Oxford Street

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BDS - Representing the Visual Merchandising Profession

British Display Society Recognising Excellence Established 1947 FORTNUM & MASON, PICCADILLY, LONDON Christmas Street decorations at CHAPEL OF LOVE St Christopher’s Place, London BDS - Representing the Visual Merchandising profession 2020 No.1 Welcome from the Chairman This year has not started well for fans of historic department stores. Sadly, Beales which opened in Bournemouth in 1881 and its other stores across the country fell into administration. Debenhams which traces its history back to 1778 named many stores shortly to close. Coupled with this, we learn that Boswell & Co in Oxford which dates back to 1738 is almost certain to close with the owners blaming the ‘current economic retail climate’ Times are certainly tough on the High Street have been so for some time, but I can’t help thinking that there are a number of retailers who just cannot seem to move forward with the times and current trends and wonder why they are struggling in the current economy. We all appreciate that On-Line Shopping, High Street Parking Charges and Business Rates are factors as to why retail is failing, however I look at stores such as Selfridges and Fortnum & Mason, where business is very brisk. I recently read an article about Dunelm who defy the gloom of UK retail by posting a major jump in profits. In the 6 months to Dec 28, sales jumped by 6% to £585m with pre- tax profits up 19.4% to £84.9m. Retailers must reinvent themselves to stay, not only, competitive but to become a Destination store. With some many retailers, it is matter of creating ‘Retail Theatre’. -

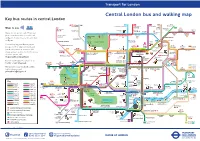

Central London Bus and Walking Map Key Bus Routes in Central London

General A3 Leaflet v2 23/07/2015 10:49 Page 1 Transport for London Central London bus and walking map Key bus routes in central London Stoke West 139 24 C2 390 43 Hampstead to Hampstead Heath to Parliament to Archway to Newington Ways to pay 23 Hill Fields Friern 73 Westbourne Barnet Newington Kentish Green Dalston Clapton Park Abbey Road Camden Lock Pond Market Town York Way Junction The Zoo Agar Grove Caledonian Buses do not accept cash. Please use Road Mildmay Hackney 38 Camden Park Central your contactless debit or credit card Ladbroke Grove ZSL Camden Town Road SainsburyÕs LordÕs Cricket London Ground Zoo Essex Road or Oyster. Contactless is the same fare Lisson Grove Albany Street for The Zoo Mornington 274 Islington Angel as Oyster. Ladbroke Grove Sherlock London Holmes RegentÕs Park Crescent Canal Museum Museum You can top up your Oyster pay as Westbourne Grove Madame St John KingÕs TussaudÕs Street Bethnal 8 to Bow you go credit or buy Travelcards and Euston Cross SadlerÕs Wells Old Street Church 205 Telecom Theatre Green bus & tram passes at around 4,000 Marylebone Tower 14 Charles Dickens Old Ford Paddington Museum shops across London. For the locations Great Warren Street 10 Barbican Shoreditch 453 74 Baker Street and and Euston Square St Pancras Portland International 59 Centre High Street of these, please visit Gloucester Place Street Edgware Road Moorgate 11 PollockÕs 188 TheobaldÕs 23 tfl.gov.uk/ticketstopfinder Toy Museum 159 Russell Road Marble Museum Goodge Street Square For live travel updates, follow us on Arch British -

1 Draft Paper Elisabete Mendes Silva Polytechnic Institute of Bragança

Draft paper Elisabete Mendes Silva Polytechnic Institute of Bragança-Portugal University of Lisbon Centre for English Studies, Faculty of Arts and Humanities, Portugal [email protected] Power, cosmopolitanism and socio-spatial division in the commercial arena in Victorian and Edwardian London The developments of the English Revolution and of the British Empire expedited commerce and transformed the social and cultural status quo of Britain and the world. More specifically in London, the metropolis of the country, in the eighteenth century, there was already a sheer number of retail shops that would set forth an urban world of commerce and consumerism. Magnificent and wide-ranging shops served householders with commodities that mesmerized consumers, giving way to new traditions within the commercial and social fabric of London. Therefore, going shopping during the Victorian Age became mandatory in the middle and upper classes‟ social agendas. Harrods Department store opens in 1864, adding new elements to retailing by providing a sole space with a myriad of different commodities. In 1909, Gordon Selfridge opens Selfridges, transforming the concept of urban commerce by imposing a more cosmopolitan outlook in the commercial arena. Within this context, I intend to focus primarily on two of the largest department stores, Harrods and Selfridges, drawing attention to the way these two spaces were perceived when they first opened to the public and the effect they had in the city of London and in its people. I shall discuss how these department stores rendered space for social inclusion and exclusion, gender and race under the spell of the Victorian ethos, national conservatism and imperialism. -

