Virtual Pipeline System

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Oil, Gas & Energy Sector

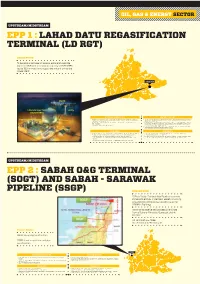

OIL, GAS & ENERGY SECTOR UPSTREAM/MIDSTREAM EPP 1 : LAHAD DATU REGASIFICATION TERMINAL (LD RGT) DESCRIPTION To develop a facilities to receive, store and vaporize imported LNG with a maximum capacity of 0.76 MTPA (up to 100 mmscfd) and supply the natural gas to the Power Plant lahad datu Berth LNG Storage Tank Jetty (0.76 MTPA) Key outcomes of the EPP / KPIs What needs to be done? Vaporization Station • Availability of natural gas supply at east coast of Sabah including Sandakan, Lahad Datu • Construction period of LNG Storage Tank which is the critical path of the project (normally and Tawau (also along the route) will take up to 24 months) • Transfer of technology and knowledge to local manpower and contractors who are involved • Front End phase of a project, where activities are mainly focused towards project planning with this project and contracting/bidding activities for the appointment of Frond End Engineering Design • Spurring the economy along the pipeline Consultant expected in mid-October 2011 • Evaluate and finalize the land lease of the reclaimed land of the proposed site with POIC. • Site Reclamation works is expected to start by Q1 2012 Key Challenges Mitigation Plan • Transporting major equipment and bulk materials from Sandakan to Lahad Datu (~200km) • Improvement of the road condition from Sandakan to Lahad Datu or consider for • Shortage of capable manpower due to simultaneous construction of LD power plant permanent/temporary jetty at Lahad Datu • Available manpower are lack of re-gas terminal construction skills (special) -

Sabah REDD+ Roadmap Is a Guidance to Press Forward the REDD+ Implementation in the State, in Line with the National Development

Study on Economics of River Basin Management for Sustainable Development on Biodiversity and Ecosystems Conservation in Sabah (SDBEC) Final Report Contents P The roject for Develop for roject Chapter 1 Introduction ............................................................................................................. 1 1.1 Background of the Study .............................................................................................. 1 1.2 Objectives of the Study ................................................................................................ 1 1.3 Detailed Work Plan ...................................................................................................... 1 ing 1.4 Implementation Schedule ............................................................................................. 3 Inclusive 1.5 Expected Outputs ......................................................................................................... 4 Government for for Government Chapter 2 Rural Development and poverty in Sabah ........................................................... 5 2.1 Poverty in Sabah and Malaysia .................................................................................... 5 2.2 Policy and Institution for Rural Development and Poverty Eradication in Sabah ............................................................................................................................ 7 2.3 Issues in the Rural Development and Poverty Alleviation from Perspective of Bangladesh in Corporation City Biodiversity -

Prk Kerusi Parlimen Pasca Pru-14 Di Sabah: P186- Sandakan, P176-Kimanis, P185-Batu Sapi Dan Darurat

Volume 6 Issue 23 (April 2021) PP. 200-214 DOI 10.35631/IJLGC.6230014 INTERNATIONAL JOURNAL OF LAW, GOVERNMENT AND COMMUNICATION (IJLGC) www.ijlgc.com PRK KERUSI PARLIMEN PASCA PRU-14 DI SABAH: P186- SANDAKAN, P176-KIMANIS, P185-BATU SAPI DAN DARURAT THE POST GE-14 PARLIAMENTARY SEAT BY-ELECTIONS IN SABAH: P186- SANDAKAN, P176-KIMANIS, P185-BATU SAPI AND THE EMERGENCY Mohd Azri Ibrahim1*, Romzi Ationg2*, Mohd Sohaimi Esa3*, Irma Wani Othman4*, Saifulazry Mokhtar5 & Abang Mohd Razif Abang Muis6 1 Centre for the Promotion of Knowledge and Language Learning, Universiti Malaysia Sabah Email: [email protected] 2 Centre for the Promotion of Knowledge and Language Learning, Universiti Malaysia Sabah Email: [email protected] 3 Centre for the Promotion of Knowledge and Language Learning, Universiti Malaysia Sabah Email: [email protected] 4 Centre for the Promotion of Knowledge and Language Learning, Universiti Malaysia Sabah Email: [email protected] 5 Centre for the Promotion of Knowledge and Language Learning, Universiti Malaysia Sabah Email: [email protected] 6 Centre for the Promotion of Knowledge and Language Learning, Universiti Malaysia Sabah Email: [email protected] * Corresponding Author Article Info: Abstrak: Article history: Kertas kerja ini mengetengahkan perbincangan tentang pelaksanaan mahupun Received date: 15.01.2021 penangguhan Pilihanraya Kecil (PRK) di Sabah dalam era pasca Pilihanraya Revised date: 15.02.2021 Umum ke-14 (PRU-14) dan kaitannya dengan pelaksanaan Perintah Kawalan Accepted date: 15.03.2021 Pergerakan (PKP) serta darurat. Secara khusus, kertas kerja ini Published date: 30.04.2021 membincangkan secara mendalam pelaksanaan PRK di P186 Sandakan dan To cite this document: P176 Kimanis. -

