Fear, Light, and M&A in the COVID-19 World

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

December 31, 2020 | Matthewsasia.Com

Matthews Asia Funds | Annual Report December 31, 2020 | matthewsasia.com GLOBAL EMERGING MARKETS STRATEGY Matthews Emerging Markets Equity Fund ASIA FIXED INCOME STRATEGIES Matthews Asia Total Return Bond Fund Matthews Asia Credit Opportunities Fund ASIA GROWTH AND INCOME STRATEGIES Matthews Asian Growth and Income Fund Matthews Asia Dividend Fund '20 Matthews China Dividend Fund ASIA GROWTH STRATEGIES Matthews Asia Growth Fund Matthews Pacific Tiger Fund Matthews Asia ESG Fund Matthews Emerging Asia Fund Matthews Asia Innovators Fund Matthews China Fund Matthews India Fund Matthews Japan Fund Matthews Korea Fund ASIA SMALL COMPANY STRATEGIES Matthews Asia Small Companies Fund Matthews China Small Companies Fund As of January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports are no longer being sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website matthewsasia.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. You may elect to receive paper copies of shareholder reports and other communications from the Funds anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 800.789.ASIA (2742). You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. -

Artificial Intelligence (AI) Technology Is Now Seeing Real Adoption by Businesses Across Multiple Sectors

TMT August 2021 ENTERPRISE ADOPTION OF AI CUTTING THROUGH THE HYPE Page 2 of 58 After several false starts over the last few decades, artificial intelligence (AI) technology is now seeing real adoption by businesses across multiple sectors. Benefits include increased business efficiency, better customer service and innovative new products and services. We expect usage to follow a similar pattern to cloud adoption, with early adopters pioneering the use of AI, and wider adoption following as the increasing availability of AI tools and services democratises the development of AI applications. In our view, while AI hype is still a factor, a disruptive trend is now well underway and companies that do not embrace it are likely to be at a competitive disadvantage. Page 3 of 58 AI is suited to making sense Increasing enterprise adoption Not without challenges of high volumes of data Companies are increasingly considering the The use of AI faces several challenges, including potential of AI to enhance their businesses, the lack of explainability of deep learning models, As a natural evolution from big data analytics, the whether for internal processes to improve the risk of bias, the potential for unethical use, the use of AI techniques such as machine learning efficiency, or to provide better or more innovative need for access to large quantities of data to train and deep learning bring an element of intelligence products and services. A range of software is models and the limited supply of data scientists. to the analytics process. Models can be trained available to companies to develop their own Regulators are considering ways to address the to identify patterns that would take humans too applications; alternatively, multiple off-the- issues around bias and ethics. -

Investment Holdings As of June 30, 2019

Investment Holdings As of June 30, 2019 Montana Board of Investments | Portfolio as of June 30, 2019 Transparency of the Montana Investment Holdings The Montana Board of Investment’s holdings file is a comprehensive listing of all manager funds, separately managed and commingled, and aggregated security positions. Securities are organized across common categories: Pension Pool, Asset Class, Manager Fund, Aggregated Individual Holdings, and Non-Pension Pools. Market values shown are in U.S. dollars. The market values shown in this document are for the individual investment holdings only and do not include any information on accounts for receivables or payables. Aggregated Individual Holdings represent securities held at our custodian bank and individual commingled accounts. The Investment Holdings Report is unaudited and may be subject to change. The audited Unified Investment Program Financial Statements, prepared on a June 30th fiscal year-end basis, will be made available once the Legislative Audit Division issues the Audit Opinion. Once issued, the Legislative Audit Division will have the Audit Opinion available online at https://www.leg.mt.gov/publications/audit/agency-search-report and the complete audited financial statements will also be available on the Board’s website http://investmentmt.com/AnnualReportsAudits. Additional information can be found at www.investmentmt.com Montana Board of Investments | Portfolio as of June 30, 2019 2 Table of Contents Consolidated Asset Pension Pool (CAPP) 4 CAPP - Domestic Equities 5 CAPP - International -

