Why Washington Keeps Giving in to Wall Street Arthur E

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Perelman, M. (2007). Some Economics of Class. in M. Yates (Ed.), More

Perelman, M. (2007). Some economics of class. In M. Yates (ed.), More unequal: Aspects of class in the United States. New York: Monthly Review Press. How much more will be required before the U.S. public awakes from its political slumber? Tepid action in the workplace, the voting booth, and the streets have allowed the right wing to steamroll revolutionary changes that have remade the entire sociopolitical structure of the United States. Since the election of Franklin Roosevelt in 1932, every Democratic administration with the exception of Lyndon Johnson's has been more conservative—often far more conservative—than the previous Democratic administration. Similarly, every elected Republican administration, with the single exception of George Herbert Walker Bush's, has been more conservative than the previous Republican administration. The deterioration in the distribution of income is a symptom of a far larger problem. Perhaps formulating the situation in the United States might help people understand their class interests as well as reveal who has benefited from the right-wing revolution. Critics of Marx have long taken pleasure in claiming that the rise of the middle class in the United States and other advanced capitalist economies disproves Marx's "predictions" of the course of capitalism. In recent decades, however, the distribution of income in the United States is coming to resemble that of many poor Latin American economies, with a shrinking middle class and an obscene share of wealth going to the richest members of society. Although proponents of the U.S. model pretend that recent economic trends represent a success, in truth they are signs of capitalism's failure. -

Artificial Intelligence, Automation, and Work

Artificial Intelligence, Automation, and Work The Economics of Artifi cial Intelligence National Bureau of Economic Research Conference Report The Economics of Artifi cial Intelligence: An Agenda Edited by Ajay Agrawal, Joshua Gans, and Avi Goldfarb The University of Chicago Press Chicago and London The University of Chicago Press, Chicago 60637 The University of Chicago Press, Ltd., London © 2019 by the National Bureau of Economic Research, Inc. All rights reserved. No part of this book may be used or reproduced in any manner whatsoever without written permission, except in the case of brief quotations in critical articles and reviews. For more information, contact the University of Chicago Press, 1427 E. 60th St., Chicago, IL 60637. Published 2019 Printed in the United States of America 28 27 26 25 24 23 22 21 20 19 1 2 3 4 5 ISBN-13: 978-0-226-61333-8 (cloth) ISBN-13: 978-0-226-61347-5 (e-book) DOI: https:// doi .org / 10 .7208 / chicago / 9780226613475 .001 .0001 Library of Congress Cataloging-in-Publication Data Names: Agrawal, Ajay, editor. | Gans, Joshua, 1968– editor. | Goldfarb, Avi, editor. Title: The economics of artifi cial intelligence : an agenda / Ajay Agrawal, Joshua Gans, and Avi Goldfarb, editors. Other titles: National Bureau of Economic Research conference report. Description: Chicago ; London : The University of Chicago Press, 2019. | Series: National Bureau of Economic Research conference report | Includes bibliographical references and index. Identifi ers: LCCN 2018037552 | ISBN 9780226613338 (cloth : alk. paper) | ISBN 9780226613475 (ebook) Subjects: LCSH: Artifi cial intelligence—Economic aspects. Classifi cation: LCC TA347.A78 E365 2019 | DDC 338.4/ 70063—dc23 LC record available at https:// lccn .loc .gov / 2018037552 ♾ This paper meets the requirements of ANSI/ NISO Z39.48-1992 (Permanence of Paper). -

DIRECTING the Disorder the CFR Is the Deep State Powerhouse Undoing and Remaking Our World

