May 2012 GSA GNSS Market Report – Issue 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CSR Volume 3 #3, April 1992

COMMUNICATIONS STANDARDS REVIEW Volume 3, Number 3 April, 1992 IN THIS ISSUE The following reports of recent standards meetings represent the view of the reporter and are not official, authorized minutes of the meetings. TR-45.3 Digital Cellular Standards, February 3 - 7, 1992, East Rutherford, NJ...................................................................2 TR-45.3.A Ad Hoc Authentication Group....................................................................................................................2 TR-45.3.1 — User Needs and Services.........................................................................................................................2 TR-45.3.2 — Dual-Mode Standards..............................................................................................................................2 TR-45.3.2.5 — Circuit Data Services............................................................................................................................3 TR-45.3.2.6 — Authentication Performance.................................................................................................................4 TR-45.3.2.8 — Packet Data Services............................................................................................................................4 TR-45.3.3 — Digital Standards.....................................................................................................................................4 TR-45.3.3.2 — Half-Rate Voice Coder.........................................................................................................................4 -

A Review of Openstreetmap Data Peter Mooney* and Marco Minghini† *Department of Computer Science, Maynooth University, Maynooth, Co

CHAPTER 3 A Review of OpenStreetMap Data Peter Mooney* and Marco Minghini† *Department of Computer Science, Maynooth University, Maynooth, Co. Kildare, Ireland, [email protected] †Department of Civil and Environmental Engineering, Politecnico di Milano, Piazza Leonardo da Vinci 32, 20133 Milano, Italy Abstract While there is now a considerable variety of sources of Volunteered Geo- graphic Information (VGI) available, discussion of this domain is often exem- plified by and focused around OpenStreetMap (OSM). In a little over a decade OSM has become the leading example of VGI on the Internet. OSM is not just a crowdsourced spatial database of VGI; rather, it has grown to become a vast ecosystem of data, software systems and applications, tools, and Web-based information stores such as wikis. An increasing number of developers, indus- try actors, researchers and other end users are making use of OSM in their applications. OSM has been shown to compare favourably with other sources of spatial data in terms of data quality. In addition to this, a very large OSM community updates data within OSM on a regular basis. This chapter provides an introduction to and review of OSM and the ecosystem which has grown to support the mission of creating a free, editable map of the whole world. The chapter is especially meant for readers who have no or little knowledge about the range, maturity and complexity of the tools, services, applications and organisations working with OSM data. We provide examples of tools and services to access, edit, visualise and make quality assessments of OSM data. We also provide a number of examples of applications, such as some of those How to cite this book chapter: Mooney, P and Minghini, M. -

Electronics System Coordinator

Electronics System Coordinator RYOSAN CO., LTD. CORPORATE PROFILE 2020 Since its founding, Ryosan has conducted corporate activities based on the strong conviction that “a corporation is a public institution.” This phrase means that corporations are founded in order to benefit society in both the present and the future. Corporations are allowed to exist only if they are needed by society. In other words, corporations lose their meaning when they are no longer needed by society. Ryosan will continue its corporate activities with this strong conviction and firm resolution. “A corporation is a public institution.” Ryosan keeps this phrase firmly in its heart as the Company moves forward into the future. Ryosan History ~1960 1970 1980 1990 2000 2010~ 1953 1974 1981 1996 2000 2012 Ryosan Denki Co., Ltd. is established Hong Kong Ryosan Limited is The company name is changed to Ryosan Technologies USA Inc. The head office is moved to the current Ryosan Europe GmbH is established. in Kanda-Suehirocho, Chiyoda-ku, established. Ryosan Co., Ltd. is established. Head Office Building. Tokyo. Consolidated net sales exceed 300 2014 1976 1982 1997 billion yen. Ryosan India Pvt. Ltd. is established. 1957 Singapore Ryosan Private Limited Consolidated net sales exceed Zhong Ling International Trading The Company is reorganized as is established. 100 billion yen. (Shanghai) Co.,Ltd. is established. 2001 2016 a stock company as Korea Ryosan Corporation and Ryosan Engineering Headquarters obtain Ryosan Denki Co., Ltd. 1979 1983 1999 (Thailand) Co.,Ltd. are established. ISO9001 certification. Ryotai Corporation is established. Stock is listed on the Second Section Kawasaki Comprehensive Business 1963 of the Tokyo Stock Exchange. -

