Troubled Company Prospector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UNITED STATES DISTRICT COURT NORTHERN DISTRICT of INDIANA SOUTH BEND DIVISION in Re FEDEX GROUND PACKAGE SYSTEM, INC., EMPLOYMEN

USDC IN/ND case 3:05-md-00527-RLM-MGG document 3279 filed 03/22/19 page 1 of 354 UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF INDIANA SOUTH BEND DIVISION ) Case No. 3:05-MD-527 RLM In re FEDEX GROUND PACKAGE ) (MDL 1700) SYSTEM, INC., EMPLOYMENT ) PRACTICES LITIGATION ) ) ) THIS DOCUMENT RELATES TO: ) ) Carlene Craig, et. al. v. FedEx Case No. 3:05-cv-530 RLM ) Ground Package Systems, Inc., ) ) PROPOSED FINAL APPROVAL ORDER This matter came before the Court for hearing on March 11, 2019, to consider final approval of the proposed ERISA Class Action Settlement reached by and between Plaintiffs Leo Rittenhouse, Jeff Bramlage, Lawrence Liable, Kent Whistler, Mike Moore, Keith Berry, Matthew Cook, Heidi Law, Sylvia O’Brien, Neal Bergkamp, and Dominic Lupo1 (collectively, “the Named Plaintiffs”), on behalf of themselves and the Certified Class, and Defendant FedEx Ground Package System, Inc. (“FXG”) (collectively, “the Parties”), the terms of which Settlement are set forth in the Class Action Settlement Agreement (the “Settlement Agreement”) attached as Exhibit A to the Joint Declaration of Co-Lead Counsel in support of Preliminary Approval of the Kansas Class Action 1 Carlene Craig withdrew as a Named Plaintiff on November 29, 2006. See MDL Doc. No. 409. Named Plaintiffs Ronald Perry and Alan Pacheco are not movants for final approval and filed an objection [MDL Doc. Nos. 3251/3261]. USDC IN/ND case 3:05-md-00527-RLM-MGG document 3279 filed 03/22/19 page 2 of 354 Settlement [MDL Doc. No. 3154-1]. Also before the Court is ERISA Plaintiffs’ Unopposed Motion for Attorney’s Fees and for Payment of Service Awards to the Named Plaintiffs, filed with the Court on October 19, 2018 [MDL Doc. -

College Retirement Equities Fund

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2010-05-27 | Period of Report: 2010-03-31 SEC Accession No. 0000930413-10-003160 (HTML Version on secdatabase.com) FILER COLLEGE RETIREMENT EQUITIES FUND Mailing Address Business Address 730 THIRD AVE 730 THIRD AVE CIK:777535| IRS No.: 136022042 | State of Incorp.:NY | Fiscal Year End: 1231 NEW YORK NY 10017 NEW YORK NY 10017 Type: N-Q | Act: 40 | File No.: 811-04415 | Film No.: 10861628 2129164905 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number File No. 811-4415 COLLEGE RETIREMENT EQUITIES FUND (Exact name of Registrant as specified in charter) 730 Third Avenue, New York, New York 10017-3206 (Address of principal executive offices) (Zip code) Stewart P. Greene, Esq. c/o TIAA-CREF 730 Third Avenue New York, New York 10017-3206 (Name and address of agent for service) Registrants telephone number, including area code: 212-490-9000 Date of fiscal year end: December 31 Date of reporting period: March 31, 2010 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Item 1. Schedule of Investments. COLLEGE RETIREMENT EQUITIES FUND - Stock Account COLLEGE RETIREMENT EQUITIES FUND STOCK ACCOUNT SCHEDULE OF INVESTMENTS (unaudited) March 31, 2010 MATURITY VALUE PRINCIPAL ISSUER RATE RATING DATE (000) BONDS - 0.0% CORPORATE BONDS - 0.0% HOLDING AND OTHER INVESTMENT OFFICES - 0.0% $ 100,000,000 j Japan Asia Investment Co Ltd 0.000% 09/26/11 NR $ 535 22,970 Kiwi Income Property Trust 8.950 12/20/14 NR 17 TOTAL HOLDING AND OTHER INVESTMENT OFFICES 552 Copyright © 2012 www.secdatabase.com. -

