GAM Star Fund P.L.C. Unaudited Half-Yearly Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

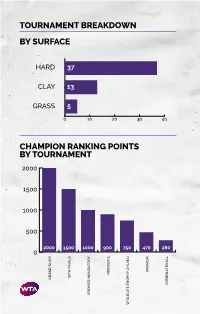

Tournament Breakdown by Surface Champion Ranking Points By

TOURNAMENT BREAKDOWN BY SURFACE HAR 37 CLAY 13 GRASS 5 0 10 20 30 40 CHAMPION RANKING POINTS BY TOURNAMENT 2000 1500 1000 500 2000 1500 1000 900 750 470 280 0 PREMIER PREMIER TA FINALS TA GRAN SLAM INTERNATIONAL PREMIER MANATORY TA ELITE TROPHY HUHAI TROPHY ELITE TA 55 WTA TOURNAMENTS BY REGION BY COUNTRY 8 CHINA 2 SPAIN 1 MOROCCO UNITED STATES 2 SWITZERLAND 7 OF AMERICA 1 NETHERLANDS 3 AUSTRALIA 1 AUSTRIA 1 NEW ZEALAND 3 GREAT BRITAIN 1 COLOMBIA 1 QATAR 3 RUSSIA 1 CZECH REPUBLIC 1 ROMANIA 2 CANADA 1 FRANCE 1 THAILAND 2 GERMANY 1 HONG KONG 1 TURKEY UNITED ARAB 2 ITALY 1 HUNGARY 1 EMIRATES 2 JAPAN 1 SOUTH KOREA 1 UZBEKISTAN 2 MEXICO 1 LUXEMBOURG TOURNAMENTS TOURNAMENTS International Tennis Federation As the world governing body of tennis, the Davis Cup by BNP Paribas and women’s Fed Cup by International Tennis Federation (ITF) is responsible for BNP Paribas are the largest annual international team every level of the sport including the regulation of competitions in sport and most prized in the ITF’s rules and the future development of the game. Based event portfolio. Both have a rich history and have in London, the ITF currently has 210 member nations consistently attracted the best players from each and six regional associations, which administer the passing generation. Further information is available at game in their respective areas, in close consultation www.daviscup.com and www.fedcup.com. with the ITF. The Olympic and Paralympic Tennis Events are also an The ITF is committed to promoting tennis around the important part of the ITF’s responsibilities, with the world and encouraging as many people as possible to 2020 events being held in Tokyo. -

Competition and Regulation 2020

COMPETITION AND REGULATION • 2020 • COMPETITION AND REGULATION • Editorial board of the series • Pál Valentiny (chairman), Institute of Economics, Centre for Economic and Regional Studies Ferenc László Kiss (honorary editor in chief) Csongor István Nagy, University of Szeged Zombor Berezvai, Hungarian Competition Authority COMPETITION AND REGULATION • 2020 • Editors PÁL VALENTINY • ZOMBOR BEREZVAI • CSONGOR ISTVÁN NAGY INSTITUTE OF ECONOMICS CENTRE FOR ECONOMIC AND REGIONAL STUDIES Budapest • 2020 The publication of the Hungarian volumes had been financially supported by the Hungarian Competition Authority Editors Pál Valentiny • Zombor Berezvai • Csongor István Nagy Copyright © Institute of Economics Centre for Economic and Regional Studies, Budapest, 2020 ISSN 1789-9702 Published by: Institute of Economics Centre for Economic and Regional Studies 1097 Budapest, Tóth Kálmán utca 4. Online available at http://www.mtakti.hu/publikacio/publikacio-kategoria/ verseny-es-szabalyozas/ Publisher: Imre Fertő Copy editor: Anna Patkós Design, page layout: Anikó Környei CONTENTS FOREWORD 7 COMPETITION POLICY 11 Tünde Gönczöl • Antitrust hipsters and their critics 13 Gergely Csorba • Should European competition policy change in reaction to global challenges? Lessons from the Siemens–Alstom merger and its impact 43 Pál Valentiny • Market and government failures. The changing relationship between industrial policy and competition policy interventions 62 Borbála Tünde Dömötörfy – Barnabás Sándor Kiss – Judit Firniksz • Ostensible Dichotomy? By object and by effect restraints in EU competition law, with special regard to the Budapest Bank case 91 Csongor István Nagy • Why is leniency policy less effective in Hungary: is there a regulatory answer? 115 REGULATION 131 Zombor Berezvai • The impact of retail regulation on consumer prices 133 Zoltán Pápai – Péter Nagy • Dancing with hands and feet tied. -

