2019-Fact-Book.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CHOCOLATE CONFECTIONERY in DENMARK 07 Feb 2014 HEADLINES

CHOCOLATE CONFECTIONERY IN DENMARK 07 Feb 2014 HEADLINES In 2013 chocolate confectionery grows by 1% in current value terms to reach sales of DKK3.2 billion Both small and big players target the premiumisation trend Twist wrapped miniatures the best performer in 2013 with current value growth of 5% Unit prices rise only moderately in 2013 Toms Gruppen A/S remains the clear leader in chocolate confectionery with a value share of 32% Chocolate confectionery anticipated a constant value CAGR decline of 1% over the forecast period COMPETITIVE LANDSCAPE Toms Gruppen A/S remained the clear leader in chocolate confectionery in Denmark in 2013 with a value share of 32%. Toms Gruppen is a well-established domestic player which owns a wide selection of traditional and well-known brands, such as Anthon Berg, Guld Barre and Yankie. These brands have been present in the Danish market for decades and together offer a wide selection of products in all categories of chocolate confectionery. Toms Gruppen’s main focus in chocolate confectionery is on the standard mid- priced segment, but the company has announced its intention to increasingly focus on the more dynamic premium segment. It remains to be seen if this strategy will be successful. The fate of Toms’/Anthon Berg’s super-premium product range A Xoco, which closed three shops in 2013, shows that it is not always easy for an established mid-priced player to be accepted as premium by consumers. Ranked second and third in chocolate confectionery in 2013 were Kraft Foods Danmark A/S and Mars Danmark A/S. -

Graham Cracker Mint Fudge by Cuchina

Graham Cracker Mint Fudge by Cuchina Crust Ingredients 1 ¾ cups graham cracker crumbs or 10 whole graham crackers* 6 tablespoons melted salted butter 1/4 cup granulated sugar * If using the whole graham crackers, place them in a re-sealable plastic bag and crust with your rolling pin. Instructions Preheat oven to 350 degrees F. In a small microwave safe bowl, cut butter into cubes, cover with small Cuchina Safe Lid, microwave on high for 35 to 40 sec., do not overcook. In medium bowl combine graham crackers, sugar, and melted butter; blend until the texture of coarse meal. Line pan with non-stick foil or parchment paper, using your hands or a flat-bottomed glass, press the mixture evenly into a 9”x 9” pan. If the crumb mixture will not stick where you press them; just add a tablespoon of water to the mix. Bake for approximately 8 to 10 minutes. Chill crust for an hour before adding fudge to help prevent crumbling when serving. Fudge Ingredients 1 ( 10oz ) bag milk chocolate chips (1 ¾ cup) 1 ( 10oz )bag mint chocolate chips (1 ¾ cup) 1 (14oz) can sweetened condensed milk 1⁄4 cup butter 1 tsp. Vanilla 1 cup chopped walnuts (Optional if not doing the crust, add to melted fudge mixture) Instructions Place chocolate chips, condensed milk, butter and vanilla in a microwave safe bowl, cover with large Cuchina Safe Lid. Microwave on medium heat for 1 minute then stir, continue heating and stirring every 30 seconds until chocolate is completely melted. This prevents the chocolate from burning. -

