AC Initiation of Coverage September 10, 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OSB Representative Participant List by Industry

OSB Representative Participant List by Industry Aerospace • KAWASAKI • VOLVO • CATERPILLAR • ADVANCED COATING • KEDDEG COMPANY • XI'AN AIRCRAFT INDUSTRY • CHINA FAW GROUP TECHNOLOGIES GROUP • KOREAN AIRLINES • CHINA INTERNATIONAL Agriculture • AIRBUS MARINE CONTAINERS • L3 COMMUNICATIONS • AIRCELLE • AGRICOLA FORNACE • CHRYSLER • LOCKHEED MARTIN • ALLIANT TECHSYSTEMS • CARGILL • COMMERCIAL VEHICLE • M7 AEROSPACE GROUP • AVICHINA • E. RITTER & COMPANY • • MESSIER-BUGATTI- CONTINENTAL AIRLINES • BAE SYSTEMS • EXOPLAST DOWTY • CONTINENTAL • BE AEROSPACE • MITSUBISHI HEAVY • JOHN DEERE AUTOMOTIVE INDUSTRIES • • BELL HELICOPTER • MAUI PINEAPPLE CONTINENTAL • NASA COMPANY AUTOMOTIVE SYSTEMS • BOMBARDIER • • NGC INTEGRATED • USDA COOPER-STANDARD • CAE SYSTEMS AUTOMOTIVE Automotive • • CORNING • CESSNA AIRCRAFT NORTHROP GRUMMAN • AGCO • COMPANY • PRECISION CASTPARTS COSMA INDUSTRIAL DO • COBHAM CORP. • ALLIED SPECIALTY BRASIL • VEHICLES • CRP INDUSTRIES • COMAC RAYTHEON • AMSTED INDUSTRIES • • CUMMINS • DANAHER RAYTHEON E-SYSTEMS • ANHUI JIANGHUAI • • DAF TRUCKS • DASSAULT AVIATION RAYTHEON MISSLE AUTOMOBILE SYSTEMS COMPANY • • ARVINMERITOR DAIHATSU MOTOR • EATON • RAYTHEON NCS • • ASHOK LEYLAND DAIMLER • EMBRAER • RAYTHEON RMS • • ATC LOGISTICS & DALPHI METAL ESPANA • EUROPEAN AERONAUTIC • ROLLS-ROYCE DEFENCE AND SPACE ELECTRONICS • DANA HOLDING COMPANY • ROTORCRAFT • AUDI CORPORATION • FINMECCANICA ENTERPRISES • • AUTOZONE DANA INDÚSTRIAS • SAAB • FLIR SYSTEMS • • BAE SYSTEMS DELPHI • SMITH'S DETECTION • FUJI • • BECK/ARNLEY DENSO CORPORATION -

Fitch Ratifica Calificación De Televisa En 'AAA(Mex)'; Perspectiva Estable

28/6/2019 [ Press Release ] Fitch Ratifica Calificación de Televisa en 'AAA(mex)'; Perspectiva Estable Fitch Ratifica Calificación de Televisa en 'AAA(mex)'; Perspectiva Estable Fitch Ratings-Monterrey-28 June 2019: Fitch Ratings ratificó la calificación de Largo Plazo en escala nacional de 'AAA(mex)' de Grupo Televisa, S.A.B. (Televisa), así como las calificaciones de largo plazo Issuer Default Rating (IDR) en escala internacional en moneda extranjera y local de 'BBB+'. La Perspectiva de las calificaciones es Estable. Al mismo tiempo, Fitch ratificó las calificaciones para los instrumentos de deuda de la compañía en 'AAA(mex)' y 'BBB+'. Al final de este comunicado se presenta una lista completa de las acciones de calificación. Las calificaciones de Televisa reflejan su estructura de negocios diversificada en los segmentos de Cable, Contenido y Sky (DTH). Durante los últimos 4 años, la empresa ha presentado un crecimiento fuerte en su segmento de Cable, el cual ha incrementado su participación en los ingresos netos de 25.7% en 2014 a 35% últimos 12 meses (UDM) al cierre de marzo de 2019, esto le ha permitido a Televisa tener estabilidad y predictibilidad mayores en la generación de flujo de efectivo. La compañía mantiene una posición de mercado fuerte en el segmento de televisión abierta en México, apoyada en su estrategia de generación robusta de contenido. Televisa ahora es menos dependiente de su negocio de publicidad, cuyo desempeño reciente ha sido débil, ya que representó alrededor de 19.2% de sus ingresos netos totales UDM a marzo de 2019, desde 31.2% en 2014. La perspectiva de un crecimiento modesto en televisión abierta, la tendencia negativa a nivel global de la televisión de paga en el largo plazo y el nivel de apalancamiento alto, son factores que limitan las calificaciones. -

