RBI in NEWS Reserve Bank Said the Aggregate Ceiling for Foreign

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Shreya to Serenade Her Fans on Valentine's

GET YOUR COPY with your JOBURG MR DELIVERY order from FREE Thurs-Sat each week YOUR FREE GUIDE TO YOUR FREE TIME ÷ 04 February - 10 February 2016 ÷ Issue 38 Katlego Maboe on Life & Travel – page 3 ‘Bad Jews’ makes a splash in Sandton – page 4 - Page 7 Shreya to serenade her fans on Valentine’s Day Oscar nominated ‘Spotlight’ hits screens – page 8 Follow us online: @48hoursinjoburg www.facebook.com/48hoursinjoburg The Next 48hOURS • Socials Fun day in the sun at the 2016 #ARAREBLEND J&B Met Pictures by andrew brown & abdurahman Khan EDITORIaL STaFF EditoriaL COnTRIbutors EditoriaL Address The Next 48hOURS is published by Managing Editor: Naushad Khan Jenny Morris Postal: P.O. Box 830, Rani Communications. Every effort has Publisher/Editor: Imran Khan Peter Feldman Maitland, 7404 been made to ensure the accuracy of Production Editor: Peter Tromp RoxyK the information provided. Editorial Assistant: Aisha Sieed Imran Khan Actual: 12 Main Rd. The Next 48hOURS will not be held Three Anchor Bay responsible for the views and opinions Senior Designer: Dane Torode Tel: 021 8024848 National Sales: Godfrey Lancellas [email protected] expressed by writers and contributors. All rights reserved. 2 The Next 48hOURS www.48hours.co.za 04 February - 10 February 2016 The Next 48hOURS • What’s Hot Travelling & Living with the stars In this regular column, we chat to at random spots in a town or mar- What has been your favourite cui- What is your speciality in the kitch- some of SA’s premier personalities ket that we were visiting and give a sine that you have discovered on en? about their travel experiences and little impromptu performance for the your travels? I make the meanest and most deli- favourite local pastimes and haunts. -

Number Games Full Book.Pdf

Should you read this book? If you think it is interesting that on September 11, 2001, Flight 77 reportedly hit the 77 foot tall Pentagon, in Washington D.C. on the 77th Meridian West, after taking off at 8:20 AM and crashing at 9:37 AM, 77 minutes later, then this book is for you. Furthermore, if you can comprehend that there is a code of numbers behind the letters of the English language, as simple as A, B, C is 1, 2, 3, and using this code reveals that phrases and names such as ‘September Eleventh’, ‘World Trade Center’ and ‘Order From Chaos’ equate to 77, this book is definitely for you. And please know, these are all facts, just the same as it is a fact that Pentagon construction began September 11, 1941, just prior to Pearl Harbor. Table of Contents 1 – Introduction to Gematria, the Language of The Cabal 2 – 1968, Year of the Coronavirus & 9/11 Master Plan 3 – 222 Months Later, From 9/11 to the Coronavirus Pandemic 4 – Event 201, The Jesuit Order, Anthony Fauci & Pope Francis 5 – Crimson Contagion Pandemic Exercise & New York Times 6 – Clade X Pandemic Exercise & the Pandemic 666 Days Later 7 – Operation Dark Winter & Mr. Bright’s “Darkest Winter” Warning 8 – Donald Trump’s Vaccine Plan, Operation Warp Speed 9 – H.R. 6666, Contact Tracing, ID2020 & the Big Tech Takeover 10 – Rockefeller’s 2010 Scenarios for the Future of Technology 11 – Bill Gates’ First Birthday on Jonas Salk’s 42nd... & Elvis 12 – Tom Hanks & the Use of Celebrity to Sell the Pandemic 13 – Nadia the Tiger, Tiger King & Year of the Tiger, 2022 14 – Coronavirus Predictive -

