Keeping Promises

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NICORP-Annualreport2011

NAIM INDAH CORPORATION BERHAD (Company No. 19727-P) ANNUAL REPORT 2011 1 NAIM INDAH CORPORATION BERHAD ANNUAL REPORT 2011 CONTENTS CORPORATE PROFILE 3 LIST OF PROPERTIES 40 CHAIRMAN’S STATEMENT 4 DIRECTORS’ REPORT 41 CHIEF EXECUTIVE OFFICER’S STATEMENT 6 STATEMENT BY DIRECTORS 46 SHARE PERFORMANCE 7 STATUTORY DECLARATION 46 CORPORATE STRUCTURE 8 INDEPENDENT AUDITORS’ REPORT 47 BOARD OF DIRECTORS 10 STATEMENTS OF FINANCIAL POSITION 49 AUDIT COMMITTEE 19 STATEMENTS OF COMPREHENSIVE INCOME 50 NOMINATION AND REMUNERATION 20 STATEMENTS OF CHANGES IN EQUITY 53 COMMITTEE STATEMENTS OF CASHFLOW 54 CORPORATE EVENTS 21 NOTES TO THE FINANCIAL STATEMENTS 56 CORPORATE GOVERNANCE STATEMENT 23 NOTICE OF ANNUAL GENERAL MEETING 127 STATEMENT OF INTERNAL CONTROL 28 PROXY FORM ENCLOSED AUDIT COMMITTEE REPORT 31 ANALYSIS OF SHAREHOLDINGS 37 Property Development Property Management 2 CORPORATE PROFILE NAIM INDAH CORPORATION BERHAD (NICORP) is predominantly engaged in the business of investment holding, theprovision of management and administrative services to its subsidiaries. It is listed on the Main Market of Bursa Malaysia Securities Berhad. Round Log Timber Extraction [email protected] 3 NAIM INDAH CORPORATION BERHAD ANNUAL REPORT 2011 CHAIRMAN’S STATEMENT Dear Shareholders, On behalf of the Board of Directors, I am pleased to present to you the 2011 Annual Report together with the Audited Financial Statements for the financial year ended 31 December 2011. Financial Review For the financial year ended 31 December 2011, we have achieved a turnover of RM14.88 million as compared to RM12.52 million in year 2010. This increment of turnover was mainly contributed by our focused efforts in the timber production segment, as well as, a marginal increment from our property investment segment. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 1ST HALF 2016 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR HIGH END CONDOMINIUM MARKET The residential market continues to remain lacklustre with lower volume and value of transactions recorded. ECONOMIC AND MARKET INDICATORS Limited project completions and new Malaysia’s economy expanded at a launches of high end condominiums / slower pace in 2015 with Gross Domestic residences during the review period. Product (GDP) growing at an annual rate of 5.0% (2014: 6.0%). For 2016, the Government has trimmed the country’s Growing pressure on rentals amid GDP growth forecast to 4 - 4.5% due to strong supply pipeline (existing and the volatility in crude oil prices and other new completions) and a challenging economic challenges. GDP continued rental market while prices in to moderate in the first quarter of 2016, the secondary market generally posting 4.2% growth, its slowest since continue to remain resilient. 3Q2009 (4Q2015: 4.5%), driven by domestic demand. Private consumption expanded by 5.3% while private Developers adopt innovative ‘push investment moderated to 2.2%. marketing’ strategies to boost Headline inflation for April 2016 registered at sales of selected projects and 2.1%. It is expected to be lower at 2% to 3% improve revenue. this year, compared to an earlier projection Aria of 2.5% to 3.5% and will continue to remain stable in 2017. (432 units) and The Residences at The Meanwhile, labour market conditions St. Regis Kuala Lumpur (160 units). continued to weaken with more retrenchment of workers, particularly in By the second half of 2016, the scheduled the manufacturing, mining and services completions of another five projects will sectors. -

The Financial Year 2012 Was, Without Doubt, Another Challenging Period for Tenaga Nasional Berhad (Tnb)

