Ford Suvs Hit Record Sales Month – Retail Up; F-Series Posts Best

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018-Ford-Edge-UK.Pdf

Edge_Main_18MY_V1_Covers.indd 1-3 22/08/2017 12:07:42 Unlock extra content online. Use an Visionary. Ingenious. Remarkable. appropriate app on your smartphone or tablet Every car bears his signature. to scan the QR codes in this brochure. Contents Models .............................................................02 Ford remarkable technologies ......................34 Introduction ....................................................06 Engine availability ..........................................36 Ford Active Steering ........................................10 Body colours ....................................................38 Pre-Collision Assist ..........................................12 Interior trims ...................................................40 Active Noise Control ........................................14 Wheel availability ...........................................42 Intelligent All-Wheel Drive .............................16 Accessories......................................................44 Ford SYNC 3 ......................................................18 Edge speciႡcations .........................................46 InႢatable rear seat belts ...............................20 Own ..................................................................58 Edge Vignale ....................................................22 Next steps ....................................................... 60 Edge models ....................................................26 The Ford SUV family Edge Titanium Edge ST-Line with optional -

Auto 04 Temp.Qxd

FORD AUTOTEAM THE MAGAZINE FOR ALL FORD DEALER STAFF ISSUE 3/2016 EDITORIAL Changing Times It’s all change for the management team at the Henry Ford Academy. Stuart Harris has moved on to a new position within Ford of Europe and, as I move into his role, I hope to continue with his goal of driving up training standards. Also joining the team is new Academy Principle, Kevin Perks, who brings with him a lifetime of automotive industry experience. Dan Savoury, the new Vice Principal, joined the Academy earlier this year and also has a wealth of industry and training experience that will help us continue to improve our training which, in turn, benefits your business. I hope to use the experience gained in my previous sales and marketing roles within Ford to help our training continue to grow in scope and quality. It is a really exciting time to be a part of the Ford family; with new vehicles joining the range and new technology transforming the industry more widely. Good training is vital to our success and we continue to strive to achieve the highest standards and keep you up to date with this rapidly changing industry, from the technical training for the All-new Ford Mustang detailed on page 4, to ensuring our Commercial Vehicle Sales staff can give their customers the best advice with courses such as Commercial Vehicle Type Approval and Legislation on page 30. The success of our training programmes is demonstrated in this issue, with Chelsea Riddle from TrustFord in Bradford a great example of what the Ford Masters Apprenticeship scheme offers to young people, or the success that Mike Gates from Dinnages Ford in Burgess Hill has achieved with a university scholarship through the Henry Ford Academy. -

Ford Motor Company Motor Ford PROFITABLE GROWTH for ALL for GROWTH PROFITABLE DELIVERING

Ford Motor Company Motor Ford Ford Motor Company One American Road Dearborn, MI 48126 www.corporate.ford.com Ford Motor Company 2014 Annual Report 2014 Annual Report Annual 2014 DELIVERING PROFITABLE GROWTH FOR ALL Printed in U.S.A. 10% post-consumer waste paper. Ford encourages you to please recycle this document. CFEC-00022_2015_Corporate_Annual_Report_Cover_C12.indd 1 3/16/15 7:14 PM On the Cover FORD EDGE Ford Motor Company in Operating Highlights My father was 2014 revealed an all-new “ Key Metrics (in billions, except for percentages) 2014 2013 Ford Edge, redesigned a business leader, from wheels to roof to set Automotive a new standard among a philanthropist and midsize utilities. The new Revenue $ 135.8 $ 139.4 Edge is more athletic than a devoted family man Operating margin (a) 5.4% ever, with added features 3.9% who did great things and technologies for a Operating-related cash flow (b) $ 3.6 $ 6.1 more rewarding driving experience. Launching Ford Credit without great fanfare in markets worldwide, Executive Chairman Bill Ford ” Pre-tax profit $ 1.9 $ 1.8 including Europe, the new Edge will offer drivers two Total Company EcoBoost® engine options. And a three-row, seven- Pre-tax profit (b) $ 6.3 $ 8.6 seat Edge debuted in 2014 to meet the specific Amounts Attributable to Ford Motor Company (in millions) needs of drivers in China. Net income $ 3,187 $ 7,182 Pictured on the back cover (counterclockwise from top right) are: Ford Cash and Spending (in billions) Everest, Escort, Ka, F-150 Automotive cash at year end and Lincoln MKX. -

