Press Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Climate and Energy Benchmark in Oil and Gas Insights Report

Climate and Energy Benchmark in Oil and Gas Insights Report Partners XxxxContents Introduction 3 Five key findings 5 Key finding 1: Staying within 1.5°C means companies must 6 keep oil and gas in the ground Key finding 2: Smoke and mirrors: companies are deflecting 8 attention from their inaction and ineffective climate strategies Key finding 3: Greatest contributors to climate change show 11 limited recognition of emissions responsibility through targets and planning Key finding 4: Empty promises: companies’ capital 12 expenditure in low-carbon technologies not nearly enough Key finding 5:National oil companies: big emissions, 16 little transparency, virtually no accountability Ranking 19 Module Summaries 25 Module 1: Targets 25 Module 2: Material Investment 28 Module 3: Intangible Investment 31 Module 4: Sold Products 32 Module 5: Management 34 Module 6: Supplier Engagement 37 Module 7: Client Engagement 39 Module 8: Policy Engagement 41 Module 9: Business Model 43 CLIMATE AND ENERGY BENCHMARK IN OIL AND GAS - INSIGHTS REPORT 2 Introduction Our world needs a major decarbonisation and energy transformation to WBA’s Climate and Energy Benchmark measures and ranks the world’s prevent the climate crisis we’re facing and meet the Paris Agreement goal 100 most influential oil and gas companies on their low-carbon transition. of limiting global warming to 1.5°C. Without urgent climate action, we will The Oil and Gas Benchmark is the first comprehensive assessment experience more extreme weather events, rising sea levels and immense of companies in the oil and gas sector using the International Energy negative impacts on ecosystems. -

World Oil Review 2018

volume 1 World Oil Review 2018 World Oil Review 2018 Contents Introduction List of Countries VI Notes and Methods VIII Oil - Supply and Demand Oil - Production Quality Reserves 2 World 46 Areas and Aggregates 2 Crude Production by Quality 46 The World Top 10 Reserves Holders 3 Crude Production by Gravity 46 Countries 4 Crude Production by Sulphur Content 46 Cluster of Companies 6 Quality and Production Volume of Main Crudes 47 Crude Production by Quality - Charts 48 Production 7 Areas and Aggregates 7 Europe 49 The World Top 10 Producers 8 Crude Production by Quality 49 Countries 9 Quality and Production Volume of Main Crudes 49 Cluster of Companies 11 Crude Production by Quality - Charts 50 The World Top 10 Natural Gas Liquids Producers 12 Countries 51 Reserves/Production Ratio 13 Russia and Central Asia 52 Areas and Aggregates 13 Crude Production by Quality 52 The World Top 10 Producers Ranked by Quality and Production Volume of Main Crudes 52 Reserves/Production Ratio 14 Crude Production by Quality - Charts 53 Countries 15 Countries 54 Consumption 18 Middle East 55 Areas and Aggregates 18 Crude Production by Quality 55 The World Top 10 Consumers 19 Quality and Production Volume of Main Crudes 55 Countries 20 Crude Production by Quality - Charts 56 Countries 57 Per Capita Consumption 23 Areas and Aggregates 23 Africa 58 The World Top 10 Consumers Ranked by Crude Production by Quality 58 Per Capita Consumption Ratio 24 Quality and Production Volume of Main Crudes 58 Countries 25 Crude Production by Quality - Charts 59 Countries 60 Production/Consumption -

THE SNAM SHAREHOLDER the GUIDE to GETTING INVOLVED in YOUR INVESTMENT 2 Snam | L'azionista Di Snam | Testatina