DEEP STATE DIRECTING THE Disorder The CFR is the Deep State powerhouse undoing and remaking our world. 2 by William F. Jasper The nationalist vs. globalist conflict is not merely an he whole world has gone insane ideological struggle between shadowy, unidentifiable and the lunatics are in charge of T the asylum. At least it looks that forces; it is a struggle with organized globalists who have way to any rational person surveying the very real, identifiable, powerful organizations and networks escalating revolutions that have engulfed the planet in the year 2020. The revolu- operating incessantly to undermine and subvert our tions to which we refer are the COVID- constitutional Republic and our Christian-style civilization. 19 revolution and the Black Lives Matter revolution, which, combined, are wreak- ing unprecedented havoc and destruction — political, social, economic, moral, and spiritual — worldwide. As we will show, these two seemingly unrelated upheavals are very closely tied together, and are but the latest and most profound manifesta- tions of a global revolutionary transfor- mation that has been under way for many years. Both of these revolutions are being stoked and orchestrated by elitist forces that intend to unmake the United States of America and extinguish liberty as we know it everywhere. In his famous “Lectures on the French Revolution,” delivered at Cambridge University between 1895 and 1899, the distinguished British historian and states- man John Emerich Dalberg, more com- monly known as Lord Acton, noted: “The appalling thing in the French Revolution is not the tumult, but the design. Through all the fire and smoke we perceive the evidence of calculating organization. -

Value, Caution and Accountability in an Era of Large Banks and Complex Finance*

2011-2012 BETTING BIG 765 BETTING BIG: VALUE, CAUTION AND ACCOUNTABILITY IN AN ERA OF LARGE BANKS AND COMPLEX FINANCE* LAWRENCE G. BAXTER** Abstract Big banks are controversial. Their supporters maintain that they offer products, services and infrastructure that smaller banks simply cannot match and enjoy unprecedented economies of scale and scope. Detractors worry about the risks generated by big banks, their threats to financial stability, and the way they externalize costs of operation to the public. This article explains why there is no conclusive argument one way or the other and why simple measures for restricting the danger of big banks are neither plausible nor effective. The complex ecology of modern finance and the management and regulatory challenges generated by ultra-large banking, however, cast serious doubt on the proposition that the benefits of big banking outweigh its risks. Consequently, two general principles are proposed for further consideration. First, big banks should bear a greater degree of public accountability by reforming certain principles of corporate governance to require greater representation of public interests at the board and executive levels of big banks. Second, given the unproven promises of performance by big banks, their unimpressive actual record of performance, and the many hazards they inevitably generate or encounter, financial regulators should consciously adopt a strict cautionary approach. Under this approach, big banks would bear a very heavy onus to demonstrate in concrete terms that their continued growth – and even the maintenance of their current scale – can be adequately managed and supervised. * © Lawrence G. Baxter. ** Professor of the Practice of Law, Duke Law School. -

Failed Financial Institution Litigation: Remember When*

\\server05\productn\N\NYB\5-1\NYB101.txt unknown Seq: 1 27-APR-09 15:14 FAILED FINANCIAL INSTITUTION LITIGATION: REMEMBER WHEN* RICHARD D. BERNSTEIN JOHN R. OLLER JESSICA L. MATELIS** INTRODUCTION As the global economic crisis continues, the effect of the credit crisis and fair value accounting will create a likely up- surge in litigation, reminiscent of the wave of lawsuits spawned by the Savings and Loan crisis of 1988-1994 (“S&L crisis”). The body of law developed during the S&L crisis provides a ready starting point for this new round of failed financial institution litigation. Moreover, new developments since the S&L crisis will also be tested in the coming years. The Federal Deposit Insurance Corporation (“FDIC”) and the Resolution Trust Corporation (“RTC”), in their capac- ity as receivers,1 and the Office of Thrift Supervision (“OTS”), in its regulatory capacity, spearheaded much of the S&L litiga- tion. The FDIC, RTC, and OTS aggressively pursued officers and directors of failed banks and thrifts, as well as various third parties, including audit firms, law firms, and a then-major in- vestment bank, that provided services to the failed institutions. At the height of the S&L crisis, the combined direct and indi- rect payments by the FDIC and the RTC to outside counsel in 1991 reached over $700 million. The collapse of Washington Mutual in September 2008 represented the largest bank failure in U.S. history;2 added to IndyMac’s collapse in July 2008 and the failure of a number of * “We lived and learned, life threw curves/There was joy, there was hurt/Remember when.” Remember When, lyrics by Alan Jackson. -

