Updated version including all new indices since 2 initial version. 3 4 5 6 Note: addition of indices does not lead to a new version of this statement. The lists will be kept up to date.The most recent update of the list was issued 09-Jun-2020. Only changes in significant indices and cessations of indices are marked as new version of the Compliance statement. This publication is for information purposes only and is not a recommendation to engage in investment activities. This publication is provided “as is” without representation or warranty of any kind. Whilst all reasonable care has been taken to ensure the accuracy of the content, Euronext does not guarantee its accuracy or completeness. Euronext will not be held liable for any loss or damages of any nature ensuing from using, trusting or acting on information provided. All proprietary rights and interest in or connected with this publication shall vest in Euronext. No part of it may be redistributed or reproduced in any form without the prior written permission of Euronext. Euronext refers to Euronext N.V. and its affiliates. Information regarding trademarks and intellectual property rights of Euronext is located at terms of use euronext For further information in relation to Euronext Indices please contact: [email protected] (c) 2020 Euronext N.V. -

Final Report Amending ITS on Main Indices and Recognised Exchanges

Final Report Amendment to Commission Implementing Regulation (EU) 2016/1646 11 December 2019 | ESMA70-156-1535 Table of Contents 1 Executive Summary ....................................................................................................... 4 2 Introduction .................................................................................................................... 5 3 Main indices ................................................................................................................... 6 3.1 General approach ................................................................................................... 6 3.2 Analysis ................................................................................................................... 7 3.3 Conclusions............................................................................................................. 8 4 Recognised exchanges .................................................................................................. 9 4.1 General approach ................................................................................................... 9 4.2 Conclusions............................................................................................................. 9 4.2.1 Treatment of third-country exchanges .............................................................. 9 4.2.2 Impact of Brexit ...............................................................................................10 5 Annexes ........................................................................................................................12 -

Euronext Dublin's Strategic Financing Programme

EURONEXT DUBLIN’S STRATEGIC FINANCING PROGRAMME 2019-2020 in partnership with IPOready | Euronext Dublin’s Strategic Financing Programme | 2019-2020 PREPARING COMPANIES TO HOW WILL THE PROGRAMME ACCESS STRATEGIC FINANCE BENEFIT ME? IPOready was launched by Euronext Dublin understand capital in 2015 to give companies a comprehensive markets, strategic understanding of how to raise strategic financing options and finance, the different options available and which options are the best mix for the growth of your business. most suitable for your business Financing is the fuel for scaling your business; achieving the right finance Padraic Clarke strategy for your business is critical to CFO - Atlantic Therapeutics enabling expansion and growth. get your business investment ready IPOready is designed to give you the skills and understand and knowledge to do this. It will help you the fund raising understand the demands of different I would recommend the IPOready process investor types (private equity, VC and public programme to any growing market) and help you to prepare your Irish company looking to access business to deliver to those expectations. significant finance as a critical strategic enabler of their growth. Even if an IPO is not the ultimate perfect your source of that finance, the investment learnings that I took away from pitch IS MY BUSINESS the programme are relevant to any fundraising situation, and were of ELIGIBLE TO benefit to Atlantic Therapeutics PARTICIPATE? in our recent equity fundraising. IPOready has provided us a fantastic -

Over 100 Exchanges Worldwide 'Ring the Bell for Gender Equality in 2021' with Women in Etfs and Five Partner Organizations