UFI Info July/August 2019

UFI Info July/August 2019 To provide material or Info is published by Asia-Pacific Middle East-Africa Latin America comments, please contact: UFI Headquarters & Regional Office Regional Office Regional Office Monika Fourneaux-Ceskova European Regional Office Suite 4114, Hong Kong Plaza Info Salons Middle East Corferias, Colombia [email protected] 17, rue Louise Michel 188 Connaught Road West Office, Dubai, UAE T: +571 3445486 92300 Levallois-Perret Hong Kong, China T: +971 6 5991352 [email protected] T: +33 1 46 39 75 00 T: +852 2525 6129 [email protected] [email protected] [email protected] Contents Calendar of UFI events and meetings 03 Welcome from the UFI President 04 CEO Column 05 GED 06 Shanghai CEO Summit 09 Photo: Shanghai CEO Summit. Indian Exhibition Industry Association 10 Taitra’s Meettaiwan event 10 Vigilance 11 SDG database for the exhibition industry 12 86th UFI Global Congress 15 News from Europe 15 Photo: GED19. News from Asia-Pacific 16 News from Latin-America 16 ISU 17 EMD 18 VMA 18 International Fair Poster competition 19 Photo: EMD 2019. 2019 Marketing Award winner 20 2019 HR Award winner 21 2019 Sustainability Award winner 22 EEIA News from Brussels 23 UFI Blog 24 News updates from our Media Partners 25 Photo: Fiexpo Latinoamerica, Santiago, Chile. UFI Info | July/August 19 | 2 Calendar of UFI events and meetings 2019/2020 Open to all industry professionals Open to UFI members only By invitation only Meeting Date Location 86th UFI Global Congress 6 - 9 November 2019 Bangkok (Thailand) Global CEO Summit 5 - 7 February 2020 Rome (Italy) -

2019 China Military Power Report

OFFICE OF THE SECRETARY OF DEFENSE Annual Report to Congress: Military and Security Developments Involving the People’s Republic of China ANNUAL REPORT TO CONGRESS Military and Security Developments Involving the People’s Republic of China 2019 Office of the Secretary of Defense Preparation of this report cost the Department of Defense a total of approximately $181,000 in Fiscal Years 2018-2019. This includes $12,000 in expenses and $169,000 in DoD labor. Generated on 2019May02 RefID: E-1F4B924 OFFICE OF THE SECRETARY OF DEFENSE Annual Report to Congress: Military and Security Developments Involving the People’s Republic of China OFFICE OF THE SECRETARY OF DEFENSE Annual Report to Congress: Military and Security Developments Involving the People’s Republic of China Annual Report to Congress: Military and Security Developments Involving the People’s Republic of China 2019 A Report to Congress Pursuant to the National Defense Authorization Act for Fiscal Year 2000, as Amended Section 1260, “Annual Report on Military and Security Developments Involving the People’s Republic of China,” of the National Defense Authorization Act for Fiscal Year 2019, Public Law 115-232, which amends the National Defense Authorization Act for Fiscal Year 2000, Section 1202, Public Law 106-65, provides that the Secretary of Defense shall submit a report “in both classified and unclassified form, on military and security developments involving the People’s Republic of China. The report shall address the current and probable future course of military-technological development of the People’s Liberation Army and the tenets and probable development of Chinese security strategy and military strategy, and of the military organizations and operational concepts supporting such development over the next 20 years. -

Rural Depopulation and Public Service Provision In

RURAL DEPOPULATION AND PUBLIC SERVICE PROVISION IN GERMANY How is public service provision in depopulated, rural regions in Germany organized and what can be learned from good practices in this field? Bachelor Thesis Author: Anna Lou Dremel (s1089439) May, 2013 Supervisors: Gert-Jan Hospers Ann Morissens European Studies School of Management and Governance Rural depopulation and public service provision in Germany May, 2013 Abstract The topic of this paper is the organization of public service provision in rural regions in Germany that are facing a decrease in size and a change in structure of their population. The decrease in population is due to rural depopulation. Especially young people are moving away from villages to urban centers, looking for better job opportunities. The change in population comes from the demographic change. Higher life expectancies and lower birth rates lead to an increase in the average age and elderly people are in need of different infrastructure and services than are the young. As a consequence the provision of public services is harder to maintain for the state and is in need of adaptation to the changed requirements. To do so many innovative projects already exist, initiated, managed, financed and supported by different actors or through their cooperation. The main actors generally involved are state, market and civil society. Their relationship and shifts in responsibility are captured under 4 labels, socialization, privatization, active citizenship and social entrepreneurship. Public services are categorized into technical, retail, social and cultural infrastructure. For each type of infrastructure two projects are introduced. The paper is aiming at analyzing the organization of the projects regarding the actor involved and the strategy used and identifying certain patterns necessary for good transferability. -