Dartmouth Law Journal Vol. 12.2 Fall 2014

BAEZ PROSECUTORIAL DISCRETION ADVISED: ANALYZING THE PROPER ROLE OF “ECONOMIC CONSEQUENCES” AS A FACTOR IN FEDERAL PROSECUTORIAL DECISIONS NOT TO SEEK CRIMINAL CHARGES LUIS BAEZ** The 2008 housing and financial crisis produced numerous books, documentaries, and legal works around the term “Too Big to Jail.” Though the United States Justice Department claimed that the term’s applicability to the financial crisis was mostly conjecture, the past few years has indicated it is—for the most part—true. While other legal and scholarly works have discussed the term and its validity, this article argues that prosecutors should be entirely barred from considering “economic consequences” of their decisions whether or not to bring criminal charges against a person or other legal entity in order to uphold justice within the criminal system. ! INTRODUCTION ............................................................................................. 2 I. THE SOURCE OF FEDERAL PROSECUTORIAL DISCRETION ..................... 4 A. The Decision to Charge ................................................................ 5 B. Selecting the Charge ..................................................................... 5 II. RULES THAT GOVERN PROSECUTORIAL DISCRETION ............................ 6 III. THE HANDLING OF PAST CORPORATE CRIMES ...................................... 9 A. The Great Depression ................................................................... 9 B. Savings & Loan Crisis ................................................................. -

Of Community Banking: the Continued Importance of Local Institutions Bob Solomon UC Irvine School of Law

UC Irvine Law Review Volume 2 Issue 3 Business Law as Public Interest Law / Article 8 Searching for Equality: A Conference on Law, Race, and Socio-Economic Class 12-2012 The alF l (and Rise?) of Community Banking: The Continued Importance of Local Institutions Bob Solomon UC Irvine School of Law Follow this and additional works at: https://scholarship.law.uci.edu/ucilr Part of the Banking and Finance Law Commons Recommended Citation Bob Solomon, The Fall (and Rise?) of Community Banking: The Continued Importance of Local Institutions, 2 U.C. Irvine L. Rev. 945 (2012). Available at: https://scholarship.law.uci.edu/ucilr/vol2/iss3/8 This Article and Essay is brought to you for free and open access by UCI Law Scholarly Commons. It has been accepted for inclusion in UC Irvine Law Review by an authorized editor of UCI Law Scholarly Commons. UCILR V2I3 Assembled v8 (Do Not Delete) 12/14/2012 5:35 PM The Fall (and Rise?) of Community Banking: The Continued Importance of Local Institutions Bob Solomon* Introduction ..................................................................................................................... 945 I. The Reality of Bank Concentration .......................................................................... 946 II. Four Principles ........................................................................................................... 950 III. ShoreBank—The Model for Community Development Banking ................... 955 IV. The Difficulties of Starting a De Novo Bank— The New Haven Experience ........................................................................... -