M.V. Solita's Passage Notes

M.V. SOLITA’S PASSAGE NOTES SABAH BORNEO, MALAYSIA Updated August 2014 1 CONTENTS General comments Visas 4 Access to overseas funds 4 Phone and Internet 4 Weather 5 Navigation 5 Geographical Observations 6 Flags 10 Town information Kota Kinabalu 11 Sandakan 22 Tawau 25 Kudat 27 Labuan 31 Sabah Rivers Kinabatangan 34 Klias 37 Tadian 39 Pura Pura 40 Maraup 41 Anchorages 42 2 Sabah is one of the 13 Malaysian states and with Sarawak, lies on the northern side of the island of Borneo, between the Sulu and South China Seas. Sabah and Sarawak cover the northern coast of the island. The lower two‐thirds of Borneo is Kalimantan, which belongs to Indonesia. The area has a fascinating history, and probably because it is on one of the main trade routes through South East Asia, Borneo has had many masters. Sabah and Sarawak were incorporated into the Federation of Malaysia in 1963 and Malaysia is now regarded a safe and orderly Islamic country. Sabah has a diverse ethnic population of just over 3 million people with 32 recognised ethnic groups. The largest of these is the Malays (these include the many different cultural groups that originally existed in their own homeland within Sabah), Chinese and “non‐official immigrants” (mainly Filipino and Indonesian). In recent centuries piracy was common here, but it is now generally considered relatively safe for cruising. However, the nearby islands of Southern Philippines have had some problems with militant fundamentalist Muslim groups – there have been riots and violence on Mindanao and the Tawi Tawi Islands and isolated episodes of kidnapping of people from Sabah in the past 10 years or so. -