KEEPING THE LIGHTS ON YOU SEE Tenaga Nasional Berhad www.tnb.com.my No. 129, Jalan Bangsar, 59200 Kuala Lumpur Tel: 603 2180 4582 Fax: 603 2180 4589 Email: [email protected] Annual Report Annual 2012 Tenaga Nasional Berhad Tenaga 200866-W annual report 2012 WE SEE... OUR COMMITMENT TO THE NATION >OH[ `V\ ZLL PZ Q\Z[ VUL ZTHSS WPLJL VM [OL IPN WPJ[\YL 6\Y YVSL PZ [V WYV]PKL TPSSPVUZ VM 4HSH`ZPHUZ ^P[O HMMVYKHISL YLSPHISL LMMPJPLU[ HUK \UPU[LYY\W[LK HJJLZZ [V LSLJ[YPJP[` -YVT WV^LYPUN [OL UH[PVU»Z HKTPUPZ[YH[P]L JHWP[HS [V SPNO[PUN \W OV\ZLOVSKZ HUK LTWV^LYPUN HSS ZLJ[VYZ VM [OL LJVUVT` ^L OH]L OLSWLK YHPZL [OL X\HSP[` VM SPML PU [OL JV\U[Y` HUK ZW\Y [OL UH[PVU»Z WYVNYLZZ V]LY [OL `LHYZ 4VYL [OHU Q\Z[ SPNO[PUN \W OVTLZ HUK Z[YLL[Z ;5) PZ JVTTP[[LK [V LUZ\YPUN [OH[ L]LY` 4HSH`ZPHU PZ HISL [V LUQV` [OL ILULMP[Z VM LSLJ[YPJP[` LHJO HUK L]LY` KH` VM [OL `LHY I` RLLWPUN [OL SPNO[Z VU KEEPING THE LIGHTS ON INSIDEwhat’s TO BE AMONG THE LEADING VISION CORPORATIONS IN ENERGY AND RELATED BUSINESSES 4 Notice of the 22nd Annual General Meeting 7 Appendix I 9 Statement Accompanying Notice GLOBALLY of the 22nd Annual General Meeting 10 Financial Calendar 11 Investor Relations 14 Share Performance WE ARE 15 Facts at a Glance 16 Chairman’s Letter to Shareholders COMMITTED TO 22 President/CEO’s Review 33 Key Highlights 34 Key Financial Highlights EXCELLENCE 35 Five-Year Group Financial Summary MISSION IN OUR 36 Five-Year Group Growth Summary PRODUCTS AND SERVICES KEEPING THE LIGHTS ON Corporate Framework Operations Review 40 About Us 135 Core Businesses 42 Corporate Information 136 Generation 1 44 Group Corporate Structure 142 Transmission 5 46 Organisational Structure 146 Distribution 47 Awards & Recognition 153 Non-Core Businesses 51 Key Past Awards 154 New Business & Major Projects 54 Media Highlights 160 Group Finance 56 Calendar of Events 163 Planning 62 Milestones Over 60 Years 168 Corporate Affairs & Services 175 Procurement Performance Review Other Services 179 Sabah Electricity Sdn. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 2ND HALF 2016 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR HIGH END CONDOMINIUM MARKET Despite the subdued market, there were noticeably more ECONOMIC INDICATORS launches and previews in the TABLE 1 second half of 2016. Malaysia’s Gross Domestic Product Completion of High End (GDP) grew 4.3% in 3Q2016 from 4.0% Condominiums / Residences in in 2Q2016, underpinned by private 2H2016 The secondary market, however, expenditure and private consumption. continues to see lower volume Exports, however, fell 1.3% in 3Q2016 of transactions due to the weak compared to a 1.0% growth in 2Q2016. economy and stringent bank KL Trillion lending guidelines. Amid growing uncertainties in the Jalan Tun Razak external environment, a weak domestic KL City market and continued volatility in the 368 Units The rental market in locations Ringgit, the central bank has maintained with high supply pipeline and a the country’s growth forecast for 2016 at weak leasing market undergoes 4.0% - 4.5% (2015: 5.0%). correction as owners and Le Nouvel investors compete for the same Headline inflation moderated to 1.3% in Jalan Ampang 3Q2016 (2Q2016: 1.9%). pool of tenants. KL City 195 Units Unemployment rate continues to hold steady at 3.5% since July 2016 (2015: The review period continues to 3.1%) despite weak labour market see more developers introducing conditions. Setia Sky creative marketing strategies and Residences - innovative financing packages Bank Negara Malaysia (BNM) lowered the Divina Tower as they look to meet their sales Overnight Policy Rate (OPR) by 25 basis Jalan Raja Muda KL City target and clear unsold stock. -