Snam | L'azionista di Snam | Testatina 1 April 2018 THE SNAM SHAREHOLDER THE GUIDE TO GETTING INVOLVED IN YOUR INVESTMENT 2 Snam | L'azionista di Snam | Testatina Dear shareholders, the purpose of this Guide is to provide annually both current and potential owners of Snam shares with a summary of relevant information. Starting from 2010, it is part of a series of tools to enhance our communication with retail investors. We believe that the trust you have showed us Snam must be cultivated through an increasingly Company profile 3 effective dialogue. The first part Snam overview 4 of the Guide outlines the Group’s Snam: an integrated player in the gas system 5 structure, its business and strategic Management team 6 guidelines. The Guide also presents Governance in action 7 some key features about Snam Regulation in Italy 8 shares and practical information Regulation in Europe 9 so that you can really get involved Inclusion in SRI indices 10 in your role as a shareholder. Snam strategy 11 We hope that these pages will be Snam in Europe 13 easy and interesting to read, Corporate structure 14 as well as helpful. By nature, this Guide is not an exhaustive Snam on the Stock Exchange Remuneration through dividends 16 product. In order to obtain Stock Market performance 17 more complete information Shareholders 19 we invite you to visit our corporate The bond market 20 website at www.snam.it or, Income Statement figures 21 for specific requests, to contact Balance Sheet figures 22 the Investor Relations department. Cash flow 23 Get involved in your Snam investment The steps to investing 25 Attend the Shareholders’ Meeting 26 Keep yourself informed and participate in corporate events 27 Snam | The Snam Shareholder | Company profile 3 Company profile Snam is Europe’s leading gas utility. -

Shell and Eni Lead Race to Net Zero

Shell and Eni lead European oil majors’ race to net zero emissions • New research from the influential Transition Pathway Initiative assesses the recent climate change announcements from six European oil & gas majors • Shell and Eni now have the most ambitious emissions-reduction plans • But claims to be aligned with ‘net-zero’ or 1.5°C are overstated, according to TPI’s analysis (12 May 2020, London) The climate ambitions of European integrated oil and gas majors have strengthened markedly in the last six months, with Total, Shell, BP, Repsol and Eni all having made commitments to significantly reduce the carbon intensity of the energy they supply. New analysis from the Transition Pathway Initiative (TPI) – an investor initiative backed by over $19 trillion of global capital - shows that four oil and gas majors - Shell, Eni, Total, Repsol - are now aligned with the emissions reductions pledged by the signatories to the Paris Agreement. BP and OMV are now the only European companies who fail to align with the Paris pledges. However, despite these commitments, none of the companies are aligned yet with ‘net zero’ or 1.5°C pathways. TPI calculates that the average European oil and gas company would need to cut its emissions intensity by over 70% between 2018 and 2050 to align with a 2°C climate scenario by 2050, while a genuine net zero strategy would require a 100% cut in absolute emissions. Even the most ambitious new targets fall far short of this. Adam Matthews, Co-Chair of TPI, and Director of Ethics and Engagement for the Church of England Pensions Board, said: “The European integrated oil and gas sector is changing rapidly. -

Saudi Aramco: National Flagship with Global Responsibilities

THE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY RICE UNIVERSITY SAUDI ARAMCO: NATIONAL FLAGSHIP WITH GLOBAL RESPONSIBILITIES BY AMY MYERS JAFFE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY JAREER ELASS JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY PREPARED IN CONJUNCTION WITH AN ENERGY STUDY SPONSORED BY THE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY AND JAPAN PETROLEUM ENERGY CENTER RICE UNIVERSITY – MARCH 2007 THIS PAPER WAS WRITTEN BY A RESEARCHER (OR RESEARCHERS) WHO PARTICIPATED IN THE JOINT BAKER INSTITUTE/JAPAN PETROLEUM ENERGY CENTER POLICY REPORT, THE CHANGING ROLE OF NATIONAL OIL COMPANIES IN INTERNATIONAL ENERGY MARKETS. WHEREVER FEASIBLE, THIS PAPER HAS BEEN REVIEWED BY OUTSIDE EXPERTS BEFORE RELEASE. HOWEVER, THE RESEARCH AND THE VIEWS EXPRESSED WITHIN ARE THOSE OF THE INDIVIDUAL RESEARCHER(S) AND DO NOT NECESSARILY REPRESENT THE VIEWS OF THE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY NOR THOSE OF THE JAPAN PETROLEUM ENERGY CENTER. © 2007 BY THE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY OF RICE UNIVERSITY THIS MATERIAL MAY BE QUOTED OR REPRODUCED WITHOUT PRIOR PERMISSION, PROVIDED APPROPRIATE CREDIT IS GIVEN TO THE AUTHOR AND THE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY ABOUT THE POLICY REPORT THE CHANGING ROLE OF NATIONAL OIL COMPANIES IN INTERNATIONAL ENERGY MARKETS Of world proven oil reserves of 1,148 billion barrels, approximately 77% of these resources are under the control of national oil companies (NOCs) with no equity participation by foreign, international oil companies. The Western international oil companies now control less than 10% of the world’s oil and gas resource base. -