COMPREHENSIVE ANNUAL FINANCIAL REPORT City of Nampa

COMPREHENSIVE ANNUAL FINANCIAL REPORT City of Nampa, Idaho for Fiscal Year Ended September 30, 2014 COMPREHENSIVE ANNUAL FINANCIAL REPORT CITY OF NAMPA, IDAHO Fiscal Year Ended September 30, 2014 Submitted by: Department of Finance, City of Nampa 411 3 rd Street South Nampa, Idaho 83651 (208) 468-5737 CITY OF NAMPA, IDAHO Table of Contents Page INTRODUCTORY SECTION Letter of Transmittal 1 Certificate of Achievement for Excellence in Financial Reporting 5 City of Nampa Organizational Charts 6 Chart of Elected Officials and Appointed Citizen Commissions 7 Mayoral Appointments 8 INDEPENDENT AUDITOR’S REPORT 9 MANAGEMENT’S DISCUSSION AND ANALYSIS 12 BASIC FINANCIAL STATEMENTS Government-wide Financial Statements Statement of Net Position 21 Statement of Activities 23 Fund Financial Statements Balance Sheet – Governmental Funds 25 Reconciliation of the Balance Sheet of Governmental Funds to the Statement of Net Position 26 Statement of Revenues, Expenditures, and Changes in Fund Balances – Governmental Funds 27 Reconciliation of the Statement of Revenues, Expenditures, and Changes in Fund Balances of Governmental Funds to the Statement of Activities 28 Statement of Net Position – Proprietary Funds 29 Statement of Revenues, Expenses, and Changes in Net Position – Proprietary Funds 31 Statement of Cash Flows – Proprietary Funds 33 Statement of Fiduciary Net Position – Fiduciary Funds 37 Statement of Changes in Fiduciary Net Position – Fiduciary Funds 38 Notes to the Financial Statements 39 REQUIRED SUPPLEMENTARY INFORMATION Schedule of Revenues, -

Connecting the Nation: Classrooms, Libraries, and Health Care Organizations in the Information Age

DOCUMENT RESUME ED 386 184 IR 055 596 AUTHOR Gonzalez, Emilio TITLE Connecting the Nation: Classrooms, Libraries, and Health Care Organizations in the Information Age. Update 1995. INSTITUTION National Telecommunications and Information Administration, Washington, DC. PUB DATE Jun 95 NOTE 41p. PUB TYPE Reports Descriptive (141) EDRS PRICE MF01/PCO2 Plus Postage. DESCRIPTORS *Access to Information; Clinics; Computer Networks; Government Role; Hospitals; *Information Networks; Institutional Cooperation; Libraries; *Public Facilities; Schools IDENTIFIERS *Connectivity; Internet; *National Information Infrastructure; National Telecommunications and Information Admin ABSTRACT Connecting every classroom, library, hospital, and clinic in the United States to the National Information Infrastructure (NII) is a priority for the ClintonAdministration. This document provides a status report on this initiativeby drawing from current data regarding Internet connectivity, abenchmark for NII access. Chapter 1of the report reviews the NII initiative and discusses the importance of being connected to the NII.Chapter 2 provides an overview of the level of connectivity of U.S.public institutions to the NII. Chapter 3 highlights how communities and government are successfully partnering with theprivate sector to promote the development of public "on-ramps" to theNII, with federal government funding serving as a catalyst. Chapter4 describes National Telecommunications and Information Administration(NTIA) programs and initiatives that arehelping to accelerate the connection of public institutions to the NII. The reportconcludes that there is much work to be done before the goalof connecting every school, library, and health careorganization to the NII is accomplished. Nevertheless, federal government funding programs can serve as a catalyst in this effort,spurring public-private partnerships even in disadvantages and remote areas of thecountry. -

001. Schedule/Index/1

You spare no expense when it comes to showing off Fluffy’s team spirit, but you don’t have Colts Banking? Bank Like a Fan!® Get your Colts Banking account* exclusively from Huntington. s#OLTSCHECKSs#OLTS6ISA®#HECK#ARDs#OLTSCHECKBOOKCOVER /PENANACCOUNTTODAYAT#OLTS"ANKINGCOMORVISITABANKINGOFlCE Offi cial Bank of the Indianapolis Colts Clarian Health *Some fees may apply. Colts and the Colts’ horseshoe logos are trademarks of the Indianapolis Colts, Inc. Member FDIC. , ® Huntington®andBankLikeaFan!®are federally registered service marks of Huntington Bancshares Incorporated. ©2009 Huntington Bancshares Incorporated. 2009 SEASONPRESEASON SCHEDULE Date Opponent Time Friday, August 14 MINNESOTA VIKINGS 7:30 p.m. Thursday, August 20 PHILADELPHIA EAGLES 8:00 p.m. Saturday, August 29 at Detroit Lions 1:00 p.m. Thursday, September 3 at Cincinnati Bengals 7:30 p.m. REGULAR SEASON Sunday, September 13 JACKSONVILLE JAGUARS 1:00 p.m. Monday, September 21 at Miami Dolphins 8:30 p.m. Sunday, September 27 at Arizona Cardinals 8:20 p.m. Sunday, October 4 SEATTLE SEAHAWKS 1:00 p.m. Sunday, October 11 at Tennessee Titans 8:20 p.m. Sunday, October 18 OPEN DATE Sunday, October 25 at St. Louis Rams 1:00 p.m. Sunday, November 1 SAN FRANCISCO 49ers 1:00 p.m. Sunday, November 8 HOUSTON TEXANS 1:00 p.m. Sunday, November 15 NEW ENGLAND PATRIOTS 8:20 p.m. Sunday, November 22* at Baltimore Ravens 1:00 p.m. Sunday, November 29* at Houston Texans 1:00 p.m. Sunday, December 6* TENNESSEE TITANS 1:00 p.m. Sunday, December 13* DENVER BRONCOS 1:00 p.m. -

