Healthcare Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Potential Opportunities from One of the Fastest Growing Major Global Healthcare Markets1

KURE 3/31/2018 China Healthcare: Potential Opportunities From One Of The Fastest Growing Major Global Healthcare Markets1 An Overview of the KraneShares MSCI All China Health Care Index ETF (Ticker: KURE) 1. Major healthcare markets defined as top five global markets by the World Health Organization. Data from the World Health Organization as of 12/31/2015. Retrieved 3/31/2018 [email protected] 1 Introduction to KraneShares About KraneShares Krane Funds Advisors, LLC is the investment manager for KraneShares ETFs. Our suite of China focused ETFs provides investors with solutions to capture China’s importance as an essential element of a well-designed investment portfolio. We strive to provide innovative, first to market strategies that have been developed based on our strong partnerships and our deep knowledge of investing. We help investors stay up to date on global market trends and aim to provide meaningful diversification. Krane Funds Advisors, LLC is majority owned by China International Capital Corporation (CICC). 2 Investment Strategy: KURE seeks to measure the performance of MSCI China All Shares Health Care 10/40 Index. The Index is a free float adjusted market capitalization weighted index designed to track the equity market performance of Chinese companies engaged in the health care sector. The KURE securities in the Index include all types of publicly issued shares of Chinese issuers, which are listed in Mainland China, Hong Kong and United States. Issuers eligible for inclusion must be classified under the Global Industry Classification Standard (GICS) as engaged in the healthcare sector. The issuers included in the Underlying Index may include small-cap, mid-cap and large-cap companies. -

Interview with Beijing Tong Ren Tang/Science Arts

[ Interview ] Mr Tan Lee Huak, owner of Science Arts Co Pte Ltd. Interview with Beijing Tong Ren Tang/Science Arts eijing Tongrentang, was founded in Kangxi 8. It is a famous time-honored brand in the Traditional Chinese Medicine industry. Science Arts collaborated Bwith Beijing Tong Ren Tang in 2004 and brought this well established brand to Singapore. Beijing Tong Ren Tang has a long Beijing Tong Ren Tang has outlets in many countries in the Asia history, being founded in the Kangxi Pacific. Its headquaters is in Beijing, China. The company has period, in 1669. Can you share with collaborated with more than 20 distributors worldwide. They us how the collaboration between have stores in the UK, Australia, Canada and countries in the Asia Pacific. Beijing Tong Ren Tang and Science It has also partnered with various distributors and companies in different Arts came about? countries. In Malaysia, they have partnered with “Hai Ou” to distibute their products. Here in Singapore, Science Arts is its sole distributor. Science Arts and Beijing Tong Ren Tang went into a collaboration in 2004. 1146 ■ Volume 11 > Number 16 > 2007 www.asiabiotech.com [ Interview ] What is Science Arts history and Science Arts have been around for 30 odd years. It was set up how did it come about? by a group of young passionate fresh graduates from The Chinese High School in the 1960s. The collaboration with Beijing Tong Ren Tang is 51% stakes held by Science Arts and 49% belongs to Beijing Tong Ren Tang. What are some of the measures that The side effects of most of our products are minimal. -

Completing the Deal

termsheet April 2018 Issue 24 Completing the Deal industry insight An Interview with Dr Fintan Walton, Are Traditional Chinese Medicines Founder and Chief Executive of PharmaVentures and Plant Extract Treatments the Basis of New Licensing and M&A As Fintan Walton, the Founder and CEO of PharmaVentures, puts it himself, Growth? he was “fortunate enough to be able to enter the world of pharmaceuticals Eric Liu when the explosion of biotechnology Business Analyst, PharmaVentures Limited took off in the 1970’s and 1980s”. He Traditional Chinese Medicines (TCMs) are gaining was educated at Trinity College, Dublin interest worldwide. However despite being as a geneticist and entered the world practised by significant numbers of people in more of biotechnology in the UK by joining Celltech, the first biotech than 140 countries, the absence of robust evidence of efficacy in Europe, in the early 1980s. What Fintan finds fascinating about and safety in conventional clinical trials remains a key challenge that period was that the technology being developed enabled in mainstream commercial adoption, through licensing and M&A scientists to really understand the basis of disease and hence, transactions. Against this backdrop 2017 was a milestone year. The come up with truly break-through medicines as more and more University of Oxford opened its first Chinese Medicine Research biotech companies emerged worldwide. “Their research led to Centre on 6th December, which is one of the first research centres inventions and so the opportunity to license patents and do deals in the West that solely focuses on the study of herbal extracts became a real driver in the biotech industry”. -