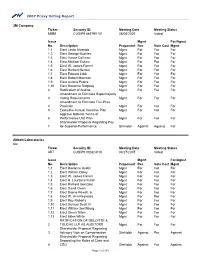

2007 Proxy Voting Report 3M Company Ticker Security ID: MMM

2007 Proxy Voting Report 3M Company Ticker Security ID: Meeting Date Meeting Status MMM CUSIP9 88579Y101 05/08/2007 Voted Issue Mgmt For/Agnst No. Description Proponent Rec Vote Cast Mgmt 1.1 Elect Linda Alvarado Mgmt For For For 1.2 Elect George Buckley Mgmt For For For 1.3 Elect Vance Coffman Mgmt For For For 1.4 Elect Michael Eskew Mgmt For For For 1.5 Elect W. James Farrell Mgmt For For For 1.6 Elect Herbert Henkel Mgmt For For For 1.7 Elect Edward Liddy Mgmt For For For 1.8 Elect Robert Morrison Mgmt For For For 1.9 Elect Aulana Peters Mgmt For For For 1.10 Elect Rozanne Ridgway Mgmt For For For 2 Ratification of Auditor Mgmt For For For Amendment to Eliminate Supermajority 3 Voting Requirements Mgmt For For For Amendment to Eliminate Fair-Price 4 Provision Mgmt For For For 5 Executive Annual Incentive Plan Mgmt For For For Approve Material Terms of 6 Performance Unit Plan Mgmt For For For Shareholder Proposal Regarding Pay- 7 for-Superior-Performance ShrHoldr Against Against For Abbott Laboratories Inc Ticker Security ID: Meeting Date Meeting Status ABT CUSIP9 002824100 04/27/2007 Voted Issue Mgmt For/Agnst No. Description Proponent Rec Vote Cast Mgmt 1.1 Elect Roxanne Austin Mgmt For For For 1.2 Elect William Daley Mgmt For For For 1.3 Elect W. James Farrell Mgmt For For For 1.4 Elect H. Laurance Fuller Mgmt For For For 1.5 Elect Richard Gonzalez Mgmt For For For 1.6 Elect David Owen Mgmt For For For 1.7 Elect Boone Powell, Jr. -

Understanding Enron: "It's About Gatekeepers, Stupid"

Columbia Law School Scholarship Archive Faculty Scholarship Faculty Publications 2002 Understanding Enron: "It's about Gatekeepers, Stupid" John C. Coffee Jr. Columbia Law School, [email protected] Follow this and additional works at: https://scholarship.law.columbia.edu/faculty_scholarship Part of the Banking and Finance Law Commons, Business Organizations Law Commons, and the Law and Economics Commons Recommended Citation John C. Coffee Jr., Understanding Enron: "It's about Gatekeepers, Stupid", 57 BUS. LAW. 1403 (2002). Available at: https://scholarship.law.columbia.edu/faculty_scholarship/2117 This Article is brought to you for free and open access by the Faculty Publications at Scholarship Archive. It has been accepted for inclusion in Faculty Scholarship by an authorized administrator of Scholarship Archive. For more information, please contact [email protected]. Understanding Enron: "It's About the Gatekeepers, Stupid" By John C. Coffee, Jr* What do we know after Enron's implosion that we did not know before it? The conventional wisdom is that the Enron debacle reveals basic weaknesses in our contemporary system of corporate governance.' Perhaps, this is so, but where is the weakness located? Under what circumstances will critical systems fail? Major debacles of historical dimensions-and Enron is surely that-tend to produce an excess of explanations. In Enron's case, the firm's strange failure is becoming a virtual Rorschach test in which each commentator can see evidence confirming 2 what he or she already believed. Nonetheless, the problem with viewing Enron as an indication of any systematic governance failure is that its core facts are maddeningly unique. -

September 23–24, 2020

Wednesday, Thursday, On Demand Sponsors September 23 September 24 Sessions A gathering for regulators and industry professionals to exchange ideas and empower success September 23–24, 2020 Wednesday, September 23 LIVE 10:00 AM – 11:00 AM – LIVE: Virtual Exhibit Hall During this allotted time, visit sponsors, ask questions, and learn from fellow colleagues about industry topics. 11:00 AM – 11:05 AM – LIVE: Welcome Remarks C&L VIRTUAL FORUM CHAIRPERSON Scott Kursman Citi 11:05 AM – 11:35 AM – LIVE: One-on-One Conversation with Robert Cook Robert Cook MODERATOR FINRA Ira D. Hammerman SIFMA 11:45 AM – 12:45 PM – LIVE: COVID-19: Lessons Learned for Compliance & Legal Professionals • Operational capacity – what does this mean for systems access, especially trading businesses • Meeting regulatory obligations for oversight in this COVID-19 environment. Anticipating unique risks in this new operating structure. • Supervisory and management challenges with remote staff and related information security challenges • Discuss today’s challenges of internal and external communications and recordkeeping • Considerations for Return-to-Work plans Michael Broadbery Andy Cadel Kevin H. Dunn Marlon Paz Emily Westerberg MODERATOR Goldman Sachs Citi National Institute for Mayer Brown Russell Amy J. Greer Occupational Safety SEC Baker & McKenzie LLP and Health 12:55 PM – 2:00 PM – LIVE: Leadership Matters: Meaningful, Measured Impact in Diversity and Inclusion This panel will take a deeper dive into how today’s financial industry leadership work must be a matter -