OVER 100 EXCHANGES WORLDWIDE 'RING THE BELL FOR GENDER EQUALITY IN 2021’ WITH WOMEN IN ETFS AND FIVE PARTNER ORGANIZATIONS Wednesday March 3, 2021, London – For the seventh consecutive year, a global collaboration across over 100 exchanges around the world plan to hold a bell ringing event to celebrate International Women’s Day 2021 (8 March 2020). The events - which start on Monday 1 March, and will last for two weeks - are a partnership between IFC, Sustainable Stock Exchanges (SSE) Initiative, UN Global Compact, UN Women, the World Federation of Exchanges and Women in ETFs, The UN Women’s theme for International Women’s Day 2021 - “Women in leadership: Achieving an equal future in a COVID-19 world ” celebrates the tremendous efforts by women and girls around the world in shaping a more equal future and recovery from the COVID-19 pandemic. Women leaders and women’s organizations have demonstrated their skills, knowledge and networks to effectively lead in COVID-19 response and recovery efforts. Today there is more recognition than ever before that women bring different experiences, perspectives and skills to the table, and make irreplaceable contributions to decisions, policies and laws that work better for all. Women in ETFs leadership globally are united in the view that “There is a natural synergy for Women in ETFs to celebrate International Women’s Day with bell ringings. Gender equality is central to driving the global economy and the private sector has an important role to play. Our mission is to create opportunities for professional development and advancement of women by expanding connections among women and men in the financial industry.” The list of exchanges and organisations that have registered to hold an in person or virtual bell ringing event are shown on the following pages. -

DEBT CAPITAL MARKETS Contents

DEBT CAPITAL MARKETS Contents About us 3 Our debt capital markets practice 4 How we deliver 5 Relevant experience 7 A genuinely global service 33 Our relationships 34 Fees 36 Partner profiles 37 2 Debt Capital Markets About us What we offer How we are different • A clear understanding of your key legal • A client‑focused approach – we are objectives – we strive to gain an in‑depth client‑focused, not product‑focused. Central understanding of your requirements and to our culture is the priority that we place objectives to enable our advice to be on client relationships and satisfying the tailored, focused and provided effectively individual needs of each of our clients • Leading expertise in debt capital markets – • A multi‑specialist approach to our practice we have been one of the leading law firms in debt – our lawyers do not work in narrow practice capital markets work throughout our history areas. We have a depth of expertise, a • Innovation – we work on cutting‑edge breadth of experience and sound commercial transactions and are known for our judgement in all areas of our legal service ability to deliver bespoke solutions • Technical excellence – our lawyers have an • Accessible and responsive lawyers – we unsurpassed reputation for technical excellence ensure availability and respond swiftly • A genuinely global, world‑class response • An ability to deliver on time – we ensure – we work as a single integrated team with delivery against client timetables with market leading firms from around the world first class transaction management who share our culture of excellence. We are not constrained by formal alliances. -

List of Best Execution Venues Last Update 28.05.2021

List of Best Execution Venues Last update 28.05.2021 Cash Equities, Depository Receipts, Bonds, Exchange Traded Funds and Exchange Traded Securitised Derivatives Country Name MIC LGT preferred broker network SIX Swiss Exchange Switzerland SIX Swiss Exchange XSWX LGT as exchange participant Switzerland SIX Swiss Exchange – Structured Products XQMH LGT as exchange participant Europe Austria Wiener Börse* XWBO Belgium Euronext Brussels* XBRU Belgium Euronext Brussels – Derivatives XBRD Cyprus CSE Cyprus SE XCYS Denmark NASDAQ Copenhagen* XCSE Finland NASDAQ Helsinki* XHEL France Euronext Paris* XPAR France NYSE Euronext MONEP XMON Germany Berlin Stock Exchange XBER Germany Düsseldorf Stock Exchange XDUS Germany Eurex Frankfurt XEUR Citigroup Global Markets Ltd CS Securities Sociedad de Valores SA Germany Frankfurt Stock Exchange* XFRA Deutsche Bank AG Germany Frankfurt Stock Exchange – Certificates XSCO Kepler Cheuvreux SA Germany Hamburg Stock Exchange XHAM Morgan Stanley Europe SE Raiffeisen Bank International AG Germany Hannover Stock Exchange XHAN Wolfgang Steubing AG Germany München Stock Exchange XMUN Germany Stuttgart Stock Exchange XSTU Germany XETRA* XETR Greece ASE Athens XATH Ireland Euronext Dublin ESM* XDUB 5 Ireland Euronext Dublin MSM* XMSM Italy Borsa Italiana* XMIL Page 1 of Italy EuroTLX ETLX Italy Italian Derivatives Market (IDEM) XDMI 9999 Luxembourg BdL Luxembourg XLUX Netherlands Euronext Amsterdam* XAMS 28052021 C en 8665 * Smart Order Routing applicable GL Country Name MIC LGT preferred broker network Europe Netherlands -

