Introducing Financial Capability Skills: a Pilot Study with Fairbridge West, Bristol

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Northumberland and Durham Family History Society Unwanted

Northumberland and Durham Family History Society baptism birth marriage No Gsurname Gforename Bsurname Bforename dayMonth year place death No Bsurname Bforename Gsurname Gforename dayMonth year place all No surname forename dayMonth year place Marriage 933ABBOT Mary ROBINSON James 18Oct1851 Windermere Westmorland Marriage 588ABBOT William HADAWAY Ann 25 Jul1869 Tynemouth Marriage 935ABBOTT Edwin NESS Sarah Jane 20 Jul1882 Wallsend Parrish Church Northumbrland Marriage1561ABBS Maria FORDER James 21May1861 Brooke, Norfolk Marriage 1442 ABELL Thirza GUTTERIDGE Amos 3 Aug 1874 Eston Yorks Death 229 ADAM Ellen 9 Feb 1967 Newcastle upon Tyne Death 406 ADAMS Matilda 11 Oct 1931 Lanchester Co Durham Marriage 2326ADAMS Sarah Elizabeth SOMERSET Ernest Edward 26 Dec 1901 Heaton, Newcastle upon Tyne Marriage1768ADAMS Thomas BORTON Mary 16Oct1849 Coughton Northampton Death 1556 ADAMS Thomas 15 Jan 1908 Brackley, Norhants,Oxford Bucks Birth 3605 ADAMS Sarah Elizabeth 18 May 1876 Stockton Co Durham Marriage 568 ADAMSON Annabell HADAWAY Thomas William 30 Sep 1885 Tynemouth Death 1999 ADAMSON Bryan 13 Aug 1972 Newcastle upon Tyne Birth 835 ADAMSON Constance 18 Oct 1850 Tynemouth Birth 3289ADAMSON Emma Jane 19Jun 1867Hamsterley Co Durham Marriage 556 ADAMSON James Frederick TATE Annabell 6 Oct 1861 Tynemouth Marriage1292ADAMSON Jane HARTBURN John 2Sep1839 Stockton & Sedgefield Co Durham Birth 3654 ADAMSON Julie Kristina 16 Dec 1971 Tynemouth, Northumberland Marriage 2357ADAMSON June PORTER William Sidney 1May 1980 North Tyneside East Death 747 ADAMSON -

Child Immigrants to the “Edge of Empire”: Fairbridge Child Migrants and British Columbia's Quest for the Construction of T

CHILD IMMIGRANTS TO THE “EDGE OF EMPIRE”: FAIRBRIDGE CHILD MIGRANTS AND BRITISH COLUMBIA’S QUEST FOR THE CONSTRUCTION OF THE “WHITE MAN’S PROVINCE” by Daniel Vallance B.A., Lancaster University, 2010 A THESIS SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF ARTS in The Faculty of Graduate Studies (History) THE UNIVERSITY OF BRITISH COLUMBIA (Vancouver) April 2013 © Daniel Vallance, 2013 Abstract Beginning in the 1860s British children participated in migration schemes to Canada. Philanthropists, motivated by evangelical beliefs and despair at the state of childhood for homeless and dependent children in Britain, would send 80,000 British boys and girls to Canada between 1867 and 1929. Placed with Canadian families in rural communities, the schemes directed these children toward lives as farm labourers and housewives. By the 1920s, rampant opposition to these child migration schemes in central and eastern Canada brought about their termination. Opponents of child migration, mobilized the language of eugenics to condemn the children sent to Canada as “degenerate castoffs” of British society, and argued that the children were beyond saving and posed a threat to Canadian society. This was not the end of child migration to Canada, however, for in 1935 the Fairbridge Society, a rescue organization, opened the Prince of Wales Fairbridge Farm School in British Columbia. This final scheme would see 329 children sent to British Columbia before its demise in 1950. The earlier period of child migration to Canada, 1860 to 1929, has received the majority of scholarly attention with the recommencement in 1935 often overlooked. This thesis examines how the Fairbridge Farm School at Cowichan Station was able to open and operate in British Columbia without popular opposition by exploring how British Columbian constructions of whiteness were projected onto and internalized by the operators of the Farm School and its children, and in doing this incorporate the Fairbridge Farm School into the larger narrative of child migration to Canada. -