Council of the Americas

- O U R M E M B E R S - AbbVie Exxon Mobil Corporation Morgan Stanley The Abraaj Group EY MUFG Accenture FedEx Express NBCUniversal International Group and Aeropuertos Argentina 2000 FERRERE NBCUniversal Telemundo Enterprises The AES Corporation Financial Times New York Life AIG Fintech Advisory, Inc. Newmont Mining Corporation AirBnB Fitch Ratings News Corp / Fox Akerman LLP Fluor NEXI The Albright Stonebridge Group Ford Motor Company Nike, Inc. Allen & Company, Inc. Freeport-McMoRan Inc. Nomura Securities American Tower Corporation FTI Consulting, Inc. Orel Energy Group Amgen, Inc gA – Grupo ASSA Panedile Andes Energia plc. General Electric Company Partners Group Apple Inc. General Motors PepsiCo Arca Continental Genneia S.A. Perez Alati, Grondona, Benites, Arntsen & Arcos Dorados S.A. Genomma Lab Martinez de Hoz Jr Artisan Partners GeoPark Pfizer Inc Baker & McKenzie LLP Gibson, Dunn & Crutcher Philip Morris International, Latin Banco Bradesco S.A. GIC America and Canada Banco Ciudad de Buenos Aires Goldman Sachs Pluspetrol Banco de la Nación Argentina Google Praxair, Inc Banco do Brasil S.A. Greenberg Traurig, LLP PRISA Bank of America Greylock Capital Management The Procter & Gamble Company Barings Grupo Financiero Galicia Principal Financial Group Barrick Gold Corporation Grupo Luz y Fuerza Puente BBVA Grupo Televisa, S.A.B. Raytheon Company Berkemeyer Attorneys and Counselors Hakluyt & Company Repsol BlackRock Hamburg Sud Riverwood Capital Bloomberg Philanthropies HBO Latin America Rio Tinto Blue Water Worldwide LLC HP Inc Ryder System, Inc. BMW GROUP HSBC Securities (USA) Inc. Santander BNY Mellon Hunton & Williams SAP Latin America & Caribbean BNP Paribas IBM Corporation Schroders The Boeing Company IC Power Nicaragua, S.A Scotiabank Bombardier Business Aircraft International Finance Corporation (IFC) Sempra Energy International The Boston Consulting Group INCAE Business School Shearman & Sterling LLP BRAiN-Brazil Investments & Business Interaudi Bank Shell Braskem S.A. -

Fomento Económico Mexicano, S.A.B. De C.V. (“FEMSA”) Is a Mexican Holding Company. Its Principal Activities Are Mainly Grou

Fomento Económico Mexicano, S.A.B. de C.V. (“FEMSA”) is a Mexican holding company. Its principal activities are mainly grouped under the following companies that operates among 12 countries: • Coca-Cola FEMSA, S.A.B de C.V. • FEMSA Comercio, S.A. de C.V., • FEMSA Negocios Estratégicos FEMSA’s mission is to generate social and economic value through their companies and institutions. It is a business of designing, building and developing large-scale business models that enable their customer to satisfy their daily needs, in an efficient and differentiated way by everything they do. They’re continuously working to: • Be the best owner, partner and operator of every Price Ratios business owned in the long term Median FEMSAUBD • Double the value of their businesses • Be the leaders on the market that they operate 29.63 • Be the best employer and neighbor to the communities where they operate By: 18.13 • Focusing on their customer • Commit to excellence • Being competent and collaborative 2.38 • A innovative spirit 1.72 0.80 1.30 P/E P/Book P/Sales HOLDING AS A GLANCE FEMSA identity relies on the diversification of its portfolio that includes equity stakes and business units: • Coca-Cola FEMSA, as the largest franchised Yields company bottling Coca-Cola products in the world, Median FEMSAUBD serving over 375 million consumer. • FEMSA Commerce, that operates the greatest chain 10.72 of proximity stores in Latin America with the Oxxo brand, also includes Health and Fuel divisions. • Strategic Businesses to provide logistics, refrigeration and plastics solutions to third-party 7.08 clients and FEMSA’s business units. -