2018 PUF Detailed Schedule of Investments

PERMANENT UNIVERSITY FUND DETAIL SCHEDULES OF INVESTMENT SECURITIES AND INDEPENDENT AUDITORS’ REPORT August 31, 2018 Deloitte & Touche LLP 500 West 2nd Street Suite 1600 Austin, TX 78701 USA Tel: +1 512 691 2300 Fax: +1 512 708 1035 www.deloitte.com INDEPENDENT AUDITORS' REPORT ON SUPPLEMENTAL SCHEDULES To the Board of Regents of The University of Texas System To the Board of Directors of The University of Texas/Texas A&M Investment Management Company We have audited the financial statements of the Permanent University Fund (the “PUF”) as of and for the years ended August 31, 2018 and 2017, and have issued our report thereon dated October 29, 2018, which contained an unmodified opinion on those financial statements. Our audits were conducted for the purpose of forming an opinion on the financial statements as a whole. The supplemental schedules consisting of the PUF’s equity securities (Schedule A), preferred stocks and convertible securities (Schedule B), purchased options (Schedule C), debt securities (Schedule D), investment funds (Schedule E), physical commodities (Schedule F), cash and cash equivalents (Schedule G), hedge fund investment funds (Schedule H), and private investment funds (Schedule I) as of August 31, 2018 are prepared in accordance with Section 66.05 of the Texas Education Code, and are presented for the purposes of additional analysis and are not a required part of the financial statements. These schedules are the responsibility of The University of Texas/Texas A&M Investment Management Company and were derived from and relate directly to the underlying accounting and other records used to prepare the financial statements. -

Asseco Group Annual Report

Asseco Group Annual report for the year ended December 31, 2020 Present in Sales revenues 60 countries PLN 12 190 million 28 009 Net profit attributable highly commited to the parent employees company's shareholders PLN 401.9 million Order backlog* PLN 5.7 billion for 2021 market capitalization PLN 7 642 million * Refers to proprietary software and services Asseco Group in 2020 non-IFRS measures (unaudited data) Non-IFRS figures presented below have not been audited or reviewed by an independent auditor. Non-IFRS figures are not financial data in accordance with EU IFRS. Non-IFRS data are not uniformly defined or calculated by other entities, and consequently they may not be comparable to data presented by other entities, including those operating in the same sector as the Asseco Group. Such financial information should be analyzed only as additional information and not as a replacement for financial information prepared in accordance with EU IFRS. Non-IFRS data should not be assigned a higher level of significance than measures directly resulting from the Consolidated Financial Statements. Financial and operational summary: • Increase in the Group’s revenues by 14% to PLN 12 190 million • Increase in non-IFRS EBIT to PLN 1 479 million and contribution to non-IFRS net profit to PLN 454 million • Higher sales in all sectors and segments of the Group’s activity • 79% revenues from the sale of proprietary software and services • Strong business diversification (geographical, sectoral, product) Selected consolidated financial data for 2020 on a non-IFRS basis For the assessment of the financial position and business development of the Asseco Group, the basic data published on a non-IFRS basis constitute an important piece of information. -

Livechat Software S.A

Report of the Management Board on the operations of LiveChat Software S.A. and LiveChat Software Capital Group for the period of 12 months ended March 31, 2018 Date of approval: June 18, 2018 Date of release: June 19, 2018 www.investor.livechatinc.com THE FASTEST WAY TO REACH CUSTOMERS Management report on the activities of LiveChat Software Capital Group Contents In 2017 fiscal year LiveChat Software Capital Group reported an increase of over 17% in consolidated sales to PLN 89.4 million, with a net Operating highlights profit of PLN 48.3 million, i.e. almost 13% more than a year earlier. Unconsolidated net profit of LiveChat Software S.A. totaled PLN 48.1 million, with revenues of PLN 89.4 million. At the end of the fiscal year, LiveChat was used by over 24 thous. clients - companies, public institutions and universities. During the year, the number of users increased by approximately 25%, which had a direct impact on the increase in revenues. The difference between the Structure of growth dynamics of the user base and the generated revenues results from, among others, the difference in the USDPLN rate, which is key for the Group's results. LiveChat Software Group The company provides its solution in the SaaS (Software as a Service) model, which allows it to offer its services on the global market. As of June 1, 2018, the number of clients exceeded 24,600, including companies from approximately 150 countries worldwide. LiveChat Software’s business model also allows it to generate very strong margins, as a result of low customer acquisition and maintenance Description of the activities expenses combined with scalability of the business. -

