Mutual Insurance: Healthcare Utopia Sparks Fresh Controversy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Identity Theft/Fraud

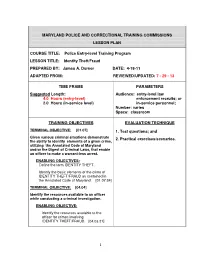

MARYLAND POLICE AND CORRECTIONAL TRAINING COMMISSIONS LESSON PLAN COURSE TITLE: Police Entry-level Training Program LESSON TITLE: Identity Theft/Fraud PREPARED BY: James A. Durner DATE: 4-18-11 ADAPTED FROM: REVIEWED/UPDATED: 7 - 29 - 13 TIME FRAME PARAMETERS Suggested Length: Audience: entry-level law 4.0 Hours (entry-level) enforcement recruits; or 2.0 Hours (in-service level) in-service personnel; Number: varies Space: classroom TRAINING OBJECTIVES EVALUATION TECHNIQUE TERMINAL OBJECTIVE: [01.07] 1. Test questions; and Given various criminal situations demonstrate 2. Practical exercises/scenarios. the ability to identify elements of a given crime, utilizing the Annotated Code of Maryland and/or the Digest of Criminal Laws, that enable an officer to make a warrant-less arrest. ENABLING OBJECTIVES: Define the term IDENTITY THEFT. Identify the basic elements of the crime of IDENTITY THEFT/FRAUD as contained in the Annotated Code of Maryland. [01.07.34] TERMINAL OBJECTIVE: [04.04] Identify the resources available to an officer while conducting a criminal investigation. ENABLING OBJECTIVE: Identify the resources available to the officer for crimes involving IDENTITY THEFT/FRAUD. [04.03.21] 1 TERMINAL OBJECTIVE: [04.05] Identify resources available to a crime victim. ENABLING OBJECTIVE: [04.05.19] Identify resources available to the victim for crimes involving IDENTITY THEFT/FRAUD. TERMINAL OBJECTIVE: [04.23] Identify the basic responsibility of the officer when Investigating the crime of identity theft. TERMINAL OBJECTIVE: [07.05] Demonstrate completion of acceptable police reports for various offenses/incidents/situations. ENABLING OBJECTIVE: Apply the law as contained in the Annotated Code of Maryland Criminal Law that requires a law enforcement officer to prepare and file a report from the victim of IDENTITY THEFT/FRAUD. -

Credit Card Processing Questions

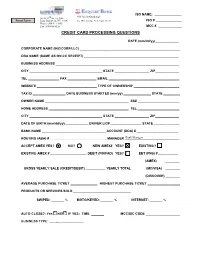

ISO NAME: _______________ 100 Jericho Quadrangle 36-36 33rd St., Ste 306 Long Island City,NY 11106 Ste 100, Jericho, New York 11753 ISO # ______________ Phone: (866)811-1005 Fax: (800)455-4126 MCC # _____________ CREDIT CARD PROCESSING QUESTIONS DATE (mm/dd/yy)_____________ CORPORATE NAME (INC/CORP/LLC) _______________________________________________________ DBA NAME (SAME AS ON CC RECEIPT) ____________________________________________________ BUSINESS ADDRESS ____________________________________________________________________ CITY ________________________________________ STATE ___________________ ZIP_____________ TEL _________________ FAX ________________ EMAIL _______________________________________ WEBSITE _________________________________ TYPE OF OWNERSHIP _________________________ TAX ID __________________ DATE BUSINESS STARTED (mm/yy) _______________ STATE _________ OWNER NAME ______________________________________________ SS# _______________________ HOME ADDRESS ____________________________________________ TEL _______________________ CITY ________________________________________ STATE ___________________ ZIP_____________ DATE OF BIRTH (mm/dd/yy)_____________ DRIVER LIC# _________________ STATE ______________ BANK NAME ___________________________________ ACCOUNT (DDA) # _______________________ ROUTING (ABA) # _______________________________ MANAGER ______________________________ ACCEPT AMEX YES? NO? NEW AMEX# YES? EXISTING? EXISTING AMEX # ____________________ DEBIT (PINPAD) YES? EBT (FNS) # ___________ (AMEX) ________ GROSS YEARLY -