Additional Informations of the Annual Report 2019

2019 Annual Report Additional information Annual Report 2019 – Additional Information I. TABLES OF RETURNS 1 Auditor’s Report on GIPS Compliance ................................................................................ 5 2 Independent Auditor’s Report ........................................................................................... 6 3 General Notes ................................................................................................................... 8 4 Rates .............................................................................................................................. 11 5 Credit ............................................................................................................................. 12 6 Long Term Bonds ............................................................................................................ 14 7 Real Return Bonds .......................................................................................................... 15 8 Short Term Investments .................................................................................................. 16 9 Real Estate ..................................................................................................................... 17 10 Infrastructures ................................................................................................................ 20 11 Public Equity ................................................................................................................... 22 12 Private -

Northern Trust EQUITY INDEX FUNDS

NORTHERN EQUITY INDEX FUNDS ANNUAL REPORT MARC H 31, 2020 Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of Northern Funds shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from Northern Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website (northerntrust.com) and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you have already elected to receive your shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from Northern Funds electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if your account is held directly with Northern Funds, by calling the Northern Funds Center at 800-595-9111 or by sending an e-mail request to: [email protected]. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, please contact your financial intermediary to continue receiving paper copies of your shareholder reports. If you invest directly with Northern Funds, you can inform Northern Funds that you wish to continue receiving paper copies of your shareholder reports by calling the Northern Funds Center at 800-595-9111 or by sending an e-mail request to: [email protected]. -

ANNUAL REPORT 2019 Important

stock code : 000063.SZ 763.HK ANNUAL REPORT 2019 Important The Board of Directors, Supervisory Committee and the Directors, Supervisors and senior management of the Company warrant that the contents of this report are true, accurate and complete without any false information, misleading statements or material omissions, and accept individual and collective legal responsibility. There are no Directors, Supervisors or senior management who do not warrant or who dispute the truthfulness, accuracy and completeness of the contents of this report. This report has been considered and approved at the Fifteenth Meeting of the Eighth Session of the Board of Directors of the Company. The respective financial statements of the Group for the year ended 31 December 2019 were prepared in accordance with PRC Accounting Standards for Business Enterprises and with Hong Kong Financial Reporting Standards respectively, and had been audited by Ernst & Young Hua Ming LLP and Ernst & Young, and an unqualified auditors’ report has been issued by each of them. During the year, there was no significant deficiency in internal control in relation to financial reporting of the Company, nor was any significant deficiency in internal control in relation to non-financial reporting identified. Mr. Li Zixue, Chairman of the Company, Ms. Li Ying, Chief Financial Officer of the Company and Mr. Xu Jianrui, Head of Finance Division of the Company, hereby declare that they warrant the truthfulness, accuracy and completeness of the financial reports contained in this report. In view of the state of affairs of the Company, the proposal for profit distribution for 2019 is as follows: distribution of RMB2 in cash (before tax) for every 10 shares to all shareholders based on the total share capital (including A shares and H shares) as at the record date for profit distribution and dividend payment. -

49,80 % 26.08.2019 US OPEN N.YORK (1R) Querrrey-Londero 1 1,20 1:3 KO NE 26.08.2019 US OPEN N.YORK (1R) Čepelová-Hsieh S.W