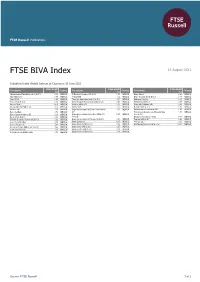

FTSE BIVA Index

2 FTSE Russell Publications 19 August 2021 FTSE BIVA Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Administradora Fibra Danhos S.A. de C.V. 0.15 MEXICO El Puerto de Liverpool SA de CV 0.53 MEXICO Grupo Mexico 8.89 MEXICO Alfa SAB de CV 0.89 MEXICO Femsa UBD 9.2 MEXICO Grupo Rotoplas S.A.B. de C.V. 0.17 MEXICO Alpek S.A.B. 0.28 MEXICO Fibra Uno Administracion S.A. de C.V. 1.91 MEXICO Industrias Penoles 1.02 MEXICO Alsea S.A.B. de C.V. 0.56 MEXICO Genomma Lab Internacional S.A.B. de C.V. 0.46 MEXICO Kimberly Clark Mex A 0.88 MEXICO America Movil L 13.59 MEXICO Gentera SAB de CV 0.35 MEXICO Megacable Holdings SAB 0.64 MEXICO Arca Continental SAB de CV 1.53 MEXICO Gruma SA B 1.37 MEXICO Nemak S.A.B. de C.V. 0.16 MEXICO Bachoco Ubl 0.36 MEXICO Grupo Aeroportuario del Centro Norte Sab de 1.31 MEXICO Orbia Advance Corporation SAB 1.59 MEXICO Banco del Bajio 0.76 MEXICO CV Promotora y Operadora de Infraestructura 1.05 MEXICO Banco Santander Mexico (B) 0.43 MEXICO Grupo Aeroportuario del Pacifico SAB de CV 2.27 MEXICO S.A. de C.V. Becle S.A.B. de C.V. 0.86 MEXICO Series B Qualitas Controladora y Vesta 0.48 MEXICO Bolsa Mexicana de Valores SAB de CV 0.62 MEXICO Grupo Aeroportuario del Sureste SA de CV 2.21 MEXICO Regional SAB de CV 0.83 MEXICO Cementos Chihuahua 0.79 MEXICO Grupo Banorte O 11.15 MEXICO Televisa 'Cpo' 4.38 MEXICO Cemex Sa Cpo Line 7.43 MEXICO Grupo Bimbo S.A.B. -

06/03/2015 I. Eventos Relevantes De Las Principales Emisoras

Fecha de Elaboración: 06/03/2015 I. Eventos Relevantes De Las Principales Emisoras (S.A.B’s) RAZÓN SOCIAL EVENTOS RELEVANTES (clave de pizarra) ARCA CONTINENTAL, S.A.B DE Sin publicación C.V (AC) ALFA, S.A.B DE C.V Sin publicación (ALFA) ALPEK, S.A.B de C.V Sin publicación (ALPEK) ALSEA, S.A.B DE C.V (ALSEA) b)De acue Ley del Mercado de Valores) con el 6 siguiente, por este mismo medio y conforme lo estable el marco normativo. General aplicables a las emisoras de valores y a otros participantes del mercado de valores. AMERICA MOVIL, S.A.B DE C.V Sin publicación (AMX) GRUPO AEROPORTUARIO DEL SURESTE, S.A.B DE C.V (ASUR) GRUPO BIMBO, S.A.B DE C.V Sin publicación (BIMBO) BOLSA MEXICANA DE Sin publicación VALORES, S.A.B DE C.V (BOLSA) CEMEX, S.A.B DE CV MONTERREY, MEXICO. 2 de Marzo de - (CEMEX) convocada para celebrarse el 26 de marzo de 2015. GRUPO CARSO, S.A.B DE C.V 2 (GCARSO) Sin publicación CONTROLADORA COMERCIAL MEXICANA, S.A.B DE C.V Cont (COMERCI) CCM se mantienen sin camb Adicionalmente, en es En 2015 se proyecta la apertura de cinco nuevas tiendas, de las cuales una corresp con Centros comerciales y mantenimiento operativo 1 $ 685 CEDIS Vallejo 1 $ 50 y Fresko. lo que 3 crezcan un 2.0% a unidades iguales y 1.8% a tiendas totales - esto debido el efecto de la venta de Restaurantes California. control de gastos administrativos y de operaciones. -

