Return of Private Foundation Fo~M 990-PF

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nonpubenrollment2014-15 INST CD 010100115658 010100115665 010100115671 010100115684 010100115685 010100115705 010100115724 01010

Nonpubenrollment2014-15 INST_CD 010100115658 010100115665 010100115671 010100115684 010100115685 010100115705 010100115724 010100118044 010100208496 010100317828 010100996053 010100996179 010100996428 010100996557 010100997616 010100997791 010100997850 010201805052 010306115761 010306809859 010306999575 010500996017 010601115674 010601216559 010601315801 010601629639 010623115655 010623115753 010623116561 010623806562 010623995677 010802115707 020801659054 021601658896 022001807067 022601136563 030200185471 030200185488 030200227054 030701998080 030701998858 031401996149 031501187966 031502185486 031502995612 031601806564 042400136448 042400139126 042400805651 042901858658 043001658554 Page 1 Nonpubenrollment2014-15 043001658555 043001658557 043001658559 043001658561 043001658933 043001659682 050100169701 050100996140 050100996169 050100999499 050100999591 050301999417 050701999254 051101658562 051101658563 051901425832 051901427119 060201858116 060503658575 060503659689 060601658556 060601659292 060601659293 060601659294 060601659295 060601659296 060601659297 060601659681 060701655117 060701656109 060701659831 060701659832 060800139173 060800808602 061700308038 062601658578 062601658579 062601659163 070600166199 070600166568 070600807659 070901166200 070901855968 070901858020 070901999027 081200185526 081200808719 091101159175 091101858426 091200155496 091200808631 100501997955 Page 2 Nonpubenrollment2014-15 101601996549 101601998246 110200185503 110200808583 110200809373 120501999934 120906999098 121901999609 130200805048 130200809895 -

Visit Chicago Area Independent Schools This Fall!

CHICAGO SHAKESPEARE THEATER Chicago Shakespeare Theater salutes Welcome THE PRODUCERS’ GUILD for its tremendous work on Family Gala 2015. DEAR FRIENDS, Who doesn’t love Disney’s The Little Mermaid? It’s one of our favorite stories from the fairy tale canon, and we are so excited to share it with you today. JOIN IN THE FUN— Contact Christopher Pazdernik at Our director Rachel Rockwell has worked for almost a year with a team of ADVOCATE FOR AND SUPPORT [email protected] designers, artists and artisans to create this magical world. In our intimate CHICAGO SHAKESPEARE! or call 312.667.4949 for details. theater, the story comes to life all around you! The Little Mermaid is one of many plays Chicago Shakespeare will produce this season. In just one year, we stage as many as nineteen different productions here on Navy Pier, on tour to schools and neighborhood parks—and all around the world. Our Theater is not only home to work by Shakespeare. We are forever inspired by this famous playwright to create new plays and musicals, and import DARE international theater artists to share their stories with Chicago audiences. We hope you enjoy your journey “under the sea” today, and that you’ll be back soon for more! For a family-friendly introduction to the Bard this summer, we Photo by Lindsey Best © 2015 Blue Man Productions, LLC. Photo by Lindsey Best © 2015 Blue Man Productions, TO LIVE invite you to come see Shakespeare’s Greatest Hits—on tour across the city, IN FULL free for all, through Chicago Shakespeare in the Parks. -