June Month Current Affairs Quiz

June Month Current Affairs Quiz JUNE MONTH CA QUIZ 1. The last leg of intra-state e-way bill system from the earlier estimate of 3.2%.For the implementation involves how many states? current fiscal year, government estimates to trim the deficit to 3.3% of GDP.Fiscal deficit a) 10 is the difference between total revenue & total expenditure of the government. b) 5 3. Which of the following PSU has emerged as c) 8 India's most profitable state-owned company for the second consecutive year? d) 4 a) BHEL Explanation: The e-waybill system for intra- State movement of goods will be implemented b) NTPC for the final eight States. The new system would be implemented for intra-State transport c) IOC in Chhattisgarh, Goa, Jammu & Kashmir, Mizoram, Odisha, Punjab, Tamil Nadu and in d) HPCL West Bengal. E-way bill operations are Explanation: Indian Oil Corporation has compulsory for inter-state movement of goods emerged as India's most profitable state- throughout the nation and intra-state owned company for the second consecutive movement. year. Indian Oil posted a record profit of 2. What was the fiscal deficit target of the Rs21,346 crore in 2017-18, followed by Indian Government for 2017-18? ONGC, whose profit stood at Rs 19,945 crore. a) 4.0% 4. What is the state bird of Andhra Pradesh? b) 2.8% a) Indian Roller c) 3.0% b) Palapitta d) 3.5% c) Rose ringed parakeet Explanation: Government has met its fiscal d) All of the above deficit target for 2017-18 at 3.53% of the Explanation: Four years after the bifurcation Gross Domestic Product.Government in the of Andhra Pradesh, the government of the Budget had revised the fiscal deficit target for residual state has announced its state symbols. -

Australian Nursing Federation – Registered Nurses, Midwives

2021 WAIRC 00144 WA HEALTH SYSTEM - AUSTRALIAN NURSING FEDERATION - REGISTERED NURSES, MIDWIVES, ENROLLED (MENTAL HEALTH) AND ENROLLED (MOTHERCRAFT) NURSES - INDUSTRIAL AGREEMENT 2020 WESTERN AUSTRALIAN INDUSTRIAL RELATIONS COMMISSION PARTIES NORTH METROPOLITAN HEALTH SERVICE, CHILD AND ADOLESCENT HEALTH SERVICE, EAST METROPOLITAN HEALTH SERVICE & OTHERS APPLICANTS -v- AUSTRALIAN NURSING FEDERATION, INDUSTRIAL UNION OF WORKERS PERTH RESPONDENT CORAM COMMISSIONER T EMMANUEL DATE MONDAY, 24 MAY 2021 FILE NO/S AG 8 OF 2021 CITATION NO. 2021 WAIRC 00144 Result Agreement registered Representation Applicants Mr L Martyr (as agent) Respondent Mr M Olson (as agent) Order HAVING heard from Mr L Martyr (as agent) on behalf of the applicants and Mr M Olson (as agent) on behalf of the respondent, the Commission, pursuant to the powers conferred under the Industrial Relations Act 1979 (WA), orders – THAT the agreement made between the parties filed in the Commission on 6 May 2021 entitled WA Health System – Australian Nursing Federation – Registered Nurses, Midwives, Enrolled (Mental Health) and Enrolled (Mothercraft) Nurses – Industrial Agreement 2020 attached hereto be registered as an industrial agreement in replacement of the WA Health System – Australian Nursing Federation – Registered Nurses, Midwives, Enrolled (Mental Health) and Enrolled (Mothercraft) Nurses - Industrial Agreement 2018 which by operation of s 41(8) is hereby cancelled. COMMISSIONER T EMMANUEL WA HEALTH SYSTEM – AUSTRALIAN NURSING FEDERATION – REGISTERED NURSES, MIDWIVES, ENROLLED (MENTAL HEALTH) AND ENROLLED (MOTHERCRAFT) NURSES – INDUSTRIAL AGREEMENT 2020 INDUSTRIAL AGREEMENT NO: AG 8 OF 2021 PART 1 – APPLICATION & OPERATION OF AGREEMENT 1. TITLE This Agreement will be known as the WA Health System – Australian Nursing Federation – Registered Nurses, Midwives, Enrolled (Mental Health) and Enrolled (Mothercraft) Nurses – Industrial Agreement 2020. -