NCAA Bowl Eligibility Policies

TABLE OF CONTENTS 2019-20 Bowl Schedule ..................................................................................................................2-3 The Bowl Experience .......................................................................................................................4-5 The Football Bowl Association What is the FBA? ...............................................................................................................................6-7 Bowl Games: Where Everybody Wins .........................................................................8-9 The Regular Season Wins ...........................................................................................10-11 Communities Win .........................................................................................................12-13 The Fans Win ...................................................................................................................14-15 Institutions Win ..............................................................................................................16-17 Most Importantly: Student-Athletes Win .............................................................18-19 FBA Executive Director Wright Waters .......................................................................................20 FBA Executive Committee ..............................................................................................................21 NCAA Bowl Eligibility Policies .......................................................................................................22 -

OTC) Margin Stocks

F e d e r a l R e s e r v e B a n k OF DALLAS ROBERT D. MCTEER, JR. P R E S ID E N T DALLAS, TEXAS AND CHIEF EXECUTIVE OFFICER 75 265-590 6 March 7, 1996 Notice 96-27 TO: The Chief Executive Officer of each member bank and others concerned in the Eleventh Federal Reserve District SUBJECT Over-the-Counter (OTC) Margin Stocks DETAILS The Board of Governors of the Federal Reserve System has revised the list of over-the-counter (OTC) stocks that are subject to its margin regulations, effective February 12, 1996. Included with the list is a listing of foreign margin stocks that are subject to Regulation T. The foreign margin stocks listed are foreign equity securities eligible for margin treatment at broker-dealers. The Board publishes complete lists four times a year, and the Federal Register announces additions to and deletions from the lists. ATTACHMENTS Attached are the complete lists of OTC stocks and foreign margin stocks as of February 12, 1996. Please retain these lists, which supersede the complete lists published as of February 13, 1995. Announcements containing additions to and deletions from the lists will be provided quarterly. MORE INFORMATION For more information regarding marginable OTC stock requirements, please contact Eugene Coy at (214) 922-6201. For additional copies of this Bank’s notice and the complete lists, please contact the Public Affairs Department at (214) 922-5254. Sincerely yours, For additional copies, bankers and others are encouraged to use one of the following toll-free numbers in contacting the Federal Reserve Bank of Dallas: Dallas Office (800) 333 -4460; El Paso Branch In trasta te (800) 592-1631, Intersta te (800) 351-1012; Houston B ra n ch In tra sta te (800) 392-4162, Intersta te (800) 221-0363; San Antonio Branch In tra sta te (800) 292-5810. -