FRN -V- Royal Dutch Shell PLC and Others Judgment

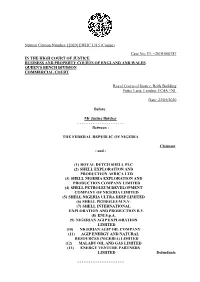

Neutral Citation Number: [2020] EWHC 1315 (Comm) Case No: CL –2018-000787 IN THE HIGH COURT OF JUSTICE BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES QUEEN'S BENCH DIVISION COMMERCIAL COURT Royal Courts of Justice, Rolls Building Fetter Lane, London, EC4A 1NL Date: 22/05/2020 Before : Mr Justice Butcher - - - - - - - - - - - - - - - - - - - - - Between : THE FEDERAL REPUBLIC OF NIGERIA Claimant - and - (1) ROYAL DUTCH SHELL PLC (2) SHELL EXPLORATION AND PRODUCTION AFRICA LTD (3) SHELL NIGERIA EXPLORATION AND PRODUCTION COMPANY LIMITED (4) SHELL PETROLEUM DEVELOPMENT COMPANY OF NIGERIA LIMITED (5) SHELL NIGERIA ULTRA DEEP LIMITED (6) SHELL PETROLEUM N.V. (7) SHELL INTERNATIONAL EXPLORATION AND PRODUCTION B.V. (8) ENI S.p.A. (9) NIGERIAN AGIP EXPLORATION LIMITED (10) NIGERIAN AGIP OIL COMPANY (11) AGIP ENERGY AND NATURAL RESOURCES (NIGERIA) LIMITED (12) MALABU OIL AND GAS LIMITED (13) ENERGY VENTURE PARTNERS LIMITED Defendants - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Roger Masefield QC and Richard Blakeley (instructed by Reynolds Porter Chamberlain LLP) for the Claimant Lord Goldsmith QC and James Willan (instructed by Debevoise & Plimpton LLP) for the 1st to 7th Defendants Richard Handyside QC and Alex Barden (instructed by Allen & Overy LLP) for the 8th to 11th Defendants Charles Fussell (Solicitor Advocate of Charles Fussell & Co LLP) for the 13th Defendant Hearing dates: 28, 29 and 30 April 2020 - - - - - - - - - - - - - - - - - - - - - Approved Judgment I direct that pursuant to CPR PD 39A para 6.1 no official shorthand note shall be taken of this Judgment and that copies of this version as handed down may be treated as authentic. ............................. MR JUSTICE BUTCHER Mr Justice Butcher FRN -v- Royal Dutch Shell PLC and others Approved Judgment Mr Justice Butcher : Introduction 1. -

Eni Safety Day: Injuries Down by 40% in 2015

Eni Safety Day: injuries down by 40% in 2015 The commitment and professionalism of employees and contract staff make Eni the top performer for safety among the world’s oil companies. New “Environment Award” announced San Donato Milanese (Milano), 16 May 2016 – Today is Eni’s 5th “Safety Day”, which was marked by company chairman Emma Marcegaglia and chief executive Claudio Descalzi and with the presentation of the positive results achieved by the company in terms of its safety performance. Commitment, professionalism and a culture of safety in 2015 enabled Eni to confirm the best performance in HSE among all of the companies in the Oil & Gas sector, with an injury frequency rate per million hours worked of 0.2, a reduction of 40% compared with 2014 with a further 10% improvement in the first quarter of 2016. This excellent result is put in context when compared with the average injury rate with absence from work in Italy and Europe, which are more than 10 both in the industrial sector and among workers in general. The performance was even better among contractors - confirming the efforts and action taken both upstream, in selection and qualification, and downstream, in terms of awareness, engagement and controls by third-parties - which, in 2015, showed a 43% improvement in injury rate. In short: Today the likelihood of injury to those working with Eni and for Eni is one in every five million hours worked. Health, safety and respect for the environment are central to Eni’s operating model, and the company is investing 40% of the Italy Plan 2016 to 2019 in safety and the environment with a significant commitment to involve the entire workforce (i.e. -

