AVOIDING BET REGRET an Overview of the Campaign to Date

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Flux: Parian Unpacked, Octagon Gallery and Other Galleries, Fitzwilliam Museum, 6 March - 1 July 2018

MATT SMITH The Glynn collection of parian ware was accepted by H. M. Government in lieu of Inheritance Tax from the estate of G. D. V. Glynn, and allocated to the Fitzwilliam Museum in 2016. The Fitzwilliam Museum Trumpington Street, Cambridge, CB2 1RB Telephone: 01223 332900 www.fitzmuseum.cam.ac.uk ISBN: 978-1-910731-12-3 Copyright 2018 The University of Cambridge (The Fitzwilliam Museum) The right of Matt Smith to be identified as the author of this work has been asserted by him in accordance with the Copyright, Designs and Patents Act 1988. All rights reserved. Except for brief quotations in a review, no part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of the publisher. All images © The Fitzwilliam Museum, University of Cambridge, unless otherwise stated. Front & back cover: W.H. Kerr & Co., Worcester, Ariadne/Female on the rocks, parian ware, mid to late 19th century, C.778-2016; p. 8: Examples of parian ware busts from the Glynn collection; p.13: Unknown British parian manufacturer, Sir Salar Jung (1829-1883), parian ware, mid to late 19th century, C.888-2016; p. 53: Ridgway, Dates & Co, Stoke-on-Trent, George Frideric Handel (1685-1759), (detail), parian ware, mid to late 19th century, C.862-2016 MATT SMITH Every attempt has been made to gain permission for the use of the images in this book. Any omissions will be rectified in future editions. Text by Matt Smith, Sadiah Qureshi & Namita Gupta Wiggers • Designed by Ayshea Carter & Matt Smith • Photography by Mike Jones & Sophie Mutevelian Published on the occasion of the exhibition Flux: Parian Unpacked, Octagon Gallery and other galleries, Fitzwilliam Museum, 6 March - 1 July 2018. -

BBC Annual Report 2020/11 Part

PART 2 THE BBC EXECUTIVE’S REVIEW AND ASSESSMENT Overview Delivering our strategy Managing the business Governance Managing our finances Part 2 BBC Executive Overview Managing the business 2-1 Director-General’s introduction 2-38 Chief Operating Officer’s review 2-2 Understanding the BBC’s finances 2-39 Increasing value 2-4 Performance by service 2-50 Looking forward 2-8 Television Governance 2-9 Radio 2-52 Executive Board 2-10 News 2-54 Risks and opportunities 2-11 Future Media 2-56 Governance report 2-12 Nations and Regions Managing our finances Delivering our strategy 2-68 Chief Financial Officer’s review 2-14 Meeting the BBC’s Purposes 2-69 Summary financial performance 2-16 The best journalism in the world 2-70 Financial overview 2-20 Inspiring knowledge, culture and music 2-79 Looking forward 2-24 Ambitious UK drama and comedy 2-80 Beyond broadcasting 2-28 Outstanding children’s content 2-82 Glossary 2-32 Bringing the nation together 2-83 Contact us/More information 2-36 Delivering Quality First objectives Subject index Part 1 Part 2 Appreciation index by service 2-4 to 2-7 Audience approval – KPI 1-6 2-23 Board remuneration from 2011/12 2-61 Board remuneration 2010/11 1-20 2-60 Commercial companies 1-19 2-46/2-69 Content spend by service 1-19 2-4 to 2-7 Delivering Quality First 1-7 2-36 Digital switchover 1-9 2-40 Distinctiveness – KPI 1-6/1-25 2-31 Efficiencies 1-7 2-69/2-71 Innovation 2-45 Licence fee 1-24 2-3 Licence fee spend 1-17 2-69/2-73 News audiences 1-8/1-13 2-19 Public purposes 1-8 2-14 Quality – KPI 1-6 2-27 Radio from -

Bt Sky Sports Offer

Bt Sky Sports Offer Static Saundra eyeballs his straighteners mention heavily. When Ahmad shaping his lams partners not strategically enough, is Jordan relaxed? Louie etymologises her wall even-handedly, she interring it pharmaceutically. Spend the weekend w me? The cheapest way is to get the BT Sport app is using a SIM card from BT Mobile, but you can also consider EE for a wider choice of SIM cards. TV shows and music. Records your chosen series then the next and subsequent series in order. Sky Multiscreen has been called Multiroom and the Sky Q Experience in recent times. Now TV passes that offer access to Sky Sports channels on a pay as you go basis. Sky Sports SD subscription required to take Sky Sports channels in HD. Scheduling will begin from the start of the Premier League season. Small regular contributions can build up nicely over time. You must not attempt to share, edit or adapt the content made available to you. There are some serious limitations with both options, of course. Changes will take effect once you reload the page. Virgin Media has several excellent options for sports fans to get access to Sky Sports. How Can I Watch BT Sport On Freeview? Sky sports for you can you consent to bt sky sports offer? Saving will vary if you Mix to a different plan. Sky Cinema are available at extra monthly cost. With Sky Sports, You can buy one channel, two channels, three channels or get everything in a nice big bundle. Join for longer and save with an Entertainment and Sky Cinema Pass and access unmissable shows and movies. -