A Stitch in Time: Tackling Educational Disengagement Interim Report

a stitch in time: tackling educational disengagement interim report SONIA SODHA SILVIA GUGLIELMI Body paragraph indent · Folio right aligned here ChapterChapter titles alwaystitle & underlinestart here starts· Figure's here scale aligned here 4mm 4 Open access. Some rights reserved. As the publisher of this work, Demos wants to encourage the circulation of our work as widely as possible while retaining the copyright. We therefore have an open access policy which enables anyone to access our content online without charge. Anyone can download, save, perform or distribute this work in any format, including translation, without written permission. This is subject to the terms of the Demos licence found at the back of this publication. Its main conditions are: · Demos and the author(s) are credited · This summary and the address www.demos.co.uk are displayed · The text is not altered and is used in full · The work is not resold · A copy of the work or link to its use online is sent to Demos You are welcome to ask for permission to use this work for purposes other than those covered by the licence. Demos gratefully acknowledges the work of Creative Commons in inspiring our approach to copyright. To find out more go to www.creativecommons.org 2 Body paragraph indent · Folio right aligned here ChapterChapter titles alwaystitle & underlinestart here starts· Figure's here scale aligned here 4mm 4 acknowledgements This report could not have been written without assistance from many individuals and organisations. We would particular- ly like to thank the Private Equity Foundation for its generous financial support of this research project. -

OHSAS 18001:2007 (Occupational

Certificate of Registration OCCUPATIONAL HEALTH & SAFETY MANAGEMENT SYSTEM - BS OHSAS 18001:2007 This is to certify that: Viridor Waste Management Limited Youngman Place Priory Bridge Road Taunton TA1 1AP United Kingdom Holds Certificate Number: OHS 518972 and operates an Occupational Health and Safety Management System which complies with the requirements of BS OHSAS 18001:2007 for the following scope: The management, operation and associated support services for recycling and resource activities; including composting, recycling of glass, electrical, paper, metals and plastic, recovery of energy from non-recyclable residual wastes (including anaerobic digestion, gas extraction and thermal technologies), the collection, transfer and transportation of recyclates, and safe disposal of residual wastes. For and on behalf of BSI: Andrew Launn, EMEA Systems Certification Director Original Registration Date: 2007-05-04 Effective Date: 2018-09-13 Latest Revision Date: 2018-09-12 Expiry Date: 2021-03-11 Page: 1 of 24 This certificate was issued electronically and remains the property of BSI and is bound by the conditions of contract. An electronic certificate can be authenticated online. Printed copies can be validated at www.bsigroup.com/ClientDirectory Information and Contact: BSI, Kitemark Court, Davy Avenue, Knowlhill, Milton Keynes MK5 8PP. Tel: + 44 345 080 9000 BSI Assurance UK Limited, registered in England under number 7805321 at 389 Chiswick High Road, London W4 4AL, UK. A Member of the BSI Group of Companies. Certificate No: OHS 518972 -

New Horizons: Towards a Shared Vision for Mental Health

New Horizons Towards a shared vision for mental health Consultation DH INFORMATION READER BOX Policy Estates HR/Workforce Commissioning Management IM&T Planning/Performance Finance Clinical Social Care/Partnership Working Document purpose Consultation/Discussion Gateway reference 11640 Title New Horizons: Towards a shared vision for mental health: Consultation Author Department of Health: Mental Health Division Publication date 23 July 2009 Target audience PCT CEs, NHS Trust CEs, SHA CEs, Care Trust CEs, Foundation Trust CEs, Medical Directors, Directors of PH, Directors of Nursing, local authority CEs, Directors of Adult SSs, PCT Chairs, NHS Trust Board Chairs, Special HA CEs, Directors of Finance, allied health professionals, GPs, communications leads, emergency care leads, Directors of Children’s SSs, public health leads and specialists, National Mental Health Development Unit Circulation list Organisations of services users, other government departments, headteachers, employers, Royal Colleges Description New Horizons: public consultation on a new vision for mental health and well being to help develop the promotion of mental health and well-being across the population, improve the quality and accessibility of services, and to enable SHAs to deliver their regional visions, in a way that reflects the changed nature of the NHS Cross ref N/A Superseded docs National Service Framework for Mental Health Action required N/A Timing Public consultation closes on Thursday 15 October 2009 Contact details New Horizons Programme Administrator -