Copyrighted Work Sample

CREDIT CARD ACCOUNT OPENING DISCLOSURE STANDARD MASTERCARD Approved Credit Limit: This Disclosure is incorporated into and becomes part of Your LOANLINER® Consumer Credit Card Agreement & Disclosure. Please keep this attached to Your LOANLINER Consumer Credit Card Agreement & Disclosure. Interest Rates and Interest Charges Annual Percentage Rate (APR) for Purchases 18.00% APR for Balance Transfers 18.00% APR for Cash Advances 18.00% Penalty APR and When it Applies None Paying Interest Your due date is at least 25 days after the close of each billing cycle. We will not charge You any interest on purchases if You pay Your entire balance by the due date each month. We will begin charging interest on cash advances and balance transfers on the transaction date. For Credit Card Tips from the To learn more about factors to consider when applying for or using a Consumer Financial Protection Bureau credit card, visit the website of the Consumer Financial Protection Bureau at http://www.consumerfinance.gov/learnmore. Fees Set-up and Maintenance Fees - Annual Fee None - Account Set-up Fee None - Program Fee None - Participation Fee None - Additional Card Fee None - Application Fee None Transaction Fees - Balance Transfer Fee None - Cash Advance Fee None - Foreign Transaction Fee 0.90% of each transaction in U.S. dollars completed outside the U.S. 0.20% of each transaction in U.S. dollars completed in a foreign currency - Transaction Fee for Purchases None Penalty Fees - Late Payment Fee Up to $15.00 - Over-the-Credit Limit Fee None - Returned Payment Fee Up to $20.00 Other Fees - Chargeback Insurance $0.49 per $100.00 of balance at the end of each statement period How We Will Calculate Your Balance: We use a method called "average daily balance (including new purchases)." See Your Account Agreement for more details. -

Payment Aspects of Financial Inclusion in the Fintech Era

Committee on Payments and Market Infrastructures World Bank Group Payment aspects of financial inclusion in the fintech era April 2020 This publication is available on the BIS website (www.bis.org). © Bank for International Settlements 2020. All rights reserved. Brief excerpts may be reproduced or translated provided the source is stated. ISBN 978-92-9259-345-2 (print) ISBN 978-92-9259-346-9 (online) Table of contents Foreword .................................................................................................................................................................... 1 Executive summary ................................................................................................................................................. 2 1. Introduction ....................................................................................................................................................... 4 2. Fintech developments of relevance to the payment aspects of financial inclusion ............. 6 2.1 New technologies ................................................................................................................................. 7 2.1.1 Application programming interfaces ......................................................................... 7 2.1.2 Big data analytics ............................................................................................................... 8 2.1.3 Biometric technologies ................................................................................................... -

Annual Report Esquire Financial Holdings, Inc. Holdings, Financial Esquire

2018Annual Report Esquire Financial Holdings, Inc. Esquire Financial Holdings, Inc. 100 JERICHO QUADRANGLE, SUITE 100 JERICHO, NEW YORK 11753 Esquire Financial Holdings, Inc. 2018 ANNUAL REPORT esq ESQ_AR18_CV.indd 1-3 4/12/19 4:11 PM CORPORATE INFORMATION DIRECTORS AND EXECUTIVE OFFICERS DIRECTORS Todd Deutsch EXECUTIVE OFFICERS Anthony Coelho Marc Grossman Andrew C. Sagliocca Chairman of the Board Russ M. Herman President, Chief Executive Officer and Director Andrew C. Sagliocca Janet Hill President, Chief Executive Officer Eric S. Bader and Director Robert J. Mitzman Executive Vice President, Chief Operating John Morgan Officer and Corporate Secretary Richard T. Powers Ari P. Kornhaber Executive Vice President, Director of Sales Jack Thompson Michael Lacapria Kevin C. Waterhouse Senior Vice President, Chief Financial Officer Selig A. Zises INVESTOR INFORMATION CORPORATE HEADQUARTERS INDEPENDENT REGISTERED PUBLIC GENERAL INQUIRIES 100 Jericho Quadrangle, Suite 100 ACCOUNTING FIRM A copy of our Annual Report to the SEC Jericho, New York 11753 Crowe LLP may be obtained without charge by written (800) 996-0213 354 Eisenhower Parkway, Suite 2050 request of stockholders to Eric Bader or by www.esquirebank.com Livingston, New Jersey 07039 calling us at (800) 996-0213. The Annual SPECIAL COUNSEL (973) 422-2420 Report is also available on our website at Luse Gorman, PC ANNUAL MEETING www.esquirebank.com. Our Code of Ethics, 5335 Wisconsin Ave., N.W., Suite 780 The Annual Meeting of the Stockholders Audit Committee Charter, Corporate Gover Washington, D.C. 20015 will be held on May 30, 2019 at 10:00 a.m., nance and Nominating Committee Charter, (202) 274-2000 Eastern time, at the executive offices of Compensation Committee Charter, and Beneficial Ownership reports of our directors TRANSFER AGENT Esquire Financial Holdings, Inc. -