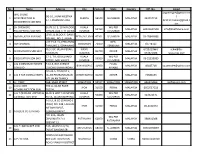

Business Name Business Category Outlet Address State 2020 Motor

Business Name Business Category Outlet Address State 2020 Motor Automotive TB 12186 LOT A 13 TAMAN MEGAH JAYA,JALAN APASTAWAU Sabah 616 Auto Parts Co Automotive Kian yap Industrial lot 113 lorong durians 112 Lorong Durian 5 88450 Kota Kinabalu Sabah Malaysia Sabah 88 Bikers Automotive D-G-5, Ground Floor, Block D, Komersial 88/288 Marketplace, Ph.10A, Jalan Pintas, Kepayan RidgeSabah Sabah Alpha Motor Trading Automotive Alpha Motor Trading Jalan Sapi Nangoh Sabah Malaysia Sabah anna car rental Automotive Sandakan Airport Sabah Apollo service centre Automotive Kudat Sabah Malaysia Sabah AQIQ ENTERPRISE Automotive Lorong Cyber Perdana 3 Penampang Sabah Malaysia 89500 Sabah ar rizqi Automotive Beaufort, Sabah, Malaysia Sabah Armada KK Automobile Sdn Bhd Automotive Ground Floor, Lot No.46, Block E, Asia City, Phase 1B Sabah arsy hany car rental Automotive rumah murah peringkat 1 no 54 Pekan Beaufort Sabah Atlanz Tyres Automotive Kampung Keliangau, Kota Kinabalu, Sabah, Malaysia Sabah Autocycle Motor Sdn Bhd Automotive lot 39, grd polytechnic, 8, Jalan Politeknik, Tuaran, Sabah, Malaysia Sabah Autohaven Superstore Automotive kg sin san peti surat 588 Kudat Sabah Malaysia Sabah Automotive Electrical Tec Automotive No 3, Block H, Hakka Building, Mile 5,5, Tuaran Road, Inanam, Kota Kinabalu, Sabah, Malaysia Sabah Azmi Sparepart Automotive Papar Sabah Malaysia Sabah Bad Monkey Garage Automotive Kg Landong Ayang Jln Landong Ayang 2 Kg Landong Ayang Jalan Landong Ayang II Kudat Sabah Malaysia Sabah BANLEE MOTOR Automotive BANLEE MOTORBATU 1 JLN MERINTAMAN98850 -