LONDON Cushman & Wakefield Global Cities Retail Guide

LONDON Cushman & Wakefield Global Cities Retail Guide Cushman & Wakefield | London | 2019 0 For decades London has led the way in terms of innovation, fashion and retail trends. It is the focal location for new retailers seeking representation in the United Kingdom. London plays a key role on the regional, national and international stage. It is a top target destination for international retailers, and has attracted a greater number of international brands than any other city globally. Demand among international retailers remains strong with high profile deals by the likes of Microsoft, Samsung, Peloton, Gentle Monster and Free People. For those adopting a flagship store only strategy, London gives access to the UK market and is also seen as the springboard for store expansion to the rest of Europe. One of the trends to have emerged is the number of retailers upsizing flagship stores in London; these have included Adidas, Asics, Alexander McQueen, Hermès and Next. Another developing trend is the growing number of food markets. Openings planned include Eataly in City of London, Kerb in Seven Dials and Market Halls on Oxford Street. London is the home to 8.85 million people and hosting over 26 million visitors annually, contributing more than £11.2 billion to the local economy. In central London there is limited retail supply LONDON and retailers are showing strong trading performances. OVERVIEW Cushman & Wakefield | London | 2019 1 LONDON KEY RETAIL STREETS & AREAS CENTRAL LONDON MAYFAIR Central London is undoubtedly one of the forefront Mount Street is located in Mayfair about a ten minute walk destinations for international brands, particularly those from Bond Street, and has become a luxury destination for with larger format store requirements. -

139 Bus Time Schedule & Line Route

139 bus time schedule & line map 139 Waterloo - Golders Green View In Website Mode The 139 bus line (Waterloo - Golders Green) has 2 routes. For regular weekdays, their operation hours are: (1) Golders Green: 24 hours (2) Waterloo: 24 hours Use the Moovit App to ƒnd the closest 139 bus station near you and ƒnd out when is the next 139 bus arriving. Direction: Golders Green 139 bus Time Schedule 42 stops Golders Green Route Timetable: VIEW LINE SCHEDULE Sunday 24 hours Monday 24 hours Waterloo Station / Tenison Way (J) Whichcote Street, London Tuesday 24 hours Waterloo Bridge / South Bank (P) Wednesday 24 hours 1 Charlie Chaplin Walk, London Thursday 24 hours Lancaster Place (T) Friday 24 hours Lancaster Place, London Saturday 24 hours Savoy Street (U) 105-108 Strand, London Bedford Street (J) 60-64 Strand, London 139 bus Info Direction: Golders Green Charing Cross Station (H) Stops: 42 Duncannon Street, London Trip Duration: 62 min Line Summary: Waterloo Station / Tenison Way (J), Trafalgar Square (T) Waterloo Bridge / South Bank (P), Lancaster Place Cockspur Street, London (T), Savoy Street (U), Bedford Street (J), Charing Cross Station (H), Trafalgar Square (T), Regent Regent Street / St James's (Z) Street / St James's (Z), Piccadilly Circus (E), Beak 11 Lower Regent Street, London Street / Hamleys Toy Store (L), Oxford Street / John Lewis (OR), Selfridges (BX), Orchard Street / Piccadilly Circus (E) Selfridges (BA), Portman Square (Y), York Street (F), 83-97 Regent Street, London Baker Street Station (C), Park Road/ Ivor Place (X), -

Job Description

JOB DESCRIPTION JOB TITLE Store Manager ROLE TYPE Full time DEPARTMENT Retail REPORTING TO Head of Retail and Omnichannel Sales LOCATION London, multiple locations available SALARY Competitive COMPANY PROFILE Orlebar Brown launched in March 2007 as a more tailored approach to men’s beach and swim shorts. Based on the traditional pattern of a tailored pair of trousers for men, and with their distinctive side fasteners, they are not just a swim short; they are the original and best shorts you can swim in. In 2010 we took Orlebar Brown off the beach, out of the pool and into the resort with a range of tees, polos and shirts, and have since then developed the product into a full lifestyle offer including shorts, trousers, sweats, outerwear, knitwear, footwear and accessories. The brand has rapidly gained global recognition and is sold through multiple channels. Web is the largest channel, delivering to customers globally through www.orlebarbrown.com. The first Orlebar Brown store opened in London in 2011, and there are now seven stores in the UK and six stores in the US, alongside stores managed by franchisees in Australia, France, Dubai, Greece and Kuwait. The brand is sold in the world’s best Menswear retailers including Selfridges, Harrods, Mr Porter, Le Bon Marche, Saks 5th Avenue and Holt Renfrew amongst others, as well as through key trend and regional independent menswear stores. In 2018 Orlebar Brown was acquired by Chanel, with a plan to continue the brand’s growth and development internationally and across channels. We are looking for another strong team player to join us on our journey in establishing Orlebar Brown as the luxury choice lifestyle brand for holiday clothes to wear every day. -