Making Hay of New IRS Reporting Requirements

News November 8, 2010 • Issue 10:11:01 Industry Update .......................................14 TCF Bank lawsuit challenges Durbin Amendment ..............................43 Making hay of new Reaching out to medical marijuana dispensaries .......................43 IRS reporting Mercator explains growth in micropayments, virtual purchasing ..........45 requirements New MasterCard credit card generates passwords ............................46 By Adam Atlas Trade Association News Attorney at Law WSAA 2010 a smashing success ...........47 s of Jan. 1, 2011, certain ISOs, acquiring banks, processors and third- Features party payment providers will be obliged to keep track of merchants' gross credit card, debit card and third-party payment (such as those SellingPrepaid: A made through PayPal Inc.) receipts. Prepaid in brief ....................................32 Open-loop prepaid part of These are not the printed receipts from purchases at the POS but those from deposits made by an acquirer or other service provider to a merchant account CTA's new fare system .........................34 for settlement of electronic transactions. Given that the bulk of income for most Prepaid's emergence in India .................36 merchants is derived from credit and debit cards, this reporting makes sense Research rundown ...................................75 from a public policy perspective. Views The reporting applies to merchants who sell more than $20,000 worth of goods and conduct more than 200 electronic transactions annually. Challenges to Dodd-Frank, Durbin heat up By Mark Brady and Ross Federgreen The 1099-K CSRSI, The Payment Advisors .................24 Service providers that make direct payments to merchants for their credit and It's the economy, again debit card and alternative payment transactions – dubbed "payment settlement By Brandes Elitch, CrossCheck Inc. -

Visa Credit Card Disclosure

CREDIT CARD ACCOUNT OPENING DISCLOSURE VISA CLASSIC Interest Rates and Interest Charges Annual Percentage Rate (APR) for 9.90% Purchases APR for Balance Transfers 9.90% APR for Cash Advances 11.90% Penalty APR and When it Applies 16.90% This APR may be applied to your account if you make a late payment. How long will the penalty APR apply? If your APRs are increased for this reason, the Penalty APR will apply until you make six consecutive minimum payments when due. Paying Interest Your due date is at least 25 days after the close of each billing cycle. We will not charge You any interest on purchases if You pay Your entire balance by the due date each month. We will begin charging interest on cash advances and balance transfers on the transaction date. For Credit Card Tips from the To learn more about factors to consider when applying for or using a Consumer Financial Protection Bureau credit card, visit the website of the Consumer Financial Protection Bureau at http://www.consumerfinance.gov/learnmore. Fees Set-up and Maintenance Fees - Annual Fee None - Account Set-up Fee None - Program Fee None - Participation Fee None - Additional Card Fee None - Application Fee None Transaction Fees - Balance Transfer Fee None - Cash Advance Fee None - Foreign Transaction Fee 1.00% of each transaction in U.S. dollars completed outside the U.S. 0.80% of each transaction in U.S. dollars completed in a foreign currency - Transaction Fee for Purchases None Penalty Fees - Late Payment Fee Up to $30.00 - Over-the-Credit Limit Fee None - Returned Payment Fee Up to $30.00 Other Fees - Chargeback Insurance None How We Will Calculate Your Balance: We use a method called "average daily balance (including new purchases)." See Your Account Agreement for more details. -