Federal Register/Vol. 86, No. 78/Monday, April 26, 2021/Notices

Federal Register / Vol. 86, No. 78 / Monday, April 26, 2021 / Notices 22067 who are to respond; including through Eni Petroleum US LLC FOR FURTHER INFORMATION CONTACT: the use of appropriate automated Eni Oil US LLC Cathy Chen, Office of the General collection techniques or other forms of Eni Marketing Inc. Counsel, U.S. International Trade information technology, e.g., permitting Eni BB Petroleum Inc. Commission, 500 E Street SW, electronic submission of responses. Eni US Operating Co. Inc. Washington, DC 20436, telephone 202– HUD encourages interested parties to Eni BB Pipeline LLC 205–2392. Copies of non-confidential submit comment in response to these Group IV documents filed in connection with this questions. investigation may be viewed on the Equinor ASA Commission’s electronic docket (EDIS) C. Authority Equinor Gulf of Mexico LLC Equinor USA E&P Inc. at https://edis.usitc.gov. For help Section 3507 of the Paperwork Group V Exxon Mobil Corporation accessing EDIS, please email Reduction Act of 1995, 44 U.S.C. ExxonMobil Exploration Company [email protected]. General Chapter 35. information concerning the Commission Group VI Anna P. Guido, may also be obtained by accessing its Shell Oil Company internet server at https://www.usitc.gov. Department Reports Management Officer, Office of the Chief Information Officer. Shell Offshore Inc. Hearing-impaired persons are advised SWEPI LP that information on this matter can be [FR Doc. 2021–08095 Filed 4–23–21; 8:45 am] Shell Frontier Oil & Gas Inc. obtained by contacting the BILLING CODE 4210–67–P SOI Finance Inc. Commission’s TDD terminal on (202) Shell Gulf of Mexico Inc. -

Eni S.P.A. Agrees to Resolve FCPA Charges As Controlling Minority Shareholder of Saipem S.P.A

April 30, 2020 Eni S.p.A. Agrees to Resolve FCPA Charges As Controlling Minority Shareholder of Saipem S.p.A. On April 17, 2020, the U.S. Securities and Exchange Commission (“SEC”) announced that it had resolved charges against Eni S.p.A., an Italian headquartered multinational oil and gas company, for violations of the recordkeeping and internal accounting controls provisions of the Foreign Corrupt Practices Act (“FCPA”). Without admitting or denying the SEC’s findings, Eni, whose American Depositary Receipts are traded on the New York Stock Exchange and is thus an “issuer” within the meaning of the FCPA, agreed to pay a combined $24.5 million in disgorgement and prejudgment interest. Notably, though the alleged facts involve substantial improper payments to senior foreign public officials to secure billions of dollars in business, and those payments were made with the knowledge and involvement of Eni’s CFO, the bribery allegations lack any apparent connection to the territory of the U.S. or the U.S. financial system, and the charges do not include any alleged violations of the FCPA’s anti-bribery provisions. According to the consent order, the charges arose out of an alleged improper payment scheme in Algeria between 2007 and 2010 by Saipem S.p.A., in which Eni was a controlling minority shareholder. Saipem allegedly contracted with an intermediary in order to obtain business from Algeria’s state-owned oil company, Sonatrach, but the intermediary provided no legitimate services. Nonetheless, Saipem’s financial statements, which were consolidated into Eni’s financial statements, falsely recorded payments to the intermediary as “brokerage fees” in violation of the books-and-records provision of the FCPA. -