No. Name Address City Postcod State Country Off. No. Email 1 JING

No. Name Address City Postcod State Country Off. No. Email [email protected] JING SHENG BG-16, JALAN MESTIKA / 1 CONSTRUCTION & CHERAS 56100 SELANGOR MALAYSIA 342957713 17, TAMAN MESTIKA [email protected] ENGINEERING SDN BHD om 2H OFFSHORE SUITE 16-3, 16TH FLOOR, KUALA WIL PER 2 50450 MALAYSIA 60321627500 [email protected] ENGINEERING SDN BHD WISMA UOA II, 21 JALAN LUMPUR K.LUMPUR LEVEL 8, BLOCK F, OASIS 3 3M MALAYSIA SDN BHD PETALING JAYA 47301 SELANGOR MALAYSIA 03-78842888 SQUARE, NO. 2, JALAN LOT 15 & 19, PERSIARAN NEG. 4 3M SEREMBA SEREMBAN 70450 MALAYSIA 66778111 TANJUNG 2, SENAWANG SEMBILAN PLO 317, JALAN PERAK, PASIR 072521288 / schw@5e- 5 5E RESOURCES SDN BHD 81700 JOHOR MALAYSIA KAWASAN GUDANG 072521388 resources.com 17-6, THE BOULEVARD KUALA WIL PER 6 8 EDUCATION SDN BHD 59200 MALAYSIA 03-22018089 OFFICE, MID VALLEY LUMPUR K.LUMPUR A & D DESIGN NETWORK F-10-3, BAY AVENUE PULAU 7 BAYAN LEPAS 11900 MALAYSIA 46447718 [email protected] SDN BHD LORONG BAYAN INDAH 1 PINANG NO 23-A, TINGKAT 1, 8 A & K TAX CONSULTANTS JALAN PEMBANGUNAN JOHOR BAHRU 81200 JOHOR MALAYSIA 72385635 OFF JALAN TAMPOI 9 A + PGRP 36B, SAGO STREET SINGAPORE 50927 SINGAPORE SINGAPORE 656325866 [email protected] A A DESIGN 390-A, JALAN PASIR 10 IPOH 31650 PERAK MALAYSIA 6052537518 COMMUNICATION SDN PUTEH, A H T (NORLAN UNITED) & BLOK B UNIT 4-8 IMPIAN KUALA WIL PER 11 50460 MALAYSIA 322722171 CARRIAGE SDN BHD KOTA, JALAN KAMPUNG LUMPUR K.LUMPUR A JALIL & CO SDN BHD ( IPOH ) NO. 14B, LALUAN IPOH 31350 PERAK MALAYSIA 05-3132072 MEDAH RAPAT, 12 A JALIL & CO SDN BHD GUNUNG RAPAT, NO. -

Property Market Review | 2020–2021 3

2021 2020 / MARKET REVIEW MARKET PROPERTY 2020 / 2021 CONTENTS Foreword | 2 Property Market Snapshot | 4 Northern Region | 7 Central Region | 33 Southern Region | 57 East Coast Region | 75 East Malaysia Region | 95 The Year Ahead | 110 Glossary | 113 This publication is prepared by Rahim & Co Research for information only. It highlights only selected projects as examples in order to provide a general overview of property market trends. Whilst reasonable care has been exercised in preparing this document, it is subject to change without notice. Interested parties should not rely on the statements or representations made in this document but must satisfy themselves through their own investigation or otherwise as to the accuracy. This publication may not be reproduced in any form or in any manner, in part or as a whole, without writen permission from the publisher, Rahim & Co Research. The publisher accepts no responsibility or liability as to its accuracy or to any party for reliance on the contents of this publication. 2 FOREWORD by Tan Sri Dato’ (Dr) Abdul Rahim Abdul Rahman Executive Chairman, Rahim & Co Group of Companies 2020 came through as the year to be remembered but not in the way anyone had expected or wished for. Malaysia saw its first Covid-19 case on 25th January 2020 with the entrance of 3 tourists via Johor from Singapore and by 17th March 2020, the number of cases had reached above 600 and the Movement Control Order (MCO) was implemented the very next day. For two months, Malaysia saw close to zero market activities with only essential goods and services allowed as all residents of the country were ordered to stay home. -

