Hantam Municipality Annual Report 2011/12 Volume 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EASTERN CAPE NARL 2014 (Approved by the Federal Executive)

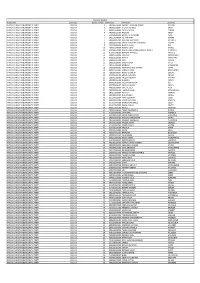

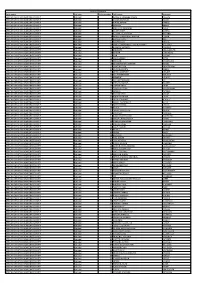

EASTERN CAPE NARL 2014 (Approved by the Federal Executive) Rank Name 1 Andrew (Andrew Whitfield) 2 Nosimo (Nosimo Balindlela) 3 Kevin (Kevin Mileham) 4 Terri Stander 5 Annette Steyn 6 Annette (Annette Lovemore) 7 Confidential Candidate 8 Yusuf (Yusuf Cassim) 9 Malcolm (Malcolm Figg) 10 Elza (Elizabeth van Lingen) 11 Gustav (Gustav Rautenbach) 12 Ntombenhle (Rulumeni Ntombenhle) 13 Petrus (Petrus Johannes de WET) 14 Bobby Cekisani 15 Advocate Tlali ( Phoka Tlali) EASTERN CAPE PLEG 2014 (Approved by the Federal Executive) Rank Name 1 Athol (Roland Trollip) 2 Vesh (Veliswa Mvenya) 3 Bobby (Robert Stevenson) 4 Edmund (Peter Edmund Van Vuuren) 5 Vicky (Vicky Knoetze) 6 Ross (Ross Purdon) 7 Lionel (Lionel Lindoor) 8 Kobus (Jacobus Petrus Johhanes Botha) 9 Celeste (Celeste Barker) 10 Dorah (Dorah Nokonwaba Matikinca) 11 Karen (Karen Smith) 12 Dacre (Dacre Haddon) 13 John (John Cupido) 14 Goniwe (Thabisa Goniwe Mafanya) 15 Rene (Rene Oosthuizen) 16 Marshall (Marshall Von Buchenroder) 17 Renaldo (Renaldo Gouws) 18 Bev (Beverley-Anne Wood) 19 Danny (Daniel Benson) 20 Zuko (Prince-Phillip Zuko Mandile) 21 Penny (Penelope Phillipa Naidoo) FREE STATE NARL 2014 (as approved by the Federal Executive) Rank Name 1 Patricia (Semakaleng Patricia Kopane) 2 Annelie Lotriet 3 Werner (Werner Horn) 4 David (David Christie Ross) 5 Nomsa (Nomsa Innocencia Tarabella Marchesi) 6 George (George Michalakis) 7 Thobeka (Veronica Ndlebe-September) 8 Darryl (Darryl Worth) 9 Hardie (Benhardus Jacobus Viviers) 10 Sandra (Sandra Botha) 11 CJ (Christian Steyl) 12 Johan (Johannes -

