Self-Help Groups in Mayurakshi Gramin Bank: Documentation Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Multi- Hazard District Disaster Management Plan

MULTI –HAZARD DISTRICT DISASTER MANAGEMENT PLAN, BIRBHUM 2018-2019 MULTI – HAZARD DISTRICT DISASTER MANAGEMENT PLAN BIRBHUM - DISTRICT 2018 – 2019 Prepared By District Disaster Management Section Birbhum 1 MULTI –HAZARD DISTRICT DISASTER MANAGEMENT PLAN, BIRBHUM 2018-2019 2 MULTI –HAZARD DISTRICT DISASTER MANAGEMENT PLAN, BIRBHUM 2018-2019 INDEX INFORMATION 1 District Profile (As per Census data) 8 2 District Overview 9 3 Some Urgent/Importat Contact No. of the District 13 4 Important Name and Telephone Numbers of Disaster 14 Management Deptt. 5 List of Hon'ble M.L.A.s under District District 15 6 BDO's Important Contact No. 16 7 Contact Number of D.D.M.O./S.D.M.O./B.D.M.O. 17 8 Staff of District Magistrate & Collector (DMD Sec.) 18 9 List of the Helipads in District Birbhum 18 10 Air Dropping Sites of Birbhum District 18 11 Irrigation & Waterways Department 21 12 Food & Supply Department 29 13 Health & Family Welfare Department 34 14 Animal Resources Development Deptt. 42 15 P.H.E. Deptt. Birbhum Division 44 16 Electricity Department, Suri, Birbhum 46 17 Fire & Emergency Services, Suri, Birbhum 48 18 Police Department, Suri, Birbhum 49 19 Civil Defence Department, Birbhum 51 20 Divers requirement, Barrckpur (Asansol) 52 21 National Disaster Response Force, Haringahata, Nadia 52 22 Army Requirement, Barrackpur, 52 23 Department of Agriculture 53 24 Horticulture 55 25 Sericulture 56 26 Fisheries 57 27 P.W. Directorate (Roads) 1 59 28 P.W. Directorate (Roads) 2 61 3 MULTI –HAZARD DISTRICT DISASTER MANAGEMENT PLAN, BIRBHUM 2018-2019 29 Labpur -

West Bengal Minorities' Development and Finance Corporation

West Bengal Minorities' Development & Finance Corporation • (A Statutory Corporation of Govt. of West Bengal) Memo No: 194 -MDC/VT-13-14 Date: 12th January,2021 ~: WBMDFC-.$1~ '5ll\JMt~. fly,: rn:f¥« C~IO:BI WEIT !-til~N,\S / <Pl©C.§iM~ - National Institute of Fashion Teechnology (NIFT). Kolkata C1J ~ ~~ WBMDFC ~ "'-!rnf@'-!> NIFT Kolkata-el ~ ~ QaR~ C~~ ~ "'-!IC<PFI ;qsrnc~··( ~ ~ri ')~M '9!11Jll~1, ~o~') - ~~M '9!11Jll'ffi, ~o~') ~ )O.oo C~ ~.oo ~'i:f ~~ ~1'1i:lR:,@-~ ~ ~'3m'i:f ~ "'-1-!Ci:ll~ ~ ~ I ~1'1i::1R,© .El'?l'~<J' .El<f~ ~ i6ll--ll~ ~ WBMDFC website (www.wbmdfc.org) 01~1 ~~~~1.,Ji:lR:,@~~~C<PR~TA&DA~~~~ I ~1.S1i:1f;©::4J'i:f~Rtii?l~~~'3 ~<Pf~~~~) "'-!HC\!>~g 1. ~ (17'/')o/')~) ~ s:i1fGf¥c;qs'G ~9RT'i:l" ~"'-l"i~l~ s:i1fGr¥c¥G "'-11..:ic<:1..:i) 2. ISrJJ s:i1fGf¥c;qs'G 3. ~ ~ f% ffi / '5JTl:ffif ffi 4. ~ <Pf9f 9ff51t9ffi, ~ ~ 5. "'-!r.!i.91~"'1-~ ~~~-~'i:f~GITT% ~ ~ ;::;,r-=ror--·,o I. ''II / 111. "I I / I -, '\ ····· o WEST BENGAL MINORITIES DEVELOPMENT & ~-~-~ - (7003597117) FINANCE CORPORATION (WBMDFC) "AMBER"DD- (NIFT) 27 /e, SECTOR 1, SALT LAKE CITY, KOLKATA 700 '1fibll<:15'/ '51"~~~'3 ~R~ 064 (WBMDFC) -18001202130 West Bengal Minorities' Development & Finance Corporation • (A Statutory Corporation of Govt. of West Bengal) 1 Memo no: 194-MDC/VT-13-14 Date: 12 h January, 2021 Notice Subject: Counselling/ Interview for Skill Training at National Institute of Fashion Technology (NIFT). Kolkata sponsored by WBMDFC Candidates applied for Skill Training course at National Institute of Fashion Technology (NIFT), Kolkata , sponsored by WBMDFC are hereby requested to attend Interview for selection from 19th January, 2021 to 22nd January, 2021 from 10.00 am to 2.p.m. -