Cross-Border Investments Lay the Foundation for Shared Regional Prosperity

Growing Together: Economic Ties between the United States and Mexico Cross-Border Investments Lay the Foundation for Shared Regional Prosperity By Christopher Wilson #USMXEcon October 2016 Growing Together: Economic Ties between the United States and Mexico Cross-Border Investments Lay the Foundation for Shared Regional Prosperity By Christopher Wilson Project Introduction The impact of trade and globalization on the average American has become a core issue in this year’s elections. We have heard measured, well-founded and serious critiques on the handling of issues like currency manipulation and preparing our workforce for participation in the global economy, but the conversation has also drawn many passionate and visceral responses, highlighting the intensity with which citizens feel the impact of economic change. Due to campaign rhetoric, Mexico has come to symbolize much of the U.S. encounter with globalization. Given that Mexico is the United States’ second largest export market, third largest overall trading partner, and the top country of origin for immigrants living in the country, this is understandable. Nonetheless, having become a top tier issue in the presidential elections, it is more important than ever that Americans have a clear and up-to-date understanding of Mexico and, in particular, the U.S.-Mexico economic relationship. With that in mind, the Mexico Institute is pleased to announce the launch of a new project, Growing Together: Economic Ties between the United States and Mexico, which explores the bilateral economic relationship in detail to understand its nature and its impact on the United States. We have commissioned original research on the employment impact of bilateral trade on the U.S. -

Larrainvial Mexican Equity Fund November 30, 2016

LarrainVial Asset Management SICAV LarrainVial Mexican Equity Fund November 30, 2016 PERFORMANCE (USD) (1) RISK (3) 140 1 2 3 4 5 6 7 120 Bajo Medio Alto 100 80 INVESTMENT OBJECTIVE (4) 60 The Larraín Vial Mexican Equity Fund invests in stocks of Mexican companies. This fund provides exposure to the new growth story of Mexico, 40 stemming from the growing manufacturing competitiveness and the profound 20 structural changes that are occurring. 0 FUND DETAILS Feb-16 Feb-14 May-14 Aug-14 Nov-14 Feb-15 May-15 Aug-15 Nov-15 May-16 Aug-16 Nov-16 Nov-13 Fund Launch Date 08/Oct/13 Portfolio Manager Helmut Henríquez SICAV LV Mexican Equity Fund FI Mexico Co-Portfolio Manager Martín Benitez Legal Form SICAV Fund, Luxemburgo Asset Management Location Santiago, Chile Base Currency USD Rentabilidad Nominal 1 Month 3 Months 6 Months 1 Year 2 Years YTD Benchmark MSCI Mexico Fund -14,86% -12,99% -14,44% -18,84% -21,88% -15,43% NAV Price 82,79 Benchmark -12,76% -11,48% -9,45% -14,27% -29,08% -9,69% ISIN LU0939495957 Bloomberg LAMMUSF LX Bloomberg Benchmark M1MX Index Fund Size 25571097,55 INDUSTRY BREAKDOWNS (2) Number of Holdings 37 Dividends Reinvested Índice de Referencia % Fondo % Consumer Staples Consumer Discretionary DEALING & PRICES Materials Dealing Frequency Daily basis Industrials Settlement Valuation date + 2 days Financials Management Fee Up to 1,60% Annual Real Estate Up to 5% of the subscription Subscription / Performance Fee Otro amount Health Care Minimum Investment Amount US$ / € 300.000 Telecommunication Services Serie High Net Worth Investors (F) 0% 5% 10% 15% 20% 25% 30% 35% 40% FUND STATISTICS (5) 3 Month 6 Months 1 Year Bench Bench Bench Fund Fund Fund TOP 10 HOLDINGS (2) mark mark mark Tracking Error ex post 10,8% -- ##### -- 9,3% -- Índice de Referencia % Fondo % VAR (95%) 3,1% 2,9% 2,0% 2,3% 2,0% 2,3% Ishares Msci Mexico Capped I Volatibilidad 35,5% 34,6% ##### 30,1% 25,3% 27,3% Medica Sur S.a.b. -