National Oil Company Efficiency: Theory and Evidence

RICE UNIVERSITY National Oil Company Efficiency: Theory and Evidence Stacy Eller Peter Hartley Kenneth B Medlock III James A. Baker III Institute for Public Policy RICE UNIVERSITY 1 RICE UNIVERSITY Theoretical Model 2 Economic model precepts RICE UNIVERSITY n Intertemporal, optimizing model of a National Oil Company (NOC) n Contrast a NOC to a shareholderowned firm n Capture systematic effects from the NOC institutional arrangement n Weaker monitoring of a NOC and differing political goals imply that in addition to commercial returns NOC management choices will reflect: u Increased employment in the firm of labor or other domestic inputs u Domestic consumer surplus from oil product sales u Pressure to increase current relative to future revenue – a high discount rate n Without these concerns, the NOC optimization problem approaches that of a private monopoly firm n In the efficient case: u Domestic oil consumers are neither taxed nor subsidized relative to other constituents, and u Domestic consumer surplus is weighed identically to NOC profits 3 NOC versus efficient case: output, inputs, cash flow RICE n Output shifted forward, lower reserves & cash flow, higher employment UNIVERSITY Output Reserves 0.40 1.20 NOC output NOC reserves 0.35 Efficient output Efficient reserves 1.00 0.30 0.80 0.25 0.20 0.60 0.15 0.40 0.10 0.20 0.05 0.00 0.00 0 5 10 15 20 25 30 0 5 10 15 20 25 30 Years Years Employment Cash Flow 4.00 0.25 NOC employment NOC cash flow 3.50 0.20 Efficient cash Efficient employment flow 3.00 0.15 2.50 0.10 2.00 0.05 1.50 0.00 -

Eni Fact Book 2020

Eni Fact Book 2020 ENI AT A GLANCE 2 Main data 4 Eni share performance 7 EXPLORATION & PRODUCTION 9 GLOBAL GAS & LNG PORTFOLIO 47 REFINING & MARKETING AND CHEMICALS 54 Refining & Marketing 55 Chemicals 65 ENI GAS E LUCE, POWER & RENEWABLES 69 Eni gas e luce 69 Power 71 Renewables 72 TABLES 75 Financial data 75 Employees 87 Quarterly information 88 Disclaimer Eni’s Fact Book is a supplement to Eni’s Annual Report and is designed to provide supplemental financial and operating information. It contains certain forward-looking statements regarding capital expenditures, dividends, buy-back programs, allocation of future cash flow from operations, financial structure evolution, future operating performance, targets of production and sale growth and the progress and timing of projects. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that will or may occur in the future. Actual results may differ from those expressed in such statements, depending on a variety of factors, including the impact of the pandemic disease; the timing of bringing new oil and gas fields on stream; management’s ability in carrying out industrial plans and in succeeding in commercial transactions; future levels of industry product supply; demand and oil and natural gas pricing; operational problems; general macroeconomic conditions; political stability and economic growth in relevant areas of the world; changes in laws and governmental regulations; development and use of new technology; -

Judge Orders Biggest Corporate Bribery Trial in History Against Shell, Eni, CEO and Executives

Press release / Dec. 20, 2017 Judge orders biggest corporate bribery trial in history against Shell, Eni, CEO and executives Landmark trial sees senior Shell executives and CEO of Eni in the dock for billion dollar Nigerian oil deal Royal Dutch Shell and Italian oil giant Eni have been ordered to stand trial in Milan on charges of aggravated international corruption for their role in a 2011 $1.1bn deal for Nigerian oil block OPL 245. Mrs Justice Barbara handed down the ruling today. The judge set March 5 as the date for the trial to begin. Eni’s current CEO Claudio Descalzi, former CEO Paolo Scaroni, Chief Operations and Technology Officer Roberto Casula were also ordered to face trial alongside four Royal Dutch Shell staff members including Malcolm Brinded CBE, former Executive Director for Upstream International and two former MI6 agents employed by Shell. No company as large as Royal Dutch Shell or such senior executives of a major oil company have ever stood trial for bribery offences. The investigation by the Milan public prosecutor was triggered by a complaint filed in Autumn 2013 by Global Witness, The Corner House, Re:Common and Nigerian anti-corruption campaigner Dotun Oloko. The case has also been investigated in Nigeria and the United States following the groups’ complaints. Public prosecutors in The Netherlands are also investigating the case. “The Nigerian people lost out on over $1 billion dollars, equivalent to the country’s entire health budget, as a result of this corrupt deal. They deserve to know the truth about what happened to their missing millions.