Mckeesport Candy Co. CANDY CIGARETTES & CIGARS

412-678-8851 [email protected] FAX: 412-673-4406 McKeesport Candy Co. Visit CandyFavorites.com to view products. *** Please note that website prices reflect suggested retail *** CHANGEMAKERS EFRUTTI GUMMI CHANGEMAKER 7272 ANGEL MINTS 110 4090 GUMMI BRACELET 40 7248 CANDY CIGARETTES 24 42134 BAKERY SHOPPE - SHARE SIZE 12 7171 CARAMEL CREAMS 170 7177 GUMMI BURGER 60 7347 CELLA CHERRY- INDIVIDUALLY WRAPPED 72 3752 GUMMI CUPCAKES 60 7173 CHARLSTON CHEW - VANILLA 96 42133 EFRUTTI GUMMI CHEESECAKES 30 4277 CHICKO STICK 36 40078 GUMMI DONUTS - SHARE SIZE 12 COWTALES 7262 GUMMI HOT DOG 60 5067 COWTALES - CARAMEL APPLE 36 4105 GUMMI PIZZA 48 5304 COWTALES - CHOCOLATE BROWNIE 36 40079 GUMMI RAINBOW UNICORN - SHARE SIZE 12 7270 COWTALES - STRAWBERRY SMOOTHIE 36 63151 GUMMI SEA CREATURES 60 7263 COWTALES - VANILLA 36 7266 GUMMI SOUR GECKO 40 7269 FUN DIP 48 EFRUTTI GUMMI BAGS - LARGE 7275 ICE CUBES 100 43030 GUMMIUNIVERSE SHELF TRAY 12 46001 JOLLY RANCHER FILLED POPS 100 6943 GUMMI LUNCH BAG SHELF TRAY 12 7286 JUNIOR MINTS - BOXES 72 42111 GUMMI LUNCH BAG SOUR TRAY 12 5443 MALLO CUPS - FUN SIZE 60 42008 GUMMI MOVIE BAG SHELF TRAY 12 4848 PRETZEL RODS 450 43203 GUMMI TREASURE HUNT SHELF TRAY 12 7313 PUMPKIN SEEDS - INDIAN 36 25¢ PRE-PRICED BOXES 5040 RAZZLES CHANGEMAKERS 240 3395 BERRY CHEWY LEMONHEADS 24 4423 RAIN-BLO GUM - MINI PACKS 48 4018 BOSTON BAKED BEANS 24 7215 REESE PEANUT BUTTER CUPS - MINI 105 7912 APPLEHEADS 24 7156 SATELLITE WAFERS 240 7913 CHERRYHEADS 24 5089 SATELLITE WAFERS - SOUR 240 5154 CHEWY LEMONHEADS 24 7318 SIXLETS -

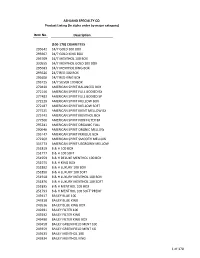

Order Book--7-3-13A.Xlsx

ASHLAND SPECIALTY CO. Product Listing (In alpha order by major category) Item No. Description (100-178) CIGARETTES 295642 24/7 GOLD 100 BOX 295667 24/7 GOLD KING BOX 295709 24/7 MENTHOL 100 BOX 330555 24/7 MENTHOL GOLD 100 BOX 295683 24/7 MENTHOL KING BOX 295626 24/7 RED 100 BOX 295600 24/7 RED KING BOX 295725 24/7 SILVER 100 BOX 279430 AMERICAN SPIRIT BALANCED BOX 272146 AMERICAN SPIRIT FULL BODIED BX 277483 AMERICAN SPIRIT FULL BODIED SP 272229 AMERICAN SPIRIT MELLOW BOX 272187 AMERICAN SPIRIT MELLOW SOFT 277525 AMERICAN SPIRIT MENT MELLOW BX 275743 AMERICAN SPIRIT MENTHOL BOX 277566 AMERICAN SPIRIT NON FILTER BX 293241 AMERICAN SPIRIT ORGANIC FULL 290940 AMERICAN SPIRIT ORGNIC MELLOW 295147 AMERICAN SPIRIT PERIQUE BOX 272260 AMERICAN SPIRIT SMOOTH MELLOW 333773 AMERICAN SPIRIT USGROWN MELLOW 251819 B & H 100 BOX 251777 B & H 100 SOFT 251959 B & H DELUXE MENTHOL 100 BOX 251975 B & H KING BOX 251892 B & H LUXURY 100 BOX 251850 B & H LUXURY 100 SOFT 251918 B & H LUXURY MENTHOL 100 BOX 251876 B & H LUXURY MENTHOL 100 SOFT 251835 B & H MENTHOL 100 BOX 251793 B & H MENTHOL 100 SOFT"PREM" 249417 BAILEY BLUE 100 249318 BAILEY BLUE KING 249516 BAILEY BLUE KING BOX 249391 BAILEY FILTER 100 249292 BAILEY FILTER KING 249490 BAILEY FILTER KING BOX 249458 BAILEY GREEN FIELD MENT 100 249359 BAILEY GREEN FIELD MENT KG 249433 BAILEY MENTHOL 100 249334 BAILEY MENTHOL KING 1 of 170 ASHLAND SPECIALTY CO. Product Listing (In alpha order by major category) Item No. Description 249532 BAILEY MENTHOL KING BOX 249474 BAILEY SKY BLUE 100 249375 BAILEY SKY BLUE -