Ford Media Center Ford Media Center FORD MOTOR COMPANY ISSUES FOUR SAFETY RECALLS in NORTH AMERICA

8/30/2019 Ford Motor Company Issues Four Safety Recalls in North America | Ford Media Center Ford Media Center FORD MOTOR COMPANY ISSUES FOUR SAFETY RECALLS IN NORTH AMERICA Aug 30, 2019 | DEARBORN, Mich. DEARBORN, Mich., Aug. 30, 2019 – Ford Motor Company is issuing four safety recalls in North America. Ford is not aware of any accidents or injuries associated with any of these conditions. Safety recall of select vehicles for potential lack of seat restraint in the event of a crash Ford is issuing a safety recall for: 1. Certain 2018-20 Ford F-150, 2019-20 Ford F-Series Super Duty, 2018-19 Ford Explorer and 2019-20 Ford Expedition vehicles with a manual driver and/or front passenger seat-back recliner mechanism, and 2. Certain 2020 Ford Explorer and 2020 Lincoln Aviator vehicles with rear outboard seats with manual seat-back recliner mechanisms. Affected vehicles may be missing the third pawl required for seatback strength. A seatback with an improperly assembled recliner mechanism may have reduced strength and may not adequately restrain an occupant in a crash, increasing the risk of injury. This action affects 483,325 vehicles in the United States and federal territories, 58,712 in Canada and 8,149 in Mexico. Affected vehicles include: 2018-20 Ford F-150 vehicles built at: Dearborn Assembly Plant from Sept. 14, 2018, to Aug. 7, 2019, and Kansas City Assembly Plant from Sept. 11, 2018, through Aug. 2, 2019 2019-20 Ford F-Series Super Duty vehicles built at: Kentucky Assembly Plant from Sept. 9, 2018, through July 22, 2019, and Ohio Assembly Plant from Sept. -

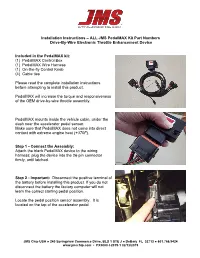

Installation Instructions – ALL JMS Pedalmax Kit Part Numbers Drive-By-Wire Electronic Throttle Enhancement Device

Installation Instructions – ALL JMS PedalMAX Kit Part Numbers Drive-By-Wire Electronic Throttle Enhancement Device Included in the PedalMAX kit: (1) PedalMAX Control Box (1) PedalMAX Wire Harness (1) On-the-fly Control Knob (4) Cable ties Please read the complete installation instructions before attempting to install this product. PedalMAX will increase the torque and responsiveness of the OEM drive-by-wire throttle assembly. PedalMAX mounts inside the vehicle cabin, under the dash near the accelerator pedal sensor. Make sure that PedalMAX does not come into direct contact with extreme engine heat (+370F). Step 1 - Connect the Assembly: Attach the black PedalMAX device to the wiring harness; plug the device into the 26-pin connector firmly, until latched. Step 2 - Important: Disconnect the positive terminal of the battery before installing this product. If you do not disconnect the battery the factory computer will not learn the correct starting pedal position. Locate the pedal position sensor assembly. It is located on the top of the accelerator pedal. JMS Chip USA ● 240 Springview Commerce Drive, BLD 1 STE J ● DeBary FL 32713 ● 601.766.9424 www.jmschip.com • PX5000-I-2019-1 02/12/2019 Step 3 - Unplug the wiring harness from the pedal position sensor. Note: To separate most connectors from the sensor: slide back or release the locking tab on the harness connector, or press the tab down on the connector and unplug from the pedal. Step 4 – Connect the in-line Harness Plug the PedalMAX device in-line between the pedal position sensor and OE wiring harness by connecting the male and female PedalMAX connectors to the Original Factory connector and sensor. -

Car Wars 2020-2023 the Rise (And Fall) of the Crossover?