8/31/2020 Livechat Software Investment Thesis Company

8/31/2020 LiveChat Software Investment Thesis Preface: Note that the company discussed below is a small cap that only trades on a foreign exchange. However, the ~$250 M USD free float and trading volumes ($925k USD/day) are still sufficient for most individuals and small funds to take a position. We also want to mention that LVC is scheduled to report earnings on Aug. 28th, which coincides with the completion of this piece. We don't have any particular view on how the stock will react, and it's not crucial to the long-term thesis; however, if there were to be a sizable move, please adjust upside projections accordingly. Company Introduction LiveChat Software (WSE: LVC) is a software-as-a-service (SaaS) company with offices in Wroclaw, Poland, and Boston, MA, USA, and a current market capitalization of around $600 M USD. The firm was launched in 2002 by founders (and current executives) Marius Cieply, Maciej Jarzabowski, and Jakub Sitarz with the idea of introducing a new channel of communication that could fill the void between time-consuming phone calls and slow emails. The company’s first product was a simple desktop web chat tool (see screenshot below left), but from there it has grown into a formidable business communications platform. LVC’s road to success was not without twists and turns, however. In 2006, the company sold a 50% stake to investment and consultancy firm Capital Partners, who in turn sold to a Naspers-backed public company called Gadu-Gadu SA in 2008. Three years later, the business came full circle – the founding management team teamed up with a private equity firm to buy back the entire stake and regain control. -

Company Overview Valuation Data Source

Valuation Data Source company overview No. Company No. Company No. Company "Bank "Saint-Petersburg" Public 60 AbClon Inc. 117 Activision Blizzard, Inc. 1 Joint-Stock Company Abdullah Al-Othaim Markets 118 Actron Technology Corporation 61 2 1&1 Drillisch AG Company 119 Actuant Corporation 3 1-800-FLOWERS.COM, Inc. Abdulmohsen Al-Hokair Group for 120 Acuity Brands, Inc. 62 4 11 bit studios S.A. Tourism and Development Company 121 Acushnet Holdings Corp. 5 1st Constitution Bancorp 63 Abengoa, S.A. 122 Ad-Sol Nissin Corporation 6 1st Source Corporation 64 Abeona Therapeutics Inc. 123 Adairs Limited 7 21Vianet Group, Inc. 65 Abercrombie & Fitch Co. 124 ADAMA Ltd. 8 22nd Century Group, Inc. 66 Ability Enterprise Co., Ltd. 125 Adamas Pharmaceuticals, Inc. Ability Opto-Electronics Technology 126 Adamis Pharmaceuticals Corporation 9 2U, Inc. 67 Co.,Ltd. 127 Adani Enterprises Limited 10 3-D Matrix, Ltd. 68 Abiomed, Inc. 128 Adani Gas Limited 11 361 Degrees International Limited 69 ABIST Co.,Ltd. 129 Adani Green Energy Limited 12 3D Systems Corporation 70 ABL Bio Inc. Adani Ports and Special Economic 13 3i Group plc 130 71 Able C&C Co., Ltd. Zone Limited 14 3M Company 131 Adani Power Limited 72 ABM Industries Incorporated 15 3M India Limited 132 Adani Transmissions Limited 73 ABN AMRO Bank N.V. 16 3S KOREA Co., Ltd. 133 Adaptimmune Therapeutics plc 74 Aboitiz Equity Ventures, Inc. 17 3SBio Inc. 134 Adastria Co., Ltd. 75 Aboitiz Power Corporation 18 500.com Limited 135 ADATA Technology Co., Ltd. 76 Abraxas Petroleum Corporation 19 51 Credit Card Inc. -