Product List - - 1800 854 234

Product List - www.TheProfessors.com.au - 1800 854 234 Allens Marella Jubes (1.3kg bag) Red Vines - Original Red Twists (1 tray x 141g) Bubblicious Fruit Twist Gum (18 packs x 5 gum pieces) Allens Marella Jubes Saver Pack (4 x 190g Bags) Red Vines - Original Red Twists (12 trays x 141g) Bubblicious Watermelon Gum (18 packs x 5 gum pieces) Hershey's Kisses (12 x 150g bags) Allens Milk Bottles (1.3kg bag) Red Vines - Original Red Twists (6 trays x 141g) Cadbury Boost Stix Twin Bar (55g x 30) Sixlets - Black- ( Bulk 4.5kg box) Allens Milko Chews (3kg bag) Red Vines 4lbs tub (240pc - unwrapped red vines in a display tub) Cadbury Buzz (42 x 20g bars in a Display Unit) Sixlets - Gold- ( Bulk 4.5kg box) Allens Milkos (150 Stick Display Unit) Cadbury Caramello Block (10 x 110g blocks) Sixlets - Lime Green- ( Bulk 4.5kg box) Allens Minties (1 kg Bag) Cadbury Caramello Koala (72 x 20gm in a Display Unit) Sweetworld Jelly Pencils (12 x400g hang sell bags) Arnotts Allens Party Mix (1.3 kg Bag) Arnotts Tim Tam Fingers (28 x 40g packs) Cadbury Caramello Rolls (36 x 55g Rolls) AB Food and Beverages Allens Pineapples (1.3kg bag) Arnotts Wagon Wheels (16 x 48g biscuits) Cadbury Cherry Ripe (48 x 52g bars in a display unit) Allens Racing Cars (1.3kg bag) Cadbury Chocolate Fish (42 x 20g in a Display Unit) Ovalteenies (24 bags in a Display Unit) Allens Retro Party Mix (1kg bag) Bassett Cadbury Chomp Caramel Bars (50 bars in Display Unit) AIT Confectionery Allens Ripe Raspberries (1.3kg Bag) Bassetts Pear Drops (12 x 200g bags) Cadbury Crunchie (42 x 50g -

Revenue Is 85% from the U.S. S&P Credit Rating: A

Company: The Hershey Company (HSY) Price: $85.45 Target Price: $106.27 Market Cap: $18.4B P/E: 20.34 52 Week H/L: $110.22/82.41 Dividend Yield: 2.70% Beta: .55 Competitive Advantages: Hershey has made significant Company Background: The Hershey Company manufactures improvements in its supply chain efficiency including chocolate and sugar confectionery products. Their main consolidating production lines and outsourcing in order to products are chocolate, gum and mint refreshment cut costs and widen margins. The company also has a very products, as well as toppings and beverages. Hershey’s customers are wholesale distributors, mass merchandisers, strong brand and market share in a steadily growing drug stores, department stores, etc. The company’s major industry. products are Hershey Bars, Reese’s, Hershey’s Kisses, Jolly Its increased Ad spending coupled with new product Rancher, Almond Joy, Kit Kat, Rolo, Twizzlers, Whoppers, York, Ice Breakers, and Bubble Yum. releases should help the company grow further in coming years. Finally, Hershey maintained positive revenue growth from 2006-2009, which speaks to the strength of the Investment Thesis: We feel as though Hershey is a sound company as well as the notion that the confectionary investment due to its superior market share in the growing industry is somewhat “recession-proof.” confectionary industry, as well as its longstanding brand. The company has above average margins, returns, and maintained positive revenue growth all throughout the financial crisis. Its increased efforts in margin expansion Risks: Hershey acquired 80% stake in Shanghai Golden and international sales signal that the company is poised to Monkey, which has underperformed significantly to date. -

THE HERSHEY COMPANY (A Delaware Corporation) 100 Crystal a Drive Hershey, Pennsylvania 17033 (717) 534-4200 I.R.S

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K È Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2007 OR ‘ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from to Commission File Number 1-183 Registrant, State of Incorporation, Address and Telephone Number THE HERSHEY COMPANY (a Delaware corporation) 100 Crystal A Drive Hershey, Pennsylvania 17033 (717) 534-4200 I.R.S. Employer Identification Number 23-0691590 Securities registered pursuant to Section 12(b) of the Act: Title of each class: Name of each exchange on which registered: Common Stock, one dollar par value New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: Class B Common Stock, one dollar par value (Title of class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes È No ‘ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ‘ No È Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