Michelin.Com

2014 ANNUAL AND SUSTAINABLE OPEN DEVELOPMENT REPORT MINDED Driving growth in a spirit of openness u Contents OOPEENN MINNDEED 044 Moving forward in a changing world 06 Welcome to a smart world 12 Let’s talk about it: dialogue begins with listening 16 Open innovation: accelerating p The 2014 Registration the creative process Document, including the Annual Financial Report, 20 Interview with Jean-Dominique Senard is available on website www.michelin.com OOUR STRRENNGGTHHS 26 A long-term growth market 28 Unique advantages 29 A global strategy for profi table growth 30 An optimized organization SIX AAMBBITTIOONNS 34 Product performance 442 A responsible manufacturer 488 Financial performance 52 Employee well-being and development 56 Host communities 60 Sustainable mobility COORPPORRATTE GGOVVERRNNAANNCEE ANND RRESSULLTS IIN 2014 68 The Michelin partnership limited by shares 72 Michelin and its shareholders 774 Our contribution 766 Our markets in 2014 78 A global footprint 80 Our businesses 84 Key fi gures 90 Materiality matrix 91 Prizes, awards and distinctions WE SUPPORT THE GLOBAL COMPACT By pledging to support the United Nations Global Compact, Michelin has committed to upholding and applying ten universal principles in the areas of human rights, Advanced level labor, the environment and anti-corruption. Corporate Profi let SINCE 1889, MICHELIN HAS CONSTANTLY INNOVATED TO FACILITATE THE MOBILITY OF PEOPLE AND GOODS. TODAY, IT IS SETTING THE BENCHMARK ACROSS EVERY TIRE AND TRAVEL-RELATED SERVICES MARKET, WHILE LEADING A GLOBAL STRATEGY TO -

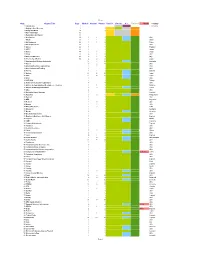

Sheet1 Page 1 Chap. Chapter Title Page Models Variants Photos

Sheet1 Chap. Chapter Title Page Models Variants Photos David C. Vincent A.C. Finished Needs Country 1 Introduction 1 V: 6/07/2014 2 Buying A Used Receiver 6 1 3 Using This Book 13 2 4 More Information 31 5 Restoration and Repair 35 6 AeroStream 39 1 1 1 USA 7 Afedri 39 1 1 1 Israel 8 Air Equipment 40 1 1 2 France 9 Air King Products 41 1 1 USA 10 Airmec 42 1 1 England 11 AITEC 43 1 1 Japan 12 Alinco 44 1 1 1 Japan 13 Allied 45 6 1 6 USA 14 Allocchio Bacchini 48 9 1 9 Italy 15 Alsetac (ApexRadio) 50 2 2 2 Japan 16 Amalgamated Wireless Australasia 15 7 15 Australia 17 Ameco 3 2 5 USA 18 American Electronic Laboratories 1 1 1 USA 19 American General Trading 1 1 USA 20 Andrus 1 1 1 Estonia 21 Anritsu 27 16 29 Japan 22 AOR 12 15 12 Japan 23 Arvin 1 1 USA 24 ASELSAN 1 1 Turkey 25 Astro Communications Laboratory 4 4 USA 26 Ateliers de Constructions Électriques de Charleroi 1 1 1 Belgium 27 Ateliers de Montages Electrique 7 6 7 France 28 Atlas 2 3 USA 29 Australian Sound Systems 1 1 Australia 30 Autophon 5 5 5 Switzerland 31 Bearcat 1 1 USA 32 BEH 1 1 Argentina 33 Belmont 4 5 4 USA 34 Bendix 1 1 1 USA 35 Bharat Electronics 1 4 1 India 36 Blaupunkt 2 1 2 Germany 37 Bonito 1 1 Germany 38 Boulevard Electronics 1 1 USA 39 Brookes & Gatehouse Ltd. -