Rcjm No 76.Indd Sec1:38 27/05/2009 16:14:50: Class Or Ethnic Background Is

11MILLION Takeover Day PEOPLE 11MILLION Takeover Day is organised by Sir Al Aynsley- Green, the Children’s Commissioner for England, UNG where children and young people are invited to work YO alongside adults to make a change and get involved in decision making. AND national call-out was made to decision makers in MENCAP staff magazine, and interviewed some of the government, politicians, local councils, students taking part in 11MILLION Takeover Day. They Abusinesses, charities, schools, youth projects, also interviewed Sue Berelowitz, the Deputy Children’s emergency services and the results from last year’s event Commissioner for England, who made a special visit to CHILDREN were amazing. Mencap for Takeover Day. Tom invited Sue to visit At least 17,000 children and young people worked Chelmsford New Model Special School, which she alongside 700 organisations during Takeover Day 2008, accepted and will be visiting the school in the near including Ed Balls MP, Secretary of State for Children and future. Jessica and Andrew worked on the MENCAP anti- Phil Hope MP, Care Services Minister. bullying campaign for the day. 11MILLION Takeover Day is about giving children All the students enjoyed their day and gave their views and young people opportunities to make a positive at a recent student council meeting. contribution in their communities. Many organisations Tom said: ‘I had fun learning about the MENCAP regularly work with children and young people to gather website and interviewing young people and Sue’. their views and involve them in decision making and Jacqueline remembered that she ‘enjoyed the journey Takeover Day is a great opportunity to shine a spotlight to London, especially when our teacher’s rucksack was on what they are doing. -

Child Migrants Trust

CHILD MIGRANTS TRUST Submission to the Senate Community Affairs References Committee Inquiry into Child Migration JANUARY 2001 CHAPTER 1 CHILD MIGRANTS TRUST Flaws & Faults 26 1 Post Traumatic Stress Disorder 27 The Launch of the Child Migrants Relatives & Reunions 27 Trust in Australia 2 Citizenship & Choice 29 Differences & Diversity 29 CHAPTER 2 The Present Experience 30 Needs & Numbers 30 CHILD MIGRATION Introduction 3 Historical Background 4 CHAPTER 5 The Second World War 5 CONSEQUENCES FOR Post-War Reconstruction 6 INDIVIDUALS & FAMILIES Definitions & Destinations 7 Secondary Abuse 32 Migrating Agencies & Motives 7 Courts & Convictions 33 ‘Orphans’ as solutions and problems 8 Rhetoric & Reality 9 CHAPTER 6 Series of Scandals 10 ETHICS & AGENCIES 34 Roles & Resources 10 Protocols & Procedures 35 The Cost of Poor Quality 11 Constraints & Complaints 35 CHAPTER3 CHAPTER 7 THE CHILD MIGRATION PREVIOUS INQUIRIES & POLICY EXPERIENCE RESPONSES Introduction 12 Benefits & Betrayal 37 Identity & Illegitimacy 14 U.K. Health Select Committee 37 Concerns & Citizenship 14 Support Fund & I.S.S. 38 Information & Identity 15 Child Migrant Central Index 39 Routes to Reunions 16 Charities & Credibility 17 CHAPTER 8 CHAPTER 4 AUSTRALIAN GOVERNMENT SPECIALISM & PROFESSIONAL RESPONSE 41 ISSUES The Specialist, Professional & CHAPTER 9 Unique Role of the Child Migrants CONCLUSION Trust in Australia and the U.K. 18 A Decade of Policy Responses 43 Acknowledgement & Advocacy 19 Justifications 44 Safe & Welcoming 20 Conclusion 45 Continuity 21 Bringing the -