About the China Academy of Chinese Medical Sciences About the Coca-Cola Company

[ Industry Watch ] About the China Academy of Chinese Medical Sciences The China Academy of Chinese Medical Sciences is China’s national center for research, healthcare and education in traditional Chinese medicine. It is administered under the Ministry of Public Health through the State Administration of Traditional Chinese Medicine of the People’s Republic of China. The academy employs 3100 professionals, including 800 doctors and professors working in 11 research institutions, five hospitals and clinics, and several educational and publishing branches. It is the most respected and trusted group engaged in research, education, and practice in traditional Chinese medicine. About The Coca-Cola Company The Coca-Cola Company is the world’s largest nonalcoholic beverage company. Along with the Coca-Cola® trademark, recognized as the world’s most valuable brand, the company markets four of the world’s top five nonalcoholic sparkling beverage brands (including Coca-Cola®, Diet Coke®, Fanta® and Sprite® beverages), and a wide range of other nonalcoholic beverages, (including diet and light beverages, waters, juices and juice drinks, teas, coffees, and energy and sports drinks). Through the world’s largest beverage distribution system, consumers in more than 200 countries enjoy the company’s beverages at a rate exceeding 1.4 billion servings each day. ■ Contact details: China Academy of Chinese Medical Sciences Address: No.16 Nanxiaojie, Dongzhimen nei, Beijing 100700 P.R.China. Tel: +86 10 64016387 Email: [email protected] URL: www.cacms.ac.cn Contact Details: The Coca-Cola Company Address: P. O. Box 1734 Atlanta, GA 30301 USA Tel: +1 (404) 515 4400 Fax: +1 (404) 515 0430 URL: www.thecoca-colacompany.com www.asiabiotech.com Volume 11 > Number 21 > 2007 ■ 1421 [ Industry Watch ] CHINA Greater China Corporation to Open TRT Wellness Centers reater China Corporation announced the formation of Tong Ren Tang Wellness Corporation in partnership with TRT USA Corp. -

Potential Opportunities from One of the Fastest Growing Major Global Healthcare Markets1

KURE 12/31/2020 China Healthcare: Potential Opportunities From One Of The Fastest Growing Major Global Healthcare Markets1 An Overview of the KraneShares MSCI All China Health Care Index ETF (Ticker: KURE) 1. Major healthcare markets defined as top five global markets by the World Health Organization. Data from the World Health Organization as of 12/31/2017, last updated on 4/7/2020. [email protected] 1 Introduction to KraneShares About KraneShares Krane Funds Advisors, LLC is the investment manager for KraneShares ETFs. Our suite of China focused ETFs provides investors with solutions to capture China’s importance as an essential element of a well-designed investment portfolio. We strive to provide innovative, first to market strategies that have been developed based on our strong partnerships and our deep knowledge of investing. We help investors current on global market trends and aim to provide meaningful diversification. Krane Funds Advisors, LLC is majority owned by China International Capital Corporation (CICC). 2 Investment Strategy: KURE seeks to measure the performance of MSCI China All Shares Health Care 10/40 Index. The Index is a free float adjusted market capitalization weighted index designed to track the equity market performance of Chinese companies engaged in the health care sector. The securities in the Index include all types of publicly issued shares of Chinese issuers, which are listed in Mainland China, Hong Kong and the KURE United States. Issuers eligible for inclusion must be classified under the Global Industry Classification Standard (GICS) as engaged in the healthcare sector. The issuers included in the Underlying Index may include small-cap, mid-cap and large-cap companies. -