Notice for Appointment of Regular / Rural Retail Outlet Dealerships

Notice for appointment of Regular / Rural Retail Outlet Dealerships Bharat Petroleum Corporation Limited proposes to appoint Retail Outlet dealers in West Bengal, as per following details: Sl. No Name of location Revenue District Type of RO Estimated Category Type of Site* Minimum Dimension (in M.)/Area of the site (in Sq. M.). * Finance to be arranged by the Mode of Fixed Fee / Security Deposit monthly Sales applicant (Rs. in Selection Minimum Bid (Rs. in Lakhs) Potential # Lakhs) amount (Rs. in Lakhs) 12 3 45678 9a9b 10 11 12 Regular / Rural MS+HSD in Kls SC CC / DC / CFS Frontage Depth Area Estimated Estimated fund Draw of Lots / working capital required for Bidding SC CC-1 requirement for development of operation of RO infrastructure at SC CC-2 RO SC PH ST ST CC-1 ST CC-2 ST PH OBC OBC CC-1 OBC CC-2 OBC PH OPEN OPEN CC-1 OPEN CC-2 OPEN PH 1 Rajapur: Block, Canning on Baruipur Canning Road South 24 Parganas Rural 70 SC CFS 30 25 750 0 0 Draw of Lots0 2 2 Upto 2.0 Km From Odlabari Chawk to Kranti Road on Right Jalpaiguri Rural 120 ST CFS 30 25 750 0 0 Draw of Lots0 2 Hand Side 3 Kadoa Murshidabad Rural 80 SC CFS 30 25 750 0 0 Draw of Lots0 2 4 Within 2 Km of Aklakhi Bazar on Uchalan - Aklakhi Road Purba Bardhaman Rural 100 SC CFS 30 25 750 0 0 Draw of Lots0 2 5 Lower Chisopani towards Kurseong Darjeeling Rural 100 ST CFS 20 20 400 0 0 Draw of Lots0 2 6 Hamiltonganj Not on SH, Alipuduar Alipurduar Rural 100 SC CFS 30 25 750 0 0 Draw of Lots0 2 7 Ethelbari (Not on NH) Alipurduar Rural 58 SC CFS 30 25 750 0 0 Draw of Lots0 2 8 Nishintapur -