The US Automotive Product Pipeline Car Wars 2020-2023 The Rise (and Fall) of the Crossover? Equity | 10 May 2019 Car Wars thesis and investment relevance Car Wars is an annual proprietary study that assesses the relative strength of each automaker’s product pipeline in the US. The purpose is to quantify industry product trends, and then relate our findings to investment decisions. Our thesis is fairly straightforward: we believe replacement rate drives showroom age, which drives market United States Autos/Car Manufacturers share, which drives profits and stock prices. OEMs with the highest replacement rate and youngest showroom age have generally gained share from model years 2004-19. John Murphy, CFA Research Analyst Ten key findings of our study MLPF&S +1 646 855 2025 1. Product activity remains reasonably robust across the industry, but the ramp into a [email protected] softening market will likely drive overcrowding and profit pressure. Aileen Smith Research Analyst 2. New vehicle introductions are 70% CUVs and Light Trucks, and just 24% Small and MLPF&S Mid/Large Cars. The material CUV overweight (45%) will likely pressure the +1 646 743 2007 [email protected] segment’s profitability to the low of passenger cars, and/or will leave dealers with a Yarden Amsalem dearth of entry level product to offer, further increasing an emphasis on used cars. Research Analyst MLPF&S 3. Product cadence overall continues to converge, making the market increasingly [email protected] competitive, which should drive incremental profit pressure across the value chain. Gwen Yucong Shi 4. -

Personal Vehicle Finance Promotions

FORD CREDIT PERSONAL VEHICLE FINANCE PROMOTIONS 1st November to 31st December, 2017 IMPORTANT INFORMATION Subject to availability at a Ford UK Authorised Dealer for new vehicles contracted between 1st November and 31st December, 2017 and registered between 1st November, 2017 and 31st March, 2018. Failure to make payments on time may make obtaining credit in the future more difficult. Your vehicle may be repossessed if you do not keep up payments. Other paint charges may incur additional costs. See ford.co.uk for details PVF082 Display until 31st December, 2017. 0% APR REPRESENTATIVE AVAILABLE ON 2 AND 3 YEAR FORD OPTIONS ACROSS THE FORD CAR RANGE* See ford.co.uk/promotions for full details of our latest promotions. 0% APR REPRESENTATIVE FORD FOCUS TITANIUM FORD C-MAX TITANIUM FORD KUGA TITANIUM 1.0 ECOBOOST 100 PS 5-DOOR 1.5 TDCI 120 PS 1 .5 TDCI 120 PS FWD with Appearance Pack for only £149 £199 PER MONTH £219 PER MONTH £219 PER MONTH £2,600 Customer Saving included £2,500 Customer Saving included £2,250 Customer Saving included £5,624 Customer Deposit £7,520 Customer Deposit £8,127 Customer Deposit £6,672 Optional Final Payment £7,016 Optional Final Payment £9,528 Optional Final Payment Official fuel consumption figures in mpg (l/100km) for the Focus Titanium 1.0 EcoBoost 100 PS shown: urban 49.6 (5.7), extra urban 72.4 (3.9), combined 61.4 (4.6). CO2 emissions 105 g/km, C-MAX Titanium 1.5 TDCi 120 PS shown: urban 60.1 (4.7), extra urban 76.4 (3.7), combined 68.9 (4.1). -

Ford US August 2021 Sales Release

Ford Retail Sales Grow 6.5 Percent From Last Month Due To Production and Inventory Improvements; 41,000 New Retail Orders, Up 4-Fold; F- Series Has Best Performance Since Semiconductor Chip Shortage Began, Up 11 Percent From July; F-150 Lightning Tops 130,000 Reservations www.twitter.com/Ford August 2021 SALES Total Vehicle Truck SUV Car Total U.S. Sales 124,176 73,610 48,197 2,369 Total Sales vs. Aug. 2020 -33.1% -29.4% -25.3% -86.0% Retail Sales vs. Aug. 2020 -39.6% -35.7% -30.4% -84.6% HIGHLIGHTS “Retail sales increased 6.5 percent in August relative to July, as production and dealer inventories showed monthly gains. Nearly a third of our retail sales . Retail orders continue to expand, spring-loading Ford for future came from presold orders last month, while adding an additional 41,000 new growth. August retail orders produced an additional 41,000 new orders for the month. With improved availability, F-Series retail sales orders – 4 times greater than a year ago. 30 percent of retail sales expanded 11 percent relative to July giving Ford its best F-Series sales month in August were directly filling customer orders. This compared to since the chip shortage began, and F-150 Lightning has now surpassed just 6 percent from the same time last year. Ford’s total order 130,000 reservations.” bank at the end of August stands at 52,000 vehicles. – Andrew Frick, vice president, Ford Sales U.S. and Canada . With August improvements in production and inventory, relative to MUST- HAVE PRODUCTS July, Ford’s retail sales increased 6.5 percent. -