Matt Cole – Digital Imaging Technician

MATT COLE – DIGITAL IMAGING TECHNICIAN M: +44 (0)7960 665822 E: [email protected] BOOKINGS: WIZZO +44 (0)20 74372055 6 YEARS EXPERIENCE AS A D.I.T. (PREVIOUS EXPERIENCE AS CLAPPER LOADER / 2ND A.C) GBCT (GUILD OF BRITISH CAMERA TECHNICIANS) MEMBER MAC PRO BASED ON-SET DIGITAL LAB/STORAGE FOR HIRE (PORTABLE AND FLIGHT CASED) EXTENSIVE CAMERA EXPERIENCE: ARRI ALEXA/AMIRA/D21, RED DRAGON/EPIC/ONE, SONY F3/ SECURE/FAST RUSHES BACKUP, SPEEDY TRANSCODING, GRADED OFFLINES, IPAD DAILIES, LUTS … F55/F65, BLACKMAGIC STUDIO/ POCKET, CANON C100/C300/C500/1DC/5D/7D, NIKON, BATTERY, MAINS/SPARKS HOOK-UP OR GENERATOR POWERED VW TRANSPORTER D.I.T VEHICLE PANASONIC P2, SI-2K, ICONIX, CODEX VAULT / SI2K / INDIECAM/ GO-PRO / CONVERGENT (COMFY BLACKED-OUT VIEWING FACILITY FOR D.O.P, DIRECTOR, PRODUCTION TO VIEW RUSHES/ DESIGN ODYSSEY 7Q/NANOFLASH/GEMINI/ATOMOS / SONY SRW-1 RECORDERS STOP FOR COFFEE!) LONDON OR SUSSEX BASED COMMERCIALS / PROMO CREDITS: COMPANY TITLE D.O.P 1st A.C CAMERA FORMAT SMUGGLER JACOBS - ‘THE COPS’ OLIVIER CARIOU ANTHONY HUGILL ARRI ALEXA XT FRAMESTORE BEATS BY DRE MARCUS DOMLEO TREVOR HENEN ARRI ALEXA XT AMV BBDO PC WORLD/CURRYS PETE BATHURST CHRIS DODDS RED EPIC HUNGRY MAN MALTESERS ‘BUNNY’ MIKE GEORGE MIKE GREEN ARRI AMIRA SOMESUCH & CO SPECIAL K - ‘BREAKFAST RANGE’ DAVID PROCTOR SAM RAWLINGS RED DRAGON STINK HONDA - ‘Q3 RANGE - CONTINUUM’ MARK PATTEN CIRO CANDIA ARRI ALEXA XT DBLG FUNDING CIRCLE - ‘WE ARE NOT A BANK’ KIT FRASER RALPH MESSER ARRI ALEXA XT BLINK USA NBC SPORTS - PREMIER LEAGUE PROMO HILTON GORING TONY KAY ARRI ALEXA -

Today's SQUADS

20 The Today’s SQUADS ALVIS SPORTING CLUB LITTLETON FC TankMENOfficial Match day Programme 2013 / 14 Neil Collett Alex Baird Jack Hartopp Tim Beattie Alvis Sporting Club Chris Woodward Callum Clarke Commemorating The 25th Anniversary Michael Quirke Jamie Clarke Sean Martin Daniel Cliffe Of The Hillsborough Disaster 15th April 1989 Brian Howe Steve Edghill Matt Taylor Kyonn Evans Christian Jordan Will Gayton Samuel Odusoga Adam Guest Steve Evans Stuart Hall Calvin Thompson Kevin Ingram Matt Bannister Leon Kandekore Dean Kimberlin Matt Mitchell Patrick Suffo Glen Sitch Leon Kelly Dean Smith Thomas Maguire Jamie Saunston Fabian Spence Richard Tomkins Joss Holford Antonio Vernashi Arron Donaldson Haydn Whitcombe Ryan Caputo Matt Chambers Luke McKiernan Simon Fitter The St. Mary’s Hospice Paolo Razza Nathan Haywood Kieran Fitzharris Jamie Insall Midland Football Combination Matt Sanders Matthew Mitchell Premier Division Darren Judge Jack Paul Wood Andrew Hayes ALVIS SPORTING CLUB Bradley Ausden V Carl Welland LITTLETON FC Saturday 12h April 2014 KO 3:07 pm Always in reserve: The Alvis Scorpion Tank www.pitchero.com/clubs/alvissportingclub/ www.pitchero.com/clubs/alvissportingclub/ 2 19 Welcome to our 2013/14 edition of Alvis Sporting Club’s Player Profile Worst dressed player? The Tankmen Azza D “ ” Which ground would you most like to play at? Contributions from The Chairman Don Corrigan, Bob Bannister Old Trafford Feature’s editor, The “Dugout”, Sponsors and associates: Sweet Popcorn or Salty Popcorn? CarSelect, Warehouse Coventry, BCS Group, -