Department Stores

SURVIVAL OF THE FITTEST: DEPARTMENT STORES With Mouse of Fraser dosing more than half its stores, Debenhams posting profit warnings, and Lord & Taylor and Barneys closing in New York, where does the future of department stores lie? Text: L/ndsey Dennis Since the collapse of BHS In 2015. It's not been an easy ride for the The retailer Is building loyalty by offering customers vouchers in department store sector. Research by property platform Lendysays return for recycling their old clothes, reducing the Impact on landfill. the number of large department stores in England has fallen by The scheme Is currently being tria I led with 100 customers. 25 per cent in less than a decade to just 180 from 240 in 2009. As well as the increase In online retail. Samantha Dover, senior House of Fraser has announced plans to close 31 of its 59 retail analyst at Mlntel. says large store estates also make It difficult stores, including its Oxford Street flagship, after launching a for department stores to respond quickly to the major changes Company Voluntary Arrangement (CVA) in June. Debenhams on the British high street, with a host of new shopping centre plans to downsize at least 30 of its stores. Marks and Spencer has developments redirecting shoppers away from traditional shopping announced plans to close 100 stores. So what can. and should, districts towards new retail destinations. She says large space department stores do moving forward? retailers don't have the flexibility to relocate in the way smaller Selfrldges was recently crowned Best Department Store In the operators can and this has left many House of Fraser stores out on World for the forth time at the Global Department Store Summit. -

Regent Street

Primary Shopping Area 2: Regent Street Shopping Area Health Check Survey August 2002 £60 INTRODUCTION Purpose of the Study i) The Government advises local authorities to base their development plans and policies on assessments of their retail centres, as set out in guidance contained within Planning Policy Guidance Note 6 (PPG6 revised) June 1996. Local authorities are advised to monitor the health of their shopping centres and to regularly collect information on key indicators. Westminster carried out health checks in 1997. A list of indicators is set out in Figure 1 (PPG6, paragraph 2.7). ii) The City of Westminster is in the process of reviewing the Westminster Unitary Development Plan Adopted 1997 (UDP). As part of this review, the Council has commissioned a study of retail centres in Westminster that includes the production of new, or updates of previous, health check surveys of shopping areas in the City. This report sets out the findings of a health check survey of Regent Street. Health Checks in Westminster iii) The City of Westminster is divided into two zones in terms of retail policy, the Central Activities Zone (CAZ) and CAZ Frontages; and areas outside the CAZ. The CAZ contains the two international centres in London; the West End and Knightsbridge; other shopping areas such as Victoria Street, as well as numerous small parades and individual shops. Outside the CAZ there are 7 District Centres and 39 Local Centres designated in the Revised (Second) Deposit UDP. For the purposes of this study the CAZ has been divided into 17 shopping areas (4 primary areas1 and 13 other areas in the CAZ). -

A Tourist Guide to London for Data Modellers

London Tourist Guide for Data Modellers 1 A Tourist Guide to London for Data Modellers Buckingham Palace with Royal Guards in traditional red Uniforms London Tourist Guide for Data Modellers 2 Table of Contents Table of Contents ....................................................................................................................... 2 Welcome .................................................................................................................................... 3 1. Introduction ............................................................................................................................ 3 A. Beginner’s Level .................................................................................................................... 5 B. Intermediate Level ................................................................................................................40 C. Advanced Level ....................................................................................................................64 First Edition: London, 2013 ISBN-13: 978-1478114192 First, I would like to say thank you to these kind people for their valuable comments on early drafts of this book. USA: Vickie Comrie Other parts of the world: Andy Cheng, Chengdu, China London Tourist Guide for Data Modellers 3 Welcome We have produced this book in response to a number of requests from visitors to our Database Answers Web site. It incorporates a selection from our Library of over 1,000 data models that are featured on the Web site: http://www.databaseanswers.org/data_models/index.htm -