List of Marginable OTC Stocks

List of Marginable OTC Stocks 1ST BANCORP (Indiana) ABC BANCORP (Georgia) ACE CASH EXPRESS, INC. $1.00 par common $1.00 par common $.01 par common 1ST BERGEN BANCORP ABC DISPENSING TECHNOLOGIES, INC. ACE*COMM CORPORATION No par common $.01 par common $.01 par common 1ST SOURCE CORPORATION ABC RAIL PRODUCTS CORPORATION ACETO CORPORATION $1.00 par common $.01 par common $.01 par common † Fixed rate cumulative trust preferred securities of 1st Source Capital Trust ABER RESOURCES LTD. ACMAT CORPORATION † Floating rate cumulative trust preferred No par common Class A, no par common securities of 1st Source Capital Trust ABIGAIL ADAMS NATIONAL BANCORP, INC. ACRES GAMING INCORPORATED 1ST UNITED BANCORP (Florida) $.01 par common $.01 par common $.01 par common ABINGTON BANCORP, INC. (Massachusetts) ACRODYNE COMMUNICATIONS, INC. 3-D GEOPHYSICAL, INC. $.10 par common $.01 par common $.01 par common ABIOMED, INC. ACT MANUFACTURING, INC. 3-D SYSTEMS CORPORATION $.01 par common $.01 par common $.001 par common ABLE TELCOM HOLDING CORPORATION ACT NETWORKS, INC. 3COM CORPORATION $.001 par common $.01 par common No par common ABR INFORMATION SERVICES INC. ACTEL CORPORATION 3D LABS INC. LIMITED $.01 par common $.001 par common $.01 par common ABRAMS INDUSTRIES, INC. ACTION PERFORMANCE COMPANIES, INC. 3DO COMPANY, THE $1.00 par common $.01 par common $.01 par common ABRAXAS PETROLEUM CORPORATION ACTIVE APPAREL GROUP, INC. 3DX TECHNOLOGIES, INC. $.01 par common $.002 par common $.01 par common ABT BUILDING PRODUCTS CORPORATION ACTIVE VOICE CORPORATION 4 KIDS ENTERTAINMENT, INC. $.01 par common No par common $.01 par common ACACIA RESEARCH CORPORATION ACTIVISION, INC. 4FRONT SOFTWARE INTERNATIONAL, INC. -

Marginable OTC and Foreign Margin Stocks

LIST OF MARGINABLE OTC STOCKS 1 AND LIST OF FOREIGN MARGIN STOCKS 2 AS OF May 12, 1997 The List of Marginable OTC Stocks and the List of Foreign Margin Stocks are published quarterly by the Board of Governors of the Federal Reserve System (the Board). The List of Marginable OTC Stocks is composed of stocks traded in the United States over-the-counter (OTC) that have been determined by the Board to be subject to margin requirements as of May 12, 1997, pursuant to Section 207.6 of Federal Reserve Regulation G, ‘‘Securities Credit by Persons Other Than Banks, Brokers, or Dealers,’’ Section 220.17 of Regulation T, ‘‘Credit by Brokers and Dealers,’’ and Section 221.7 of Regulation U, ‘‘Credit by Banks for the Purpose of Purchasing or Carrying Margin Stocks.’’ It also includes all OTC stocks designated as National Market System (NMS) securities. Additional NMS securities may be added in the interim between Board quarterly publications; these securities are immediately marginable upon designation as NMS securities. The names of these securities are available at the National Association of Securities Dealers, Inc. and at the Securities and Exchange Commission. This List supersedes the previous List of Marginable OTC Stocks published effective February 10, 1997. The List of Foreign Margin Stocks is composed of foreign equity securities that have met the Board’s eligibility criteria, pursuant to Regulation T, Section 220.17. These foreign equity securities are eligible for margin treatment at broker–dealers on the same basis as domestic margin securities. This list supersedes the previous List of Foreign Margin Stocks published effective February 10, 1997. -

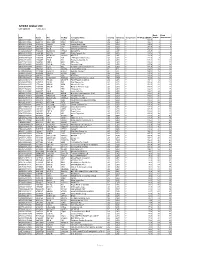

STOXX Global 200 Last Updated: 01.05.2015

STOXX Global 200 Last Updated: 01.05.2015 Rank Rank ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) (PREVIOUS) US0378331005 2046251 AAPL.OQ AAPL Apple Inc. US USD Y 650.5 1 1 US5949181045 2588173 MSFT.OQ MSFT Microsoft Corp. US USD Y 356.1 2 3 US30231G1022 2326618 XOM.N XON Exxon Mobil Corp. US USD Y 330.2 3 2 US4781601046 2475833 JNJ.N JNJ Johnson & Johnson US USD Y 247.8 4 4 US3696041033 2380498 GE.N GE General Electric Co. US USD Y 242.7 5 7 CH0012005267 7103065 NOVN.VX 477408 NOVARTIS CH CHF Y 236.7 6 6 US9497461015 2649100 WFC.N NOB Wells Fargo & Co. US USD Y 230.6 7 5 CH0038863350 7123870 NESN.VX 461669 NESTLE CH CHF Y 223.9 8 8 US46625H1005 2190385 JPM.N CHL JPMorgan Chase & Co. US USD Y 211.0 9 9 US7427181091 2704407 PG.N PG Procter & Gamble Co. US USD Y 191.6 10 10 US7170811035 2684703 PFE.N PFE Pfizer Inc. US USD Y 190.8 11 11 US1667641005 2838555 CVX.N CHV Chevron Corp. US USD Y 187.4 12 14 US92343V1044 2090571 VZ.N BEL Verizon Communications Inc. US USD Y 186.8 13 13 JP3633400001 6900643 7203.T 690064 Toyota Motor Corp. JP JPY Y 182.3 14 12 CH0012032048 7110388 ROG.VX 474577 ROCHE HLDG P CH CHF Y 180.3 15 15 GB0005405286 0540528 HSBA.L 040054 HSBC GB GBP Y 170.8 16 21 US00206R1023 2831811 T.N SBC AT&T Inc. -