The AXIS-REIT TEAM

The AXIS-REIT TEAM AXIS-REIT ANNUAL REPORT 2012 61 The Axis-REIT TEAM 2. 6. 4. 1. 3. 7. 1. Y Bhg Dato’ George Stewart LaBrooy 5. Chief Executive Officer/Executive Director 2. Leong Kit May 5. Stephanie Ping Chief Financial Officer/Executive Director Head of Business Development and Investor Relations 3. Chan Wai Leo Head of Origination and Investments 6. Selina Khor Property Manager 4. Jackie Law Head of Real Estate 7. Siva Shankar General Manager of Facilities Management 62 AXIS-REIT ANNUAL REPORT 2012 11. 9. 8. 13. 12. 10. 8. Nikki Ng Head of Credit Control 11. Pauline Tan Head of Legal and Compliance 9. Tan Kee Hong Finance Manager 12. Stacy Cheng Assistant Accountant 10. James Gorgey Building Technical Services and Project 13. Rebecca Leong Manager External Company Secretary from Archer Corporate Services Sdn Bhd AXIS-REIT ANNUAL REPORT 2012 63 The Axis-REIT TEAM Y Bhg Dato’ George Stewart LaBrooy Chief Executive Officer/ Executive Director Dato’ Stewart LaBrooy is responsible for the overall management and operations of Axis-REIT. He works closely with the Executive Committee and the Board of Directors to formulate the strategic direction for the Fund. Together with the members of his management team, he works to ensure that all business activities are in alignment with the Fund’s strategic goals. Dato’ Stewart has been a spokesperson for the Malaysian REIT Industry since listing and has been an invited speaker at several prominent international, regional and local property and REIT conferences. He is an active member of APREA (“Asian Public Real Estate Association”) where he serves as Vice President on the Executive Board and is the Chairman of the Malaysian REIT Managers Association (MRMA). -

2018 >> Group Highlights 2018

Stay Together. Stay Integrated Report 2018 >> GROUP HIGHLIGHTS 2018 Earnings Per Share 14.8 sen Shareholders Fund Dividend Per Share RM14.14 8.55 sen billion Ongoing Projects 45 Effective Land Banks 9,516 acres Revenue Strong GDV in the Pipeline Unbilled Sales Total Sales RM3.59 RM149.70 RM12.32 Achieved billion billion billion RM5.12 Profit Before Tax Profit Attributable to Owners Total Strong, Dynamic & billion RM991.0 of the Company Diversified Employees million RM671.0 2,300 million People* * Approximate 1 STAY TOGETHER. STAY SETIA >> Inside this Report Our growth trajectory is anchored in sound fundamentals. Our diligence, integrity and Content persistent focus on sound business practices provide a solid foundation for our continued delivery of value in the long term. Introduction 6 Our Approach to Reporting With decades of experience setting the bar in 8 About This Integrated Report Malaysia’s property market, we know beyond a doubt that it is only together that we can thrive. Our Business Our success is a truly befitting reflection of our 10 Who We Are belief that together, we can weather all challenges 12 Our Presence and achieve even greater heights. 14 Corporate Structure 17 Corporate Information As we continue to expand, we are also now 18 Corporate Calendar celebrating the deeper meaning that our name 25 Accolades stands for. We remain loyal to our stakeholders and steadfast in our commitment to quality and Our Leadership growth – striving to ensure a better life for all. 26 Chairman’s Message 30 Board of Directors Therefore, in staying true to our nature and our 40 Key Management Profile name, we will continue to “STAY TOGETHER. -

Cover Story Featured Property

Editor Chief Operating Officer’s Foreword Roshan Kaur Sandhu Writer Reena Kaur Bhatt Head of Creatives Angeline Lim Senior Graphic Designers Jason Kwong Wing Wong Junior Graphic Designer Rechean Soong Ad Operations Executive Nur Alia Ahamd Tamezi Chief Operating Officer - International Arthur Charlaftis Group Finance Director Kenneth A Kent General Manager (Agent Sales) Leon Kong Chief Information Officer Changing The Way The World Experiences Harmit Singh Property! The iProperty Group was welcomed into the REA Group family Head of iProperty TV earlier this year and our growing global team have already united a Jonathan Ong common goal - to change the way the world experiences property. International Correspondents Ee Von Ng & Leslie Lin Just how are we changing the way the world experiences property? Well, with our International site, we have more than 4 million property listings from 56 countries. That’s a world of properties right at your fingertips. To help you make an informed decision about your next property move, iPropertyIQ.com offers insights and data into the property iProperty.com Malaysia Sdn Bhd (600850-K) market. The site offers the most comprehensive source of property Suite 11.01, Level 11 Menara IGB Mid Valley City, Lingkaran Syed Putra data and analytics for Malaysia, Singapore, Indonesia and Hong 59200 Kuala Lumpur, Malaysia Kong, delivering incredible value to property agents, investors and Phone: (603) 2264 6888 developers. Fax: (603) 2264 6900 Sales enquiries: [email protected] We want to continue to deliver innovative solutions that meet the Editorial matters: [email protected] General enquiries: [email protected] needs of both our customers and consumers today and well into Subscription: [email protected] the future. -