Mexican Multinational Enterprises: Navigating Uncertainty from NAFTA to the USMCA March 2020

1 Mexican Multinational Enterprises: Navigating Uncertainty from NAFTA to the USMCA March 2020 Mexico City and New York, The Institute for Economic Research (IIEc) of the National Autonomous University of Mexico (UNAM) and the Columbia Center on Sustainable Investment (CCSI), a joint center of Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their ninth survey of Mexican multinationals.1 The survey, conducted in 2019, is part of a long-term study of the rapid global expansion of multinational enterprises (MNEs) from emerging markets. The present report focuses on data for the year 2017. Highlights In 2017, the 20 largest Mexican MNEs had foreign assets of US$ 153 billion (Table 1), foreign revenue of US$ 100 billion, and 408,231 foreign employees (Annex I, Table 1). The two largest companies (América Móvil and CEMEX) together controlled US$ 74 billion, equivalent to 48% of the total foreign assets of the companies on the list. The four largest MNEs (also including FEMSA and Grupo Mexico) together controlled US$ 104 billion, equivalent to 68% of the total. Companies in the food and beverage sectors (seven) dominate the list, followed by companies in the non-metallic minerals (three) and diversified (three) sectors. Only two companies are 1 The authors of this report, Dr. Jorge Basave Kunhardt and Dra. Maria Teresa Gutiérrez Haces are senior researchers at the Economics Research Institute of National University of Mexico (UNAM). The authors kindly ask that this work be cited properly. Technical support was provided by Vanessa Mora and Iris Velasco. -

MVIS Mexico Equal Weight Index

FACTSHEET MVIS Mexico Equal Weight Index The MVIS Mexico Equal Weight Index (MVMXEQ) index tracks the performance of the largest and most liquid companies incorporated in Mexico, employing an equal weighting scheme. The index also includes non-local companies incorporated outside Mexico that generate at least 50% of their revenue in Mexico. MVMXEQ covers at least 90% of the investable universe. Key Features All Time High/Low 52-Week High/Low Total Return Net Index 2,017.55/500.55 1,683.84/1,139.93 Index Data INDEX PARAMETERS FUNDAMENTALS* ANNUALISED PERFORMANCE* Launch Date 01 Jun 2017 Components 38.00 Price/Earnings Trailing 15.94 1 Month -4.59% Type Country Volatility (1 year) 18.57 Price/Book 1.83 1 Year 37.50% Currency USD Full MCap bn USD 434.87 Price/Sales 1.66 3 Years 1.46% Base Date 29 Dec 2006 Float MCap bn USD 229.26 Price/Cash Flow 9.13 5 Years 1.85% Base Value 1,000.00 Correlation* (1 year) 0.92 Dividend Yield 2.50 Since Inception 3.16% * as of 30 Sep 2021 * IPC * Total Return Net Index Country and Size Weightings COUNTRY WEIGHTINGS EXCL. OFFSHORE* COUNTRY WEIGHTINGS INCL. OFFSHORE* SIZE WEIGHTINGS MX Large-Cap US Mid-Cap CA MX Small-Cap GB Micro-Cap LU Country Count Weight Country Offshore Count Weight Size Count Weight Mexico 29 77.39% Mexico 9 38 100.00% Large-Cap ( > 6 bn) 18 47.24% United States 4 10.53% Mid-Cap (1.5 bn - 6 bn) 20 52.76% Canada 3 7.46% Small-Cap (0.2 bn - 1.5 bn) 0 0.00% United Kingdom 1 2.47% Micro-Cap (0.0 bn - 0.2 bn) 0 0.00% Luxembourg 1 2.16% *Companies incorporated outside of a certain region or country that generate at least 50.00% of their revenues (or, where applicable, have at least 50.00% of their assets) in that region or country. -