Sabah 90000 Tabika Kemas Kg

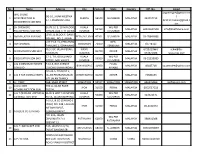

Bil Nama Alamat Daerah Dun Parlimen Bil. Kelas LOT 45 BATU 7 LORONG BELIANTAMAN RIMBA 1 KOMPLEKS TABIKA KEMAS TAMAN RIMBAWAN Sandakan Sungai SiBuga Libaran 11 JALAN LABUKSANDAKAN SABAH 90000 TABIKA KEMAS KG. KOBUSAKKAMPUNG KOBUSAK 2 TABIKA KEMAS KOBUSAK Penampang Kapayan Penampang 2 89507 PENAMPANG 3 TABIKA KEMAS KG AMAN JAYA (NKRA) KG AMAN JAYA 91308 SEMPORNA Semporna Senallang Semporna 1 TABIKA KEMAS KG. AMBOI WDT 09 89909 4 TABIKA KEMAS KG. AMBOI Tenom Kemabong Tenom 1 TENOM SABAH 89909 TENOM TABIKA KEMAS KAMPUNG PULAU GAYA 88000 Putatan 5 TABIKA KEMAS KG. PULAU GAYA ( NKRA ) Tanjong Aru Putatan 2 KOTA KINABALU (Daerah Kecil) KAMPUNG KERITAN ULU PETI SURAT 1894 89008 6 TABIKA KEMAS ( NKRA ) KG KERITAN ULU Keningau Liawan Keningau 1 KENINGAU 7 TABIKA KEMAS ( NKRA ) KG MELIDANG TABIKA KEMAS KG MELIDANG 89008 KENINGAU Keningau Bingkor Keningau 1 8 TABIKA KEMAS (NKRA) KG KUANGOH TABIKA KEMAS KG KUANGOH 89008 KENINGAU Keningau Bingkor Keningau 1 9 TABIKA KEMAS (NKRA) KG MONGITOM JALAN APIN-APIN 89008 KENINGAU Keningau Bingkor Keningau 1 TABIKA KEMAS KG. SINDUNGON WDT 09 89909 10 TABIKA KEMAS (NKRA) KG. SINDUNGON Tenom Kemabong Tenom 1 TENOM SABAH 89909 TENOM TAMAN MUHIBBAH LORONG 3 LOT 75. 89008 11 TABIKA KEMAS (NKRA) TAMAN MUHIBBAH Keningau Liawan Keningau 1 KENINGAU 12 TABIKA KEMAS ABQORI KG TANJUNG BATU DARAT 91000 Tawau Tawau Tanjong Batu Kalabakan 1 FASA1.NO41 JALAN 1/2 PPMS AGROPOLITAN Banggi (Daerah 13 TABIKA KEMAS AGROPOLITAN Banggi Kudat 1 BANGGIPETI SURAT 89050 KUDAT SABAH 89050 Kecil) 14 TABIKA KEMAS APARTMENT INDAH JAYA BATU 4 TAMAN INDAH JAYA 90000 SANDAKAN Sandakan Elopura Sandakan 2 TABIKA KEMAS ARS LAGUD SEBRANG WDT 09 15 TABIKA KEMAS ARS (A) LAGUD SEBERANG Tenom Melalap Tenom 3 89909 TENOM SABAH 89909 TENOM TABIKA KEMAS KG. -

The Kimanis By-Election: a Much-Needed Sweet (Manis) Victory for Warisan

ISSUE: 2020 No. 3 ISSN 2335-6677 RESEARCHERS AT ISEAS – YUSOF ISHAK INSTITUTE ANALYSE CURRENT EVENTS Singapore |16 January 2020 The Kimanis By-election: A Much-needed Sweet (Manis) Victory for Warisan Lee Poh Onn and Kevin Zhang*1 EXECUTIVE SUMMARY • On 18 January 2020, a by-election will be held for the parliamentary seat of Kimanis in Sabah. The Federal Court has upheld the Election Court's ruling that Anifah Aman's victory in the 14th General Elections (GE14) was nullified by election discrepancies. • This by-election is seen as a referendum on the Warisan state government’s performance over the past 18 months since replacing the Barisan Nasional (BN) after GE14, and the outcome would have some impact on Sabah Chief Minister Shafie Apdal’s standing. Warisan-PH and BN had won an equal number of state seats, but Warisan formed the state government only after the defection of some BN state assemblymen. At the Federal level, the Pakatan Harapan government sorely needs a victory in Kimanis to reverse the trend of by-election defeats it has suffered over the past year. • Warisan began the election contest on a stronger footing but it is shaping up to be a close fight. Both candidates, Warisan’s Karim Bujang and UMNO’s Mohamad Alamin, have strong political experience in Kimanis. • Bread and butter issues matter greatly to Kimanis residents who mostly suffer from low incomes and poor infrastructure. Warisan is on the defensive against the BN’s claims that the state government has failed to bring economic uplift to the area. -

The Financial Year 2012 Was, Without Doubt, Another Challenging Period for Tenaga Nasional Berhad (Tnb)