Important Information About Bank's Responsibilities

PREFACE Thank you for selecting us for your payment processing needs. Accepting numerous payment options provides a convenience to your customers, increases your customers’ ability to make purchases at your establishment, and helps speed payment to your account. Your Merchant Processing Application will indicate the types of payments and Services you have elected to accept. These Processing Terms and Conditions (the “Program Guide”) presents terms governing the acceptance of Visa®, MasterCard®, and Discover® Network Credit Card and Non-PIN Debit Card payments, PayPal® in-store Card payments, American Express® Card transactions and applicable Non-Bank Services. This Program Guide, your Merchant Processing Application and the schedules thereto (collectively, the “Agreement”), including, without limitation, the Interchange Qualification Matrix and American Express Program Pricing and one of the Interchange Schedules, as applicable to your pricing method as set forth in the Merchant Processing Application, contains the terms and conditions under which Processor and/or Bank and/or other third parties, will provide services . We will not accept any alterations or strike-outs to the Agreement and, if made, any such alterations or strike-outs shall not apply. Please read this Program Guide completely. You acknowledge that certain Services referenced in the Agreement may not be available to you. IMPORTANT INFORMATION ABOUT BANK’S RESPONSIBILITIES: Discover Network Card Transactions, PayPal in-store Card Transactions, American Express Card Transactions and other Non-Bank Services are not provided to you by Bank but are provided by Processor and/or third parties. The provisions of this Agreement regarding Discover Network Card Transactions, PayPal in-store Card Transactions, American Express Card Transactions and other Non- Bank Services constitute an agreement solely between you and Processor and/or third parties. -

Copyrighted Work Sample

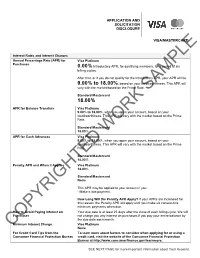

APPLICATION AND SOLICITATION DISCLOSURE VISA/MASTERCARD Interest Rates and Interest Charges Annual Percentage Rate (APR) for Visa Platinum Purchases 0.00% Introductory APR, for qualifying members, for a period of six billing cycles. After that, or if you do not qualify for the Introductory APR, your APR will be 9.00% to 18.00%, based on your creditworthiness. This APR will vary with the market based on the Prime Rate. Standard Mastercard 18.00% APR for Balance Transfers Visa Platinum 9.00% to 18.00%, when you open your account, based on your creditworthiness. This APR will vary with the market based on the Prime Rate. Standard Mastercard 18.00% APR for Cash Advances Visa Platinum 9.00% to 18.00%, when you open your account, based on your creditworthiness. This APR will vary with the market based on the Prime Rate. Standard Mastercard 18.00% Penalty APR and When it Applies Visa Platinum 18.00% Standard Mastercard None This APR may be applied to your account if you: - Make a late payment. How Long Will the Penalty APR Apply? If your APRs are increased for this reason, the Penalty APR will apply until you make six consecutive minimum payments when due. How to Avoid Paying Interest on Your due date is at least 25 days after the close of each billing cycle. We will Purchases not charge you any interest on purchases if you pay your entire balance by the due date each month. Minimum Interest Charge Visa Platinum None COPYRIGHTED WORK SAMPLE For Credit Card Tips from the To learn more about factors to consider when applying for or using a Consumer Financial Protection Bureau credit card, visit the website of the Consumer Financial Protection Bureau at http://www.consumerfinance.gov/learnmore. -

Merchant Guide for E-Commerce Fraud Protection Merchant Guide for E-Commerce Fraud Protection Merchant Guide for E-Commerce Fraud Protection

Merchant Guide for E-Commerce Fraud Protection Merchant Guide for E-Commerce Fraud Protection Merchant Guide for E-Commerce Fraud Protection Introduction As e-commerce explodes in popularity, so does e-commerce fraud – and every e-commerce merchant, from tiny start-ups to massive chains, is vulnerable. There are multiple types of fraud and ways to prevent it — but managing fraud protection the wrong way can be costly and frustrating. It’s important, therefore, to understand exactly what e-commerce fraud looks like, what other risks merchants face, and what e-commerce fraud protection tools can help thwart these attacks without inadvertently turning away good customers. That’s why we’ve built this resource: to help you understand your risks, so you can take the right steps to protect your business, your profits, and your good reputation. Let’s dive in! 2 Merchant Guide for E-Commerce Fraud Protection Shortcuts The State of E-Commerce Fraud Growth in Fraud Attacks on Merchants Cost of Fraud Attacks Understanding E-Commerce Fraud Types of E-Commerce Fraud E-Commerce Fraud and Industry Risk Understanding Chargebacks The Chargeback Process Types of Chargebacks Chargeback Fees and Chargeback Ratios Chargeback Solutions Fraud Detection, Fraud Prevention and Fraud Management Fraud Filters False Declines Manual Fraud Review Machine Learning/AI Fraud Managed Services E-Commerce Fraud FAQs 3 Merchant Guide for E-Commerce Fraud Protection Introduction to E-Commerce Fraud Whether you’re a longstanding multichannel retail organization with millions of dollars in sales or a small retailer getting your business off the ground, e-commerce fraud is aggravating and expensive. -