Council of the Americas

- O U R M E M B E R S - AbbVie EY Morgan Stanley The Abraaj Group FedEx Express MUFG AdCap Securities FERRERE Mylan N.V. Aeropuertos Argentina 2000 Financial Times New York Life The AES Corporation Fintech Advisory, Inc. News Corp / Fox AIG Fitch Ratings NEXI Akerman LLP Fluor Nike, Inc. Akin, Gump, Strauss, Hauer & Feld, LLP Ford Motor Company Nomura Securities The Albright Stonebridge Group Freeport-McMoRan Orel Energy Group Allen & Company, Inc. FTI Consulting, Inc. Panedile Argentina S.A.I.C.F. e I. Alpha WeNvest gA – Grupo ASSA Partners Group American Tower Corporation General Electric Company PepsiCo Amgen, Inc General Motors South America Perez Alati, Grondona, Benites, Arntsen & Andes Energia plc. Genneia S.A. Martinez de Hoz Jr Apple Inc. Genomma Lab Pfizer Inc Arca Continental GeoPark Philip Morris International, Latin Archer Daniels Midland Company Gibson, Dunn & Crutcher America and Canada Arcos Dorados S.A. GIC Pluspetrol Artisan Partners Goldman Sachs PointState Capital LP Baker & McKenzie LLP Google Inc. Praxair, Inc Banco Bradesco S.A. Greenberg Traurig, LLP Prisa Banco Ciudad de Buenos Aires Greylock Capital Management The Procter & Gamble Company Banco de la Nación Argentina Grupo Financiero Galicia Principal Financial Group Banco do Brasil Grupo Luz y Fuerza Puente Banco Santander Grupo Argos SA PwC Bank of America Grupo Televisa, S.A.B. Raytheon Company Barings Hakluyt & Company Repsol Barrick Gold Corporation Hamburg Sud Riverwood Capital BBVA HBO Latin America Rio Tinto Berkemeyer Attorneys and Counselors HP Inc Ryder System, Inc. BlackRock HSBC Securities (USA) Inc. Sancor Seguros Bloomberg Philanthropies Hunton & Williams SAP LAC (Latin America & Caribbean) Blue Water Worldwide LLC IBM Corporation Scotiabank BMW GROUP IC Power Nicaragua, S.A Sempra Energy International BNY Mellon IFC Shearman & Sterling LLP BNP Paribas INCAE Business School Shell The Boeing Company Interaudi Bank Simpson Thacher & Bartlett LLP Bombardier Business Aircraft Intesa Sanpaolo Smartmatic The Boston Consulting Group IRSA Inversiones y Representaciones S.A. -

EMGP October 2017

“The Uneven Trends of Mexican MNEs: Between sluggishness and strength in the international markets” Mexico City and New York, November 27, 2017 The Institute for Economic Research (IIEc) of the National Autonomous University of Mexico (UNAM) and the Columbia Center on Sustainable Investment (CCSI), a joint center of Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their sixth survey of Mexican multinationals today.1 The survey, conducted during 2017, is part of a long-term study of the rapid global expansion of multinational enterprises (MNEs) from emerging markets.2 The present report focuses on data for year 2015. Highlights In 2015, the 20 largest Mexican MNEs had foreign assets of US$ 141 billion (Table 1), foreign revenue of US$ 89 billion, and 379,481 foreign employees (Annex I, Table 1). The two largest companies (América Móvil and CEMEX) together controlled US$ 82 billion, equivalent to 58% of the total assets held by all companies on the list. The largest four MNEs (also including Grupo FEMSA and Grupo México) collectively held US$ 106 billion, equivalent to about 75% of the total. Companies of the food and beverage sector (six) dominate the list, followed by diversified companies (four). Only two companies are not listed on a stock market: PEMEX, an oil company wholly-owned by the Mexican State, and XIGNUX, a privately-held conglomerate. The 20 listed MNEs have a total of 348 foreign subsidiaries. Since the 1990s, the highest concentration of subsidiaries has been in Latin America, followed by North America, 1 This report was prepared by Dr.