Birbhum Dmsion' Pwd

1L_i' Public Works Department Government of West Bensal Notification No.3P-37ll3l4l7-R/PL dated 11.08.2015.- In exercise of the power conferred by section 3 of the West Bengal Highways Act, 1964 (West Ben. Act XXVIII of 1964) (hereinafter referred to as the said Act), the Governor is pleased hereby to declare, with immediate effect, the road and its length as mentioned in column (2) and column (3), respectively, of Schedule below under the Public Works Department in Birbhum district, as highway within the meaning of clause ( c) of section 2 of the said Act:- SCHEDULE BIRBHUM DISTRICT DMSION: BIRBHUM DMSION' PWD b!t sl. Name of the Road No. OE (r) (2) (3) I Bolpur Byepass Road (Provat Sarani) t.50 2 Bolpur Ilambazar Road 18.00 Bolpur Nanur Road 19.20 4 Bolpur Palitpur Road 25.70 28.40 5 Bolpur Purandarpur Road 6 Bolpur Santiniketan Road 4.00 7 Hasan Kamra Health Centre via Chandpara Road 6.00 8 Illambazar Banksanka Suri Road 7.50 9 Kulkuri Muralpur Road 13.00 1.43 10 Mayurakshi Bridge including both side approaches ll Md. Bazar Kulkuri Road 6.00 t2 Md. Bazar Sainthia Road 12.70 r3 Patelnagar C.D.P. TownshiP Road 8.00 l4 Rampurhat Ayas road with link Baidara Bgrrqgg 12.90 l5 Rampurhat Dumka Road 12.30 r 3.30 16 Rampurhat Dunigram Road 17 Rampurhat Parulia Road 14.00 l8 Sainthia Sultanpur Road 19.00 l9 Santiniketan Sriniketan Road 3.00 20 Seorakuri Fullaipur Road 3.50 21 Sherpur B shnupur Road 2.00 22 Shyambat Goalpara Road 2.20 z) Sriniketan Gopalnagar Bye Pass Road 5.00 24 Suri Dubraipur Road 2.80 25 Suri Md. -

List of Common Service Centres in Birbhum, West Bengal Sl. No

List of Common Service Centres in Birbhum, West Bengal Sl. No. Entrepreneur's Name District Block Gram Panchyat Mobile No 1 Kartik Sadhu Birbhum Bolpur Sriniketan Bahiri-Panchshowa 9614924181 2 Nilanjan Acharya Birbhum Bolpur Sriniketan Bahiri-Panchshowa 7384260544 3 Sk Ajijul Birbhum Bolpur Sriniketan Bahiri-Panchshowa 8900568112 4 Debasree Mondal Masat Birbhum Bolpur Sriniketan Kankalitala 9002170027 5 Pintu Mondal Birbhum Bolpur Sriniketan Kankalitala 9832134124 6 Jhuma Das Birbhum Bolpur Sriniketan Kasba 8642818382 7 Koushik Dutta Birbhum Bolpur Sriniketan Kasba 9851970105 8 Soumya Sekher Ghosh Birbhum Bolpur Sriniketan Kasba 9800432525 9 Sujit Majumder Birbhum Bolpur Sriniketan Raipur-Supur 9126596149 10 Abhijit Karmakar Birbhum Bolpur Sriniketan Ruppur 9475407865 11 Rehena Begum Birbhum Bolpur Sriniketan Ruppur 9679799595 12 Debparna Roy Bhattacharya Birbhum Bolpur Sriniketan Sarpalehana-Albandha 7001311193 13 Proshenjit Das Birbhum Bolpur Sriniketan Sarpalehana-Albandha 8653677415 14 Asikar Rahaman Birbhum Bolpur Sriniketan Sattore 9734247244 15 Faijur Molla Birbhum Bolpur Sriniketan Sattore 8388870222 16 Debabrata Mondal Birbhum Bolpur Sriniketan Sian-Muluk 9434462676 17 Subir Kumar De Birbhum Bolpur Sriniketan Sian-Muluk 9563642924 18 Chowdhury Saddam Hossain Birbhum Bolpur Sriniketan Singhee 8392006494 19 Injamul Hoque Birbhum Bolpur Sriniketan Singhee 8900399093 20 Sanjib Das Birbhum Bolpur Sriniketan Singhee 8101742887 21 Saswati Ghosh Birbhum Bolpur Sriniketan Singhee 7550858645 22 Sekh Baul Birbhum Bolpur Sriniketan Singhee -