Adestella Investment Management | [email protected] | 1

August 31, 2020 Dear Fellow Investors, Adestella gained approximately 68% in the second quarter. April alone saw gains that would have constituted the best quarter in the fund’s history, and we were able to further build on them in both May and June. As a result, we not only recovered all losses incurred in the first quarter but also managed to finish one of the most unusual half-years in recent (and not so recent) memory with a gain of 30%. Just as importantly, these outsized returns were generated without taking outsized risks – instead of trying to quickly regain the first quarter drawdown with one or two huge bets, our portfolio of 25-30 stocks was not materially different over the two periods. As would be expected during a period in which markets rallied sharply, our long positions comprised more than 100% of the net return, while our shorts were a few hundred basis points drag. We also benefited from the US dollar’s weakening over the period, as a good portion of our holdings are denominated in borrowed foreign currency. Both US and international stocks were strong performers; their net contributions to overall returns were split evenly. An updated performance table is provided at the end of this letter. COVID Contemplations As discussed in my last letter, I continue to believe there is a disconnect between the media’s narratives of the pandemic and the actual facts on the ground. Case growth in the southern states this summer has been billed as a “second wave” while conveniently ignoring a.) these regions had no first wave and b.) the combination of flat positivity rates with 50%+ growth in testing per day. -

Investment Holdings As of December 31, 2019

Investment Holdings As of December 31, 2019 Transparency of the Montana Investment Holdings The Montana Board of Investment’s holdings file is a comprehensive listing of all manager funds, separately managed and commingled, and aggregated security positions. Securities are organized across common categories: Pension Pool, Asset Class, Manager Fund, Aggregated Individual Holdings, and Non‐Pension Pools. Market values shown are in U.S. dollars. The market values shown in this document are for the individual investment holdings only and do not include any information on accounts for receivables or payables. Aggregated Individual Holdings represent securities held at our custodian bank and individual commingled accounts. The Investment Holdings Report is unaudited and may be subject to change. The audited Unified Investment Program Financial Statements will be made available once the Legislative Audit Division issues the Audit Opinion. Once issued, the Legislative Audit Division will have the Audit Opinion available online at http://leg.mt.gov/css/publications/audit/reports.asp and the complete audited financial statements will also be available on the Board’s website http://investmentmt.com/AnnualReportsAudits. Additional information can be found at www.investmentmt.com Table of Contents Consolidated Asset Pension Pool (CAPP) 4 CAPP ‐ Domestic Equities 5 CAPP – Core Fixed Income 24 CAPP ‐ International Equities 29 CAPP ‐ Private Equities 45 CAPP ‐ Real Estate 48 CAPP ‐ Natural Resources 50 CAPP – Non Core Fixed Income 52 CAPP ‐ Cash 62 Short -

Investment Holdings As of June 30, 2018 Transparency of the Montana Investment Holdings

Investment Holdings As of June 30, 2018 Transparency of the Montana Investment Holdings The Montana Board of Investment’s holdings file is a comprehensive listing of all manager funds, separately managed and commingled, and aggregated security positions. Securities are organized across common categories: Pension Pool, Asset Class, Manager Fund, Aggregated Individual Holdings, and Non-Pension Pools. Market values shown are in U.S. dollars. The market values shown in this document are for the individual investment holdings only and do not include any information on accounts for receivables or payables. Aggregated Individual Holdings represent securities held at our custodian bank and individual commingled accounts. The Investment Holdings Report is unaudited and may be subject to change. The Independent Auditor’s Report and Consolidated Unified Investment Program Financial Statement will be made available once the Legislative Audit Division issues the Audit Opinion. Once issued, the Legislative Audit Division will have the Audit Opinion available online at https://www.leg.mt.gov/ publications/audit/agency-search-report by selecting Board of Investments under Agency and the Board’s website http://investmentmt.com/AnnualReportsAudits will contain a link. Additional information can be found at www.investmentmt.com Montana Board of Investments | June 30, 2018 | 2 Table of Contents Consolidated Asset Pension Pool (CAPP) 4 CAPP - Domestic Equity 5 CAPP - International Equity 20 CAPP - Private Equity 34 CAPP - Natural Resources 36 CAPP - Private -

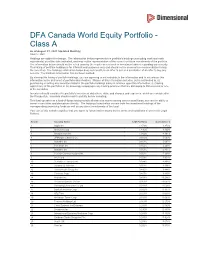

DFA Canada World Equity Portfolio - Class a As of August 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada World Equity Portfolio - Class A As of August 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a fund-of-funds and generally allocates its assets among other mutual funds, but has the ability to invest in securities and derivatives directly. The holdings listed below contain both the investment holdings of the corresponding underlying funds as well as any direct investments of the fund.