Bofa List of Execution Venues

This List of Execution Venues and the associated Bank of America EMEA Order Execution Policy Summary form part of the General Terms & Conditions of Business available on the Bank of America MifID II Website www.bofaml.com/mifid2 The tables below set out the execution venues accessed by entities in the Bank of America Entities List and Associated Companies. These tables are not exhaustive and we may amend them from time to time in accordance with our policies. MLI and BofASE may also use other execution venues from time to time where they deem appropriate but in accordance with their policies (including the Bank of America Order Execution Policy). Asset class Region Regulated Markets of which MLI / BofASE is a direct member and MTFs accessed by MLI / BofASE Equities EMEA Aquis UK Equities EMEA Athex Group Equities EMEA Bloomberg BV Equities EMEA Bloomberg UK Equities EMEA Borsa Italiana Equities EMEA Cboe BV Equities EMEA Cboe UK Equities EMEA Deutsche Borse Xetra Equities EMEA Equiduct Equities EMEA Euronext Amsterdam Equities EMEA Euronext Brussels Equities EMEA Euronext Dublin Equities EMEA Euronext Lisbon Equities EMEA Euronext Oslo Equities EMEA Euronext Paris Equities EMEA ITG Posit Equities EMEA Liquidnet Equities EMEA Liquidnet Europe Equities EMEA London Stock Exchange 1 – ©2020 Bank of America Corporation Asset class Region Regulated Markets of which MLI / BofASE is a direct member and MTFs accessed by MLI / BofASE Equities EMEA NASDAQ OMX Nordic – Helsinki Equities EMEA NASDAQ OMX Nordic – Stockholm Equities EMEA NASDAQ OMX -

Admission Notice INVESCO PHYSICAL MARKETS PUBLIC LIMITED COMPANY

CORPORATE EVENT NOTICE: Admission Notice INVESCO PHYSICAL MARKETS PUBLIC LIMITED COMPANY LOCATION: Dublin DATE: 21st May 2021 MARKET: Euronext Dublin ADMISSION NOTICE Euronext Dublin approves the admission of the undermentioned securities to listing on the Official List and trading on the regulated market of Euronext Dublin. INVESCO PHYSICAL MARKETS PUBLIC LIMITED COMPANY Series 1 – Issue of 60,000 Secured Gold-Linked Certificates due 2100 IE00B579F325 Increase This announcement has been issued through the Companies Announcement Service of Euronext Dublin. The present notice and the contents thereof are only provided for information purposes in order to facilitate the fair, orderly and efficient functioning of the market and is not a recommendation to engage in investment activities. The contents of this notice are provided “as is” based on information provided to the market operator without representation or warranty of any kind. Euronext will not be held liable for any loss or damages of any nature ensuing from using, trusting or acting on information provided. No information set out or referred to in this notice shall form the basis of any contract. The creation of rights and obligations in respect of financial products that are traded on the exchanges operated by Euronext’s subsidiaries shall depend solely on the applicable rules of the market operator. The Euronext Markets comprise the markets operated by Euronext Amsterdam, Euronext Brussels, Euronext Dublin, Euronext Lisbon, Euronext Paris and Euronext UK Markets, referred to respectively as the Amsterdam, Brussels, Dublin, Lisbon, Paris and London markets, as relevant. Euronext refers to Euronext N.V. and its affiliates. Information regarding trademarks and intellectual property rights of Euronext is located at https://www.euronext.com/terms-use. -

FTSE Global Equity Index Series Ground Rules Visit Or E-Mail [email protected]