Dewan Rakyat

Bil. 13 Isnin 31 Mac 2014 MALAYSIA PENYATA RASMI PARLIMEN DEWAN RAKYAT PARLIMEN KETIGA BELAS PENGGAL KEDUA MESYUARAT PERTAMA K A N D U N G A N JAWAPAN-JAWAPAN LISAN BAGI PERTANYAAN-PERTANYAAN (Halaman 1) RANG UNDANG-UNDANG DIBAWA KE DALAM MESYUARAT (Halaman 19) RANG UNDANG-UNDANG: Rang Undang-undang Perbekalan Tambahan (2013) 2014 (Halaman 20) USUL-USUL: Waktu Mesyuarat dan Urusan Dibebaskan Daripada Peraturan Mesyuarat (Halaman 19) Usul Anggaran Pembangunan Tambahan Pertama 2013 (Halaman 24) --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- Diterbitkan Oleh: CAWANGAN PENYATA RASMI PARLIMEN MALAYSIA 2014 DR 31.3.2014 i AHLI-AHLI DEWAN RAKYAT 1. Yang Berhormat Tuan Yang di-Pertua, Tan Sri Datuk Seri Panglima Pandikar Amin Haji Mulia, P.S.M., S.P.D.K., S.U.M.W., P.G.D.K., J.S.M., J.P. 2. “ Timbalan Yang di-Pertua, Datuk Seri Ronald Kiandee, P.G.D.K., A.S.D.K. [Beluran] - UMNO 3. “ Timbalan Yang di-Pertua, Dato’ Haji Ismail bin Haji Mohamed Said, D.I.M.P., S.M.P., K.M.N. [Kuala Krau] - UMNO MENTERI 1. Yang Amat Berhormat Perdana Menteri dan Menteri Kewangan I, Dato’ Sri Mohd. Najib bin Tun Abdul Razak, Orang Kaya Indera Shah Bandar, S.P.D.K., S.S.A.P., S.S.S.J., S.I.M.P., D.P.M.S., D.S.A.P., P.N.B.S. (Pekan) – UMNO 2. “ Timbalan Perdana Menteri dan Menteri Pendidikan I, Tan Sri Dato’ Haji Muhyiddin bin Mohd. Yassin, P.S.M., S.P.M.P., S.P.M.J., S.M.J., P.I.S., B.S.I. -

Rahim & Co Research Property Market Review 2016 / 2017

Property Market Review 2016/2017 1 FOREWORD Standard & Poor’s affirmed Malaysia’s A- sovereign rating with strong external position & monetary policy flexibility 2016 was a year of unpredictability I would say. First is the Growth – Inclusive Prudent Spending – Wellbeing of The Rakyat”, a Brexit Referendum results which surprised many, then Portugal pragmatic and Rakyat-Centric budget has emphasized such priority defeated the home favourites’ France and won their first European to enhance the living standards of the rakyat with a special focus on Championship, followed by the election of the Republican candidate the lower and middle-income groups through various programmes Donald Trump as the 45th president of the United States of America and provisions. These include special “step-up” financing for outnumbering the pollster’s pre-election favourite Hillary Clinton PR1MA programme, a “house for rent” programme, stamp-duty just before the end of the year. exemption on instruments of transfer and loan agreement for first home ownership. All these initiatives are aimed to encourage more On the Malaysian property scene, 2016 saw another challenging home ownership and to benefit first-time home buyers. This will year under a tough environment from both the economic and also indirectly boost the property sector especially in the affordable property fronts. Numbers reported in the Property Market Report housing segment. by the Valuation & Property Services Department (JPPH) showed the prolonging of the downward trend in property market activity The World Bank’s “Economic Monitor Report” released in June that started since 2013 though it momentarily improved in 2014 by 2016 had estimated the Malaysian economy to grow at a slower 0.8%.