Supreme Court, Appellate Division First Department

SUPREME COURT, APPELLATE DIVISION FIRST DEPARTMENT MAY 9, 2013 THE COURT ANNOUNCES THE FOLLOWING DECISIONS: Gonzalez, P.J., Tom, Sweeny, Renwick, Richter, JJ. 10007 Start Elevator, Inc., Index 108412/09 Plaintiff-Appellant, -against- New York City Housing Authority, Defendant-Respondent. _________________________ Agulnick & Gogel, LLC, Great Neck (William A. Gogel of counsel), for appellant. Kelly D. MacNeal, New York (Lauren L. Esposito of counsel), for respondent. _________________________ Order, Supreme Court, New York County (Barbara R. Kapnick, J.), entered June 1, 2010, which granted defendant’s motion to dismiss the complaint, unanimously affirmed, without costs. Plaintiff’s contention that its April 28 and May 4, 2004 letters constituted a notice of claim pursuant to section 23 of the parties’ contract is unavailing (see e.g. Bat-Jac Contr. v New York City Hous. Auth., 1 AD3d 128, 129 [1st Dept 2003]). The April 28 letter merely stated that plaintiff would forward an estimate for the increased cost due to the change from ceramic tiles to glazed structural brick; however, section 23(a) requires that a notice of claim state the “amount of the extra cost.” Although plaintiff’s May 4 letter stated the amount of the extra cost, it was “not designated as a notice of claim” (Bat-Jac, 1 AD3d at 128; see also Everest Gen. Contrs. v New York City Hous. Auth., 99 AD3d 479, 479-480 [1st Dept 2012]), and instead was a change order form requiring defendant to accept and approve the change by signing it. Defendant’s signature does not appear on the May 4 letter. Even assuming that plaintiff’s letters constitute a notice of claim, the release plaintiff signed bars this action (see e.g. -

Title: the Distribution of an Illustrated Timeline Wall Chart and Teacher's Guide of 20Fh Century Physics

REPORT NSF GRANT #PHY-98143318 Title: The Distribution of an Illustrated Timeline Wall Chart and Teacher’s Guide of 20fhCentury Physics DOE Patent Clearance Granted December 26,2000 Principal Investigator, Brian Schwartz, The American Physical Society 1 Physics Ellipse College Park, MD 20740 301-209-3223 [email protected] BACKGROUND The American Physi a1 Society s part of its centennial celebration in March of 1999 decided to develop a timeline wall chart on the history of 20thcentury physics. This resulted in eleven consecutive posters, which when mounted side by side, create a %foot mural. The timeline exhibits and describes the millstones of physics in images and words. The timeline functions as a chronology, a work of art, a permanent open textbook, and a gigantic photo album covering a hundred years in the life of the community of physicists and the existence of the American Physical Society . Each of the eleven posters begins with a brief essay that places a major scientific achievement of the decade in its historical context. Large portraits of the essays’ subjects include youthful photographs of Marie Curie, Albert Einstein, and Richard Feynman among others, to help put a face on science. Below the essays, a total of over 130 individual discoveries and inventions, explained in dated text boxes with accompanying images, form the backbone of the timeline. For ease of comprehension, this wealth of material is organized into five color- coded story lines the stretch horizontally across the hundred years of the 20th century. The five story lines are: Cosmic Scale, relate the story of astrophysics and cosmology; Human Scale, refers to the physics of the more familiar distances from the global to the microscopic; Atomic Scale, focuses on the submicroscopic This report was prepared as an account of work sponsored by an agency of the United States Government. -

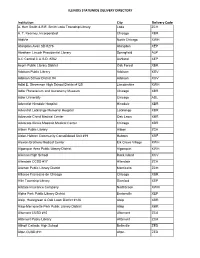

Illinois Statewide Delivery Directory

ILLINOIS STATEWIDE DELIVERY DIRECTORY Institution City Delivery Code A. Herr Smith & E.E. Smith Loda Township Library Loda ZCH A. T. Kearney, Incorporated Chicago XBR AbbVie North Chicago XWH Abingdon-Avon SD #276 Abingdon XEP Abraham Lincoln Presidential Library Springfield ALP A-C Central C.U.S.D. #262 Ashland XEP Acorn Public Library District Oak Forest XBR Addison Public Library Addison XGV Addison School District #4 Addison XGV Adlai E. Stevenson High School District #125 Lincolnshire XWH Adler Planetarium and Astronomy Museum Chicago XBR Adler University Chicago ADL Adventist Hinsdale Hospital Hinsdale XBR Adventist LaGrange Memorial Hospital LaGrange XBR Advocate Christ Medical Center Oak Lawn XBR Advocate Illinois Masonic Medical Center Chicago XBR Albion Public Library Albion ZCA Alden-Hebron Community Consolidated Unit #19 Hebron XRF Alexian Brothers Medical Center Elk Grove Village XWH Algonquin Area Public Library District Algonquin XWH Alleman High School Rock Island XCV Allendale CCSD #17 Allendale ZCA Allerton Public Library District Monticello ZCH Alliance Francaise de Chicago Chicago XBR Allin Township Library Stanford XEP Allstate Insurance Company Northbrook XWH Alpha Park Public Library District Bartonville XEP Alsip, Hazelgreen & Oak Lawn District #126 Alsip XBR Alsip-Merrionette Park Public Library District Alsip XBR Altamont CUSD #10 Altamont ZCA Altamont Public Library Altamont ZCA Althoff Catholic High School Belleville ZED Alton CUSD #11 Alton ZED ILLINOIS STATEWIDE DELIVERY DIRECTORY AlWood CUSD #225 Woodhull -