In This Issue... Machinery Marvels Page 46 Crop Momentum Page 66 LAMMA Comes in from the Cold Building Blocks for a Wonder Wheat

20th Anniversary Edition See p8 for your chance to win a bottle of quality malt whisky In this issue... Machinery marvels LAMMA comes in fr Confer om the cold page 46 ence call Crop momentum page 10 Building blocks for a wonder wheat Potato blight page 66 page 82 Opinion 4 Talking Tilth - A word from the editor. 6 Smith’s Soapbox - Views and opinions from an Essex peasant….. Volume 21 Number 1 8 Publisher’s perspective - A look back on 20 years of CPM. February 2019 91 Last Word - A view from the field from CPM’s technical editor. Technical 10 Conferences - Farming’s fourth revolution starts here New Year conferences were tinged with a buzz of confidence, both for the technology the sector has to access, and how it could be applied in the field. 16 CPSB conference - New thinking shapes up the toolbox There were no new products but plenty of new ideas for some of arable farming’s biggest challenges from scientists who gathered in Brighton. 20 Theory to Field - Ensuring a future for fungicides Preserving the efficacy of fungicides has never been more important. 24 Tech Talk - Savvy selection eases pressure Managing barley diseases without undue selection pressure on fungicides. 28 Real Results Pioneers - Spreading risk but staying focused At the coal face of commercial agriculture without the cushion of subsidies, farming in New Zealand is about an understanding of farming fundamentals. Editor 32 OSR nutrition - Optimising sulphur in OSR AHDB has recently updated industry guidelines for sulphur in OSR Tom Allen-Stevens . 36 Company profile - A pipeline of promise Technical editor At a time when innovations in crop protection are thin on the ground, Lucy de la Pasture Corteva Agriscience is bringing an array of new products to market. -

Psyphil Celebrity Blog Covering All Uncovered Things..!! Vijay Tamil Movies List New Films List Latest Tamil Movie List Filmography

Psyphil Celebrity Blog covering all uncovered things..!! Vijay Tamil Movies list new films list latest Tamil movie list filmography Name: Vijay Date of Birth: June 22, 1974 Height: 5’7″ First movie: Naalaya Theerpu, 1992 Vijay all Tamil Movies list Movie Y Movie Name Movie Director Movies Cast e ar Naalaya 1992 S.A.Chandrasekar Vijay, Sridevi, Keerthana Theerpu Vijay, Vijaykanth, 1993 Sendhoorapandi S.A.Chandrasekar Manorama, Yuvarani Vijay, Swathi, Sivakumar, 1994 Deva S. A. Chandrasekhar Manivannan, Manorama Vijay, Vijayakumar, - Rasigan S.A.Chandrasekhar Sanghavi Rajavin 1995 Janaki Soundar Vijay, Ajith, Indraja Parvaiyile - Vishnu S.A.Chandrasekar Vijay, Sanghavi - Chandralekha Nambirajan Vijay, Vanitha Vijaykumar Coimbatore 1996 C.Ranganathan Vijay, Sanghavi Maaple Poove - Vikraman Vijay, Sangeetha Unakkaga - Vasantha Vaasal M.R Vijay, Swathi Maanbumigu - S.A.Chandrasekar Vijay, Keerthana Maanavan - Selva A. Venkatesan Vijay, Swathi Kaalamellam Vijay, Dimple, R. 1997 R. Sundarrajan Kaathiruppen Sundarrajan Vijay, Raghuvaran, - Love Today Balasekaran Suvalakshmi, Manthra Joseph Vijay, Sivaji - Once More S. A. Chandrasekhar Ganesan,Simran Bagga, Manivannan Vijay, Simran, Surya, Kausalya, - Nerrukku Ner Vasanth Raghuvaran, Vivek, Prakash Raj Kadhalukku Vijay, Shalini, Sivakumar, - Fazil Mariyadhai Manivannan, Dhamu Ninaithen Vijay, Devayani, Rambha, 1998 K.Selva Bharathy Vandhai Manivannan, Charlie - Priyamudan - Vijay, Kausalya - Nilaave Vaa A.Venkatesan Vijay, Suvalakshmi Thulladha Vijay 1999 Manamum Ezhil Simran Thullum Endrendrum - Manoj Bhatnagar Vijay, Rambha Kadhal - Nenjinile S.A.Chandrasekaran Vijay, Ishaa Koppikar Vijay, Rambha, Monicka, - Minsara Kanna K.S. Ravikumar Khushboo Vijay, Dhamu, Charlie, Kannukkul 2000 Fazil Raghuvaran, Shalini, Nilavu Srividhya Vijay, Jyothika, Nizhalgal - Khushi SJ Suryah Ravi, Vivek - Priyamaanavale K.Selvabharathy Vijay, Simran Vijay, Devayani, Surya, 2001 Friends Siddique Abhinyashree, Ramesh Khanna Vijay, Bhumika Chawla, - Badri P.A. -