34327Gen317f.Pdf

... Mpumalanga MP325 • Bushbl.lckr!dge [Sushbl.lcklidge] CONGRESS OF THE PEOPLE PR(3) KUBAYl NOMSA LCPR 0 0 Mpumalanga MPa25 • Bushtw<:l<ridge [8\Jshbl.lckr!dge] DEMOCRATIC ALLJANCE/DEMOKRATIESE ALUANSIE P~(1) THOBAKGALE HAMILTON PHII.UP !.CPR Mpumalanga MP325 • Sushbl.lckrldge [8\Jshbl.lcklidge] DEMOCRATIC ALUANCE!DEMOKRATIESE ALUANSIE PR(2) MKHONTO PATRINAH MMASEllO LCPR DEMOCRA11C ALLJANCE/DEMOKRATIESE AWANSIE PR(3) SIBULELO RODGERS SELLO LCPR z Mpumalanga MP325 • Sushbuckrldge [8\Jshbl.lcklidge] 0 Mpumalanga MP325 • 8ushbud<ridgeJ8ushouckridga] INDEPENDENT CANDIDATE 83205013 CHABANGU MAJOSI MOSES LC ward Mpumalanga MP325 • Sushbl.ld<ridge [Bushbucklidgs] PAN AFRICANIST CONGRESS OF AZANIA PR(1) KHOZA MAURICE JANJI LCPR w Northern Cape NC091 • Sol Plaaije [Kimberley) AFRICAN NATIONAL CONGRESS PR(6) NDLAZI SOlOMON POGISHO LCPR f:j 1\) Northern Cape NC091 - Sol Plaaije [Kimberley] AFRICAN NATIONAL CONGRESS PR(7) NGOBEZA WINNIFREO NONGAZI LCPR -.J Northam Cape NC091 - Sol Ph>U!!ijo [Kimberley] AFRICAN NATIONAL CONGRESS PR(6) MATIKA OCTAVIOUS MANGAUSO LC PR Northern Cape NC091 • Sol Plaaije [Klmbe~eyj AFRICAN NATIONAL CONGRESS PR(9) BISHOP PATRICE DIPUO LCPR Northern Cape NC091 • Sol Plaaije [Kimberley] AFRICAN NATIONAL CONGRESS PR(10) LEVEN MARIA MAGDALENA LC PR Northern Cape NC091 • Sol Plaaije !Kimberley] AFRICAN NATIONAL CONGRESS PR(11) MAPHAGE MINAH LCPR Northern Cape NC091 • Sol Plaaije [Kimberley] AFRICAN NATIONAL CONGRESS PR(12) SETLHABI ELLEN KEROMAMANE LCPR Northern Cape NC091 • Sol Plaaije [Kim~ey] AFRICAN NATIONAL CONGRESS PR(13) -

LIST of MEMBERS (Female)

As on 28 May 2021 LIST OF MEMBERS (Female) 6th Parliament CABINET OFFICE-BEARERS OF THE NATIONAL ASSEMBLY MEMBERS OF THE NATIONAL ASSEMBLY As on 28 May 2021 MEMBERS OF THE EXECUTIVE (alphabetical list) Minister of Agriculture, Land Reform and Rural Development ............. Ms A T Didiza Minister of Basic Education ....................................................... Mrs M A Motshekga Minister of Communications and Digital Technologies ....................... Ms S T Ndabeni-Abrahams Minister of Cooperative Governance and Traditional Affairs ............... Dr N C Dlamini-Zuma Minister of Defence and Military Veterans ..................................... Ms N N Mapisa-Nqakula Minister of Forestry, Fisheries and Environment ............................... Ms B D Creecy Minister of Human Settlements, Water and Sanitation ...................... Ms L N Sisulu Minister of International Relations and Cooperation ......................... Dr G N M Pandor Minister of Public Works and Infrastructure ................................... Ms P De Lille Minister of Small Business Development ....................................... Ms K P S Ntshavheni Minister of Social Development .................................................. Ms L D Zulu Minister of State Security ......................................................... Ms A Dlodlo Minister of Tourism ................................................................. Ms M T Kubayi-Ngubane Minister in The Presidency for Women, Youth and Persons with Disabilities ..................................................................... -

National List

NATIONAL LIST 1 Otta Helen Maree 2 Mmoba Solomon Seshoka 3 Lindiwe Desire Mazibuko 4 Suhla James Masango 5 Joseph Job Mcgluwa 6 Andrew Grant Whitfield 7 Semakaleng Patricia Kopane 8 Gregory Allen Grootboom 9 Dion Travers George 10 David John Maynier 11 Desiree van der Walt 12 Gregory Rudy Krumbock 13 Tarnia Elena Baker 14 Leonard Jones Basson 15 Zisiwe Beauty Nosimo Balindlela 16 Annelie Lotriet 17 Dirk Jan Stubbe 18 Anchen Margaretha Dreyer 19 Phumzile Thelma Van Damme 20 Stevens Mokgalapa 21 Michael John Cardo 22 Stanford Makashule Gana 23 Mohammed Haniff Hoosen 24 Gavin Richard Davis 25 Kevin John Mileham 26 Natasha Wendy Anita Michael 27 Denise Robinson 28 Werner Horn 29 Ian Michael Ollis 30 Johanna Fredrika Terblanche 31 Hildegard Sonja Boshoff 32 Lance William Greyling 33 Glynnis Breytenbach 34 Robert Alfred Lees 35 Derrick America 36 James Robert Bourne Lorimer 37 Terri Stander 38 Evelyn Rayne Wilson 39 James Vos 40 Thomas Charles Ravenscroft Walters 41 Veronica van Dyk 42 Cameron MacKenzie 43 Tandeka Gqada 44 Dianne Kohler 45 Darren Bergman 46 Zelda Jongbloed 47 Annette Steyn 48 Sejamotopo Charles Motau 49 David Christie Ross 50 Archibold Mzuvukile Figlan 51 Michael Waters 52 John Henry Steenhuisen 53 Choloane David Matsepe 54 Santosh Vinita Kalyan 55 Hendrik Christiaan Crafford Kruger 56 Johanna Steenkamp 57 Annette Theresa Lovemore 58 Nomsa Innocencia Tarabella Marchesi 59 Karen De Kock 60 Heinrich Cyril Volmink 61 Michael Bagraim 62 Gordon Mackay 63 Erik Johannes Marais 64 Marius Helenis Redelinghuys 65 Lungiswa Veronica James -