Fintech and Consumer Protection: a Snapshot

FINTECH AND CONSUMER PROTECTION:Wh A Snapshot March 2019 By Lauren Saunders National Consumer Law Center® © Copyright 2019, National Consumer Law Center, Inc. All rights reserved. ABOUT THE AUTHOR Lauren Saunders is Associate Director at the National Consumer Law Center (NCLC) and manages the Washington, DC office, where she directs NCLC’s federal legislative and regulatory work. Lauren is a recognized expert in various areas, including small dollar loans, fintech, prepaid cards, credit cards, bank accounts, and consumer protection regulation. She is the lead author of Consumer Banking and Payments Law, contributes to other NCLC treatises, and has authored several reports and white papers. She previously directed the Federal Rights Project of the National Senior Citizens Law Center; was Deputy Director of Litigation at Bet Tzedek Legal Services; and was an associate at Hall & Phillips. She graduated magna cum laude from Harvard Law School and was an Executive Editor of the Harvard Law Review, and holds a Masters in Public Policy from Harvard’s Kennedy School of Government and a B.A., Phi Beta Kappa, from Stanford University. ACKNOWLEDGMENTS Special thanks to NCLC colleagues John Van Alst, Michael Best, Carolyn Carter, Alys Cohen, Joanna Darcus, April Kuehnhoff, Andrew Pizor, John Rao, Odette Williamson, and Chi Chi Wu as well as Christina Tetreault at Consumer Reports for their input. The author would also like to thank Jan Kruse for editorial assistance and Anna Kowanko for layout assistance. ABOUT THE NATIONAL CONSUMER LAW CENTER Since 1969, the nonprofit National Consumer Law Center® (NCLC®) has used its expertise in consumer law and energy policy to work for consumer justice and economic security for low-income and other disadvantaged people, including older adults, in the United States. -

VIRTUAL 22-25 Feb 2021

POSitivitymagazine THE OFFICIAL MAGAZINE OF MERCHANT PAYMENTS ECOSYSTEM • ISSUE 88 / JANUARY 2021 VIRTUAL 22-25 Feb 2021 Merchant Payments MPE Visa Fraud Prevention Ecosystem 2021 To Acquire in Ecommerce Predictions Plaid Report PREDICTIONS 2021 on page 12 on page 14 on page 24 ATTENDEEEDITORIAL PROFILE ....just a small taste of companies attending MPE 2020 MERCHANTS Dave Birch Director of Innovation Consult Hyperion (Chairman of MPE 2021 conference) INDUSTRY EXPERTS Dear POSitivity magazine readers, integrate payments, we arrive in a truly different place where the physical and online worlds merge. We‘ve talk- ed many times before about shifting from check-out to When we look forward to 2021, it is no surprise that CO- check-in models of retailing and it seems that the pan- VID-19 is the dominant factor. So far as the merchant demic is driving a great many organisations to make the paymentsSOLUTION world PROVIDERSis concerned, the shape of the post- transition: when retailers ask customers to check-in, so pandemic new normal transaction environment must they know who the customers are, they can actually de- be the key strategic consideration for stakeholders and liver much better, personalised services. I am desperately keen to hear the variety of informed opinion on this topic that I have come to expect at Mer- Integrated Transport and Access chant Payments Ecosystem every year. Here at Consult Hyperion we’d like to contribute to these conversations I can remember a number of discussions about the dis- by providing a useful framework for discussion: our an- proportionate role of transit in bringing new transac- nual “Live Five”, our yearly set of suggestions for strate- tions modes to the general at past MPE events.