KEEPING THE LIGHTS ON YOU SEE Tenaga Nasional Berhad www.tnb.com.my No. 129, Jalan Bangsar, 59200 Kuala Lumpur Tel: 603 2180 4582 Fax: 603 2180 4589 Email: [email protected] Annual Report Annual 2012 Tenaga Nasional Berhad Tenaga 200866-W annual report 2012 WE SEE... OUR COMMITMENT TO THE NATION >OH[ `V\ ZLL PZ Q\Z[ VUL ZTHSS WPLJL VM [OL IPN WPJ[\YL 6\Y YVSL PZ [V WYV]PKL TPSSPVUZ VM 4HSH`ZPHUZ ^P[O HMMVYKHISL YLSPHISL LMMPJPLU[ HUK \UPU[LYY\W[LK HJJLZZ [V LSLJ[YPJP[` -YVT WV^LYPUN [OL UH[PVU»Z HKTPUPZ[YH[P]L JHWP[HS [V SPNO[PUN \W OV\ZLOVSKZ HUK LTWV^LYPUN HSS ZLJ[VYZ VM [OL LJVUVT` ^L OH]L OLSWLK YHPZL [OL X\HSP[` VM SPML PU [OL JV\U[Y` HUK ZW\Y [OL UH[PVU»Z WYVNYLZZ V]LY [OL `LHYZ 4VYL [OHU Q\Z[ SPNO[PUN \W OVTLZ HUK Z[YLL[Z ;5) PZ JVTTP[[LK [V LUZ\YPUN [OH[ L]LY` 4HSH`ZPHU PZ HISL [V LUQV` [OL ILULMP[Z VM LSLJ[YPJP[` LHJO HUK L]LY` KH` VM [OL `LHY I` RLLWPUN [OL SPNO[Z VU KEEPING THE LIGHTS ON INSIDEwhat’s TO BE AMONG THE LEADING VISION CORPORATIONS IN ENERGY AND RELATED BUSINESSES 4 Notice of the 22nd Annual General Meeting 7 Appendix I 9 Statement Accompanying Notice GLOBALLY of the 22nd Annual General Meeting 10 Financial Calendar 11 Investor Relations 14 Share Performance WE ARE 15 Facts at a Glance 16 Chairman’s Letter to Shareholders COMMITTED TO 22 President/CEO’s Review 33 Key Highlights 34 Key Financial Highlights EXCELLENCE 35 Five-Year Group Financial Summary MISSION IN OUR 36 Five-Year Group Growth Summary PRODUCTS AND SERVICES KEEPING THE LIGHTS ON Corporate Framework Operations Review 40 About Us 135 Core Businesses 42 Corporate Information 136 Generation 1 44 Group Corporate Structure 142 Transmission 5 46 Organisational Structure 146 Distribution 47 Awards & Recognition 153 Non-Core Businesses 51 Key Past Awards 154 New Business & Major Projects 54 Media Highlights 160 Group Finance 56 Calendar of Events 163 Planning 62 Milestones Over 60 Years 168 Corporate Affairs & Services 175 Procurement Performance Review Other Services 179 Sabah Electricity Sdn. -