SPRING Sports Program

FREESPRING Sports 2015Program 2016Courtesy of the Marmion Sports Boosters Senior Keepsake Edition 1 Rt. 47 just North of Rt. 71 in Yorkville www.groundeffectsinc.com 630-553-6195 WHERE BEAUTIFUL LANDSCAPES BEGIN We have everything you need to create a backyard paradise! Mulches - Decorative Stone - Sand & Gravel - Retaining Walls - Pulverized Dirt - Paving Bricks “Areas largest supply of flagstone, outcropping & boulders” 52 2 ABBOT JOHN BRAHILL OSB ’67 President ANTHONY TINERELLA ’84 ANDREW DAMATO ’01 Head of School and Principal Athletic Director ABOUT US Location: 1000 Butterfield Rd Aurora, Illinois 60502 Phone: 630-897-6936 Website: www.marmion.org Founded in 1933 by the Benedictine Community of Enrollment: 529 St. Meinrad Abbey, Indiana - Marmion Academy has Nickname: Cadets experienced a long, rich history among private college Colors: Red & Blue preparatory schools. As the only Catholic boys high Conference: Chicago Catholic League school in the Midwest offering a JROTC program and LEAD program, the Academy provides its students with unparalleled opportunities for intellectual accomplish- ment, spiritual growth and leadership development. HEAD COACHES Baseball (Varsity): Frank Chapman The 325 acre campus includes attractive, modern facili- Baseball (Soph.): Bob Winkel ties for its student body of 529 young men. Recognized Baseball (Frosh.): Robert Reder as one of the top private secondary schools in the Bass Fishing: Joe Large region, Marmion presents a highly respected faculty Lacrosse (Varsity): Kevin Griffin including 44 lay faculty members and 6 Benedictines. Lacrosse (JV): Angelo Carbonara With a college acceptance rate of 100 percent and 127 Lacrosse (Soph.): Dan Ludwig National Merit Finalists among its graduates, Marmion Tennis: John Tsang students consistently rank among the best. -

City of Evansville, Indiana Downtown Master Plan

City of Evansville, Indiana Downtown Master Plan FINAL REPORT October 2001 Claire Bennett & Associates KINZELMAN KLINE GOSSMAN 3 Table of Contents Table of Contents F. Market Positioning 3. Conclusions and Recommendations Acknowledgments IV. Metropolitan Area Commercial Centers 1. Introduction 1.1 Planning Objectives 4. Strategic Redevelopement I. Target Area Map 4.1 Town Meeting and S.W.O.T. II. Zoning Map 4.2 Design Charrette Process 2. Strategic Planning 4.3 Strategic Vision 2.1 Strategic Thinking (issues, goals, and objectives) 5. Conclusions and Recommendations 1. Develop Three Distinctive Downtown Districts 2.2 Urban Design Principles 5.1 The Vision 2. Reintroduce Evansville to Downtown Living 3. Initial Assessment 5.2 Downtown Evansville’s Revitalization 4.4 Redevelopment Opportunities 3.1 History, Diversity & Opportunity 1. Target Market 3.2 Physical Assessment of Downtown I. Overall Concept Plan Retail, Housing, Office II. District Diagram 1. Transportation, Circulation, and Parking 2. Principles of Revitalization III. Main Street Gateway Concept I. Parking Inventory Map 3. Organizational Strategy IV. Main Street Phasing Plan II. Estimated Walking Coverage Map V. Main Street Corridor Phasing Plan 4. Commercial Strategy 3.3. Market Analysis VI. Main Street “Placemaking” 5.3 Implementation 1. Introduction VII. Streetscape Enhancements 1. Strategic Goals A. Background and Project Understanding VIII. Pilot Block 2. Development and Business Incentives IX. Civic Center Concept Plan 2. Fact Finding and Analysis 3. Policy Making and Guidance X. Fourth Street Gateway Concept A. Project Understanding XI. Riverfront West Concept 4. Sustainable Design B. Market Situation XII. Gateway and Wayfinding 5. Final Thoughts C. Trade Area Delineations XIII. -