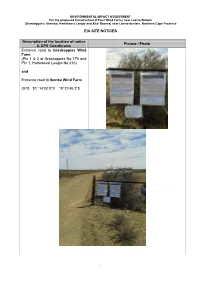

EIA SITE NOTICES Description of the Location of Notice & GPS

ENVIRONMENTAL IMPACT ASSESSMENT For the proposed Construction of Four Wind Farms near Loeriesfontein (Graskoppies; Ithemba; Hartebeest Leegte and Xha! Booma) near Loeriesfontein, Northern Cape Province EIA SITE NOTICES Description of the location of notice Picture / Photo & GPS Coordinates Entrance road to Graskoppies Wind Farm (Ptn 1 & 2 of Graskoppies No 176 and Ptn 1, Hartebeest Leegte No 216) and Entrance road to Itemba Wind Farm GPS: 30° 14'02.9"S 19°23'46.2"E 1 Description of the location of notice Picture / Photo & GPS Coordinates Entrance to Ixha Boom Wind Farm (Ptn 2, Georgs Vley Np 217) GPS: 30° 17'21.3"S 19°14'18.0"E 2 Description of the location of notice Picture / Photo & GPS Coordinates Entrance to Hartebeestleegte Wind Farm (Ptn Remainder, Hartebeest Leegte No 216) GPS: 30° 26'13.7"S 19°13'06.7"E 3 SiVEST Environmental Division Established in 1952 ENVIRONMENTAL IMPACT ASSESSMENTS (EIAs) FOR THE PROPOSED DEVELOPMENT OF FOUR (4) WIND FARMS AND BASIC ASSESSMENTS (BAs) FOR THE ASSOCIATED GRID CONNECTION NEAR LOERIESFONTEIN, NORTHERN CAPE PROVINCE (DEA REFERENCE NUMBERS TO BE ANNOUNCED) In terms of the National Environmental Management Act, 1998 (Act No. 107 of 1998) (NEMA) as amended and the Environmental Impact Assessment (EIA) Regulations, 2014 under Government Notices No R982, R983, R984 and R985 promulgated on 4 December 2014, notice is hereby given that South Africa Mainstream Renewable Power Developments (Pty) Ltd (hereafter referred to as “Mainstream”) has appointed SiVEST SA (Pty) Ltd, as the independent environmental assessment practitioner (EAP), to undertake the required Environmental Impact Assessments (EIAs), Basic Assessments (BAs) and public participation process for the above-mentioned proposed project. -

Party List Rank Name Surname African Christian Democratic Party

Party List Rank Name Surname African Christian Democratic Party National 1 Kenneth Raselabe Joseph Meshoe African Christian Democratic Party National 2 Steven Nicholas Swart African Christian Democratic Party National 3 Wayne Maxim Thring African Christian Democratic Party Regional: Western Cape 1 Marie Elizabeth Sukers African Independent Congress National 1 Mandlenkosi Phillip Galo African Independent Congress National 2 Lulama Maxwell Ntshayisa African National Congress National 1 Matamela Cyril Ramaphosa African National Congress National 2 David Dabede Mabuza African National Congress National 3 Samson Gwede Mantashe African National Congress National 4 Nkosazana Clarice Dlamini-Zuma African National Congress National 5 Ronald Ozzy Lamola African National Congress National 6 Fikile April Mbalula African National Congress National 7 Lindiwe Nonceba Sisulu African National Congress National 8 Zwelini Lawrence Mkhize African National Congress National 9 Bhekokwakhe Hamilton Cele African National Congress National 10 Nomvula Paula Mokonyane African National Congress National 11 Grace Naledi Mandisa Pandor African National Congress National 12 Angela Thokozile Didiza African National Congress National 13 Edward Senzo Mchunu African National Congress National 14 Bathabile Olive Dlamini African National Congress National 15 Bonginkosi Emmanuel Nzimande African National Congress National 16 Emmanuel Nkosinathi Mthethwa African National Congress National 17 Matsie Angelina Motshekga African National Congress National 18 Lindiwe Daphne Zulu -