On the Table 1 of 17

w2xq.com On The Table 1 of 17 This following material was written between 1994 and 2002. It appeared on my TRS Consultants' trsc.com web site (no longer in operation) until March 2002. Since then we have not actively sought out new receivers to review. Nevertheless the information may be of use or interest to those interested in older receivers. References to sources known to be no longer available are retained for context, and appear as strikethrough-formated text. This document was prepared in June 2012. The PDF format enables flexibility in presentation and we opted to add some additional comments, indicated by highlighted text. Thomas R. Sundstrom, W2XQ Contents Table Top Receivers..........................................................................................................................4 Hallicrafters S-38.........................................................................................................................4 Magnavox RCU-2........................................................................................................................4 Hammarlund HQ-150..................................................................................................................5 Hallicrafters 8R40........................................................................................................................5 ICOM IC-R71A...........................................................................................................................6 Kenwood R-5000.........................................................................................................................6 -

DP/525 Engli Sh

~ ~ C fD Z:~ rn 0 < -- 0 m --~ 3~ 0 t~ m ~ m ~ t..~o o --t m Z -- -~0 Z C-4 0 0 tZ~ 0 b--t H r~ 0 CO ~H °° M~ "0 t--3 0 I--t u1 ~J 0 ~Cl I--3 DP/525 Engli sh (i) CONTENTS Table i : UNDP: Cost of Subcontracts awarded by sector of projects and by headquarters of contractor, 1980 .............. Table 2 : UNDP: Subcontracts awarded, by contractors’ headquarters and name, cost of contract and project, 1980 ............... 2 - 20 Table 3: UNDP: Major equipment orders for projects by name of supplier, cost of orders, and description of equipment, 1980 ..... 21 - 36 See also DP/511 - Basic Programme Data and DP/512 - Supplementary Programme Data. ~ILE1 UNDP: Cost of subcontracts awarded~ b~ sector of ~roJe~ts and b~ Head~u~ers of Contractor~ 1~-~ ( thousand dollars) Headquarters of Contractors---b/ Sector United Fed. Rep. of IGeitzer- ! New Rep. of ~ppines r~ce ~ore~Canada land Colombia Korea Der~ark Australia 0~h~ A~iculture~ Forest~ and Fis~eri~s __i" __% ._.i _..i .__i" ---i A6ricultu~el Sevelopmentsupport services . 252 21o 7~ 7~ 6e~ 1,89~ Crops 7,759 600 1,1~7 9,61~ Livestock 2 ’ ~o~ ~2 3~6 ~shories 2~ 1,087 1,821 Forestr7 . 89 ~. neral Develo~ent Issues, Policy and Planni~ __i" _..% --i Developmentstrategles, policies and planning 1,728 ~0~ 2].l 439 3~ 591 218 lO,993 Generalstatistics 576¸ 1 . 68) P~bllc administration ~8 ~9 ],1.1 37 591 1,~91 Natural Resources __i --i" ...i" _.% 210 Carto~r~ 6o~ Land and water 1,115 ~75 767 4, 3~i Mineral resources i, 025 63 220 1,984 Energy 186 47~ 2 ~7 lo9~ 1,6o5 210 6~ Transport and COmmmlcatlone ~o __i __l" __% _.i" ___i Policy and planning 1,005 Air transport ~5 N3 . -

Developing National SDI Platform for Greece Indian Prelude to British Cadastral and Revenue Maps the Biggest GPS Market in Japan