Press Guests at State Dinners - Lists and Memos (9)” of the Ron Nessen Papers at the Gerald R

The original documents are located in Box 23, folder “Press Guests at State Dinners - Lists and Memos (9)” of the Ron Nessen Papers at the Gerald R. Ford Presidential Library. Copyright Notice The copyright law of the United States (Title 17, United States Code) governs the making of photocopies or other reproductions of copyrighted material. Ron Nessen donated to the United States of America his copyrights in all of his unpublished writings in National Archives collections. Works prepared by U.S. Government employees as part of their official duties are in the public domain. The copyrights to materials written by other individuals or organizations are presumed to remain with them. If you think any of the information displayed in the PDF is subject to a valid copyright claim, please contact the Gerald R. Ford Presidential Library. Digitized from Box-- 23 of The Ron Nessen Papers at the Gerald R. Ford Presidential Library -- GUEST LIST FOR THE DINNER TO BE GIVEN BY THE PRESIDENT AND MRS. FORD IN HONOR OF HIS EXCELLENCY THE PRESIDENT OF THE REPUBLIC OF COLOMBIA AND MRS. LOPEZ ON THURSDAY, SEPT EM- BER 25, 1975 AT EIGHT O'CLOCK, THE WHITE HOUSE . His Excellency The President of the Republic of Colombia and Mrs. Lopez His Excellency The Ambassador of the Republic of Colombia and Mrs. Turbay His Excellency Rodrigo Botero Montoya and Mrs. Botero Minister of Finance His Excellency Rafael Pardo Buelvas and Mrs. Pardo Minister of Agriculture His Excellency Jorge Ramirez Ocampo and Mrs. Ramirez Minister of Economic Development His Excellency Humberto Salcedo Collantes and Mrs. -

ED269866.Pdf

DOCUMENT RESUME ED 269 866 EA 018 406 AUTHOR Yeager, Robert J., Comp. TITLE Directory of Development. INSTITUTION National Catholic Educational Association, Washington, D.C. PUB DATE 86 NOTE 34p. AVAILABLE FROMPublication Sales, National Catholic Educational Association, 1077 30th Street, N.W., Suite 100, Washington, DC 20007-3852 ($10.95 prepaid). PUB TYPE Reference Materials - Directories/Catalogs (132) EDRS PRICE MF01/PCO2 Plus Postage. DESCRIPTORS Administra"orsi 4.Catholic Schools; Elementary Secondary ,ducatien; *Institutional Advancement; National Surveys; Postsecondary Education IDENTIFIERS Development Officers ABSTRACT This booklet provides a listing of all the Catholic educational institutions that responded to a nationalsurvey of existing insti utional development provams. No attemptwas made to determine the quality of the programs. The information is providedon a regional basis so that development personnel can mo.s readily make contact with their peers. The institutions are listed alphabetically within each state grouping, and each state is listed alphabetically within the six regions of the country. Listingsare also provided for schools in Belgium, Canada, Guam, Italy, and Puerto Rico. (PGD) *********************************.************************************* * Reproductions supplied by =DRS are the best that can be made * * from the original document. * ***********************0*****************************************1***** £11 Produced by The Office of Development National Catholic Education Association Compiled by -

K–12 Student Artists in the Museum Carol Anderson, Mcnay Docent Mary Hogan, Mcnay Docent and Chair-Elect Linda Smith, Mcnay Do