Business Name Business Category Outlet Address State 2020 Motor

Business Name Business Category Outlet Address State 2020 Motor Automotive TB 12186 LOT A 13 TAMAN MEGAH JAYA,JALAN APASTAWAU Sabah 616 Auto Parts Co Automotive Kian yap Industrial lot 113 lorong durians 112 Lorong Durian 5 88450 Kota Kinabalu Sabah Malaysia Sabah 88 Bikers Automotive D-G-5, Ground Floor, Block D, Komersial 88/288 Marketplace, Ph.10A, Jalan Pintas, Kepayan RidgeSabah Sabah Alpha Motor Trading Automotive Alpha Motor Trading Jalan Sapi Nangoh Sabah Malaysia Sabah anna car rental Automotive Sandakan Airport Sabah Apollo service centre Automotive Kudat Sabah Malaysia Sabah AQIQ ENTERPRISE Automotive Lorong Cyber Perdana 3 Penampang Sabah Malaysia 89500 Sabah ar rizqi Automotive Beaufort, Sabah, Malaysia Sabah Armada KK Automobile Sdn Bhd Automotive Ground Floor, Lot No.46, Block E, Asia City, Phase 1B Sabah arsy hany car rental Automotive rumah murah peringkat 1 no 54 Pekan Beaufort Sabah Atlanz Tyres Automotive Kampung Keliangau, Kota Kinabalu, Sabah, Malaysia Sabah Autocycle Motor Sdn Bhd Automotive lot 39, grd polytechnic, 8, Jalan Politeknik, Tuaran, Sabah, Malaysia Sabah Autohaven Superstore Automotive kg sin san peti surat 588 Kudat Sabah Malaysia Sabah Automotive Electrical Tec Automotive No 3, Block H, Hakka Building, Mile 5,5, Tuaran Road, Inanam, Kota Kinabalu, Sabah, Malaysia Sabah Azmi Sparepart Automotive Papar Sabah Malaysia Sabah Bad Monkey Garage Automotive Kg Landong Ayang Jln Landong Ayang 2 Kg Landong Ayang Jalan Landong Ayang II Kudat Sabah Malaysia Sabah BANLEE MOTOR Automotive BANLEE MOTORBATU 1 JLN MERINTAMAN98850 -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 1ST HALF 2019 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR More market activity in the high-end condominium / HIGH END CONDOMINIUM serviced apartment segment (> RM1 million) in 2018 and MARKET this momentum is expected to continue into 2019. MARKET SUPPLY AND 1H2019 saw the launches of a INDICATIONS DEMAND few high-end condominium / The Malaysian economy continues with As of 1H2019, the completion of 602 units serviced apartment projects in its growth momentum albeit at a slower of high-end condominiums / serviced Kuala Lumpur City. The projects pace of 4.7% in 2018 (2017: 5.9%). It apartments from two projects brought are generally smaller in scale, on continued to expand 4.5% in 1Q2019 the cumulative supply in Kuala Lumpur pockets of land. (4Q2018: 4.7%), supported by private to 56,786(R) units. The completed projects sector expenditure. For the whole year were Opus KL (357 units) and Residensi The prices of new launches of 2019, economic growth is expected Sefina (245 units). remain flattish as the high-end to range between 4.3% and 4.8%. In (Note: (R) The cumulative supply has residential segment continues to May 2019, the Department of Statistics been revised) be challenging. Malaysia (DOSM) rebased of the country’s gross domestic product (GDP), The scheduled completion of Sky Suites In the secondary market, the from year 2010 to 2015. @ KLCC (986 units), 8 Kia Peng (442 units), Tower 1 and Tower 2 @ Star overall transacted price of The current period of low headline Residences (1,039 units), Aria KLCC selected schemes analysed was inflation, recorded at 1.0% in 2018 (2017: (598 units), Stonor 3 (400 units), Novum lower by 1.6% when compared 3.7%), is largely due to key policies such Bangsar (729 units), TWY Mont’ Kiara to 2018 as purchasers continue as the fixing of domestic retail fuel prices (484 units), Arte Mont’ Kiara (1,706 to be spoilt for choice. -

Real Estate Market Outlook 2019 Malaysia

CBRE|WTW RESEARCH | A P A C REAL ESTATE MARKET OUTLOOK MALAYSIA CBRE RESEARCH ABOUT US “2018’s property market was gripped by rigidity, high asking price of saleable assets restrains yield. This resulted in a quiet market where sizeable investments and significant deals were hard to come by. Slowly but surely, recovery shall make its way into 2019 once the dust settled in view of the recent change in government. The market could still brace for optimism with commercial and industrial sectors being the potential bright spot.” Sr FOO GEE JEN MANAGING DIRECTOR, CBRE | WTW FORMATION In 1975, C H Williams Talhar Wong & Yeo (WTWY) was CBRE | WTW entered into an agreement in May 2016 to established in Sarawak. C H Williams Talhar & Wong form a joint venture to provide a deep, broad service (Sabah) (WTWS) was established in 1977. offering for the clients of both firms. This combines Malaysia’s largest real estate services provider, WTW’s The current management is headed by Group Chairman, local expertise and in-depth relationships in Malaysia Mohd Talhar Abdul Rahman. with CBRE’s global reach and broad array of market leading services. The current Managing Directors of the WTW Group operations are: The union of CBRE and WTW is particularly significant because of our shared history. In the1970s, CBRE • CBRE | WTW: Mr. Foo Gee Jen acquired businesses from WTW in Singapore and Hong Kong, which remain an integral part of CBRE’s Asian • C H Williams Talhar & Wong (Sabah) Sdn Bhd: operations. Mr. Leong Shin Yau The wider WTW Group comprises a number of • C H Williams Talhar Wong & Yeo Sdn Bhd: subsidiaries and associated offices located in East Mr. -