Changing Healthcare

Changing Healthcare ACTCM students learn how to apply ancient wisdom to Apply Online Master of Science in Traditional Chinese Medicine www.actcm.edu/apply Doctorate of Acupuncture and Chinese Medicine modern healthcare practices. Chinese Medicine is a medical Submit the following: • Official Transcript(s) from all system that has been used for thousands of years to prevent, colleges attended • Personal Statement diagnose, and treat disease. It is based on the belief that • 2 Letters of Recommendation qi (the body’s vital energy) flows along meridians (channels) • Completed Application Form • Professional Resume in the body and keeps a person’s physical, spiritual, emotional • Application Fee and mental health in balance. Chinese medical modalities • 2 Passport Size Photos include acupuncture, diet, herbal therapy, meditation, ACTCM Admissions Team 455 Arkansas Street massage and exercise. San Francisco, CA 94107 Phone: (415)401-0464 Email: [email protected] www.actcm.edu ACTCM Graduates Lead the Field As… Acupuncturists Without Borders who give Acupuncturists who set up private practices medical aid to communities in crisis. around the country. Herbalists who grow herbs and create Educators who publish on TCM, wellness, herbal pharmacies. nutrition, and holistic healthcare. Healers who establish integrative health centers. Practitioners who are leading the way towards integrative healthcare in hospitals and clinics. Experts at forefront of healthcare research, ACTCM is Transforming AOM Education teaching and policy making. Through our merger with California Institute of Integral Studies (CIIS) we are advancing opportunities for the holistic care of mind, body and spirit. ACTCM at CIIS is creating clinic services that explore the interface between Chinese medicine and mental health. -

Beijing Tong Ren Tang Chinese Medicine Company Limited 北京同仁堂國藥有限公司

Beijing Tong Ren Tang ChineseMedicineCompanyLimited RenTang Beijing Tong BeijingBeijing TongTong RenRen TangTang ChineseChinese MedicineMedicine CompanyCompany LimLimitedited 北京同仁堂國藥有限公司北京同仁堂國藥有限公司 (incorporated(incorco porated inin HongHong KongKoongg withwith limitedlimitedd lliliability)ability) (於香港註冊成立之有限公司)(於香港註冊冊成立之立之有限公司) StockStock codecoodde 股份股份代號:份代號:818138388 北京同仁堂國藥有限公司 Beijing Tong Ren Tang Chinese Medicine Company Limited 北京同仁堂國藥有限公司 www.tongrentangcm.com Annual Report2013 Annual 年報 2013 Annual Report 年報 password####TRT8138 CHARACTERISTICS OF THE GROWTH ENTERPRISE MARKET (“GEM”) OF THE STOCK EXCHANGE OF HONG KONG LIMITED (THE “STOCK EXCHANGE”) GEM has been positioned as a market designed to accommodate companies to which a higher investment risk may be attached than other companies listed on the Stock Exchange. Prospective investors should be aware of the potential risks of investing in such companies and should make the decision to invest only after due and careful consideration. The greater risk profile and other characteristics of GEM mean that it is a market more suited to professional and other sophisticated investors. Given the emerging nature of companies listed on GEM, there is a risk that securities traded on GEM may be more susceptible to high market volatility than securities traded on the Main Board and no assurance is given that there will be a liquid market in the securities traded on GEM. Hong Kong Exchanges and Clearing Limited and the Stock Exchange take no responsibility for the contents of this report, -

China Healthcare

KURE 6/30/2018 China Healthcare: Potential Opportunities From One Of The Fastest Growing Major Global Healthcare Markets1 An Overview of the KraneShares MSCI All China Health Care Index ETF (Ticker: KURE) 1. Major healthcare markets defined as top five global markets by the World Health Organization. Data from the World Health Organization as of 12/31/2015. Retrieved 6/30/2018 [email protected] 1 Introduction to KraneShares About KraneShares Krane Funds Advisors, LLC is the investment manager for KraneShares ETFs. Our suite of China focused ETFs provides investors with solutions to capture China’s importance as an essential element of a well-designed investment portfolio. We strive to provide innovative, first to market strategies that have been developed based on our strong partnerships and our deep knowledge of investing. We help investors stay up to date on global market trends and aim to provide meaningful diversification. Krane Funds Advisors, LLC is majority owned by China International Capital Corporation (CICC). 2 Investment Strategy: KURE seeks to measure the performance of MSCI China All Shares Health Care 10/40 Index. The Index is a free float adjusted market capitalization weighted index designed to track the equity market performance of Chinese companies engaged in the health care sector. The securities in the Index include all types of publicly issued shares of Chinese issuers, which are listed in Mainland China, Hong Kong and KURE United States. Issuers eligible for inclusion must be classified under the Global Industry Classification Standard (GICS) as engaged in the healthcare sector. The issuers included in the Underlying Index may include small-cap, mid-cap and large-cap companies. -