Husband First Name Father

Company CIN L27102WB1999PLC089755 JAI BALAJI INDUSTRIES LIMITEDDate Of AGM(DD‐MON‐YYYY) 18‐DEC‐2012 Name Sum of unpaid and unclaimed dividend 46,731.20 Sum of interest on unpaid and unclaimed 0 Sum of matured deposit 0 Sum of interest on matured deposit 0 Sum of matured debentures 0 Sum of interest on matured debentures 0 Sum of application money due for refund 0 Sum of interest on application money due for 0 FATHER/ PROPOSED FATHER/ FATHER/ MIDDLE LAST HUSBAND PIN FOLIO NO. OF INVESTMENT AMOUNT DATE OF FIRST NAME HUSBAND FIRST HUSBAND ADDRESS COUNTRY STATE DISTRICT NAME NAME MIDDLE CODE SECURITIES TYPE DUE (RS.) TRANSFER NAME LAST NAME NAME TO IEPF Amount for SANATAN KUMAR 96,BIYANIYO KI GALI, WARD NO.1, SIKAR UMA DEVI BIYANI INDIA Rajasthan 332001 1201370000023568 unclaimed and 13.20 20‐NOV‐2018 BIYANI RAJASTHAN INDIA unpaid dividend Amount for BEHARI VILL‐ PRITINAGAR, ROAD NO‐ 2, DIST‐ NADIA, KALYAN MAJUMDER INDIA West Bengal 741247 1201600000024542 unclaimed and 40.00 20‐NOV‐2018 MAJUMDER RANAGHAT WEST BENGAL INDIA unpaid dividend A‐1, VANDAN APARTMENT,, TRIBHUVAN Amount for GAJENDRA KUMAR SHANKARLAL COMPLEX, GHOD‐DOD ROAD, SURAT INDIA GGjujarat 395007 1202650000024701 unclliaime d and 20.00 20‐NOV‐2018 CHANDALIYA CHANDALIYA GUJARAT INDIA unpaid dividend A 34 SHIV SHANTI PARK, NR MIPCO CHOWKDI, Amount for BHAVESH MANU MANU MOTI GNFC ROAD, BHARUCH GUJARAT INDIA Gujarat 392015 1304140000024860 unclaimed and 0.40 20‐NOV‐2018 PATEL PATEL INDIA unpaid dividend Amount for ANIL SINGH RAMKRISHNA 16, VIVEK VIHAR COLONY, AGRA ROAD, Uttar INDIA -