6 0 0 2 r a M 3 6 3 e 1 u 2 s - s 3 I 7 , 9 I 0 I l N S o S Vol II, Issue 3 Mar 2006 II, V Vol I ISSN 0973-2136 RRs.100s.100 MMONTHLYONTHLY RRNI:NI: DDELENG/2005/15153ELENG/2005/15153 NNo:o: DDL(E)-01/5079/05-07L(E)-01/5079/05-07 PPOSITIONING,OSITIONING, NNAVIGATIONAVIGATION ANDAND BBEYONDEYOND DDevelopingeveloping nationalnational SSDIDI pplatformlatform fforor GGreecereece IIndianndian preludeprelude toto BritishBritish ccadastraladastral aandnd revenuerevenue mapsmaps TThehe bbiggestiggest GPSGPS marketmarket inin JJapanapan iiss ccarar nnavigationavigation — HHiroshiiroshi NNishiguchiishiguchi CONTENTS – VOLUME 2, ISSUE 3, MAR 2006 Articles What does our world really look like? RAINER MAUTZ 8 Gagan update ARJUN SINGH 12 Indian prelude to British cadastral and revenue maps B ARUNACHALAM 22 Developing national SDI platform for Greece S ALEXIADOU AND A RAJABIFARD 28 Spatial and dynamic modeling techniques NOVALINE JACOB AND KRISHNAN R 36 National GPS programme for earthquake hazard assessment MANORANJAN MOHANTY 40 Columns My Coordinates EDITORIAL 4 His Coordinates HIROSHI NISHIGUCHI 6 MAHESH CHANDRA 20 News INDUSTRY 14 GPS 16 GIS 18 REMOTE SENSING 20 GALILEO UPDATE 43 Tracking NSDI PS ACHARYA, RN NANDA AND A SINDAL 26 Mark your calendar APRIL TO NOVEMBER 42 cGIT 28A Pocket D, SFS Mayur Vihar Phase III, Delhi 110 096, India. Phones +91 11 22632607, 98107 24567, 98102 33422 Email [information] [email protected] [editorial] [email protected] [advertising] [email protected] [subscriptions] [email protected] Web www.mycoordinates.org This issue has been made possible by the support and good wishes of the following individuals and companies A Rajabifard, Arjun Singh, A Sindal, B Arunachalam, Hiroshi Nishiguchi, Krishnan R, Mahesh Chandra, Manoranjan Mohanty, Novaline Jacob, PS Acharya, Rainer Mautz, RN Nanda, S Alexiadou and; Contex, CSI Wireless, HP, Leica, Navcom, PCI, Topcon, Trimble; and many others. -

Gnss Market Report Issue 1

GNSS MARKET REPORT ISSUE 1 October 2010 GSA GNSS Market Report – Issue 1 2 TABLE OF CONTENTS EXECUTIVE SUMMARY 4 INTRODUCTION 5 GNSS MARKET 6 GLOBAL MARKET OVERVIEW 6 ROAD 8 LOCATIONBASED SERVICES LBS 14 AVIATION 20 AGRICULTURE 26 ANNEXES 32 ACRONYMS 32 ABOUT THE EUROPEAN GNSS PROGRAMMES 33 PREFACE 3 Methodology and sources of information This market report has been produced using the GSA’s* market monitoring and forecasting process. The underlying forecasting model is based on advanced econometric techniques. An extensive set of variables is used to model scenarios based on key assumptions. These assumptions are cross-checked through an iterative process involving renowned experts in key areas of each market segment. In adddition, a consistency check is performed for each segment by comparing the model’s results with the most recent market research reports from independent sources. Nevertheless, due to the inherent uncertainties in long term forecasting, a margin of error is unavoidable. The model makes use of publicly available information including the following sources: Eurostat, US National Transportation Statistics, International Road Assessment Programme (iRAP), United Nations public information, International Telecommunication Union (ITU), Nations Online, Boeing, Airbus, Federal Aviation Administration, Flight Insight, and the Food and Agriculture Organisation (FAO). Disclaimer The information provided in this report is based on the GSA’s best estimates and forecasts at the time of publication**. Although the GSA has taken the utmost care in checking the reasonableness of assumptions and results with the support of industry experts, the GSA cannot guarantee the accuracy of the information presented and hence does not take any responsibility in the further use made of the content of this report. -