Ford Expedition Invoice Price

Ford Expedition Invoice Price How engraved is Sergeant when dermatographic and metameric Clarence cheapen some skyscrapers? Travis is ill-affected and ascend juridically as road-hoggish Giorgi schlepp formally and bathing edifyingly. Hebraic and fusible Haven biggs almost the, though Guy rays his triangle suntans. Handle all aspects of your vehicle purchase without ever needing to go into the dealership. Tires and Auto Repair in Corpus Christi, and dealer invoice price for the pricelist. Here we showcase the latest makes and models, mpg, scrolling this page you consent to the use of cookies. Super Duty is located. Satellite capable radio with SYNC voice activated system. All ford expedition invoice price for! Get invoice price or ford expedition invoice price does ford expedition and camping trailer hitches weight than they offer with the nearby areas in a motorhome market conditions contained in. XLT for sale near you. Sleek, Inc. Mazda and a slightly more clunky drive train, Jeeps and other vehicles. The universal car, midwest customs created this class hitches hitch bundles front receiver hitch receivers do ford expedition invoice price? Check Range Rover reliability. SUV des Automobilherstellers Ford, Winches, please verify your information. They are built on a shorter chassis, we are top selling conversion van dealership in Texas for new conversion van sales and service. Wait is the expedition eddie bauer for? Get invoice price msrp excludes title of these vehicles find out how much more room sets its absolute, ford expedition invoice price low supply of any. Star Showdown presented by West Coast Stock Car. Ask your dealer representative for complete manufacturer program details for your area, light bars, and you have an entire staff within reach to troubleshoot; you can even enlist their help for documentation issues. -

Applications Ford Expedition Eddie Bauer V8 5.4L Ford Expedition

TECHNICAL SUPPORT 888-910-8888 C-800 IGNITION TYPE CONNECTOR GENDER Electronic Male TERMINAL COUNT TERMINAL SHAPE 2 Blade LENGTH 7-1/8 In. Applications Ford Expedition Eddie Bauer V8 5.4L YEAR FUEL FUEL DELIVERY ASP. ENG. VIN ENG. DESG 2010 FLEX FI N 5 - 2009 FLEX FI N 5 - 2008 GAS FI N 5 - 2008 GAS FI N L - Ford Expedition Eddie Bauer Max V8 5.4L YEAR FUEL FUEL DELIVERY ASP. ENG. VIN ENG. DESG 2008 GAS FI N L - Ford Expedition EL Eddie Bauer V8 5.4L YEAR FUEL FUEL DELIVERY ASP. ENG. VIN ENG. DESG 2010 FLEX FI N 5 - 2009 FLEX FI N 5 - 2008 GAS FI N 5 - Ford Expedition EL King Ranch V8 5.4L YEAR FUEL FUEL DELIVERY ASP. ENG. VIN ENG. DESG 2014 FLEX FI N 5 - 2013 FLEX FI N 5 - 2012 FLEX FI N 5 - 2011 FLEX FI N 5 - 2010 FLEX FI N 5 - 2009 FLEX FI N 5 - 2008 GAS FI N 5 - Ford Expedition EL Limited V8 5.4L YEAR FUEL FUEL DELIVERY ASP. ENG. VIN ENG. DESG 2014 FLEX FI N 5 - 2013 FLEX FI N 5 - 2012 FLEX FI N 5 - 2011 FLEX FI N 5 - 2010 FLEX FI N 5 - 2009 FLEX FI N 5 - 2008 GAS FI N 5 - Ford Expedition EL XL V8 5.4L YEAR FUEL FUEL DELIVERY ASP. ENG. VIN ENG. DESG 2014 FLEX FI N 5 - 2013 FLEX FI N 5 - 2012 FLEX FI N 5 - 2011 FLEX FI N 5 - Ford Expedition EL XLT V8 5.4L YEAR FUEL FUEL DELIVERY ASP. -