General Notices • Algemene Kennisgewings

Reproduced by Data Dynamics in terms of Government Printers' Copyright Authority No. 9595 dated 24 September 1993 4 No. 42460 GOVERNMENT GAZETTE, 15 MAY 2019 GENERAL NOTICE GENERAL NOTICES • ALG EMENE KENNISGEWINGS NOTICEElectoral Commission/….. Verkiesingskommissie OF 2019 ELECTORAL COMMISSION ELECTORALNOTICE 267 COMMISSION OF 2019 267 Electoral Act (73/1998): List of Representatives in the National Assembly and Provincial Legislatures, in respect of the elections held on 8 May 2019 42460 ELECTORAL ACT, 1998 (ACT 73 OF 1998) PUBLICATION OF LISTS OF REPRESENTATIVES IN THE NATIONAL ASSEMBLY AND PROVINCIAL LEGISLATURES IN TERMS OF ITEM 16 (4) OF SCHEDULE 1A OF THE ELECTORAL ACT, 1998, IN RESPECT OF THE ELECTIONS HELD ON 08 MAY 2019. The Electoral Commission hereby gives notice in terms of item 16 (4) of Schedule 1A of the Electoral Act, 1998 (Act 73 of 1998) that the persons whose names appear on the lists in the Schedule hereto have been elected in the 2019 national and provincial elections as representatives to serve in the National Assembly and the Provincial Legislatures as indicated in the Schedule. SCHEDULE This gazette is also available free online at www.gpwonline.co.za Reproduced by Data Dynamics in terms of Government Printers' Copyright Authority No. 9595 dated 24 September 1993 NATIONAL ASSEMBLY LIST Party List Rank ID Name Surname AFRICAN CHRISTIAN DEMOCRATIC PARTY National 1 5401185719080 KENNETH RASELABE JOSEPH MESHOE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 2 5902085102087 STEVEN NICHOLAS SWART AFRICAN CHRISTIAN DEMOCRATIC -

Vol. 647 15 May 2019 No

Vol. 647 15 May 2019 No. 42460 Mei 2 No.42460 GOVERNMENT GAZETTE, 15 MAY 2019 STAATSKOERANT, 15 MEl 2019 No.42460 3 Contents Gazette Page No. No. No. GENERAL NOTICES • ALGEMENE KENNISGEWINGS Electoral Commission! Verkiesingskommissie 267 Electoral Act (73/1998): List of Representatives in the National Assembly and Provincial Legislatures, in respect of the elections held on 8 May 2019 ............................................................................................................................ 42460 4 4 No.42460 GOVERNMENT GAZETTE, 15 MAY 2019 GENERAL NOTICES • ALGEMENE KENNISGEWINGS ELECTORAL COMMISSION NOTICE 267 OF 2019 ELECTORAL ACT, 1998 (ACT 73 OF 1998) PUBLICATION OF LISTS OF REPRESENTATIVES IN THE NATIONAL ASSEMBLY AND PROVINCIAL LEGISLATURES IN TERMS OF ITEM 16 (4) OF SCHEDULE 1A OF THE ELECTORAL ACT, 1998, IN RESPECT OF THE ELECTIONS HELD ON 08 MAY 2019. The Electoral Commission hereby gives notice in terms of item 16 (4) of Schedule 1A of the Electoral Act, 1998 (Act 73 of 1998) that the persons whose names appear on the lists in the Schedule hereto have been elected in the 2019 national and provincial elections as representatives to serve in the National Assembly and the Provincial Legislatures as indicated in the Schedule. SCHEDULE NATIONAL ASSEMBLY LIST Party List Rank ID Name ~urname AFRICAN CHRISTIAN DEMOCRATIC PARTY National 1 5401185719080 KENNETH RASELABE JOSEPH MESHOE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 2 5902085102087 STEVEN NICHOLAS SWART AFRICAN CHRISTIAN DEMOCRATIC PARTY National 3 6302015139086 -