K–12 Student Artists in the Museum Carol Anderson, McNay Docent Mary Hogan, McNay Docent and Chair-elect Linda Smith, McNay Docent and Chair Kate Carey, Head of Education McNay Art Museum • Built in 1929 by artist and collector Marion Koogler McNay • First Modern Art Museum in Texas, 1954 • Bequests include Mary Cassatt, Marc Chagall, Pablo Picasso, Diego Rivera, & Vincent Van Gogh • Mission: Engage a diverse community in the discovery and enjoyment of the visual arts Spotlight at the McNay • Year-long deep dive with one artwork established 2011 • Creative responses to artwork on view • Celebration in May to honor students & teachers • Exhibition of K–12 student artwork in dedicated gallery (for an entire year) Why Spotlight a Single Object? • A 2018 study by NAEA and AAMD showed the lasting impact of a one-time museum visit. • Students improve problem solving, develop better questioning skills, and extend periods of intense concentration. • "I love that my students, the majority of whom come from low-income families in communities of color, can come to the McNay and see themselves represented there." —San Antonio Teacher Spotlight Exhibition A student painted a portrait of her brother. At Spotlight, she told him, "Look, now you are a work of art!" —2019 Spotlight Participant Spotlight Impact 2016 2017 2018 2019 Rack Gives Back Support Students 578 668 1,014 1,549 Schools 13 14 16 31 Student Projects Exhibited 90 277 439 445 Title I Schools 6 7 6 14 Families reached at After School Outreach Activities 0 1,750 3,785 4,000+ Magnificent Seven Spotlight Schools Roosevelt High School, Camelot Elementary, Montgomery Elementary, and Windcrest Elementary Opening Question • What does outreach look like in your museum? • Who is the target audience? • Support & considerations. -

Edgar Degas French, 1834–1917 Woman Arranging Her Hair Ca

Edgar Degas French, 1834–1917 Woman Arranging her Hair ca. 1892, cast 1924 Bronze McNay Art Museum, Mary and Sylvan Lang Collection, 1975.61 In this bronze sculpture, Edgar Degas presents a nude woman, her body leaned forward and face obscured as she styles her hair. The composition of the figure is similar to those found in his paintings of women bathing. The artist displays a greater interest in the curves of the body and actions of the model than in capturing her personality or identity. More so than his posed representations of dancers, the nude served throughout Degas’ life as a subject for exploring new ideas and styles. French Moderns McNay labels_separate format.indd 1 2/27/2017 11:18:51 AM Fernand Léger French, 1881–1955 The Orange Vase 1946 Oil on canvas McNay Art Museum, Gift of Mary and Sylvan Lang, 1972.43 Using bold colors and strong black outlines, Fernand Léger includes in this still life an orange vase and an abstracted bowl of fruit. A leaf floats between the two, but all other elements, including the background, are abstracted beyond recognition. Léger created the painting later in his life when his interests shifted toward more figurative and simplified forms. He abandoned Cubism as well as Tubism, his iconic style that explored cylindrical forms and mechanization, though strong shapes and a similar color palette remained. French Moderns McNay labels_separate format.indd 2 2/27/2017 11:18:51 AM Pablo Picasso Spanish, 1881–1973 Reclining Woman 1932 Oil on canvas McNay Art Museum, Jeanne and Irving Mathews Collection, 2011.181 The languid and curvaceous form of a nude woman painted in soft purples and greens dominates this canvas. -

Illinois Tech Contract Usage 2019-2020

Illinois Technology Contract Usage 2019-2020 MHEC CONTRACTS leverage the potential volume of back to the institutions. Additionally, because of MHEC’s the region’s purchasing power while saving institutions statutory status, many of these contracts can also be time and money by simplifying the procUrement process. adopted for use by K-12 districts and schools, as well as The2 contracts0182019 provide competitive solutions established cities, states, and local governments. An added benefit in accordance with public procurement laws thereby for smaller institutions is that these contracts allow these negating the institution’s need to conduct a competitive institutions to negotiate from the same pricing and terms sourcing event. By offering a ready-to-use solution with normally reserved for larger institutions. MHEC relies on theANNUAL ability to tailor the already negotiated contract to institutional experts to participate in the negotiations, match the institution’s specific needs and requirements, sharing strategies and tactics on dealing with specific MHECREPORT contracts shift some of the negotiating power contractual issues and vendors. HARDWARE CONTRACTS Illinois College of Optometry McHenry County College Rock Valley College Higherto theEducation MemberIllinois Community States College Midwestern University Rockford University Board Aurora University Monmouth College Roosevelt University Illinois Eastern Community Benedictine University Moraine Valley Community Rosalind Franklin University of Colleges College Medicine and Science