Udyog Samachar

UUddyyaammii BBaannggllaa MSME-Development Institute Kolkata 2nd Year, Vol: IX, August 2020 Udyami Bangla 2nd Year, Vol: IX, August 2020 This page is left blank intentionally 2 Udyami Bangla 2nd Year, Vol: IX, August 2020 From the Desk of Director In-Charge: From a complete standstill situation, economy started moving forward slowly in the unlock phases. Situation of the economy is very critical. According to some estimates, India’s economy may have contracted by as much as a fourth in the June quarter because of the Covid-19 pandemic and the lockdown that ensued. The government has taken several measures to revive the Indian economy. It is expected that the economy will return to high growth trajectory soon. While the countrywide lockdown brought most economic activities to a grinding halt in urban areas, rural India continued to be normal in view of exemptions from restrictions allowed to farmers to conduct farming operations. These exemptions helped to maintain continuity in the supply chain. Food Corporation of India and State Governments carried out massive procurement of rabi crops, mainly wheat. A vibrant agricultural sector is a guarantee for meeting the primary needs of the poor, vis-à-vis the rural demand may be maintained. Low crude oil price is also a boon for Indian economy which is largely dependent on oil imports. Covid-related crash in crude oil prices has proved to be a windfall for India. Import bill has reduced, making the current account deficit in the balance of payments more manageable. India is enjoying enormous benefits as a result of the current low prices of crude oil. -

Terracotta Temples of Birbhum: an Ethno-Archaeological Prospect

Terracotta Temples of Birbhum: An Ethno‐archaeological Prospect Arunima Sinha1 1. Department of Ancient Indian History, Culture and Archaeology, Deccan College Post Graduate and Research Institute, Deemed to be University, Pune – 411 006, Maharashtra, India (Email: [email protected]) Received: 16 August 2017; Revised: 20 September 2017; Accepted: 26 October 2017 Heritage: Journal of Multidisciplinary Studies in Archaeology 5 (2017): 676‐697 Abstract: The terracotta temples of Birbhum are one of the unparalleled cultural heritages of the country. Present paper speaks about the aesthetic values of these monuments. In addition, present work has tried to bridge a temporal gap between past and present social cognition as reflected in the making of these monuments of Birbhum. The paper shows past life‐ways carried remarkable influence and inspiration to the artists and architects of studied monuments. Ethno‐archaeological parallels can be witnessed in modern day rural Birbhum as discussed in present paper. Keywords: Art, Architecture, Cultural Heritage, Analogy, Ethno‐archaeology, Terracotta Temple, Birbhum Introduction The art of terracotta dates back to the Indus Valley civilisation. It was about 3,000 years before the birth of Christ when Indians mastered the magic of this craft. Astonishingly, yet, it is only in Bengal and a few places in Jharkhand that this craft was used to decorate temples, mosques and other places of worship. In Bengal, artisans opted for terracotta tiles or plaques mainly due to the non‐availability of stone and for its easy usage. Bengal province (modern Bangladesh and the Indian state of West Bengal) saw a remarkable surge in patronage and experimentation in art and architecture in the form of terracotta brick temple, from the mid‐17th to the mid‐19th century. -

Birbhum Dmsion. Pwd

Public Works Department Government of West Bensal Notification No. 3P-37l131437-RIPL dated 11.08.2015.-ln exercise of the power conferred by Section 5 of the West Bengal Highways Act, 1964 (West Ben. Act XXVIil of 1964) (hereinafter referred to as the said Act), the Governor is pleased hereby to appoint, with immediate effect, the Highway Authority within the meaning of clause (d) of section 2 of the said Act as mentioned in column (4) of Schedule below, in respect of road and its length under under the Public Works Department in Birbhum district as mentioned in column (2) and column (3), respectively, of the said Schedule, for the purposes of the said Act:- SCHEDULE BIRBHUM DISTRICT DMIIION: BIRBHUM DMSION. PWD st. a0. Highway Name of the Road No. OE Authority (l) (2) (3) (41 I Bolpur Bvepass Road (Provat Sarani) 1.50 2 Bolpur Ilambazar Road 18.00 3 Bolpur Nanur Road 19.20 4 Bolour Palitpur Road 25.70 5 Bolpur Purandarpur Road 28.40 6 Bolpur Santiniketan Road 4.00 7 Hasan Kamra Health Centre via Chandpara Road 6.00 8 Illambazar Banksanka Suri Road 7.50 9 Kulkuri Muralpur Road 13.00 0 Mayurakshi Bridge including both side approaches 1.43 i) Executive I Md. Bazar Kulkuri Road 6.00 Engineer, 2 Md. Bazar Sainthia Road 12.70 Birbhum Division J Patelnagar C.D.P. Township Road 8.00 ii) Assistant 4 Rampurhat Ayas road with link Baidara Barrage 12.90 Engineers under 5 Rampurhat Dumka Road 12.30 Birbhum Division 6 Rampurhat Dunigram Road 13.30 having Rampurhat Parulia Road 14.00 jurisdiction of the 8 Sainthia Sultanpur Road 19.00 road. -