Ground Rules FTSE Global Equity Index Series v10.9 ftserussell.com An LSEG Business September 2021 Contents 1.0 Introduction .................................................................... 3 2.0 Management Responsibilities ....................................... 5 3.0 FTSE Russell Index Policies ......................................... 7 4.0 Country Inclusion Criteria ............................................. 9 5.0 Inclusion Criteria .......................................................... 11 6.0 Eligible Security Screens ............................................ 12 7.0 Periodic Review of Constituents ................................ 16 8.0 Additions Outside of a Review ................................... 21 9.0 Corporate Actions and Events .................................... 24 10.0 Treatment of Dividends ............................................... 26 11.0 Industry Classification Benchmark (ICB)................... 27 12.0 Algorithm and Calculation Method ............................. 28 Appendix A: Eligible Exchanges and Market Segments .... 29 Appendix B: Eligible Classes of Securities ......................... 34 Appendix C: Calculation Schedule ...................................... 39 Appendix D: Country Additions and Deletions ................... 41 Appendix E: Country Classification ..................................... 43 Appendix F: Country Indices ................................................ 44 Appendix G: FTSE Russell China Share Descriptions ....... 45 Appendix H: Further Information ........................................ -

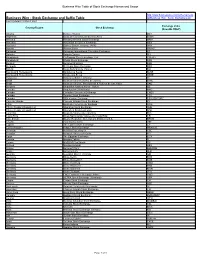

Stock Exchange and Suffix Table Ml/Business Wire Stock Exchanges.Pdf Last Updated 12 March 2021

Business Wire Table of Stock Exchange Names and Usage http://www.businesswire.com/schema/news Business Wire - Stock Exchange and Suffix Table ml/Business_Wire_Stock_Exchanges.pdf Last Updated 12 March 2021 Exchange Value Country/Region Stock Exchange (NewsML ONLY) Albania Bursa e Tiranës BET Argentina Bolsa de Comercio de Buenos Aires BCBA Armenia Nasdaq Armenia Stock Exchange ARM Australia Australian Securities Exchange ASX Australia Sydney Stock Exchange (APX) APX Austria Wiener Börse WBAG Bahamas Bahamas International Securities Exchange BS Bahrain Bahrain Bourse BH Bangladesh Chittagong Stock Exchange, Ltd. CSEBD Bangladesh Dhaka Stock Exchange DSE Belgium Euronext Brussels BSE Bermuda Bermuda Stock Exchange BSX Bolivia Bolsa Boliviana de Valores BO Bosnia and Herzegovina Banjalucka Berza BLSE Bosnia and Herzegovina Sarajevska Berza SASE Botswana Botswana Stock Exchange BT Brazil Bolsa de Valores do Rio de Janeiro BVRJ Brazil Bolsa de Valores, Mercadorias & Futuros de Sao Paulo SAO Bulgaria Balgarska fondova borsa - Sofiya BB Canada Aequitas NEO Exchange NEO Canada Canadian Securities Exchange CNSX Canada Toronto Stock Exchange TSX Canada TSX Venture Exchange TSX VENTURE Cayman Islands Cayman Islands Stock Exchange KY Chile Bolsa de Comercio de Santiago SGO China, People's Republic of Shanghai Stock Exchange SHH China, People's Republic of Shenzhen Stock Exchange SHZ Colombia Bolsa de Valores de Colombia BVC Costa Rica Bolsa Nacional de Valores de Costa Rica CR Cote d'Ivoire Bourse Regionale Des Valeurs Mobilieres S.A. BRVM Croatia -

Northern Trust Emea Order Execution Policy

NORTHERN TRUST EMEA ORDER EXECUTION POLICY For Professional Clients of the following Northern Trust entities: • Northern Trust Global Services SE, and its branches • Northern Trust Securities LLP, and its branches • The Northern Trust Company, London branch Publication date: 1 January 2021 Contents INTRODUCTION .................................................................................................................................................................... 3 A. Purpose of this policy .................................................................................................................................................................................... 3 B. What is Best Execution? ............................................................................................................................................................................... 3 POLICY SCOPE ..................................................................................................................................................................... 4 A. Northern Trust entities subject to this Policy ................................................................................................................................................. 4 B. Types of Clients ............................................................................................................................................................................................. 4 C. Activities .......................................................................................................................................................................................................