Datum Místo konání události Zápas Tip Kurs Výsl. Stav FREE TIPY 17.08.2019 ATP WINSTOM SALEM (Q) Chrysosos - Peliwo 1 2,11 2:0 OK ANO Úspěšnost 65,80 % 17.08.2019 CORDENONS (SF) Eriksson-Jahn 2 1,44 0:2 OK ANO 17.08.2019 ITK KOKSIJDE (SF) Soderlung-Geens 1 1,37 2:0 OK ANO Podaných tipů: Vyhraných: 18.08.2019 ITK KOKSIJDE (F) Onclin-Soderlung 2 1,41 0:2 OK ANO Prohraných: Nevyhodnocených 18.08.2019 CORDENONS (F) Jahn-O´Connell 1 1,64 0:2 KO ANO 19.08.2019 US OPEN N.YORK (Q) Molleker-Torpegaard 2 1,54 0:2 OK ANO 367 0 19.08.2019 US OPEN N.YORK (Q) Nadna-Otte 2 1,35 0:2 OK ANO 19.08.2019 L´AAQUILLA CHALL. (2K) Seyboth Wild-Belluci 1 1,39 2:0 OK ANO 1073 20.08.2019 US OPEN N.YORK (Q) Vatutin-Couacaud 2 1,36 0:2 OK ANO 20.08.2019 US OPEN N.YORK (Q) Caruso-Chung 1 1,39 2:0 OK ANO 706 21.08.2019 US OPEN N.YORK (Q) Kavčič-Uchiyama 2 1,61 0:2 OK ANO 21.08.2019 US OPEN N.YORK (Q) Kwon Soon Woo-Otte 1 1,23 2:0 OK ANO 21.08.2019 US OPEN N.YORK (Q) Torpegaard-Galan D. 1 1,46 1:2 KO ANO 21.08.2019 US OPEN N.YORK (Q) Barrere-Milojevic 1 1,53 2:1 OK ANO 22.08.2019 ITF POZNAŇ (2R) Mridha-Sakamoto 1 3,25 2:0 OK NE 22.08.2019 ITF POZNAŇ (2R) Vellotti-Oliveiri 1 1,63 2:1 OK NE 22.08.2019 US OPEN N.YORK (Q) Caruso-Rosol 1 1,45 0:2 KO NE 22.08.2019 US OPEN N.YORK (Q) Bemmelmans-Ivashka 2 1,38 0:2 OK NE 23.08.2019 ITF SANTANDER (QF) Luz-Nikles 1 1,30 2:1 OK NE 23.08.2019 US OPEN N.YORK (Q) Koepfer-Uchiyama 1 1,49 2:0 OK NE 24.08.2019 ITF SCHLIEREN (SF) Ehrat-Bonzi 1 1,50 1:2 KO NE Úspěšnost KLIENTU (Jejich tiketů) 25.08.2019 ITF HELSINKI (SF) Cerundolo-Salminen 1 1,50 2:0 OK NE 26.08.2019 US OPEN N.YORK (1R) Corič-Donskoy 1 1,24 3:0 OK NE 49,80 % 26.08.2019 US OPEN N.YORK (1R) Querrrey-Londero 1 1,20 1:3 KO NE 26.08.2019 US OPEN N.YORK (1R) Čepelová-Hsieh S.W. -

SIPS Transnational Partnership Sustainable Business Concepts for the Social Economy 2007

SIPS Transnational Partnership Sustainable Business Concepts for the Social Economy 2007 sharing identifying promoting supporting 1 2 SIPS CONFERENCE BOOK SIPS Transnational Partnership 3 SIPS Transnational Partnership ISBN 978-952-5716-02-3 ISBN 978-952-5716-04-7 (PDF) Layout and Cover Design: Markku Böök Published by SESF Development Partnership, VATES Foundation, Finland Printed by Savion Kirjapaino Oy, Finland, 2007 4 Contents Foreword ............................................................................. 7 Marjatta Varanka The Members of the Transnational Development Partnership..................................................... 8 Kari Karhu Business Models Described by the Working Groups ..................................... 11 Mike Berriman and Petra Dreyer Learning Points of the Study Visits ..................................... 21 Kari Karhu Expanding Values; A guide to Social Franchising in the Social Enterprise sector ............................................ 24 Toby Johnson, Keith Richardson and Guy Turnbull European Social Franchising Network................................. 52 Giovanna Maranzana Appendices ....................................................................... 55 1. Community Renewable Energy - Developing renewable energy and community profits ............................... 55 2. CAP Märkte - a chain of neighbourhood supermarkets employing disabled people ......................................................................... 58 3. Welfare Italia - the mark of good care, Comunità Solidali........................... -

S.-E. Bärsch, Taxation of Hybrid Financial Instruments and the Remuneration Derived Therefrom in an International and Cross-Bor