2019 Proxy Statement and 2018 Annual Report

NOTICEOF201ͻANNUALMEETING ANDPROXYSTATEMENT 201ͺANNUALREPORT TOSTOCKHOLDERS May 2ͳ, 201ͻ 10:00 a.m., Eastern Daylight Time GIANT Center 550 West Hersheypark Drive Hershey, Pennsylvania Michele Buck President and Chief Executive Officer April 11, 2019 Dear Stockholder: I am pleased to invite you to The Hershey Company’s 2019 Annual Meeting of Stockholders. Our meeting will be held on Tuesday, May 21, 2019, at 10:00 a.m. Eastern Standard Time. Detailed instructions for attending the meeting and how to vote your Hershey shares prior to the meeting are included in the proxy materials that accompany this letter. Your vote is extremely important to us, and I encourage you to review the materials and submit your vote today. This year we are celebrating the company’s 125th anniversary. We are one of the few Fortune 500 companies that are connecting with consumers as strongly today as we were more than a century ago and that is because, quite simply, we love making the brands that our consumers love. As we celebrate this extraordinary milestone, I am honored to lead a company with teams of people who care about one another and their communities, have deep pride in our incredible portfolio of brands and recognize that as the stewards of this incredible legacy, we are entrusted to build for the future and make the strategic decisions that ensure Hershey is well-positioned for generations to come. As I look back on 2018, the marketplace continues to be dynamic and fast-moving. We have amazing brands in categories that are growing. Consumers continue to snack throughout the day and Hershey is offering more snacking options to satisfy their needs by broadening our product portfolio beyond confection to reflect the changing way people want to snack. -

Kraft Foods Produktoversigt

Kraft Foods Produktoversigt Kaffe og cacao . Chokolade . Kiks . Tyggegummi og bolsjer BR352/DK/04.2012/932186/Abena Grafisk BR352/DK/04.2012/932186/Abena “Kaffe dufter som friskmalet himmel“ Jessi Lane Adams Gevalia 1853 Professionel - formalet Varenr. Varebeskrivelse Størrelse Antal pr. karton 121655 Gevalia 1853 Professionel 1000 g 6 121657 Gevalia 1853 Professionel 175 g 30 121656 Gevalia 1853 Professionel 65 g 64 Gevalia økologisk - formalet Varenr. Varebeskrivelse Størrelse Antal pr. karton 121600 Gevalia Professionel Økologisk 1000 g 6 121620 Gevalia Økologisk 400 g 16 121626 Gevalia Professionel Økologisk 175 g 30 121659 Gevalia Professionel Økologisk 65 g 64 Gevalia Professionel - formalet Varenr. Varebeskrivelse Størrelse Antal pr. karton 121661 Gevalia Professionel Rød 1000 g 6 121605 Gevalia Professionel Rød 500 g 12 121660 Gevalia Professionel Rød 175 g 30 121625 Gevalia Professionel Rød 65 g 64 Karat Professionel - formalet Varenr. Varebeskrivelse Størrelse Antal pr. karton 121643 Karat Professionel Plantage 500 g 12 121606 Karat Professionel Rubin 500 g 12 121662 Karat Professionel Rubin 65 g 64 2 Uanset hvor i verden du befinder dig, kender du allerede til flere af Kraft Foods produkter. Se Abenas sortiment fra Kraft Foods, så finder du måske en af dine egne favoritter. Kraft Foods stærke mærkevarer gør dem til markedsførende inden for områderne chokolade, kaffe, kiks og andre fødevarer som chokoladedrik, smøreost, bagværk og desserter. Gevalia - helbønner Varenr. Varebeskrivelse Størrelse Antal pr. karton 121636 Gevalia 1853 Professionel 1000 g 8 121658 Gevalia Professionel Økologisk 1000 g 8 Mastro Lorenzo - helbønner til espressokaffe Varenr. Varebeskrivelse Størrelse Antal pr. karton 121602 Mastro Lorenzo Aroma Oro Økologisk 1000 g 8 121603 Mastro Lorenzo Aroma Bar 1000 g 8 3 Gevalia - instant Varenr. -