Turning a Blind Eye: Why Washington Keeps Giving in to Wall Street

GW Law Faculty Publications & Other Works Faculty Scholarship 2013 Turning a Blind Eye: Why Washington Keeps Giving In to Wall Street Arthur E. Wilmarth Jr. George Washington University Law School, [email protected] Follow this and additional works at: https://scholarship.law.gwu.edu/faculty_publications Part of the Law Commons Recommended Citation Arthur E. Wilmarth, Jr., Turning a Blind Eye: Why Washington Keeps Giving In to Wall Street, 81 University of Cincinnati Law Review 1283-1446 (2013). This Article is brought to you for free and open access by the Faculty Scholarship at Scholarly Commons. It has been accepted for inclusion in GW Law Faculty Publications & Other Works by an authorized administrator of Scholarly Commons. For more information, please contact [email protected]. GW Law School Public Law and Legal Theory Paper No. 2013‐117 GW Legal Studies Research Paper No. 2013‐117 Turning a Blind Eye: Why Washington Keeps Giving In to Wall Street Arthur E. Wilmarth, Jr. 2013 81 U. CIN. L. REV. 1283-1446 This paper can be downloaded free of charge from the Social Science Research Network: http://ssrn.com/abstract=2327872 TURNING A BLIND EYE: WHY WASHINGTON KEEPS GIVING IN TO WALL STREET Arthur E. Wilmarth, Jr.* As the Dodd–Frank Act approaches its third anniversary in mid-2013, federal regulators have missed deadlines for more than 60% of the required implementing rules. The financial industry has undermined Dodd–Frank by lobbying regulators to delay or weaken rules, by suing to overturn completed rules, and by pushing for legislation to freeze agency budgets and repeal Dodd–Frank’s key mandates. -

TV Report: Sharon Told of Killings

Some miss it, jYankee magazine Allied wins others not at all uses him a lot Bendix battle ... page 3 ... page 11 ... page 20 Manchester, Conn. Cloudy today, rain tomorrow. Saturday, Sept. 25, 1982 Single copy 25c — See page 2 Ipralft TV report: Sharon told of killings TEL AVIV, Israel (UPI) - Israel Yishai and Sharon occurred last television, in .one of the most Friday, the start of the Jewish New detailed accounts of Israeli Year celebration of Rosh Hashanah, knowledge of the massacre in and nearly a day after the massacre Beirut, said Friday night its of as many as 1,000 men, women and reporter told Defense Minister Ariel children began in the Chatila and Sharon about the killings but Sharon Sabra refugee camps. wished him a happy new year and Sharon previously has admitted hung up after five minutes. the Israelis ordered and helped its The report by Ron Ben Yishai, the Christian Phalange allies plan an en television’s military correspondent, try into the camps. But Sharon in also said Prime Minister Menachem sisted the Phalange were given Begin may^ave been the last person direct orders not to touch women to learn about the massacre. and children and only to “purge” the It said Begin heard about the camps of any remaining PLO killings at 5 p.m, last Saturday, “ap fighters. parently on the radio news.” The report said the Christian The conversation bet\veen Ben Phalangists who entered the refugee camps were led by Eli Bekha, chief information officer for the Phalange and dressed in uniforms resembling those used in renegade Lebanese At least Major Saad Haddad’s army.