Districtv Ijlans of West Bengal 1956-61

Government of i* W est Bengal Districtv IJlans of West Bengal 1956-61 330.»S4WB W516D P.C.SL CONTENTS Introductorv note District Plaa— Burdwan 1 Birbhuia 14 Bankura 26 Midnapore 38 Hooghly ., 53 Howrah .. 65 24-Parganae 76 Calcutta .. 90 Nadia .. 95 Murshidabad 107 Malda 121 West Dinajpur 134 Jalpaiguri ,. 146 Darjeeling 158 Cooch Behar 169 Purulia .. 180 Appendix'— Schemes not classified imder district plan.. 184 U) DISTRICT PLANS INTRODUCTORY NOTE According to the direction of the Planning Commission, a State Plan has to resented in two different ways, namely, according to different sectors of develop- t represented in it and according to regions or districts. We have already ared and published our Plan according to sectors of development and now jreak up the Plan district-wise. This is necessary in order to educate public ion, encourage local initiative and obtain public Co-operation in the execution Ihe Plan. The National Plan and the State Plan are being prepared on annual basis within Framework of the Five-Year Plan in order to make necessary modifications and stments in the course of execution. Consequently the appropriate period District Plans would also be a year. We accordingly began preparing our rict Plans with particular reference to the first year against the background le Five Year Plan. Originally the intention was that such District Plans would repared every year. But from our experience in the works so far, it seems that aration of annual District Plans every year may not be possible under the ?nt circumstances. We have, therefore given in the following pages the dis- -wise break up of the Plan as a whole as far as available. -