Malaysia 2018 ASIA PACIFIC REAL ESTATE MARKET OUTLOOK | MALAYSIA

CBRE | WTW RESEARCH 2018 ASIA PACIFIC REAL ESTATE MARKET OUTLOOK Malaysia 2018 ASIA PACIFIC REAL ESTATE MARKET OUTLOOK | MALAYSIA FORMATION A B OU T W T W CBRE | WTW entered into an agreement in May 2016 to Colin Harold Williams established C H Williams & Co in form a joint venture to provide a deep, broad service offering Kuala Lumpur in 1960. C H Williams & Company merged for the clients of both firms. This combines Malaysia’s in 1974 with Talhar & Company founded by Mohd Talhar largest real estate services provider, WTW’s local expertise Abdul Rahman and the inclusion of Wong Choon Kee to and in-depth relationships in Malaysia with CBRE’s global form C H Williams Talhar & Wong (WTW). reach and broad array of market leading services. In 1975, C H Williams Talhar Wong & Yeo (WTWY) was The union of CBRE and WTW is particularly significant established in Sarawak. C H Williams Talhar & Wong because of our shared history. In the1970s, CBRE acquired (Sabah) (WTWS) was established in 1977. businesses from WTW in Singapore and Hong Kong, which remain an integral part of CBRE’s Asian operations. The current management is headed by Group Chairman, Mohd Talhar Abdul Rahman. The wider WTW Group comprises a number of subsidiaries and associated offices located in East Malaysia including: The current Managing Directors of the WTW Group operations are: • C H Williams Talhar Wong & Yeo Sdn Bhd (1975) • CBRE | WTW: Mr. Foo Gee Jen • C H Williams Talhar & Wong (Sabah) Sdn Bhd (1977) • C H Williams Talhar & Wong (Sabah) Sdn Bhd: Mr. -

No. Name Address City Postcod State Country Off. No. Email 1 JING

No. Name Address City Postcod State Country Off. No. Email [email protected] JING SHENG BG-16, JALAN MESTIKA / 1 CONSTRUCTION & CHERAS 56100 SELANGOR MALAYSIA 342957713 17, TAMAN MESTIKA [email protected] ENGINEERING SDN BHD om 2H OFFSHORE SUITE 16-3, 16TH FLOOR, KUALA WIL PER 2 50450 MALAYSIA 60321627500 [email protected] ENGINEERING SDN BHD WISMA UOA II, 21 JALAN LUMPUR K.LUMPUR LEVEL 8, BLOCK F, OASIS 3 3M MALAYSIA SDN BHD PETALING JAYA 47301 SELANGOR MALAYSIA 03-78842888 SQUARE, NO. 2, JALAN LOT 15 & 19, PERSIARAN NEG. 4 3M SEREMBA SEREMBAN 70450 MALAYSIA 66778111 TANJUNG 2, SENAWANG SEMBILAN PLO 317, JALAN PERAK, PASIR 072521288 / schw@5e- 5 5E RESOURCES SDN BHD 81700 JOHOR MALAYSIA KAWASAN GUDANG 072521388 resources.com 17-6, THE BOULEVARD KUALA WIL PER 6 8 EDUCATION SDN BHD 59200 MALAYSIA 03-22018089 OFFICE, MID VALLEY LUMPUR K.LUMPUR A & D DESIGN NETWORK F-10-3, BAY AVENUE PULAU 7 BAYAN LEPAS 11900 MALAYSIA 46447718 [email protected] SDN BHD LORONG BAYAN INDAH 1 PINANG NO 23-A, TINGKAT 1, 8 A & K TAX CONSULTANTS JALAN PEMBANGUNAN JOHOR BAHRU 81200 JOHOR MALAYSIA 72385635 OFF JALAN TAMPOI 9 A + PGRP 36B, SAGO STREET SINGAPORE 50927 SINGAPORE SINGAPORE 656325866 [email protected] A A DESIGN 390-A, JALAN PASIR 10 IPOH 31650 PERAK MALAYSIA 6052537518 COMMUNICATION SDN PUTEH, A H T (NORLAN UNITED) & BLOK B UNIT 4-8 IMPIAN KUALA WIL PER 11 50460 MALAYSIA 322722171 CARRIAGE SDN BHD KOTA, JALAN KAMPUNG LUMPUR K.LUMPUR A JALIL & CO SDN BHD ( IPOH ) NO. 14B, LALUAN IPOH 31350 PERAK MALAYSIA 05-3132072 MEDAH RAPAT, 12 A JALIL & CO SDN BHD GUNUNG RAPAT, NO.