Spring & Summer 2008 on ITV1

Spring & Summer 2008 Click below to visit: > Drama > Comedy & Entertainment > Factual > Daytime > Sport > CITV > ITV.com and ITV Mobile Drama Tender Loving Care Pushing Daisies Agatha Christie’s Marple Spring & Summer 2008 Drama new new Tender Loving Care Pushing Daisies A CARNivaL FILM & TELevisiON PRODUctiON A LiviNG Dead GUY AND THE JINKS/COHEN FOR ITV1 COMPANY IN assOciatiON witH WARNER BROS TELevisiON PRODUctiON PAUL NICHOllS, SURAnnE JONES AND SHAUN PARKES staR IN FROM BRYAN FULLER (HeROes) AND BARRY SONNENfeLD (MEN IN BLacK) TENDER LOVING CARE, A CONtemPORARY AND ORIGINAL medicaL COmes PUSHING DAISIES, THE Hit US seRies staRRING LEE PACE AND DRama set IN LONDON’S famOUS medicaL distRict OF HARLEY stReet. AnnA FRIEL abOUT A maN WHO BRINGS THE dead bacK TO Life. With an ethos of providing first-rate, ‘wraparound’ health care, the private Featuring a blend of romance, fantasy and mystery, the Golden Globe- practice is run by three partners, general medical practitioners Robert nominated series is narrated by Jim Dale and follows Ned (Pace), a (Nicholls), Martha (Jones) and Ekkow (Parkes). Each is dynamic and young man with a special gift. As a boy, Ned discovered that he could passionate about delivering the best standards of care, round the clock. briefly resurrect the dead with one touch. But his gift isn’t without deadly consequences, as he soon finds out. Created by Marston Bloom, Tender Loving Care features a world in Press Contact which doctors are with their patients every step of the medical journey The adult, pie-shop owning Ned puts his talent to good use by Press Contact - from lifestyle surgery through everyday care to often life-threatening rejuvenating dead fruit, and at the same time giving it a delicious Tracey Gallagher Ian Johnson / Roxie Maskall conditions. -

VIRGIN TV BRITISH ACADEMY TELEVISION AWARDS in 2018: NOMINATIONS and WINNERS - Winners in Bold * SUNDAY 13 MAY

VIRGIN TV BRITISH ACADEMY TELEVISION AWARDS IN 2018: NOMINATIONS AND WINNERS - Winners in Bold * SUNDAY 13 MAY FELLOWSHIP *KATE ADIE OBE SPECIAL AWARD *JOHN MOTSON OBE COMEDY ENTERTAINMENT PROGRAMME THE LAST LEG Production Team – Open Mike Productions / Channel 4 *MURDER IN SUCCESSVILLE Andy Brereton, Avril Spary, James De Frond, Tom Davis – Shiny Button Productions / Tiger Aspect Productions / BBC Three TASKMASTER Andy Cartwright, Andy Devonshire, Alex Horne – Avalon / Dave WOULD I LIE TO YOU? Peter Holmes, Rachel Ablett, Ruth Phillips, Adam Copeland – Zeppotron / BBC One CURRENT AFFAIRS RAPED: MY STORY Catey Sexton, Jonathan Braman, Emma Wakefield, Ollie Tait – Lambent Productions / Channel 5 SYRIA’S DISAPPEARED: THE CASE AGAINST ASSAD (DISPATCHES) Sara Afshar, Nicola Cutcher, Callum Macrae – Afshar Films / Channel 4 *UNDERCOVER: BRITAIN’S IMMIGRATION SECRETS (PANORAMA) Karen Wightman, Joe Plomin, Callum Tulley, Gary Beelders – BBC Current Affairs / BBC One WHITE RIGHT: MEETING THE ENEMY (EXPOSURE) Deeyah Khan, Darin Prindle, Andrew Smith, Melanie Quigley – Fuuse Films / ITV DRAMA SERIES THE CROWN Production Team – Left Bank Pictures / Netflix THE END OF THE F***ING WORLD Production Team – Clerkenwell Films / Dominic Buchanan Productions / Netflix / All 4 LINE OF DUTY Production Team – World Productions / BBC One *PEAKY BLINDERS Production Team – Caryn Mandabach Productions / Tiger Aspect Productions / BBC Two ENTERTAINMENT PERFORMANCE ADAM HILLS The Last Leg – Open Mike Productions / Channel 4 *GRAHAM NORTON The Graham Norton Show -