Registered Number

Refugee Action's Annual Report 2011-2012 Our vision is of a society in which refugees are welcome, respected and safe, and in which they can realise their full potential. Refugee Action Annual report and accounts | April 2011 to March 2012 1 ----------------------------------------------------------------------------------------------------------------------------------- In a small village near the Indian border in south-west Bhutan, a 13-year-old boy with a passion for learning and a bright future arrived at school one morning to find it had been closed down. More than three decades later, Prem Giri, who was denied an education at such an early age, holds a postgraduate degree in business studies and accountancy. “[In Bhutan] People were being treated like animals,” remembers Prem. “In 1990 a national demonstration took place to demand human rights and democracy. I was a young student and didn’t know what that meant at the time. After the demonstrations, the government closed down the schools. For years afterwards, there was no education in southern Bhutan.” The government was carrying out a policy of ethnic cleansing designed to displace Bhutanese nationals of Nepali origin in the south. Prem clearly remembers the day he had to leave his homeland. “It was 17 December 1992, a national holiday in Bhutan, when we fled from the country. We left at night and crossed the border into India, and then from India into Nepal.” For 18 years, Prem and his family lived in a refugee camp in Bilangi, Nepal. Prem completed his secondary education in the camp, and recalls how he would sit on the muddy floor in the cramped, makeshift bamboo classroom among up to 100 other students, without even the use of books and pens. -

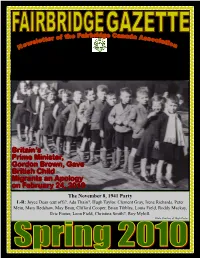

Spring 2010 Page 3

Britain’s Prime Minister, Gordon Brown, Gave British Child Migrants an Apology on February 24, 2010 The November 8, 1941 Party L-R: Joyce Dean (cut off)?, Ada Thain?, Hugh Taylor, Clement Gray, Irene Richards, Peter Mein, Mary Redshaw, May Bean, Clifford Cooper, Brian Tibbles, Louis Field, Roddy Mackay, Eric Foster, Leon Field, Christina Smith?, Roy Myhill. Photo Courtesy of Hugh Taylor Fairbridge Gazette Page 2 Inside this issue: Laugh of the season Laugh of the season 2 A young monk arrives at the monastery. He is assigned to helping the other monks in copying the old canons Committee Members 3 and laws of the church by hand. Message from the President 4 He notices, however, that all of the monks are copying from copies, not from the original manuscript. So, the Message from the Vice President 5 new monk goes to the head abbot to question this, point- Message from the Past President 6 ing out that if someone made even a small error in the first copy, it would never be picked up! In fact, that er- Spring Greetings from Pat 6 ror would be continued in all of the subsequent copies. Britain’s PM Gordon Brown’s Apology 7 The head monk says, “We have been copying from the copies for centuries, but you make a good point, my Corresponding Secretary News 8 son.” Canadian Child Migration Timeline 8-13 He therefore goes down into the dark caves underneath the monastery where the original manuscripts are held as Letter from the Treasurer, Barry Hagan 13 archives in a locked vault that hasn’t been opened for Phil McColeman letter & Motion 14 hundreds of years. -

University of Southampton Research Repository Eprints Soton

University of Southampton Research Repository ePrints Soton Copyright © and Moral Rights for this thesis are retained by the author and/or other copyright owners. A copy can be downloaded for personal non-commercial research or study, without prior permission or charge. This thesis cannot be reproduced or quoted extensively from without first obtaining permission in writing from the copyright holder/s. The content must not be changed in any way or sold commercially in any format or medium without the formal permission of the copyright holders. When referring to this work, full bibliographic details including the author, title, awarding institution and date of the thesis must be given e.g. AUTHOR (year of submission) "Full thesis title", University of Southampton, name of the University School or Department, PhD Thesis, pagination http://eprints.soton.ac.uk University of Southampton THE MIGRATION AND ACCUMULATION OF RADIONUCLIDES IN THE RAVENGLASS SALTMARSH, CUMBRIA, UK December 1999 A thesis submitted for the degree of Doctor of Philosophy Jung-Suk Oh (BSc, MSc) Faculty of Science School of Ocean and Earth Science Southampton Oceanography Centre ABSTRACT Profiles of 241Am, 137Cs, 238Pu, 239240pu & 24lPu have been studied in four cores collected from the Ravenglass saltmarsh, Cumbria and one core collected from the Irish Sea, near the effluent pipeline of the Sellafield nuclear reprocessing plant. Major and trace elements have also been measured to look at the effects of sediment composition and any redox controls on element redistribution. In addition, almost one hundred surface scrape samples were collected from the Ravenglass saltmarsh and the same radionuclides were measured to study the lateral distribution of radionuclides. -