Banking & Finance Awareness January 2016

Banking & Finance Awareness January 2016 RBI asked the banks to open banks in villages with a population of more than 5000 Reserve Bank of India (RBI) asked State Level Bankers‟ Committee (SLBC) banks to identify villages with population above 5,000 without a bank branch of a scheduled commercial bank in their state. • Identified villages may be selected among scheduled commercial banks for opening of branches and should be completed by March 31, 2017. SEBI rejects Sahara plea to restore portfolio manager licence SEBI has rejected Sahara Asset Management Company‟s plea to reconsider an order cancelling the portfolio manager licence of the company, Reason: Not „fit and proper‟ for this business. New listing norms for stock exchanges : • The exchanges would need to take steps for maintaining of 51 percentage of shareholding of Public Category and ensuring that holding of trading members, associates or agents does not exceed 49 per cent. • The depositories shall generate an alert when such holding exceeds 2 per cent and monitor the same under intimation to Sebi. • The stock exchanges, both listed and where the securities are listed, and depositories will have to ensure that such mechanism be in place latest by March 31, 2016. Punjab National Bank launches host of digital banking solutions Punjab National Bank has launched host of digital banking solutions including green PIN and enrichment of its mobile app. • Motive: To enable the customer to locate PNB ATM with PNB ATM Assist • Android app: To use GPS and locate the nearest PNB ATM • Green PIN facility: Under this customer can obtain duplicate PIN for debit card instantly through SMS request. -

Important Questions on General Awareness Part 1 for Competitive Exam

Important Questions on General Awareness Part 1 for Competitive Exam. 1. Who grabbed India's first athletics medal in the 20th edition of Common wealth Games ? Ans- Vikas Gowda 2. Book “One Life is Not Enough: An Autobiography” written by.. Ans- Kunwar Natwar Singh 3. Which player has been suspended from Indian men hockey team in the Commonwealth Games 2014 ? Ans- Sardar Singh 4. Which country will sign a pact with India for new BrahMos missile version Su-30MKI. Ans- Russia 5. Double-Decker train will run between the..............and …….. Ans- Lucknow & New Delhi 6. Which Indian women wrestler bagged gold medal in 55kg freestyle in Commonwealth Games 2014 Ans- Babita Kumari 7. RBI has recently cancelled the licence of................in Hyderabad (Telangana). Ans- Vasai Co-operative Urban Bank Ltd 8. Name the US Defence Secretary who visited New Delhi to encourage defence ties between the duos. Ans- Alfredo Di Stefano 9. National Security Advisor in defence ? Ans- Ajit K Doval 10. The first Indian woman mountaineer...................... has been awarded with …………… Ans- Bachendri Pal , Bharat Gaurav 11. Who is the first Indian woman gymnast who won bronze medal in Commonwealth Games 2014 ? Ans- Dipa Karmakar 12. India and Nepal has recently signed pacts which include 5,600 MW. Name of the project is …… Ans- Pancheshwar Multipurpose Project 13. Who received Ramon Magsaysay Awards 2014 ? Ans- Hu Shuli and Wang Canfa 14. Which edition of Commonwealth Games (CWG) 2014 was held recently ? Ans- 20 15. Which country topped with the most medals in Commonwealth Games 2014 ? Ans- Scotland 16. Which Indian men wrestler bagged gold in 65kg freestyle in Commonwealth Games 2014. -

100 the SOUTH-WEST CORNER of QUEENSLAND. (By S

100 THE SOUTH-WEST CORNER OF QUEENSLAND. (By S. E. PEARSON). (Read at a meeting of the Historical Society of Queensland, August 27, 1937). On a clear day, looking westward across the channels of the Mulligan River from the gravelly tableland behind Annandale Homestead, in south western Queensland, one may discern a long low line of drift-top sandhills. Round more than half the skyline the rim of earth may be likened to the ocean. There is no break in any part of the horizon; not a landmark, not a tree. Should anyone chance to stand on those gravelly rises when the sun was peeping above the eastem skyline they would witness a scene that would carry the mind at once to the far-flung horizons of the Sahara. In the sunrise that western region is overhung by rose-tinted haze, and in the valleys lie the purple shadows that are peculiar to the waste places of the earth. Those naked, drift- top sanddunes beyond the Mulligan mark the limit of human occupation. Washed crimson by the rising sun they are set Kke gleaming fangs in the desert's jaws. The Explorers. The first white men to penetrate that line of sand- dunes, in south-western Queensland, were Captain Charles Sturt and his party, in September, 1845. They had crossed the stony country that lies between the Cooper and the Diamantina—afterwards known as Sturt's Stony Desert; and afterwards, by the way, occupied in 1880, as fair cattle-grazing country, by the Broad brothers of Sydney (Andrew and James) under the run name of Goyder's Lagoon—and the ex plorers actually crossed the latter watercourse with out knowing it to be a river, for in that vicinity Sturt describes it as "a great earthy plain." For forty miles one meets with black, sundried soil and dismal wilted polygonum bushes in a dry season, and forty miles of hock-deep mud, water, and flowering swamp-plants in a wet one. -