Annex S.-E. Ba¨rsch, Taxation of Hybrid Financial Instruments and the Remuneration 325 Derived Therefrom in an International and Cross-border Context, DOI 10.1007/978-3-642-32457-4, # Springer-Verlag Berlin Heidelberg 2012 Table A.1 Tax treaties concluded between EEA/EU/OECD member states up to 2011a EEA/EU/OECD member states AT AU BE BG CA CH CL CY CZ DE DK EE ES FI FR GR HU IE IT JP KR LT LU LV MT MX NL NO NZ PL PT RO SK SL SW TR UK US EEA/EU/ AT xxxxx—xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxx OECD AU x x—x x——xx x—xxx—xxxxx———xx x x xx—xx—x—x x member BE xx xxxxxxxxxxxxxxxxxxxxxx x xxxxxxxxxxxx states BG x—x x x—xxx x xxxxx xxxxxxx x x—x x—xxx xx x x x x CA xxxx xxxxxxxxxxxxxxxxxxxx x xxxxxxxxx—xx CH xxxxx x—xxxxxxxxxxxxxxxx—xxxxxxxxxx—xx CL —— x — x x ———x —x—x——x——x———— x — x x x x———x — x — CY x—x x x—— x x x———xx xxx—————x ——x—x—x xx x—x x CZ xxxxxx—x xxxxxxxxxxxxxxxx xxxxxxxxxxxxx DE xxxxxx—xx xxxxxxxxxxxxxxx xxxxxxxxxx—xx DK xxxxxxxxxx xxx—xxxxxxxxxx x xxxxxxxxxxxx EE x—xxxx——xxx xxxxxxx—xxxxx—xx—xxxxxxxxx ES xxxxxxx—xxxx xxxxxxxxxxxx xxxxxxxxxxxxx FI xxxxxx——xxxxx xxxxxxxxxxx xxxxxxxxxxxxx FR xxxxxxxxxx—xxx xxxxxxxxxx x xxxxxxxxxxxx GR x—xxxx—xxxxxxxx xxx—xxxxx xxx—xxxxxxxxx HU xxxxxx—xxxxxxxxx xxxxxxxx—xx—xxxxxxxxx IE xxxxxxxxxxxxxx—xx xxxx—xx x xxxxxxxxxxxx IT xxxxxx—xxxxxxxxxxx xxxxxx x xxxxxxxxxxxx JP x x x x x x——x x x—xxx—xxx x—x——x x x x x—x x—x x x x KR x x x x x x x—x x x xxxx x xxxx x x x x x x x x xx x x x x x x x LT x—xxxx——xxxxxxxxxxx—x xxx—xx—xxxxxxxxx LU x—xxxx——xxxxxxxxxxxxxx xx x xx—xxxxxxxxx LV x—xxxx——xxxxxxxxxxx—xxx -

2019 Wta Rankings Year-End Top 100 by Nation

2019 WTA RANKINGS YEAR-END TOP 100 BY NATION UNITED STATES LATVIA OF AMERICA 17 2 RUSSIA 9 POLAND 2 CZECH REPUBLIC 8 SLOVENIA 2 CHINA 6 CANADA 1 GERMANY 5 DENMARK 1 FRANCE 4 ESTONIA 1 SPAIN 4 GREECE 1 UKRAINE 4 ITALY 1 AUSTRALIA 3 MONTENEGRO 1 BELGIUM 3 ITALY 1 BELARUS 3 NETHERLANDS 1 KAZAKHSTAN 3 PUERTO RICO 1 ROMANIA 3 SERBIA 1 SWITZERLAND 3 SLOVAKIA 1 CROATIA 2 SWEDEN 1 GREAT BRITAIN 2 TAIPEI 1 JAPAN 2 TUNISIA 1 PLAYER PROFILES PLAYER EKATERINA ALEXANDROVA RUS DATE OF BIRTH RANKING HIGHS 15-NOV-1994 (CHELYABINSK, RUSSIA) SINGLES DOUBLES HEIGHT 6’ (1.83 M) PLAYS 35 98 RIGHT-HANDED (TWO-HANDED BACKHAND) 07OCT2019 21OCT2019 WTA YEAR-END RANKING CAREER HIGHLIGHTS YEAR RANK W-L • Posted 30 tour-level match wins during 2019 season, in 2019 35 30-24 which she reached SF at Budapest, Seoul and Linz and 2018 93 9-13 made QF at St.Petersburg, ‘s-Hertogenbosch, Eastbourne 2017 73 6-12 and Moscow 2016 133 3-3 • Made Top 50 debut after QF run at ‘s-Hertogenbosch (June 2015 269 -- 17, 2019) 2014 256 -- • Other highlights in 2019 included upset of No.5 Halep en 2013 410 -- route to R16 at Beijing – the first win of her career over a 2012 772 -- Top 5 player – and 3r showing at Roland Garros • Reached maiden WTA final at 2018 Linz (l. Giorgi). Other SINGLES TITLES (0) notable results in 2018 were QF run at Seoul (d. No.10 FINALIST (1): 2018 - Linz. Ostapenko en route for her first career Top 10 win) and lifted WTA 125K Series title at Limoges DOUBLES TITLES (1) • Competed in the main draw of all four Grand Slams in 2019 Budapest w/Zvonareva 2017 for first time in career.