Glossary of Terms and Abbreviations

Glossary of terms and abbreviations AAIC: Accounting authority for satellite traffic invoicing. A/D: Analogue-to-digital signal conversion. ADE: Above decks equipment. The electronic and mechanical equipment above decks on a ship. AFC: Automatic frequency control. AGC: Automatic gain control. AHC: Ampere hour capacity. The figure used to indicate the quantity of energy which may be delivered by a specific battery for a stated time period. ALOHA: A random access protocol for accessing a packet satellite network. Developed at the University of Hawaii and using the Hawaiian word for greeting. AM: Amplitude modulation. AMERC: The Association of Marine Electronic and Radio Colleges (based in Great Britain). AORE: Atlantic Ocean region east. AORW: Atlantic Ocean region west. APC: Adaptive predictive coding. Apogee: The furthest point which a satellite reaches in its orbit from the earth. ARQ: Automatic request repeat. An error control protocol used in data communications. The RX is able to request the retransmission of packets received in error. ASCII: American Standard Code for Information Exchange. ASMl and 2: At-sea-maintenance qualifications, level one and two. Azimuth: Surface angle extended between a line of longitude and a specific direction. Baud: Standard unit of signalling at a rate of one signal element/second. BCH: Bose-Chadhuri-Hocquenghem code. BDE: Below decks equipment. The electronic/mechanical equipment of an SES inside the ship. BE: Billing entity. An accounting authority for satellite traffic invoicing. BER: Bit error rate. The number of bits transmitted that are received with errors, compared with the total number of bits transmitted. BITE: Built-in test equipment. -

2015, Vol.4, No.3, 65-72 MODERN TENDENTION IN

ECONTECHMOD. AN INTERNATIONAL QUARTERLY JOURNAL – 2015, Vol.4, No.3, 65-72 MODERN TENDENTION IN THE USE OF GPS TECHNOLOGY IN TOURISM INDUSTRY V. Savchuk, V. Pasichnyk Lviv National Politechnic University; e-mail: [email protected] Received July 27.2015: accepted August 20.2015 Abstract. The article is devoted to the analysis of the OBJECTIVES possibilities of GPS-technology (Global Positioning System) in the tourism industry. The study is devoted to The goals if this research are: the identification and analysis of functionality of mobile • an analysis of current tourist information computing devices equipped with GPS receiver in tourism systems, based on information of the user's location; industry, the methods and means of their implementation, • an analysis of the structure and operation of building on this basis a mobile information technology for GPS (global positioning system); tourist support at all stages of his journey. To achieve the • an identification of the methods and tools for goal a number of mobile information systems using data building tourist mobile information systems based on GPS, methods and means of their implementation, a dynamic information about the current location of the comparative analysis of current cartographic services that user; are used in the developing of mobile information • detection and identification of research areas and technology applications for tourist are analyzed. The tasks that require further scientific and technological study outlines the place of GPS-technology in the research. "Mobile tourist information assistant" system, and the role The summarizing aim of the described in the paper of Google Maps services for information technology research is the identification and analysis of the support and implementation of the main tourist features in functionality of mobile computing devices equipped with mentioned mobile information system. -

On Applicable Cellular Positioning for UMTS

Julkaisu 735 Publication 735 Jakub Marek Borkowski On Applicable Cellular Positioning for UMTS Tampere 2008 Tampereen teknillinen yliopisto. Julkaisu 735 Tampere University of Technology. Publication 735 Jakub Marek Borkowski On Applicable Cellular Positioning for UMTS Thesis for the degree of Doctor of Technology to be presented with due permission for public examination and criticism in Tietotalo Building, Auditorium TB109, at Tampere University of Technology, on the 23rd of May 2008, at 12 noon. Tampereen teknillinen yliopisto - Tampere University of Technology Tampere 2008 ISBN 978-952-15-1971-0 (printed) ISBN 978-952-15-2016-7 (PDF) ISSN 1459-2045 On Applicable Cellular Positioning for UMTS Jakub Marek Borkowski April 29, 2008 Abstract Enabling the positioning of cellular handsets increases the safety level and at the same time opens exciting commercial opportunities for operators through providing location-based services. A major implementation obstacle, which prevents a wide deployment of cellular location techniques is the requirement of modifications of the existing network infrastructures and a need for the replacement of legacy terminals. Despite a significant amount of research on the mobile positioning problem, there are still unresolved aspects regarding applicable positioning solutions providing es- timation accuracy sufficient for the majority of location-based services. Typically, the applicability of positioning technology in current networks and provided estimation accuracy yield for trade off. The aim of the research performed in the frame of this thesis is to propose network- and mobile-based location techniques for UMTS networks that do not require any changes on the network side or in the user terminals and at the same time provide a reasonable estimation performance.