Confucius Study Day Health Beliefs & Medical Culture of Chinese Students Th Halifax Hall Sheffield 5 March 2016

Confucius Study Day Health Beliefs & Medical Culture of Chinese Students th Halifax Hall Sheffield 5 March 2016 Morning Programme 09:00 – Registration 09:45 – Traditional Chinese Medical Culture vs. Western Medical Culture 10:45 – Coffee 11:00 – Modern China: Health, Medical System & Beliefs 12:00 – Lunch Break Afternoon Programme 12:50 – Workshop 1 13:40 – Workshop 2 14:30 – Workshop 3 15:20 – Coffee 15:35 – Heaven, Earth & Man: Holistic Treatment in Traditional Chinese Medicine Programme supported by: Workshops Psychological Disorder and Mental Health Confucius Institute at the University of Sheffield Tai Chi & Health Maintenance 英国谢菲尔德大学孔子学院 Tui Na (Chinese Massage) www.studenthealthassociation.co.uk Dr. Guan, QingWei Director of Beijing Tong Ren Tang Chinese Medicine Hospital and a prominent Traditional Chinese Physician Heaven, Earth & Man: Holistic Treatment in Traditional Chinese Medicine The Student Health Association is delighted to introduce our renowned speaker, Dr. Guan, Qingwei, the Director and Chief Physician of Beijing Tong Ren Tang Chinese Medicine Hospital, is the successor of the "Beijing Tong Ren Tang Chinese Medicine Culture"---the first batch of Chinese national intangible cultural heritage. Not only is he an outstanding expert in various Chinese medicine associations, he is also one of the distinguished speakers of Confucius Institute of Chinese Medicine Culture. Prof. Fanyi Meng Senior Lecturer at Lincoln College Modern China: Health, Medical System & Health Belief Afternoon Workshop: Psychological Disorder and Mental Health Prof. Dan Jiang Chair of European Alumni of BUCM (Beijing University of Chinese Medicine) Afternoon Workshop: Tai Chi and Health Maintenance Dr Guobing Wang Afternoon Workshop: Tuina (Chinese Massage) Chinese Language Taster: This will take place informally throughout the day. -

Traditional Chinese Medicine Publisher Wolters Kluwer India Private Limited Contact for Any Questions Or Additional Information, Please Contact Us

Chinese Medicine and Culture Call For Papers Official website:http://www.cmaconweb.org Scope: Chinese Medicine and Culture (ISSN: 2589-9627) is a peer-reviewed academic journal The dedicated to publishing primary focus of Chinese Medicine and Culture is on new and original research and their results in the areas of Chinese medicine, both at home and abroad. Topics of interest include, but are not limited to, the following: Interpretation of the Classics Archaeology and Cultural Relics Historical Events Life Preservation Acupuncture and Herbal Medicine Traditional Sports Health Care Global Information on Chinese Medicine Instructions to Authors: Submitted manuscripts must be submitted via ScholarOne (https://mc03.manuscriptcentral.com/cmac) as WORD files. Submitted papers should not be previously published in or be under consideration for publication in another conference orany other journal (or conference proceedings). Editorial Board of Chinese Medicine and Culture reserves the right to not review papers that have been submitted or published elsewhere. Submissions must include title, abstract (150-200 words), keywords (5-8 keywords), author(s) and affiliation(s) with e-mail addresses as well as one photo of the first author. Review and Publication of Manuscripts: Submitted papers will be reviewed by relevant authorities and judged on originality, technical correctnessaccuracy, relevance, and overall quality of articles in keeping with the journal’s wider scope. Languages English (3000-5000 Words) Frequency Quarterly Sponsor Shanghai -