FINAL F&S / Ferrara Pan Close Release

FOR IMMEDIATE RELEASE FARLEY’S & SATHERS AND FERRARA PAN COMPLETE MERGER Round Lake, MN and Forest Park, IL – June 18, 2012 –Farley’s & Sathers Candy Company, Inc. (“Farley’s & Sathers”) and Ferrara Pan Candy Company, Inc.(“Ferrara Pan”) today announced that they have completed their previously announced merger. The combined company, which will be called Ferrara Candy Company, Inc., will be a leading general line candy manufacturer. Salvatore Ferrara II, Chairman and CEO of Ferrara Candy Company, Inc., said, “We are pleased to complete the transaction, which creates a leader in our category. The new Ferrara Candy Company will offer a robust portfolio of branded and private label confections that consumers love, from Lemonheads® and Red Hots® to Trolli®, Brach’s® and Now and Later®. Together, we are entering an exciting new chapter that will allow us to delight our customers with the same great products they know and love, while continuing to innovate our offerings. I want to thank the hard working employees of both companies for their support throughout this process and together, I am confident we will reach new heights.” Catterton Partners, the leading consumer-focused private equity firm, which owns Farley’s & Sathers, will remain as a majority investor in the combined company. “This transaction brings together the best products and people in the industry,” said Scott Dahnke, Managing Partner of Catterton Partners. “The combination will leverage Ferrara Pan’s and Farley’s & Sathers’ combined portfolio of iconic brands, collective knowledge and expertise, and broad supply chain to create a powerhouse in confections. As shareholders, we look forward to the significant upside that will result through this compelling combination.” About Farley’s & Sathers Since its inception on February 20, 2002, Farley's & Sathers Candy Company, Inc. -

The Hershey Company

BAMA 514 002 –Brand Audit The Hershey Company The Hershey Company BAMA 514 002 Brand Audit Project (25673039) (75548123) (75800128) (76044122) 2/8/2013 0 BAMA 514 002 –Brand Audit The Hershey Company Contents EXECUTIVE SUMMARY .................................................................................................................................. 3 I. Brand History ............................................................................................................................................ 4 Table 1: Hershey’s Branded Products ................................................................................................... 5 II. Intended Brand Meaning .......................................................................................................................... 7 Target Market ........................................................................................................................................... 7 Table 2: Target Market Segmentation .................................................................................................. 7 Brand Meaning .......................................................................................................................................... 8 Table 3: Assessment of Brand Meaning (as reported by Hershey’s) ................................................... 8 III. Actual Brand Meaning ............................................................................................................................. 9 Primary Associations ................................................................................................................................ -

Download and Print the List

Boston Children’s Hospital GI / Nutrition Department 300 Longwood Avenue, Boston, MA 02115 617-355-2127 - CeliacKidsConnection.org This is a list of gluten-free candy by company. Many of your favorite candies may be made by a company you do not associate with that candy. For example, York Peppermint Patties are made by Hershey. If you do not know the parent company, you can often find the name on the product label. In addition, this list is searchable. Open the list in Adobe reader and use the search or magnifying glass icon and search for the name of your favorite candy. Ce De Candy / Smarties Ferrara Candy Co. Continued www.smarties.com • Brach’s Chocolates - Peanut Caramel From the Ce De “Our Candy” Page Clusters, Peanut Clusters, Stars, All Smarties® candy made by Smarties Candy Chocolate Covered Raisins Company is gluten-free and safe for people with • Brach's Double Dipped Peanuts/Double Celiac Disease. Dippers (they are processed in a facility that processes wheat) If the UPC number on the packaging begins with • Brach’s Cinnamon Disks “0 11206”, you can be assured that the product • Brach's Candy Corn - All Varieties is gluten-free, manufactured in a facility that • Brach's Cinnamon Imperials makes exclusively gluten-free products and safe • Brach's Conversation Hearts to eat for people with Celiac Disease. • Brach's Halloween Mellowcremes - All Varieties • Brach's Jelly Bean Nougats Ferrara Candy Company • Brach's Lemon Drops 800-323-1768 • Brach's Wild 'N Fruity Gummi Worms www.ferrarausa.com • Butterfinger (Formerly a Nestle candy) From an email dated 9/15/2020 & 9/18/2020 • Butterfinger bites (Formerly a Nestle Ferrara products contain only Corn Gluten.