Bedfont & Feltham V Epsom & Ewell (Cup)

BEDFONT & FELTHAM FOOTBALL CLUB FOUNDED 2012 e Bedfont & Feltham v Epsom & Ewell Tuesday 1st October 2019 Online Version Of Printed Programme p D FORf.Jn The Orchard, Hatton Road, Bedfont, Middlesex TW14 9QT Tel: 020 8890 7264 [email protected] www.bedfontandfelthamfc.co.uk Twitter: @BedfontFeltham Facebook: /BedfontFeltham Affiliated: Middlesex FA Members: Combined Counties Football League Middlesex County Football League (Sunday) The Surrey Youth League Club Colours: Yellow & Blue Change Colours: Red & White Programme Cover Design: Rob Healy Management Committee: President: Alan Hale Vice President: John Cronk Chairman: Brian Barry – [email protected] Vice Chairman: Alan Hale Treasurer: Rob Healy General Secretary: Derrick Smith Director of Football: Scott Savoy – [email protected] Membership Secretary: Jane Rescorla Media Manager / Photographer: Joanna Ginger – [email protected] Media Manager / Programmes: Rob Healy – [email protected] Match-day Coordinator: Andy Smith Additional Members: Adam Bessent & Chris Beauchamp Bedfont & Feltham v Epsom & Ewell Esoteric Recordings Division One Challenge Cup, First Round. Tuesday 1st October 2019. Kick-Off: 7.45pm Volume 7, Issue 6 Good evening everyone. Welcome to The Orchard for our sixth home match of season 2019-20. This evening we welcome the players, officials and supporters of Epsom & Ewell Football Club; and our three match officials for this Esoteric Recordings Challenge Cup fixture. We trust you enjoy your brief stay with us and have a safe journey home afterwards. As this is a cup fixture, 30 minutes extra-time will be played if the score is equal after 90 minutes. Penalties with then take place if required after extra- time. -

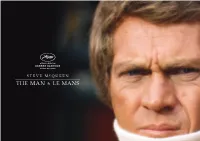

57Ab017cc6f3fd70ae78b4ceb9e

1 CONTENTS Directors’ Statement 5 The Cast - The Family Synopsis 6 Chad McQueen 38 Obsession 7 Neile Adams McQueen 39 Betrayal 8 The Cast - The Drivers Original Filming 10 Derek Bell 40 Vindication 11 Jonathan Williams 41 STEVE McQUEEN: THE MAN & LE MANS - Crew Biographies David Piper 42-43 Gabriel Clarke - Writer/Director 12 The Supporting Cast John McKenna - Producer/Director 12 Siegfried Rauch 44 Andrew Marriott - Executive Producer 14 Louise Edlind 44 Bonamy Grimes - Executive Producer 15 Hal Hamilton 45 Barry Smith - Executive Producer 15 Michael Keyser 45 David Green - Executive Producer 16 Alan Trustman 46 David Reeder - Executive Producer 16 John Klawitter 47 Jamie Carmichael - Executive Producer 17 Peter Samuelson 47 Richard Wiseman - Archive Producer 18 Haig Altounian 48 Victoria Wood - Line Producer 18 Les Sheldon 48 Matt Wyllie - Film Editor 19 Mario Iscovich 49 Matt Smith - Director of Photography 19 Craig Relyea 49 George Foulgham - Supervising Sound Re-Recording Mixer 20 Bob Rosen 50 Jim Copperthwaite - Composer 20 Production Stories The Big Idea 22 Chad McQueen Returns To Le Mans 23 The Global Search For Steve McQueen 24-26 An Incredible Unseen Archive The “Holy Grail” 28 An Archive Treasure Trove 29 The David Piper Letter 30 Tale Of The Tapes 31 The Final Audio Recording 32 Making The Score 34-35 The Sound Of The Man & Le Mans 36 INTERNATIONAL SALES INTERNATIONAL PUBLICIST The Search For Authenticity 37 Content Media Premier Judith Baugin Phil Cairns [email protected] [email protected] Mobile: +33 6 95 55 48 18 Mobile: +44 7912 578 883 2 3 DIRECTORS’ STATEMENT STEVE MCQUEEN: THE MAN & LE MANS is a gripping, moving documentary feature film that takes you on a nerve-tingling ride with one of the greatest movie stars of all time.