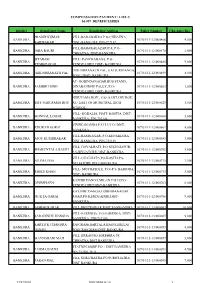

Compensation Payment : List-5 66,059 Beneficiaries

COMPENSATION PAYMENT : LIST-5 66,059 BENEFICIARIES District Beneficiary Name Beneficiary Address Policy Number Chq.Amt.(Rs.) PRADIP KUMAR VILL-BARABAKRA P.O-CHHATNA, BANKURA 107/01/11-12/000466 4,500 KARMAKAR DIST-BANKURA, PIN-722132 VILL-BARAKALAZARIYA, P.O- BANKURA JABA BAURI 107/01/11-12/000476 2,000 CHHATNA, DIST-BANKURA, SITARAM VILL- PANCHABAGA, P.O- BANKURA 107/01/11-12/000486 9,000 KUMBHAKAR KENDUADIHI, DIST- BANKURA, HIRENDRANATH PAL, KATJURIDANGA, BANKURA HIRENDRANATH PAL 107/01/11-12/000499 8,000 POST+DIST- BANKURA. AT- GOBINDANAGAR BUS STAND, BANKURA SAMBHU SING DINABANDHU PALLY, P.O- 107/01/11-12/000563 1,500 KENDUADIHI, DIST- BANKURA, NIRUPAMA ROY , C/O- SANTANU ROU, BANKURA SMT- NIRUPAMA ROY AT- EAST OF MUNICIPAL HIGH 107/01/11-12/000629 5,000 SCHOOL, VILL- KODALIA, POST- KOSTIA, DIST- BANKURA MONGAL LOHAR 107/01/11-12/000660 5,000 BANKURA, PIN-722144. VIVEKANANDA PALLI, P.O+DIST- BANKURA KHOKAN GORAI 107/01/11-12/000661 8,000 BANKURA VILL-RAMNAGAR, P.O-KENJAKURA, BANKURA AJOY KUMBHAKAR 107/01/11-12/000683 3,000 DIST-BANKURA, PIN-722139. VILL-GOYALHATI, P.O-NIKUNJAPUR, BANKURA SHAKUNTALA BAURI 107/01/11-12/000702 3,000 P.S-BELIATORE, DIST-BANKURA, VILL-GUALHATA,PO-KOSTIA,PS- BANKURA NILIMA DAS 107/01/11-12/000715 1,500 BELIATORE,DIST-BANKURA VILL- MOYRASOLE, P.O+P.S- BARJORA, BANKURA RINKU KHAN 107/01/11-12/000743 3,000 DIST- BANKURA, KAJURE DANGA,MILAN PALLI,PO- BANKURA DINESH SEN 107/01/11-12/000763 6,000 KENDUADIHI,DIST-BANKURA KATJURE DANGA,GOBINDANAGAR BANKURA MUKTA GARAI ROAD,PO-KENDUADIHI,DIST- 107/01/11-12/000766 9,000 BANKURA BANKURA ASHISH KARAK VILL BHUTESWAR POST SANBANDHA 107/01/12-13/000003 10,000 VILL-SARENGA P.O-SARENGA DIST- BANKURA SARADINDU HANSDA 107/01/12-13/000007 9,000 BANKURA PIN-722150 KARTICK CHANDRA RAJGRAM(BARTALA BASULIMELA) BANKURA 107/01/12-13/000053 8,000 HENSH POST RAJGRAM DIST BANKURA VILL JIRRAH PO JOREHIRA PS BANKURA MAYNARANI MAJI 107/01/12-13/000057 5,000 CHHATNA DIST BANKURA STATION MORE PO + DIST BANKURA BANKURA PADMA BAURI 107/01/12-13/000091 4,500 PIN 722101 W.B. -

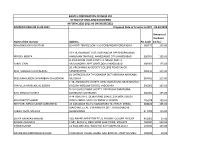

DIVIDEND PAID on 15.04.2021 Name of the Investor

RAILTEL CORPORATION OF INDIA LTD DETAILS OF UNCLAIMED DIVIDEND INTERIM 2020-2021 AS ON 30/06/2021 DIVIDEND PAID ON 15.04.2021 Proposed Date of Transfer to IEPF : 28.04.2028 Amount of Dividend Name of the Investor Address Pin Code (In Rs.) MR MANSUKH M DATTANI B/H KIRTI TEMPLE SONI VAD PORBANDAR PORBANDAR 360575 155.00 10-118, NAVRANG FLAT, BAPUNAGAR OPP BHIDBHANJAN MR DEV MEHTA HANUMAN TAMPALE, AHMEDABAD CITY AHMEDABAD 380024 155.00 B-1/64,ARJUN TOWER OPP.C.P.NAGAR PART-2 SAROJ JOSHI NR.SAUNDRYA APPT.GHATLODIA AHMEDABAD 380061 155.00 20, KRUSHNAKUNJ SOCIETY COLLEGE ROAD,TALOD MRS. SONALBEN B BHALAVAT SABARKANTHA 383215 155.00 61 CHITRODIPURA TA VISNAGAR DIST MEHSANA MEHSANA MISS RAMILABEN ISHWARBHAI CHAUDHARI MEHSANA 384001 155.00 C 38, ANANDVAN SOCIETY, NEW SAMA ROAD, NEAR NAVYUG PRAFULLA HARSUKHLAL SODHA ENGLISH MEDIUM SCHOOL VADODARA 390002 192.00 B-201 GOKULDHAM SOCIETY DEDIYASAN MAHESANA RAVI PRAKASH GUPTA MAHESANA MAHESANA 384001 155.00 A 44 HIM STATE DEWA ROAD SHAHEED BHAGAT SINGH MR MUAZZIZ SHARAF WARD AMRAI GAON LUCKNOW LUCKNOW 226028 155.00 MR PATEL NIRAVKUMAR SURESHBHAI 19 DAMODAR FALIYU VARADHARA TA VIRPUR KHEDA 388260 155.00 WARD NO 1, TAL .SHRIRAMPUR DIST. AHMEDNAGAR SARIKA AMOL MAHALE SHRIRAMPUR 413709 155.00 SATYA NARAYAN MANTRI 203, ANAND APPARTMENT, 9, BIJASAN COLONY INDORE 452001 15.00 ROSHNI AGARWAL P 887, BLOCK A, 2ND FLOOR LAKE TOWN KOLKATA 700089 310.00 VINOD KUMAR 11 RAJA ENCLAVE, ROAD NO. 44 PITAMPURA DELHI 110034 155.00 NAYAN MAHENDRABHAI BHOJAK S RAJAWADI CHAWL JAMBLI GALI BORIVALI WEST MUMBAI 400092 10.00 VETTOM HOUSE PANACHEPPALLY P O KOOVAPPALLY (VIA) TOM JOSE VETTOM KOTTAYAM DIST 686518 100.00 FLAT NO-108,ADHITYA TOWERS BALAJI COLONY TIRUPATI T.V.RAJA GOPALAN CHITTOOR(A.P) 517502 100.00 R K ESTET, VIMA NAGAR, RAIYA ROAD, NEAR DR. -