Company Vendor ID (Decimal Format) (AVL) Ditest Fahrzeugdiagnose Gmbh 4621 @Pos.Com 3765 0XF8 Limited 10737 1MORE INC

Vendor ID Company (Decimal Format) (AVL) DiTEST Fahrzeugdiagnose GmbH 4621 @pos.com 3765 0XF8 Limited 10737 1MORE INC. 12048 360fly, Inc. 11161 3C TEK CORP. 9397 3D Imaging & Simulations Corp. (3DISC) 11190 3D Systems Corporation 10632 3DRUDDER 11770 3eYamaichi Electronics Co., Ltd. 8709 3M Cogent, Inc. 7717 3M Scott 8463 3T B.V. 11721 4iiii Innovations Inc. 10009 4Links Limited 10728 4MOD Technology 10244 64seconds, Inc. 12215 77 Elektronika Kft. 11175 89 North, Inc. 12070 Shenzhen 8Bitdo Tech Co., Ltd. 11720 90meter Solutions, Inc. 12086 A‐FOUR TECH CO., LTD. 2522 A‐One Co., Ltd. 10116 A‐Tec Subsystem, Inc. 2164 A‐VEKT K.K. 11459 A. Eberle GmbH & Co. KG 6910 a.tron3d GmbH 9965 A&T Corporation 11849 Aaronia AG 12146 abatec group AG 10371 ABB India Limited 11250 ABILITY ENTERPRISE CO., LTD. 5145 Abionic SA 12412 AbleNet Inc. 8262 Ableton AG 10626 ABOV Semiconductor Co., Ltd. 6697 Absolute USA 10972 AcBel Polytech Inc. 12335 Access Network Technology Limited 10568 ACCUCOMM, INC. 10219 Accumetrics Associates, Inc. 10392 Accusys, Inc. 5055 Ace Karaoke Corp. 8799 ACELLA 8758 Acer, Inc. 1282 Aces Electronics Co., Ltd. 7347 Aclima Inc. 10273 ACON, Advanced‐Connectek, Inc. 1314 Acoustic Arc Technology Holding Limited 12353 ACR Braendli & Voegeli AG 11152 Acromag Inc. 9855 Acroname Inc. 9471 Action Industries (M) SDN BHD 11715 Action Star Technology Co., Ltd. 2101 Actions Microelectronics Co., Ltd. 7649 Actions Semiconductor Co., Ltd. 4310 Active Mind Technology 10505 Qorvo, Inc 11744 Activision 5168 Acute Technology Inc. 10876 Adam Tech 5437 Adapt‐IP Company 10990 Adaptertek Technology Co., Ltd. 11329 ADATA Technology Co., Ltd. -

NCAA Football Records

Bowl/All-Star Game Records 2008-09 Bowl Schedule ............................ 270 2007-08 Bowl Results ................................. 272 All-Time Bowl-Game Results ................... 273 Team-by-Team Bowl Results ................... 282 Bowl Championship Series Results ...... 297 Major Bowl-Game Attendance .............. 297 Individual Records ....................................... 303 Team Records ................................................ 305 Individual Record Lists ............................... 307 Team Record Lists ........................................ 314 Longest Plays ................................................. 323 Bowl Championship Series Individual Record Lists........................... 324 Team Record Lists .................................... 328 Longest Plays ............................................. 334 Bowl Coaching Records ............................ 335 Conference Bowl Records ........................ 353 Award Winners in Bowl Games.............. 354 Bowls and Polls ............................................. 363 Bowl-Game Facts ......................................... 369 Special Regular- and Postseason Games .................................. 370 270 2008-09 BOwl SCHEDULE 2008-09 Bowl Schedule ALLSTATE SUGAR BOWL One Citrus Bowl Place GMAC BOWL New Orleans, Louisiana, January 2, 2009, 8 p.m. Orlando, Florida 32805-2451 Mobile, Alabama, January 6, 2009, 8 p.m. Paul J. Hoolahan, Chief Executive Officer fcsports.com Frank Modarelli Allstate Sugar Bowl Office Phone: 407/423-2476 GMAC Bowl 1500