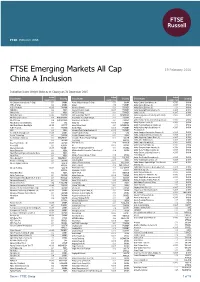

FTSE Emerging Markets All Cap China a Inclusion

FTSE PUBLICATIONS FTSE Emerging Markets All Cap 19 February 2016 China A Inclusion Indicative Index Weight Data as at Closing on 31 December 2015 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 361 Degrees International (P Chip) 0.01 CHINA Ajisen China Holdings (P Chip) 0.01 CHINA Anhui Golden Seed Winery (A) <0.005 CHINA 3SBio (P Chip) 0.03 CHINA Akbank 0.13 TURKEY Anhui Gujing Distillery (A) <0.005 CHINA A.G.V. Products <0.005 TAIWAN Akcansa Cimento 0.01 TURKEY Anhui Gujing Distillery (B) 0.01 CHINA ABB India 0.02 INDIA Akenerji Elektrik Uretim <0.005 TURKEY Anhui Guofeng Plastic Industry (A) <0.005 CHINA Abbott India 0.01 INDIA AKFEN Holding 0.01 TURKEY Anhui Heli (A) <0.005 CHINA Ability Enterprise <0.005 TAIWAN AKR Corporindo Tbk PT 0.02 INDONESIA Anhui Hengyuan Coal Industry & Electricity <0.005 CHINA Aboitiz Equity Ventures 0.08 PHILIPPINES Aksa Akrilik Ve Kimya Sanayii 0.01 TURKEY Power (A) Aboitiz Power 0.04 PHILIPPINES Aksa Enerji Uretim AS 0.01 TURKEY Anhui Honglu Steel Construction (group) (A) <0.005 CHINA Abu Dhabi Commercial Bank 0.09 UAE Aksigorta <0.005 TURKEY Anhui Huamao Textile (A) <0.005 CHINA Abu Dhabi Islamic Bank Egypt <0.005 EGYPT Alam Sutera Realty 0.01 INDONESIA Anhui Huaxing Chemical Industry (A) 0.01 CHINA AcBel Polytech 0.01 TAIWAN Alarko Hldgs <0.005 TURKEY Anhui Huilong Agricultural Means of <0.005 CHINA ACC 0.03 INDIA Albaraka Turk Katilim Bankasi AS <0.005 TURKEY Production (A) Accelink Technologies (A) <0.005 CHINA Aldar Properties PJSC 0.06 UAE Anhui Jianghuai Automotive Chassis (A) <0.005 CHINA Accton Technology 0.01 TAIWAN Alembic Pharmaceuticals 0.01 INDIA Anhui Jiangnan Chemical Industry (A) <0.005 CHINA Ace Hardware Indonesia 0.01 INDONESIA Alexander Forbes Equity Holdings 0.01 SOUTH Anhui Jingcheng Copper Share (A) <0.005 CHINA Acer 0.03 TAIWAN Proprietary AFRICA Anhui Jinhe Industrial (A) <0.005 CHINA Aces Electronic Co. -

Chapter 1: Introduction

Regulation of the Practice of Traditional Medicine in China, India, and Malaysia By Cheng Soon Goh Submitted in accordance with the requirement for the degree of PhD The University of Leeds School of Law March, 2012 The Candidate confirms that the work submitted is her own and that appropriate credit has been given where reference has been made to the work of others. This copy has been supplied on the understanding that it is copyright material and that no quotation from the thesis may be published without proper acknowledgement. ii Acknowledgements I would like to record my gratitude to my supervisor, Professor Graham Dutfield, for providing me with his most valuable and generous help during the preparation of the dissertation. Professor Dutfield has guided and supported me throughout the course of this doctoral research. He has shown great patience in reading and commenting on the draft of this thesis. He has also introduced me to the “intellectual property rights” perspective of traditional medicine. I gratefully acknowledge the invaluable review comments from Professor Gerard Bodeker (University of Oxford), and his contacts in the Global Initiative for Traditional Systems (GIFTS) of Health, Oxford. Professor Bodeker has provided helpful criticism at various stages of my research and writing. Thoughts and ideas for improvements in the write-up have been stimulated. His constant encouragement and unbounded generosity on knowledge sharing are greatly appreciated. Moreover, I would also like to express my warm appreciation and gratitude to Professor Bodeker in directing me to the “policy” perspective of healthcare. Many thanks go to Dato’ Dr. Dorai Raja (President of Malaysian Association of Traditional Indian Medicine, Malaysia) for the many discussions on a variety of issues; to Antony Taubman (then Director of Global Intellectual Property Issues Division and Life Sciences Programme, WIPO) for his invaluable opinions, to Dr.