Undergraduate Catalog 14-16

UNDERGRADUATE CATALOG: 2014-2016 Connecticut State Colleges and Universities ACADEMIC DEPARTMENTS, PROGRAMS, AND Accreditation and Policy COURSES Message from the President Ancell School of Business Academic Calendar School of Arts & Sciences Introduction to Western School of Professional Studies The Campus School of Visual and Performing Arts Admission to Western Division of Graduate Studies Student Expenses Office of Student Aid & Student Employment Directory Student Affairs Administration Academic Services and Procedures Faculty/Staff Academic Programs and Degrees Faculty Emeriti Graduation Academic Program Descriptions WCSU Undergraduate Catalog: 2014-2016 1 CONNECTICUT STATE COLLEGES & UNIVERSITIES The 17 Connecticut State Colleges & Universities (ConnSCU) provide affordable, innovative and rigorous programs that permit students to achieve their personal and career goals, as well as contribute to the economic growth of Connecticut. The ConnSCU System encompasses four state universities – Western Connecticut State University in Danbury, Central Connecticut State University in New Britain, Eastern Connecticut State University in Willimantic and Southern Connecticut State University in New Haven – as well as 12 community colleges and the online institution Charter Oak State College. Until the state’s higher education reorganization of 2011, Western was a member of the former Connecticut State Unviersity System that also encompassed Central, Eastern and Southern Connecticut state universities. With origins in normal schools for teacher education founded in the 19th and early 20th centuries, these institutions evolved into diversified state universities whose graduates have pursued careers in the professions, business, education, public service, the arts and other fields. Graduates of Western and other state universities contribute to all aspects of Connecticut economic, social and cultural life. -

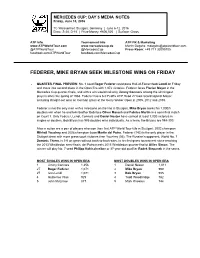

Federer, Mike Bryan Seek Milestone Wins on Friday

MERCEDES CUP: DAY 5 MEDIA NOTES Friday, June 10, 2016 TC Weissenhof, Stuttgart, Germany | June 6-12, 2016 Draw: S-28, D-16 | Prize Money: €606,525 | Surface: Grass ATP Info Tournament Info ATP PR & Marketing www.ATPWorldTour.com www.mercedescup.de Martin Dagahs: [email protected] @ATPWorldTour @MercedesCup Press Room: +49 711 32095705 facebook.com/ATPWorldTour facebook.com/MercedesCup FEDERER, MIKE BRYAN SEEK MILESTONE WINS ON FRIDAY QUARTER-FINAL PREVIEW: No. 1 seed Roger Federer could pass Hall-of-Famer Ivan Lendl on Friday and move into second place in the Open Era with 1,072 victories. Federer faces Florian Mayer in the Mercedes Cup quarter-finals, and with a win would trail only Jimmy Connors among the winningest players since the spring of 1968. Federer has a 6-0 FedEx ATP Head 2 Head record against Mayer, including straight-set wins on German grass at the Gerry Weber Open in 2005, 2012 and 2015. Federer is not the only man with a milestone on the line in Stuttgart. Mike Bryan seeks his 1,000th doubles win when he and twin brother Bob face Oliver Marach and Fabrice Martin in a semi-final match on Court 1. Only Federer, Lendl, Connors and Daniel Nestor have earned at least 1,000 victories in singles or doubles. Bob Bryan has 985 doubles wins individually. As a team, the Bryans are 984-300. Also in action are a pair of players who won their first ATP World Tour title in Stuttgart: 2002 champion Mikhail Youzhny and 2008 champion Juan Martin del Potro.