Dwarsug Appendix E4

NOTIFICATION OF THE BASIC ASSESSMENT PROCESS AND PUBLIC PARTICIPATION PROCESS 19 October 2018 Dear Stakeholder BASIC ASSESSMENT AND PUBLIC PARTICIPATION PROCESS DWARSRUG WIND ENERGY FACILITY ACCESS ROAD NEAR LOERIESFONTEIN, NORTHERN CAPE PROVINCE NOTICE OF BASIC ASSESSMENT PROCESS The applicant, South African Mainstream Renewable Power (Pty) Ltd, is proposing the development of an access road for the authorised Dwarsrug Wind Energy Facility (WEF) ~60km north of Loeriesfontein, in the Northern Cape Province. The proposed access road will fall within the jurisdiction of the Hantam Local Municipality and within the greater Namakwa District Municipality. The affected properties will include the following: » Remainder of the Farm Brakpan No. 212; » Stinkputs No. 229 » Portion 1 of the Farm Aan de Karee Doorn Pan No. 213 » Remainder of the Farm Sous No. 226 » Narosies No. 228 The applicant is proposing two alternative access roads which will be assessed, including: » Alternative 1 - Gravel road from Granaatboskolk to the project site (approx. 11.26km); and » Alternative 2 - Gravel road from Granaatboskolk to the project site (approx. 8.20km). BASIC ASSESSMENT PROCESS An application for Environmental Authorisation (EA) will be submitted for the proposed access road to the Northern Cape Province Department of Environment and Nature Conservation (NC DENC) as the Competent Authority (CA), in accordance with the National Environmental Management Act (No. 107 of 1998) (NEMA) and the provisions of the 2014 Environmental Impact Assessment (EIA) Regulations, as amended on 07 April 2017, published in GNR 324 to GNR 327. Savannah Environmental (Pty) Ltd has been appointed as the independent Environmental Assessment Practitioner (EAP), responsible for undertaking the Basic Assessment (BA) processes, in order to identify and assess all potential environmental impacts associated with the project for the area as identified, and recommend appropriate mitigation and management measures in an Environmental Management Programme (EMPr). -

Party Name List Type Order Number Idnumber Full Names Surname

National NPE2019 Party name List type Order number IDNumber Full names Surname AFRICAN CHRISTIAN DEMOCRATIC PARTY National 1 5401185719080 KENNETH RASELABE JOSEPH MESHOE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 2 5902085102087 STEVEN NICHOLAS SWART AFRICAN CHRISTIAN DEMOCRATIC PARTY National 3 6302015139086 WAYNE MAXIM THRING AFRICAN CHRISTIAN DEMOCRATIC PARTY National 4 7403090279083 NOSIZWE ABADA AFRICAN CHRISTIAN DEMOCRATIC PARTY National 5 5602145803084 MOKHETHI RAYMOND TLAELI AFRICAN CHRISTIAN DEMOCRATIC PARTY National 6 5901170249084 JO-ANN MARY DOWNS AFRICAN CHRISTIAN DEMOCRATIC PARTY National 7 5804220857080 KEITUMETSE PATRICIA MATANTE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 8 6802235024083 GRANT CHRISTOPHER RONALD HASKIN AFRICAN CHRISTIAN DEMOCRATIC PARTY National 9 7810230406089 BERNICE PEARL OSA AFRICAN CHRISTIAN DEMOCRATIC PARTY National 10 7304165540088 MZUKISI ELIAS DINGILE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 11 6812205532080 DAVID EUGENE MOSES JOSHUA BARUTI NTSHABELE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 12 8612075246086 BONGANI MAXWELL KHANYILE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 13 6108055129089 ANNIRUTH KISSOONDUTH AFRICAN CHRISTIAN DEMOCRATIC PARTY National 14 8709135113080 MARVIN CHRISTIANS AFRICAN CHRISTIAN DEMOCRATIC PARTY National 15 5403065155088 IVAN JARDINE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 16 6302220199081 LINDA MERIDY YATES AFRICAN CHRISTIAN DEMOCRATIC PARTY National 17 7905155604088 MONGEZI MABUNGANI AFRICAN CHRISTIAN DEMOCRATIC PARTY National 18 6508220834085 KGOMOTSO -