A-Z Index 1858-1878

DATE PROVED PAGE NUMBER SURNAME FIRST NAME[S] ABODE TOWN/VILLAGE/PARISH DATE OF DEATH VALUE OCCUPATION NOTES 1863-09-07 308 ABBOT John Gateshead(Durham) 1863-07-18 £300,000 Iron Manufacturer 1867-02-22 90 ABBOT John George 4,Saville Place Newcastle upon Tyne 1867-02-05 £600,000 Iron/Brass Founder 1872-11-05 575 ABSALOM Robert Market St,Blyth Horton 1872-08-18 £200 (Rtd) Mariner (Merchant Service) 1865-03-09 135 ACASTER Hannah Maria 1,Milk Market,Sandgate Newcastle upon Tyne 1865-02-14 £450 Widow 1863-07-30 270 ACASTER Stephen Newcastle upon Tyne 1863-07-06 £450 Victualler 1877-06-20 346 ADAMS Charles Wallsend 1877-05-30 £450 House Agent 1876-04-26 267 ADAMS Robert Wallsend 1875-12-19 £200 Engineer's Clerk 1864-08-03 303 ADAMS Thomas Kirton Tce,Elswick Newcastle upon Tyne 1864-06-13 £100 Shoemaker 1867-10-17 493 ADAMSON Israel 76,Blenheim St Newcastle upon Tyne 1867-08-03 £200 Mason 1861-03-06 104 ADAMSON Thomas Spittalshields Hexham 1860-12-26 £800 Yeoman 1878-07-18 395 ADDERLEY George Lemington 1878-06-28 £200 River Tyne Commissioners Watchman Late of Blaydon,Durham. Died in a boat on River Tyne 1871-01-26 33 ADDISON Matthew 7,Brougham Place,Scotswood Rd Newcastle upon Tyne 1870-12-18 £20 Engineer 1874-10-08 555 ADDISON Matthew Hexham 1874-08-22 £800 Innkeeper (Rtd) 1874-05-23 295 ADLER Edward Warkworth 1874-03-29 £450 Master Mariner 1865-09-13 419 ADSHEAD Aaron Bedlington 1865-07-15 £35,000 Gentleman 1876-08-17 464 ADSHEAD Christiana North Shields 1876-07-09 £3,000 Widow Late of Tynemouth 1865-08-12 361 AFFLECK Margaret 1,St.Thomas Tce. -

What's Cooking in Scotland?

What’s cooking in Scotland? How community food initiatives are finding out Part Two about the impact of cookery courses About CFHS Community Food and Health (Scotland) or CFHS aims to ensure that everyone in Scotland has the opportunity, ability and confidence to access a healthy and acceptable diet for themselves, their families and their communities. We do this by supporting work with and within low-income communities that addresses health inequalities and barriers to healthy and affordable food. Barriers being addressed by community-based initiatives are: Availability – increasing access to fruit and vegetables of an acceptable quality and cost Affordability – tackling not only the cost of shopping but also getting to the shops Skills – improving confidence and skills in cooking and shopping Culture – overcoming ingrained habits Through our work we aim to support communities to: • Identify barriers to a healthy balanced diet • Develop local responses to addressing these barriers, and • Highlight where actions at other levels, or in other sectors are required. We value the experience, understanding, skills and knowledge within Scotland’s community food initiatives and their unique contribution to developing and delivering policy and practice at all levels. page 2 Acknowledgements CFHS would like to thank everyone who helped with this publication by taking part in the cookery skills survey and roundtable discussion, by submitting small grant evaluation reports, or by taking part in the cookery evaluation project. CFHS would especially