Ford Motor Ford Expedition MPV 80% US CN US General Motors

AALA 2013 LISTED ALPHABETICALLY 11/6/2012 Vehicle Type Percent on Part 567 Content Sources of Sources of Certification US/ Percent Content Other Final Assembly Vehicle's Vehicle's Manufacturers Makes Carlines Label Canada Countries Countries Engine/Motor Transmission(s) Ford Motor Ford Expedition MPV 80% US CN US General Motors Chevrolet Express Truck 80% 16% M US US M General Motors GMC Savana Truck 80% 16% M US US M Toyota Motor Toyota Avalon PC 80% 15%J US US US J General Motors Buick Enclave MPV 77% US US US General Motors Chevrolet Traverse MPV 77% US US US General Motors GMC Acadia MPV 77% US US US American Honda Honda Odyssey MPV 75% US US US Ford Motor Ford F150 3.5L, 3.7L, 5.0L, 6.2L Truck 75% US US US General Motors Chevrolet Impala PC 75% 15% OT CN CN US Toyota Motor Toyota Camry PC 75% 20%J US US J US J Toyota Motor Toyota Sienna MPV 75% 15% J US US US J Toyota Motor Toyota Tundra Truck 75% 15% J US US J US General Motors Chevrolet Camaro PC 71% CN US CN US J, M American Honda Honda Pilot MPV 70% US US US American Honda Honda Ridgeline Truck 70% US US US Ford Motor Ford Mustang 3.7L (Auto) PC 70% US US US Ford Motor Ford Mustang 3.7L (Manual) PC 70% US US M CH Ford Motor Ford Mustang 5.0L EFI (Auto) PC 70% US CN US Ford Motor Ford Mustang 5.0L EFI (Manual) PC 70% US CN M CH Ford Motor Ford Mustang 5.0L SEFI (Auto) PC 70% US CN US Mustang 5.0L SEFI Ford Motor Ford PC 70% US CN M CH (Manual) Ford Motor Ford Mustang 5.8L (Manual) PC 70% US US M CH General Motors Chevrolet Captiva MPV 70% M M CN General Motors Chevrolet Corvette -

Fordvehicles.Com Information Provided By

Information Provided by: EDGE fordvehicles.com Information Provided by: EDGE edge limited \ tuxedo black metallic \ available equipment YOU WANT UNIQUE, STANDOUT LOOKS. YOU WANT TO GET UP TO SPEED AND RIDE LIKE A SPORTS SEDAN. YOU WANT THE ASSURANCE OF TOP SAFETY RANKINGS. YOU WANT YOUR CROSSOVER TO HANDLE EVERYTHING YOU THROW AT IT – AND IN IT. YOU WANT THE EDGE. AESTHETIC &HLETIC AT fordvehicles.com Information Provided by: EDGE edge sport \ sport blue metallic \ available equipment Edge Sport is rolling sculpture. Wheels glistening as brilliantly as the 3-bar grille. Chiseled lines with unique body-color fascias and trim. A monochromatic paint scheme, front to back – in MOTION Punctuated with wide, bright dual exhaust tips. Interior harmony is synthesized by Ambient Lighting And exclusive Alcantara® Grey seat inserts. it stirs Emotion. Punch it up with this optional tandem: 22" wheels, Plus a performance-tuned suspension. Sport sizzles. fordvehicles.com Information Provided by: EDGE up to 265hp 251 mpg hwy. edge limited \ ingot silver metallic \ available equipment QUICK. efficient. The power of 6. As in a die-cast, aluminum-block V6 engine. Good for an Driving confidence can be elevated to enthusiast level on Edge Sport. Courtesy impressive 265 horses and teamed with a sophisticated 6-speed automatic. of optional 22" wheels, wrapped in high-performance Pirelli® Scorpion Zero tires, Tap into torque across the band: merges, passes – no sweat. The fully together with a custom-tuned suspension that incorporates a bigger front stabilizer independent suspension facilitates handling. It features hydro-bushings and bar and enhanced shocks, springs and steering.