( 2019-21 ) in Self-Financed B.Ed. Colleges Under B.U

Provisional Rank List of Other University Candidates for admission to 2 year B.Ed. Programme ( 2019-21 ) in Self-Financed B.Ed. Colleges under B.U. SUBJECT Name Category spTransId Grade Point Rank Allotted College Name Admission Fee Bengali OINDRILA BASAK GENERAL 794210106190868823 45.10 1 138 Swami Vivekananda B.Ed. College, Chandipur 20,000 Bengali CHANDAN KISKU ST 769763105190846053 44.09 2 112 Gurukul TT Centre 20,000 Bengali SIBSHANKAR BARI GENERAL 057912606190679233 43.95 3 55 Kaniska College of Edn. 20,000 Bengali antara panda GENERAL 929970306190385046 43.91 4 71 Vivekananda College, Kamladanga, Purandarpur 20,000 Bengali YEASMIN JAHAN GENERAL 752090406190808044 43.38 5 146 Toshani College of Edn., Salisanda 20,000 Bengali SHALMOLI SENGUPTA GENERAL 484702805190949170 42.45 6 10 Dishari College of Edn., Burdwan 20,000 Bengali SHALMOLI SENGUPTA GENERAL 893120406190727994 42.45 7 10 Dishari College of Edn., Burdwan 20,000 Bengali POULAMI HAZRA GENERAL 230570306190572480 42.41 8 5 Bam Vivekananda B.Ed. College, Bam, Joteram 20,000 Bengali ANANNYA DUTTA GENERAL 778650306190717388 42.29 9 5 Bam Vivekananda B.Ed. College, Bam, Joteram 20,000 Bengali DHARANI MAHATO GENERAL 972270506190204956 41.75 10 1 ABS Academy, Durgapur 20,000 Bengali BHASWATI GHOSHAL GENERAL 746460306190813014 41.73 11 39 Uttaran College of Edn., Khana Jn. Road 20,000 Bengali ALOLIKA MUKHOPADHYAY GENERAL 790102805190615226 41.52 12 29 Parbati Teachers Training Inst., Chanda, Jamuria 20,000 Bengali RIYA KUNDU GENERAL 856072705191171348 41.23 13 91 Mazidia Academy 20,000 Bengali SHALINI NEOGI GENERAL 337340406190850856 41.14 14 34 Sarat Chandra Teacher Training Institute, Laskarpur, Kuley 20,000 Bengali MADHUMITA PATI GENERAL 944200506191163564 40.91 15 41 Abodh Institution 20,000 Bengali PARAMITA MANDAL GENERAL 887492106190785501 40.70 16 45 Birhambir Teachers' Training Institute 20,000 Bengali DALIA KHATUN GENERAL 145672605191041276 40.69 17 7 Chatta PTTI 20,000 Bengali SANDIP GHOSH GENERAL 218590506191160405 40.27 18 67 Spandan College of Edn.