Stanhopeplc.Com Stanhope 2020 Stanhope 2020

2020 STANHOPEPLC.COM STANHOPE 2020 STANHOPE 2020 “Every project is different. We start with a blank canvas and our collective experience.” Stanhope are fortunate to have been involved in some of London’s major placemaking projects. We provide innovative responses to complex development opportunities and are known for delivering high quality developments within budget and time constraints. Stanhope’s overriding objective is to leave a legacy of sustainable improvement to the built environment. We aim to create memorable places for living, working and enjoyment that provide a range of uses supporting local communities and acting as a catalyst for further renewal. DAVID CAMP CEO 2 3 STANHOPE 2020 STANHOPE 2020 Stanhope: Originate | Design | Build | Manage Stanhope is a multi-skilled property developer. Our multi-disciplinary in house team can offer the right experience at every stage of the We deliver projects from inception to operation. development process. Originate Design Build Manage Defining the overall vision and brief Establishing the foundations to Managing the process to make the Delivering ongoing asset for the project make the project possible project a reality management and growth RESEARCH CONCEPTUAL DESIGN PROCUREMENT STRATEGY Site | Area | Trends | Uses Uses | Product | Massing Strategy | Implementation | Risk Objectives | Financials | Approach ACQUISITION PLANNING TECHNICAL DESIGN IMPLEMENTATION Appraisals | Legals | Risk Analysis Strategy | Consultation | Consents Buildability | Efficiency | Supply Chain Teams | Services -

Investment Opportunity Development of World Class Department Store

Investment opportunity Development of world class department store Opportunity We offer you participation in redevelopment of the iconic KOTVA to create world class department store. 2 Vision To create the “must visit“ and most outstanding retail destination in Prague. 3 Náměstí Republiky Old Town Square High street location The scale and location of the building give Kotva a unique presence in the heart of Prague retail. Prague & Kotva 2,7 1975 million residents in since then Kotva has Prague urban region. been an iconic retail place for Prague and the Czech Republic. 8 5th million foreign largest department tourists are visiting store in Europe at the Prague every year. time of its opening. 178 % 2021 Prague purchasing relaunch of new exciting power of Europe and innovative average. department store as Prague retail landmark. 5 Key facts Standard floor 4 000 sq m Ground plan is created by 28 7 above ground connected and 2 hexagons underground creating unique levels open space plan Current 200 parking occupancy places above 95% Net leasable area 30 000 sq m Management team The department store retail team are specialist management consultants and project managers with experience from some of the world’s leading international department stores including Selfridges, Harrods, Harvey Nichols, Liberty, Lane Crawford, TSUM and Tsvetnoy. 7 Joint venture partnership The owner proposes acquisition of a share of the asset with the project of a future high-end department store. Expected return of investment is above 250 %. Contact Miroslav Linhart Partner After signing of the NDA you will be provided with access [email protected] to the gated webpage section with further information. -

Corporate Governance Statements FY 2019/20 Contents

Selfridges Retail Limited Corporate Governance Statements FY 2019/20 Contents 03 04 12 The Directors and Their The Six Wates Principles Stakeholder Duties under Section and how Selfridges Engagement 172 of the Companies applies these Statement Act 2006 (Section 172) 03 The Directors and Selfridges Retail Limited (Selfridges) is incorporated in the UK and of the Company and its stakeholders, as well as having regard headquartered in London. Selfridges is a world renowned retailer to the requirements of Section 172. This is further developed below. Their Duties under which provides leading luxury shopping experiences for customers Section 172 of the from across the globe; and it is part of the wider ‘Selfridges Group’ Selfridges continues to adopt the Wates Principles for Corporate Companies Act comprised of Selfridges and other international retail businesses. Governance first implemented in 2019, during which year Selfridges 2006 (Section 172) reviewed its internal governance framework to align with good Selfridges has its flagship store on London’s Oxford Street along practice in governance. This included ensuring that there is an with two stores in Manchester at Exchange Square and the Trafford appropriate rhythm for key meetings in Selfridges, with appropriate Centre, as well as another in Birmingham Bullring Centre and also Terms of Reference in place, that attendees’ roles and responsibilities a digital business. These stores are recognised as some of the world’s are considered, meetings are minuted, and matters which should be top retail destinations. Selfridges is renowned for its unique shopping addressed by the board of directors including principal decisions are experiences for both domestic and international customers.