Party Name List Type Order Number Full Names Surname AFRICAN

National NPE2019 Party name List type Order number Full names Surname AFRICAN CHRISTIAN DEMOCRATIC PARTY National 1 KENNETH RASELABE JOSEPH MESHOE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 2 STEVEN NICHOLAS SWART AFRICAN CHRISTIAN DEMOCRATIC PARTY National 3 WAYNE MAXIM THRING AFRICAN CHRISTIAN DEMOCRATIC PARTY National 4 NOSIZWE ABADA AFRICAN CHRISTIAN DEMOCRATIC PARTY National 5 MOKHETHI RAYMOND TLAELI AFRICAN CHRISTIAN DEMOCRATIC PARTY National 6 JO-ANN MARY DOWNS AFRICAN CHRISTIAN DEMOCRATIC PARTY National 7 KEITUMETSE PATRICIA MATANTE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 8 GRANT CHRISTOPHER RONALD HASKIN AFRICAN CHRISTIAN DEMOCRATIC PARTY National 9 BERNICE PEARL OSA AFRICAN CHRISTIAN DEMOCRATIC PARTY National 10 MZUKISI ELIAS DINGILE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 11 DAVID EUGENE MOSES JOSHUA BARUTI NTSHABELE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 12 BONGANI MAXWELL KHANYILE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 13 ANNIRUTH KISSOONDUTH AFRICAN CHRISTIAN DEMOCRATIC PARTY National 14 MARVIN CHRISTIANS AFRICAN CHRISTIAN DEMOCRATIC PARTY National 15 IVAN JARDINE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 16 LINDA MERIDY YATES AFRICAN CHRISTIAN DEMOCRATIC PARTY National 17 MONGEZI MABUNGANI AFRICAN CHRISTIAN DEMOCRATIC PARTY National 18 KGOMOTSO WELHEMINAH TISANE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 19 LANCE PATRICK GROOTBOOM AFRICAN CHRISTIAN DEMOCRATIC PARTY National 20 MARIE ELIZABETH SUKERS AFRICAN CHRISTIAN DEMOCRATIC PARTY National 21 MPHO LAWRENCE CHAUKE AFRICAN CHRISTIAN DEMOCRATIC PARTY -

2014 National and Provincial Elections: Candidate Lists

2014 National and Provincial Elections: Candidate Lists Order Party Name List type Number Full names Surname AFRICAN CHRISTIAN DEMOCRATIC PARTY National 1 KENNETH RASELABE JOSEPH MESHOE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 2 STEVEN NICHOLAS SWART AFRICAN CHRISTIAN DEMOCRATIC PARTY National 3 CHERYLLYN DUDLEY AFRICAN CHRISTIAN DEMOCRATIC PARTY National 4 WAYNE MAXIM THRING AFRICAN CHRISTIAN DEMOCRATIC PARTY National 5 OCTAVIA MATSHIDISO MDHLULI AFRICAN CHRISTIAN DEMOCRATIC PARTY National 6 MOKHETHI RAYMOND TLAELI AFRICAN CHRISTIAN DEMOCRATIC PARTY National 7 MOKADI DANIEL MATSIMELA AFRICAN CHRISTIAN DEMOCRATIC PARTY National 8 ANNIRUTH KISSOONDUTH AFRICAN CHRISTIAN DEMOCRATIC PARTY National 9 GAYNORE CELE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 10 EDWARD PESULO AFRICAN CHRISTIAN DEMOCRATIC PARTY National 11 GERHARDUS PETRUS KOEKEMOER AFRICAN CHRISTIAN DEMOCRATIC PARTY National 12 MBELU EMMANUELLE KABAMBA MUTEBA AFRICAN CHRISTIAN DEMOCRATIC PARTY National 13 BRENDON GOVENDER AFRICAN CHRISTIAN DEMOCRATIC PARTY National 14 LINDA MERIDY YATES AFRICAN CHRISTIAN DEMOCRATIC PARTY National 15 JANE REIKANTSEMANG MOKGELE AFRICAN CHRISTIAN DEMOCRATIC PARTY National 16 TAMBO ANDREW MOKOENA AFRICAN CHRISTIAN DEMOCRATIC PARTY National 17 MARSHA GABRIEL AFRICAN CHRISTIAN DEMOCRATIC PARTY National 18 KGASHIANE ANNA RAMOVHA AFRICAN CHRISTIAN DEMOCRATIC PARTY National 19 EMILY BALOYI AFRICAN CHRISTIAN DEMOCRATIC PARTY National 20 MONGEZI MABUNGANI AFRICAN CHRISTIAN DEMOCRATIC PARTY National 21 PULE JOSEPH RAMPAI AFRICAN CHRISTIAN DEMOCRATIC PARTY